Professional Documents

Culture Documents

FF Issues Export Documentation Overview

Uploaded by

Masood-ur-RehmanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FF Issues Export Documentation Overview

Uploaded by

Masood-ur-RehmanCopyright:

Available Formats

VEDP International Trade www.exportvirginia.org clientservices@yesvirginia.

a.org ( 804) 545-5764 Fast Facts EXPORT DOCUMENTATION Export documentation is a tedious but necessary process that all exporters must pay close attention to, as documentation requirements vary considerably by country, commod ity, and situation. Although exporters must fill out and submit many different forms for each international shipment, most require similar data elements and can (and should!) be duplicated precisely from one document to the next. Fortunately, there are software products that capture the primary details of the shipment and insert them into the necessary documents without fla w. This Fast Fact will describe many of the documents your business will need in order to export s uccessfully. Shipping documents are the key to international trade, and have been used for th ousands of years. Documents outline the sale, shipment, and responsibilities of each party so that the full transaction is understood and complete without delay or additional costs. Docume nts also ensure compliance with applicable regulations.

Using an experienced Freight Forwarder will help you to avoid problems and secur e your relationship with your customers. Consider providing your Forwarder with a suita ble letter of authorization to act as your agent on overseas documentation matters. Although no t a required or standardized document, preparing a thorough and well organized Shipper s Letter of Instructions (SLI) is a good practice for your company to establish. You can give your Forwarder limited authorization and initial instructions with an SLI as soon as the shipme nt details emerge, which allows time to prepare documents, make arrangements, and ask questions. Al though a Freight Forwarder is not absolutely required for a successful export shipment, a licensed Customs House Broker is required to clear goods imported into any country, including the United States.

Below are some factors to consider when determining which documents are needed f or a particular shipment. . Country of origin and destination, as well as transshipment . Mode of transportation truck, rail, ocean, air, pipeline

. Commodity agriculture, livestock, safety/security, end-use, intangible- software , service . Size value, volume, weight, dimensions . Parties to the transaction shipper, consignee, agents, brokers, banks

Based on these factors, many of the following documents (described in more detai l on pages 2-5) may be required for an international shipment. These documents can be prepared b y the exporter and then processed or forwarded by a Freight Forwarder. . Invoices Commercial, Pro-forma, Consular . Packing Lists Dock, or Warehouse, Receipt . Bills of Lading (B/L) Ocean B/L, or Motor/Truck or Air Bill, or Way Bill . Electronic Export Information (formerly the Shipper s Export Declaration, or SED) is not an actual document but still a very important part of the export process . Certificates of Origin (C/O), sometimes country-specific NAFTA C/O, Israel C/O . Declaration of Dangerous Goods (DGD) Hazmat, placards . Certificates Insurance, Free Sale, Inspection, Phytosanitary, Authentication (Ap ostille) . Miscellaneous: Letters of Credit, ATA Carnet, Duty Drawback

OVERVIEW EXPORT DOCUMENTATION THE FORMS AND PROCESS

Essential Documentation The invoice and bill of lading are the two documents required for every export shipment. As such, you should ensure that all other documents associated with the shipment match the information on these documents.

Invoices Pro-forma Invoice: A pro-forma invoice is an invoice sent to the buyer before the shipment, giving the buyer a chance to review the sale terms (quantity of goods, value, specifications) and get an import license, if required in their country. It also allows the buyer to work with their bank to arrange any financial process for payment. For example, to open a Documentary Credit (Letter of Credit), the buyer s bank will use the pro-fo rma invoice as a source of information. The exporter/seller should not send their customer a proforma invoice unless they fully understand what they are offering to the buyer. If no changes are required on the pro-forma invoice after the buyer reviews it, the exporter can simply change its date and title and turn it into a commercial invoice.

