Professional Documents

Culture Documents

SKF in India Transfer Expenses Policy: (Version 4 - July 1, 2010)

Uploaded by

anks_raOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SKF in India Transfer Expenses Policy: (Version 4 - July 1, 2010)

Uploaded by

anks_raCopyright:

Available Formats

SKF in INDIA TRANSFER EXPENSES POLICY (Version 4 July 1, 2010)

OBJECTIVE These rules have been framed with a view to standardize the entitlement / procedures for employees of SKF in India, who are transferred from one place to another and in the process have to change their city of stay. APPLICABILITY Transfer Expenses are paid to all management cadre employees who have to move cities. EFFECTIVE DATE These rules become effective from July 1, 2010. TRAVEL TRANSFER All employees will be entitled to travel expenses for self and immediate family (spouse and children only) as per norms of the Domestic Travel Policy as applicable to their grade. TRANSPORT CHARGES FOR PERSONAL EFFECTS - TRANSFER This reimbursement will cover cost of crating charges, transportation, insurance, octroi, loading and unloading and all other charges, subject to producing the documentary evidence. For Work Levels 1 to 5, reimbursement of cost of transportation of personal effects will be at actuals. Three Quotations from Transporters, will have to be forwarded to the concerned Purchase Office for their approval. The payment will be done directly to the Transporter. TRANSPORT CHARGES FOR PERSONAL VEHICLE TRANSFER Based on the distance, company will pay the Petrol and incidental expenses of the Vehicle @ Rs.6.50/- per km. in case of 4 wheelers. Reimbursement of Local Travel by own 2 wheeler @ Rs. 2/- per km for Work Levels 4 & 5. TRANSIT ARRANGEMENTS TRANSFER All management cadre employees on joining the Company from an outstation location or being transferred from one location to another can stay in Hotel or Company Guest House. Wherever provided, they have to stay in Company Guest House. The duration of stay in the Guest House

cannot be more than 30 days and the same can be split between the two locations. In case of Hotel stay the same cannot be for more than 30 days and again can be split between the two locations. DONATIONS TRANSFER In the event of the employee having children going to school and in the event of his / her having to pay donations to secure admission in the school, then on submission of relevant proof the company will reimburse the same subject to a cap of 2 months Basic Salary of the employee per child. DOUBLE ESTABLISHMENT TRANSFER In the event of the employee having to move in the middle of the year (school term) on account of which he / she will not be in a position to move his / her family, then he / she will be entitled to the following benefits till the completion of the academic term (April of the concerned year) 1. One return trip to where his family is based (as per his / her domestic travel entitlements) at the end of every quarter. Please note that the same applies only for every completed quarter and not part thereof. 2. At Grade Level 4 & 5 an amount equivalent to Rs.10,000/- till the completion of the academic year. At locations where the company has a Guest House the company can provide the same and then the payment will no longer be applicable. 3. At Grade Level 2 & 3 an amount equivalent to Rs.15,000/- per month till the completion of the academic year. At locations where the company has a Guest House the company can provide the same and then the payment will no longer be applicable. 4. At Grade Level 1 accomodation will be provided by the company. 5. In case the employee is transferred to Mumbai location, then the above amounts will be double. Please note that all the above apply only till the completion of the immediate academic year. Post that if the employee on his own opts to retain his family at the original place, he / she will not be entitled to any benefits. In special circumstances on account of education of children the double establishment allowance can be extended to a maximum of 2 years if the children are studying in critical years like 9th to 12th. SPECIAL ALLOWANCE TRANSFER In the event of an employee getting transferred to another location at the same level as she / he is currently then the employee will be paid a Special Allowance equivalent to the Double Establishment allowance for a period of 3 years under the following circumstances.

1. The city to which the employee is moving is a higher category city that his / her current city. 2. The employee is moving to a new factory location. For the purpose of this policy the cities are classified as Category 1 : Mumbai Category 2 : Delhi, Chennai, Bangalore, Hyderabad and Kolkatta Category 3 : Ahmedabad and Pune Category 4 : Other Locations. In the event of the employee getting promoted during the 3 year period then the Special Allowance will stop from the date of promotion. In case an employee is moved to Category 1 city, then Special Allowance will be twice that of the Double Establishment allowance. The special allowance will not apply in cases where the employee initiates the transfer for personal reasons. LEAVE TRANSFER A Special Leave of 5 days will be allowed for the purpose of packing and crating of household effects and for the period of journey from one location to another. INCIDENTAL EXPENSES - TRANSFER All employees are entitled to one time payment, as given below, to take care of Sundry Expenses of incidental nature for which bills cannot be maintained / kept. This is to cover all minor expenses, which the employee may incur. Work Level 4 and 5 2 and 3 1 Amount Rs. 10,000/Rs. 15,000/Rs. 25,000/-

