Professional Documents

Culture Documents

GAIN Report: Philippines Cotton and Products Annual 2004

Uploaded by

api-3838281Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GAIN Report: Philippines Cotton and Products Annual 2004

Uploaded by

api-3838281Copyright:

Available Formats

USDA Foreign Agricultural Service

GAIN Report

Global Agriculture Information Network

Template Version 2.09

Required Report - public distribution

Date: 5/17/2004

GAIN Report Number: RP4026

RP4026

Philippines

Cotton and Products

Annual

2004

Approved by:

David C. Miller

FAS Manila

Prepared by:

Pia Abuel-Ang

Report Highlights:

With Philippine raw cotton production supplying less than 3 percent of total domestic cotton

requirements, the Philippines will continue to rely on imports to meet domestic demand in

MY 2004-05 and beyond. The United States is likely to remain the largest supplier of

combed cotton, followed by Pakistan, Australia and South Africa. With the end of the quota

system for garments starting in 2005, domestic cotton consumption is forecast to decline

next year. The garments and textile sector is the single largest buyer of raw cotton and the

garments sector is country's second highest export earner.

Includes PSD Changes: Yes

Includes Trade Matrix: No

Annual Report

Manila [RP1]

[RP]

GAIN Report - RP4026 Page 2 of 4

Production

Cotton production in MY 2003-04 is likely to increase slightly to 700 MT mainly due to

improved cotton yield. There are currently about 150,000 hectares certified for cotton

production, however only about 15 percent is actually planted to cotton. At present,

domestic lint supplies only about 3 percent of local requirements.

The Philippine Cotton Development Administration (CODA) believes there is a market for

Philippine cotton both domestically and internationally. Domestic cotton prices have been

consistently higher than imported cotton lint (by about 20 percent) for the past 10 years.

The Philippines only produces medium staple cotton of superior quality while imports are

mostly comprised of short-medium and long staple cotton of various fiber qualities.

Consumption

Domestic consumption of raw cotton has been falling and is forecast to again decline in MY

2004-05 as result of a rise in imports of lower-priced garments from other Asian countries,

particularly from China as well as the termination of the quota system which will affect

exports. The uncertainty of the quota system for garments in the United States, European

Union and Canada, set to expire by the end of the year as mandated by the World Trade

Organization, is likely to pull down demand for raw cotton. The garments and textile sector

is the single largest buyer of domestic and imported cotton in the country.

The garment sector is the country’s second largest foreign exchange earner and has

contributed an average of 7 percent to the country’s total export earnings for the past three

years. At present, the United States remains the largest market for Philippine garments

accounting for 74 percent of garment exports. Other important markets include the

European Union (13%), non-quota markets (11%) and Canada (3%).

Trade

With domestic production supplying about 3 percent of domestic demand, the Philippines will

continue to rely on cotton imports to meet its raw cotton requirements. In MY 2002-03, the

United States supplied nearly half of total Philippine cotton lint requirements and will likely

continue to be the main source of cotton for the country in the coming year. Other sources

include Pakistan, Australia and South Africa, collectively supplying about 20 percent of cotton

demand. Raw cotton imports are forecast to decline in MY 2004-05 and beyond as imports

of low-price cotton garments continue to rise and a drop in garments exports is forecast for

next year.

Policy

According to the provisions of the 1994 Agreement on Textiles and Clothing (ATC), garments

and textiles will be fully integrated in the World Trade Organization and the quota system is

to be phased out by 2005.

In 2002, aware of these challenges, the Garments and Textile Export Board (GTEB) under the

Philippine Department of Trade And Industry (DTI) launched the “Garment Export Industry

Transformation Plan and Assistance Package.” The objective is to enhance the

competitiveness of the industry. The assistance package is comprised of the following:

UNCLASSIFIED USDA Foreign Agricultural Service

GAIN Report - RP4026 Page 3 of 4

• Development Assistance Programs – designed to improve productivity through

investments in technology and skills upgrading, address speed-to-market concerns,

develop and promote diversified markets and products, and provide access to

financing.

