Professional Documents

Culture Documents

Tribunal Form

Uploaded by

Ami KarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tribunal Form

Uploaded by

Ami KarCopyright:

Available Formats

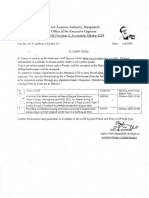

FORM OF APPEAL TO THE TAXES APPELLATE TRIBINAL.

In the Taxes Appellate Tribunal.. No .of 2011 Appellant: Harun Twisting Industries (Pvt.) Ltd.

Income Tax * Circle in which assessment was made and * range/zone/in which it is located. Income year Assessment year Section of the income Tax Ordinance, 1984 Under which the Deputy Commissioner of Taxes passed the order. * Inspecting joint Commissioner of Taxes determining the appeal. * Appellate Joint Commissioner of Taxes determining the appeal. * Appellate Commissioner of Taxes determining the appeal. Date of communication of the order of the deputy Commissioner of Taxes. Inspecting Joint Commissioner of Taxes Appellate Joint Commissioner of Taxes Appellate Joint Commissioner of Taxes determining the appeal. Appellate Commissioner of Taxes determining the appeal Address to which notices may be sent to the respondent Address to which notice nay be sent to the Appellant Claim in appeal.

VS

Respondent: Taxes Commissioner Appeal

Office of the Deputy Commissioner of Taxes Company Circle -21, Taxes Zone-7, Dhaka. 2008-2009 2009-2010 83(2) /82 C

15-09-2011

15-09-2011 Office of the Deputy Commissioner of Taxes Company Circle -21, Taxes Zone-7, Dhaka. Director,Harun Twisting Industries (Pvt.) Ltd., Plot-2, Road -3, Section-7, Mirpur, Dhaka. As per grounds of Appeal

GROUND ON APPEAL

1. Appeal was made only to reduce the wastage sale on the basis of accuracy. But Appellate Commissioner of

Taxes, Taxes Appeal Zone-3, has refused the appeal with the cause under section 153(3) without putting comments on wastage sale.

2. The garments are 100% export oriented and clothing are supplied by the buyer with a reasonable

consideration of wastage which has comes the wastage sale value only 12,000.00. With all consideration the learned DCT has estimated wastage sale Tk. 2,00,000.00 instead of Tk. 12,000.00. As per Section 153(3) taxes has been paid for an amounting taka 2,78,500.00 (Copy Attached)

3.

Signature: .. (Appellant/Authorized Representative, if any)

Verification.

I Harun Twisting Industries (Pvt.) Ltd. the appellant / authorized representative, do hereby declare that what is stated above is true to the best of my information and belief. Verified today, the day of November 2011

Signature: .. (Appellant/Authorized Representative, if any)

Note- 1. The memorandum of appeal) including the grounds of appeal when filed on a separate paper) must be in triplicate and shall be accompanied by two copies (at least one of which should be certified copy) of the order appealed against and two copies of the order of the Deputy Commissioner of Taxes. 2. The memorandum of appeal in the case of an appeal by the assessee must be accompanied by a fee of five hundred taka. It is suggested that the fee be credited in the Treasury or a branch of the Sonali Bank or the Bangladesh Bank after obtaining a challan from the Deputy Commissioner of Taxes and the triplicate portion of the challan sent to the Appellate Tribunal with the memorandum of appeal. The Appellate Tribunal shall not accept cheques, drafts, hundies or other negotiable instruments. 3. The memorandum of appeal shall set forth concisely and under distinct heads, the grounds of appeal without any argument or narrative and such grounds shall be numbered consecutively. Delete which ever is inapplicable.