Vithal Nayak Director HR

You might also like

- Relocation Policy 104Document5 pagesRelocation Policy 104Arindam RayNo ratings yet

- Transfer Support PolicyDocument3 pagesTransfer Support PolicyPranav SahilNo ratings yet

- Relocation RevDocument7 pagesRelocation RevSavita matNo ratings yet

- Purpose: Transfer and RelocationDocument3 pagesPurpose: Transfer and RelocationiamgodrajeshNo ratings yet

- Leave Fare Concession: 1. Definition of Family'Document20 pagesLeave Fare Concession: 1. Definition of Family'Gyan TiwariiNo ratings yet

- Domestic Relocation Policy - V 1 0 PDFDocument2 pagesDomestic Relocation Policy - V 1 0 PDFNneka100% (1)

- Transfer Policy 982Document3 pagesTransfer Policy 982Rakhi ChakiNo ratings yet

- Centene Renter Policy - Revised February 15 2014 PDFDocument9 pagesCentene Renter Policy - Revised February 15 2014 PDFmlamhangNo ratings yet

- KSF - Relocation Policy V1.0Document6 pagesKSF - Relocation Policy V1.0rakhi.chadagaNo ratings yet

- Relocation PolicyDocument2 pagesRelocation PolicyDipika100% (1)

- Aisbisf-Cir-04 Dated 19.04.2022-Uniform Transfer Policy For Award Staff (2022)Document7 pagesAisbisf-Cir-04 Dated 19.04.2022-Uniform Transfer Policy For Award Staff (2022)Mahesh GhsNo ratings yet

- TravelPolicy RevDocument8 pagesTravelPolicy RevSamidha PadhiNo ratings yet

- 2.19 FNB Relocation PolicyDocument5 pages2.19 FNB Relocation PolicyXbox FlashingNo ratings yet

- India - Relocation Policy - 2014 PDFDocument5 pagesIndia - Relocation Policy - 2014 PDFmahakagrawal3100% (1)

- Fees Concession ProfarmaDocument3 pagesFees Concession ProfarmacherryprasaadNo ratings yet

- Settling in For New JoineesDocument1 pageSettling in For New JoineesSandeepNo ratings yet

- Head Office: Manipal-576104 Human Resources Department:Ird: Transfer Policy For Officers in Scale I, Ii & IiiDocument3 pagesHead Office: Manipal-576104 Human Resources Department:Ird: Transfer Policy For Officers in Scale I, Ii & Iiimahesh raghavNo ratings yet

- CEA 2023 NotificationDocument5 pagesCEA 2023 Notificationrama chandra marndiNo ratings yet

- Relocation PolicyDocument2 pagesRelocation PolicyDipika100% (1)

- Wipro International Travel PolicyDocument15 pagesWipro International Travel PolicyRiaNo ratings yet

- FR & SR An OverviewDocument36 pagesFR & SR An Overviewgreenmile2100% (1)

- Workilng Beyond Office Hours - Holiday Working Policy - Ver 4Document3 pagesWorkilng Beyond Office Hours - Holiday Working Policy - Ver 4Shahzad SundraniNo ratings yet

- Leave Policy - GTSDocument7 pagesLeave Policy - GTSSupreet SinghNo ratings yet

- A Wholly Owned Subsidiary of Air India LimitedDocument6 pagesA Wholly Owned Subsidiary of Air India Limitedalia patilNo ratings yet

- Transfer LetterDocument3 pagesTransfer LetterUr's GopinathNo ratings yet

- CA Compensable Time Policy Requirement (Homecare and ST)Document25 pagesCA Compensable Time Policy Requirement (Homecare and ST)EniNo ratings yet

- Income Tax Bba 5 Sem QuestionDocument18 pagesIncome Tax Bba 5 Sem QuestionArun GuptaNo ratings yet

- HR Policy Manual (Existing)Document20 pagesHR Policy Manual (Existing)Priyatham GangapatnamNo ratings yet

- Domestic Travel HR PolicyDocument9 pagesDomestic Travel HR PolicyrahulvaliyaNo ratings yet

- Transfer GuidelinesDocument3 pagesTransfer Guidelinesdv181No ratings yet

- 1545028677237-Lse 18Document16 pages1545028677237-Lse 18Manoj SharmaNo ratings yet

- Leave Travel Concession PDFDocument7 pagesLeave Travel Concession PDFMagesssNo ratings yet

