Professional Documents

Culture Documents

Natural Gas/ Power News: Africa's East Coast in Natural-Gas Spotlight

Uploaded by

choiceenergyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Natural Gas/ Power News: Africa's East Coast in Natural-Gas Spotlight

Uploaded by

choiceenergyCopyright:

Available Formats

Follow

November 29, 2011 Energy Data Highlights Retail gasoline price 11/28/2011: $3.307/gal down$0.061 from week earlier up$0.451 from year earlier Retail diesel price 11/28/2011: $3.964/gal down$0.046 from week earlier up$0.802 from year earlier Crude oil futures price 11/25/2011: $96.77/bbl down$0.64 from week earlier up$96.77 from year earlier Natural gas futures price 11/25/2011: $3.542/mmBtu up$0.226 from week earlier up$3.542 from year earlier Weekly coal production 11/19/2011: 21.218 million tons down0.055 million tons from week earlier down0.315 million tons from year earlier

Natural Gas/ Power News

EIA Storage Release 11/23/11 (Actual): +9 Bcf Previous Week: +19 Bcf +0.6% Change from 1 Year Ago +6.4% Change 5-year Average Africa's East Coast in Natural-Gas Spotlight The east coast of Africa confirmed its place as one of the brightest spots on the global energy landscape after Anadarko Petroleum Corp. sharply raised its estimate for the amount of natural gas contained in a big field it has found off the coast of Mozambique. Anadarko's chief executive, James Hackett, said the revised estimate increased the company's confidence that "this could be one of the most important natural-gas fields discovered in the last 10 years." Anadarko said it had

increased the estimate of recoverable resources from the four discoveries made in its Offshore Area 1 block to between 15 trillion and 30 trillion cubic feet of gas. Initially, the Texas-based company had said the field contained six trillion cubic feet, a figure it raised to 10 trillion cubic feet in October. Thirty trillion cubic feet would be enough to meet an entire year's gas consumption by the U.S. Anadarko, whose partners in the block include Dublin-based Cove Energy PLC and Japan's Mitsui & Co., is the field's operator, with a 36.5% interest. "I'm convinced that in 10 years' time, Tanzania, Mozambique and Kenya will together form a major gas hub for Asian and Far Eastern markets," said John Craven, CEO of Cove Energy, in an interview. http://online.wsj.com/article/SB1000142405297020393560457706579183822006 0.html?mod=WSJ_Commodities_LEFTTopNews Anadarko discovers big natural gas field Anadarko Petroleum Corp. said Monday that a natural gas field discovered off the coast of Mozambique is the largest the company has ever found. The Houston oil and gas company said the East African offshore field contains 15 trillion to 30 trillion cubic feet of recoverable natural gas, up from an initial estimate of 6 trillion cubic feet. That's enough to satisfy U.S. natural gas demand for a year. The Anadarko discovery, along with a similarly large find by Italian energy company Eni SpA in October, has elevated Mozambique as a potentially major gas exporter. http://newsok.com/national-business-briefs/article/3627419#ixzz1f6DAXbwC Norway's Statoil to shut output at some North Sea fields Norway's Statoil said Friday it will shut output at some of its North Sea oil and gas fields over the weekend as a major storm heads to the region. It declined to say which fields would be concerned, but said they were situated in the Norwegian sea. "We will reduce production on a few installations as a precautionary measure," Ola Anders Skauby, a spokesman for Statoil, told Platts. "We do not expect it to have a significant impact on production overall." Statoil said some fields would stop output as soon as Friday, but declined to say how long the shutin would last. http://www.platts.com/RSSFeedDetailedNews/RSSFeed/NaturalGas/8626451

Green/ Alternative Energy News

Managing the risks in renewable energy The study identified eight types of risk facing the renewable energy industry, including financial, business/strategic, operational, political/regulatory, and weather related volume risk. The challenges of managing these risks are expected to increase as the scale and complexity of renewable-fuel power plants grows, in response to growing demand for low-carbon electricity. Indeed, in 2010 global investment in new renewable energy projects exceeded investment in new fossil-fuel plants for the first time... Meanwhile, Shell and ConocoPhillips, which also operate oil and gas fields in the Norwegian sector of the North Sea, said their operations were unlikely to be affected.

http://www.commodities-now.com/commodities-now-reports/power-andenergy/9023-managing-the-risks-in-renewable-energy.html

Energy Subsidies Stymie Wind, Solar Innovation This month, the U.S. Department of Commerce launched a formal investigation into complaints, lodged by the U.S. solar-cell manufacturers, that the government of China is funneling loan guarantees, grants and subsidies to its solar-cell companies. http://www.bloomberg.com/news/2011-11-27/energy-subsidies-stymie-wind-solarinnovation-nathan-myhrvold.html Chinese solar power companies say US trade complaint will hurt American jobs, consumers Leaders of Chinas solar power industry rejected a U.S. trade complaint that they receive unfair government support and said Tuesday possible sanctions would hurt American consumers and development of clean energy. http://www.washingtonpost.com/business/chinese-solar-power-companies-say-ustrade-complaint-will-hurt-american-jobsconsumers/2011/11/29/gIQA5ZcZ7N_story.html Google Pulls the Plug on a Renewable Energy Effort Google has quietly dropped a four-year-old initiative to make renewable energy cheaper than coal, which it promoted with an abbreviation that read like a math formula, RE<c . http://green.blogs.nytimes.com/2011/11/28/google-pulls-the-plug-on-a-renewableenergy-effort/

Crude Oil News

OPEC Daily Basket Price 11/28/2011- $108.75 (OPEC Daily Basket Price 11/25/2011- $107.73)

Crude Oil Advances as Euro Extends Gains After Italian Treasury-Bond Sale Crude oil rose a third day in New York, recouping earlier losses as a strengthening euro and advancing equities signaled investors were less concerned that Europes debt crisis will derail the global recovery. West Texas Intermediate futures gained as much as 1.1 percent, having earlier lost 1 percent. Demand for 2014 bonds auctioned by Italy today was 1.5 times the amount sold. The U.S. Energy Department may say tomorrow oil inventories rose for the first time in a month, while gasoline supplies climbed for a third week, according to a Bloomberg News survey. Sentiment has improved on news of the successful Italian bond auction, said Andrey Kryuchenkov, an analyst at VTB Capital in London. Were seeing a

stronger euro as a result, and crude prices gaining alongside the broader commodity market rebound. http://www.bloomberg.com/news/2011-11-29/crude-oil-advances-as-euro-extendsgains-following-italian-bond-sale.html

Oil Up Above $110 After Italian Bond Auction Oil pushed above $110 a barrel on Tuesday after Italy successfully completed a closely-watched bond auction, which boosted investor confidence, lifting European stocks and the euro to a session high. Brent crude futures [LCOCV1 109.89 0.89 (+0.82%)] were up $1.29 to $110.29 a barrel earlier Tuesday, and U.S. crude [CLCV1 98.16 -0.05 (-0.05%)] was up 81 cents to $99.02 a barrel after pushing to an intraday high of $99.30 following the bond auction Analysts and traders said oil was being supported by geopolitical risk and supply fundamentals given tight inventories in the United States. "We get inventory data later today and tomorrow which may show a further decline in product stocks and could lend support to crude oil prices. Brent will stay range-bound at $105-$110 a barrel," said Carsten Fritsch, an analyst at Commerzbank in Frankfurt. The market is also eyeing a meeting of euro zone finance ministers to be held in Brussels from 1400 GMT. http://www.cnbc.com/id/45468844 Crude Flirts With $100 on Geopolitical Unrest Oil futures neared $100 a barrel, lifted by unrest in Syria and the prospect of additional sanctions against Iran...Futures ended the day higher following news of geopolitical unrest on several fronts. The European Union signaled it would recommend additional sanctions on Iran, including a possible oil-import ban, during a meeting of foreign ministers set for Thursday in Brussels. Meanwhile, the Arab League on Sunday approved economic sanctions on Syria as punishment for the regime's crackdown on protesters. "This unrest in Syria, possible sanctions against Iranit's potentially bullish stuff," said Peter Donovan, vice president at Vantage Trading, an oil options brokerage in New York. Iran exported 2.2 million barrels of oil a day last year, according to the U.S. Energy Information Administration, making it the world's third-largest oil exporter. The EU was the second-biggest recipient of that oil. Although Syria itself isn't a major oil producer, the scale of the uprising has fed concern that the popular unrest in the region could spread to major oil producers like Saudi Arabia. http://online.wsj.com/article/SB1000142405297020380220457706592370618559 2.html?mod=WSJ_Commodities_LeadStory Iran embargo talk buoys Russian crude It is not yet clear whether France will succeed in placing a European Union embargo on imports of Iranian oil. But the talk is already having a noticeable impact on the physical crude markets. Traders have been placing their bets on a potential shutdown of Tehrans oil supplies using Urals, a Russian benchmark that has a similar quality to Iranian crude. The price of the Russian grade has surged to a rare premium to global benchmark Brent. The move reflects both speculation on an embargo and the fact that the market for high-sulphur, low-quality heavy sour oil is tight. Crude oil traders closely watch the Russian grade because it is widely

consumed by European refineries on the Mediterranean, which are also big importers of Iranian oil. http://www.ft.com/intl/cms/s/0/7db459c6-1a6f-11e1-ae1400144feabdc0.html#axzz1f64rS7ik IEA head concerned about tight oil market, but encouraged by Libya International Energy Agency Director Maria van der Hoeven said Monday that tight oil supplies continue to threaten the global economy, even as Libyan production returns quicker than some expected. Van der Hoeven, during an interview in Washington, said the rebuilding of Libya's petroleum sector "looks as if it's going quite fast. This of course is very interesting and reassuring." http://www.platts.com/RSSFeedDetailedNews/RSSFeed/Oil/6711247 Sudan halts oil exports from south Sudan has halted exports of oil from its newly independent southern neighbour, undermining the latest negotiations between the two sides to agree a revenuesharing deal. South Sudan, which separated from Khartoum on July 9 following decades of civil war, produces 75 per cent of the former countrys oil but exports it through northern infrastructure.We stopped exportation of the southern oil, Ali Ahmed Osman, Khartoums acting oil minister, told reporters in Khartoum on Monday. We gave them four months free, without any sort of agreement, he said of the 200,000 bpd exported by the South. South Sudans government responded angrily to the move. We consider it a sign of irresponsible and abusive anger which does not show any sense of leadership in the government of Sudan, Elizabeth James Bol, South Sudans deputy oil minister, told reporters. http://www.ft.com/intl/cms/s/0/65fa8b24-19ee-11e1-988800144feabdc0.html#axzz1f64rS7ik Houston researchers receive funding to reduce risks of offshore drilling Five Houston-based projects focused on reducing risks of ultra-deepwater drilling are among recipients of $9.6 million in federal awards from the Office of Fossil Energy, the U.S. Department of Energy announced Monday. The federal funds cover only a portion of each projects full cost. In total, the six awarded projects have a pricetag of more than $26.4 million over three years, according to the Department of Energy. The sixth project is based in Boulder, Colo. and studies the impact of hurricanes on offshore production operations in the Gulf of Mexico. Operated by the University Corporation for Atmospheric Research, the $1.8 million project will receive $360,000 in federal funding over three years. http://fuelfix.com/blog/2011/11/29/houston-researchers-receive-federal-funding-toreduce-risks-of-offshore-drilling/

Gasoline prices fall but stay at record levels Pump prices continued to fall in California and the rest of the nation, but they remained at record levels for the end of November. The average price of a gallon of regular gasoline in California fell 6.8 cents over the last week to $3.718, according to the Energy Department's weekly survey. That was 56.6 cents higher than the year-earlier per-gallon average and 32 cents higher than the old record

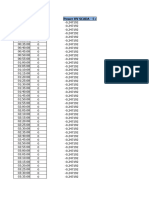

for this time of year, which was set in 2007. http://www.latimes.com/business/la-fi-gas-prices-20111129,0,2720176.story Recent Rig Counts Date of Last Year's Count 24 Nov 10 24 Nov 10 September 2010

Area U.S. Canada

Date of Last Cou Change from Prior Count nt Prior Count Count 23 Nov 2000 11 23 Nov 484 11 -1 -3 +23 18 Nov 11 18 Nov 11 Septembe r 2011

Change from Last Year +313 +69 +98

Internatio October 1197 nal 2011

http://investor.shareholder.com/bhi/rig_counts/rc_index.cfm

Weather

to 10 Day Outlooks Temperature

Precipitation

8 to 14 Day Outlooks Temperature

Precipitation

You might also like

- Energy Myths and Realities: Bringing Science to the Energy Policy DebateFrom EverandEnergy Myths and Realities: Bringing Science to the Energy Policy DebateRating: 4 out of 5 stars4/5 (4)

- Energy Data Highlights: Frosty Air Heating Up Gas FuturesDocument8 pagesEnergy Data Highlights: Frosty Air Heating Up Gas FutureschoiceenergyNo ratings yet

