Professional Documents

Culture Documents

Financial Accounting and Analysis Exam Questions

Uploaded by

Praveena MallampalliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting and Analysis Exam Questions

Uploaded by

Praveena MallampalliCopyright:

Available Formats

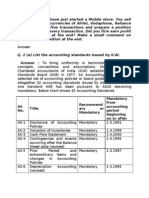

CODE NO: R5-11004/MBA JAWAHARLAL NEHRU TECHNOLOGICAL UNIVERSITY HYDERABAD MBA-I Semester Regular Examinations February -2010 FINANCIAL

ACCOUNTING AND ANALYSIS Time:3hours Max.Marks:60 Answer any Five questions All questions carry equal marks --1. Discuss the basic concepts and fundamental accounting assumptions. 2. A trial balance prepared by the accountant of XYZ is furnished below. You are required to prepare the Trading and profit and loss account for the year ending 31st December 2003 and a balance sheet as on that date. Rs. Rs. Opening stock 12,500 Sales & Purchases 26,400 86,000 Coal & water 1,600 Insurance 2,300 Postage 800 Printing 300 Machinery 21,000 Furniture 20,000 Returns 1.800 1,500 Commission 2.000 21,000 Wages 4,000 Overdraft 18,000 Discount 3,000 2,500 Outstanding salary 1,000 Salary 6,000 Buildings 28,000 Bills Payable 7,000 Bills Receivable 5,000 XYZs capital 15,000 XYZs drawing 2,000 Prepaid Insurance 300 Patents 1,000 Cash 14,000 1,52,000 1,52,000 Additional information a) The closing stock was valued at Rs.68,000. b) Wages include Rs. 700 paid to workmen for installing the machinery. c) Sample distributed but unrecorded Rs.850.

w w

3.

. w

tu jn

or w

. ld

m co

A firm purchased on 1st January, 1984 certain machinery for Rs. 58,200 and spent Rs.1,800 on its erection. On 1st July, 1984 additional machinery costing Rs.20,000 was purchased. On 1st January 1984 having become obsolete was auctioned for Rs.28,600 and on the same data fresh machinery was purchased at a cost of Rs.40,000. Depreciation was provided for annually on 31st December at the rate of 10 percent on written down value. In 1987, however, the firm changed this method of providing depreciation on the original cost of the machinery. Give the Machinery Account as it would stand at the end of each year from 1984 to 1987. cont..2

CODE NO: R5-11004/MBA

::2::

4.(i) Define inventory why proper valuation of inventory is important? (ii) Compare LIFO and FIFO as methods of inventory valuation. 5. A limited company was incorporated with an authorized capital of Rs.2 lakhs divided into 20,000 equity shares of Rs.10 each. The company issued 10,000 equity shares at a premium of Rs 2 per share payable as follows. Rs 2 on application, Rs 5 ( including premium) on allotment, Rs3 on first call and Rs 2 on final call. Applications were received for 15,000 shares. The directors made the allotment as follows: To applicants of 3,000 shares, the allotment was refused and to the remaining applicants allotment was made pro rate. Money paid in excess on application was adjusted towards the sum due on allotment. All the shareholders other than Manak remitted the call monies on the respective due dates. Manak, a shareholder to whom 200 shares were allotted failed to pay the first call money and second call money and his shares were forfeited. The forfeited shares were re-issued to Rajan as fully paid for Rs 9 per share. Give necessary journal entries and ledger entries to record these transactions. From the following information prepare funds flow statement of ABC ltd. Liabilities Share capital: Equity shares 6% Redeemable Pref. shares Profit & loss A/C Proposed Dividend Trade creditors Bills payable I yr 4,50,000 2,25,000 60,000 55,000 72,000 32,000 II yr 6,00,000 1,52,000 75,000 67,000 90,000 25,000 Assets

6.

w w

7. 8.