- 183 - MTNL Transfer Policy 2011Document10 pages183 - MTNL Transfer Policy 2011hardikpanchal92No ratings yet

- Business Travel Policy PDFDocument4 pagesBusiness Travel Policy PDFSunny Billava67% (3)

- Travel FAQsDocument2 pagesTravel FAQsjrathi5848No ratings yet

- Nas Oil Gas LLC Dubai Job Offer AgreementDocument5 pagesNas Oil Gas LLC Dubai Job Offer AgreementMohamedNo ratings yet

- HR PolicyDocument38 pagesHR PolicyKrishnav BarmanNo ratings yet

- New Modified Transfer Policy of BSNLDocument12 pagesNew Modified Transfer Policy of BSNLKabul DasNo ratings yet

- 1 Transfer PolicyfjfDocument1 page1 Transfer PolicyfjfBalachandar SathananthanNo ratings yet

- Notice: No.F.2-1/2019 (Atd) - Nvs (Estt - Ii) / Mayor 2019Document3 pagesNotice: No.F.2-1/2019 (Atd) - Nvs (Estt - Ii) / Mayor 2019Anshul PatialNo ratings yet

- 1.7 H.R Policies: 1.7.1 Talent ManagementDocument9 pages1.7 H.R Policies: 1.7.1 Talent Managementaditi thakurNo ratings yet

- Relocation Policy Guidelines 2012 SEZDocument3 pagesRelocation Policy Guidelines 2012 SEZrohitmarcheight0% (1)

- Policy/Guidelines 1. Working Hour'sDocument31 pagesPolicy/Guidelines 1. Working Hour'sKhyati TrivediNo ratings yet

- WWIL Travel PolicyDocument9 pagesWWIL Travel PolicyYo Yo Moyal RajNo ratings yet

- LTC PDFDocument11 pagesLTC PDFMagesssNo ratings yet

- pdf-1004 1Document26 pagespdf-1004 1neeraj00715925No ratings yet

- TMP Officers 2002Document6 pagesTMP Officers 2002Alen KarbiaNo ratings yet

- Transfer Policy of OfficersDocument19 pagesTransfer Policy of OfficersSin SahabNo ratings yet

- Kuwait Private Sector Labour LawDocument14 pagesKuwait Private Sector Labour Lawsajeerezhimala0% (1)

- Advances Policy V1.6 - 15 Dec 2014Document4 pagesAdvances Policy V1.6 - 15 Dec 2014sangeethaNo ratings yet

- Al Naboodah Construction Group LLCDocument5 pagesAl Naboodah Construction Group LLCanon_62778587967% (6)

- Unplanned Leave. Planned Leave - Leave Planning in Advance andDocument11 pagesUnplanned Leave. Planned Leave - Leave Planning in Advance andSHERINNo ratings yet

- Olam HR PolicyDocument21 pagesOlam HR PolicyShashi NaganurNo ratings yet

- Rewards and Benefits AnnexureDocument2 pagesRewards and Benefits Annexureriteshh05No ratings yet

- KSTC - HSEQ HR Policy Ver. 2. April 2024Document6 pagesKSTC - HSEQ HR Policy Ver. 2. April 2024mohamed.magdey279No ratings yet

- ,DanaInfo Ecclb - wipro.com+ZHR FTR BONDDocument2 pages,DanaInfo Ecclb - wipro.com+ZHR FTR BONDSumit26784No ratings yet

- Relocation PolicyDocument4 pagesRelocation PolicyANURAG THAKURNo ratings yet

- Allowances and Minmum Wage ActDocument22 pagesAllowances and Minmum Wage ActjinujithNo ratings yet

- BS en 10250-3 2000Document16 pagesBS en 10250-3 2000denys7No ratings yet

- Din 13-51Document1 pageDin 13-51anks_raNo ratings yet

- Din 976Document7 pagesDin 976anks_raNo ratings yet

- Is 1364 5 2002 PDFDocument13 pagesIs 1364 5 2002 PDFBimal DeyNo ratings yet

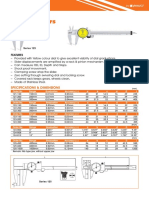

- Dial CalipersDocument1 pageDial Calipersanks_raNo ratings yet

- Din 13-51Document1 pageDin 13-51anks_raNo ratings yet

- Hardinge Workholding: Spindle Tooling For Manual & CNC LathesDocument48 pagesHardinge Workholding: Spindle Tooling For Manual & CNC Lathesanks_raNo ratings yet

- Fabory - Fasteners - Technical InformationDocument77 pagesFabory - Fasteners - Technical InformationPieter van der Meer100% (1)