• Lowering of Business Costs – through reduction in quota fees by 30 percent to help

exporters compete with other low-cost countries. In 2004, all quota fees are to be

eliminated.

• Quota Incentives – to encourage exporters to undertake productivity and growth

enhancing activities that are necessary to be competitive.

At present, imported cotton has a Most Favored Nation (MFN) tariff rate of 1 percent and a

Common Effective Preferential Tariff (CEPT) rate of 3 percent under the ASEAN Free Trade

Agreement (AFTA).

2004 MFN/CEPT Tariff Rates

Tariff Code Description MFN CEPT Remarks

5201.00.00 Cotton, not carded or combed 1 3 All ASEAN members

Source: Tariff & Customs Code of the Philippines

Last year, CODA sought the approval of the National Biosafety Committee of the Philippines

(NBCP) to propagate Bt Cotton. According to the NBCP, CODA has since withdrawn its

application likely due to the perceived limited market potential of Bt cotton in the country.

As of February 2004, the Bureau of Plant Industry (BPI) under the Department of Agriculture

(DA) announced that it will now allow the importation of the following cotton products/

transformation events for direct food, feed or processing use:

Transformation Introduced Date Safety Technology

Event Trait & Gene Approved Assessment Developer

Food Feed

Cotton 1445 Tolerance to round-up 12/05/2003 Yes Yes Monsanto

herbicide –CP4EPSPS Company

Cotton 15985 Resistance to 12/05/2003 Yes Yes Monsanto

lepidopteran pests – Company

Cry2Ab2 gene

Cotton 531 Resistance to 02/05/2004 Yes Yes Monsanto

lepidopteran pests – Company

Cry1Ac

Source: Bureau of Plant Industry, Department of Agriculture

Marketing

On June 1 – July 15, 2004, Cotton Council Incorporated (CCI) will carry out a mall-based

promotional activity to promote the Cotton USA label. The two-fold activity will involve a

music/band competition where all participating bands will be required to prepare an original

composition with the word “FEEL or FEELING” and a raffle drawing. The purchase of any

denim brand with the COTTON USA label will entitle a customer to join the promotion. The

said promotional activity aims to raise awareness in the Philippine market, particularly

among consumers, about the high quality of US cotton.

UNCLASSIFIED USDA Foreign Agricultural Service

GAIN Report - RP4026 Page 4 of 4

In July 2003, CCI organized a photo exhibit entitled “Cotton USA’s Field to Fashion” at the

Shangrila Plaza Mall to educate cotton buyers about the complete process that cotton

undergoes before it becomes a pair of jeans or a white knit shirt. Otherwise known as the

“Cotton Story,” the exhibit is a visual account of how cotton garments are produced.

PSD Table

Country Philippines

(HECTARES)

Commodity Cotton (MT)

Revised 2002 Estimate 2003 Forecast 2004

Old New Old New Old New

Market Year Begin 08/2002 08/2003 08/2004

Area Planted 0 0 0 0 0 0

Area Harvested 2000 2000 2000 2000 0 2000

Beginning Stocks 15459 12323 12846 11276 9145 9776

Production 653 653 653 700 0 720

Imports 38102 44500 28304 30500 0 29000

TOTAL SUPPLY 54214 57476 41803 42476 9145 39496

Exports 0 0 0 0 0 0

USE Dom. Consumption 41368 46200 32659 32700 0 31600

Loss Dom. Consumption 0 0 0 0 0 0

TOTAL Dom. Consumption 41368 46200 32659 32700 0 31600

Ending Stocks 12846 11276 9144 9776 0 7896

TOTAL DISTRIBUTION 54214 57476 41803 42476 0 39496

UNCLASSIFIED USDA Foreign Agricultural Service

You might also like

- Food Outlook: Biannual Report on Global Food Markets May 2019From EverandFood Outlook: Biannual Report on Global Food Markets May 2019No ratings yet

- Food Outlook: Biannual Report on Global Food Markets: June 2020From EverandFood Outlook: Biannual Report on Global Food Markets: June 2020No ratings yet