- Natural Gas/ Power News: Shale Gas Opens Door To U.S. LNG ExportsDocument9 pagesNatural Gas/ Power News: Shale Gas Opens Door To U.S. LNG ExportschoiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas: Boom or BustDocument8 pagesEnergy Data Highlights: Natural Gas: Boom or BustchoiceenergyNo ratings yet

- Energy and Markets Newsletter 091911Document9 pagesEnergy and Markets Newsletter 091911choiceenergyNo ratings yet

- Natural Gas/ Power News: Market Changes Contribute To Growing Marcellus Area Spot Natural Gas TradingDocument9 pagesNatural Gas/ Power News: Market Changes Contribute To Growing Marcellus Area Spot Natural Gas TradingchoiceenergyNo ratings yet

- Natural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberDocument9 pagesNatural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberchoiceenergyNo ratings yet

- Natural Gas/ Power News: Proposed KMI and El Paso Merger Would Create Largest U.S. Natural Gas Pipeline CompanyDocument7 pagesNatural Gas/ Power News: Proposed KMI and El Paso Merger Would Create Largest U.S. Natural Gas Pipeline CompanychoiceenergyNo ratings yet

- Energy Data Highlights: Power Outage May Have Caused More Than $100M in Losses To AreaDocument8 pagesEnergy Data Highlights: Power Outage May Have Caused More Than $100M in Losses To AreachoiceenergyNo ratings yet

- Energy Data Highlights: Shale Gas & The Re-Shaping of European Power PoliticsDocument8 pagesEnergy Data Highlights: Shale Gas & The Re-Shaping of European Power PoliticschoiceenergyNo ratings yet

- Energy Data Highlights: Is Fracking Set To Transform The Oil Market?Document9 pagesEnergy Data Highlights: Is Fracking Set To Transform The Oil Market?choiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas Key To US Energy Security: Former President Carter The USDocument9 pagesEnergy Data Highlights: Natural Gas Key To US Energy Security: Former President Carter The USchoiceenergyNo ratings yet

- Energy Data Highlights: Crude Oil Futures PriceDocument8 pagesEnergy Data Highlights: Crude Oil Futures PricechoiceenergyNo ratings yet

- Energy Data Highlights: North Dakota Bakken Shale Infrastructure Projects Reach $3 Billion MarkDocument8 pagesEnergy Data Highlights: North Dakota Bakken Shale Infrastructure Projects Reach $3 Billion MarkchoiceenergyNo ratings yet

- Natural Gas/ Power News: From King Coal To King GasDocument10 pagesNatural Gas/ Power News: From King Coal To King GaschoiceenergyNo ratings yet

- Natural Gas/ Power News: Middle East Can Expect 'Dash For Gas', Shell Exec Tells Oman ConferenceDocument11 pagesNatural Gas/ Power News: Middle East Can Expect 'Dash For Gas', Shell Exec Tells Oman ConferencechoiceenergyNo ratings yet

- Natural Gas/ Power News: Shale's Bounty Goes Beyond Oil and GasDocument10 pagesNatural Gas/ Power News: Shale's Bounty Goes Beyond Oil and GaschoiceenergyNo ratings yet

- Natural Gas/ Power News: ERCOT Congestion Rights Value Falls in Latest AuctionDocument10 pagesNatural Gas/ Power News: ERCOT Congestion Rights Value Falls in Latest AuctionchoiceenergyNo ratings yet

- Natural Gas/ Power News: Shale-Gas Drilling To Add 870,000 U.S. JobsDocument10 pagesNatural Gas/ Power News: Shale-Gas Drilling To Add 870,000 U.S. JobschoiceenergyNo ratings yet

- Natural Gas/ Power NewsDocument10 pagesNatural Gas/ Power NewschoiceenergyNo ratings yet

- Energy Data Highlights: Greek Turmoil Threatens Europe's Gas Pipe ProjectsDocument8 pagesEnergy Data Highlights: Greek Turmoil Threatens Europe's Gas Pipe ProjectschoiceenergyNo ratings yet

- Energy Data Highlights: Gas Futures Climb On Inventory Data, WeatherDocument8 pagesEnergy Data Highlights: Gas Futures Climb On Inventory Data, WeatherchoiceenergyNo ratings yet

- Natural Gas Set To Lead Turkish Power Market: Utility ExecutiveDocument8 pagesNatural Gas Set To Lead Turkish Power Market: Utility ExecutivechoiceenergyNo ratings yet

- Energy Data Highlights: Shale Attracts Heavy HittersDocument9 pagesEnergy Data Highlights: Shale Attracts Heavy HitterschoiceenergyNo ratings yet

- Energy Data Highlights: Gas Drillers Face Chaos' in Land Law RulingDocument10 pagesEnergy Data Highlights: Gas Drillers Face Chaos' in Land Law RulingchoiceenergyNo ratings yet

- Energy Data Highlights: Anadarko Petroleum Scores Again in MozambiqueDocument10 pagesEnergy Data Highlights: Anadarko Petroleum Scores Again in MozambiquechoiceenergyNo ratings yet

- Energy and Markets Newsletter 090611Document8 pagesEnergy and Markets Newsletter 090611choiceenergyNo ratings yet

- Energy and Markets Newsletter 111511Document9 pagesEnergy and Markets Newsletter 111511choiceenergyNo ratings yet

- Energy Data Highlights: Poland Shale Tests Show Europe Unlikely To Match U.S. Boom, Bernstein SaysDocument9 pagesEnergy Data Highlights: Poland Shale Tests Show Europe Unlikely To Match U.S. Boom, Bernstein SayschoiceenergyNo ratings yet

- Energy Data Highlights: Chesapeake Energy Continues March To Liquids: CEODocument8 pagesEnergy Data Highlights: Chesapeake Energy Continues March To Liquids: CEOchoiceenergyNo ratings yet

- Energy Data Highlights: Japan Utilities' LNG Imports, Consumption Climb To RecordDocument7 pagesEnergy Data Highlights: Japan Utilities' LNG Imports, Consumption Climb To RecordchoiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas Leads Gains in Raw Materials: Commodities at CloseDocument11 pagesEnergy Data Highlights: Natural Gas Leads Gains in Raw Materials: Commodities at ClosechoiceenergyNo ratings yet

- Energy Data Highlights: Canadian Natural Gas Advances As Midwest Braces For Cold NightsDocument10 pagesEnergy Data Highlights: Canadian Natural Gas Advances As Midwest Braces For Cold NightschoiceenergyNo ratings yet

- Natural Gas/ Power News: NY Opens Hearings On Hydraulic FracturingDocument11 pagesNatural Gas/ Power News: NY Opens Hearings On Hydraulic FracturingchoiceenergyNo ratings yet

- Natural Gas/ Power News: A Quarter of California's Electricity Comes From Outside The StateDocument9 pagesNatural Gas/ Power News: A Quarter of California's Electricity Comes From Outside The StatechoiceenergyNo ratings yet

- Energy Data Highlights: Shale Gas Reserves Could Reignite U.S. EconomyDocument8 pagesEnergy Data Highlights: Shale Gas Reserves Could Reignite U.S. EconomychoiceenergyNo ratings yet

- Energy Data Highlights: Big Gas Find For Italy's EniDocument9 pagesEnergy Data Highlights: Big Gas Find For Italy's EnichoiceenergyNo ratings yet

- Energy Data Highlights: Electric Generating Capacity Additions in The First Half of 2011Document8 pagesEnergy Data Highlights: Electric Generating Capacity Additions in The First Half of 2011choiceenergyNo ratings yet

- Energy and Markets Newsletter 112111Document8 pagesEnergy and Markets Newsletter 112111choiceenergyNo ratings yet

- Energy Data Highlights: Sierra Club Wants Natural Gas ReformsDocument7 pagesEnergy Data Highlights: Sierra Club Wants Natural Gas ReformschoiceenergyNo ratings yet

- Crude Oil News: OPEC Daily Basket Price 11/22/2011-$108.34 (OPEC Daily Basket Price 11/21/2011 - $107.74)Document11 pagesCrude Oil News: OPEC Daily Basket Price 11/22/2011-$108.34 (OPEC Daily Basket Price 11/21/2011 - $107.74)choiceenergyNo ratings yet

- Energy and Markets Newsletter 0801711Document7 pagesEnergy and Markets Newsletter 0801711choiceenergyNo ratings yet

- Energy and Markets Newsletter 111611Document8 pagesEnergy and Markets Newsletter 111611choiceenergyNo ratings yet

- Energy and Markets Newsletter 110811Document10 pagesEnergy and Markets Newsletter 110811choiceenergyNo ratings yet

- Energy Data Highlights: Tennessee Gas Pipeline Places 300 Line Project in ServiceDocument9 pagesEnergy Data Highlights: Tennessee Gas Pipeline Places 300 Line Project in ServicechoiceenergyNo ratings yet

