Professional Documents

Culture Documents

4022 Eo 01

Uploaded by

Anupama BandaruOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4022 Eo 01

Uploaded by

Anupama BandaruCopyright:

Available Formats

OVERVIEW OF PERSONAL INSURANCE (22-1) [Personal insurance transfers the financial consequences of losses from individuals and families

to insurers. A loss exposure is any condition that creates the possibility of financial loss.] [The three major types of loss exposures faced by individuals and families: 1. property loss exposures--EO 2, 2. liability loss exposures--EO 3, and 3. financial planning loss exposures--EO 4.] EO 1. 1. 2. 3. THE THREE ELEMENTS OF A LOSS EXPOSURE: asset (aka item subject)--is the subject or item exposed to loss, such as a home, money, personal property, a workers income, an investment portfolio, or a workers good health; peril or cause of loss--is the agent that causes reduction in the assets value; and financial consequence of loss--is the reduction the assets value, which varies depending on the type of asset exposed to loss, the cause of loss, and the severity of loss.

EO 2. A PROPERTY LOSS EXPOSURE is a condition or set of circumstances that presents the possibility of property damage, destruction, or disappearance as a result of a peril (cause of loss). ASSETS EXPOSED TO PROPERTY LOSS: 1. Real property--is what youd leave behind if you sold your home--the land and all its attached structures, whether built on or built into the land, and all those structures attached fixtures. Kinds of real property that might be exposed to loss include the individuals or familys home, vacation home, detached garage, built-in swimming pool, gazebo, satellite dish, tool shed, dog house, condominium private and common areas, and rental property. 2. Personal property--is what youd take with you if you sold your home. Kinds of personal property that might be exposed to loss: personal a. dwelling contents--normally located at home, so exposed to the same types of losses as the house; but also movable, so also subject to theft. Contents losses are generally easy to value. b. high-valued property--small and light, but expensive, so highly subject to theft; includes money, securities, coins, silverware, precious metals, jewelry, gems, watches, furs, and guns. c. property with intrinsic value--intrinsic value based on rarity, artistic merit, historic value, or other scarce characteristics; includes art, stamp collections, antiques, photographs, computer software, and valuable papers. Values of property with intrinsic value should be agreed to when insurance is purchased; not at time of loss. d. business personal property--such property should be insured by the business even when its at someones home. e. motor vehicles, watercraft, aircraft, and recreational vehicles--if self-powered, such vehicles are either completely excluded under homeowners coverage and need separate insurance or the coverage is extremely limited. Exception: Self-propelled equipment for maintaining premises (such as riding lawnmowers) and self-propelled wheelchairs are adequately covered by homeowners insurance. CAUSES OF PROPERTY LOSS include fire, lightning, windstorm, hail, aircraft, riot, vehicles, explosion, smoke, vandalism, theft, falling objects, weight of ice and snow, volcanic eruption, flood, damage caused by building mechanical systems, auto collision, earthquake, and other means. Obsolete 12/16/2009 Copyright 2008 Orders: 1-888-BURNHAM, 9 to 5 Eastern. Please, tell a friend. 22-1-1 by Ray Burnham, Southbridge, MA 01550 Purchasers use only.

