Professional Documents

Culture Documents

Catch Me If You Can Movie Review

Uploaded by

Jn Fancuvilla LeañoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Catch Me If You Can Movie Review

Uploaded by

Jn Fancuvilla LeañoCopyright:

Available Formats

CATCH ME IF YOU CAN SEC 1 of NIL states the requirements of an instrument to be negotiable.

SEC 185 of NIL defined a check that is a bill of exchange drawn on a bank payable on demand. Frank Abagnale Jr. uses forges payroll checks from PanAm Airlines. Cashiers check means that it is drawn by the cashier of a bank upon the bank itself, payable on demand to the payee and it is accepted practice in the business sector that a cashiers check is deemed as cash. Frank uses this kind of check in order to cash it immediately by the teller because it is deemed trusted by the banks. SEC 7 of NIL defined some instances when an instrument is payable on demand. Check is payable upon demand at sight or on presentation of the payee to the bank. SEC 8 states instances when it is payable to order. Check is payable to order of a payee who is not maker, drawer or drawee. SEC 22 states that infants may incur no liability except where he is guilty of actual fraud. Frank is 17 a minor and the courts decided that he is actually guilty of fraud and sent him to jail. SEC 23 defined forgery is meant the counterfeit-making or fraudulent alteration of any writing with the intent thereby to defraud. Frank counterfeits payroll checks and cashiers checks and presents it to the beautiful tellers to use his charm in order to cash the check. SEC 24 states that the presumption of consideration in the instrument is prima facie and SEC 25 defined a value which is any consideration given to support a simple contract. Frank indorsed a cashiers check to Cheryl for a valuable consideration to receive by Frank. Cheryl received it with not a valid negotiation because Frank delivered it to Cheryl only without indorsing it at the back of the check and the effect of it is it is transferred by mere assignment only transfer of rights under a contract and ceases it to be negotiable under SEC 30 of NIL. SEC. 58 states that the fraudulent alteration by holder, forgery and other infirmities appearing on the face of the instrument is a real defence. SEC 62 states the liability of an acceptor. The bank when he/she accepts the check, it becomes the acceptor of the check. Under SEC 62, he/she admits the existence of the drawer, the genuineness of his signature and his capacity and authority to draw the instrument and the existence of the payee and his then capacity to indorse. At first, banks first refuse to cash the check of frank because they didnt know him or the policy of the banks prohibited them to do so because they will bear the losses if they cashed it to a wrong person or if the check is defective. SEC 70 defined presentment for payment because in checks there is only presentment for payment. SEC 75 states that presentment for payment must be made during banking hours. Sec 186 states that a check must be presented for payment within a reasonable time after its issue. SEC 189 states the instances when the banks may refuse payment and in the movie, the reason is that the holder refuses to identify himself and the bank has the reason to believe that the check is a forgery. SY, RICHARD G. AC09404

You might also like

- Nego Finals Reviewer Cabochan 1Document5 pagesNego Finals Reviewer Cabochan 1dbaterisNo ratings yet

- CASE DIGEST - Metrobank vs. CADocument7 pagesCASE DIGEST - Metrobank vs. CAMaria Anna M Legaspi100% (1)

- Case Digests Atty CabochanDocument38 pagesCase Digests Atty CabochanAthena Lajom100% (1)

- Ofracio, Karlo RicaplazaDocument7 pagesOfracio, Karlo RicaplazaKarlo OfracioNo ratings yet

- Sales and Lease Atty. Busmente Compiled List of TopicsDocument3 pagesSales and Lease Atty. Busmente Compiled List of TopicsKate HizonNo ratings yet

- Midterms Sales Case DoctrinesDocument6 pagesMidterms Sales Case DoctrinesJuan Carlo CastanedaNo ratings yet

- CREDIT ASG Recit Qs PDFDocument3 pagesCREDIT ASG Recit Qs PDFDana RuedasNo ratings yet

- Yek Seng Co Vs CA DigestDocument1 pageYek Seng Co Vs CA Digesthigh protector100% (1)

- 60 Tan Vs CA 239 Scra 310Document1 page60 Tan Vs CA 239 Scra 310Alan Gultia100% (1)

- Busmente Case List - Output PDFDocument13 pagesBusmente Case List - Output PDFDarla GreyNo ratings yet

