Professional Documents

Culture Documents

ShortSaleMoneyMachineA ZBlueprint

Uploaded by

pwr2getwealthOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ShortSaleMoneyMachineA ZBlueprint

Uploaded by

pwr2getwealthCopyright:

Available Formats

short sale money machine

J osh Ca n t we l l

Strategi c Real Estate Coach

Copyright Notice

All rights reserved. No part of this publication may be reproduced or transmitted in any form or

by any means electronic or mechanical. Any unauthorized use, sharing, reproduction, or distribu-

tion is strictly prohibited.

Legal Notice

While attempts have been made to verify information provided in this publication, neither the

author nor the publisher assumes any responsibility for errors, omissions, or contradictory

information contained in this document.

This document is not intended as legal, investment, or accounting advice. The purchaser or

reader of this document assumes all responsibility for the use of these materials and information.

Strategic Real Estate Coach assumes no responsibility or liability whatsoever on behalf of any

purchaser or reader of these materials.

2008 Strategic Real Estate Coach

short sale money machine

Chapter 1: The Macro Perspective ........................................................ 7

What is a Short Sale? .................................................................. 10

Note & Mortgage ....................................................................... 14

Traditional Real Estate Investing ..................................................... 14

Short Sale Real Estate Investing ..................................................... 15

The Foreclosure Process .............................................................. 17

Documents ......................................................................... 17

Appraisal ............................................................................ 18

Foreclosure Options for Lenders & Homeowners ...................................... 19

Sell .................................................................................. 19

Short Sale........................................................................... 20

Repayment Plan ................................................................... 20

Forbearance ........................................................................ 20

LoanModifcation ................................................................. 20

Partial Claim ....................................................................... 21

Deed-in-Lieu ....................................................................... 21

Foreclosure Auction ............................................................... 22

Bank Owned ........................................................................ 22

Contracts ................................................................................ 22

Sellers Market Versus Buyers Market ................................................ 24

Revenue Producing Activities ........................................................ 25

Realefow ............................................................................... 27

Chapter 2: Lead & Property Acquisition ................................................ 27

Choosing a Proactive or Passive Approach ......................................... 29

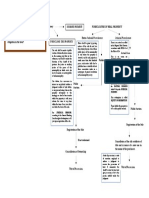

Step 1: Information Mining ............................................................ 29

The List ............................................................................. 31

The Courthouse .................................................................... 31

short sale money machine

Referrals ............................................................................ 33

Step 2: The Multiple Medium Approach ............................................. 34

Direct Mail .......................................................................... 34

Postcards ........................................................................... 34

Letters .............................................................................. 35

Door Knocking ..................................................................... 36

Cold Calling......................................................................... 37

Voice Broadcast .................................................................... 39

CentersofInfuence:Referrals .................................................. 40

Step 3: The Consistency Formula .................................................... 41

Step 4: Deal Filter ..................................................................... 41

Step 5: The Credibility Filter ......................................................... 43

The Credibility Factor: Seller Script ............................................ 44

Step 6: The Positive Results Conversation .......................................... 45

The Positive Results Conversation .............................................. 45

Marketing Wrap .................................................................... 53

Chapter 3: Working with the Banks ...................................................... 55

Understanding Your Loss Mitigator .................................................. 58

The Short Sale Package ............................................................... 59

Whats Required?....................................................................... 59

Necessary but NOT Required by the Lender ....................................... 60

The Legal Package ..................................................................... 66

Making the Offer ....................................................................... 67

Organizing Your Files .................................................................. 70

Submitting a Short Sale Package .................................................... 72

Short States ............................................................................. 74

Submission Follow Up ................................................................. 75

short sale money machine

Getting the BPO Ordered ............................................................. 75

The BPO Appointment ................................................................ 79

Negotiating the Final Price ........................................................... 80

Liens ..................................................................................... 81

Counteroffers ........................................................................... 81

Negotiating 2nd & 3rd Mortgages .................................................... 82

Pulling Title ............................................................................. 83

Closing ................................................................................... 84

Reasons Why Short Sales Get Declined ............................................. 85

Chapter 4: Selling the House ............................................................. 89

The Short Sale Quick-Turn ............................................................ 90

The Option Contract .................................................................. 91

A Survey of Exit Strategies ........................................................... 92

Retailing ............................................................................ 92

Wholesaling ........................................................................ 93

Lease Options and Rentals ....................................................... 93

Lease Options ...................................................................... 93

The Green Light Selling System ...................................................... 94

Red Phase Marketing (Pre-BPO) ................................................. 95

Yellow Phase Marketing (Post BPO) ............................................. 95

Green Phase Marketing (Post-BPO) .............................................. 96

Staging the House ..................................................................... 99

Building a Buyers List .................................................................. 99

CentersofInfuence ...................................................................100

REIA Groups.............................................................................101

Newsletters .............................................................................101

RealefowPower-Matching ............................................................102

short sale money machine

Investor Open Houses .................................................................103

The End Buyer ..........................................................................104

Other Items of Interest About the Contract........................................104

A to B then B to C .....................................................................105

Closing Process .........................................................................106

The Title Company ....................................................................107

Conclusion ..............................................................................108

Appendix ....................................................................................109

short sale money machine

short sale money machine

7

Chapter 1: The Macro Perspective

With the foreclosure crisis in the news and on the front pages, it seems as if everyone wants

tofndawaytocapitalizeonthefallingpricesofthehousingmarket.Theshortsalewasonce

an esoteric method of buying properties in default from banks only the most knowledgeable

and skilled real estate professionals understood how to set up a business centered on this

once uncommon technique. Today, short sale companies have sprouted all over the American

landscape, and everyone seems to be interested in understanding how to more effectively work

with the banks to buy properties in pre-foreclosure.

