Professional Documents

Culture Documents

Financial Services & Institutions - An Introduction

Uploaded by

Mayank KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Services & Institutions - An Introduction

Uploaded by

Mayank KumarCopyright:

Available Formats

MBFI Lecture Note # 01 Financial Services & Institutions - An Introduction

Financial Services: Financial services refer to services provided by the finance industry. Movement of money Converting currencies Facilitating business Facilitating import export Travelers Cheques Deposits Loans Facilitating issue of securities Facilitating trading of securities Investing in securities Advising companies in financial matters Provide risk cover Advise in risk management areas Regulators

Financial Institutions Commercial Banks Investment Banks Consumer finance companies Investment funds Mutual funds Stock brokerages Stock exchanges Credit card companies Insurance companies 1

MBFI Lecture Note # 01

Financial Institutions can be defined as entities whose assets are almost entirely financial assets. And, Financial Assets can be defined as claims on others such as individuals, firms, companies, institutions and the government (claims such as receivables sundry debtors are generally not considered as financial assets). However, in India, the legal definition [Section 45-I of the RBI Act 1934] is as follows. "Financial Institution" means any non-banking institution which carries on as its business or part of its business any of the following activities, namely:a) the financing, whether by way of making loans or advances or otherwise, of any activity other than its own; b) the acquisition of shares, stock, bonds, debentures or securities issued by a government or local authority or other marketable securities of a like nature; c) letting or delivering of any goods to a hirer under a hire-purchase agreement as defined in clause (c ) of section 2 of the Hire-Purchase Act, 1972; d) the carrying on of any class of insurance business; e) managing, conducting or supervising, as foreman, agent or in any other capacity, of chits or kuries as defined in any law which is for the time being in force in any State, or any business, which is similar thereto; f) collecting, for any purpose or under any scheme or arrangement by whatever name called monies in lump sum or otherwise, by way of subscriptions or by sale of units, or other instruments or in any other manner and awarding prizes or gifts, whether in cash or kind, or disbursing monies in any other way, to persons from whom monies are collected or to any other person. But does not include any institution, which carries on as its principal business,a) agricultural operations; or b) industrial activity; or; 2

MBFI Lecture Note # 01 c) the purchase or sale of any goods (other than securities) or the providing of any services; or d) the purchase, construction or sale of immovable property, so however, that no portion of the income of the institution is derive from the financing of purchases, constructions or sales of immovable property by other persons; The whole set of financial institutions are, for various reasons, seen as comprising two sub-sets viz., Banks and Non Banking Financial Institutions. Such a distinction is made because of the critical nature of banks in the financial system in the economic system and the consequent imperative of close monitoring and intensive regulation of banks.

Commercial Banking and Investment Banking Banking, the oldest of all financial service professions, started as a money changing business safe keeping of wealth. It has then started providing services facilitating payments and remittances both personal and business related. In due course it evolved into a profession offering a whole range of financial services. Two major categories of services are the commercial banking and investment banking. While commercial banking refers to the business of taking deposits and making loans, investment banking is used for the activity related assisting corporations in raising funds in the capital markets. In recent years the lines dividing the two have blurred, especially as commercial banks have started offering more investment banking services to becoming a one-stop service provider. The exact structure varies from country to country and depends on local regulations.

MBFI Lecture Note # 01 Commercial banks Banks are financial institutions with a key difference that sets them apart from other such institutions in that they are authorized to accept deposits payable on demand. Because of this unique character of banks, they are both highly regulated and have a restrictive legal definition in all countries. In India banking has been defined in the Banking Regulation Act 1949 {Sec 5 (b) }. According to the BR Act banking means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawable by cheque, draft, order or otherwise. In the US, a bank has been defined as an organization that makes loans, has FDIC (Federal Deposit Insurance Corporation) insured deposits and has been granted banking powers either by the State or by the Federal Government

Basic Functions Performed by Commercial Banks

Payment System o Checking Accounts or Current Accounts When a customer deposits his/her money in a bank, the bank typically opens an account in his/her name. The account could be of three different types a current account or account meant for facilitating every day transactions, both receipts and payments. Such accounts are usually favoured by businessmen/commercial entities unlike savings bank accounts favoured by individuals for their savings or fixed deposits wherein the money is locked in for a specific period. In most countries no interest is paid on current and savings accounts. In India, however, while no interest is paid on balances in current accounts, banks pay interest (presently 3.5%) on balances in savings bank accounts. Both are checking accounts in the sense that account holders 4

MBFI Lecture Note # 01 can draw checks and banks have to honour these cheques provided they have funds or balance in their accounts. o Movement of funds DD, TT, MT & EFT Banks facilitate the movement of funds from one place to another by issuing what are known as demand drafts (DD), telegraphic transfers (TT), mail transfers (MT) and electronic fund transfers (EFT). A customer in Chennai who wants to send money to someone in Mumbai, for instance, can simply tell his banker to issue a DD/TT favouring that person payable in Mumbai. Financial Intermediation o Banks enable financial intermediation ie they intermediate between those who have money/savings (Savers) and those who need money/investors/entrepreneurs (Borrowers) o Efficient allocation of capital is crucial for an economy to ensure that resources put to best and efficient use o Economic growth depends on savings and efficient use of saving

MBFI Lecture Note # 01 Indian Financial System Historical Perspective Financial systems evolve over a period of time and are influenced by the politico economic environment. And, economic development is accompanied by growth of financial organizations. Upto 1951 Post independence and before the Five Year Plans started Closed character of industrial entrepreneurship Not well organized securities and capital market Lack of intermediaries Lack of institutional infrastructure Bank lending security and collateral based The Plans period (up to the late eighties) Pursuance of goals of accelerated economic growth with social justice Adoption of the mixed economy model and use of Five Year Plans Need felt for alignment of financial system with the priorities of governments economic policy Government control over distribution of credit & finance Emphasis shifted from Business to Development

Directed bank lending loans only for desired sectors Fortification of the institutional structure New institutions : development banks UTI

Insurance companies Public / government ownership to direct savings into desired sectors Nationalization of major banks in 1969

Control over corporate management of banks 6

MBFI Lecture Note # 01 Cap on voting rights of shareholders Approval of RBI required over appointment of the Chairman managing Director and other Directors of the Board of Directors Micro regulation by RBI Problems in this period PSU banks Concentration on deposit mobilization, branch expansion and following ministry/RBI directives Lack of competition Bureaucratization Not profit oriented, NPAs, overstaffing Non-uniform accounting Low capitalization Development Financial Institutions (DFIs) DFIs acted as mere canalizing agencies- channeling money from the government to borrowers Accumulated mountains of debt NPAs and no prudential norms Became dens of corruption

BOP Crisis of the early 1990s led to structural changes and reforms leading to a the present liberalized and deregulated environment

MBFI Lecture Note # 01 Indian Financial System An Overview Financial Banks D F Is NBFCs Institution s Services Merchant / Investment Bankers Mutual Funds Credit Rating Agencies

Insurance

Life Insurance Companies General Insurance Companies

RBI Regulators SEBI IRDA Primar y Capital Market Markets Money Market Foreign Exchange Market Secondar y

Shares Equity Instruments Hybrid Debt Convertible Debentures G-Secs, Bonds, Debentures, CDs, CPs, Call Money, ICDs 8 Debt

MBFI Lecture Note # 01 Banking Scenario in India Types of Banks in India Commercial Banks Cooperative Banks Regional Rural Banks Local Area Banks