FINANCIAL CONSEQUENCES THAT MIGHT RESULT FROM A PROPERTY LOSS: 1. reduction in the propertys value--from its pre-loss to its post-loss value, 2. increased expenses--for additional living expenses or car rental, and 3. lost income--if owned property was rented to others. EO 3. A LIABILITY LOSS EXPOSURE is a condition that creates the possibility that an individuals financial resources may be diminished as a result of a liability loss (claim for money damages due to injury to another or damage to anothers property). ASSETS EXPOSED TO LIABILITY LOSS include all currently owned financial assets and, possibly, some future income. Damages refers to the monetary award one party is required to pay to another for 1. bodily injury or 2. property damage for which the first party is legally liable. Compensatory damages compensate a person for his bodily injury or property damage. Compensatory damages include 1. special damages (compensation for out-of-pocket losses) and 2. general damages (compensation for noneconomic losses, such as pain and suffering). Punitive (aka exemplary) damages punish wrongdoers and set an example to others to deter similar future misconduct. THE CAUSE OF LIABILITY LOSS is the chance of a claim for money damages (since financial loss starts with investigation), including defense, and maybe culminating with a judgment for money damages. BASES ON WHICH LIABILITY CLAIMS FOR DAMAGES MIGHT BE SOUGHT: 1. Tort liability--arises from a tort (non-contractual civil wrong against another). a. Intentional torts: Defamation damages anothers reputation with an untruth. Its libel if its written; slander if its spoken. Assault threatens another with unprivileged touching. Battery is the actual touching. Trespass is unauthorized use of anothers land. Nuisance interferes with anothers quiet enjoyment of his property. b. Negligence torts--require the four elements of negligence: 1) a legal duty to another, 2) a breach of that duty, 3) injury or harm to another, 4) as a direct result of the breach. [Simply, breached duty caused damage.] Negligence is the failure to use reasonable care to prevent injury to another or damage to anothers property. You might serve a friend tainted food or shoot someones horse while deer hunting. c. Absolute liability torts--involve inherently dangerous, but legal, activities such as owning a wild pet, a vicious dog, or a gun; blasting; and using explosives. The injured party only needs to prove injury as a result of the defendants activity. 2. Contractual liability--arises when one person agrees to accept the financial responsibility for anothers liability. Leases and rental agreements often shift the owners liability to the user. 3. Statutory liability--is liability imposed by a specific law. Most commonly, statutory liability relates to auto liability and workers compensation. Obsolete 12/16/2009 Copyright 2008 Orders: 1-888-BURNHAM, 9 to 5 Eastern. Please, tell a friend. 22-1-2 by Ray Burnham, Southbridge, MA 01550 Purchasers use only.

FINANCIAL CONSEQUENCES THAT MIGHT RESULT FROM A LIABILITY LOSS: 1. investigation costs, 2. defense costs, and 3. damages--if the defense is not successful or the claim settles out of court. EO 3. A PERSONAL FINANCIAL PLANNING LOSS EXPOSURE is a situation that might cause financial loss to an individual or his family and/or that is related to retirement, premature death, poor health, disability, or unemployment. FOUR TYPES OF PERSONAL FINANCIAL PLANNING LOSS EXPOSURES: 1. Retirement--The assets exposed to loss include the workers regular income and benefits, such as health insurance. Upon retirement, a worker must replace most of his regular income with Social Security, private retirement plans, and personal savings. The primary risk associated with retirement is that the retired worker will not have enough assets and retirement income to compensate for the loss of income and benefits. 2. Premature death--A death is premature if it occurs before a person reaches his life expectancy. The assets exposed to loss include the decedents future income. The causes of loss include accident, illness, and intentional death. 3. Poor health and disability--An individual faces a. increased expenses--for medical care due to illness or injury and b. decreased revenues--lost income and reduced employee benefits due to illness or injury. The causes of loss associated with health and disability loss exposures are chronic illness and/or physical or mental disability. The four types of disability classifications: a. Temporary partial disability--means the worker can perform some job duties for a period of time and will eventually resume full job duties. b. Temporary total disability--means the worker can perform no job duties for a period of time, but will eventually resume full job duties. c. Permanent partial disability--means the worker will not recover, but can work at a lower capacity. d. Permanent total disability--means the worker can not work and will not recover. 4. Unemployment--The assets exposed to loss include income and employer-provided benefits. The causes of loss may be voluntary or involuntary. Earnings stop, but costs of job searching, retraining, and counseling increase. EO 5. PERSONAL RISK MANAGEMENT is the 1) identification, 2) analysis, and 3) treatment of the pure loss exposures of an individual or family. THE SIX STEPS IN THE RISK MANAGEMENT PROCESS: 1. Identify loss exposures--Individuals and families usually rely on themselves, friends, family, and their insurance agents to help identify loss exposures. The most common personal loss exposures arise from home and auto ownership. 2. Analyze loss exposures--Estimate the likelihood and significance of the losses identified. The four dimensions used in loss exposure analysis: a. Loss frequency--is the number of losses within a specified period. b. Loss severity--is the amount of a loss, measured in dollars. c. Total dollar losses--is the total dollar amount of all losses within a specified period. d. Timing--has two dimensions: when losses occur and when payments are made. 3. Examine alternative risk management treatment techniques--See EO 6. Obsolete 12/16/2009 Copyright 2008 Orders: 1-888-BURNHAM, 9 to 5 Eastern. Please, tell a friend. 22-1-3 by Ray Burnham, Southbridge, MA 01550 Purchasers use only.

4. 5.

6.

