Professional Documents

Culture Documents

Jitendra Mohananey B. Com., LL.B., ACA, ACS +91 9810287311

Uploaded by

rahulmohiniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jitendra Mohananey B. Com., LL.B., ACA, ACS +91 9810287311

Uploaded by

rahulmohiniCopyright:

Available Formats

Jitendra Mohananey B. Com., LL.B., ACA, ACS Jitendra_mohananey@yahoo.

com +91 9810287311

Wk 1

Jitendra Mohananey Qualification: B.Com., LL.B., ACA, ACS Occupation: Vice President Finance - LITL Post qualification Experience: 25 years Industries Worked: IT, Telecom, Infrastructure, F & B, Oil & Gas Companies worked: JK Synthetics Ltd, YKK Corp, Brown Forman Corp, Bharti, Emerson, IGL etc. Experience: Fund Raising Banks, FIs, FIIs, ECB, IPO and Private Equity , M & A, Corporate Las, Taxation Faculty: IIPM, IILM and EBS

MERGER & ACQUISITIONS COURSE DURATION: 3 HRS PER WEEK FOR 12 WEEKS COURSE CREDITS: 3 1. FORMS OF BUSINESS ALLIANCES (7 HRS) Strategic choice of type of business alliance Merger and acquisition and take-over Introduction to restructuring problems; types of mergers; reasons for M & A; vertical, horizontal, conglomerate, concentric mergers. History of mergers the first to the fourth wave and causes thereof. The strategic Process Theories of mergers and tender offering financial synergy and managerial synergy. 2. DEFINING AND SELECTING TARGET (5 HRS) Pricing of mergers (Pricing the competitive bid for take- over) Negotiation/approach for merger Acquisition and take over contracting; implementation of M & A; managing post-merger issues 3. VALUING FIRMS AND THE DIFFERENT METHODS OF VALUATION (7 HRS) Product life cycle effect on valuation. Corporate and financial restructuring Divestiture Mechanism, process and techniques legalities involved in M & A and take-over Ethical issues of merger and take-over 4. ACCOUNTING FOR MERGERS (5 HRS) Financing the mergers and Take-overs Corporate restructuring divestment and abandonment 5. JOINT VENTURE AND ALLIANCES (7 HRS) Leveraged buyout Share repurchase. Takeover defences International take over and restructuring The M & A process Implementation and management guides for Mergers & Acquisitions. 6. LEGAL ASPECTS OF M&A (5 HRS) Legal aspects of mergers/amalgamation and acquisition; provisions of Companies Act; SEBI regulation; Takeover Code; schemes of amalgamation; court approvals REQUIRED READINGS: GAUGHAN: Mergers, Acquisition & Corporate Restructuring (John Wiley) SUDI SUDERSANAM: Creating Value from M&A (Pearson)

Internal Assessment 25 marks

Class room conduct Attendance Assignments Class room presentations by students

Meaning

Need

Types

Valuation

Financing Defenses Laws

1. Asset Based a) Book Vlaue b) Adjusted Book Value c) Replacement Value 2. Relative/Market Based 1. EBITDA Multiple 2. P/E Multiple 3. Income 1. C apitalization 2. Dividend 3. DCF

1. Companies Act 2. Banking Regulation Act 3. Competition Act 4. Income tax Act 5. SEBI - SAST (Substantial Acquisition of Shares & Take over Regulations, 2011) 6. FEMA (Cross Border M & As) 7. RBI Guidelines (Banking Companies)

Process / Procedures

Merger

Acquisition

Take over De merger Reverse merger Amalgamation Absorption Reconstruction

Merger

An arrangement where by

assets of two or more companies become vested in, or under the control of one company which may or may not be one of the original companies, which has its shareholders, all or substantially all, the shareholders of one or both of the merging companies exchanging their shares for shares in other or third company.

A Limited

B Limited

A B Limited (New or existing Company)

Impact/Result

One or more companies cease to exist Either new company is incorporated

OR

Existing company takes over assets and liabilities

A Limited

B Limited

Reverse Merger

Acquisition of Public Company (listed) by Private Company to enjoy the benefits of listing by not going to the public Normally a sick/small company is merged with healthy company, in reverse merger a healthy company is merged with small/sick company Public Company (listed) is generally a shell/sick Company

No assets No liabilities Hidden legal liabilities

Process:

A shell/sick/loss making company which is listed is identified

Identified Company issues a large number of shares to the unlisted Company/its promoters

By virtue of this the unlisted company acquires controlling stake and has virtual control over the Board of the Shell Company

Godrej soaps Ltd. (GSL) with pre merger turnover of 436.77 crores entered into scheme of reverse merger with loss making Gujarat Godrej innovative Chemicals Ltd. (GGICL) (with pre merger turnover of Rs. 60 crores) in 1994 US Airways was acquired by America West Airlines, with the goal of removing the former from Chapter 11 bankruptcy.

