Professional Documents

Culture Documents

Balansheet

Uploaded by

raman0007Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balansheet

Uploaded by

raman0007Copyright:

Available Formats

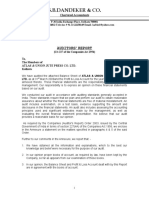

http://www.tatasteel.com/media/pdf/annual-report-2009-10.pdf TO THE MEMBERS OF TATA STEEL LIMITED 1.

We have audited the attached Balance Sheet of TATA STEEL LIMITED (the Company) as at 31st March, 2010, the Pro t and Loss Account and the Cash Flow Statement of the Company for the year ended on that date, both annexed thereto, in which are incorporated the Returns from the Singapore Branch audited by another auditor. These nancial statements are the responsibility of the Companys Management. Our responsibility is to express an opinion on these nancial statements based on our audit. 2. We conducted our audit in accordance with the auditing standards generally accepted in India. Those Standards require that we plan and perform the audit to obtain reasonable assurance about whether the nancial statements are free of material misstatements. An audit includes examining, on a test basis, evidence supporting the amounts and the disclosures in the nancial statements. An audit also includes assessing the accounting principles used and the signi cant estimates made by the Management, as well as evaluating the overall nancial statement presentation. We believe that our audit provides a reasonable basis for our opinion. 3. As required by the Companies (Auditors Report) Order, 2003 (CARO) issued by the Central Government in terms of Section 227(4A) of the Companies Act, 1956, we give in the Annexure a statement on the matters speci ed in paragraphs 4 and 5 of the said Order. 4. Further to our comments in the Annexure referred to in paragraph 3 above, we report that:

(i) we have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purposes of our audit; (ii) in our opinion, proper books of account as required by law have been kept by the Company so far as it appears from our examination of those books and proper Returns adequate for the purposes of our audit have been received from the Singapore Branch audited by another auditor; (iii) the reports on the accounts of the Singapore Branch audited by another auditor has been forwarded to us and has been dealt with by us in preparing this report; (iv) the Balance Sheet, the Pro t and Loss Account and the Cash Flow Statement dealt with by this report are in agreement with the books of account and the audited Branch Returns; (v) in our opinion, the Balance Sheet, the Pro t and Loss Account and the Cash Flow Statement dealt with by this report are in compliance with the Accounting Standards referred to in Section 211(3C) of the Companies Act, 1956; (vi) in our opinion and to the best of our information and according to the explanations given to us, the said accounts give the information required by the Companies Act, 1956 in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India: (a) in the case of the Balance Sheet, of the state of affairs of the Company as at 31st March, 2010; (b) in the case of the Pro t and Loss Account, of the pro t of the Company for the year ended on that date and (c) in the case of the Cash Flow Statement, of the cash ows of the Company for the year ended on that date. 5. On the basis of the written representations received from the Directors as on 31st March, 2010 taken on record by the

Board of Directors, we report that none of the Directors is disquali ed as on 31st March, 2010 from being appointed as a director in terms of Section 274(1)(g) of the Companies Act, 1956.

[Referred to in paragraph (3) of our report of even date] (i) Having regard to the nature of the Companys business/activities/results clauses (x), (xii), (xiii), and (xiv) of CARO are not applicable. (ii) In respect of its xed assets: (a) The Company has maintained proper records showing full particulars, including quantitative details and situation of the xed assets. (b) Some of the xed assets were physically veri ed during the year by the Management in accordance with a programme of veri cation which, in our opinion, provides for physical veri cation of xed assets at reasonable intervals. According to the information and explanation given to us, no material discrepancies were noticed on such veri cation. (c) The xed assets disposed off during the year, in our opinion, do not constitute a substantial part of the xed assets of the Company and such disposal has, in our opinion, not affected the going concern status of the Company. (iii) In respect of its inventory: (a) As explained to us, the inventories of nished and semi- nished goods and raw materials at Works, Mines and Collieries were physically veri ed during the year by the Management. In respect to stores and spare parts and stocks at stockyards and with Consignment/Conversion Agents, the Company has a programme of veri cation of