Commercial Invoice: A commercial invoice is prepared by the seller/exporter and addressed to the buyer/importer, and is one of the first documents prepared when a transactio n has been agreed upon. The invoice identifies the buyer and seller, describes the goods so ld and all terms of sale, including IncoTerms, payment terms, relevant bank information, shipping de tails, etc. An invoice may be itemized to show cost of goods, freight, and insurance, or other special handling. The invoice may be numbered and have multiple purchase order numbers. U.S. Customs does not actually need a copy of the invoice, unless requested, but the information i ncluded is used to prepare other documents.

Consular invoice: A consular invoice is the commercial invoice stamped or notari zed by the consulate or embassy of your customer s country, if required. For example, if you are exporting to Egypt and your buyer requires a consular invoice, the Egyptian embassy in Washin gton, D.C. will do this for a small fee. Usually a freight forwarder will offer this service, bu t an exporter can send the original invoice to the consulate, have it notarized/legalized as required, pay the fee, and have

the documents returned or forwarded on. It is important to understand that consu lar invoices are required in the buyer s country, so you need to add the time/costs associated with obtaining one to the price of the goods you are shipping.

The invoice should include a [non]-diversion statement, as provided below. As th e U.S. Principal Party of Interest (or exporter of record), this statements attests to and inform s your customers that you are using due diligence to control the shipment and abide by regulations, pa rticularly shipments to embargoed/sanctioned countries.

"These commodities, technology, or software, were exported from the United State s in accordance with the Export Administration Regulations. Diversion contrary to United States law i s prohibited."

VEDP International Trade www.exportvirginia.org clientservices@yesvirginia.org ( 804) 545-5764 Fast Facts EXPORT DOCUMENTATION Essential data elements must be uniform on all documents: . . . . . . . . Name & Address of Seller / Shipper Name & Address of Buyer / Consignee Origin Point & Destination Point Port of Load / Unload Description of the Goods Number of Pieces, Cartons, Crates Net weight, Gross Weight, Volume Invoice & Purchase Order Numbers

Material Handling Packing List: A packing list is prepared by the shipper and is a detailed break down of the items within a shipment. It may also include any special marks for identification. For e xample, the customer may want ABC XX in blue letters on the side of the packaging. For insuran ce claims and tracking purposes, it helps to describe what is in each package . The packing l ist should also reference the customer s purchase order number and destination. Often, a packing l ist is taped to palletized cargo or on the main carton/box of a shipment so that the importer s cu stoms agency or any transportation handlers can have easy access to it to know what the goods ar e and their destination. The quantity and items listed on the commercial invoice must match with the packing list, but not necessarily match the pro-forma invoice. Some companies prepare a packing list that is identical to the commercial invoice, minus the prices and other monetary deta ils.

Dock (or Warehouse) Receipt: The dock or warehouse receipt is issued by a wareho use supervisor or port officer and certifies that the goods have been received by th e shipping company. This document is used to transfer accountability when goods are moved b y the domestic carrier to the port of embarkation and left with the international carr ier. At this time, the carrier s Bill of Lading is also signed by both parties and copies are issued acco rdingly.

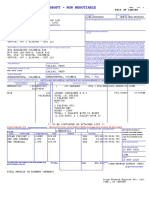

Bills of Lading (B/L) A Bill of Lading is issued by the carrier to the shipper for receipt of the good s, and is a contract between the owner of the goods and the carrier to deliver the goods. Sometimes t he B/L acts as title to the goods so an Original B/L is issued- usually a set of three. Whoever p resents one of those Original, Negotiable B/L can take possession of the goods. A B/L can be ei ther negotiable or non-negotiable.

Non-negotiable (or straight ) B/L: Indicates that the shipper will deliver the good s to the buyer and that title of the goods has not been transferred to the shipper (i.e., the b uyer or seller owns the goods while they are being shipped). This type of B/L is often used when pay ment for the goods has already been made in advance.