Scheduled Banks o RBI , after being satisfied that a bank conforms to certain standards, gives recognition to it by including it in the Second Schedule to the Reserve Bank of India Act 1934 o Importance Status Certain privileges such are refinance etc Support from RBI in case of trouble Stricter regulation and supervision by RBI

o As of now, all commercial banks, RRBs, State cooperative Banks and most Urban Cooperative banks are scheduled Commercial Banks Companies which have been granted banking license by RBI Doing commercial banking Public Sector Banks Old Private Sector Banks New Private Sector Banks Foreign Banks ( branches of banks incorporated outside India) RBI treats all commercial banks on the same footing

MBFI Lecture Note # 01 Cooperative Banks Financial Institutions set up in the cooperative mode State Cooperative Banks District / Central Cooperative Banks Urban Cooperative Banks / Primary Credit Societies

Primarily under the Registrar of Cooperative Societies Banks regulated by RBI - brought under RBI regulation in 1966 Though the ownership pattern id different, thye are an important segment of the financial (& payment) system Recently difficulties in some of the banks in this sector created problems in the entire banking system currently the dual control is an area of concern

Regional Rural Banks 196 in number set up in 1976 to provide credit and other facilities in the rural area o local area of operations o manned by local people (hence low cost and local knowledge) o sponsored by a public sector bank o ownership GOI 50%, State 15% and bank 35% o all RRBs have been granted the scheduled bank status o supervision is by NABARD Local Area Banks guidelines issued in 1996 Minimum Capital Rs 5 crs (promoter not less than 2 crs) Commercial banking but limited to three contiguous districts 7 approved 5 issued licenses

10

MBFI Lecture Note # 01 New Private Sector Banks opened up in 1993 minimum capital 100 crs ( 25 % by promoters) minimum capital revised in 2001 to Rs 200 crs (40% by promoters) conversion of NBFCs allowed o should have AAA rating o CRAR not less than 12% o Net NPA not more than 5%

Current Issues and Challenges o Competition o Lower margins o Market determined interest rates - volatile interest rates o More sophisticated and knowledgeable customers o Increasing banking activity o Asset quality issues & NPAs o Securitization o Technological advances o Introduction of Basel II Norms

11

You might also like

- Banking OmbudsmanDocument66 pagesBanking Ombudsmanmrchavan143No ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- 188lic of India NewDocument99 pages188lic of India Newpriyanka1591No ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Vaibhav (Banking and Insurance) - 1Document10 pagesVaibhav (Banking and Insurance) - 1Vaibhav TiwariNo ratings yet

- UNIT 1 Indian Financial SystemDocument50 pagesUNIT 1 Indian Financial Systemamol_more37No ratings yet

- Unit 1Document12 pagesUnit 1Manav MundraNo ratings yet

- A Study On Credit AppraisalDocument83 pagesA Study On Credit AppraisalMallik ArjunNo ratings yet

- Non Banking Financial CompaniesDocument50 pagesNon Banking Financial CompaniesVaibhav SinglaNo ratings yet

- BBI FinalDocument25 pagesBBI FinalVarsha ParabNo ratings yet

- Sakshis Project PDFDocument58 pagesSakshis Project PDFSams MadhaniNo ratings yet

- Meaning of Finance: Information Has Been Collected From The WebsiteDocument93 pagesMeaning of Finance: Information Has Been Collected From The WebsiteShobhit GoswamiNo ratings yet

- Financial InsitutionsDocument14 pagesFinancial Insitutionscatprep2023No ratings yet

- Shriram Finace Sip ReportDocument64 pagesShriram Finace Sip Reportshiv khillari75% (4)

- Public Sector BanksDocument47 pagesPublic Sector Bankspoorvi agrawalNo ratings yet

- Non Banking Financial InstitutionsDocument10 pagesNon Banking Financial InstitutionsPal MarfatiaNo ratings yet

- Union Bank of IndiaDocument58 pagesUnion Bank of Indiadivyesh_variaNo ratings yet

- Financial Services in IndiaDocument78 pagesFinancial Services in IndiaKrunal Vyas0% (1)