. w

tu jn

9,54,000

or w

Goodwill Plant

. ld

I yr

m co

II yr 1,40,000 2,50,000 1,95,000 1,25,000 2,35,000 57,000 77,000 10,79,000

1,90,000 1,60,000

Building Inventory Debtors Bills Receivable Cash

2,40,000 92,000 1,75,000 45,000 52,000 9,54,000

10,79,000

Additional information: a) An interim divided of Rs35,000 has been paid in II yr. b) Payment of income tax of Rs52,000 was paid during II yr. c) Depreciation of Rs35,.000 and Rs 42,000 have been charged on plant and building respectively in II yr. d) A part of the plant worth Rs20,000 was sold for Rs30,000.

What do you mean by ratio analysis? Discuss about classification of ratios and important ratios in each group of ratios. Discuss the importance of financial analysis. Describe any two methods of financial analysis in detail with suitable examples.

You might also like

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsDocument3 pagesAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhNo ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Sample PaperDocument28 pagesSample PaperSantanu KararNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- Svu Bcom CA Syllabus III and IVDocument19 pagesSvu Bcom CA Syllabus III and IVram_somala67% (9)

- Accounting For Managers GTU Question PaperDocument3 pagesAccounting For Managers GTU Question PaperbhfunNo ratings yet

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- Accountancy EngDocument8 pagesAccountancy EngBettappa Patil100% (1)

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- Isc Accounts 5 MB: (Three HoursDocument7 pagesIsc Accounts 5 MB: (Three HoursShivam SinghNo ratings yet

- Recommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterDocument7 pagesRecommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterdnbiswasNo ratings yet

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- Corporate Accounting I exam questions and solutionsDocument3 pagesCorporate Accounting I exam questions and solutionsRiteshHPatelNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- BBA I Financial Accounting 11007400Document2 pagesBBA I Financial Accounting 11007400Nazif SamdaniNo ratings yet

- ADL 03 Ver2+Document6 pagesADL 03 Ver2+DistPub eLearning SolutionNo ratings yet

- CAP-III Advanced Financial ReportingDocument17 pagesCAP-III Advanced Financial ReportingcasarokarNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNo ratings yet

- Accountancy - Paper-I - 2012Document3 pagesAccountancy - Paper-I - 2012MaryamQaaziNo ratings yet

- PAF KIET Financial Acc Final Paper MBA-city Campus 161213Document7 pagesPAF KIET Financial Acc Final Paper MBA-city Campus 161213Shahzaib NadeemNo ratings yet

- Accounts Preliminary Paper No 9 PDFDocument6 pagesAccounts Preliminary Paper No 9 PDFAMIN BUHARI ABDUL KHADERNo ratings yet

- Advanced Corporate AccountingDocument6 pagesAdvanced Corporate Accountingamensinkai3133No ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- VEC Dept of Mgt Studies BA7106 QBDocument12 pagesVEC Dept of Mgt Studies BA7106 QBSRMBALAANo ratings yet

- Fund Flow StatementDocument7 pagesFund Flow StatementvipulNo ratings yet

- ACCOUNTANCY AND BUSINESS STATISTICS First Paper: Corporate AccountingDocument12 pagesACCOUNTANCY AND BUSINESS STATISTICS First Paper: Corporate AccountingGuruKPONo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- Accountancy Model QuestionsDocument19 pagesAccountancy Model QuestionsSunil Kumar AgarwalaNo ratings yet

- Accounting For Managers MBA GTUDocument3 pagesAccounting For Managers MBA GTUbhfunNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Document20 pagesCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNo ratings yet

- Bcss & Faa Que - PaperDocument3 pagesBcss & Faa Que - PaperNaresh GuduruNo ratings yet

- Pac Mids With Solution 1,2,3,4,8Document67 pagesPac Mids With Solution 1,2,3,4,8Shahid MahmudNo ratings yet