- FORTUNATO RODRIGUEZ VsDocument2 pagesFORTUNATO RODRIGUEZ VsEiren QuimsonNo ratings yet

- Ramiscal v. Hernandez Case DigestDocument2 pagesRamiscal v. Hernandez Case DigestHannah Keziah Dela CernaNo ratings yet

- Re Cases Submitted For Decision Before Judge Damaso A. Herrera M-ViiiDocument2 pagesRe Cases Submitted For Decision Before Judge Damaso A. Herrera M-ViiiJeanella Pimentel CarasNo ratings yet

- Assign Credits & Rights for 40 Characters or LessDocument8 pagesAssign Credits & Rights for 40 Characters or LessRezzan Joy Camara MejiaNo ratings yet

- Avito Yu v. Atty. Cesar Tajanlangit (Adm. Case No. 5691, March 13, 2009)Document2 pagesAvito Yu v. Atty. Cesar Tajanlangit (Adm. Case No. 5691, March 13, 2009)Linalyn LeeNo ratings yet

- Compiled Case Digest CabochanDocument32 pagesCompiled Case Digest CabochanPrincess M. SantiagoNo ratings yet

- 1-31-2020 Modomo V LayugDocument1 page1-31-2020 Modomo V LayugPatrick Alvin AlcantaraNo ratings yet

- Sales Case Doctrines - MidtermsDocument14 pagesSales Case Doctrines - MidtermsI.F.S. VillanuevaNo ratings yet

- Nego Table of ContentsDocument7 pagesNego Table of ContentsSham GaerlanNo ratings yet

- Sale with Right to Repurchase CaseDocument2 pagesSale with Right to Repurchase CaseRoseanne MateoNo ratings yet

- De Vera v. MayansocDocument17 pagesDe Vera v. MayansocGfor FirefoxonlyNo ratings yet

- ELEC Suggested AnswersDocument3 pagesELEC Suggested AnswersRio SanchezNo ratings yet

- Pubcorp Atty Pascasio Case DigestDocument34 pagesPubcorp Atty Pascasio Case DigestMegan Mateo100% (1)

- A1Document2 pagesA1Sean ArcillaNo ratings yet

- Nego Sample-QuestionsDocument11 pagesNego Sample-QuestionsFranz Dela CruzNo ratings yet

- Gregorio V CrisologoDocument2 pagesGregorio V CrisologoKatrina Janine Cabanos-ArceloNo ratings yet

- Laurel Vs VardeleonDocument2 pagesLaurel Vs VardeleonheyoooNo ratings yet

- 02 in The Matter of Disbarment of Siegel and CanterDocument3 pages02 in The Matter of Disbarment of Siegel and CanterPaolo Enrino PascualNo ratings yet

- Gilat Satellite Networks, Ltd. vs. UCPBDocument4 pagesGilat Satellite Networks, Ltd. vs. UCPBJeffrey MedinaNo ratings yet

- Investors Finance Corporation vs. Autoworld Sales CorporationDocument3 pagesInvestors Finance Corporation vs. Autoworld Sales CorporationMike E DmNo ratings yet

- Admin-PubOff-Elec-PubCorp (Case Digests) - Pascasio P.2Document92 pagesAdmin-PubOff-Elec-PubCorp (Case Digests) - Pascasio P.2shinhyeNo ratings yet

- Lloyd - S Enterprises and Credit Corp. vs. Sps. Dolleton (Case Digest)Document1 pageLloyd - S Enterprises and Credit Corp. vs. Sps. Dolleton (Case Digest)Benneth SantoluisNo ratings yet

- Gargallo v. Dohle Seafront and Dohle 2015 ManningDocument1 pageGargallo v. Dohle Seafront and Dohle 2015 ManningnathNo ratings yet

- Digest of Zayas v. Luneta Motor Co. (G.R. No. L-30583)Document2 pagesDigest of Zayas v. Luneta Motor Co. (G.R. No. L-30583)Rafael PangilinanNo ratings yet

- Limson v. CADocument3 pagesLimson v. CAJMRNo ratings yet

- G.R. No. 84281Document1 pageG.R. No. 84281Rocky LadignonNo ratings yet

- Bedan Hymm, Mission and VisionDocument3 pagesBedan Hymm, Mission and VisionMak FranciscoNo ratings yet