- India's $105M Cotton Textile Exports to Nigeria Have Growth PotentialDocument80 pagesIndia's $105M Cotton Textile Exports to Nigeria Have Growth PotentialLoveth KonniaNo ratings yet

- Value Chain Analysis of Organic Cotton Sub Sector in TanzaniaDocument15 pagesValue Chain Analysis of Organic Cotton Sub Sector in TanzaniaOchieng JustusNo ratings yet

- Zimbabwe Cotton Sector Value Chain AnalysisDocument43 pagesZimbabwe Cotton Sector Value Chain AnalysisHavanyaniNo ratings yet

- Agriculture Law: RS21712Document6 pagesAgriculture Law: RS21712AgricultureCaseLawNo ratings yet

- Jute Matters WebDocument60 pagesJute Matters WebAsraar AhmedNo ratings yet

- Organic Cotton CultivationDocument11 pagesOrganic Cotton CultivationSambitPriyadarshiNo ratings yet

- The Cotton Industry in The Philippines: ' Country StatementDocument8 pagesThe Cotton Industry in The Philippines: ' Country StatementJocelle AlcantaraNo ratings yet

- Philippine Abaca Industry Roadmap 2018 2022Document129 pagesPhilippine Abaca Industry Roadmap 2018 2022Jet Evasco100% (2)

- Produce Poultry FeedDocument26 pagesProduce Poultry FeedMOHIT KHATWANINo ratings yet

- Ethiopia Cotton Production Annual - Addis Ababa - Ethiopia - 5-29-2019Document8 pagesEthiopia Cotton Production Annual - Addis Ababa - Ethiopia - 5-29-2019DemelashNo ratings yet

- Dossier Annex II.4Document39 pagesDossier Annex II.4Ganesh PMNo ratings yet

- Jute Diversified ProductDocument39 pagesJute Diversified ProductIffat Ara AhmedNo ratings yet

- F L C P C I U: ARM Evel Otton Roduction Onstraints N GandaDocument32 pagesF L C P C I U: ARM Evel Otton Roduction Onstraints N GandaIsaka IsseNo ratings yet

- Regional Workshop On Trade Capacity Building & Private Sector DevelopmentDocument31 pagesRegional Workshop On Trade Capacity Building & Private Sector Developmentsrhq786No ratings yet

- Textile Industry Growth in PakistanDocument41 pagesTextile Industry Growth in PakistanHuma AliNo ratings yet

- Textile PDFDocument31 pagesTextile PDFsweetshah2No ratings yet

- Textile Industry of PakistanDocument12 pagesTextile Industry of PakistanTayyab Yaqoob QaziNo ratings yet

- Quantitative and Qualitative Requirements of Cotton For IndustryDocument4 pagesQuantitative and Qualitative Requirements of Cotton For IndustrySabesh MuniaswamiNo ratings yet

- Pakistan's Textile Industry: A Backbone of the EconomyDocument59 pagesPakistan's Textile Industry: A Backbone of the EconomyFaiEz AmEen KhanNo ratings yet

- Cotton Hand BookDocument75 pagesCotton Hand BookEdnet KenyaNo ratings yet

- Ethiopian Tanners Association - Current Problems of The Leather Industry - 2000Document6 pagesEthiopian Tanners Association - Current Problems of The Leather Industry - 2000greenefutures100% (1)

- Status and DirectionDocument28 pagesStatus and Directionmlganesh666No ratings yet

- Abaca-Production and ManagementDocument4 pagesAbaca-Production and Managementkenn1o10% (1)

- Coconut Coir Value Chain AnalysisDocument35 pagesCoconut Coir Value Chain AnalysisMarian E Boquiren83% (6)

- Chapter 1Document67 pagesChapter 1satseehraNo ratings yet

- Https WWW IhsDocument5 pagesHttps WWW IhsrishikeshmandawadNo ratings yet

- Research Report On Spinning Sector of Bangladesh-InitiationDocument24 pagesResearch Report On Spinning Sector of Bangladesh-InitiationjohnsumonNo ratings yet