- Energy Data Highlights: Russian Gas Takes Route in The Baltic SeaDocument8 pagesEnergy Data Highlights: Russian Gas Takes Route in The Baltic SeachoiceenergyNo ratings yet

- Energy Data Highlights: Traders Push Bearish Bets On Reliance Options To 2-Year High On Gas OutputDocument8 pagesEnergy Data Highlights: Traders Push Bearish Bets On Reliance Options To 2-Year High On Gas OutputchoiceenergyNo ratings yet

- Energy Data Highlights: China, Kazakhstan Sign Agreement To Expand Natural-Gas Pipeline NetworkDocument8 pagesEnergy Data Highlights: China, Kazakhstan Sign Agreement To Expand Natural-Gas Pipeline NetworkchoiceenergyNo ratings yet

- Energy Data Highlights: Obama To Speed Up Power Line Projects in 12 StatesDocument10 pagesEnergy Data Highlights: Obama To Speed Up Power Line Projects in 12 StateschoiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas Ends 2011 at 27-Month LowDocument9 pagesEnergy Data Highlights: Natural Gas Ends 2011 at 27-Month LowchoiceenergyNo ratings yet

- Energy Data Highlights: NYMEX January Gas Futures Contract Falls 2.6 Cents Midday TuesdayDocument9 pagesEnergy Data Highlights: NYMEX January Gas Futures Contract Falls 2.6 Cents Midday TuesdaychoiceenergyNo ratings yet

- Energy Data Highlights: Sakhalin Energy Partners Could Decide On Train 3 in 2012Document9 pagesEnergy Data Highlights: Sakhalin Energy Partners Could Decide On Train 3 in 2012choiceenergyNo ratings yet

- Energy and Markets Newsletter 091611Document7 pagesEnergy and Markets Newsletter 091611choiceenergyNo ratings yet

- Energy and Markets Newsletter January 10-2012Document8 pagesEnergy and Markets Newsletter January 10-2012choiceenergyNo ratings yet

- Energy Data Highlights: Upper Devonian May Hold As Much Gas As Marcellus Shale: Range ExecutiveDocument9 pagesEnergy Data Highlights: Upper Devonian May Hold As Much Gas As Marcellus Shale: Range ExecutivechoiceenergyNo ratings yet

- Energy Data Highlights: Mid-Summer Heat Pushes Up Natural Gas Use at Electric Power PlantsDocument8 pagesEnergy Data Highlights: Mid-Summer Heat Pushes Up Natural Gas Use at Electric Power PlantschoiceenergyNo ratings yet

- Energy and Markets Newsletter 0802611Document8 pagesEnergy and Markets Newsletter 0802611choiceenergyNo ratings yet

- Energy Data Highlights: Heating Costs Look To CoolDocument9 pagesEnergy Data Highlights: Heating Costs Look To CoolchoiceenergyNo ratings yet

- Energy Data Highlights: ICE Claims CME Argument To Eliminate Natural Gas Limit Is FlawedDocument3 pagesEnergy Data Highlights: ICE Claims CME Argument To Eliminate Natural Gas Limit Is FlawedchoiceenergyNo ratings yet

- Energy Data Highlights Energy Data HighlightsDocument8 pagesEnergy Data Highlights Energy Data HighlightschoiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas Leads Gains in Raw Materials: Commodities at CloseDocument11 pagesEnergy Data Highlights: Natural Gas Leads Gains in Raw Materials: Commodities at ClosechoiceenergyNo ratings yet

- Energy Data Highlights: Crude Oil Futures PriceDocument8 pagesEnergy Data Highlights: Crude Oil Futures PricechoiceenergyNo ratings yet

- Energy and Markets Newsletter January 4-2012Document10 pagesEnergy and Markets Newsletter January 4-2012choiceenergyNo ratings yet

- Energy Data Highlights: Barnett Shale Continues To Lose Its Luster For Producers: TradeDocument6 pagesEnergy Data Highlights: Barnett Shale Continues To Lose Its Luster For Producers: TradechoiceenergyNo ratings yet

- Energy and Markets Newsletter January 18-2012Document11 pagesEnergy and Markets Newsletter January 18-2012choiceenergyNo ratings yet

- Energy Data Highlights: NYMEX January Gas Futures Contract Falls 2.6 Cents Midday TuesdayDocument9 pagesEnergy Data Highlights: NYMEX January Gas Futures Contract Falls 2.6 Cents Midday TuesdaychoiceenergyNo ratings yet