Select the best technique--Choose the technique(s) that best prevent or reduce losses and/or finance those losses that do occur. Implement the selected technique(s)--Take the necessary steps to make the techniques happen. Examples: Make a list of assets at risk. Buy loss reduction devices. Hire loss prevention services. Begin loss control programs. Get expert help for complicated exposures. Buy insurance. Review and revise the plan as needed--Periodically review the risk management program and make adjustments as needed to address changes in loss exposures. TWO TYPES OF RISK MANAGEMENT TECHNIQUES: Risk control techniques--prevent and/or reduce loss exposures. Risk financing techniques--generate funds to pay for losses that do occur.

EO 6. 1. 2.

FIVE CATEGORIES OF RISK CONTROL TECHNIQUES: 1. Avoidance--shuns exposures that dont have to be assumed and/or eliminates exposures that already exist. 2. Loss control--changes the loss exposure through a. loss prevention measures--reduce loss frequency (how often losses occur--measures the number of losses) and b. loss reduction measures--reduce loss severity (the amount of damage caused by losses which do occur--measures the size of losses). 3. Separation--disperses resources over two or more locations. Example: Keep some jewelry at home and some in a banks safety deposit box. 4. Duplication--creates copies or spares of important items and stores them at separate locations. Example: Save important files on both the computers hard drive and on a removable flash drive. 5. Diversification--spreads loss exposures over several projects, products, markets, and/or regions. Example: Allocate investments among a mix of stocks and bonds from companies in different industries. THREE CATEGORIES OF RISK FINANCING TECHNIQUES: 1. Noninsurance transfer--transfers the loss exposure to another party that is not an insurance company. Examples: A hold harmless agreement is a contract in which one party assumes anothers legal liability, such as in an apartment lease. Hedging is a financial transaction in which one asset is held to offset the risks associated with another asset. 2. Insurance transfer--transfers the loss exposure to an insurer. 3. Retention--has the individual or family bear the loss exposure and fund the consequences of any losses directly. Example: a deductible (part of an insured loss that is not paid by the insurer). Planned retention retains identified loss exposures. Unplanned retention retains unidentified loss exposures. EO 7. 1. 2. 3. PERSONAL INSURANCE consists of three layers: Individual insurance--such as homeowners and personal auto insurance. Group insurance--such as group health and life insurance sold to a firms employees. Social insurance--that provide a base layer of protection for losses caused by injury, death, retirement, and unemployment. Social insurance programs include Social Security, unemployment insurance, railroad worker programs, and state temporary disability insurance. Orders: 1-888-BURNHAM, 9 to 5 Eastern. Please, tell a friend. 22-1-4 by Ray Burnham, Southbridge, MA 01550 Purchasers use only.

Obsolete 12/16/2009 Copyright 2008

HOW INSURANCE ADDRESSES PERSONAL LOSS EXPOSURES: 1. Property and liability loss exposures--The personal auto policy (PAP) covers auto-related property and liability loss exposures. The homeowners policy covers homes and their contents, and also personal liability. The personal umbrella policy covers large awards for personal liability. 2. Retirement loss exposures--Individuals use savings plans, pension plans, and individual retirement accounts to mitigate the financial consequences of retirement loss. Social Security is available for workers who are at least 62 years old. Some retirees convert their savings into annuities to guarantee monthly incomes for life. 3. Premature death loss exposures--Life insurance is the most common way to manage the premature death exposure. Two methods for determining how much life insurance to buy: a. Needs-based approach--determines the appropriate amount of life insurance by analyzing the familys cash requirements to meet debts and to meet obligations to dependents (based on their number and ages) and the surviving spouse and to pay for educational expenses, mortgage and rent requirements, and other needs. b. Human life value approach--determines life insurance needs by calculating the economic value of a persons life based on that persons earning capacity and others financial dependence on that earning capacity. 4. Health and disability loss exposures--Health and disability insurance reduces the financial burden of illness and disability. Social insurance programs include Medicare, Medicaid, and workers compensation insurance. Workers compensation refers to those state statutes that provide for fixed awards and medical reimbursement to employees and their dependents for employment-related injury and illness. 5. Unemployment loss exposures--State unemployment compensation programs provide weekly cash benefits to eligible workers who are involuntarily unemployed. Unemployment benefits are typically paid up to a set maximum number of weeks, but a state may increase the number of weeks depending on economic conditions, especially high state unemployment rates. Federally-subsidized benefits may be available in states with especially depressed economies. EO 8. 1. THE SIX PARTS OF A PROPERTY-CASUALTY POLICY: Declarations--provide specific details about the insured and the subject of the insurance. The declarations page identifies the policy number, the coverage period, the insurer and agent, the insured, the other entities with covered interests, the insureds mailing address, the physical address, the description of covered property or operations, the policy limits, the deductible, the premium, and any applicable forms and endorsements (documents that amend the policy). Definitions--assign meanings to policy terms. Policies often indicate defined terms with boldface type, quotation marks, capital letters, or italics. Undefined words and phrases follow these general rules of contract interpretation: a. Everyday words are given their ordinary meanings. b. Technical words are given their technical meanings. c. Words with established legal meanings are given those legal meanings. d. Consideration is given to local, cultural, and trade meanings. Insuring agreements--state that under some circumstances the insurer will make a payment or will provide a service. A policy may have more than one insuring agreement. Example: The personal auto policy (PAP) provides coverage (and has insuring agreements) for liability, medical payments, uninsured motorists, and damage to your auto. Orders: 1-888-BURNHAM, 9 to 5 Eastern. Please, tell a friend. 22-1-5 by Ray Burnham, Southbridge, MA 01550 Purchasers use only.