stocks over a three-year period. In our opinion, having regard to the nature and location of stocks, the frequency of veri cation is reasonable. In case of materials lying with third parties, certi cates con rming stocks have been received for stocks held. (b) In our opinion and according to the information and explanation given to us, the procedures of physical veri cation of inventories followed by the Management were reasonable and adequate in relation to the size of the Company and the nature of its business. (c) In our opinion and according to the information and explanations given to us, the Company has maintained proper records of its inventories and no material discrepancies were noticed on physical veri cation. (iv) The Company has neither granted nor taken any loans, secured or unsecured, to/from companies, rms or other parties listed in the Register maintained under Section 301 of the Companies Act, 1956. Consequently, clauses (iii) (a) to (iii) (g) of paragraph 4 of CARO are not applicable. (v) In our opinion and according to the information and explanations given to us, having regard to the explanations that some of the items purchased are of special nature and suitable alternative sources are not readily available for obtaining comparable quotations, there is an adequate internal control system commensurate with the size of the Company and the nature of its business with regard to purchases of inventory and xed assets and the sale of goods and services. During the course of our audit, we have not observed any major weakness in such internal control system. 02) Tata_IFS_09-10.indd 124 7/3/2010 2:42:55 PM125 (vi) In respect of contracts or arrangements entered in the Register maintained in pursuance of Section 301 of the Companies

Act, 1956, to the best of our knowledge and belief and according to the information and explanations given to us: (a) The particulars of contracts or arrangements referred to Section 301 that needed to be entered in the Register maintained under the said Section have been so entered. (b) Where each of such transaction is in excess of Rs.5 lakhs in respect of any party, the transactions have been made at prices which are prima facie reasonable having regard to the prevailing market prices at the relevant time. (vii) In our opinion and according to the information and explanations given to us, the Company has complied with the provisions of Sections 58A and 58AA or any other relevant provisions of the Companies Act, 1956 and the Companies (Acceptance of Deposits) Rules, 1975 with regard to the deposits accepted from the public. According to the information and explanations given to us, no order has been passed by the Company Law Board or the National Company Law Tribunal or the Reserve Bank of India or any Court or any other Tribunal. (viii) In our opinion, the Company has an adequate internal audit system commensurate with the size and the nature of its business. (ix) We have broadly reviewed the books of account maintained by the Company pursuant to the rules made by the Central Government for the maintenance of cost records under Section 209(1) (d) of the Companies Act, 1956 in respect of manufacture of bearings, steel tubes and pipes, steel, chrome ore and alloys and electricity, and are of the opinion that prima facie the prescribed accounts and records have been made and maintained. We have, however, not made a

detailed examination of the records with a view to determining whether they are accurate or complete. To the best of our knowledge and according to the information and explanations given to us, the Central Government has not prescribed the maintenance of cost records for any other product of the Company. (x) According to the information and explanations given to us in respect of statutory dues: (a) The Company has generally been regular in depositing undisputed dues, including Provident Fund, Investor Education and Protection Fund, Income-tax, Sales Tax, Wealth Tax, Service Tax, Custom Duty, Excise Duty, Cess and other material statutory dues applicable to it with the appropriate authorities. We are informed that the Company intends to obtain exemption from operation of Employees State Insurance Act at all locations and necessary steps have been taken by the Company. We are also informed that actions taken by the authorities at some locations to bring the employees of the Company under the Employees State Insurance Scheme has been contested by the Company and accordingly full payment has not been made of the contributions demanded. (b) There were no undisputed amounts payable in respect of Income-tax, Wealth Tax, Custom Duty, Excise Duty, Cess and other material statutory dues in arrears as at 31st March, 2010 for a period of more than six months from the date they became payable, except for collection of Sales tax which we are informed are refundable to customers because they have been collected in excess or which have been collected pending receipt of necessary certi cates from the customers.

1. Accounting Policies (a) Basis for Accounting The nancial statements are prepared under the historical cost convention on an accrual basis of accounting in accordance with the generally accepted accounting principles, Accounting Standards noti ed under Section 211(3C) of the Companies Act, 1956 and the relevant provisions thereof. (b) Revenue Recognition (i) Sales comprises sale of goods and services, net of trade discounts. (ii) Export incentive under the Duty Entitlement Pass Book Scheme has been recognised on the basis of credits afforded in the pass book. (c) Employee Bene ts (i) Short-term employee bene ts are recognised as an expense at the undiscounted amount in the Pro t and Loss Account of the year in which the related service is rendered. (ii) Post employment bene ts are recognised as an expense in the Pro t and Loss Account for the year in which the employee has rendered services. The expense is recognised at the present value of the amount payable towards contributions. The present value is determined using the market yields of government bonds, at the balance sheet date, as the discounting rate. (iii) Other long-term employee bene ts are recognised as an expense in the Pro t and Loss Account for the period in which the employee has rendered services. Estimated liability on account of long-term bene ts is discounted to the current value, using the market yield on government bonds, as on the date of balance sheet.

(iv) Actuarial gains and losses in respect of post employment and other long-term bene ts are charged to the Pro t and Loss Account. (v) Miscellaneous Expenditure In respect of the Employee Separation Scheme (ESS), net present value of the future liability for pension payable is amortised equally over ve years or upto nancial year ending 31st March, 2010, whichever is earlier. The increase in the net present value of the future liability for pension payable to employees who have opted for retirement under the Employee Separation Scheme of the Company is charged to the Pro t and Loss Account. (d) Fixed Assets All xed assets are valued at cost less depreciation. Pre-operation expenses including trial run expenses (net of revenue) are capitalised. Borrowing costs during the period of construction is added to the cost of eligible xed assets. Blast Furnace relining is capitalised. The written down value of the asset consisting of lining/relining expenditure embedded in the cost of the furnace is written off in the year of fresh relining. (e) Depreciation (I) Capital assets whose ownership does not vest in the Company is depreciated over their estimated useful life or ve years, whichever is less. (II) In respect of other assets, depreciation is provided on a straight line basis applying the rates speci ed in Schedule XIV to the Companies Act, 1956 or rates based on estimated useful life whichever is higher. However, asset value upto Rs. 25,000 is fully depreciated in the year of acquisition. The details of estimated life for each category of asset is as under : (i) Buildings 30 to 62 years. (ii) Plant and Machinery 6 to 21 years.

(iii) Railway Sidings 21 years. (iv) Vehicles and Aircraft 5 to 18 years. (v) Furniture, Fixtures and Of ce Equipment 5 years. (vi) Intangibles (Computer Software) 5 to 10 years. (vii) Development of property for development of mines and collieries are depreciated over the useful life of the mine or lease period whichever is less, subject to maximum of 10 years. (viii) Blast Furnace relining is depreciated over a period of 10 years (average expected life). (ix) Freehold land is not depreciated. (x) Leasehold land is amortised over the life of the lease. (xi) Roads 30 to 62 years. (f) Foreign Currency Transactions Foreign Currency Transactions (FCT) and forward exchange contracts used to hedge FCT are initially recognised at the spot rate on the date of the transaction/contract. Monetary assets and liabilities relating to foreign currency transactions and forward exchange contracts remaining unsettled at the end of the year are translated at year end rates. The company has opted for accounting the exchange differences arising on reporting of long term foreign currency monetary items in line with Companies (Accounting Standards) Amendment Rules 2009 relating to Accounting Standard 11 (AS-11) noti ed by Government of India on 31st March, 2009. Accordingly the effect of exchange differences on foreign currency loans of the company is accounted by addition or deduction to the cost of the assets so far it relates to depreciable capital assets and in other cases by transfer to Foreign Currency Monetary Items Translation Difference Account to be amortised over the balance period of the longterm monetary items or period upto 31st March, 2011 whichever is earlier. The differences in translation of FCT and forward exchange contracts used to hedge FCT (excluding the long term foreign

currency monetary items accounted in line with Companies (Accounting Standards) Amendment Rules 2009 on Accounting Standard 11 noti ed by Government of India on 31st March, 2009) and realised gains and losses, other than those relating to SCHEDULE M : NOTES ON BALANCE SHEET AND PROFIT AND LOSS ACCOUNT 02) Tata_IFS_09-10.indd 150 7/3/2010 2:53:13 PM151 SCHEDULE M : NOTES ON BALANCE SHEET AND PROFIT AND LOSS ACCOUNT : continued xed assets are recognised in the Pro t and Loss Account. The outstanding derivative contracts at the balance sheet date other than forward exchange contracts used to hedge FCT are valued by marking them to market and losses, if any, are recognised in the Pro t and Loss Account. Exchange difference relating to monetary items that are in substance forming part of the Companys net investment in non integral foreign operations are accumulated in Foreign Exchange Fluctuation Reserve Account. (g) Investments Long term investments are carried at cost less provision for diminution other than temporary, if any, in value of such investments. Current investments are carried at lower of cost and fair value. (h) Inventories Finished and semi- nished products produced and purchased by the Company are carried at lower of cost and net realisable value. Work-in-progress is carried at lower of cost and net realisable value. Coal, iron ore and other raw materials produced and purchased by the Company are carried at lower of cost and net realisable value. Stores and spare parts are carried at lower of cost and net realisable value. Necessary provision is made and charged to revenue in case of identi ed obsolete and non-moving items.

Cost of inventories is generally ascertained on the weighted average basis. Work-in-progress and nished and semi- nished products are valued on full absorption cost basis. (i) Relining Expenses Relining expenses other than expenses on Blast Furnace relining are charged as an expense in the year in which they are incurred. (j) Research and Development Research and Development costs (other than cost of xed assets acquired) are charged as an expense in the year in which they are incurred. (k) Deferred Tax Deferred Tax is accounted for by computing the tax effect of timing differences which arise during the year and reverse in subsequent periods. 2. Contingent Liabilities (a) Guarantees The Company has given guarantees aggregating Rs. 355.28 crores (31.03.2009 : Rs. 81.22 crores) to banks and nancial institutions on behalf of others. As at 31st March, 2010, the contingent liabilities under these guarantees amounted to Rs. 355.28 crores (31.03.2009 : Rs. 81.22 crores). (b) Claims not acknowledged by the Company As at As at 31.03.2010 31.03.2009 Rs. crores Rs. crores (i) Excise 296.59 216.72 (ii) Customs 13.68 13.68

(iii) Sales Tax and VAT 587.97 456.01 (iv) State Levies 173.62 154.67 (v) Suppliers and Service Contract 71.02 70.52 (vi) Labour Related 36.92 190.42 (vii) Income Tax 143.44 176.60 (c) Claim by a party arising out of conversion arrangement - Rs. 195.82 crores (31.03.2009 : Rs. 195.82 crores). The Company has not acknowledged this claim and has instead led a claim of Rs. 139.65 crores (31.03.2009 : Rs. 139.65 crores) on the party. The matter is pending before the Calcutta High Court. (d) The Excise Department has raised a demand of Rs. 235.48 crores (31.03.2009 : Rs. 235.48 crores) denying the bene t of Noti cation No. 13/2000 which provides for exemption to the integrated steel plant from payment of excise duty on the freight amount incurred for transporting material from plant to stock yard and consignment agents. The Company led an appeal with CESTAT, Kolkata and the order of the department was set aside. The department has led an appeal in Supreme Court where the matter is pending. (e) TMT bars and rods in coil form are sent to external processing agents (EPA) for decoiling and cutting into speci ed lengths before the products are despatched for sale. Excise department demanded duty from the EPA, holding the activity as manufacture and ignoring the payment of duty made by Tata Steel. An appeal against the order of the Commissioner of Central Excise, Jamshedpur was led in CESTAT, Kolkata and was allowed in favour of the EPA. Subsequently, the department challenged the same in Jharkhand High Court, Ranchi, which is still pending for hearing. Subsequent demands in this regard have not been adjudicated. The liability till 31st March 2010, if materializes, will be to the tune of Rs. 291.22 crores (31.03.2009 : Rs. 271.60 crores). However,

