Professional Documents

Culture Documents

Corporate Governance Mechanisms and Firms' Financial Performance in Nigeria

Uploaded by

NonasaidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Governance Mechanisms and Firms' Financial Performance in Nigeria

Uploaded by

NonasaidCopyright:

Available Formats

22 Afro-Asian J. Finance and Accounting, Vol. 2, No. 1, 2010 Copyright 2010 Inderscience Enterprises Ltd.

. Corporate governance mechanisms and firms financial performance in Nigeria Ahmadu U. Sanda*, Aminu S. Mikailu and Tukur Garba Department of Economics, Usmanu Danfodiyo University, Sokoto, Nigeria E-mail: ahmaduus@yahoo.com E-mail: amikala2001@yahoo.com E-mail: ttukurus@yahoo.com *Corresponding author Abstract: This paper investigates the effects of certain corporate governance mechanisms on the performance of firms listed on the Nigerian Stock Exchange. Based on a sample of 93 firms for the period 1996 through 1999, our results show an optimal board size of ten, favour concentrated over diffused ownership, and support separation of posts of CEO and chair. Moreover, while director shareholding is found to be an insignificant factor affecting firm performance, the results show expatriate CEOs performing better than their local counterparts. We need to err on the side of caution as sampling selection was based on data availability rather than any probability criterion. Keywords: corporate governance; agency theory; stakeholder theory; concentration effect; director shareholding effect; Nigeria. Reference to this paper should be made as follows: Sanda, A.U., Mikailu, A.S.

and Garba, T. (2010) Corporate governance mechanisms and firms financial performance in Nigeria, Afro-Asian J. Finance and Accounting, Vol. 2, No. 1, pp.2239. Biographical notes: Ahmadu Umaru Sanda is a Senior Lecturer in Economics, at Usmanu Danfodiyo University, Sokoto (UDUS) Nigeria. His research interest is in corporate governance and asset pricing. He has to his credit publications in Asian Academy of Management Journal, Capital Market Review and Malaysian Management Review, amongst other journals. Aminu S. Mikailu is the Former Vice-Chancellor at UDUS, a Professor of Management Accounting and Finance with research interest in taxation, fiscal policy, corporate governance and Islamic finance. He has published in many journals, including the Nigerian Journal of Accounting Research, The Nigerian Journal of Renewable Energy and Journal of Public Administration and Local Government. Tukur Garba is a Senior Lecturer in Economics at UDUS. His main research interest is in development economics, financial economics and quantitative economics. His work has been published in a number of journals including The Nigerian Journal of Accounting Research, Maiduguri Journal of Arts and Social Sciences and Journal of Research and Development in Africa. Corporate governance mechanisms and firms financial performance 23

1 Introduction Corporate governance is concerned with ways in which all parties interested in the wellbeing of the firm (or stakeholders) attempt to ensure that managers and other insiders take measures (or adopt mechanisms) that safeguard the interests of the stakeholders. A typical firm is characterised by numerous owners having no management function, and managers with no or little equity interest in the firm. The freerider problem associated with diffused ownership of equity tends to prevent any shareholder from taking unilateral action to bear the costs of monitoring the managers, who may pursue interests that conflict with those of the shareholders. A significant amount of literature has developed on agency theory and how corporate governance mechanisms might help resolve the conflicts. Much of the literature has been built upon the theoretical works of Ross (1973), Jensen and Meckling (1976) and Fama (1980). The stakeholder theory has been popularised in the works of John and Senbet (1998) and an extension of it, enlightened stakeholder theory, has been propagated by Jensen (2002). For the stakeholder theory, concern should go beyond the traditional management-shareholder relationship to include all other stakeholders (such as employees, government, creditors). Jensen (2002) criticises the traditional stakeholder theory, arguing that in the presence of tradeoffs and conflicts, the theory offers no clear guidance on how to resolve such conflicts. This research aims to examine the relationship between certain measures of corporate

governance mechanisms [such as those suggested by John and Senbet (1998) and Monks and Minow (1995)] and firms financial performance in a developing stock exchange such as Nigeria where there is a yawning gap between theory and evidence. In more specific terms, our objective is to examine how enterprise performance may be affected by director shareholding, outside directors, board size, ownership concentration, CEO duality, foreign CEOs and leverage. A short look at the views of eminent scholars might provide a clue to the significance of this study. Metrick and Ishii (2002) maintain that corporate governance increases firm efficiency. Grosfeld (2002) support this view, arguing that corporate governance helps the process of privatisation. By promoting efficiency and investment, corporate governance helps the development of the stock market, which Demirguc-Kunt and Levine (1996) associate with improved macroeconomic growth. The rest of this paper is structured into nine sections. Section 2 gives an overview of the regulatory framework. Sections 3 and 4 are devoted to theoretical framework and literature review respectively, while Section 5 lists out the hypotheses of the study. The methodology is outlined in Section 6, while Section 7 deals with the type and sources of data. After presenting the results in Section 8, we discuss them in Section 9, before providing a concluding remark in Section 10. 2 Regulatory framework The Nigerian Stock Exchange came into being in 1960, but started operations with fewer

than ten stocks in 1961. Since then, the market has remained small, compared to what obtains in other countries. According to Standard and Poors (2000) by 2003 market capitalisation for the entire market stood at US$2,940 million, equivalent only to 2%, 24 A.U. Sanda et al. 1.1% and 0.9% of that of Malaysian, South African and South Korean stock exchanges respectively. Emenuga (1998) argues that the market suffers from other problems, with liquidity of the market averaging only 2%, compared to the average of Taiwan (174.9%) and South Korea (97.8%). The weak regulatory framework contributes to this situation. The Security and Exchange Commission (SEC) was established in 1979, and the Securities and Investment Act in 1999. Thus the stock exchange operated for almost two decades without a regulatory organ, and for another two with a regulatory organ weakened by the absence of a comprehensive legal document to assist in the discharge of its regulatory duties. From the works of Klapper and Love (2002), Dean and Andreyeva (2001) and Garcia and Liu (1999), we know that weak regulatory environment could have deleterious consequences for corporate governance and firm performance. 3 Theoretical framework Agency problem posits that in the presence of information asymmetry the agent is likely to pursue interests that may hurt the principal (Ross, 1973; Fama, 1980). This constitutes the theoretical framework upon which this paper is based. The theory has helped provide

