Professional Documents

Culture Documents

Report 1

Uploaded by

Hasan Ali AssegafOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Report 1

Uploaded by

Hasan Ali AssegafCopyright:

Available Formats

Regression Analysis of Kuala Lumpur Composite Index

Abstract This paper attempts to examine the relationship between Kuala Lumpur Composite Index (KLCI) and selected macroeconomic variables namely industrial production, lending rate, money supply, inflation, exchange rate and financial crisis from December 1993 until December 2010. The methodology used in this study is multiple regression analysis based on Ordinary Least Square (OLS) method. The result indicates that industrial production, lending rate, money supply, exchange rate and financial crisis seem to significantly affect the KLCI, whereas inflation does not have significance effect. We suggest the significant variables to be considered as the policy instruments by the government in order to stabilize stock price. Introduction Kuala Lumpur Composite Index (KLCI) is the main index in Kuala Lumpur Stock Exchange (KLSE). It comprises of the largest 30 companies by full market capitalization on KLSEs Main Board. Market capitalization is essentially stock price multiply by shares outstanding. Like any other stock indexes, KLCI is used to monitor the behavior of a group of stocks. As the result, KLCI would provide an accurate performance indicator of the Malaysian stock market as well as the countrys economy. According to stock valuation model, stock price represent the discounted present value of future cash flows for the investors. This means any change in macroeconomic variables could affect the cash flows and consequently the stock price. The importance of studies in Malaysian stock market has become increasingly important. This is due to several reasons. First, Malaysian Stock Market is one of the most prominent emerging markets in the region. It is currently number 8 biggest stock market in Asia in terms of

1

Regression Analysis of Kuala Lumpur Composite Index

market capitalization. Second, nowadays most of the member of society has important stake on the stock market. We can divide those people into two groups. The first group is those people who are directly affected by changes in stock market. This group include individual who invest their money is stock market by purchasing stocks. It is reported that currently 18% of Malaysias population invest in stock market. The second group is those people who are indirectly affected by changes in stock market. The individual in this group does not invest in stock market, however they have their money in institutions that invest in stock market. Therefore the success or loss in investment of those institutions will affect the well being of many people. Examples of such institutions are pension funds, insurance companies and sovereign funds. In Malaysia there are two institutions which organize pension funds, Employee Provident Fund (EPS) and Kumpulan Wang Persaraan (KWAP). Currently KWAP is fourth biggest owner of stock in KLSE. Khazanah Nasional is the organizer of sovereign funds in Malaysia. It is reported in KLSE website that 33.58% of all stock in Malaysia is owned by such institutions. Third, study on stock market relationship with macroeconomic variables will give government some idea which variable should be considered as the policy instruments by the government in order to stabilize stock prices. The objective of this study itself is to to determine and examine the relationship between the macroeconomic variables and its degree of influence over the stock market index (KLCI). in addition, we would like to test and to conclude on the assumptions and perceptions of these variables. Literature Review

Regression Analysis of Kuala Lumpur Composite Index

Stock prices reflect expectations of the future performances of corporate and profits. Therefore, if there are any changes in macroeconomic variables that could affect corporate profits and performances, it would affect the stock market as well. As a result, stock prices could be used as an indicator for the economic activities. Due to the relationship between stock prices and macroeconomic variables, Maysami, Howe and Hamzah (2004) suggested that there are several macroeconomic variables that can be used to construct the nations policies for stabilizing stock market. They propose that short and long-term interest rates, industrial production, price levels, exchange rate and money supply would be appropriate variables. While before the studies mainly focused on developed countries stock market, there is a rising trend of studies that extend the analysis to the case of developing countries. For the case of Malaysia, Ibrahim and Yusoff (2001) make analysis between the stock prices (KLCI) and macroeconomic variables such as industrial production (IP), money supply (M2), price level as a measure of consumer price index (CPI) and exchange rate. KLCI is positively related to CPI and negatively related to M2. The positive association between KLCI and CPI seems to support the view that the stock prices in Malaysia are a good hedge against inflation. In Abdul Madjid and Yusof (2009) study, they found out that macroeconomic variables such as industrial production index (IP), money supply M3, real effective exchange rate (REER), interest rate (treasury bill rate (TBR)) and federal fund rates (FFR) are significant explanatory factors of Islamic stock market returns in Malaysia. Their approach is based on Autoregressive Distributed Lag model (ARDL). In another study, Ibrahim and Aziz (2003) analyze the linkage between stock prices and four macroeconomic variables. They discover that there is a positive short-run and long-run

Regression Analysis of Kuala Lumpur Composite Index

relationship between stocks prices with CPI while; stock prices have negative association with money supply and the exchange rate. Abdul Rahman, Mohd Sidek, and Tafri (2009) explore the interactions between selected macroeconomic variables and stock prices for the case of Malaysia in a vector autoregressive (VAR) framework. They show that changes in Malaysian stock market index do have correlation with changes in money supply, interest rate, exchange rate, reserves and industrial production index. Ahmed (2008) in his study by using Johansen`s approach of cointegration, revealed that there is links between aggregate macroeconomic variables and stock indices of India in the longrun. The variables are index of industrial production, exports, foreign direct investment, money supply, exchange rate, interest rate, NSE Nifty and BSE Sensex in India Azman-Saini, Habibullah, Law and Dayang-Afizzah (2006) in their study by using Granger non-causality found that Malaysian stock prices are led by the exchange rate during the crisis period. During the crisis period, the Malaysian Ringgit depreciated against US dollar and it significantly influences the Malaysian stock prices. Cheng, Lo and Ma (1990) in their study by using multiple regression analysis found that there are correlations between Hong Kongs Hang Seng Index with trade balance, consumer price index, M2, total money supply, total saving deposit unemployment rate and lending rate. Gan, Lee, Yong and Zhang (2006) investigate the relationship between stock prices and macroeconomic variables for New Zealand. The variables that used are long-run and short-run interest rate, inflation rate, exchange rate, GDP, money supply and domestic retail oil price. They found that there is relationship between stock prices and macroeconomic variables in New