- Energy and Markets Newsletter January 12-2012Document7 pagesEnergy and Markets Newsletter January 12-2012choiceenergyNo ratings yet

- Energy and Markets Newsletter January 13-2012Document7 pagesEnergy and Markets Newsletter January 13-2012choiceenergyNo ratings yet

- Energy and Markets Newsletter 122711Document11 pagesEnergy and Markets Newsletter 122711choiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas Ends 2011 at 27-Month LowDocument9 pagesEnergy Data Highlights: Natural Gas Ends 2011 at 27-Month LowchoiceenergyNo ratings yet

- Energy and Markets Newsletter January 10-2012Document8 pagesEnergy and Markets Newsletter January 10-2012choiceenergyNo ratings yet

- Energy and Markets Newsletter January 11-2012Document7 pagesEnergy and Markets Newsletter January 11-2012choiceenergyNo ratings yet

- Natural Gas/ Power News: ERCOT Congestion Rights Value Falls in Latest AuctionDocument10 pagesNatural Gas/ Power News: ERCOT Congestion Rights Value Falls in Latest AuctionchoiceenergyNo ratings yet

- Natural Gas/ Power News: Shale's Bounty Goes Beyond Oil and GasDocument10 pagesNatural Gas/ Power News: Shale's Bounty Goes Beyond Oil and GaschoiceenergyNo ratings yet

- Energy and Markets Newsletter 121511Document10 pagesEnergy and Markets Newsletter 121511choiceenergyNo ratings yet

- Natural Gas Set To Lead Turkish Power Market: Utility ExecutiveDocument8 pagesNatural Gas Set To Lead Turkish Power Market: Utility ExecutivechoiceenergyNo ratings yet

- Natural Gas/ Power News: A Quarter of California's Electricity Comes From Outside The StateDocument9 pagesNatural Gas/ Power News: A Quarter of California's Electricity Comes From Outside The StatechoiceenergyNo ratings yet

- Natural Gas/ Power News: From King Coal To King GasDocument10 pagesNatural Gas/ Power News: From King Coal To King GaschoiceenergyNo ratings yet

- Natural Gas/ Power News: Crestwood Midstream Plans Marcellus Pipeline in West VirginiaDocument7 pagesNatural Gas/ Power News: Crestwood Midstream Plans Marcellus Pipeline in West VirginiachoiceenergyNo ratings yet

- Natural Gas/ Power News: Crestwood Midstream Plans Marcellus Pipeline in West VirginiaDocument7 pagesNatural Gas/ Power News: Crestwood Midstream Plans Marcellus Pipeline in West VirginiachoiceenergyNo ratings yet

- Natural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberDocument9 pagesNatural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberchoiceenergyNo ratings yet

- Natural Gas/ Power News: Proposed KMI and El Paso Merger Would Create Largest U.S. Natural Gas Pipeline CompanyDocument7 pagesNatural Gas/ Power News: Proposed KMI and El Paso Merger Would Create Largest U.S. Natural Gas Pipeline CompanychoiceenergyNo ratings yet

- Natural Gas/ Power News: Middle East Can Expect 'Dash For Gas', Shell Exec Tells Oman ConferenceDocument11 pagesNatural Gas/ Power News: Middle East Can Expect 'Dash For Gas', Shell Exec Tells Oman ConferencechoiceenergyNo ratings yet

- Energy and Markets Newsletter 120711Document10 pagesEnergy and Markets Newsletter 120711choiceenergyNo ratings yet

- Natural Gas/ Power News: Shale-Gas Drilling To Add 870,000 U.S. JobsDocument10 pagesNatural Gas/ Power News: Shale-Gas Drilling To Add 870,000 U.S. JobschoiceenergyNo ratings yet

- Natural Gas/ Power NewsDocument10 pagesNatural Gas/ Power NewschoiceenergyNo ratings yet

- Crude Oil News: OPEC Daily Basket Price 11/22/2011-$108.34 (OPEC Daily Basket Price 11/21/2011 - $107.74)Document11 pagesCrude Oil News: OPEC Daily Basket Price 11/22/2011-$108.34 (OPEC Daily Basket Price 11/21/2011 - $107.74)choiceenergyNo ratings yet

- 5 Electricity - With GRESADocument15 pages5 Electricity - With GRESADianne CalladaNo ratings yet

