Professional Documents

Culture Documents

Jain Irrigation Systems Limited: Valuation Report - February 1, 2012

Uploaded by

sanjeev_agarwal7777Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jain Irrigation Systems Limited: Valuation Report - February 1, 2012

Uploaded by

sanjeev_agarwal7777Copyright:

Available Formats

February 1, 2012

Jain Irrigation Systems Limited (NSE: JISLJALEQS)

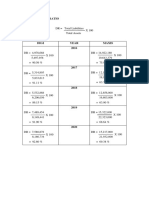

Outlook and forecasts: Given the dependence on government subsidies, JISL would tend to do well in an environment where economic activity is improving, as rising tax collections would alleviate fiscal pressures and facilitate timely subsidy payouts. However, the current environment does not inspire confidence in such an outlook, mainly because central and state fiscal deficits are unlikely to reduce in the near-term given the slowing economic activity and Central Government's plan to incur substantial new subsidies under the recently announced "Food Security Bill". As such, our base case is that JISL will continue to experience long working capital cycle of around 185 days (but expect a range of 170-200 days) over the medium-term. Further, we expect JISL to increase its revenues at an annual rate of about 22.5% (range of 20-25%), which implies revenues of Rs. 45 billion and Rs. 55 billion in the 12 months to Sep-2012 and Sep-2013, respectively. Operating margins are likely to remain stable at around 19-20% over the same period. Valuation and sensitivities: Based on the above expectations, our "median" fair value estimate of JISL is approximately Rs. 110 per common share, implying an upside potential of some 15% over the current price of Rs. 95. However, our median estimate is particularly sensitive to JISL's working capital cycle, and we would not be surprised to see the share price decline to around Rs. 70, if the working capital cycle were to deteriorate to say 200 days. That said, long positions at that level could mean a high certainty of a profit to those who exercise enough patience and hold-on to their investment. Contrarily, if the working capital cycle were to improve to around 170 days, which is what we'd expect when fiscal pressures are not as intense as they currently are, share price should increase to around Rs. 150-160. Overall, while it will be vital to watch the trajectory of the working capital cycle over the next few quarters, at current market price of Rs. 95 per share, the risk-return profile of an investment in JISL appears attractive from a long-term perspective.

Business model: Jain Irrigation Systems Limited (JISL) is the second largest manufacturer and marketer of micro irrigation and piping systems (MIS) globally and a leading processor of agro products. Significant part of the company's revenues though come from sale of MIS, demand for which is mainly driven by government subsidies to promote adoption of micro irrigation. These subsidies typically range between 70-90% of the cost of MIS but subsidy payouts are usually delayed, taking between 6 and 12 months. As a result, JISL experiences a long working capital cycle -- some 185 days of LTM sales, as of Sep.30, 2011 -- a significant drag on a business that generates after tax return on capital of around 17-18%, but owing to the payout delays, cash return of only 9-10% p.a. Recent developments: The delay in subsidy payouts is a long-standing and widespread issue across sectors, and is one without any structural solutions so far. Therefore, in a bid to alleviate the pressure on its balance sheet, JISL plans to sponsor a 40% owned unconsolidated NBFC, with remaining stakes held by JISL promoters and other investors. According to JISL, the NBFC will finance customers, thereby helping in reducing the company's working capital needs and passing-on the interest cost associated with subsidy delays to the end customers. In our view however, the proposed NBFC would not alter the underlying economics of the subsidy-driven MIS business. JISL would still own at least 40% of the economic risks associated with customer financing -- perhaps more as the offbalance sheet structure may encourage aggressive lending practices (for ex. 15% down payment vs. a minimum of 30% currently). Further, JISL might not save much on interest costs as it may need to compensate the incremental costs to customers via price cuts. As such, we don't see material "economic" benefits (as opposed to "accounting" benefits) from the proposed NBFC. If anything, the "off-balance" sheet customer financing structure would tend to obfuscate investor visibility in the core business and therefore could be a negative from a corporate governance perspective.

This report has been published by India Midcaps, a unit of Ficus Research Private Limited ("Ficus" or "India Midcaps"). The report is proprietary, protected by copyright laws, and, as such, should not be reproduced or redistributed in part or in full without written permission of India Midcaps. This report is not a solicitation to invest in the securities referenced in this report. Users should verify all claims and opinions expressed in the report, and do their own research before investing in any security discussed. Investing in equity securities carries a high degree of risk and investors may lose money trading or investing in such securities. Under no circumstance India Midcaps or its associates will be held responsible for any liability towards any user of this report. Furthermore, note that India Midcaps or its associates may buy, sell, or trade in securities referenced in this report. For more information on India Midcaps, please visit www.indiamidcaps.com or email info@indiamidcaps.com

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Citibank Research PaperDocument5 pagesCitibank Research Paperzwyzywzjf100% (1)

- Kotak StatementDocument5 pagesKotak StatementAdv RINKY JAISWALNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument8 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancedilNo ratings yet

- Soal Pas Myob Kelas Xii GanjilDocument4 pagesSoal Pas Myob Kelas Xii GanjilLank BpNo ratings yet

- MMT and Its CritiquesDocument10 pagesMMT and Its CritiquestymoigneeNo ratings yet

- Breakdown ShortDocument1 pageBreakdown ShortJulie Anthonette RistonNo ratings yet

- FIN 420 CASE STUDY Leverage RatioDocument4 pagesFIN 420 CASE STUDY Leverage RatioNur AdibahNo ratings yet

- Rural Finance and Micro FinanceDocument32 pagesRural Finance and Micro FinanceThe Cultural CommitteeNo ratings yet

- SHR TCDocument2 pagesSHR TCManikandanNo ratings yet

- Cash Management Techniques of Selected ADocument50 pagesCash Management Techniques of Selected AivyNo ratings yet

- Coffee Table Booklet 19012024Document244 pagesCoffee Table Booklet 19012024Antony ANo ratings yet

- Internal Factor Evaluation MatrixDocument13 pagesInternal Factor Evaluation MatrixAlexis SyNo ratings yet

- Statement of Cash FlowsDocument13 pagesStatement of Cash FlowsAldrin ZolinaNo ratings yet

- Estatement - 2021 10 22Document3 pagesEstatement - 2021 10 22Joseph HudsonNo ratings yet

- Hire Purchase System: By:Ca Parveen JindalDocument27 pagesHire Purchase System: By:Ca Parveen Jindalphani chowdaryNo ratings yet

- Fabm2 - Q2 - M3Document14 pagesFabm2 - Q2 - M3Christopher AbundoNo ratings yet

- End of America-Porter Stansberry PDFDocument39 pagesEnd of America-Porter Stansberry PDFgeorge100% (1)

- Finanacial Performance Analysis of HDFC BankDocument54 pagesFinanacial Performance Analysis of HDFC BankSharuk KhanNo ratings yet

- Axis Service Charges of Foreign ExchangeDocument9 pagesAxis Service Charges of Foreign ExchangeHimesh ShahNo ratings yet

- 3) From - SF - To - VaRDocument48 pages3) From - SF - To - VaRDunsScotoNo ratings yet

- Mutual FundDocument47 pagesMutual FundSubhendu GhoshNo ratings yet

- 2018 Working Capital Management: Test Code: R38 WCAM Q-BankDocument6 pages2018 Working Capital Management: Test Code: R38 WCAM Q-BankMarwa Abd-ElmeguidNo ratings yet

- Accounting Standards and Company Audit AnswersDocument9 pagesAccounting Standards and Company Audit AnswersrinshaNo ratings yet

- Government of Kerala: Rs. Rs. RsDocument25 pagesGovernment of Kerala: Rs. Rs. RsmuhammedNo ratings yet

- Chapter 2 Capital MarketsDocument9 pagesChapter 2 Capital MarketsFarah Nader Gooda100% (1)

- Customer Request and Complaint Form: Please Tick Relevant Request Service Request NumberDocument1 pageCustomer Request and Complaint Form: Please Tick Relevant Request Service Request NumberDesikanNo ratings yet

- Uucms - Karnataka.gov - in ExamGeneral PrintExamApplicationDocument1 pageUucms - Karnataka.gov - in ExamGeneral PrintExamApplicationmdirfaniffu5No ratings yet

- Bank of BarodaDocument99 pagesBank of BarodaYash Parekh100% (2)

- Indonesia Economic Update 2023 q2Document18 pagesIndonesia Economic Update 2023 q2Jaeysen CanilyNo ratings yet

- 143 Quiz4Document3 pages143 Quiz4Leigh PilapilNo ratings yet