4

Regression Analysis of Kuala Lumpur Composite Index

Zealand. The impact of inflation rate and M2 on stock prices is found to be negative. Their explanation for negative relationship between stock price and M2 is because money supply in New Zealand is influences by foreign investors, so when interest rate is high as compare to other countries, investors would like to keep their money in banks rather than involving in risky investment, on the other hand, when the interest rate is low they might prefer to invest into other markets. Humpe and Macmillan (2007) study the influence of several macroeconomic variables on stock prices in US and Japan using single cointegration vector. They found the data for US are suggest stock prices are positively related to industrial production and negatively related to both the consumer price index and long term interest rate. They also find an insignificant positive relationship between US stock prices and the money supply. However for Japanese data, they found that stock prices are influenced positively by industrial production and short term interest rates but it is negatively influenced by the money supply. The positive relationship between stock prices and inflation is also seen in the Pacific Basin Countries such as Australia, Hong Kong, Indonesia, Japan, South Korea, Malaysia, Philippines, Singapore, and Thailand in Al-Khazali and Pyun (2004). This paper finds the negative relationships in the short-run, but a positive relationship between the same variables over the long-run. They conclude that the stock prices in Asia are actually a good hedge against inflation in the long-run. Meanwhile, another study based on Korea stock prices by Kwon and Shin (1999) indicates that there is relationship between exchange rates, trade balance and money supply with stock prices. Similarly, Maghyereh (2002) examines the long-run relationship between the

Regression Analysis of Kuala Lumpur Composite Index

Jordanian stock prices and selected macroeconomic variables, by using Johansens cointegration analysis with the monthly data from 1987 to 2000. The variables are industrial production, inflation, interest rates, trade balance, foreign exchange, oil price, and money supply. The results indicate that macroeconomic variables are reflected in stock prices in the Jordanian market. Maysami and Koh (2000) examine the dynamic relations between macroeconomic variables such as exchange rate, long and short term interest rates, inflation, money supply, domestic exports, and industrial production with Singapore stock markets using the vector error correction model which covered the period from 1988 to 1995. They found that all the macroeconomic variables have significant relations with the changes in Singapores stock market levels. Nasseh and Strauss (2000) investigate the relationship between stock prices and domestic and international macroeconomic variables in six countries in European continent; France Germany, Italy, Netherlands, Switzerland, and the U.K. by using a cointegration approach. Their paper consists with quarterly data during 1962 to 1995. They find that Industrial Production Indies (IP) and Business Surveys of Manufacturing Order (BSM) can explain movement of stock prices in long-run. They also find the negative influence of interest rates on stock prices. However, short-run interest rate is positively influenced stock prices. Tsoukalas (2003) observes the relationships between stock prices and macroeconomic factors like exchange rate, industrial production, money supply and CPI from the year 1975 to 1998 by using vector autoregressive model (VAR) in the Cyprus equity market. The results indicate a good relationship between stock prices and those mentioned macroeconomic factors. According to him, because of higher demand for services like tourism and off-shore banking, it

Regression Analysis of Kuala Lumpur Composite Index

is not surprising to see the strong relationship between stock prices and exchange rate in Cyprus economy. Hypotheses Relationship between Variables and KLCI Based on financial theory and results of literature review, we hypothesize certain relationship between KLCI and each independent variable. Industrial Production (IP) IP KLCI

IP is typically used as a proxy of real economic activity. Therefore increase in IP would indicate economic growth. The level of economic activity in the country would affect corporate profitability. For instance during economic grow which is indicated by increase in IP, there will be rise in output and therefore increase in expected future cash flows which would raise the stock price. The opposite effect will be true during recession. Hence, we suggest a positive relationship between IP and stock price. This assumption is consistent with assumption mentioned in Maysami, Howe and Hamzah, (2004), Ahmed (2008), Humpe and Macmillan (2007), Ibrahim and Yusoff (2001), Abdul Madjid and Yusof (2009) and Maghyereh (2002). Lending Rate (LR) LR KLCI

Change in lending rate will directly affected nominal risk free rate. Through CAPM model, the change in risk free rate would be transmitted to discount rate (required rate of return). k = rRF + (rM - rRF)b where k= required rate of return in stock, rRF= risk free rate, rM= market return and b= beta coefficient of the company.

Regression Analysis of Kuala Lumpur Composite Index

The change in discount rate would automatically cause change in stock price. This is based on Gordons Growth Stock Valuation equation, P=D1/(k-g) where P= stock price, D1= dividends after first period, g= constant growth rate of the dividends and k= required rate of return on the stock. For instance, increase in lending rate will subsequently increase nominal risk free rate, which would increase discount rate (required return). Increase in discount rate will decrease price of the stock, ceteris paribus. Similar hypotheses are mentioned in Ahmed (2008), Gan, Lee, Yong and Zhang (2006), Humpe and Macmillan (2007), Maghyereh (2002), Maysami and Koh (2000), Nasseh and Strauss (2000), Abdul Rahman, Mohd Sidek, and Tafri (2009) and Tsoukalas (2003). According to Maysami, Howe and Hamzah, (2004) there are two more rationale of negative relationship between lending rate and stock price. First interest rates can influence the level of corporate profits which in turn influence the price that investors are willing to pay for the stock through expectations of higher future dividends payment. Most companies finance their capital equipments and inventories through borrowings. A reduction in interest rates reduces the costs of borrowing and thus serves as an incentive for expansion. This will have a positive effect on future expected returns for the firm. Second, as substantial amount of stocks are purchased with borrowed money, hence an increase in interest rates would make stock transactions more costly. Investors will require a higher rate of return before investing. This will reduce demand and lead to a price depreciation. Based on the overwhelming similarity in previous academic literatures, we suggest a negative relationship between lending rate and stock price.

8

Regression Analysis of Kuala Lumpur Composite Index

Money Supply (M2) M2

KLCI

Money supply is used monetary policy tool by the central bank. When central bank increase money supply, it means that central bank pursue expansionary monetary policy which would stimulate the economy. One of the expected results is corporate earnings would increase. This would likely result in an increase in future cash flows and stock prices. This hypothesis is supported by Maysami, Howe and Hamzah (2004), Ahmed (2008), Humpe and Macmillan (2007), Maghyereh (2002), Maysami and Koh (2000), Abdul Rahman, Mohd Sidek, and Tafri (2009). According to Abdul Madjid and Yusof (2009), the effect of money supply on stock prices, however, can be negative. This is due to positive correlation between money supply and the rate of inflation. An increase in the money supply may lead to an increase in the discount rate and lower stock prices. However, this negative effect may be countered by the economic stimulus provided by money growth. Maysami and Koh (2000), who found a positive relationship between money supply and stock returns in Singapore, further support this hypothesis. Therefore we suggest that money supply has positive relationship with KLCI Exchange Rate (ER) ER KLCI

Malaysia is an export dominated country. For an export dominated country, currency depreciation will have a favorable impact on a domestic stock market. As the Malaysian Ringgit depreciates against foreign currencies, products exported from Malaysia become cheaper in the world market. As a result, if the demand for these good is elastic, the volume of exports from the country increases, which in turn causes higher cash flows, profits and the stock prices of the

9

Regression Analysis of Kuala Lumpur Composite Index

domestic companies. The opposite should happen when the currency of the country appreciates against foreign currencies. This suggestion is mentioned in many studies such as Maysami, Howe and Hamzah, (2004), Ahmed (2008), Gan, Lee, Yong and Zhang (2006), Ibrahim and Yusoff (2001), Abdul Madjid and Yusof (2009), Ibrahim and Aziz (2003) and Maghyereh (2002), Maysami and Koh (2000). Hence, we assume that exchange rate and KLCI has negative relationship. Consumer Price Index (CPI) CPI KLCI

The effect of increase in inflation to KLCI is similar with increase in lending rate. Inflation increases the nominal risk-free rate and raises the discount rate in the valuation model. Since cash flows do not rise at the same rate as inflation (Maysami, Howe and Hamzah, 2004), the rise in discount rate leads to lower stock prices. Therefore, we expect the that inflation and KLCI has negative relationship. This hypotheses is consistent with Ahmed (2008), Gan, Lee, Yong and Zhang (2006), Humpe and Macmillan (2007), Maghyereh (2002), Maysami and Koh (2000). Financial Crisis (FC) FC KLCI

Financial crisis is driven by economic decline and panic. The terrible economic performance is combined with crowd behavior who will sell their shares in order to avoid a higher financial loss due to the decrease in stock price. However, this crowd behavior who tries to sell their shares caused the price to decline even more. Therefore, there will be dramatic decline in stock price when financial crisis occurs. For this reason, we expect negative relationship between financial crisis and KLCI.

10

Regression Analysis of Kuala Lumpur Composite Index

Methodology For this study, we analyze the regression of KLCI and selected independent variables which are industrial production, lending rate, money supply, exchange rate, inflation and financial crisis as dummy variable. Our analysis covers 17 years period using monthly data (M12 1993 M12 2010). The selection of monthly data is intended to better capture the volatility nature of stock market. For KLCI we use end of month values of KLCI index. KLCI is used because it is the main index in KLSE. For real economic activity, we use industrial production index as the proxy. For lending rate we use average lending rate to proxy interest rates. We select lending rate as proxy for interest rates because up to 2004, Bank Negara Malaysia used lending rate as the benchmark for interest rates in the country. Nevertheless, in 2004 lending rate was replaced by overnight rate. However because our analysis cover more period before 2004 (11 years) compare to after 2004 (6 years), therefore we use lending rate. M2 is used as money supply variable and is expressed in Ringgit. The exchange rate represented by employing the official rate at the end of the month for Ringgit per USD. For inflation, we use CPI as proxy to inflation. Lastly, we use financial crisis as dummy variable. If financial crisis occurs in a specific month, the value would be 1 and if financial crisis does not occurs in that month, the value would be 0. We derived from Hasan (1999) and Mahani & Rajah (2009) the period in which financial crisis occurs. All of the independent variables data are obtained from the IMFs International Financial Statistic Database (IFS). The data on KLCI are collected from Yahoo Finance. Multiple linear regression analysis is used to study the correlation between the KLCI and the identified macroeconomic factors. Multiple linear regressions are a method used to model the

11

Regression Analysis of Kuala Lumpur Composite Index

linear relationship between a dependent variable and one or more independent variables. It is based on ordinary least squares (OLS) method. Due to the fact that some variable such as M2, Lending Rate, CPI and Industrial Production affected KLCI after some periods, we need to include time lag of each variables in the equation. Since the effect of time lags of the variables on KLCI is unknown, the KLCI at period t is correlated with each independent variable from periods t-8 to t+2. Therefore we can identify the most significant time lag having the most significant effect on KLCI for each independent variable by using simple regression models. The significance of a time lag is determined by its level of correlation with KLCI, the higher being the more significant. This method was implemented in Cheng, Lo and Ma (1990) study. The most significant time lags are subsequently used in our multiple regression models. Software package Minitab is utilized to develop the equation. All regression coefficients will be evaluated individually through individual test to ensure only significant independent variables will be represented in the final equation. Model Estimation In this part, we present the result of data analysis by using Multiple Regression Analysis. Multiple Regressions is a way to describe the relationship between a dependent variable and several independent variables. This approach basically based on Ordinary Least Square (OLS) method. In developing the model, first we used our educated guesses. Nevertheless, we found out that the result is unsatisfactory. Therefore after we have done extensive literature review, we came out with the second model where we replaced several independent variables from Model 1 with

12

Regression Analysis of Kuala Lumpur Composite Index

more significant independent variables suggested in the literature reviews. Afterwards, we apply Stepwise Regression Procedure through backward selection to come out with the third model. We therefore do three steps until obtaining the best one as follows. Model 1 The first step, employ KLCI as dependent variable with Lending Rate (LR), Money Supply (M2), Gross Domestic Product (GDP), and Consumer Price Index (CPI) as independent variables. We use quarterly data from Q1 1991 up to Q4 2010 and we do not use time lag in the equation. The model is: KLCI = + 1 CPI + 2 GDP + 3 M2 + 4 LR