- 6.21 J.M. Tuason & Co. Inc. v. CADocument3 pages6.21 J.M. Tuason & Co. Inc. v. CALyssa TabbuNo ratings yet

- Cordova v. Reyes Daway Lim Bernardo Lindo Rosales Law Offices (2007Document2 pagesCordova v. Reyes Daway Lim Bernardo Lindo Rosales Law Offices (2007Cherlene TanNo ratings yet

- Spouses-OCCEÑA-petitioners-vs.-LYDIA-MORALES-OBSIANA-ESPONILLA-ELSA-MORALES-OBSIANA-SALAZAR-and-DARFROSA-OBSIANA-SALAZAR-ESPONILLA-respondentsDocument3 pagesSpouses-OCCEÑA-petitioners-vs.-LYDIA-MORALES-OBSIANA-ESPONILLA-ELSA-MORALES-OBSIANA-SALAZAR-and-DARFROSA-OBSIANA-SALAZAR-ESPONILLA-respondentsRonielleNo ratings yet

- SALES AND LEASE CASE DOCTRINESDocument2 pagesSALES AND LEASE CASE DOCTRINESvonjovenNo ratings yet

- Mansion Biscuit Corp vs Court of AppealsDocument1 pageMansion Biscuit Corp vs Court of AppealsJan ZealNo ratings yet

- 8 Sui Man Hui Chan v. CADocument3 pages8 Sui Man Hui Chan v. CARioNo ratings yet

- ENRIQUEZ v. NATIONAL BANKDocument1 pageENRIQUEZ v. NATIONAL BANKdelayinggratificationNo ratings yet

- The SapphireDocument3 pagesThe SapphireNrnNo ratings yet

- Sales and LeaseDocument8 pagesSales and LeaseHi Law SchoolNo ratings yet

- Dayrit v. NorquillaDocument2 pagesDayrit v. NorquillaJoselito BautistaNo ratings yet

- Lao vs. Court of Appeals upholds sale as absoluteDocument1 pageLao vs. Court of Appeals upholds sale as absoluteHazel LomonsodNo ratings yet

- Delos Reyes Vs Aznar 179 Scra 653Document1 pageDelos Reyes Vs Aznar 179 Scra 653MuhammadIshahaqBinBenjaminNo ratings yet

- LTD Case DigestDocument28 pagesLTD Case DigestCharles MagistradoNo ratings yet

- Felix vs. BuenasedaDocument3 pagesFelix vs. BuenasedaBalaod MaricorNo ratings yet

- 1st Set Labstand Case Digests - UsitaDocument13 pages1st Set Labstand Case Digests - UsitaLyssa Tabbu100% (1)

- LAO V CA GR NoDocument1 pageLAO V CA GR NokeithnavaltaNo ratings yet

- Philippine American Accident Insurance Company Inc V FloresDocument1 pagePhilippine American Accident Insurance Company Inc V FloresCzar Ian AgbayaniNo ratings yet

- RIGHTS OF PURCHASERS IN DOUBLE SALE SITUATIONSDocument3 pagesRIGHTS OF PURCHASERS IN DOUBLE SALE SITUATIONSTruman TemperanteNo ratings yet

- Liam VS UcpbDocument6 pagesLiam VS UcpbKate HizonNo ratings yet

- Requirements of negotiability and key casesDocument9 pagesRequirements of negotiability and key casesQUEEN NATALIE TUASONNo ratings yet

- NEGO Case DigestDocument13 pagesNEGO Case DigestptbattungNo ratings yet

- Bank Liable for Forged EndorsementsDocument2 pagesBank Liable for Forged EndorsementsJenNo ratings yet

- Negotiable Instruments Cheques Banking LawDocument5 pagesNegotiable Instruments Cheques Banking LawJoshua MorrisNo ratings yet

- Liquidity ratios analysisDocument6 pagesLiquidity ratios analysisJn Fancuvilla LeañoNo ratings yet

- NFJPIA Mockboard 2011 Auditing TheoryDocument6 pagesNFJPIA Mockboard 2011 Auditing TheoryKathleen Ang100% (1)

- AfpDocument3 pagesAfpJn Fancuvilla LeañoNo ratings yet

- Practice Multiple Choice For Internal ControlDocument5 pagesPractice Multiple Choice For Internal ControlJn Fancuvilla LeañoNo ratings yet