- Written Interview Questions - Wadia GhandyDocument7 pagesWritten Interview Questions - Wadia Ghandyshantanu.shimpi220No ratings yet

- Unit-1 Banking and Insurance ManagementDocument25 pagesUnit-1 Banking and Insurance ManagementChandra sekhar VallepuNo ratings yet

- Shivam - Kumar - MFS AssignmentDocument8 pagesShivam - Kumar - MFS AssignmentShivam KumarNo ratings yet

- Assignment On NBFI Sector in BangladeshDocument10 pagesAssignment On NBFI Sector in BangladeshFarhan Ashraf SaadNo ratings yet

- Bhavna Patil (NBFC)Document55 pagesBhavna Patil (NBFC)BHAVNA PATIL100% (3)

- Non-Banking Financial CompaniesDocument25 pagesNon-Banking Financial CompaniesbboysupremoNo ratings yet

- Executive SummaryDocument7 pagesExecutive SummaryHirdayraj Saroj100% (1)

- NBFC Full NotesDocument69 pagesNBFC Full NotesJumana haseena SNo ratings yet

- Accounts of IndividualsDocument67 pagesAccounts of IndividualsgauriNo ratings yet

- Financial System of Bangladesh - An OverviewDocument11 pagesFinancial System of Bangladesh - An OverviewMD Hafizul Islam HafizNo ratings yet

- NBFC'S & RNBFC'SDocument54 pagesNBFC'S & RNBFC'SdivyamcfaNo ratings yet

- FM&FS IiDocument15 pagesFM&FS IiAyesha ParveenNo ratings yet

- Non-Banking Financial Companies (NBFCS) : Project byDocument25 pagesNon-Banking Financial Companies (NBFCS) : Project byBhupen YadavNo ratings yet

- Attachment Indian Financial System IDocument43 pagesAttachment Indian Financial System IPratheesh BoseNo ratings yet

- Commercial Banks: Roup Members: Kiran Faiz Sumera Razaque Danish Ali Geeta BaiDocument45 pagesCommercial Banks: Roup Members: Kiran Faiz Sumera Razaque Danish Ali Geeta BaiAdeel RanaNo ratings yet

- Financial Markets and ServicesDocument12 pagesFinancial Markets and Servicessrilekha thamalampudiNo ratings yet

- Commercial Banking in IndiaDocument37 pagesCommercial Banking in Indiashaurya bandilNo ratings yet

- Banking Revision NotesDocument14 pagesBanking Revision Notesbeena antuNo ratings yet

- MB18FM02 Managing Banks and Financial InstitutionsDocument29 pagesMB18FM02 Managing Banks and Financial Institutionsdaniel rajkumarNo ratings yet

- Banking Financial Services Management - Unit 1: Overview of Indian Banking SystemDocument64 pagesBanking Financial Services Management - Unit 1: Overview of Indian Banking SystemtkashvinNo ratings yet

- UNIT - I Part IDocument23 pagesUNIT - I Part IRam MohanreddyNo ratings yet

- Meaning of Banking: 1. Central BanksDocument6 pagesMeaning of Banking: 1. Central BanksMuskanNo ratings yet

- Measures To Solve Problems of NPADocument29 pagesMeasures To Solve Problems of NPAYogesh ShankarNo ratings yet

- Dhanalaxmi Bank Final Project Report by YkartheekgupthaDocument75 pagesDhanalaxmi Bank Final Project Report by YkartheekgupthaYkartheek GupthaNo ratings yet

- Q1 Banking 1Document18 pagesQ1 Banking 1Adarsh ShetNo ratings yet

- Commercial Bankes in Sri LankaDocument15 pagesCommercial Bankes in Sri LankaRaashed RamzanNo ratings yet

- Banking (Mohit Sharma)Document84 pagesBanking (Mohit Sharma)riya das100% (1)