We have to consider four outputs which indicate whether the model is fit or not. Firstly, the Adjusted R square which depicts the proportion of variation in KLCI explained by LR, M2, GDP, and CPI. Table 1 shows us that the Adjusted R square is 43.7% whereby too less to explain the relationship between KLCI and LR, M2, GDP, and CPI. Table 1 Regression Analysis SE Coef T 512.1 4.8 6.69 -4.5 0.003337 1.81 0.0004775 1.6 18.7 -0.08

Predictor Constant CPI GDP M2 LR

Coef 2459.4 -27.09 0.006038 0.0007654 -1.54

P 0 0 0.074 0.113 0.935

VIF 16.868 53.805 36.428 2.882

The regression equation is: KLCI = 2459 - 27.1 CPI + 0.00604 GDP + 0.000765 M2 - 1.5 LR S = 199.527 R-Sq = 46.5% R-Sq(adj) = 43.7%

13

Regression Analysis of Kuala Lumpur Composite Index

Source Regression Residual Error Total

DF 4 75 79

Analysis of Variance SS MS 2597723 649431 2985813 39811 5583536

F 16.31

P 0

Secondly, we employ F-testing procedure to see the significance of independent variables to dependent variable. If F > critical value, we can reject Ho which means at least one of the independent variables does not equal to zero. By 5% level of significance, 4 and 75 degrees of freedom, we can get critical value namely 2.53 from the F distribution table. Based on Table 1, we can see that F test statistic is 16.31. Hence, we can reject Ho which gives conclusion that at least one of the independent variables does not equal to zero. Thirdly is Correlation Matrix which shows the multicollinearity between independent variables. According to correlation matrix below, we can see that the value of each correlation between independent variables is higher than 0.7 in absolute values. It means that there are high correlations among independent variables. Hence, we can conclude that there is multicollinearity problem in this model. Table 2 Correlation Matrix KLCI LR M2 GDP LR -0.431 M2 0.588 -0.778 GDP 0.574 -0.802 0.986 CPI 0.473 -0.794 0.958 0.969

14

Regression Analysis of Kuala Lumpur Composite Index

We could also detect multicollinearity from Variance inflation factor (VIF). The rule of thumbs regarding VIF is the value is higher than 10, there is serious multicollinearity problem in the model. From Table 1 we can see that three out of four variables has VIF higher than 10. Therefore, we can conclude that there is multicollinearity problem in the model. Fourthly is Individual Significant Test, we can continue to examine whether there is a linear relationship between each of the independent variables and KLCI as dependent variable. We apply t-Test approach. If t > critical value, we can reject Ho which means the specific independent variable does not have significant relationship with KLCI. From t-distribution table, we get critical value of t at 5% level of significance and 75 degree of freedom which is 2.00. According to Table 1, GDP, M2, and LR have t-statistic lower than critical value which is 2.00. Therefore we conclude that these variables do not have significant effect on KLCI at 5% level of significance. Model 2 After extensive literature review, we come out with the second model. In the second model, we attempts to regress between KLCI against Industrial Production (IP), Lending Rate (LR), Money Supply (M2), Exchange Rate (ER), Consumer Price Index (CPI), and Financial Crisis (FC) as dummy variable. We come out with these independent variables based on previous literatures. We use monthly data from M12 1993 up to M12 2010 to better reflect the volatile nature of the stock markets. In addition, we use the effect of time lag in the equation. The time lag used for each independent variables are based on the most significant time lag method explained under methodology. We conclude that the most significant time lag for each variables

15

Regression Analysis of Kuala Lumpur Composite Index

are IP at t-3, LR at t-8, M2 at t-8 and CPI at t-8, while FC and ER have no time lag. Therefore our model become KLCI = + 1 IPt-3 + 2 LRt-8 + 3 M2t-8 + 4 CPIt-8 + 5 ER + 6 FC

From the table 3 below, we get an increase in Adjusted R square which become 85.26%. It reflects that Adjusted R square is better than Model 1. Table 3 Regression Analysis Coef SE Coef T 2125.1 329.9 6.44 -152 23.55 -6.45 14.515 7.025 2.07 -8.868 5.099 -1.74 6.83 1.056 6.47 0.0007189 0.0001967 3.65 -386.77 28.51 -13.56

Predictor Constant FC LR CPI IP M2 ER

P 0 0 0.04 0.084 0 0 0

VIF 1.469 3.865 62.163 8.936 47.372 3.911

The regression equation is KLCI = 2125 + 6.83 IP + 14.5 LR + 0.000719 M2 - 8.87 CPI - 387 ER - 152 FC S = 99.3081 R-Sq = 85.7% R-Sq(adj) = 85.2%

Source Regression Residual Error Total

DF 6 190 196

Analysis of Variance SS MS 11205651 1867608 1873799 13079449 9862

F 189.37

P 0

16

Regression Analysis of Kuala Lumpur Composite Index

Secondly, based on Table 3, we can see that F test statistic is 189.37. By 5% level of significance, 6 and 190 degrees of freedom, we can get critical value namely 2.18 from the F distribution table. Hence, we can reject Ho where give conclusion that that at least one of the independent variables does not equal to zero. Table 4 Correlation Matrix KLCI IP LR M2 ER CPI IP 0.407 LR -0.443 -0.802 M2 0.543 0.882 -0.71 ER -0.588 0.374 -0.156 0.192 CPI 0.389 0.921 -0.749 0.964 0.392 FC -0.131 0.097 0.166 0.154 0.084 0.081

According to correlation matrix below, there are six correlations between independent variables which exceed 0.7 in absolute values. It means that there are high correlations among independent variables. Hence, we can conclude that there is still multicollinearity problem in this model. Based on VIF, we can see from Table 3 that there are two variables which has VIF higher than 10. Therefore, we can conclude that there is multicollinearity problem in model 2. Fourthly is Individual Significant Test. The critical value of t at 5% level of significance and 190 degree of freedom is 1.972. According to Table 3, all independent variables except CPI have t-statistic greater than critical value. Therefore, we can conclude that these variables have significant effect on KLCI at 5% level of significance. Hence, we have to drop CPI because this variable does not have significant effect on KLCI at 5% level of significance.

17

Regression Analysis of Kuala Lumpur Composite Index

Model 3 In this step, we drop CPI because this variable does not have significant effect on KLCI at 5% level of significance. This change makes our model become KLCI = + 1 IPt-3 + 2 LRt-8 + 3 M2t-8 + 4 ER + 5 FC

We expect that this factor can give higher Adjusted R square which indicates better model. According to Table 5, we get lower Adjusted R square than the second model, which is, 85.1 %. However the decrease in Adjusted R square is insignificant, which is 0.1%. Table 5 Regression Analysis Coef SE Coef T 1578.4 100.7 15.68 -136.06 21.81 -6.24 17.562 6.839 2.57 6.467 1.04 6.22 0.00039587 0.0006517 6.07 -426.54 17.12 -24.91

Predictor Constant FC LR IP M2 ER

P 0 0 0.011 0 0 0

VIF 1.247 3.625 8.587 5.144 1.396

The regression equation is KLCI = 1578 + 6.47 IP + 17.6 LR + 0.000396 M2 - 427 ER - 136 FC S = 99.8330 R-Sq = 85.4% R-Sq(adj) = 85.1%

Source Regression Residual Error Total Total

DF 5 191 196 196

Analysis of Variance SS MS 11175823 2235165 1903626 13079449 13079449 9967

F 224.26

P 0

18

Regression Analysis of Kuala Lumpur Composite Index

Table 6 Correlation Matrix IP LR M2 ER FC KLCI IP LR M2 ER 0.407 -0.443 -0.802 0.543 0.882 -0.71 -0.588 0.374 -0.156 0.192 -0.131 0.097 0.166 0.154 0.084

In this model, we can see that based on correlation matrix, there are three correlations among independent variable exceed 0.7 in absolute value. It means based on correlation matrix, there is still multicollinearity problem in our model. However, according to Gujarati (2004) and Lind, Marchal, & Wathen (2010) VIF is a better measurement of multicollinearity compare to correlation matrix. From table 5, we can see that there is no VIF which exceeds 10. Therefore we would like to conclude that in Model 3 there is no serious multicollinearity problem. Global Test To do the global test, we employ F-testing procedure to see if any of the independent variables do have the ability to explain the variation in independent variables. The null hypothesis is Ho:

1= 2= 3= 4= 5= 6=0.Therefore

the

alternate

hypotheses

is

H1:

1 2 3 4 5 60.

Based on the hypotheses, we would like to reject Ho because if Ho is

rejected it means that at least one of the coefficient of independent variables do have significance. We select level of significance to be 5%. To rule of thumbs for the decision in F testing is if F > critical value, we can reject Ho which means at least one of the independent variables coefficient does not equal to zero. By 5% level of significance, 5 and 191 degrees of

19

Regression Analysis of Kuala Lumpur Composite Index

freedom, we can get critical value namely 2.66 from the F distribution table. Based on Table 5 above, we can see that F test statistic is 224.26. Hence, we can reject Ho which gives conclusion that at least one of the independent variables coefficient does not equal to zero.

Individual Test Last of all is Individual Significant Test. In individual test, we test each independent variable independently to determine whether each variable has significant relationship with dependent variables based on t distribution. Similar like global test we would like to reject Ho because Ho states that the coefficient of an independent variable is equal to zero which means it has no significant relationship with KLCI. We will test the hypotheses at 5% level of significance and 191 degree of freedom. The critical value from t distribution table is 1.972. Because the hypotheses have equal sign therefore it is two tailed. According to Table 5, all independent variables have t-statistic greater than critical value. Therefore, we can conclude that these variables have significant effect on KLCI at 5% level of significance.

20

Regression Analysis of Kuala Lumpur Composite Index

We could also see from the p value of each independent variable to see whether those independent variables have significant relationship with KLCI. The rule of thumb for p value is when p value is lower than level of significance, we reject Ho. From table 5 we can observe that all of the independent variables has p value that is lower than 0.05. Therefore, we can conclude that all of the independent variables have significant relationship with KLCI. Interpretation of Coefficient According to Table 5, we can summarize our model as: KLCI = 1578 + 6.47 IPt-3 + 17.6 LRt-8 + 0.000396 M2t-8 - 427 ER -136 FC

21

Regression Analysis of Kuala Lumpur Composite Index

This model involves intercept ( ) and slope ( i). We thus can interpret coefficients above as: = 1578 This means that we estimate KLCI would be 1578 when all independent variables equal to zero = 6.47

Holding other variables constant, 1 unit increase in IP will lead to increase in KLCI by 6.47 after 3 months. Positive sign of = 17.6

1

indicates positive relationship between IP and KLCI

Holding other variables constant, one percent increase in Lending Rate (LR) will lead to increase in KLCI by 17.6 after 8 months. Positive sign of Lending Rate (LR) and KLCI. = 0.00039587

2

indicates positive relationship between

Holding other variables constant, one million Ringgit increase in M2 will lead to increase in KLCI by 0.00039587 after 8 months. Positive sign of Lending Rate (M2) and KLCI.

4= 2

indicates positive relationship between

-426.54

Holding other variables constant, one Ringgit appreciation against US Dollar will lead to decrease in KLCI by 426.54. Negative sign of Exchange Rate (ER) and KLCI.

4

indicates negative relationship between

22

Regression Analysis of Kuala Lumpur Composite Index

= -136.06

Holding other variables held constant, when financial crisis occur KLCI will be less by 136.06. Negative sign of Conclusion This paper studies the effects of macroeconomic variables namely: industrial production, money supply, lending rate, exchange and financial crisis on KLCI. The findings indicate that these variables have significant relationship with KLCI. The best model generates 85.1% Adjusted R2. It means that 85.1% of the variation in KLCI can be explained by macroeconomic factors in the model. The expected relationships between independent variables and dependent variable stated earlier are correct except for Lending Rate. Rather than has negative relationship with KLCI, Lending Rate has positive relationship with KLCI. This positive relationship between lending rate and stock index is also encountered in Humpe and Macmillan (2007) paper regarding correlation between stock market movements and macroeconomic variable in Japan. Their rationale is Central Bank used interest rates for growth stimulus. Therefore, the positive coefficient can be explained by counter-cyclical central bank responses to economic fluctuations. It remains true, of course, that the applicability of the multiple regression technique to forecast stock price index accurately is limited. However it could provide a general guideline of stock indexs movement. For instance, when Bank Negara Malaysia increases money supply in the country, KLCI is expected to increase after some time.