insights not only into the problems arising between management and shareholders but also between management and a wider class of stakeholders. The stakeholder theory [see John and Senbet (1998) for a comprehensive review] and the related enlightened stakeholder theory developed by Jensen (2002) constitute important extensions on the applications of the agency problem. Jensen (2002) finds faults in stakeholder theory since the multiplicity of objective functions that it recognises violates the proposition that a single-valued objective is a prerequisite for purposeful or rational behaviour by any organization [Jensen, (2002), p.237). The enlightened stakeholder theory has an important advantage in that it offers a simple criterion to enable managers decide whether they are protecting the interests of all stakeholders: invest a dollar of the firms resources as long as that will increase by at least one dollar the long term value of the firm. 4 Literature review Finance literature suggests that both market and non-market mechanisms can be employed to help resolve the agency problem between managers and other stakeholders. The market mechanisms are of two broad categories managerial labour market (which rewards good managers, and punishes poor-performing ones) and the market for corporate takeover. Fama (1980) asserts that a firm can be viewed as a team, whose members realise that in order for the team to survive, they must compete with other teams, and that the productivity of each member has a direct effect on the team and its

members. However, owing to problems associated with poison pills, takeover bids might be thwarted (Demsetz and Lehn, 1985). Thus, corporate governance mechanisms are being trumpeted as a means of reducing the agency problem, since market mechanisms may not by themselves resolve it. Empirical works abound on the mechanisms aimed to help reduce the agency problem. Abstracting from other dimensions of corporate governance (such as incentive Corporate governance mechanisms and firms financial performance 25 schemes) we focus on five mechanisms insider shareholding, board composition, board size, ownership concentration and debt. For each of these aspects of corporate governance, we provide albeit briefly a review of important literature. The literature on relationship between insider shareholding and firm performance has produced mixed results. Empirical evidence on the relationship between insider shareholding and firm performance is mixed: DeAngelo and DeAngelo (1985) report positive relationship; McConnell and Servaes (1990) and Nor et al. (1999) document a curvilinear relationship; Loderer and Martin (1997) find no significant relation; and Yeboah-Duah (1993) supports a linear relation. The role of outside directors has been recognised in the literature. The Sarbane-Oxley Act in the USA, and Cadbury Committee Report (1992) in the UK and Bhagat and Black (2001) all emphasise its importance in enhancing enterprise performance. Yet, the

picture emerging from empirical evidence is rather blurred as both the magnitude and direction of the relationship are often contested. Weisbach (1988), Mehran (1995) and Pinteris (2002) provide evidence showing a positive effect of outside directors on firm performance. However, John and Senbet (1998) caution that despite the appeal of outside directors, the empirical evidence from the works of Fosberg (1989) is rather mixed, with no clear picture emerging. Several other works such as Hermalin and Weisbach (1991), Bhagat and Black (1999, 2001), Yermack (1996), Metrick and Ishii (2002) and Weir and Laing (2001) report no significant relation between outside directorship and firm performance. Since the role of foreign investment has been acknowledged as an important determinant of firm performance, we consider the nationality of a chief executive as an important aspect of corporate governance that needs be investigated for its impact on enterprise performance. Echoing the results of Laing and Weir (1999), Estrin et al. (2001) test whether foreign firms perform better than domestic ones, using a panel data set on Bulgaria, Romania and Poland, 19941998, reporting that foreign firms perform better than domestic ones. Board size is another corporate governance variable commonly investigated for its impact on enterprise performance. Reviewing the works of Monks and Minow (1995), Yermack (1996) seems to support small boards, arguing that large boardrooms tend to be

slow in taking decisions, and hence can be an obstacle to change. This is consistent with the works of Lipton and Lorsch (1992) who find evidence in support of small firms, arguing specifically for an optimal board size of ten. The fourth element of governance mechanism examined in this study is ownership concentration. Wruck (1989) suggests the tendency for firm performance to rise at low levels of ownership concentration and to fall after a point as additional levels of concentration may be harmful (for example through the prevention of takeover) and huge enough to offset the positive effect of monitoring. Shleifer and Vishny (1997) review the works of Gorton and Schmid (1996) which supports a positive effect of block holders on enterprise performance. The evidence is inconclusive. Renneboog (2000), Demsetz and Lehn (1985) and Holderness and Sheehan (1988) find a weak association between performance and ownership concentration. In contrast, Mrck et al. (1988) supports the tendency for firm performance to rise at low levels of concentration and to fall at higher levels. Another variable being examined for its effects on firm performance is leverage. Large creditors, like large stakeholders, also have interest in seeing that managers 26 A.U. Sanda et al. take performance-improving measures. Referring to the works of Kaplan and Minton (1994) and Kang and Shivdasani (1995), Shleifer and Vishny (1997) support this view. John and Senbet (1998) offer an explanation as to why the problem of debt

agency tends to persist. According to them, debt holders are entitled to claims and these have the tendency to rise at low levels of firm performance, and to remain constant beyond a certain level of that performance. Thus, good performance benefits the stockholders more than it does debt holders, but this is not true when performance is very low. In fact as the firm moves towards bankruptcy, equity holders face the risk of losing only their shareholdings, passing the burden of such bankruptcy to the debt holders. Taken together, these outcomes encourage managers working to protect the interest of equity holders to embark upon risky, high-return projects. In order to ensure the protection of the interest of creditors, the literature suggests that they be represented on the board of the firm. 5 Hypotheses of the study Seven hypotheses are tested in this study. Stated in the null, we hypothesise that there is no significant relationship between firm performance and each of the following: insider shareholding, outside directors, size of the board, ownership concentration and leverage. Two other hypotheses are tested: first we propose no significant difference in mean performance of firms run by foreign CEOs and those by local ones; second we hypothesise that average performance is not significantly different in firms with CEO serving as chair, compared to firms in which the two roles are separated. 6 Methodology