2.

3.

Obsolete 12/16/2009 Copyright 2008

4.

5.

6.

Conditions--qualify an otherwise enforceable promise of the insurer. Examples: The insureds duties to pay premiums, report losses promptly, document losses, and cooperate with the insurer. Exclusions--include any policy provision that eliminates coverage for a specified loss exposure. Exclusions clarify coverage by indicating what is not covered. Examples: Most property insurance policies exclude war and nuclear contamination. Most liability policies exclude loss that the insured expected or intended. Miscellaneous provisions--do not qualify as declarations, definitions, insuring agreements, conditions, or exclusions. Miscellaneous provisions may discuss the insurer/insured relationship or establish policy procedures, without carrying the force of conditions. Example: a valuation provision that states the method of measuring covered losses.

SEVEN REASONS FOR POLICY EXCLUSIONS: to 1. eliminate uninsurable loss exposures--such as war, earthquake, flood, normal wear and tear, inherent vice, and the insureds intentional acts. 2. help control moral hazards. Moral hazards arise from a. active inducement of loss and/or b. the temptation to exaggerate loss. 3. help control attitudinal hazards. Attitudinal hazards aka morale hazards arise from a. passive indifference to loss and/or b. carelessness in controlling loss. 4. eliminate coverage duplications between standard policies--such as the exclusion of business losses from personal liability policies. 5. eliminate unneeded coverage for typical purchasers--such as the HOs limits on boats, money, and business property. 6. eliminate coverage that requires special rating or underwriting treatment--such as the exclusion of steam boiler explosions from commercial property policies. 7. keep premiums more affordable--such as by eliminating coverage for road damage to tires from personal auto policies. EO 9. 1. POLICY ANALYSIS: Pre-loss policy analysis--determines what losses would be covered. Three skills required for before-loss policy analysis: the abilities to a. understand the different ways policies describe coverage, b. identify and evaluate unusual policy provisions, and c. understand the risks exposures. Pre-loss policy analysis relies on scenario analysis, which involves determining what losses might occur and then comparing the provisions of the policy against those possible losses. Sources of information for an insureds scenario analysis include the insureds past loss experience, the experiences of friends and relatives, and insurance producers. Post-loss policy analysis--determines if that particular loss is covered. Two steps in post-loss policy analysis: a. Determine if the claim is covered by the policy. b. Then, if the claim is covered, find the dollar amount to be paid. The primary method of post-loss policy analysis is the DICE method (acronym for declarations, insuring agreements, conditions, and exclusions), which involves a four-step systematic review of the policy provisions to see if any of the provisions precluded coverage. Orders: 1-888-BURNHAM, 9 to 5 Eastern. Please, tell a friend. 22-1-6 by Ray Burnham, Southbridge, MA 01550 Purchasers use only.

2.

Obsolete 12/16/2009 Copyright 2008

THE DICE METHOD OF POST-LOSS POLICY ANALYSIS: 1. Declarations page--Did the loss occur during the policy period? Did the policy cover the person or property at the time of the loss? 2. Insuring agreement--Did the loss occur to covered property or due to a covered event? Was the loss caused by a covered cause of loss? Did the loss occur in the coverage territory? 3. Conditions--Did the insured meet his duties? 4. Exclusions--Does the policy eliminate coverage for the loss? DETERMINING THE AMOUNT PAYABLE--Property insurance policies include valuation provisions that indicate how values are determined. Liability insurance policies contain promises to provide the defense and to pay the amount of legal liability. Policies may include other expenses, such as expenses to protect property against further loss. Settlement calculations should consider the valuation basis, the deductible, any coinsurance, the policy limit, and any other loss-sharing provisions.