- Financial Markets and InstitutionssDocument30 pagesFinancial Markets and InstitutionssEntityHOPENo ratings yet

- Vishakha Black Book ProjectDocument48 pagesVishakha Black Book ProjectrohitNo ratings yet

- Non-Banking Financial Companies (NBFCS) : Reserve Bank of India (Rbi) Reserve Bank of India Act, 1934 DirectionsDocument3 pagesNon-Banking Financial Companies (NBFCS) : Reserve Bank of India (Rbi) Reserve Bank of India Act, 1934 DirectionsDeep DograNo ratings yet

- Chapter - Ii: Chit Funds - A Conceptual OverviewDocument26 pagesChapter - Ii: Chit Funds - A Conceptual OverviewsairishikeshNo ratings yet

- NBFCs Black Book ProjectDocument9 pagesNBFCs Black Book ProjectBHAVNA PATIL75% (4)

- India Financial System 2018 PDFDocument41 pagesIndia Financial System 2018 PDFPiyush ChaturvediNo ratings yet

- Final Project On IPODocument21 pagesFinal Project On IPOizhar1234567No ratings yet

- BII Final NOTES UNIT1Document26 pagesBII Final NOTES UNIT1SOHAIL makandarNo ratings yet

- Business Math NotesDocument14 pagesBusiness Math NotesBeatrice Anne CanapiNo ratings yet

- BANKING AND INSURANCE (1) .Docx NewDocument59 pagesBANKING AND INSURANCE (1) .Docx Newsuganya100% (1)

- BIFS - CompleteDocument170 pagesBIFS - CompleteAvinesh curseNo ratings yet

- NBFCDocument17 pagesNBFCsagarg94gmailcom100% (1)

- Iii Semester Mba: Finance: 3.3.1 Indian Financial SystemDocument8 pagesIii Semester Mba: Finance: 3.3.1 Indian Financial Systemmasia sonaNo ratings yet

- Union Bank of IndiaDocument58 pagesUnion Bank of IndiaRakesh Prabhakar ShrivastavaNo ratings yet

- CHAP - 04 - Financial Statements of Bank - For StudentDocument87 pagesCHAP - 04 - Financial Statements of Bank - For Studentkhanhlmao25252No ratings yet

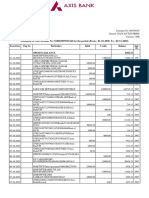

- Statement of Axis Account No:918010099547443 For The Period (From: 01-10-2020 To: 02-11-2020)Document5 pagesStatement of Axis Account No:918010099547443 For The Period (From: 01-10-2020 To: 02-11-2020)minniNo ratings yet

- Banks and The Importance of Banking Importance of Bank HistoryDocument33 pagesBanks and The Importance of Banking Importance of Bank HistoryMohammad Farhan shaikh50% (4)

- Statement Standarter 1231Document1 pageStatement Standarter 1231SW ProjectNo ratings yet

- M/S. Harsiddh Engineering Co.: A Summary of Your Relationship/s With Us: Relationship Type Currency Assets LiabilitiesDocument2 pagesM/S. Harsiddh Engineering Co.: A Summary of Your Relationship/s With Us: Relationship Type Currency Assets LiabilitiesSanjayNo ratings yet

- HSBC Bank StatementDocument1 pageHSBC Bank Statementwilliams edwards78% (9)

- Hardware and Software Requirements of The ProjectDocument5 pagesHardware and Software Requirements of The Projectfaisal ShamimNo ratings yet

- Banking CompanyDocument5 pagesBanking CompanyPragathi PraNo ratings yet

- Internship Report On Allied Bank Limited 2009Document61 pagesInternship Report On Allied Bank Limited 2009aisharafiq198793% (14)

- 2022 06 04 - StatementDocument5 pages2022 06 04 - Statementmaria1983-2014100% (1)