- Garments Sector - PACRA Research - Dec20 - 1607595607Document20 pagesGarments Sector - PACRA Research - Dec20 - 1607595607MUHAMMAD HAMZANo ratings yet

- Cotton: Trends in Global Production, Trade and PolicyDocument14 pagesCotton: Trends in Global Production, Trade and PolicyInternational Centre for Trade and Sustainable DevelopmentNo ratings yet

- Textiles Sector - Achievement ReportDocument12 pagesTextiles Sector - Achievement ReportAnkitaNo ratings yet

- Nigeria Dairy MarketDocument15 pagesNigeria Dairy Marketdangler310% (1)

- Cotton by SaurabhDocument19 pagesCotton by SaurabhsaurabhNo ratings yet

- Spinning Project Profile FinalDocument23 pagesSpinning Project Profile FinalFaizan Motiwala67% (3)

- Cotton GinningDocument4 pagesCotton Ginningb4i_i4bNo ratings yet

- Cotton Fibre Quality Research Needs in IndiaDocument11 pagesCotton Fibre Quality Research Needs in IndiaprabhjotseehraNo ratings yet

- Abaca VCA (REGION 5) PDFDocument65 pagesAbaca VCA (REGION 5) PDFAks Somvanshi67% (3)

- Pakistan Cotton Production and TCP's Price Stabilization RoleDocument9 pagesPakistan Cotton Production and TCP's Price Stabilization RoleaowaisNo ratings yet

- Call For Support Woven For Raw MaterialDocument10 pagesCall For Support Woven For Raw MaterialSamwovenNo ratings yet

- Elite Fabs Deva - MsDocument51 pagesElite Fabs Deva - MsDevaragulNo ratings yet

- Indian Textile Industry: October 2006Document22 pagesIndian Textile Industry: October 2006Vikram Bhati100% (1)

- Economics of Corn Farming FinalDocument67 pagesEconomics of Corn Farming FinalOliver TalipNo ratings yet

- Atl - Textile IndustryDocument4 pagesAtl - Textile IndustryIa LoureenNo ratings yet

- The Philippine Coconut Industry: Performance, Issues and RecommendationsDocument8 pagesThe Philippine Coconut Industry: Performance, Issues and RecommendationsMhean Cortez Absulio100% (1)

- Commodity ReportDocument8 pagesCommodity Reporthamna MalikNo ratings yet

- Status of Global Paper IndustryDocument23 pagesStatus of Global Paper IndustryarjunanpnNo ratings yet

- Research On GTPDocument24 pagesResearch On GTPRosemary AsiamahNo ratings yet

- Activity 2 - Industry StationerDocument7 pagesActivity 2 - Industry StationerKrizza Camelle CalipusanNo ratings yet

- Finding The Moral Fiber: Why Reform Is Urgently Needed For A Fair Cotton TradeDocument48 pagesFinding The Moral Fiber: Why Reform Is Urgently Needed For A Fair Cotton TradeOxfamNo ratings yet

- Los Grobo G.grobocopatelDocument31 pagesLos Grobo G.grobocopatelJames Smart100% (1)

- Internship Report On Gohar TextileDocument107 pagesInternship Report On Gohar Textilesiaapa60% (5)

- Milling, Pet Food and Animal Feed: Sub-Sector Skills PlanDocument46 pagesMilling, Pet Food and Animal Feed: Sub-Sector Skills PlanElisaNo ratings yet

- TNI Agrarian Justice Programme Examines Trends in Brazil's Sugarcane IndustryDocument24 pagesTNI Agrarian Justice Programme Examines Trends in Brazil's Sugarcane IndustryHimanshu MogheNo ratings yet

- Cote D Ivoire Agricultural Sector UpdateDocument75 pagesCote D Ivoire Agricultural Sector UpdateSan SouciNo ratings yet

- Agriculture Law: RS20896Document6 pagesAgriculture Law: RS20896AgricultureCaseLawNo ratings yet