5

indicates negative relationship between Financial Crisis and KLCI.

23

Regression Analysis of Kuala Lumpur Composite Index

This result signals the importance of these variables as government targets to emphasize policy effects on stock market. For that reason we suggest Malaysian government to consider money supply, interest rate, and exchange rate when formulating policies to stabilize stock market. Reference Abdul Madjid, M. S. and Yusof, R. M. (2009). Long-run relationship between Islamic stock returns and macroeconomic variables: An application of the autoregressive distributed lag model. Humanomics, Vol. 25 No. 2, pp. 127-141. Retrieved on 28th May 2011. Retrieved from http://www.emeraldinsight.com/journals.htm?articleid=1795261.

Abdul Rahman, A., Mohd Sidek, N.Z., & Tafri, F.H. (2009). Macroeconomic determinants of Malaysian Stock Market. African Journal of Business Management Vol.3 (3), pp. 95-106. Retrieved on 28th May 2011. Retrieved from http://www.academicjournals.org/ajbm/abs tracts/abstracts/abstracts2009/Mar/Rahman%20et%20al.htm

Ahmed, S. (2008). Aggregate economic variables and stock markets in India. International Research Journal of Finance and Economics, 14, 141-164. Retrieved on 26th May 2001. Retrieved from http://www.eurojournals.com/irjfe%2014%20shahid.pdf

Al-Khazali, O. M. and Pyun, C. S. (2004). Stock Prices and Inflation: New Evidence from the Pacific-Basin Countries. Review of Quantitative Finance and Accounting, 22, 123140. Retrieved on 27th May 2011.Retrieved from http://ideas.repec.org/a/kap/rqfnac/v22y2004i2p123140.html

24

Regression Analysis of Kuala Lumpur Composite Index

Azman-Saini, W.N.W., Habibullah, M.S., Law, S.H. and Dayang-Afizzah, A.M. (2006). StockPrices, exchange rates and causality in Malaysia: a note. MPRA Paper, No. 656, 1-15. Retrieved on 29th May 2011. Retrieved from http://mpra.ub.uni-

muenchen.de/656/1/MPRA_paper_656.pdf

Cheng T.C.E., Lo Y.K., & Ma K.W. (1990). Forecasting stock price index by multiple regression. Managerial Finance, Vol. 16: 1, 27 31. Retrieved on 27th May 2011.Retrieved from http://www.emeraldinsight.com/journals.htm?issn=03074358&volume=16&issue=1&articleid=1 648969&show=html Gan, C., Lee, M., Yong, H.H.A., & Zhang, J (2006). Macroeconomic variables and stock market interactions: New Zealand evidence. Investment Management and Financial Innovation, 3(4), 89-101. Retrieved on 27th May 2011. Retrieved from http://academic.research.microsoft.com/Publication/5576578/macroeconomicvariables-and stock-market-interactions-new-zealand-evidence

Gujarati (2004). Basic Econometris. 4th Edition. McGraw-Hill, pp. 359-362.

Hasan, Z. (1999). Recent financial crisis in Malaysia: response, results, challenges. MPRA Paper No.21844, p.39. Retrieved on 28th May 2011. Retrieved from http://ideas.repec.org/p/pra/mprapa/21844.html

Humpe, A. & Macmillan, P.D. (2005). Can macroeconomic variables explain long term stock market movements? A comparison of the US and Japan.1-22. Retrieved on 27th May 2011.

25

Regression Analysis of Kuala Lumpur Composite Index

Retrieved from http://ideas.repec.org/p/san/cdmawp/0720.html

Ibrahim, M & Aziz. (2003). Macroeconomic variables and the Malaysian equity market. Journal of Economic Studies, 30, 6-27. Retrieved on 29th May 2011. Retrieved from http://www.emeraldinsight.com/journals.htm?articleid=846211&show=html

Ibrahim, M & Yusoff, W. S. W. (2001). Macroeconomics Variables, Exchange Rate and Stock Price: A Malaysian Perspective. IIUM Journal of Economics and Management, 9(2), 141-163. Retrieved on 26th May 2011. Retrieved from http://www.iium.edu.my/enmjournal/92art2.pdf

Lind, D. A., Marchal, W. G. & Wathen, S. A. (2008). Statisitical Techniques in Business and Economics. 13th Edition. McGraw-Hill, New York. pp 534.

Maghyereh, A. I. (2003). Causal relations among stock prices and macroeconomic variables in the small, open economy of Jordan. JKAU: Econ. & Adm., Vol.17 (2), 3-12. Retrieved on 28th May 2011. Retrieve from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=317539

Mahani, Z. A. and Rajah, R. (2009). The global financial crisis and the malaysian economy: impact and responses. UNDP Report, p. 26. Retrieved on 26th May 2011. Retrieved from http://www.undp.my/uploads/UNDP%20Report%20The%20Global%20Financial%20Crisis%20 and%20the%20Malaysian%20Economy.pdf Maysami, R. C. & Koh, T. S. (2000). A Vector Error Correction Model of Singapore Stock Market. International Review of Economic and Finance, 9, 79-96. Retrieved on 27th May 2011. Retrieved from http://ideas.repec.org/a/eee/reveco/v9y2000i1p79-96.html

Maysami, R.C., Howe, L.C., & Hamzah, M.A. (2004). Relationship between macroeconomic

26

Regression Analysis of Kuala Lumpur Composite Index

variables and stock market indices: cointegration evidence from stock exchange of Singapores All-S sector indices. Jurnal Pengurusan, 24, 47-77. Retrieved on 28th May 2011. Retrieved from http://journalarticle.ukm.my/1762/

Nasseh, A. and Strauss, J. (2000). Stock prices and domestic and international macroeconomic activity: a cointegration approach. The Quarterly Review of Economics and Finance, 40, 229 -245. Retrieved on 27th May 2011. Retrieved from http://ideas.repec.org/a/eee/quaeco/v40y2000i2p229-245.html