Negotiable (or shipper s order ) B/L: Serves as a title document to the goods, issue d to the order of a party, usually the shipper, whose endorsement is required to effect it s negotiation. It can also be issued to the order of the buyer s bank as part of a documentary credit/ letter of credit stipulation so that when the buyer s bank receives the Original B/L, they c an endorse it over to the buyer at the time of payment for the buyer to clear the goods at customs. Sometimes the negotiable B/L may be consigned To Order without reference to a company. A negotia ble B/L can be bought or traded while the goods are in transit, whereas a Straight B/L is non-negotiable and is consigned to the buyer.

The B/L is frequently electronically manifested by the shipping line company usi ng the data sent by the shipper or its agent. Bills of Lading also include a notify party (usually the buyer or their agent) so that when the vessel arrives at the port of destination, the carrier c an notify the party that the goods are available, are in need of customs clearing, or are ready for pick up. Usually the importer can pick up the goods after customs clearance and duties are paid. Freig ht Collect means the consignee pays the freight charges as well. Freight Prepaid means the sh ipper pays the freight charges, but not customs clearance unless the terms are delivered dut y paid . If VEDP International Trade www.exportvirginia.org clientservices@yesvirginia.org ( 804) 545-5764 Fast Facts EXPORT DOCUMENTATION

payment is due to the exporter before the importer receives the goods, advance ch arges can be added to the bill so the importer pays for the goods along with the other charge s. Two checks should be received so the carrier can forward one check to the exporter for the cost of goods.

Inland Bill of Lading: Issued by the trucking company and/or the railroad line f or taking the goods from the exporter s facility to the port of embarkation or consolidation facility.

Ocean Bill of Lading (OBL): The Ocean B/L is an invoice, and may be issued as a c lean bill of lading, meaning the carrier certifies that the goods have been received without visible damage. An On-Board B/L may be issued when the goods are received into the carrier s port fa cility, basically confirming the cargo will be sailing.

Air Way Bill (AWB): The Air Way Bill is a form of bill of lading used for the ai r transport of goods. AWBs are non-negotiable, mainly because of the short amount of time that the goo ds are in transit. The original AWB is rarely needed by the importer at the other end of t he shipment to prove ownership of goods. A house airway bill is issued by a freight forwarder on behalf of the actual carrier, which is the case when a freight forwarder has a contract rate w ith an air cargo service to expedite the documentation.

Export and License Declaration Electronic Export Information (EEI): EEI is the acronym for the new process of fil ing what was the Shipper s Export Declaration (SED) form 7525V. Census uses the EEI to collect trade data on the products, quantities, dollar value, volume and destinations of U.S. exports. To properly complete an EEI, the exporter is responsible for classifying their product under the appropriate Schedule B Number, or HS Code. An EEI is filed online and the Internal Transacti on Number (Sample: ITN X20091110000001) is applied to key shipping documents, i.e., Invoic e, B/L, verifying the actual filing. An EEI is required for U.S. exports valued $2,500 o r more per individual Schedule B Number. If the value is under $2,500, the exporter must note that usi ng the following statement: No EEI required, shipment valued under $2,500 per individual Schedule

B Number. Also, this process is used to manage U.S. export regulations for any commodity r equiring an export license and, regardless of value, the license number must be in the EEI. Filing an EEI is not required for shipments to Canada (unless an export license is involved), nor if shipping between U.S. territories, such as the Virgin Islands. However, it is required fo r shipments to Puerto Rico.

See VEDP Fast Facts

Mandatory AES

Certificates Certificate of Origin (C/O): A document prepared by the original manufacturer an d certified by a quasi-official authority - such as a Chamber of Commerce - stating the items coun try of origin. Most countries that require a C/O will accept a generic C/O as long as all of th e required data elements are given. However, some countries, like Israel, have a special green C /O form that must be used. To take advantage of duty free provisions in a U.S. Free Trade Agr eement, be sure to use the particular C/O that addresses the rules of origin criteria for each cou ntry.

VEDP International Trade www.exportvirginia.org clientservices@yesvirginia.org ( 804) 545-5764 Fast Facts EXPORT DOCUMENTATION

Certificate of Insurance: This document indicates the type and amount of insuran ce in force on a particular shipment for loss or damage while in transit. It is sometimes referre d to as Marine insurance, but may cover the entire voyage.