- Problems and Prospects of Exporting Jute From BangladeshDocument25 pagesProblems and Prospects of Exporting Jute From BangladeshNurul Absar RashedNo ratings yet

- Textile Industry BackgroundDocument26 pagesTextile Industry BackgroundPunit Francis100% (1)

- Food Outlook: Biannual Report on Global Food Markets: June 2022From EverandFood Outlook: Biannual Report on Global Food Markets: June 2022No ratings yet

- Food Outlook: Biannual Report on Global Food Markets: November 2022From EverandFood Outlook: Biannual Report on Global Food Markets: November 2022No ratings yet

- En Cima Market StudyDocument67 pagesEn Cima Market Studyapi-3838281100% (2)

- Technical Appraisal Table of ContentsDocument5 pagesTechnical Appraisal Table of Contentsapi-3838281No ratings yet

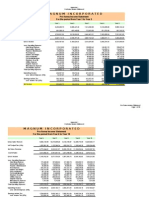

- Magnum Financial FinalDocument27 pagesMagnum Financial Finalapi-3838281No ratings yet

- Magnum Final Finally FsDocument30 pagesMagnum Final Finally Fsapi-3838281No ratings yet

- Technical Appraisal FinalDocument67 pagesTechnical Appraisal Finalapi-3838281No ratings yet

- Power Point - Market Demand ComputationDocument9 pagesPower Point - Market Demand Computationapi-3838281100% (1)

- En Cima Appendix - 3Document1 pageEn Cima Appendix - 3api-3838281No ratings yet

- En Cima Appendix - 5Document5 pagesEn Cima Appendix - 5api-3838281No ratings yet

- En Cima Appendix - 4Document2 pagesEn Cima Appendix - 4api-3838281No ratings yet

- Power PointDocument7 pagesPower Pointapi-3838281No ratings yet

- Power Point TechnicalDocument9 pagesPower Point Technicalapi-3838281No ratings yet

- Technical AppraisalDocument64 pagesTechnical Appraisalapi-3838281No ratings yet

- En Cima Appendix - 2Document2 pagesEn Cima Appendix - 2api-3838281No ratings yet

- Power Point - MarketingDocument11 pagesPower Point - Marketingapi-3838281No ratings yet

- Pant SaloonDocument27 pagesPant Saloonapi-3838281No ratings yet

- My Part For Report FinalDocument4 pagesMy Part For Report Finalapi-3838281No ratings yet

- Denim Sewing GuidelinesDocument3 pagesDenim Sewing Guidelinesapi-3838281No ratings yet

- My Part For ReportDocument5 pagesMy Part For Reportapi-3838281No ratings yet

- Viktor JeansDocument2 pagesViktor Jeansapi-3838281No ratings yet

- WE'RE NOT Sweatshops - Garments Exporters Worry About Int'l ImageDocument2 pagesWE'RE NOT Sweatshops - Garments Exporters Worry About Int'l Imageapi-3838281No ratings yet

- Org Structure - HR Matters - Daily OpernsDocument10 pagesOrg Structure - HR Matters - Daily Opernsapi-3838281No ratings yet

- Pattern For Org StructureDocument8 pagesPattern For Org Structureapi-3838281No ratings yet

- Operating CostsDocument13 pagesOperating Costsapi-3838281No ratings yet

- The Philippine Garments IndustryDocument4 pagesThe Philippine Garments Industryapi-3838281100% (3)

- RectoDocument2 pagesRectoapi-3838281No ratings yet

- RRJ JeansDocument1 pageRRJ Jeansapi-3838281100% (1)

- Plains and PrintsDocument2 pagesPlains and Printsapi-3838281100% (3)

- Philippines Cotton and Products Annual 2004Document3 pagesPhilippines Cotton and Products Annual 2004api-3838281No ratings yet

- PIF2006Document57 pagesPIF2006api-3838281No ratings yet

- June Garments Exports Adjust To PriceDocument2 pagesJune Garments Exports Adjust To Priceapi-3838281No ratings yet

- Quality Management in Digital ImagingDocument71 pagesQuality Management in Digital ImagingKampus Atro Bali0% (1)

- Level 3 Repair PBA Parts LayoutDocument32 pagesLevel 3 Repair PBA Parts LayoutabivecueNo ratings yet

- Honda Wave Parts Manual enDocument61 pagesHonda Wave Parts Manual enMurat Kaykun86% (94)

- Petty Cash Vouchers:: Accountability Accounted ForDocument3 pagesPetty Cash Vouchers:: Accountability Accounted ForCrizhae OconNo ratings yet

- 2014 mlc703 AssignmentDocument6 pages2014 mlc703 AssignmentToral ShahNo ratings yet

- Music 7: Music of Lowlands of LuzonDocument14 pagesMusic 7: Music of Lowlands of LuzonGhia Cressida HernandezNo ratings yet

- Us Virgin Island WWWWDocument166 pagesUs Virgin Island WWWWErickvannNo ratings yet

- The European Journal of Applied Economics - Vol. 16 #2Document180 pagesThe European Journal of Applied Economics - Vol. 16 #2Aleksandar MihajlovićNo ratings yet

- C6030 BrochureDocument2 pagesC6030 Brochureibraheem aboyadakNo ratings yet

- Manual Analizador Fluoruro HachDocument92 pagesManual Analizador Fluoruro HachAitor de IsusiNo ratings yet

- FINAL A-ENHANCED MODULES TO IMPROVE LEARNERS - EditedDocument22 pagesFINAL A-ENHANCED MODULES TO IMPROVE LEARNERS - EditedMary Cielo PadilloNo ratings yet

- ITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFDocument280 pagesITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFMohamed AliNo ratings yet

- PandPofCC (8th Edition)Document629 pagesPandPofCC (8th Edition)Carlos Alberto CaicedoNo ratings yet

- Polyol polyether+NCO Isupur PDFDocument27 pagesPolyol polyether+NCO Isupur PDFswapon kumar shillNo ratings yet

- Riddles For KidsDocument15 pagesRiddles For KidsAmin Reza100% (8)

- Rohit Patil Black BookDocument19 pagesRohit Patil Black BookNaresh KhutikarNo ratings yet

- Orc & Goblins VII - 2000pts - New ABDocument1 pageOrc & Goblins VII - 2000pts - New ABDave KnattNo ratings yet

- Propiedades Grado 50 A572Document2 pagesPropiedades Grado 50 A572daniel moreno jassoNo ratings yet

- Lifespan Development Canadian 6th Edition Boyd Test BankDocument57 pagesLifespan Development Canadian 6th Edition Boyd Test Bankshamekascoles2528zNo ratings yet

- CR Vs MarubeniDocument15 pagesCR Vs MarubeniSudan TambiacNo ratings yet

- Briana SmithDocument3 pagesBriana SmithAbdul Rafay Ali KhanNo ratings yet

- FS2004 - The Aircraft - CFG FileDocument5 pagesFS2004 - The Aircraft - CFG FiletumbNo ratings yet

- Exercises2 SolutionsDocument7 pagesExercises2 Solutionspedroagv08No ratings yet

- Guiding Childrens Social Development and Learning 8th Edition Kostelnik Test BankDocument16 pagesGuiding Childrens Social Development and Learning 8th Edition Kostelnik Test Bankoglepogy5kobgk100% (27)

- Agricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsDocument84 pagesAgricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsRachel vNo ratings yet

- International Certificate in WealthDocument388 pagesInternational Certificate in Wealthabhishek210585100% (2)

- How Psychology Has Changed Over TimeDocument2 pagesHow Psychology Has Changed Over TimeMaedot HaddisNo ratings yet

- Estimation of Working CapitalDocument12 pagesEstimation of Working CapitalsnehalgaikwadNo ratings yet

- BIBLIO Eric SwyngedowDocument34 pagesBIBLIO Eric Swyngedowadriank1975291No ratings yet

- 2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTDocument5 pages2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTIbrahim JaberNo ratings yet