You might also like

- 224 XXDocument1 page224 XXAmi KarNo ratings yet

- JB, O) !J1.1 - : Civil Aviation Authority, Bangladesh Office of The Executive Engineer E/M Division-!, Kunnitola, Dhaka-1229Document1 pageJB, O) !J1.1 - : Civil Aviation Authority, Bangladesh Office of The Executive Engineer E/M Division-!, Kunnitola, Dhaka-1229Ami KarNo ratings yet

- E-GAP - Session V - Jane Hupe - Carbon Markets - FinalDocument7 pagesE-GAP - Session V - Jane Hupe - Carbon Markets - FinalAmi KarNo ratings yet

- CAC-3 Low Visibility Helicopter OpsDocument4 pagesCAC-3 Low Visibility Helicopter OpsAmi KarNo ratings yet

- Ri WRN,: 1"1 11"1 1"'1'!1 R !l"1 1"'l'flDocument1 pageRi WRN,: 1"1 11"1 1"'1'!1 R !l"1 1"'l'flAmi KarNo ratings yet

- 125 XXDocument1 page125 XXAmi KarNo ratings yet

- CAA Bangladesh E-Tender Notice for O&M Works and Pump InstallationDocument1 pageCAA Bangladesh E-Tender Notice for O&M Works and Pump InstallationAmi KarNo ratings yet

- Civil Aviation Authority, Bangladesh: EngiDocument1 pageCivil Aviation Authority, Bangladesh: EngiAmi KarNo ratings yet

- Power System Nagrath-Kothari-Solutions PDFDocument88 pagesPower System Nagrath-Kothari-Solutions PDFAmi Kar100% (1)

- Npa 2017-14Document62 pagesNpa 2017-14Mário MineiroNo ratings yet

- Theoretical and Practical Training SyllabusDocument1 pageTheoretical and Practical Training SyllabusAmi KarNo ratings yet

- Power System Nagrath-Kothari-Solutions PDFDocument88 pagesPower System Nagrath-Kothari-Solutions PDFAmi Kar100% (1)

- CAAB Post Holder FormDocument1 pageCAAB Post Holder FormAmi KarNo ratings yet

- How to Apply for Cantonment Board Services in BangladeshDocument1 pageHow to Apply for Cantonment Board Services in BangladeshAmi KarNo ratings yet

- BELL407GX 282019 Req ForeignDocument1 pageBELL407GX 282019 Req ForeignAmi KarNo ratings yet

- ReadmeDocument1 pageReadmeAmi KarNo ratings yet

- CAAB Post Holder FormDocument1 pageCAAB Post Holder FormAmi KarNo ratings yet

- ReadmeDocument7 pagesReadmeAndrei SlevoacaNo ratings yet

- ReadmeDocument7 pagesReadmeAndrei SlevoacaNo ratings yet

- UNDP guidance on micro-grants for poverty reductionDocument3 pagesUNDP guidance on micro-grants for poverty reductionAmi KarNo ratings yet

- User Guide - 6 - 2018 PDFDocument89 pagesUser Guide - 6 - 2018 PDFAmi KarNo ratings yet

- A 109E A109S AW 109SP Helicopter SpecificationDocument33 pagesA 109E A109S AW 109SP Helicopter SpecificationBayu Panji BaskoroNo ratings yet

- A109S-AW109SP IETP - 23rd Issue 2018-04-05 - BookletDocument3 pagesA109S-AW109SP IETP - 23rd Issue 2018-04-05 - BookletAmi KarNo ratings yet

- Windows 8 - Notice PDFDocument1 pageWindows 8 - Notice PDFSanthosh KumarNo ratings yet

- Service InformationDocument23 pagesService InformationAmi KarNo ratings yet

- A109 EquiptmentDocument3 pagesA109 EquiptmentAmi KarNo ratings yet

- CostDocument1 pageCostAmi KarNo ratings yet

- Diabetic Foot UlcerDocument1 pageDiabetic Foot UlcerKartika Ramadhani BahriNo ratings yet

- How to Apply for Cantonment Board Services in BangladeshDocument1 pageHow to Apply for Cantonment Board Services in BangladeshAmi KarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- GE Group5 ChipotleMexicanGril Report FinalDocument29 pagesGE Group5 ChipotleMexicanGril Report FinalGustavo Dantas100% (3)

- Beauty SalonDocument6 pagesBeauty SalonsharatchandNo ratings yet

- Cost Accounting 1 8 FinalDocument16 pagesCost Accounting 1 8 FinalAsdfghjkl LkjhgfdsaNo ratings yet

- BERLE Theory of Enterprise 1947Document17 pagesBERLE Theory of Enterprise 1947Sofia DavidNo ratings yet