Demerger

A corporate entity disposes off one or more of its business units to another corporate body which may be existing or a new one

Business Unit Original Company May or may not lose control

Value split

Unlocks the value in the assets of splited unit

Unlocking the wealth

Generally in real estate Some examples

Bharti Air tel - Tower Reliance Communications Towers India Bulls Real Estate Camlin Chemical Division Zee Regional Channels & Cable Sun Pharma Innovative R & D

A Unit

B Unit

X Limited (New)

ABC Limited

C Unit Y Limited (Existing)

Take over

Transfer of Control from one ownership to another ownership

Transfer of Control

Capital Financing From Market Preferential issue

Investor

Debt Financing Technology Support

Change in the Composition of the Board of Directors

Acquisition

Purchase of one Company by another

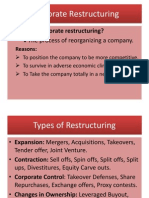

Restructuring

Organic

Inorganic

Organic

An Organic Restructuring - Internal Change without a change in Corporate Entity

Capital/Financial Restructuring: Change in the Share Capital / Debt Issue of Shares Debentures, Bonds Sweat Equity ESOP Buy Back Reduction Redemption

Business Restructuring Rationalization of work Force Diversification/Expansion Geographic Conversions New trade or line of business

Inorganic

Restructuring of Corporate body where there is a third party element involved

Merger Reverse Merger De Merger Acquisition Take over Amalgamation Absorption Joint Ventures etc

Economies of Scale Quick way to grow Elimination of competition Diversification Integration

Backward Forward Capture new markets New products

Technology Technical/managerial manpower Trade cycles To enjoy MONOPOLY Patent Unified control and self sufficiency Personal Ambitions Government policy /pressure Tax benefits Managerial motivation

Financial benefits of M & As arise from:

Reduction in

Costs Tax Capital Requirement

Increase in

Revenue

Improved marketing New markets New products etc.

Vertical

Horizontal

Conglomerate

Vertical Merger

Two or more companies working in the manufacturing/production of an item where the out put / finished product of one becomes input/ raw material for other, the producers thus join together for mutual benefit.

Union of Customer (s) and Vendor (s) Vertical Merger can be for

Forward

Acquisition of

Existing or Prospective customers

Backward

Acquisition of

Existing or Prospective vendors

Producer of Power

PRODUCTION, TRANSMISSION & DISTRIBUTION Transmission of Power COMPANY Distribution

of Power End users

Some other examples

Indian Rayon acquired Madura Garments IBM acquired Daksh Denim producer (textile) merges with Jeans manufacturer Brewery merging with Chain of pubs Coffee grower merging with Coffee retailer e.g. Nescafe Joinery merges with Real Estate Builder Cement plant merges with Infrastructure Company Iron ore company merges with Steel producer

RIL

Textiles Gas Refineries & Oil and Only Polyester Fiber Petrochemical Exploration Vimal

Advantages:

Seamless demand and supply (Time, Quality, Price) Least uncertainty Monopoly Lower Transaction costs

Disadvantages

Higher organizational costs Monopoly Lack of competition

When two or more companies generally competitors to each other, generally with overlapping geographic markets, consolidate, said to be a horizontal merger. Example Indian

IBP & IOC Bank of Punjab & Centurion Bank ICICI Bank & Bank of Rajasthan

Global

Price Waterhouse & Coopers E & Y and Arthur Anderson Boeing & Mc Donnell Douglas Chase Manhattan Chemical Bank Sony acquired Ericson Tata Tea acquired Tetley Tea Suzlon acquired Re power system Hindalco acquired Novelis Tata Chem acquired General Industrial products

Elimination of Competition Growth & Expansion Geographic New Markets New Products New/Advance Technology Pooling of Managerial Skills Financial Benefits

What is a Conglomerate

Merger of two or more companies operating in totally unrelated activities. Mergers which are neither horizontal nor vertical are Conglomerate Mergers.