Certificate of Inspection: Some customers will require a pre-shipment inspection o satisfy their own requirements or local regulations, according to an industry, government, or carrier specification. Neutral organizations specialize in these types of certifications , whereby an inspector checks the goods in question prior to shipment. Sometimes an inspector can look at a sample, but other times inspection must occur when the goods are packaged to iss ue a certificate.

Certificate of Free Sale: This form may be required by the importing country to ensure that the goods offered for entry comply with domestic requirements for sale in the U.S. I t is often required for agricultural, medicinal, or cosmetic products and can be issued by the VEDP or U.S. FDA.

Certificate of Authentication (Apostille): An original document that has been no tarized may require authentication by the Secretary of the Commonwealth. An Apostille certificate will be issued according to the country (language) of destination, confirming the status of the notary who has witnessed the original document.

Phytosanitary Certificate: Primarily a document required to import goods into th e U.S., confirming compliance with phytosanitary safety regarding agricultural and animal health st andards.

Special Documents Declaration of Dangerous Goods (DGD): A DGD declares the nature, quantity, and q uantity of hazardous materials and reports the proper classification for each item.

ATA Carnet: A Carnet, sometimes referred to as a merchandise passport , is used for shipping goods to countries on a temporary, duty-free basis only. For a fee, this passpor

t allows a company to ship needed materials to foreign trade shows or conduct repairs overs eas. Within a year, the materials must return to the U.S. in order to avoid a hefty fine.

Documentary Letters of Credit (L/C): A letter of credit is a document issued by a bank committing to pay the seller/exporter a stated amount of money on behalf of the buyer/impor ter as long as the specific terms and conditions are met. Of all shipping documents, errors or maki ng changes to the L/C are the most costly and time consuming because of the risk of payment in err or.

See VEDP Fast Facts

Payment Terms and Export Finance .

Knowledge of the proper forms required, along with uniformity and document contr ol, will help exporters prevent errors in shipping documentation, save processing time, create good file management, improve customer service, and of course, avoid costly fines. VEDP International Trade www.exportvirginia.org clientservices@yesvirginia.org ( 804) 545-5764 Fast Facts EXPORT DOCUMENTATION

VEDP International Trade www.exportvirginia.org clientservices@yesvirginia.org ( 804) 545-5764 Fast Facts EXPORT DOCUMENTATION *Information provided by VEDP Fast Facts is intended as advice and guidance only . The information is in no way exhaustive and the VEDP is not a licensed broker, banker, shipper or customs agency. VEDP shall not be liable for any damages or costs of any type arising out of, or in any way connected with the use of, these Fast Facts. Last Updated: November 2009 VEDP SERVICES The VEDP offers a number of export-related services to Virginia businesses, incl uding group market visits and market research by our Global Network of in-country consultant s. These services are available to all Virginia exporters. For more information, please v isit our website: www.exportvirginia.org

ADDITIONAL RESOURCES . American Association of Exporters and Importers: http://www.aaei.org/ . Export Practitioner: http://www.exportprac.com/ . UNZ & Co.: http://www.unzco.com . U.S. Department of Commerce: Bureau of Industry & Security: www.bis.doc.gov Exporter Resources: www.Export.gov International Trade Administration: www.Trade.gov

WORKS CITED Hinkelman, Edward G. Dictionary of International Trade. 6th Edition. 2005. World Trade Press.