- De-je-Ar - Templet Letest PV2 - APDIYTID DecDocument121 pagesDe-je-Ar - Templet Letest PV2 - APDIYTID Decjohn jason bayudanNo ratings yet

- PID PVOBox TI en 10 PDFDocument8 pagesPID PVOBox TI en 10 PDFbalajiiconNo ratings yet

- Draft Nanotechnology Policy For Kenya 6 March 2014Document28 pagesDraft Nanotechnology Policy For Kenya 6 March 2014Fancyfantastic KinuthiaNo ratings yet

- PESTEL Analysis of MoroccoDocument2 pagesPESTEL Analysis of Moroccoethernalx67% (15)

- RAYZON - LLIOS Mono Facial DATASHEETDocument2 pagesRAYZON - LLIOS Mono Facial DATASHEETsenthilSKNo ratings yet

- Seminar Report: Load Management System With Intermittent Power On The GridDocument14 pagesSeminar Report: Load Management System With Intermittent Power On The GridnogeshwarNo ratings yet

- Comparative Study On Solar Policies PDFDocument65 pagesComparative Study On Solar Policies PDFAbhimanyu JayakanthNo ratings yet

- Solar Power System Generator Portable Energy Alibaba - Buscar Con GoogleDocument8 pagesSolar Power System Generator Portable Energy Alibaba - Buscar Con GoogleMilagros Da SilvaNo ratings yet

- Solar Energy For Future World A Review-1-3Document3 pagesSolar Energy For Future World A Review-1-3Magali PosadaNo ratings yet

- Fluidized Bed GasifiersDocument9 pagesFluidized Bed GasifiersNikhilesh BhargavaNo ratings yet

- Residential Grid-Connected Renewable Energy System Design Using HOMERDocument1 pageResidential Grid-Connected Renewable Energy System Design Using HOMERthepianicianNo ratings yet

- Thesis Statement About Renewable EnergyDocument9 pagesThesis Statement About Renewable Energydwnt5e3k100% (2)

- Energies: Assessment of All-Electric General Aviation AircraftDocument19 pagesEnergies: Assessment of All-Electric General Aviation Aircraftamine bounounaNo ratings yet

- Grid-Connected PV System Case StudyDocument7 pagesGrid-Connected PV System Case StudyHayan JanakatNo ratings yet

- Geothermal EnergyDocument19 pagesGeothermal EnergyCatherine Joy BesanaNo ratings yet

- PPN88 Planning For Domestic Rooftop Solar Energy Systems May 2022Document4 pagesPPN88 Planning For Domestic Rooftop Solar Energy Systems May 2022Darren MNo ratings yet

- Theory Construction and Model Building Assingment by Naseer 1102Document6 pagesTheory Construction and Model Building Assingment by Naseer 1102NaseerNo ratings yet

- CO2 Methanation for Renewable Energy Storage in Gas GridsDocument6 pagesCO2 Methanation for Renewable Energy Storage in Gas GridszirimiaNo ratings yet

- Contoh CSR ReportDocument44 pagesContoh CSR ReportEko Aris PriyantoNo ratings yet

- List of Power Projects Used in Plexos Modelling of Generation Capacity Expansion Planning - REMB&EPIMB 0616 - FINALDocument12 pagesList of Power Projects Used in Plexos Modelling of Generation Capacity Expansion Planning - REMB&EPIMB 0616 - FINALCamz RoxasNo ratings yet

- Demo v4.0Document78 pagesDemo v4.0TulasiramKurapatiNo ratings yet

- Biological Carbon Fixation: Types of BiofuelsDocument18 pagesBiological Carbon Fixation: Types of BiofuelsSakshi SharmaNo ratings yet

- Rajasthan PFADocument92 pagesRajasthan PFASanjay KumarNo ratings yet

- Maritime Globalpresentation en Jan2020 OptimizedDocument207 pagesMaritime Globalpresentation en Jan2020 OptimizeddlopezarNo ratings yet

- Sam Webinars 2020 Modeling PV SystemsDocument51 pagesSam Webinars 2020 Modeling PV SystemsAdri AndiNo ratings yet

- Thermal Energy StorageDocument31 pagesThermal Energy Storagejorge ivan montoya arbelaezNo ratings yet

- The Indonesian Electricity System - A Brief Overview: TakeawaysDocument8 pagesThe Indonesian Electricity System - A Brief Overview: TakeawaysUda PieNo ratings yet

- Future Fuels Apec RegionDocument104 pagesFuture Fuels Apec RegionmalikscribdNo ratings yet