Tsoukalas, D. (2003). Macroeconomic Factors and Stock Prices in the Emerging Cypriot Equity Market. Managerial Finance, 29(4), 87-92. Retrieved on 27th May 2011. Retrieved from http://www.emeraldinsight.com/journals.htm?articleid=865857

27

Regression Analysis of Kuala Lumpur Composite Index

Appendix Data Set Model 1

CPI PENINSULAR MALAYSIA DESCRIPTOR Index Number National Currency Millions Ringgit Index Number Index Number GROSS DOMESTIC PRODUCT AVERAGE LENDING RATE

M2

KLCI

Q1 1991 Q2 1991 Q3 1991 Q4 1991 Q1 1992 Q2 1992 Q3 1992 Q4 1992 Q1 1993 Q2 1993 Q3 1993 Q4 1993 Q1 1994 Q2 1994 Q3 1994 Q4 1994 Q1 1995 Q2 1995 Q3 1995 Q4 1995 Q1 1996 Q2 1996 Q3 1996 Q4 1996 Q1 1997 Q2 1997 Q3 1997 Q4 1997 Q1 1998 Q2 1998 Q3 1998 Q4 1998 Q1 1999 Q2 1999 Q3 1999 Q4 1999

66.55 67.56 67.78 68.34 69.42 70.63 71.30 71.77 72.44 73.07 73.50 73.67 75.39 75.52 76.18 76.96 77.88 78.31 78.84 79.52 80.49 81.17 81.68 82.18 83.05 83.17 83.55 84.41 86.62 87.94 88.29 88.95 90.06 90.27 90.34 90.77

31,604.00 31,549.00 35,294.00 36,676.00 35,077.00 36,006.00 39,250.00 40,348.00 39,892.00 42,472.00 45,152.00 44,677.00 43,605.00 46,665.00 51,777.00 53,413.00 51,315.00 54,511.00 57,189.00 59,457.00 58,835.00 61,994.00 65,274.00 67,628.00 64,994.00 67,790.00 71,854.00 77,157.00 70,779.00 70,218.00 71,976.00 70,271.00 67,576.00 73,737.00 78,080.00 81,373.00

88,345.80 88,311.40 91,103.90 96,092.50 100,114.00 104,774.00 110,160.00 114,481.00 117,540.00 122,879.00 128,314.00 139,800.00 154,480.00 151,018.00 155,862.00 160,366.00 164,687.00 176,552.00 185,709.00 198,873.00 209,497.00 214,674.00 222,697.00 238,209.00 249,522.00 260,235.00 270,202.00 292,217.00 288,595.00 281,734.00 286,081.00 296,472.00 305,437.00 317,154.00 322,896.00 337,138.00

9.10 9.30 9.30 9.69 9.91 10.17 10.30 10.27 10.22 10.16 9.93 9.82 9.35 8.95 8.54 8.21 8.35 8.65 8.80 9.13 9.57 9.85 10.14 10.21 10.15 10.52 10.74 11.10 12.46 13.51 12.56 10.01 9.59 8.74 8.08 7.84

587.05 618.70 522.69 556.22 593.21 592.33 602.28 643.96 643.25 721.17 853.83 1275.32 952.72 1011.58 1129.76 971.21 984.07 1026.62 1000.60 995.17 1149.08 1136.31 1135.27 1237.96 1203.10 1077.30 814.57 594.44 719.52 455.64 373.52 586.13 502.82 811.10 675.45 812.33

28

Regression Analysis of Kuala Lumpur Composite Index

Before Time Lag

AVERAGE LENDING RATE Percent per Annum CPI PENINSULAR MALAYSIA Index Number OFFICIAL RATE, END OF PERIOD Ringgit per US Dollar

KLCI DESCRIPTOR Index Number

INDUSTRIAL PRODUCTION Index Number

M2 Millions Ringgit

FINANCIAL CRISIS Dummy

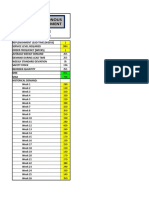

M12 1993 M1 1994 M2 1994 M3 1994 M4 1994 M5 1994 M6 1994 M7 1994 M8 1994 M9 1994 M10 1994 M11 1994 M12 1994 M1 1995 M2 1995 M3 1995 M4 1995 M5 1995 M6 1995 M7 1995 M8 1995 M9 1995 M10 1995 M11 1995 M12 1995 M1 1996 M2 1996 M3 1996 M4 1996 M5 1996 M6 1996 M7 1996 M8 1996 M9 1996 M10 1996 M11 1996 M12 1996 M1 1997 M2 1997 M3 1997 M4 1997

1275.32 1106.99 1125.63 952.72 1054.5 993.73 1011.58 1027.51 1130.01 1129.76 1108.85 1013.13 971.21 883.29 979.64 983.1 951.8 1050 1026.62 1060.21 1015.07 1000.6 957.61 951.69 995.17 1055.42 1084.41 1149.08 1189.54 1141.07 1136.31 1068.23 1118.57 1135.27 1168.31 1226.52 1237.96 1216.72 1270.67 1203.1 1080.17

9.65 9.44 9.36 9.25 9.12 8.96 8.78 8.67 8.46 8.49 8.24 8.16 8.24 8.26 8.31 8.47 8.60 8.68 8.66 8.76 8.81 8.83 8.94 9.16 9.28 9.42 9.58 9.71 9.72 9.84 10.00 10.13 10.17 10.13 10.40 10.10 10.12 10.18 10.13 10.14 10.46

74.642 74.961 75.721 75.493 75.493 75.569 75.493 75.949 76.101 76.481 76.633 77.013 77.241 77.546 78.078 78.002 78.002 78.458 78.458 78.610 78.838 79.066 79.218 79.598 79.750 80.206 80.739 80.511 80.815 81.271 81.423 81.575 81.575 81.879 81.879 82.259 82.411 82.791 83.247 83.095 82.943