- Internship Report On Credit Policy of Dutch-Bangla Bank LimitedDocument94 pagesInternship Report On Credit Policy of Dutch-Bangla Bank LimitedSifat Shahriar Shakil80% (10)

- Icici Bank Loans PDFDocument3 pagesIcici Bank Loans PDFRagothaman RNo ratings yet

- Ch5 Test BankDocument41 pagesCh5 Test BankK59 Le Nhat ThanhNo ratings yet

- Sage Pastel Partner Exam PaperDocument9 pagesSage Pastel Partner Exam PapertichimuteroNo ratings yet

- Ap TocDocument6 pagesAp TocPriscilla Pereda RojasNo ratings yet

- Poonam 1 PDFDocument80 pagesPoonam 1 PDFbhagyashreeNo ratings yet

- Correspondent Services Agreement (CSA) - 2G2 - Adam Syahrul Ramadhan - 21430034Document7 pagesCorrespondent Services Agreement (CSA) - 2G2 - Adam Syahrul Ramadhan - 21430034AdamS RamadhanNo ratings yet

- STANDARD ChartDocument103 pagesSTANDARD ChartPbawal100% (9)

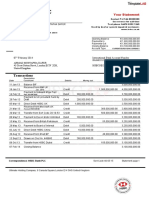

- Statement of Axis Account No:918030113821568 For The Period (From: 01-03-2023 To: 12-03-2023)Document2 pagesStatement of Axis Account No:918030113821568 For The Period (From: 01-03-2023 To: 12-03-2023)SEETHARAMA MURTHYNo ratings yet

- Internship Report On Askari Bank LimitedDocument28 pagesInternship Report On Askari Bank LimitedRahatullah Mallick55% (11)

- Accounting Cycle Journal Entries With Chart of AccountsDocument2 pagesAccounting Cycle Journal Entries With Chart of Accountsreigoraoul56No ratings yet

- IntAcc Quiz 1 PDFDocument9 pagesIntAcc Quiz 1 PDFMyles Ninon LazoNo ratings yet

- CV MUHAMMAD WAQAR - Accounting and FinanceDocument3 pagesCV MUHAMMAD WAQAR - Accounting and FinanceMuhammad Waqar100% (1)

- Md. Bodurl Alam Report PDFDocument64 pagesMd. Bodurl Alam Report PDFMd Khaled NoorNo ratings yet

- A Project Report On Comparative Study of Salary Accounts of Various Banks at Icici BankDocument62 pagesA Project Report On Comparative Study of Salary Accounts of Various Banks at Icici BankBabasab Patil (Karrisatte)No ratings yet

- Law Prep MockDocument40 pagesLaw Prep MockAmulya KaushikNo ratings yet

- Module 7 - Banking Institutions, History, Classifications, and Functions PDFDocument39 pagesModule 7 - Banking Institutions, History, Classifications, and Functions PDFRodel Novesteras ClausNo ratings yet

- Crown Banking: You and Wells FargoDocument5 pagesCrown Banking: You and Wells Fargosherr jonesNo ratings yet

- Bank Statement SbiDocument7 pagesBank Statement SbiMohd AjmalNo ratings yet

- Charlotte Foster - TransUnion Personal Credit Report - 20200530Document38 pagesCharlotte Foster - TransUnion Personal Credit Report - 20200530sherr jones100% (1)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthFrom EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthRating: 4 out of 5 stars4/5 (20)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- Mind over Money: The Psychology of Money and How to Use It BetterFrom EverandMind over Money: The Psychology of Money and How to Use It BetterRating: 4 out of 5 stars4/5 (24)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsFrom EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsRating: 5 out of 5 stars5/5 (1)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsFrom EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)From EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Rating: 4 out of 5 stars4/5 (5)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Valley Girls: Lessons From Female Founders in the Silicon Valley and BeyondFrom EverandValley Girls: Lessons From Female Founders in the Silicon Valley and BeyondNo ratings yet