- 73003Document2 pages73003Izo SeremNo ratings yet

- Introduction and Company Profile of SbiDocument4 pagesIntroduction and Company Profile of Sbiharman singh100% (1)

- Unacademy - UPSC CSE Prelims Mock Test PDFDocument17 pagesUnacademy - UPSC CSE Prelims Mock Test PDFSumit NarayanNo ratings yet

- XXX Final FimDocument50 pagesXXX Final FimSiddhesh RaulNo ratings yet

- Diebold Opteva328 ProductCard v201501Document2 pagesDiebold Opteva328 ProductCard v201501Ramon Alberto Portillo MedinaNo ratings yet

- Real Estate MarketsDocument21 pagesReal Estate MarketsPriyanka DargadNo ratings yet

- Government of Malaysia V Government of The SDocument13 pagesGovernment of Malaysia V Government of The SSara Azhari100% (1)

- Bank AsiaDocument17 pagesBank AsiaShahriar KabirNo ratings yet

- Central Bank Vs FloresDocument3 pagesCentral Bank Vs FloreschrystelNo ratings yet

- RFBT Handout Bank Secrecy and Unclaimed Balances - Batch 2019Document3 pagesRFBT Handout Bank Secrecy and Unclaimed Balances - Batch 2019E.D.JNo ratings yet

- Bank ADocument3 pagesBank ASARY MISHEL NUÑEZ ACEVEDONo ratings yet

- Questus Global Capital Markets On GXGDocument3 pagesQuestus Global Capital Markets On GXGlcdcomplaintNo ratings yet

- Private Debt Investor Special ReportDocument7 pagesPrivate Debt Investor Special ReportB.C. MoonNo ratings yet

- Habib Bank LimitedDocument16 pagesHabib Bank Limitedhasanqureshi3949100% (2)

- LPMPC Products and Services - Part 1 - As of Octob 3Document8 pagesLPMPC Products and Services - Part 1 - As of Octob 3phoebekayleonaNo ratings yet

- Mock Bar - Commercial Law PDFDocument8 pagesMock Bar - Commercial Law PDFPatricia Anne GarciaNo ratings yet

- Airindia IntroductionDocument14 pagesAirindia IntroductionJacob Pradeep ImmanuelNo ratings yet

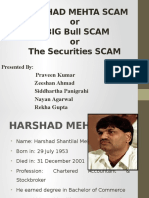

- The BIG Bull SCAM: The Harshad Mehta Securities ScamDocument16 pagesThe BIG Bull SCAM: The Harshad Mehta Securities ScamZeeshan Ahmad100% (1)

- Economics House of CR CardHouse of Cards Credit Card ProjectsDocument32 pagesEconomics House of CR CardHouse of Cards Credit Card Projectsforum502No ratings yet

- Mobile Services Tax Invoice BreakdownDocument3 pagesMobile Services Tax Invoice BreakdownValencia MabenNo ratings yet

- Company Profile Landmark Royal, Road Construction, Earthwork Excavation, WBM WORK, SITE LEVELING ETCDocument6 pagesCompany Profile Landmark Royal, Road Construction, Earthwork Excavation, WBM WORK, SITE LEVELING ETCneerajkhari3100% (2)

- Assignment On SidbiDocument7 pagesAssignment On SidbiPratibha Jha0% (1)

- MISFA SME Report - PublicDocument28 pagesMISFA SME Report - PublicKirsten WeissNo ratings yet

- Ch05 Foreign Exchange MarketDocument6 pagesCh05 Foreign Exchange MarketAbbey CiouNo ratings yet

- En 12485Document184 pagesEn 12485vishalmisalNo ratings yet

- Role of Depository ParticipantsDocument4 pagesRole of Depository ParticipantsKarishma AgarwalNo ratings yet

- Risk Return Analysis of Major Indian BanksDocument40 pagesRisk Return Analysis of Major Indian BanksSapna AggarwalNo ratings yet

- Free Electricity RetiredDocument2 pagesFree Electricity Retiredmuhammad nazirNo ratings yet

- Financial AccountigDocument19 pagesFinancial Accountigalbertoca990No ratings yet

- The Union Bank of The Philippines 11Document2 pagesThe Union Bank of The Philippines 11Sebastiel Dela RosaNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet