Professional Documents

Culture Documents

Financial Inclusion 9

Uploaded by

putul6Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Inclusion 9

Uploaded by

putul6Copyright:

Available Formats

FINANCIAL INCLUSION IN SUSTAINABLE DEVELOPMENT. Mr.

Chitta Ranjan Mishra The Indian economy continues to suffer from the problems of poverty. The importance of the study is to examine the economic development of the poor and low income groups with supporting financial institutions. Financial inclusion is conceived as a major driving force to achieve self sustained inclusive economic growth. Financial inclusion can be defined as the process of ensuring access to financial services and timely availability groups such as weaker section and low income groups at an affordable cost (Report to the committee on financial in India, 2008) Financial inclusion, in the meaning of extending banking products at an affordable cost to the vast section of disadvantaged and low income groups. The major importance is to ensure inclusive growth by removing the constraints of poor infrastructure, improving economic efficiency and spreading the benefits of growth over a vast population which has remained outside the purview of this development process. Financial inclusion creates sustainable business opportunities for the financial system. In the view by increasing the economic opportunities of the poor and low income people. This term broadly refers to availability of banking services at an affordable cost to the disadvantaged and low income groups .The basic concept of financial inclusion is having a saving or current account at any bank. Now-adays the banking system has become more dynamic and there is an increasing trend in the number of depositors in bank. But financial services have not accessed to low income groups in Rural and urban areas, because they have no awareness about the financial product and services and the financial organization have not become able to provide any banking services to the poor people. So the Government of India, Reserve bank of India and NABARD together have initiated a number of the following programs. Like 1-Self Employment program

2-SHG-Bank linkage program 3-Post offices program 4-Village development program 5-Kissan credit card (KCC) All these programs are poverty alleviation schemes of the Government and the Reserve bank of India has initiated several measures to achieve the financial inclusion such as facilitating No frill account for low deposits and credit. All these programs were implemented in a proper way but partially success was achieved because the financial institutions did not give importance to the financial services, so that the poor people have not become aware about the banking product and services . The Reserve Bank of India has been carried out with an aim to evaluate the present progress towards financial inclusion of BPL population and motivate the bankers to complete the unfinished programmed. Those successful banks, who focused on the rural and urban sector by providing financial inclusion services, now they are planning to open saving and current account which was not sufficient for financial inclusion. Majority of the people did not know about the process of opening the accounts and could not get the passbook. In this stage actually awareness should be built first and linked to a bank by opening of accounts. The major point, opening of a bank account is meaning less for rural poor because the distance of the bank branches is a major problem and the people have not enough the money to operate deposit accounts. Financial inclusion need to be measured not just by the number of saving accounts holders but also by the extent of awareness about the various banking services and products as well as their effective use by them. A self-help-group (SHGs) comprises 15 to 20 members .The program rekindled the basic human train of self worth of every member in a group by handling saving and internal lending , the groups nature to acquire credit

worthness for themselves and earn confidence of banks for loners by providing trust as collateral. In the other cases the SHGs should be used to get people used to banking facilities. There are other condition like employments that generates income, access to natural resources wages employment, education and so on that help in linking people to financial institution. The last step referring to operating system of SHGs for the mobilization of saving with banks and bank lone disbursement to SHGs, repayment of lone, building up leadership and establishing linkage with banks and ultimately examining the social benefits derived by the members. Any policy or programmed for delivering financial support services to the poor aims at improving their standard of living and helping them to cross the poverty barrier.The importance of banks providing deposit and credit facilities to poor people. So banking awareness needs to be created for better financial inclusion. Financial inclusion may be successful if the priorities will be given upon the daily transaction of accounts (saving and current) and loans facilities , insurance, education loan etc. Finally it provides appropriate financial services and increases the economic opportunities for the poor and low income people, which will lead towards positive results in social progress and economic development of our country

You might also like

- CALCULUS PHYSICS MIDTERMDocument41 pagesCALCULUS PHYSICS MIDTERMMACARIO QTNo ratings yet

- CBT For BDDDocument13 pagesCBT For BDDGregg Williams100% (5)

- Financial Inclusion: The Need For All-Round Growth of The Economy of India Group 2Document36 pagesFinancial Inclusion: The Need For All-Round Growth of The Economy of India Group 2Hubspot GroupNo ratings yet

- Strategy and Efforts of A Public Sector Bank For Financial InclusionDocument10 pagesStrategy and Efforts of A Public Sector Bank For Financial InclusionKhushi PuriNo ratings yet

- Access to Finance: Microfinance Innovations in the People's Republic of ChinaFrom EverandAccess to Finance: Microfinance Innovations in the People's Republic of ChinaNo ratings yet

- Photosynthesis Lab ReportDocument7 pagesPhotosynthesis Lab ReportTishaNo ratings yet

- Lewis Corporation Case 6-2 - Group 5Document8 pagesLewis Corporation Case 6-2 - Group 5Om Prakash100% (1)

- Financial Inclusion Study of SBI & ICICI BanksDocument128 pagesFinancial Inclusion Study of SBI & ICICI BanksDinesh Nayak100% (1)

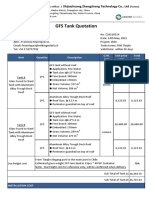

- GFS Tank Quotation C20210514Document4 pagesGFS Tank Quotation C20210514Francisco ManriquezNo ratings yet

- Cot 2Document3 pagesCot 2Kathjoy ParochaNo ratings yet

- UD150L-40E Ope M501-E053GDocument164 pagesUD150L-40E Ope M501-E053GMahmoud Mady100% (3)

- Financial InclusionDocument96 pagesFinancial InclusionIcaii Infotech100% (6)

- Desana Texts and ContextsDocument601 pagesDesana Texts and ContextsdavidizanagiNo ratings yet

- Research Paper On Financial InclusionDocument36 pagesResearch Paper On Financial Inclusionimsarfrazkhan96% (28)

- A Study On Awareness Towards Financial Inclusion Among Rural Areas With Special Reference To CoimbatoreDocument27 pagesA Study On Awareness Towards Financial Inclusion Among Rural Areas With Special Reference To CoimbatoreprathikshaNo ratings yet

- Tutu 3Document2 pagesTutu 3putul6No ratings yet

- Financial Inclusion & Financial Literacy: SBI InitiativesDocument5 pagesFinancial Inclusion & Financial Literacy: SBI Initiativesprashaant4uNo ratings yet

- Role of RBI in Financial InclusionDocument12 pagesRole of RBI in Financial InclusionShannon Ford100% (3)

- Financial InclusiionDocument37 pagesFinancial InclusiionPehoo ThakurNo ratings yet

- Paper Presentation On Financial InclusionDocument6 pagesPaper Presentation On Financial InclusionaruvankaduNo ratings yet

- What Is Financial Inclusion?: Providing Formal Credit AvenuesDocument5 pagesWhat Is Financial Inclusion?: Providing Formal Credit AvenuesRahul WaniNo ratings yet

- Fs - Financial InclusionDocument7 pagesFs - Financial InclusionWasim SNo ratings yet

- Coverage of Financial Inclusion in Tamil NaduDocument20 pagesCoverage of Financial Inclusion in Tamil NaduNitesh KumarNo ratings yet

- Report On Financial Inclusion and Financial Literacy Awareness Programme Conducted by JanMitramDocument9 pagesReport On Financial Inclusion and Financial Literacy Awareness Programme Conducted by JanMitramManish SinghNo ratings yet

- Financial InclusionDocument3 pagesFinancial Inclusionapi-3701467No ratings yet

- Financial InclusionDocument10 pagesFinancial InclusionSonali SharmaNo ratings yet

- What Is Financial InclusionDocument10 pagesWhat Is Financial InclusionSanjeev ReddyNo ratings yet

- Finacial Inclusion and ExclusionDocument20 pagesFinacial Inclusion and Exclusionbeena antuNo ratings yet

- Financial Inclusion: Corporate Finance ProjectDocument16 pagesFinancial Inclusion: Corporate Finance ProjectPallavi AgrawallaNo ratings yet

- Financial Inclusion in IndiaDocument4 pagesFinancial Inclusion in IndiaPiyush BisenNo ratings yet

- Financial Inclusion - A Road India Needs To TravelDocument8 pagesFinancial Inclusion - A Road India Needs To Traveliysverya9256No ratings yet

- 13 - Conclusion and SuggestionsDocument4 pages13 - Conclusion and SuggestionsjothiNo ratings yet

- Financial Inclusion for Rural GrowthDocument14 pagesFinancial Inclusion for Rural GrowthDeepu T MathewNo ratings yet

- Microfinance Assignment - BCMDocument9 pagesMicrofinance Assignment - BCMpoojaNo ratings yet

- 100 % Financial Inclusion: A Challenging Task Ahead: Dr. Reena AgrawalDocument16 pages100 % Financial Inclusion: A Challenging Task Ahead: Dr. Reena AgrawalAashi Sharma100% (1)

- Black Book CHP 1Document19 pagesBlack Book CHP 1Raj GandhiNo ratings yet

- What Is Financial Inclusion: Chillibreeze WriterDocument4 pagesWhat Is Financial Inclusion: Chillibreeze WriterTenzin SontsaNo ratings yet

- Fic Cir 14102011Document12 pagesFic Cir 14102011bindulijuNo ratings yet

- FINANCIAL INCLUSIONS: AIMING FOR EQUITABLE ACCESSDocument9 pagesFINANCIAL INCLUSIONS: AIMING FOR EQUITABLE ACCESSSmitaPathakNo ratings yet

- Newxx PDFDocument159 pagesNewxx PDFnehaprakash028No ratings yet

- Journal 4 PDFDocument159 pagesJournal 4 PDFnehaprakash028No ratings yet

- RBI Deputy Governor Discusses Importance of Financial Inclusion and Banks' RoleDocument9 pagesRBI Deputy Governor Discusses Importance of Financial Inclusion and Banks' RoleAnamika Rai PandeyNo ratings yet

- Need For Financial Inclusion and Challenges Ahead - An Indian PerspectiveDocument4 pagesNeed For Financial Inclusion and Challenges Ahead - An Indian PerspectiveInternational Organization of Scientific Research (IOSR)No ratings yet

- FinancDocument3 pagesFinancRahul Rao JanagamNo ratings yet

- Inclusive BankingDocument13 pagesInclusive BankingMukeshKataraNo ratings yet

- Complete ProjectDocument72 pagesComplete ProjectKevin JacobNo ratings yet

- Ap 18Document5 pagesAp 18Anitha PeyyalaNo ratings yet

- Inclusion FinDocument4 pagesInclusion Finnikhil_mallikar2067No ratings yet

- Pardhmantri Rojgar Yojayana Arshdeep Project (Pmjdy)Document78 pagesPardhmantri Rojgar Yojayana Arshdeep Project (Pmjdy)Raj KumarNo ratings yet

- Financial Inclusion - RBI - S InitiativesDocument12 pagesFinancial Inclusion - RBI - S Initiativessahil_saini298No ratings yet

- Financial InclusionDocument15 pagesFinancial InclusionNitin SharmaNo ratings yet

- Introduction JP ProposalDocument7 pagesIntroduction JP ProposalPriya SonuNo ratings yet

- Pradhan Mantri Jan Dhan Yojana: A National Mission On Financial Inclusion in IndiaDocument5 pagesPradhan Mantri Jan Dhan Yojana: A National Mission On Financial Inclusion in Indiaprateeksri10No ratings yet

- Financial Inclusion in India: Emerging Profitable ModelsDocument6 pagesFinancial Inclusion in India: Emerging Profitable ModelsSamuel GeorgeNo ratings yet

- Financial Exclusion: Financial Inclusion or Inclusive Financing Is The Delivery of Financial Services at Affordable CostsDocument6 pagesFinancial Exclusion: Financial Inclusion or Inclusive Financing Is The Delivery of Financial Services at Affordable CostsVashist SharmaNo ratings yet

- Financial Inclusion 123Document4 pagesFinancial Inclusion 123janvidnavapriaNo ratings yet

- Strategy Adopted For Financial InclusionDocument7 pagesStrategy Adopted For Financial Inclusionanmolsaini01No ratings yet

- Micro-Finance in The India: The Changing Face of Micro-Credit SchemesDocument11 pagesMicro-Finance in The India: The Changing Face of Micro-Credit SchemesMahesh ChavanNo ratings yet

- Financial Inclusion Seminar WorkDocument11 pagesFinancial Inclusion Seminar WorkSaloni GoyalNo ratings yet

- Inclusive Growth: by Mr. Ganesh Pawar, Mr. Sushil Kumar, Mr. Joshi & Mr. Deepak ChawlaDocument13 pagesInclusive Growth: by Mr. Ganesh Pawar, Mr. Sushil Kumar, Mr. Joshi & Mr. Deepak ChawlaAshis LamaNo ratings yet

- Financial Inclusion and UrbanCooperative BanksDocument7 pagesFinancial Inclusion and UrbanCooperative BanksmanojNo ratings yet

- What Is Financial InclusionDocument2 pagesWhat Is Financial InclusionAsit MohantyNo ratings yet

- Initiatives: Financial Inclusion and Financial Literacy: Andhra Bank'sDocument8 pagesInitiatives: Financial Inclusion and Financial Literacy: Andhra Bank'sJagamohan OjhaNo ratings yet

- Financial Inclusion in India: A Theoritical Assesment: ManagementDocument6 pagesFinancial Inclusion in India: A Theoritical Assesment: ManagementVidhi BansalNo ratings yet

- Smu Project ReportDocument78 pagesSmu Project ReportAbhishek AnandNo ratings yet

- Social Impact Assessment of Pradhanmantri Jan Dhan YojanaDocument8 pagesSocial Impact Assessment of Pradhanmantri Jan Dhan YojanaNikhil GargNo ratings yet