the company has already paid duty amounting to Rs. 189.52 crores (2008-09: Rs. 169.05 crores) till date based on the nal sale

Rosa Parks, King George VI, Abraham Lincoln and Woodrow Wilson. Read more: http://www.brighthub.com/office/home/articles/76450.aspx#ixzz1P3nTvA42

You might also like

- Financial Modelling Fundamentals PDFDocument44 pagesFinancial Modelling Fundamentals PDFHeisnam BidyaNo ratings yet

- The Mysterious Benedict Society and The Prisoner's Dilemma (Book 3) by Trenton Lee Stewart (Preview)Document47 pagesThe Mysterious Benedict Society and The Prisoner's Dilemma (Book 3) by Trenton Lee Stewart (Preview)Little, Brown Books for Young Readers63% (16)

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Bhavya Creators PVT LTD BalanceSheet 2011Document16 pagesBhavya Creators PVT LTD BalanceSheet 2011ghyNo ratings yet

- Spicer: Dana Heavy Tandem Drive AxlesDocument34 pagesSpicer: Dana Heavy Tandem Drive AxlesPatrick Jara SánchezNo ratings yet

- Solicitor General Vs Metropolitan Manila Authority, 204 SCRA 837 (1991) - BernardoDocument1 pageSolicitor General Vs Metropolitan Manila Authority, 204 SCRA 837 (1991) - Bernardogeni_pearlc100% (1)

- Auditors' Report To The Members Of: Sultania Trade PVT - LTDDocument7 pagesAuditors' Report To The Members Of: Sultania Trade PVT - LTDAankit Kumar Jain DugarNo ratings yet

- Auditing 2Document110 pagesAuditing 2Nitesh KotianNo ratings yet

- Auditor's Report (Finolex Industries) Year End: Mar '10: AuditorsDocument6 pagesAuditor's Report (Finolex Industries) Year End: Mar '10: Auditorssuchi_23goyalNo ratings yet

- ITC Report of AuditorsDocument3 pagesITC Report of AuditorsRajavati NadarNo ratings yet

- Auditors Reports 2012 IoclDocument4 pagesAuditors Reports 2012 IoclSunita NairNo ratings yet

- ITC Auditors ReportDocument3 pagesITC Auditors Reportubaid7491No ratings yet

- Audit Report of AciDocument5 pagesAudit Report of Acimizanur rahmanNo ratings yet

- Auditors' Report To The Members of HSCC (India) LTDDocument5 pagesAuditors' Report To The Members of HSCC (India) LTDPraveen KumarNo ratings yet

- Specimen Auditors Report With CaroDocument5 pagesSpecimen Auditors Report With CaroaakashagarwalNo ratings yet

- Auditors Report FinalDocument5 pagesAuditors Report FinalloyalkaNo ratings yet

- Caro Audit ReportDocument4 pagesCaro Audit ReportAfroz AhmedNo ratings yet

- Haldiram Foods International LTD 2005Document10 pagesHaldiram Foods International LTD 2005Saurabh PatilNo ratings yet

- A9 RORUkwaaDocument8 pagesA9 RORUkwaaanzy3011No ratings yet

- Auditor's Report (TVS Motor Company)Document12 pagesAuditor's Report (TVS Motor Company)Viraj WadkarNo ratings yet

- Auditor'S Report To The ShareholdersDocument5 pagesAuditor'S Report To The ShareholdersAbhishek ChoudhriNo ratings yet

- ESV-report 1-1Document5 pagesESV-report 1-1asphalt 9 legendsNo ratings yet

- 2007Document72 pages2007anilkumbarNo ratings yet

- Annexure To The AuditorsDocument4 pagesAnnexure To The AuditorsTejashree Gharat-KaduNo ratings yet

- Haldiram Foods International LTD Annual Report 2005Document10 pagesHaldiram Foods International LTD Annual Report 2005Nishant SinghNo ratings yet

- V.Ghatalia: & AssociatesDocument33 pagesV.Ghatalia: & AssociatesPorusSinghNo ratings yet

- Independent Auditor'S ReportDocument5 pagesIndependent Auditor'S ReportHimanshu ThakkarNo ratings yet

- Luthra & Luthra: Auditor'S ReportDocument5 pagesLuthra & Luthra: Auditor'S Reportswatis_49No ratings yet

- V.Ghatalia Associates: Auditors' Report To The Members of National Spot Exchange LimitedDocument34 pagesV.Ghatalia Associates: Auditors' Report To The Members of National Spot Exchange LimitedPorusSinghNo ratings yet

- IcplDocument7 pagesIcplDeepak GuptaNo ratings yet

- Reports of CrisilDocument24 pagesReports of CrisilAditya MishraNo ratings yet

- Independent Auditors' Report: Report On The Standalone Financial StatementsDocument12 pagesIndependent Auditors' Report: Report On The Standalone Financial StatementskalaswamiNo ratings yet

- ESV-report 1Document5 pagesESV-report 1asphalt 9 legendsNo ratings yet

- Independent Auditor1Document9 pagesIndependent Auditor1kalaswamiNo ratings yet

- Stand Alone Ar 201112 CrainDocument18 pagesStand Alone Ar 201112 CrainParas KhushiramaniNo ratings yet

- RRK Finhold Private LimitedDocument23 pagesRRK Finhold Private LimitedVanusha AdihettyNo ratings yet

- Lupin Pharma Care LTD., InDIADocument22 pagesLupin Pharma Care LTD., InDIAPradeesh ChowraaNo ratings yet

- Audit Assignment: Name: Pallavi Minz Roll No: 225 Sec: I Tut Group: I 50Document4 pagesAudit Assignment: Name: Pallavi Minz Roll No: 225 Sec: I Tut Group: I 50Pallavi Minz LakraNo ratings yet

- The Statutory Audit Report of ITC LTDDocument8 pagesThe Statutory Audit Report of ITC LTDsvrbchaudhariNo ratings yet

- S.K.Kapoor & Co: PNB Housing Finance LTD., NEW DELHI - 110 001Document25 pagesS.K.Kapoor & Co: PNB Housing Finance LTD., NEW DELHI - 110 001Shoaib RehmanNo ratings yet

- Auditors' Report To, The Members Of: XYZ (India) LTDDocument5 pagesAuditors' Report To, The Members Of: XYZ (India) LTDalisha_bhalmeNo ratings yet

- Independent AuditorsDocument5 pagesIndependent AuditorsHamza ShafiqNo ratings yet

- S.B.Dandeker & Co.: Auditors'ReportDocument5 pagesS.B.Dandeker & Co.: Auditors'Reportravibhartia1978No ratings yet

- Annual Report: ABN AMRO Asset Management (India) LimitedDocument17 pagesAnnual Report: ABN AMRO Asset Management (India) Limitedmanuel querolNo ratings yet

- 35 Caro Audit ReportDocument2 pages35 Caro Audit ReportRNA253686No ratings yet

- S.B.Dandeker & Co.: Auditors'ReportDocument5 pagesS.B.Dandeker & Co.: Auditors'Reportravibhartia1978No ratings yet

- Traded As: Industry Founded Founder Headquarters Area Served Key PeopleDocument16 pagesTraded As: Industry Founded Founder Headquarters Area Served Key PeopleRajesh KumarNo ratings yet

- DLF LIMITED Auditors ReportDocument6 pagesDLF LIMITED Auditors ReportAvinash MulikNo ratings yet

- S.B.Dandeker & Co.: Auditors'ReportDocument5 pagesS.B.Dandeker & Co.: Auditors'Reportravibhartia1978No ratings yet

- TVS Audit ReportDocument5 pagesTVS Audit ReportYashasvi MohandasNo ratings yet

- ABN AMRO Asset Management (India) Limited: Annual Accounts 2003-2004Document14 pagesABN AMRO Asset Management (India) Limited: Annual Accounts 2003-2004manuel querolNo ratings yet

- S.B.Dandeker & Co.: Auditors ReportDocument5 pagesS.B.Dandeker & Co.: Auditors Reportravibhartia1978No ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Auditing CIA 1Document9 pagesAuditing CIA 1Kalyani JayakrishnanNo ratings yet

- Audit Report Caro in ExcelDocument14 pagesAudit Report Caro in ExcelNikhil KasatNo ratings yet

- .V Porwal: J IA Auto Components LTDDocument12 pages.V Porwal: J IA Auto Components LTDShyam SunderNo ratings yet

- Ongc Auditor ReportDocument7 pagesOngc Auditor ReportSanjay VenkateshNo ratings yet

- S.B.Dandeker & Co.: Auditors'ReportDocument5 pagesS.B.Dandeker & Co.: Auditors'ReportRavi BhartiaNo ratings yet

- Annexure C1 PDFDocument21 pagesAnnexure C1 PDFMita SethiNo ratings yet

- Reliance Digital Media Distribution LimitedDocument17 pagesReliance Digital Media Distribution LimitedJAGTAR SINGHNo ratings yet

- S.G.Keshavamurthy & Co. Chartered Accountants: Independent Auditor'S ReportDocument20 pagesS.G.Keshavamurthy & Co. Chartered Accountants: Independent Auditor'S Reportshubham ThakerNo ratings yet

- Spica Hydraulics Private LimitedDocument4 pagesSpica Hydraulics Private Limitedaishwarya raikarNo ratings yet

- CH22Document38 pagesCH22raman0007No ratings yet

- Itc Sustainability Report 2012Document134 pagesItc Sustainability Report 2012raman0007No ratings yet

- BudgetDocument10 pagesBudgetraman0007No ratings yet

- Detergent Wars Toothpaste TussleDocument1 pageDetergent Wars Toothpaste Tussleraman0007No ratings yet

- CSR BrochureDocument31 pagesCSR Brochureraman0007No ratings yet

- Tourism & Hospitality ServicesDocument14 pagesTourism & Hospitality Servicesraman0007No ratings yet

- 01 - Foundation of Info. Sysytems in BusinessDocument30 pages01 - Foundation of Info. Sysytems in Businessraman0007No ratings yet

- Paper 1Document35 pagesPaper 1Nagendra GkNo ratings yet

- Session 4 Managerial Economics: Click To Edit Master Subtitle StyleDocument48 pagesSession 4 Managerial Economics: Click To Edit Master Subtitle Styleraman0007No ratings yet

- Final Project On LicDocument90 pagesFinal Project On Licraman0007No ratings yet

- Chap 10 PresentationDocument35 pagesChap 10 Presentationraman0007No ratings yet

- Early History: Cadbury PLC Is A BritishDocument24 pagesEarly History: Cadbury PLC Is A Britishraman0007No ratings yet