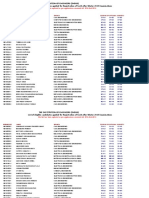

In this section, we present in Table 1 variable definition and measurement, and then proceed to specify the models estimated in this paper. Table 1 Variable definitions and measurement Variable Measurement PE ratio Price-earning ratio, measured as ratio of share price to earning per share ROA Return on assets, measured by expressing net profit as a proportion of total assets ROE Return on equity, measured by expressing net profit as a proportion of value of equity Q Modified Tobins Q obtained by dividing year-end market capitalisation by the book value of total assets DIRSHARE Director shareholding, measured by expressing total number of shares owned by directors of firm as a proportion of outstanding shares of the firm BOARDSIZE Board size, measured by taking the total number of members of the board of directors of a firm OUTSIDE Outside directors: measured by taking the number of outside directors as a proportion of board size Corporate governance mechanisms and firms financial performance 27 Table 1 Variable definitions and measurement (continued) Variable Measurement CONCENT Ownership concentration, measured by dividing the proportion of shares owned by the largest shareholders by the number of those large shareholders Debt Leverage, measured by expressing debt as a proportion of share capital

FIRMSIZE Firm size, obtained by taking the natural logs of total assets CEOSTATUS CEO duality, a dummy variable, taking a value of 0 for firms with CEO serving as chairman, and 1 otherwise DIRSHSQUARE Quadratic term, obtained by squaring the values of director shareholding BDSZSQUARE Quadratic term for board size, obtained by squaring board size CEOFOREIGN Foreign CEO, a dummy variable taking a value of 0 for firms with Nigerian CEOs, and 1 otherwise CONCENTSq Quadratic term, obtained by squaring the values of ownership contration Dji Sectoral dummies representing all sectors but one, in order to avoid the dummy-variable trap The models estimated in this paper are given below: i01i2i 3I4ii FIRMPERFORM a a DIRSHARE a BOARDSIZE a OUTSIDE a CONCENT = + + + + + (1) i01i2i 3I4ii FIRMPERFORM b b DIRSHARE b BOARDSIZE b OUTSIDE b CONCENT = + + + + + (2) i01i2i 3I4i5i FIRMPERFORM DIRSHARE BOARDSIZE OUTSIDE CONCENT FIRMSIZE

= + + + + + (3) i01i2i 3i4i 5i6i 7 FIRMPERFORM OUTSIDE DIRSHARE DIRSHSQUARE BOARDSIZE CEOSTATUS BDSIZESQUARE CON = + + + + + + + CENTi +8FIRMSIZEi +mi (4) i01i2 3i4i 56i 7 FIRMPERFORM OUTSIDE DIRSHAREi DIRSHSQUARE BOARDSIZE CEOFOREIGN STATUS BDSIZESQU = + + + + + +

+ i8i 9ii ARE CONCENT FIRMSIZE m + + + (5) i01i2i 3i4i 56i 7 FIRMPERFORM OUTSIDE DIRSHARE DIRSHSQUARE BOARDSIZE CEOFOREIGN STATUS BDSIZESQU = + + + + + + + i8i 9 i 10 i i ARE CONCENT COCENTSQ FIRMSIZE m + + + + (6) 28 A.U. Sanda et al. i01i2i 3i4i

56i 7 FIRMPERFORM OUTSIDE DIRSHARE DIRSHSQUARE BOARDSIZE CEOFOREIGN STATUS BDSIZESQU = + + + + + + + i8i 9 i 10 i j ji i ARE CONCENT COCENTSQ FIRMSIZE D + + + + + (7) i01i2i 3i4i 56i 7 FIRMPERFORM OUTSIDE DIRSHARE DIRSHSQUARE BOARDSIZE CEOFOREIGN STATUS BDSIZESQU = + +

+ + + + + i8i 9 i 10 i 11 i j ji i ARE CONCENT COCENTSQ FIRMSIZE w Debt D + + + + + + (8) The results obtained from the estimation of equations (1) to (8) above are given in Tables 2 through 9 respectively. It is important to emphasise that except in equation (8), each of the seven other equations was estimated four times, one each for the four measures of performance (ROA, ROE, PE ratio, and Q). 7 Data and data collection The population for this study comprises all firms listed on the Nigerian Stock Exchange over the period 1996 through 1999. As at the time when the data set was being collected, there were no more than 150 firms listed on the Nigerian Stock Exchange, but 93 of them had complete data on the variables specified in our models. Therefore sampling selection was based on data availability, not probability. However, the sample covers all sectors of the exchange, and all the major firms are represented in the sample. For this reason the

sample has a good representation of the population and the conclusions derived from this study may be relevant to the entire population. 8 Results Table 2 shows the results obtained from estimation of equation 1. Most coefficient estimates are insignificant. We suspected problems from the data, and therefore took logarithmic transformation of the variables and reestimated the model, reporting the results in Table 3. In Table 3, a clear pattern seems to emerge. One, director shareholding is negatively related to performance, and is significant in two out of four cases Two, board size is significant in just one out of four cases. Three, outside directors bear negative (but insignificant) coefficient estimates in all the four specifications. Third, ownership concentration is significantly positively related to performance, in three out of four cases. A chief limitation of the results in Table 3 is that they do not control for firm size. Table 4 does so. Corporate governance mechanisms and firms financial performance 29 Table 2 Coefficient estimates for equation (1) Dependent variable ROA ROE TOBIN Q PE ratio Director shareholding .00597 (1.23) .026 (.348) 0.00001 (1.062) .069 (1.1) Board size .036 (.577) .562 (.571) .0038 (5.7)*** .423 (.497) Outside directors .0977 (1.66)* .948 (1.029) .0027 ( 3.95)*** .14 (.18) Ownership concentration .0055 (1.459) .0039 (.066) - .011 (.215) R2 0.05 0.01 0.12 0.02

F 2.33* 0.36 11.78*** 0.66 Note: Significant at 10% (*); 5% (**); 1% (***). Table 3 Coefficient estimates for equation (2) ROA ROE Q PE ratio Director shareholding .058 (1.064) .0341 (.640) .19 ( 5.1)*** .064 (2.7)*** Board size .044 (.713) .202 (3.35)*** .0289 (.634) .0429 (1.574) Outside directors .879 (1.551) .264 (.479) .31 (.769) .075 (.296) Ownership concentration .0157 (2.348)** .0136 (2.100)** .0159 (3.32)*** .0019 (.678) R2 0.07 0.09 0.25 0.07 F 2.10** 3.89*** 12.69*** 2.86** Note: Significant at 10% (*); 5% (**); 1% (***). Table 4 Coefficient estimates for equation (3) ROA ROE Q PE ratio Director shareholding .1155 (2.223)** .0307 (.562) .2587 (7.414)*** .0725 ( 2.997)*** Board size .1843 (2.907)** .1941 (2.913)*** .163717 (3.767)*** .060589 (2.025)** Outside directors .760 (1.449) .2705 (.490) .2376 (.681) .0887 (.348) Ownership concentration .01489 (2.412)** .0136 (2.100)** .014714 (3.546)*** .0022 ( .760) Total assets .527 (5.324)*** .0311 (.299) .4871 (7.264)*** .06584 (1.411) R2 0.21 0.09 0.44 0.09 F 8.44*** 3.11*** 24.16*** 2.70** Note: Significant at 10% (*); 5% (**); 1% (***). Three points emerge from the results in Table 4. One, director shareholding is