- Gender Equality and Social Inclusion Diagnostic for the Finance Sector in BangladeshFrom EverandGender Equality and Social Inclusion Diagnostic for the Finance Sector in BangladeshNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Financial InclusionDocument3 pagesFinancial Inclusionputul6No ratings yet

- Financial InclusionDocument3 pagesFinancial Inclusionputul6No ratings yet

- Financial InclusionDocument3 pagesFinancial Inclusionputul6No ratings yet

- Tutu 6Document2 pagesTutu 6_chitta_mishraNo ratings yet

- Tutu 6Document2 pagesTutu 6_chitta_mishraNo ratings yet

- FINANCIAL INCLUSION - MR Chitta Ranjan MIishraDocument2 pagesFINANCIAL INCLUSION - MR Chitta Ranjan MIishraputul6No ratings yet

- Tutu 6Document2 pagesTutu 6_chitta_mishraNo ratings yet

- Tutu 6Document2 pagesTutu 6_chitta_mishraNo ratings yet

- Tutu 6Document2 pagesTutu 6_chitta_mishraNo ratings yet

- FINANCIAL INCLUSION - MR Chitta Ranjan MIishraDocument2 pagesFINANCIAL INCLUSION - MR Chitta Ranjan MIishraputul6No ratings yet

- Corporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Document18 pagesCorporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Lia asnamNo ratings yet

- Rapport DharaviDocument23 pagesRapport DharaviUrbanistes du MondeNo ratings yet

- SiloDocument7 pagesSiloMayr - GeroldingerNo ratings yet

- Dolni VestoniceDocument34 pagesDolni VestoniceOlha PodufalovaNo ratings yet

- Form 4 Additional Mathematics Revision PatDocument7 pagesForm 4 Additional Mathematics Revision PatJiajia LauNo ratings yet

- Crystallizers: Chapter 16 Cost Accounting and Capital Cost EstimationDocument1 pageCrystallizers: Chapter 16 Cost Accounting and Capital Cost EstimationDeiver Enrique SampayoNo ratings yet

- Physics Derived Units and Unit Prefixes Derived UnitDocument15 pagesPhysics Derived Units and Unit Prefixes Derived UnitJohnRenzoMolinarNo ratings yet

- British Universal Steel Columns and Beams PropertiesDocument6 pagesBritish Universal Steel Columns and Beams PropertiesjagvishaNo ratings yet

- Duca Industries March 2023 pay slip for Dipankar MondalDocument1 pageDuca Industries March 2023 pay slip for Dipankar MondalPritam GoswamiNo ratings yet

- Objective Mech II - IES 2009 Question PaperDocument28 pagesObjective Mech II - IES 2009 Question Paperaditya_kumar_meNo ratings yet

- CBSE Class 6 Whole Numbers WorksheetDocument2 pagesCBSE Class 6 Whole Numbers WorksheetPriyaprasad PandaNo ratings yet

- Indian Standard: Pla Ing and Design of Drainage IN Irrigation Projects - GuidelinesDocument7 pagesIndian Standard: Pla Ing and Design of Drainage IN Irrigation Projects - GuidelinesGolak PattanaikNo ratings yet

- Meet Your TeamDocument2 pagesMeet Your TeamAyushman MathurNo ratings yet

- DOE Tank Safety Workshop Presentation on Hydrogen Tank TestingDocument36 pagesDOE Tank Safety Workshop Presentation on Hydrogen Tank TestingAlex AbakumovNo ratings yet

- Typical T Intersection On Rural Local Road With Left Turn LanesDocument1 pageTypical T Intersection On Rural Local Road With Left Turn Lanesahmed.almakawyNo ratings yet

- Hi-Line Sportsmen Banquet Is February 23rd: A Chip Off The Ol' Puck!Document8 pagesHi-Line Sportsmen Banquet Is February 23rd: A Chip Off The Ol' Puck!BS Central, Inc. "The Buzz"No ratings yet

- Tutorial 1 Discussion Document - Batch 03Document4 pagesTutorial 1 Discussion Document - Batch 03Anindya CostaNo ratings yet

- Revit 2010 ESPAÑOLDocument380 pagesRevit 2010 ESPAÑOLEmilio Castañon50% (2)

- Nokia CaseDocument28 pagesNokia CaseErykah Faith PerezNo ratings yet

- Empanelment of Architect-Consultant - Work Costing More Than 200 Lacs. (Category-B)Document6 pagesEmpanelment of Architect-Consultant - Work Costing More Than 200 Lacs. (Category-B)HARSHITRAJ KOTIYANo ratings yet

- IQ CommandDocument6 pagesIQ CommandkuoliusNo ratings yet