43.756 42.202 42.369 42.994 45.119 46.577 45.452 48.535 48.410 50.743 49.660 48.660 50.993 49.618 48.535 49.035 50.285 55.409 52.368 54.950 55.075 55.075 55.825 53.617 55.409 55.159 53.534 55.575 58.575 59.408 55.492 62.783 58.867 61.158 62.783 59.367 62.449 62.408 58.867 61.908 64.782

139,800.00 146,708.00 151,745.00 154,480.00 151,733.00 147,965.00 151,018.00 149,096.00 153,117.00 155,862.00 155,882.00 155,843.00 160,366.00 164,398.00 166,566.00 164,687.00 165,976.00 170,001.00 176,552.00 176,615.00 183,266.00 185,709.00 187,756.00 192,398.00 198,873.00 205,668.00 210,674.00 209,497.00 212,205.00 213,204.00 214,674.00 217,052.00 219,742.00 222,697.00 229,566.00 229,496.00 238,209.00 246,200.00 250,029.00 249,522.00 248,345.00

2.702 2.762 2.728 2.673 2.688 2.579 2.604 2.594 2.553 2.566 2.553 2.558 2.560 2.557 2.555 2.537 2.472 2.466 2.440 2.458 2.499 2.507 2.545 2.543 2.542 2.563 2.551 2.537 2.493 2.501 2.496 2.496 2.495 2.509 2.534 2.527 2.529 2.487 2.483 2.479 2.513

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

29

Regression Analysis of Kuala Lumpur Composite Index

After Time Lag

KLCI Index Number

AVERAGE LENDING RATE Percent per Annum

CPI PENINSULAR MALAYSIA Index Number

INDUSTRIAL PRODUCTION Index Number

M2 Millions Ringgit

OFFICIAL RATE, END OF PERIOD Ringgit per US Dollar

FINANCIAL CRISIS Dummy

1130.01 1129.76 1108.85 1013.13 971.21 883.29 979.64 983.1 951.8 1050 1026.62 1060.21 1015.07 1000.6 957.61 951.69 995.17 1055.42 1084.41 1149.08 1189.54 1141.07 1136.31 1068.23 1118.57 1135.27 1168.31 1226.52 1237.96 1216.72 1270.67 1203.1 1080.17 1104.83 1077.3 1012.84 804.4 814.57 664.69 545.44 594.44

9.65 9.44 9.36 9.25 9.12 8.96 8.78 8.67 8.46 8.49 8.24 8.16 8.24 8.26 8.31 8.47 8.60 8.68 8.66 8.76 8.81 8.83 8.94 9.16 9.28 9.42 9.58 9.71 9.72 9.84 10.00 10.13 10.17 10.13 10.40 10.10 10.12 10.18 10.13 10.14 10.46

74.642 74.961 75.721 75.493 75.493 75.569 75.493 75.949 76.101 76.481 76.633 77.013 77.241 77.546 78.078 78.002 78.002 78.458 78.458 78.610 78.838 79.066 79.218 79.598 79.750 80.206 80.739 80.511 80.815 81.271 81.423 81.575 81.575 81.879 81.879 82.259 82.411 82.791 83.247 83.095 82.943

46.577 45.452 48.535 48.410 50.743 49.660 48.660 50.993 49.618 48.535 49.035 50.285 55.409 52.368 54.950 55.075 55.075 55.825 53.617 55.409 55.159 53.534 55.575 58.575 59.408 55.492 62.783 58.867 61.158 62.783 59.367 62.449 62.408 58.867 61.908 64.782 66.407 62.324 67.824 66.990 65.741

139,800.00 146,708.00 151,745.00 154,480.00 151,733.00 147,965.00 151,018.00 149,096.00 153,117.00 155,862.00 155,882.00 155,843.00 160,366.00 164,398.00 166,566.00 164,687.00 165,976.00 170,001.00 176,552.00 176,615.00 183,266.00 185,709.00 187,756.00 192,398.00 198,873.00 205,668.00 210,674.00 209,497.00 212,205.00 213,204.00 214,674.00 217,052.00 219,742.00 222,697.00 229,566.00 229,496.00 238,209.00 246,200.00 250,029.00 249,522.00 248,345.00

2.553 2.566 2.553 2.558 2.560 2.557 2.555 2.537 2.472 2.466 2.440 2.458 2.499 2.507 2.545 2.543 2.542 2.563 2.551 2.537 2.493 2.501 2.496 2.496 2.495 2.509 2.534 2.527 2.529 2.487 2.483 2.479 2.513 2.513 2.525 2.631 2.958 3.194 3.430 3.505 3.892

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1.00 1.00 1.00 1.00 1.00 1.00

30

Regression Analysis of Kuala Lumpur Composite Index

31

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- SYSTEM WIDE CONCEPT-henny PDFDocument15 pagesSYSTEM WIDE CONCEPT-henny PDFDELA MAYNo ratings yet

- Upload Fav To System 7Document2 pagesUpload Fav To System 7Hasan Ali AssegafNo ratings yet

- I Oniqua 12 Best Practices OG FINALDocument9 pagesI Oniqua 12 Best Practices OG FINALHasan Ali AssegafNo ratings yet

- MinmaxcalcuationDocument1 pageMinmaxcalcuationHasan Ali AssegafNo ratings yet

- Page - 1Document20 pagesPage - 1Hasan Ali AssegafNo ratings yet

- Questionnaire MMDocument111 pagesQuestionnaire MMapi-3781101100% (9)

- Questionnaire MMDocument111 pagesQuestionnaire MMapi-3781101100% (9)

- Presidential Election and Indonesia'S Economic Outlook: (Kamis, 15 Juli 2004) - Kontribusi Dari SoedradjadDocument3 pagesPresidential Election and Indonesia'S Economic Outlook: (Kamis, 15 Juli 2004) - Kontribusi Dari SoedradjadHasan Ali AssegafNo ratings yet

- Report 1Document31 pagesReport 1Hasan Ali AssegafNo ratings yet

- Data Monitor Report - Soft DrinksDocument26 pagesData Monitor Report - Soft DrinksKhushi SawlaniNo ratings yet

- Presentation Group 1Document30 pagesPresentation Group 1Hasan Ali Assegaf50% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)