- Pac All CAF MidtermsDocument130 pagesPac All CAF MidtermsShahid MahmudNo ratings yet

- Distance education exam questionsDocument8 pagesDistance education exam questionsSadhasivan SNo ratings yet

- 5419 Advance AccountingDocument5 pages5419 Advance AccountingmansoorNo ratings yet

- Accounting concepts and principles in financial statementsDocument6 pagesAccounting concepts and principles in financial statementskartikbhaiNo ratings yet

- Class Exercise AccountingDocument4 pagesClass Exercise AccountingMohsin Farooq100% (1)

- 3hr Paper 4feb 2010Document3 pages3hr Paper 4feb 2010Bhawna BhardwajNo ratings yet

- Adv Accts 100ADocument9 pagesAdv Accts 100ASurajNo ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- C.A. Final Financial Reporting Consolidated BSDocument7 pagesC.A. Final Financial Reporting Consolidated BSDivyesh TrivediNo ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Bba 3 Sem AccountsDocument9 pagesBba 3 Sem Accountsanjali LakshcarNo ratings yet

- R05 - Financial Accounting and AnalysisDocument3 pagesR05 - Financial Accounting and AnalysisSrinivas NallamalliNo ratings yet

- No.............................. MAY'2011: Ipco Group-I Paper-1 AccountingDocument12 pagesNo.............................. MAY'2011: Ipco Group-I Paper-1 AccountingSamson KoshyNo ratings yet

- 22ODBBT103Document5 pages22ODBBT103Pallavi JaggiNo ratings yet

- ISQ EXAMINATION ACCOUNTING FOR FINANCIAL SERVICESDocument6 pagesISQ EXAMINATION ACCOUNTING FOR FINANCIAL SERVICEStysonhishamNo ratings yet

- BK Paper 45 MarksR3 PrelimDocument5 pagesBK Paper 45 MarksR3 Prelimpsawant770% (1)

- Multiple Choice Questions: Section-IDocument6 pagesMultiple Choice Questions: Section-Isah108_pk796No ratings yet

- MKGM Accounts Question Papers ModelDocument101 pagesMKGM Accounts Question Papers ModelSantvana ChaturvediNo ratings yet

- Paper - 1: Advanced AccountingDocument19 pagesPaper - 1: Advanced AccountingZamda HarounNo ratings yet

- CCE E MBA (Aviation Management) Assignment 1Document6 pagesCCE E MBA (Aviation Management) Assignment 1Sukhi MakkarNo ratings yet

- Model Question Set 1Document2 pagesModel Question Set 1Destiny Tuition CentreNo ratings yet

- Assignment-Code 438Document5 pagesAssignment-Code 438Alice JasperNo ratings yet

- What Is Forfeiture of ShareDocument3 pagesWhat Is Forfeiture of ShareSathish SmartNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Fast Nearest Neighbor Search With KeywordsDocument5 pagesFast Nearest Neighbor Search With KeywordsJAYAPRAKASHNo ratings yet

- Seunit 1Document4 pagesSeunit 1Praveena MallampalliNo ratings yet

- LSCM 01Document14 pagesLSCM 01Praveena MallampalliNo ratings yet

- Beg 01Document12 pagesBeg 01Praveena MallampalliNo ratings yet

- Light Maharashtrian breakfast Kanda Pohe recipeDocument8 pagesLight Maharashtrian breakfast Kanda Pohe recipePraveena MallampalliNo ratings yet

- CP Officer Exam AnswerDocument3 pagesCP Officer Exam AnswerDaniel GetachewNo ratings yet

- Smartaisle Containment Brochure EnglishDocument32 pagesSmartaisle Containment Brochure EnglishAsad NizamNo ratings yet

- Mazda2 Brochure August 2009Document36 pagesMazda2 Brochure August 2009Shamsul Zahuri JohariNo ratings yet

- Trash and Recycling Space Allocation GuideDocument24 pagesTrash and Recycling Space Allocation GuideJohan RodriguezNo ratings yet