Why Needed

Diversification Extending Corporate Territories Extending Product Range

Example

PepsiCo Pizza Hut Walt Disney American Broadcasting Phillip Morris Craft Proctor & Gamble Clorox

Beauty and Grooming - Gucci, Gillette, Camay, Max Factor House Hold Care - Ariel, Tide, Mr. Clean Health & Well being Oral B, Vicks etc.

Godrej

Furniture Health and Well being Food

Wipro

Software Hardware Soaps CFLs Switches

Thank you very much

Feedback & Queries: jitendra_mohananey@yahoo.com +91 9810287311

You might also like

- Corporate Restructuring Concepts and Forms SEODocument19 pagesCorporate Restructuring Concepts and Forms SEOAnuska JayswalNo ratings yet

- Introduction To Corporate RestructuringDocument94 pagesIntroduction To Corporate RestructuringDevansh GoenkaNo ratings yet

- Mergers & Acquisitions KSLUDocument51 pagesMergers & Acquisitions KSLUHans TalawarNo ratings yet

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word Documentishagoyal595160100% (1)

- Mergers & Acquisitions: Satellite CPE Study Circle 28 February 2020Document75 pagesMergers & Acquisitions: Satellite CPE Study Circle 28 February 2020thOUGHT fOR cHANGENo ratings yet

- Corporate RestructuringDocument58 pagesCorporate RestructuringHarshNo ratings yet

- Corp Mod 1Document19 pagesCorp Mod 1Astik TripathiNo ratings yet

- Acquisition and MergingDocument19 pagesAcquisition and MergingTeerraNo ratings yet

- Corporate ResDocument22 pagesCorporate Res20bal216No ratings yet

- Corporate+RestructuringDocument10 pagesCorporate+RestructuringSamarth PathakNo ratings yet

- Title of The Paper:: Mergers and Acquisitions Financial ManagementDocument25 pagesTitle of The Paper:: Mergers and Acquisitions Financial ManagementfatinNo ratings yet

- Submitted To Course InstructorDocument15 pagesSubmitted To Course InstructorAmitesh TejaswiNo ratings yet

- Reverse MergersDocument16 pagesReverse MergersIshita AroraNo ratings yet

- Merger & Acquisition: Presented By: Chitra Singaraju (06) Rashmi VaishyaDocument15 pagesMerger & Acquisition: Presented By: Chitra Singaraju (06) Rashmi VaishyaRashmi VaishyaNo ratings yet

- SynopsisDocument3 pagesSynopsisRahul SharmaNo ratings yet

- MRP Final ReportDocument114 pagesMRP Final Reportjohn_muellorNo ratings yet

- Merger and Acquisition IntroDocument198 pagesMerger and Acquisition IntroKaustubh BhandariNo ratings yet

- Corporate Restructuring Process ExplainedDocument101 pagesCorporate Restructuring Process ExplainedAman Kumar SharanNo ratings yet

- Mergers and AcquisitionsDocument80 pagesMergers and Acquisitionsyash khandol71% (7)

- Chap 7 - SummaryDocument12 pagesChap 7 - SummaryMimi HassanNo ratings yet

- Mergers, Acquisitions & Corporate RestructuringDocument44 pagesMergers, Acquisitions & Corporate RestructuringkayNo ratings yet

- M&A Rough DraftDocument71 pagesM&A Rough DraftsokajiNo ratings yet

- Mergers & AcquisitionDocument25 pagesMergers & AcquisitionBharath Pavanje100% (1)

- CRI Part 1 - CS Vaibhav Chitlangia - Yes Academy, PuneDocument333 pagesCRI Part 1 - CS Vaibhav Chitlangia - Yes Academy, Puneswapnil tiwariNo ratings yet

- Chapter 18 Business Expansion PowerpointDocument16 pagesChapter 18 Business Expansion Powerpointapi-384311544No ratings yet

- Mergers, Acquisitions and Corporate RestructuringDocument15 pagesMergers, Acquisitions and Corporate RestructuringSubrahmanya100% (2)

- Corporate RestructuringDocument14 pagesCorporate Restructuringkshamamehta100% (2)

- Corporate Finance Chapter10Document55 pagesCorporate Finance Chapter10James ManningNo ratings yet

- Corporate RestructuringDocument10 pagesCorporate RestructuringKARISHMAATA2100% (1)