Obsolete 12/16/2009 Copyright 2008

Orders: 1-888-BURNHAM, 9 to 5 Eastern. Please, tell a friend. 22-1-7 by Ray Burnham, Southbridge, MA 01550 Purchasers use only.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Enterprise Performance Management NotesDocument16 pagesEnterprise Performance Management NoteswoalynnNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Important Insurance Financial Awareness QuestionsDocument11 pagesImportant Insurance Financial Awareness QuestionsJagannath JagguNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Banca San Giovanni Case Study: Fransiskus Allan Gunawan - Indra Tangkas PSDocument3 pagesBanca San Giovanni Case Study: Fransiskus Allan Gunawan - Indra Tangkas PSAllan GunawanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Recto Law and Maceda LawDocument4 pagesThe Recto Law and Maceda LawMs. FitNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Bond Market - MMSDocument124 pagesBond Market - MMSkanhaiya_sarda5549No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Complaint AffidavitDocument4 pagesComplaint AffidavitDever GeronaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Techniques of Asset/liability Management: Futures, Options, and SwapsDocument43 pagesTechniques of Asset/liability Management: Futures, Options, and SwapsSushmita BarlaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Wealthy Barber 1Document11 pagesThe Wealthy Barber 1api-526752866No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- BPI vs. Sps. SantiagoDocument3 pagesBPI vs. Sps. SantiagoAlecsandra ChuNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Presented By: URVI SINGH Research Scholar Enrollment Number: 2014PHDCOM003 Supervisor: Dr. RUCHITA VERMA Assistant ProfessorDocument18 pagesPresented By: URVI SINGH Research Scholar Enrollment Number: 2014PHDCOM003 Supervisor: Dr. RUCHITA VERMA Assistant ProfessorHari KrishnaNo ratings yet

- DocxDocument7 pagesDocxHeni OktaviantiNo ratings yet

- Module 16 - Cash and Cash EquivalentsDocument7 pagesModule 16 - Cash and Cash EquivalentsLuiNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Toyota Shaw IncDocument2 pagesToyota Shaw IncBrains SagaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Wealth DynamicsDocument32 pagesWealth Dynamicsmauve08No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Philippine Economic Zone Authority (PEZA)Document7 pagesPhilippine Economic Zone Authority (PEZA)LeaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Berar Finance LimitedDocument9 pagesBerar Finance LimitedKamlakar AvhadNo ratings yet

- GANESHDocument64 pagesGANESHganesh_shuklaNo ratings yet

- Business Intelligence in BankingDocument299 pagesBusiness Intelligence in Bankingsohado100% (1)

- 14 Interest Rate and Currency SwapsDocument45 pages14 Interest Rate and Currency SwapsJogendra BeheraNo ratings yet

- Conflictofinterest AGDocument204 pagesConflictofinterest AGbonecrusherclanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Structured Finance SolutionsDocument7 pagesStructured Finance SolutionsHimanshu DovalNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Impact of of Issuance of Sovereign Bonds On Short Term andDocument3 pagesImpact of of Issuance of Sovereign Bonds On Short Term andAkash BafnaNo ratings yet

- Export Credit Agencies - The Unsung Giants of International Trade and FinanceDocument207 pagesExport Credit Agencies - The Unsung Giants of International Trade and Financeace187No ratings yet

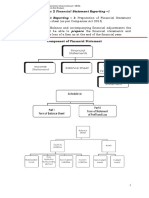

- Financial Statement ReportingDocument20 pagesFinancial Statement ReportingAshwini Khare0% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Sadaya v. Sevilla case on accommodation partiesDocument16 pagesSadaya v. Sevilla case on accommodation partiesAdrian HilarioNo ratings yet

- Deloitte Annual Review of Football Finance (2014)Document10 pagesDeloitte Annual Review of Football Finance (2014)Tifoso BilanciatoNo ratings yet

- Error: Reference Source Not FoundDocument11 pagesError: Reference Source Not FoundAnaValenzuelaNo ratings yet

- Capital Structure Analysis of Hero Honda, For The Year 2005 To 2010Document8 pagesCapital Structure Analysis of Hero Honda, For The Year 2005 To 2010shrutiNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- MODULE 5 Interest RateDocument4 pagesMODULE 5 Interest RateDonna Mae FernandezNo ratings yet

- Asset Quality Report Deutche Bank and BNPDocument5 pagesAsset Quality Report Deutche Bank and BNPblazivica999No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)