- Doctrine of Repugnancy ExplainedDocument13 pagesDoctrine of Repugnancy ExplainedAmita SinwarNo ratings yet

- Spo2 M1191aDocument247 pagesSpo2 M1191ashashibiya33No ratings yet

- NFL 101 Breaking Down The Basics of 2-Man CoverageDocument10 pagesNFL 101 Breaking Down The Basics of 2-Man Coveragecoachmark285No ratings yet

- Donate Your Corneas PleaseDocument19 pagesDonate Your Corneas PleaseRahul PinnamaneniNo ratings yet

- Life of A Loan, GM FinancialDocument12 pagesLife of A Loan, GM Financialed_nycNo ratings yet

- Ashish Dixit ResumeDocument2 pagesAshish Dixit Resume9463455354No ratings yet

- 1.1 Nature and Scope of International Financial ManagementDocument26 pages1.1 Nature and Scope of International Financial ManagementTuki DasNo ratings yet

- Training MatrixDocument4 pagesTraining MatrixJennyfer Banez Nipales100% (1)

- Group Project in Patient RoomDocument14 pagesGroup Project in Patient RoomMaida AsriNo ratings yet

- Appendix 27 - CASH RECEIPTS REGISTERDocument1 pageAppendix 27 - CASH RECEIPTS REGISTERPau PerezNo ratings yet

- PT Amar Sejahtera General LedgerDocument6 pagesPT Amar Sejahtera General LedgerRiska GintingNo ratings yet

- Infrared Spectroscopy of FAME in Biodiesel Following DIN 14078 PDFDocument2 pagesInfrared Spectroscopy of FAME in Biodiesel Following DIN 14078 PDFPedro AluaNo ratings yet

- Proceedings of The Third International Conference On Computational Intelligence and InformaticsDocument881 pagesProceedings of The Third International Conference On Computational Intelligence and InformaticsJanes DstNo ratings yet

- Assessment of Electronic Collection Development in Nigerian University LibrariesDocument24 pagesAssessment of Electronic Collection Development in Nigerian University Librariesmohamed hassanNo ratings yet

- Online Assignment Instant-36 PDFDocument8 pagesOnline Assignment Instant-36 PDFsolutionsNo ratings yet

- FINAL REPORT WV Albania Buiding Futures PotentialDocument30 pagesFINAL REPORT WV Albania Buiding Futures PotentialVasilijeNo ratings yet

- 40W 2.1CH Digital Audio Amplifier with EQDocument4 pages40W 2.1CH Digital Audio Amplifier with EQDylan Gonzalez VillalobosNo ratings yet

- Pizza Crust Menu in Karachi - Restaurant Online Ordering PakistanDocument2 pagesPizza Crust Menu in Karachi - Restaurant Online Ordering PakistanSyed Rafay HashmiNo ratings yet

- StompIO-1 User ManualDocument92 pagesStompIO-1 User ManualFederico Maccarone50% (2)

- Literature Review Economics SampleDocument8 pagesLiterature Review Economics Sampleafmzynegjunqfk100% (1)

- Fundamental analysis of ACC Ltd and India's cement industryDocument5 pagesFundamental analysis of ACC Ltd and India's cement industryDevika SuvarnaNo ratings yet

- BITUMINOUS MIX DESIGNDocument4 pagesBITUMINOUS MIX DESIGNSunil BoseNo ratings yet

- Business Math - QuizDocument2 pagesBusiness Math - QuizHannah Giezel MalayanNo ratings yet

- Sing Pilot CardDocument1 pageSing Pilot CardTushar Gupta100% (1)

- Pondicherry University: Examination Application FormDocument2 pagesPondicherry University: Examination Application FormrahulnkrNo ratings yet

- Apc Materials PropertiesDocument15 pagesApc Materials PropertiesnamyefNo ratings yet