- Chapter Six (6) : Merger and Acquisitions Advanced Financial Management 24/01/2024 by Section One StudentsDocument25 pagesChapter Six (6) : Merger and Acquisitions Advanced Financial Management 24/01/2024 by Section One StudentsBantamkak FikaduNo ratings yet

- Corporate Management Company Demerger Bankruptcy Repositioning Buyout Debt RestructuringDocument8 pagesCorporate Management Company Demerger Bankruptcy Repositioning Buyout Debt Restructuringrushikesh kakadeNo ratings yet

- Dr. Rakesh Kumar Sharma SBSBS, Thapar University, PatialaDocument29 pagesDr. Rakesh Kumar Sharma SBSBS, Thapar University, PatialaSaburao ChalawadiNo ratings yet

- Corporate RestructuringDocument27 pagesCorporate RestructuringAkash Bafna100% (1)

- Define The Following Terms: Merger: Corporate Action Buys Target CompanyDocument3 pagesDefine The Following Terms: Merger: Corporate Action Buys Target CompanyengrchocoNo ratings yet

- Corporate Restructuring: Prof Ashish K MitraDocument18 pagesCorporate Restructuring: Prof Ashish K MitraSanchit GuptaNo ratings yet

- M&A Intro by Prof. Rahul KavishwarDocument51 pagesM&A Intro by Prof. Rahul Kavishwarsalman parvezNo ratings yet

- Corporate RestructuringDocument18 pagesCorporate Restructuringbhavya_bajaj968No ratings yet

- Seminar Presentation ON Mergers & Acquisitions: Issues and ChallengesDocument13 pagesSeminar Presentation ON Mergers & Acquisitions: Issues and ChallengesSubrata kumar sahooNo ratings yet

- Corporate Restructuring, Mergers & Acquisitions OverviewDocument25 pagesCorporate Restructuring, Mergers & Acquisitions OverviewGarima MadanNo ratings yet

- Welcome To Class 8: Corporate Mergers & AcquisitionsDocument22 pagesWelcome To Class 8: Corporate Mergers & AcquisitionsKEREN MILLETNo ratings yet

- Merger Acquisition and Corporate RestructuringDocument30 pagesMerger Acquisition and Corporate Restructuringtafese kuracheNo ratings yet

- M&A Guide to Mergers and AcquisitionsDocument29 pagesM&A Guide to Mergers and AcquisitionsNavya DeepthiNo ratings yet

- Merger of Mahindra SatyamDocument17 pagesMerger of Mahindra Satyamdarius_dszNo ratings yet

- Advanced Accounting Concepts Chapter 5Document38 pagesAdvanced Accounting Concepts Chapter 5vishalNo ratings yet

- Introduction To M&ADocument44 pagesIntroduction To M&AChirag ShahNo ratings yet

- Merger AcquisitionDocument43 pagesMerger AcquisitionGanesh SangNo ratings yet

- A Case Study of Acquisition of Spice Communications by Isaasdaddea Cellular LimitedDocument13 pagesA Case Study of Acquisition of Spice Communications by Isaasdaddea Cellular Limitedsarge1986No ratings yet

- 0 Share: Meaning and Need For Corporate RestructuringDocument11 pages0 Share: Meaning and Need For Corporate Restructuringdeepti_gaddamNo ratings yet

- Presented by Chamkaur Singh L-2k9-BS-04-MBADocument54 pagesPresented by Chamkaur Singh L-2k9-BS-04-MBATanvi SinghNo ratings yet

- Corporate Restructuring TechniquesDocument51 pagesCorporate Restructuring TechniquesLEKHAN GAVINo ratings yet

- SFM - B2444 - Alan Paul JaxonDocument13 pagesSFM - B2444 - Alan Paul JaxonSoorajKrishnanNo ratings yet

- M&A GUIDELINES UNDER SEBI & RBIDocument23 pagesM&A GUIDELINES UNDER SEBI & RBIAditya AnandNo ratings yet

- Mergers and Aqu.Document35 pagesMergers and Aqu.KinjalMehtaNo ratings yet

- Cours MA Private EquityDocument198 pagesCours MA Private EquityOmar MechyakhaNo ratings yet

- FM - Chapter 32Document5 pagesFM - Chapter 32Amit SukhaniNo ratings yet

- Expansion and Financial RestructuringDocument50 pagesExpansion and Financial Restructuringvikasgaur86100% (5)

- Corporate Restructuring Strategies and FormsDocument25 pagesCorporate Restructuring Strategies and Formsvaibhav100% (1)

- Valuation of M&A DealsDocument58 pagesValuation of M&A Dealsgirish8911No ratings yet

- Corporate Governance: A practical guide for accountantsFrom EverandCorporate Governance: A practical guide for accountantsRating: 5 out of 5 stars5/5 (1)

- InventoryDocument8 pagesInventoryJoana Marie Mara SorianoNo ratings yet

- Capm Advantages and DisadvantagesDocument3 pagesCapm Advantages and DisadvantagesHasanovMirasovičNo ratings yet

- What Is Credit AnalysisDocument7 pagesWhat Is Credit AnalysisAbyotBeyechaNo ratings yet

- Industry Analysis InsightsDocument24 pagesIndustry Analysis InsightsSaurabh Krishna SinghNo ratings yet

- FAR - Learning Module - EDITEDDocument37 pagesFAR - Learning Module - EDITEDSire John LloydNo ratings yet

- Acc407 - 406 Chapter 1 Introduction To AccountingDocument17 pagesAcc407 - 406 Chapter 1 Introduction To AccountingNurul Fatimah PajarNo ratings yet

- Ajanta Pharma PresentatDocument29 pagesAjanta Pharma PresentatBhaskar DasguptaNo ratings yet

- Chapter 7 - Financial RatiosDocument8 pagesChapter 7 - Financial RatiosNatasha GhazaliNo ratings yet

- Midterm Exam Formulas CAPM Returns Dividends Stocks PortfoliosDocument4 pagesMidterm Exam Formulas CAPM Returns Dividends Stocks PortfoliosChristian Peralta ÜNo ratings yet

- ch14 PDFDocument38 pagesch14 PDFerylpaez92% (12)

- Options ProblemsDocument11 pagesOptions Problemsbts trashNo ratings yet

- Capital Budgeting TechniquesDocument12 pagesCapital Budgeting Techniquesshahin selkar100% (1)

- Ind As 20Document12 pagesInd As 20RITZ BROWNNo ratings yet

- Banks Providing Merchant Banking Services in IndiaDocument7 pagesBanks Providing Merchant Banking Services in IndiasakshiNo ratings yet

- Finance 1 lecture notes on financial institutions and marketsDocument60 pagesFinance 1 lecture notes on financial institutions and marketsLi NguyenNo ratings yet

- 8ff3e9 Listing of SecuritiesDocument33 pages8ff3e9 Listing of SecuritiesYashvi100% (1)

- Annual Report 2016 PDFDocument231 pagesAnnual Report 2016 PDFFøèzÅhåmmédNo ratings yet

- Australian GAAP Vs IFRSDocument25 pagesAustralian GAAP Vs IFRSMichael ZhangNo ratings yet

- Problems 1st PartDocument17 pagesProblems 1st PartMelyssa Ayala0% (1)

- KKGI - Annual Report - 2018 PDFDocument314 pagesKKGI - Annual Report - 2018 PDFfujiNo ratings yet

- Stock Valuation and Preferred Stock FeaturesDocument25 pagesStock Valuation and Preferred Stock Featureshind alteneijiNo ratings yet

- Entrepreneurship - MGT602 VUDocument5 pagesEntrepreneurship - MGT602 VUjawad khalidNo ratings yet

- Corporate Law - Case Comment On Rupak Gupta v. UP Hotels Ltd.Document12 pagesCorporate Law - Case Comment On Rupak Gupta v. UP Hotels Ltd.Harsh Gautam100% (1)

- Financial Management Project AnalysisDocument10 pagesFinancial Management Project AnalysisAlisha Shaw0% (1)

- Accounting For Liabilities and Equity 9Document6 pagesAccounting For Liabilities and Equity 9Lynmar EnorasaNo ratings yet

- Intermediate Accounting III Cash Basis vs Accrual BasisDocument23 pagesIntermediate Accounting III Cash Basis vs Accrual BasisKezNo ratings yet

- Course Out MamDocument7 pagesCourse Out MamrahulkatareyNo ratings yet

- TSPC Q4 2021 FSDocument91 pagesTSPC Q4 2021 FSPanama TreasureNo ratings yet

- M3P2Document8 pagesM3P2Vincent BusacayNo ratings yet

- Synthese Corporate Finance2021Document58 pagesSynthese Corporate Finance2021Hakim FgrchNo ratings yet