significantly negatively related with performance in three out of four cases. Two, board size bears positive relationship with performance and is significant in half of the cases. Three, outside directorship is not statistically significant in any of the four specifications. Finally, ownership concentration is significant is three out of four regressions. Table 5 shows the results intended to examine the effects of nonlinearity. 30 A.U. Sanda et al. Table 5 Coefficient estimates for equation (4) ROA ROE Q PE ratio Outside director .166984 (.248) .484363 (.692) .434273 (1.017) .258913 ( .813) Director shareholding .1163 (2.259)** .0262 (.490) .241464 (.149)*** .072582 (2.976)*** Director shareholding squares .00781 (.331) .0050 (.204) .002968 (.195) .006714 ( .611) Board size .515857 (1.006) .5979 (1.121) 1.1880 (3.383)*** .142838 (.553) CEO status .8247 (1.692)* 1.04 (2.052)** .105101 (.341) .279897 (1.271) Board size squares .0193 (.669) .023 (.781) .0576 (2.949)*** .011829 (.825) Concentration .4933 (2.586)*** .5287 (2.66)*** .60574 (4.886)*** .028144 (.318) Total assets .547 (5.43)*** .0058 (.056) .4736 (7.151)*** .058268 (1.215)

R2 0.23 0.13 0.5 0.11 F 5.84*** 2.95*** 18.26*** 2.12*** Note: Significant at 10% (*); 5% (**); 1% (***). Table 6 Coefficient estimates for equation (5) ROA ROE Q PE ratio Outside director .670 (1.020) 1.06 (1.517) .118 (.260) .329 (.984) Director shareholding .074 (1.476) .028 (.525) .2198 (6.165)*** .049 (1.920)* Director shareholding squares .005 (.208) .0041 (.175) .0049 (.314) .0148 (1.310) Board size .348 (.574) .132 (.205) .9357 (2.175)** .180 (.580) CEO foreign 1.76 (6.453)*** 1.71 (5.879)*** .5396 (2.783)*** .033 (.229) CEO status 1.53 (3.319)*** 1.63 (3.330)*** .154 (.483) .3003 (1.325) Board size sq .03 1 (.925) .005 (.150) .044 (1.828)* .0073 ( .421) Concentration .127 (.634) .104 (.490) .40 (2.812)*** .056 (.549) Total assets .477933 (5.09)*** .090546 (.908) .445569 ( 6.583)*** .028 (.578) R2 0.39 0.28 0.5 0.07 F 10.52*** 6.44*** 15.62*** 1.13 Note: Significant at 10% (*); 5% (**); 1% (***). As may be seen in Table 5 the measures of board independence, namely outside directors, is not significant; the other measure, namely, CEOSTATUS, is significant in 2 out of 4 cases and in both of those cases the dummy variable has a positive coefficient estimate, suggesting the need for separation of offices of CEO and chairman. Third, ownership

concentration is significantly positive in three out of four cases. The results on Q, presented in Column 3, require a close examination in view of certain peculiarities. Five out of eight variables are significant at 1% level. In particular, both measures of board Corporate governance mechanisms and firms financial performance 31 size are significant, with the quadratic one having a negative sign. Taking partial derivatives and solving for optimal values gave results suggesting an optimal value of board size of ten. Beyond this level a negative relationship is predicted to set in. Table 6 is specifically intended to test whether or not foreign CEOs perform better than local ones. In three out of four cases, the coefficient estimate of the Foreign CEO dummy variable is positive and significant at 1% level, implying that firms with foreign CEOs tend to perform better. Ownership concentration: a double edged sword? Next, we include a quadratic term for ownership concentration in order to test for the effect of non-linearity. The results are given in Table 7. We focus attention on one measure of ownership performance Q for a couple of reasons. Except for this measure of performance, the parameter estimates for the other measures are not stable, tending to wander rather erratically. From the results, seven of the nine parameter estimates are significant at 1%, with the adjusted R2 computed at 55.6%. We also observe a statistically significant non-linear relationship between ownership concentration and firm performance.

Table 7 Coefficient estimates for equation (6) Dependent variable Regressors ROA ROE Q PE ratio Outside directors 0.095 (0.151) 0.723 (1.167) 0.469 (1.208) 0.142 (0.459) Director shareholding 0.089 (1.704)* 0.018 (0.357) 0.237 (7.27)*** 0.072 ( 2.87)*** Director shareholding squares 0.0 (0.441) 0.004 (0.189) 0.0015 (0.106) 0.0068 (0.603) Board size 0.36 (0.676) 0.35 (0.656) 1.045 (3.120)*** 0.08 ( 0.319) Board size squares 0.006 (0.214) 0.005 (0.172) 0.0455 (2.438)** 0.007 (0.507) Expatriate CEOs 1.436 (5.55)*** 1.444 (5.7)*** 0.57 (3.506)*** 0.068 (0.530) CEO status 0.737 (1.633) 1.04 (2.3)** 0.246 (0.885) 0.28 (1.352) Ownership concentration 0.791 (0.428) 2.32 (1.27) 4.355 (3.680)*** 2.037 (2.268)** Ownership concentration squares 0.123 (0.431) 0.36 (1.27) 0.61 (3.33)*** 0.325 ( 2.348)** Total assets 0.527 (5.3)*** 0.022 (0.232) 0.556 ( 8.96)*** 0.065 (1.350) R2 0.346 0.261 0.553 0.042

F 9.401*** 6.62*** 19.811*** 1.636 Note: Significant at 10% (*); 5% (**); 1% (***). 32 A.U. Sanda et al. Accounting for industry variations The relationship between firm performance and governance mechanisms might well vary from one sector of the exchange to another. To address this issue, 13 dummy variables were included and the results shown in Table 8. The automobile sector showed a better level of performance than the textile, conglomerate, insurance, construction and packaging sectors of the exchange. Table 8 Coefficient estimates for equation (7) Dependent variable Regressors ROA ROE Q PE ratio Outside directors 1.064 (1.306) 0.66(0.810) 1.44( 3.26)*** .226(0.544) Director shareholding 0.065 (0.896) 0.03(0.411) 0.19(4.78)*** 0.077(2.1)** Director shareholding squares 0.05(1.597) 0.03 (0.957) 0.039(2.25)** 0.003(0.179) Board size 0.18 (0.264) 0.499(0.71) 1.33(3.23)*** .252 (0.63) Board size squares 0.02 (0.555) 0.04(1.106) 0.065(2.92)*** 0.011(0.5) Expatriate CEOs 1.35 (3.9)*** 1.315(3.4)*** .25(1.16) .213(1.04) CEO status 0.98(1.47) 0.65(0.97) .629(1.74)* 0.326( 0.96) Ownership concentration

0.005(0.003) 1.504(0.731) 3.79 (3.32)*** 2.565 (2.39)** Ownership concentration squares 0.049(0.16) 0.229(0.73) 0.5(3.18)*** 0.42(2.6)** Total assets 0.73(4.6)*** 0.005(0.032) 0.59(6.68)*** 0.14(1.71)* Banking 1.41(1.87)* 1.447(1.92)* 0.779(1.85)* .628 (1.56) Breweries 1.49(1.4) 1.711(1.62) .135(0.2) .436(0.82) Building 2.15(2.6)*** 1.80(2.2)** 1.077(2.43)** .248(0.610) Conglomerates 2.34(2.59)** 2.079(2.3)** 2.22(4.6)*** .292(0.67) Construction 2.34(2.56)** 1.233(1.3) 1.185(2.4)** 0.104(0.22) Food and beverages 1.05(1.338) 0.22(0.3) 0.03(0.078) .230(0.59) Health 2.41(2.13)** 1.46(1.29) 0.8(1.357) .659(1.11) Industrial 3.54(3.6)*** 1.99(2.0)** 0.06 (0.112) .653(1.29) Insurance 1.63(2.32)** 0.64(0.9) 1.35(3.48)*** 0.0784(0.22) Packaging 3.98(4.4)*** 2.19(2.4)** 1.669(3.43)*** .376 (0.81) Petroleum 0.82(0.92) .168 (0.19) .589(1.24) 0.087(0.20) Textiles 3.15(3.1)*** 1.7(1.64) 1.43(2.54)** 0.586( 1.03) R2 0.48 0.379 0.741 0.099 F 7.161*** 5.083*** 19.2*** 1.663** Note: Significant at 10% (*); 5% (**); 1% (***). Corporate governance mechanisms and firms financial performance 33 A second result is that despite the extension of the model, the nature of the relationship between board size and firm performance has remained unchanged, with the results

predicting an optimal size of ten board members. A more interesting insight offered by the inclusion of sector dummies into the regression analysis is concerning the relationship between firm performance and governance variables, notably ownership concentration and director shareholding. As in the previous results, statistically significant relationship is found between firm performance and the two governance variables mentioned above. Given the negative coefficient estimate of the quadratic term for the concentration variable, performance is predicted to rise within a certain range and fall thereafter. In contrast, given the positive sign of the coefficient estimate for the quadratic term for director shareholding, it is predicted that beyond a certain level of director shareholding, further ownership of shares by directors would lead to improvements in performance. This will sound rather perplexing, for the literature suggests a limit within which such a positive relationship can be expected to hold. Do the results therefore run counter to theoretical expectation? To answer this question we refer to the coefficient estimates of the two quadratic terms in the model. A negative coefficient estimate for the quadratic term for ownership concentration implies a -shape for the relationship between concentration and firm performance. Taking partial derivatives and solving for optimal values we obtained results implying that beyond ownership concentration of 32.46%, a negative relationship will set in. By the same

token, a positive coefficient estimate for the quadratic term for director shareholding implies a U-shaped relationship between director shareholding and firm performance. Taking partial derivatives and solving for optimal values we obtained results indicating that beyond director shareholding of 8.94%, a positive relationship is predicted between firm performance and director shareholding. In view of this, we propose that there is a limit to which this relationship might hold, although the Ushaped nature of the function suggests otherwise. As directors own more and more shares, this will increase ownership concentration. If the level of director shareholding continued to rise and thereby caused the level of ownership concentration to rise beyond the threshold of 32.46%, would the relationship between director shareholding still be positive in view of the U-shaped nature of the function? The answer depends on whether performance is falling (due to concentration effects) faster than it is rising (due to director shareholding effect). Looking at the coefficient estimate of the two quadratic terms, the absolute value for that of concentration is higher than that of director shareholding. Thus, after ownership concentration of 32.46%, the negative effects of it will outweigh the positive effect of director shareholding. Hence the negative effects of concentration seem to prevent director shareholding from having an unlimited range within which to exhibit a positive correlation with performance. These results are tentative and further investigation is

required to address these and related issues. Such issues include for example the need to estimate the level of director shareholding required to raise the level of ownership concentration to the threshold level. Effects of leverage The regression analysis was also extended to incorporate two new elements in Table 9. 34 A.U. Sanda et al. Table 9 coefficient estimates for equation (8) Dependent variable Q Outside directors 2.052 (3.116)*** Director shareholding .177 (1.827)* Director shareholding squares 0.02105 (0.668) Board size 2.074 (3.023)*** Board size squares .121 (3.122)*** Expatriate CEOs 3.125 (4.686)*** CEO status 2.017 (2.659)*** Ownership concentration 4.817 (2.514)** Ownership concentration squares 1.028 (3.712)*** Total assets 1.292 (9.318)*** Debt .446 (7.176)*** Banking 1.958 (2.951)*** Breweries 1.144(1.345) Building 5.023 (5.664)*** Conglomerates 3.015 (3.784)*** Construction .902 (1.164) Industrial 1.107 (1.836)* Insurance 0.05269 (.128) Packaging 1.498 (2.465)** Petroleum .134 (0.204) Textiles 1.255 (0.783) R2 0.919 F 46.533*** Note: Significant at 10% (*); 5% (**); 1% (***). The first was the need to consider leverage in the computation of Q and the second was to