Jagoe, John R. Export Sales and Marketing Manuel. 20th Edition. 2007. Export Ins titute.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Internship ReportDocument51 pagesInternship ReportMd. Saber Siddique100% (1)

- BP Voy 3Document16 pagesBP Voy 3Victor PerkinsNo ratings yet

- Tvs Dynamic Global Freight Services LTD.,: Shipper'S Letter of InstructionsDocument1 pageTvs Dynamic Global Freight Services LTD.,: Shipper'S Letter of InstructionsVignesh DeepNo ratings yet

- Beepeevoy 3Document15 pagesBeepeevoy 3Maxim AndrosovNo ratings yet

- Store Keeping and Clearing and ForwardingDocument10 pagesStore Keeping and Clearing and ForwardingSooraj PurushothamanNo ratings yet

- Difference ProtestDocument4 pagesDifference ProtestAmrit Singh RaiNo ratings yet

- Nhava Sheva, IN Port: From Haulage ExportDocument3 pagesNhava Sheva, IN Port: From Haulage ExportjaiminisaiNo ratings yet

- R-O-006 Bill of LoadingDocument2 pagesR-O-006 Bill of LoadingPrastyo Bimo100% (1)

- Lecture 7 - DocumentationDocument31 pagesLecture 7 - Documentationshuting2teoh100% (2)

- Ref. Book: Law On Sales, by Hector de Leon.: Tradition Is A Derivative Mode of Acquiring Ownership byDocument4 pagesRef. Book: Law On Sales, by Hector de Leon.: Tradition Is A Derivative Mode of Acquiring Ownership byKristine Esplana ToraldeNo ratings yet

- CP EDI 404 Guidelines (Intermodal) - v7010Document70 pagesCP EDI 404 Guidelines (Intermodal) - v7010Kmr SampathNo ratings yet

- Ces Wrong Answer Summarypdf CompressDocument4 pagesCes Wrong Answer Summarypdf CompressАлександр ПасканныйNo ratings yet

- Short Notes For Caiib AfmDocument96 pagesShort Notes For Caiib AfmRitesh TiwariNo ratings yet

- Oral Exam - Part 1Document18 pagesOral Exam - Part 1api-3848501No ratings yet

- Carrier Packet WatermarkDocument9 pagesCarrier Packet Watermarkapi-269523613No ratings yet

- BL Sudun39990075010Document2 pagesBL Sudun39990075010Alvaro Javier Herrera100% (3)

- C-TPAT Membership Security Model Summary: Report Generated By: Hugo MedranoDocument33 pagesC-TPAT Membership Security Model Summary: Report Generated By: Hugo MedranoaLBERTONo ratings yet

- Title ViDocument6 pagesTitle VizepzepNo ratings yet

- Pt. Karya Sukses Setia: Proposal Eksportir Jevon Trilliun Setiawan - 2201748012Document11 pagesPt. Karya Sukses Setia: Proposal Eksportir Jevon Trilliun Setiawan - 2201748012LaurenciaNo ratings yet

- Magaya Cargo System User ManualDocument283 pagesMagaya Cargo System User Manualvmnyuvaraj rajNo ratings yet

- Esanchit CodesDocument2 pagesEsanchit CodesSushil Shail100% (2)

- FDW - Topic 6-8Document10 pagesFDW - Topic 6-8John Mico MarceNo ratings yet

- Summer Report On Import Export ProcedureDocument56 pagesSummer Report On Import Export ProcedureBalakrishna ChakaliNo ratings yet

- BL Example 3Document1 pageBL Example 3Christhoper AndrewNo ratings yet

- Maritime Law - GlossaryDocument109 pagesMaritime Law - GlossaryNithin Varghese100% (1)

- Ejemplo de MBL OneDocument3 pagesEjemplo de MBL OneVanessa AnguloNo ratings yet

- Shipping Dispute Over Unpaid Freight ChargesDocument1 pageShipping Dispute Over Unpaid Freight Chargeskanari100% (1)

- Philippine Charter v. Chemoil, 463 SCRA 202, G.R. No. 161833, July 08, 2005 PDFDocument29 pagesPhilippine Charter v. Chemoil, 463 SCRA 202, G.R. No. 161833, July 08, 2005 PDFEj CalaorNo ratings yet

- Annie TitipDocument5 pagesAnnie TitipChristine LimbongNo ratings yet

- Group 5 - Ocean Bill of LadingDocument29 pagesGroup 5 - Ocean Bill of LadingKhang Nguyễn100% (1)