- DerivativesDocument45 pagesDerivativesraman0007No ratings yet

- EcoDocument4 pagesEcoraman0007No ratings yet

- LifeDocument8 pagesLiferaman0007No ratings yet

- CarusoComplaint Redacted PDFDocument20 pagesCarusoComplaint Redacted PDFHudson Valley Reporter- PutnamNo ratings yet

- Enlightment On Islamic Thoughts PDFDocument17 pagesEnlightment On Islamic Thoughts PDFFeroz KiNo ratings yet

- Control Scheme For Acb Transformer Incomer Module Type-DaetDocument86 pagesControl Scheme For Acb Transformer Incomer Module Type-DaetAVIJIT MITRANo ratings yet

- CAT35240 - Masters and Minions SmallDocument1 pageCAT35240 - Masters and Minions SmallPGaither84No ratings yet

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- Fam Law II - CompleteDocument103 pagesFam Law II - CompletesoumyaNo ratings yet

- Shah Amin GroupDocument11 pagesShah Amin GroupNEZAMNo ratings yet

- R Vs L.P.Document79 pagesR Vs L.P.NunatsiaqNews100% (1)

- Transpo Case Digests FinalsDocument21 pagesTranspo Case Digests Finalsaags_06No ratings yet

- 101domain API Reseller Agreement - EncryptedDocument19 pages101domain API Reseller Agreement - EncryptedBenNo ratings yet

- Dansart Security Force v. BagoyDocument4 pagesDansart Security Force v. BagoyAyo LapidNo ratings yet

- 409-Prohibiting Harassment Intimidation or Bullying Cyberbullying Sexting Sexual Harassment StudentsDocument8 pages409-Prohibiting Harassment Intimidation or Bullying Cyberbullying Sexting Sexual Harassment Studentsapi-273340621No ratings yet

- 8eeed194-a327-4f92-90a1-8ccc8dee52f0Document6 pages8eeed194-a327-4f92-90a1-8ccc8dee52f0Don RedbrookNo ratings yet

- ASME B16-48 - Edtn - 2005Document50 pagesASME B16-48 - Edtn - 2005eceavcmNo ratings yet

- Problem NoDocument6 pagesProblem NoJayvee BalinoNo ratings yet

- +++barnett (2007) Informed Consent Too Much of A Good Thing or Not EnoughDocument8 pages+++barnett (2007) Informed Consent Too Much of A Good Thing or Not EnoughSandraNo ratings yet

- Theme I-About EducationDocument4 pagesTheme I-About EducationAlexandru VlăduțNo ratings yet

- Rizzo v. Goode, 423 U.S. 362 (1976)Document19 pagesRizzo v. Goode, 423 U.S. 362 (1976)Scribd Government DocsNo ratings yet

- Petron Corporation and Peter Milagro v. National Labor Relations Commission and Chito MantosDocument2 pagesPetron Corporation and Peter Milagro v. National Labor Relations Commission and Chito MantosRafaelNo ratings yet

- Barangay ProfilesDocument3 pagesBarangay ProfilesMello Jane Garcia DedosinNo ratings yet

- LetterDocument2 pagesLetterAppleJoyAbao-PeleñoNo ratings yet

- Crisis After Suffering One of Its Sharpest RecessionsDocument5 pagesCrisis After Suffering One of Its Sharpest RecessionsПавло Коханський0% (2)

- 48 2 PDFDocument353 pages48 2 PDFGrowlerJoeNo ratings yet

- Pabillo Vs ComelecDocument4 pagesPabillo Vs ComelecChokie BamNo ratings yet

- Pt4onlinepresentation Medina 170815105639Document19 pagesPt4onlinepresentation Medina 170815105639Roxas Marry GraceNo ratings yet

- Money and Banking Q&ADocument9 pagesMoney and Banking Q&AKrrish WaliaNo ratings yet

- Berlin Briefing 1 - Debating at The WUDC Berlin 2013 PDFDocument9 pagesBerlin Briefing 1 - Debating at The WUDC Berlin 2013 PDFChaitanya PooniaNo ratings yet