include debt as a control variable. A number of important changes in the results emerged in terms of significance and signs of the parameter estimates. Although CEO status remained significant with the expected negative sign, a significant positive effect was obtained for outside directors. Moreover, the measure of leverage turned out to be significant and with positive sign, a finding running in support of our a priori expectation of a positive sign for the linear measure of debt. 9 Results discussion Results are discussed in accordance with the seven hypotheses presented in Section 5 of this paper. The first hypothesis seeks to examine the effect of director shareholding on firm performance. The results are significant in 15 out of 25 regressions, indicating a negative relationship between director shareholding and firm performance. These results are not Corporate governance mechanisms and firms financial performance 35 consistent with the theoretical expectation of a positive relationship proposed by DeAngelo and DeAngelo (1985). An explanation for this unexpected finding may be found in a recent work by Sanda et al. (2008) who report that in Nigeria, there is evidence of a significant concentration of shares in a network of family holdings, with such family control producing governance structures in which many members of the same family sit around a family-related CEO or chairman. In addition, Morck and Yeung (2003) argue that such ownership structures tend to produce governance structures that could cause

expropriation of minority shareholders by the dominant family holdings. The second hypothesis seeks to examine the effects of outside directors on enterprise performance. The results are not significant in 23 out of 25 regressions, implying that the null hypothesis is not rejected. Although supporting the earlier works of Fosberg (1989), Hermalin and Weisbach (1991) and others, our results are inconsistent with the results reported in the works of Wesisbach (1988), Mehran (1995) and Pinteris (2002) who report significant positive relationship between the two variables. The absence of a significant relationship reported here may be a pointer to the need for rethinking the governance structures of firms quoted in Nigerian Stock Exchange. Both theory and empirical results alluded to earlier on suggest that outside directors are expected to contribute to significant performance improvement. That this is not the case in Nigeria may be indicative of a tendency for CEO or management to gain significant control of the board, including the outside directors, making them unable to exercise the sort of control required of them. Additionally, if the CEO has direct or indirect influence in the appointment or renewal of appointment of board members, even outside directors might be forced to compromise their independence. As in this case, often a lack of significant result could be an important finding. It means that outside directors are not effective in promoting the interest of the firm. This raises the

issue of the need for the regulatory authorities in Nigeria to examine more closely the need to review the code of corporate governance in ways that will ensure that outside directors are more effective in checking the affairs of managers as a means of raising firm performance. The third hypothesis examines the effect of board size on performance. Our results appear to uphold the predictions of the theory within a certain range, there is a positive relationship operating between board size and firm performance. Our results show an optimal board size of ten, a finding consistent with the predictions of Yermack (1996). A recent study by Sanda et al. (2008) shows that most firms listed on the Nigerian Stock Exchange report board size of less than ten even over the period of this study (1996 to 1999). This suggests that Nigerian boardrooms are operating below the size that is optimal for effective promotion of enterprise performance. The fourth hypothesis tests the effects of ownership concentration on performance. The coefficient estimates are positive and significant in 15 out of 25 regressions. Moreover, they show a negative coefficient estimate for nearly all the quadratic terms for ownership concentration. These findings are in conformity with Wruck (1989) and others who predict that within a certain range of ownership concentration, a positive relationship with performance would be expected. Our finding may be a reflection of weak legal system in Nigeria since according to Coffee (1999) such a system may not protect the

interest of minority shareholders, leading to more concentrated ownership structures. Moreover, where agency problem is prevalent, concentrated ownership structures could be a reflection of shareholder response for curbing the excesses of management. 36 A.U. Sanda et al. The fifth hypothesis examines the effects of CEO duality. A major shortcoming of this test is that there is hardly any literature to suggest the nature of this relationship. Our test is based on Nigerias code of corporate governance which recommends separation of the roles of CEO and chair. The results show that in 5 out of 17 regressions, CEOs separating the two roles perform better than those combining them. Only in 2 out of 17 regressions was the reverse result found. The sixth hypothesis tests the effects of CEO nationality on firm performance. It was found that in 9 out of 17 regressions, foreign CEOs perform significantly better than local ones. By testing this hypothesis and reporting that foreign CEOs perform better than local ones, this should help to justify policy to attract foreign investors as well as to support capacity development efforts for local CEOs. Finally, our results show significant positive relationship between leverage and enterprise performance, a finding that leads to the rejection of the null hypothesis. There are several possible explanations. One, where corporate governance structures are weak, creditors could take on the monitoring role of management in order to enable the process of loan recovery. This result is consistent with an aspect of the literature cited in this

paper concerning the finding [reported in Kaplan and Minton (1994) and others] that large creditors have the capacity to monitor managers in order to raise enterprise performance. In the same vein, finance and economics literature suggests a link between financial development and economic growth. Such literature pays additional emphasis on the capital market since it has the capacity to generate long term funds badly needed for investment. A positive relationship between debt and performance could actually be a reflection of the weakness of the countrys capital market, resulting in over reliance on the banking system for funds to support enterprise growth. All in all, it could be surmised that the results have offered important insights into the relationship between corporate governance variables and firms financial performance in Nigeria. To the extent that we have provided policy implications emanating from these findings, we are content that these results have enabled us to achieve a modest objective of our study gaining additional understanding of the sort relationship between a set of governance variables and enterprise performance in Nigeria. 10 Conclusions In this paper, we set out to examine the relationship between enterprise performance and a set of corporate governance variables since it is widely realised that a weak corporate governance structure could engender problems that could have significant ramifications on all stakeholders including government, employees, and above all, shareholders. In summary, the story emerging from this research is that unlike the findings in other

countries, but in keeping with the outcomes of other researches, outside directors are found to make no significant contribution to firm performance, and that director shareholding may actually hurt the enterprise. Another aspect of the results is concerning the finding that both ownership concentration and board size exhibit a significant non-linear relationship, helping to raise performance within a certain range, but causing it to fall beyond an optimal level. It is striking to note that while foreign CEOs are found to perform better than local ones, firms having a chief executive serving as chairman are found to record lower levels of performance compared to firms in which the two roles are separated. That leverage is found to show significant positive relationship with Corporate governance mechanisms and firms financial performance 37 performance could be indicative of conscious efforts by major creditors (such as banks) to take on a monitoring responsibility in ways that help to enhance firm performance. These results have helped to enable the achievement of this researchs broad objective of attempting to understand the nature of the relationship between corporate governance and the performance of firms listed on the Nigerian Stock Exchange. A couple of caveats need be mentioned at this stage. One, as mentioned in a preceding section, the sample was selected based on data availability, but since it accounted for more than half of listed firms and was drawn from all the sectors, the sample is broadly representative of the population through which it was drawn. Further

research based on the adoption of a probability criterion in sampling selection is however called for in order to ascertain the extent to which the conclusions emerging from this research could be regarded as representative of the entire population of firms listed on the countrys stock exchange. A second limitation is concerning the method of statistical analysis, which relied on the standard OLS regression rather than on the more robust, quintile regressions or even panel data analysis. These limitations suggest the need for future research that a uses the entire population of firms on the stock exchange since most of them now maintain electronic copies of the statement of accounts b adopts other methods of econometric techniques of data analysis such as fixed and random effects regression that are necessary in the analysis of panel data. Acknowledgements The authors are grateful to African Economic Research Consortium (AERC) for financial support, anonymous reviewers for useful comments and Paul Collier, Lemma Senbet and other participants of the Finance and Resource Mobilisation Group at the AERC meetings held in December 2001, May 2002 and November/December 2003 in Nairobi. All errors are our own. References Bhagat, S. and Black, B. (2001) The non-correlation between board independence and long-term firm performance, Journal of Corporation Law, Vol. 27, pp.231-271. Bhagat, S. and Black, B. (1999) The uncertain relationship between board composition and firm

performance, Business Lawyer, Vol. 54, pp.921963. Cadbury Committee Report (1992) Report on the Financial Aspects of Corporate Governance, Gee Publishing, London. Coffee, J.C. (1999) Privitization and corporate governance: the lessons from securities market failure, Journal of Corporation Law, Vol. 25, pp.139. Dean, J.W. and Andreyeva, T. (2001) Privatisation, ownership structure and company performance: the case of Ukraine, Journal for Institutional Innovation, Development & Transition, Vol. 5, pp.6272. DeAngelo, H. and DeAngelo, L. (1985) Managerial ownership of voting rights: a study of public corporations with dual classes of common stock, Journal of Financial Economics, Vol. 14, No. 1, pp.3369. Demirguc-Kunt, A. and Levine, R. (1996) Stock market development and financial intermediaries: stylized facts, The World Bank Economic Review, Vol. 10, No. 2, pp.291231. 38 A.U. Sanda et al. Demsetz, H. and Lehn, K. (1985) The structure of corporate ownership: causes and consequences, Journal of Political Economy, Vol. 93, No. 6, pp.11551177. Emenuga, C. (1998) The Nigerian capital market and Nigerias economic performance, Proceedings of the One-day Seminar of the Nigerian Economic Society, 21 January. Estrin, S., Konings, J., Zolkiewski, Z. and Angelucci, M. (2001) The effect of ownership and competitive pressure on firm performance in transition countries: micro evidence from Bulgaria, Romaia and Poland, Paper Presented at LICOS, K.U. Leuven; a Phare Ace Workshop on Competition policy in Romania, 7 August.

Fama, E.F. (1980) Agency problems and the theory of the firm, Journal of Political Economy, Vol. 88, No. 2, pp.288307. Fosberg, R. (1989) Outside directors and managerial monitoring, Akron Business and Economic Review, Vol. 20, pp.2432. Garcia, V.F. and Liu, L. (1999) Macroeconomic determinants of stock market development, Journal of Applied Economics, May, Vol. 2, No. 1, pp.2959. Gorton, G. and Schmid, F. (1996) Universal Banking and Performance of German firms, National Bureau of Economic Research, Working Paper No. 5453. Grosfeld, I. (2002) Exploring the link between privatization and other policies in transition, Paper Presented at Beyond Transition Conference, organized by Centre for Analysis of Social Exclusion, London School of Economics, FALENTY, 1213 April. Hermalin, B.E. and Weisbach, M.S. (1991) The effects of board composition and director incentives on firm performance, Financial Management Winter, Vol. 20, No. 4, pp.101112. Holderness, C. and Sheehan, D. (1988) The role of majority shareholders in publicly held corporations, Journal of Financial Economics, Vol. 20, pp.317346. Jensen, M.C. (2002) Value maximization, stakeholder theory, and the corporate objective function, Business Ethics Journal, Vol. 12, No. 2, pp.235256. Jensen, M.C. and Meckling, W.H. (1976) Theory of the firm: managerial behaviour, agency costs and ownership structure, Journal of Financial Economics, Vol. 2, pp.305360. John, K. and Senbet, L.W. (1998) Corporate governance and board effectiveness, Journal of Banking and Finance, Vol. 22, No. 4, pp.371403.

Kang, J. and Shivdasani, A. (1995) Firm performance, corporate governance and top executive turnover in Japan, Journal of Financial Economics, Vol. 38, No. 1, pp.2958. Kaplan, S. and Minton, B. (1994) Appointment of outsiders to Japanese boards: determinants and implications for managers, Journal of Financial Economics, Vol. 36, No. 2 pp.225258. Klapper, L.F. and Love, I. (2002) Corporate governance, investor protection, and performance in emerging markets, World Bank Policy Research Working Paper, World Bank Policy Research Working Paper No. 2818. Laing, D. and Weir, C.M. (1999) Governance structures, size and corporate performance in UK firms, Management Decision, Vol. 37, No. 5, pp.457464. Lipton, M. and Lorsch, J.W. (1992) A modest proposal for improved corporate governance, Business Lawyer, November, Vol. 48, No. 1. Loderer, C. and Martin, K. (1997) Executive stock ownership and performance: tracking faint traces, Journal of Financial Economics, August, Vol. 45, No. 2, pp.223255. McConnell, J.J. and Servaes, H. (1990) Additional evidence on equity ownership and corporate value, Journal of Financial Economics, Vol. 27, No. 2 pp.595 612. Mehran, H. (1995) Executive compensation structure, ownership and firm performance, Journal of Financial Economics, Vol. 38, No. 2, pp.163184. Metrick, A. and Ishii, J. (2002) Firm-level corporate governance, Paper Presented at Global Corporate Governance Forum Research Network Meeting, April. Monks, R.A.G. and Minow, N. (1995) Corporate Governance, Basil Blackwell, Cambridge.

Corporate governance mechanisms and firms financial performance 39 Mrck, R., Schleifer, A. and Vishny, R.W. (1988) Management ownership and market valuation: an empirical analysis, Journal of Financial Economics, Vol. 20, Nos. 12, pp.293315. Morck, R. and Yeung, B. (2003) Agency problems in large family business group, Entrepreneurship: Theory and Practice, Vol. 27 No. 4, pp.367 382. Nor, F.M., Said, R.M. and Redzuan, H. (1999) Structure of ownership and corporate financial performance: a Malaysian case, Malaysian Management Review, Vol. 34 No. 2, pp.4448. Pinteris, G. (2002) Ownership structure, board characteristics and performance of Argentine banks, Working paper, University of Illinois, Fall. Renneboog, L. (2000) Ownership, managerial control and governance of companies listed on the Brussels stock exchange, Journal of Banking and Finance, Vol. 24, No. 12, pp.19591995. Ross, S. (1973) The economic theory of agency: the principals problem, American Economic Review, Vol. 63, No. 2, pp. 134139. Sanda, A.U., Garba, T. and Mikailu, A.S. (2008) Board independence and firm financial performance: evidence from Nigeria, Paper Presented at the Economic Development in Africa Conference, organised by the Centre for the Study of African Economies, Department of Economics, University of Oxford, England, 1618 March. Shleifer, A. and Vishny, R.W. (1997) A survey of corporate governance, Journal of Financial Economics, Vol. 52, No. 2, pp.737783. Standard and Poors (2000) Emerging Stock Markets Fact Book, New York, USA.

Weir, C.M. and Laing, D. (2001) Governance structure, director independence and corporate performance in the UK, European Business Review, Vol. 13, No. 2, pp.8695. Weisbach, M. (1988) Outside directors and CEO turnover, Journal of Financial Economics, Vol. 20, Nos. 12, pp.431460. Wruck, K.H. (1989) Equity ownership concentration and firm value: evidence from private equity financings, Journal of Financial Economics, Vol. 23, No. 1, pp.328. Yeboah-Duah, K. (1993) Stock ownership and the performance of the firm in Malaysia, Capital Market Review, Vol. 1, pp.83108. Yermack, D.L. (1996) Higher market valuation of companies with a small board of directors, Journal of Financial Economics, Vol. 40, No. 2, pp.185211.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Synopsis On Cyber Cafe Management SystemDocument22 pagesSynopsis On Cyber Cafe Management Systemyadavdhaval9No ratings yet

- Application Research of MRAC in Fault-Tolerant Flight ControllerDocument1 pageApplication Research of MRAC in Fault-Tolerant Flight ControlleradcadNo ratings yet

- COP ImprovementDocument3 pagesCOP ImprovementMainak PaulNo ratings yet

- Class XI Chemistry Question BankDocument71 pagesClass XI Chemistry Question BankNirmalaNo ratings yet

- Mini Project FormatDocument5 pagesMini Project Formatriteshrajput078No ratings yet

- Efectele Pe Termen Lung Ale Alaptatului OMSDocument74 pagesEfectele Pe Termen Lung Ale Alaptatului OMSbobocraiNo ratings yet

- Justifying The CMM: (Coordinate Measuring Machine)Document6 pagesJustifying The CMM: (Coordinate Measuring Machine)pm089No ratings yet

- Experiment 1 - Friction Losses in PipesDocument34 pagesExperiment 1 - Friction Losses in PipesKhairil Ikram33% (3)

- FY&ZM JofHY (ASCE) 1943-7900Document12 pagesFY&ZM JofHY (ASCE) 1943-7900DM1988MM1No ratings yet

- Operations Management and Decision MakingDocument55 pagesOperations Management and Decision MakingAnkit SinghNo ratings yet

- Microelectronics: Circuit Analysis and Design, 4 Edition by D. A. Neamen Problem SolutionsDocument6 pagesMicroelectronics: Circuit Analysis and Design, 4 Edition by D. A. Neamen Problem SolutionsJano Jesus AlexNo ratings yet

- Matlab DrawingDocument82 pagesMatlab Drawinghpeter195798No ratings yet

- Lab 8 - LP Modeling and Simplex MethodDocument8 pagesLab 8 - LP Modeling and Simplex MethodHemil ShahNo ratings yet

- VHDL ExperimentsDocument55 pagesVHDL Experimentssandeepsingh93No ratings yet

- SAP Table BufferingDocument31 pagesSAP Table Bufferingashok_oleti100% (3)

- Eclipse RCPDocument281 pagesEclipse RCPjpradeebanNo ratings yet

- CS250 LCD Keypad User Manual: GE InterlogixDocument32 pagesCS250 LCD Keypad User Manual: GE InterlogixpttnpttnNo ratings yet

- Blockaura Token 3.1: Serial No. 2022100500012015 Presented by Fairyproof October 5, 2022Document17 pagesBlockaura Token 3.1: Serial No. 2022100500012015 Presented by Fairyproof October 5, 2022shrihari pravinNo ratings yet

- F 0177 914 Continuous Emission MonitorDocument2 pagesF 0177 914 Continuous Emission MonitorKUNALNo ratings yet

- List of Eligible Candidates Applied For Registration of Secb After Winter 2015 Examinations The Institution of Engineers (India)Document9 pagesList of Eligible Candidates Applied For Registration of Secb After Winter 2015 Examinations The Institution of Engineers (India)Sateesh NayaniNo ratings yet

- Norstar ICS Remote Tools, NRU Software Version 11Document1 pageNorstar ICS Remote Tools, NRU Software Version 11Brendan KeithNo ratings yet

- NX Advanced Simulation坐标系Document12 pagesNX Advanced Simulation坐标系jingyong123No ratings yet

- More About Generating FunctionDocument11 pagesMore About Generating FunctionThiên LamNo ratings yet

- Lecture Notes in Computational Science and EngineeringDocument434 pagesLecture Notes in Computational Science and Engineeringmuhammad nurulNo ratings yet

- Non-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Document8 pagesNon-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Shubham RautNo ratings yet

- Barium Strontium TitanateDocument15 pagesBarium Strontium Titanatekanita_jawwNo ratings yet

- Proceeding Book SIBE 2017Document625 pagesProceeding Book SIBE 2017Yochanan meisandroNo ratings yet

- 978402applied Math Test Paper - Xi Set 2 - Sem 2Document4 pages978402applied Math Test Paper - Xi Set 2 - Sem 2MehulNo ratings yet

- GGGDocument23 pagesGGGWarNaWarNiNo ratings yet

- Hadoop HiveDocument61 pagesHadoop HivemustaqNo ratings yet