- Augat v. AegisDocument7 pagesAugat v. AegisRobert Sunho LeeNo ratings yet

- Cost of Capital Calculations for Preference Shares, Bonds, Common Stock & WACCDocument5 pagesCost of Capital Calculations for Preference Shares, Bonds, Common Stock & WACCshikha_asr2273No ratings yet

- Unit 2-Cost Classification TutorialDocument4 pagesUnit 2-Cost Classification TutorialBarby AngelNo ratings yet

- Risk Aversion, Neutrality, and PreferencesDocument2 pagesRisk Aversion, Neutrality, and PreferencesAryaman JunejaNo ratings yet

- Partnership - I: "Your Online Partner To Get Your Title"Document10 pagesPartnership - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Equity analysis of auto stocksDocument4 pagesEquity analysis of auto stocksYamunaNo ratings yet

- OFFICIAL ANNOUNCEMENT DEBT BURDEN LIBERATION - M1 MASTER BOND in EnglishDocument5 pagesOFFICIAL ANNOUNCEMENT DEBT BURDEN LIBERATION - M1 MASTER BOND in EnglishWORLD MEDIA & COMMUNICATIONS88% (8)

- 17.defect Liability Period and Account Closing - en .Wan SaipallahDocument34 pages17.defect Liability Period and Account Closing - en .Wan SaipallaherickyfmNo ratings yet

- Balance Sheet of Union Bank of IndiaDocument2 pagesBalance Sheet of Union Bank of Indiajini02No ratings yet

- Answer Formula Edited XDocument176 pagesAnswer Formula Edited Xmostafa motailqNo ratings yet

- Warranty Liability: Start of DiscussionDocument2 pagesWarranty Liability: Start of DiscussionclarizaNo ratings yet

- 2019 Mid-Semester Mock Exam SolutionDocument11 pages2019 Mid-Semester Mock Exam SolutionMichael BobNo ratings yet

- BCG Forage Core Strategy - Telco (Task 2 Additional Data)Document9 pagesBCG Forage Core Strategy - Telco (Task 2 Additional Data)Fadil JauhariNo ratings yet

- Game Plans, Sajjan Jindal, Managing Director, JSW SteelDocument2 pagesGame Plans, Sajjan Jindal, Managing Director, JSW SteelSangitaa AdvaniNo ratings yet

- BPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988 Ruling on Contract of DepositDocument4 pagesBPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988 Ruling on Contract of DepositaldinNo ratings yet

- Ability Abrogation Accent All Abject abrogation Accepted AccordionDocument12 pagesAbility Abrogation Accent All Abject abrogation Accepted AccordionMae Anthonette RamosNo ratings yet

- Analytical Tools - End Term - Tri 3 Set 1Document9 pagesAnalytical Tools - End Term - Tri 3 Set 1wikiSoln blogNo ratings yet

- AACE Cash FlowDocument17 pagesAACE Cash FlowFrancois-No ratings yet

- Chapter 4 Consolidated Financial Statements Piecemeal AcquisitionDocument11 pagesChapter 4 Consolidated Financial Statements Piecemeal AcquisitionKE XIN NGNo ratings yet

- Makalah BOP - Kelompok 2 - Monetary EconomicsDocument15 pagesMakalah BOP - Kelompok 2 - Monetary EconomicsMochammad YusufNo ratings yet

- Bwa M 033116Document10 pagesBwa M 033116Chungsrobot Manufacturingcompany100% (1)

- Solution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L BlackDocument5 pagesSolution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L BlackMarjorie Rosales100% (39)

- Joint and Solidary ObligationsDocument13 pagesJoint and Solidary ObligationsNimfa Sabanal100% (2)

- Land Titles and Deeds Exam QuestionsDocument4 pagesLand Titles and Deeds Exam QuestionslabotogNo ratings yet

- The Stock Repair Strategy: Interactive Brokers WebcastDocument19 pagesThe Stock Repair Strategy: Interactive Brokers Webcast9952090083No ratings yet

- Accounting NSC P1 MG Sept 2022 Eng GautengDocument13 pagesAccounting NSC P1 MG Sept 2022 Eng GautengSweetness MakaLuthando LeocardiaNo ratings yet