- Item Name:deep Ballnose Canabalisation Hitachi Vs RPM.: Qty:2nos Tool DimensionDocument2 pagesItem Name:deep Ballnose Canabalisation Hitachi Vs RPM.: Qty:2nos Tool Dimensionanks_raNo ratings yet

- Ballnose Details PDFDocument2 pagesBallnose Details PDFanks_raNo ratings yet

- Is 1570Document139 pagesIs 1570jajodia239No ratings yet

- ISO 7089 (Washer)Document1 pageISO 7089 (Washer)anks_raNo ratings yet

- James and Megan Webb Recently Purchased A Home For 300 000Document1 pageJames and Megan Webb Recently Purchased A Home For 300 000Amit PandeyNo ratings yet

- Harvardian College vs. Country BankersDocument1 pageHarvardian College vs. Country BankersChaNo ratings yet

- Deloitte IT Governance SurveyDocument20 pagesDeloitte IT Governance Surveymrehan2k2No ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document2 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)rajib paulNo ratings yet

- Draft Copy - 2 MW PV Project PDFDocument142 pagesDraft Copy - 2 MW PV Project PDFMahendra Asawale100% (1)

- Amended Sections in Insurance CodeDocument5 pagesAmended Sections in Insurance CodeCrislene CruzNo ratings yet

- Art 1544Document8 pagesArt 1544jayhandarwinNo ratings yet

- OS Original ReportDocument61 pagesOS Original ReportJithin KottikkalNo ratings yet

- Applied Direct TaxationDocument548 pagesApplied Direct TaxationVarun SinghNo ratings yet

- Confirmation FormDocument2 pagesConfirmation FormLi XiangNo ratings yet

- Gujarat Law Society GLS Law College, Ahmedabad Integrated Five-Year B.A.LL.B ProgrammeDocument6 pagesGujarat Law Society GLS Law College, Ahmedabad Integrated Five-Year B.A.LL.B ProgrammeHarsh SharmaNo ratings yet

- How To Start A Money Remittance Business in The PhilippinesDocument3 pagesHow To Start A Money Remittance Business in The Philippinesar vinNo ratings yet

- Confidential Information Exchange AgreementDocument6 pagesConfidential Information Exchange AgreementRachelle Anne BillonesNo ratings yet

- Cooperative Housing and FHADocument49 pagesCooperative Housing and FHAYamang TagguNo ratings yet

- Insurance in Your State ActivityDocument3 pagesInsurance in Your State Activityalexis tamanaNo ratings yet

- Chapter 2Document48 pagesChapter 2Muhaizam MusaNo ratings yet

- 01 MeetingDocument113 pages01 MeetingslumbaNo ratings yet

- Huum - Info Shriram Life Insurance Company Wiki PRDocument2 pagesHuum - Info Shriram Life Insurance Company Wiki PRRitik JainNo ratings yet

- Raj Bank PPT 2003Document32 pagesRaj Bank PPT 2003Sunny Bhatt100% (1)

- Auditing Theory - Internal Control ConsiderationDocument11 pagesAuditing Theory - Internal Control ConsiderationNeil BacaniNo ratings yet

- FFFS Tender Doc1Document410 pagesFFFS Tender Doc1brumanciaNo ratings yet

- Taxation I - PreFinals - Corporation Income TaxationDocument91 pagesTaxation I - PreFinals - Corporation Income TaxationMicha Chernobyl Malana-CabatinganNo ratings yet

- Specialized Accounting TechniquesDocument5 pagesSpecialized Accounting TechniquesFridah Apondi100% (1)

- Japan Retirement SystemDocument44 pagesJapan Retirement SystemMea Sañana GumawaNo ratings yet

- "Customer Satisfaction On Service Provided by Future Generali" QuestionnaireDocument4 pages"Customer Satisfaction On Service Provided by Future Generali" QuestionnaireVyshnavi KarthicNo ratings yet

- HDFC Life Sampoorn Samridhi Plus - Brochure PDFDocument12 pagesHDFC Life Sampoorn Samridhi Plus - Brochure PDFmonicaNo ratings yet

- Lof and Scopic HistoryDocument22 pagesLof and Scopic HistoryBansal SunilNo ratings yet

- Personal BudgetDocument4 pagesPersonal BudgetIvana GrinfelderNo ratings yet

- RFP For PA DTD 05022021Document73 pagesRFP For PA DTD 05022021pramod_kmr73No ratings yet

- ECS Direct Debit Mandate FormDocument3 pagesECS Direct Debit Mandate FormManish KumarNo ratings yet