The purpose of this course is singular: to provide a how-to guide to investing in pre-foreclosures

using the short sale process.

Several years ago we built a successful real estate

business in a market considered the worst in the

U.S. outside of New Orleans and perhaps Detroit.

For many years, Ohio was one of the leading states

in foreclosures; moreover, Cuyahoga County, the

home county of Cleveland, led the country in this

sad category. The number of houses on the market

at any one time has averaged to a two year supply

meaning that if sales returned to the level enjoyed

by the rest of the U.S. a few years ago, it would take two years to sell all the available property

in northeastern Ohio.

So how did we do it? How did we build a business that gathered momentum and signifcant

earnings at a time and in a place where all of our competition closed shop? First, we didnt try to

short sale money machine

8

cut corners. Where most of our competition sought short cuts by circumventing local and state

laws, we chose another path: that of continuing education. The real estate industry is changing

on a weekly basis. We knew early on that only by making a commitment to learning would we

put our company in a position to grow and excel in a market as unforgiving as ours. Second, we

allowed ourselves to constantly monitor and adjust our business to the needs of the area. We

didnt buy into a structure and impose it upon the market, we allowed the market to direct how

we built our business.

While many companies are now in the business of teaching others how to

complete a short sale transaction, all the companies that we are aware of

are marketing companies geared toward selling their products: they arent

investors and they arent currently doing short sale transactions.

While we are in the business of teaching others how to do what we have

done so successfully, we are also still acquiring, negotiation, and closing

our own deals every week.

What we have learned about real estate is that with the right tools and understanding investors

cancreateabusinessthatrefectstheirneedsandtheirdreamswhethertheyincludebuilding

a company that operates on a national level or a smaller mom and pop business that operates

locally. Before reading Short Sale Money Machine, consider reading The Short Sale Manifesto

(www.shortsalemanifesto.com), which will provide a broad summary of what a short sales business

entails. The Short Sale Money Machine has been written to provide more in-depth information

on topics discussed in The Manifesto. Real estate investing is a dynamic industry for which

the only constant is change. By using the basic ideas in this text,

investors will have an outline as to how to conduct a short sale

transaction.

I have got to tell you, it was

OUTSTANDING! It is the best program

I have seen. They give you the real

deal, the meat and potatoes. I highly

recommend that you sign up. YOU

WILL NOT BE DIAPPOINTED!

~Charise Stone, Sterling VA

short sale money machine

9

Understanding the short sale process requires knowledge

beyondtheusualtransactionsthatdefnearealestatebusiness.

Traditional real estate investing entails locating property, buying

property, rehabbing property, managing property and selling

property. These styles of investing offer enough complexities to

keep any real estate investor busy. The short sale will dramatically increase the number of balls

that the investor needs to juggle.

Despite the complexities and the additional knowledge that is required, learning short sales has

several distinct advantages that will be discussed later. Of primary importance to any investor

concernsfndingsellerswhoarenotonlymotivated,butalsowillingtoselltheirhouseforasteep

discount. Short Sales allows the investor to do both, with minimum expense. More importantly,

unlike traditional real estate investing when a seller accepts a low-ball offer, theres is no issue of

taking equity because a short sale has no equity.

Negotiations are done directly with the lending

institution that holds the note.

While at frst intimidating, the process of

understanding how to negotiate with the banks

is one of the best ways to learn about real

estate. Some investors might say short sales

take too much time, and theres not enough

proftwhichiscertainlytrueifaninvestordoes

not understand how the short sale business requires a more expansive skill set. Not just anyone

can succeed in this business: its not for average investors; however, for those investors willing

to challenge themselves to think about real estate differently, as well as how they organize their

We attended the meeting in Orlando

(and) we found it VERY helpful and

EXTREMELY right to the point. To

quote Dr. Phil here, Greg and Josh Just

get it. If you really want a dynamic and

informative program, then I think this is

the event you need to come to!

~Forestview Group, Dale Bjordahl

short sale money machine

10

businesses,theshortsalebusinessisnotonlyhighlyproftable,itsfun.

Whatever your goals are for investing in real estate, there are two

important lessons to keep in mind right from the get go:

Establish a goal and identify the benchmarks needed to keep 1.

you on track; and

Create and implement an effective strategy to get you where 2.

you need to go.

In any job it is easy to get caught up in the day-to-day struggle and

forget where it is you ultimately want to go. Its also too easy to forget the reasons why you

undertook the responsibility of running your own business that is what you are doing not just

investing in real estate but creating a business.

What do you want to have happen?

Isittoachievefnancialindependence?

Isittocreateasteadysourceofpositivecashfow?

Is it to leave behind a legacy?

What is a Short Sale?

A short sale takes place anytime a property is sold for less than what is

owed on the mortgage and the lenders who own the underlying mortgages

accept less than full payoff as a settlement. This allows the property to

transfer to the buyer even though the lenders did not receive everything

they were owed. Short sales usually take place during the foreclosure

(the event was) straight

forward, direct, had access

to experts, 3 days of solid

training! Good information

no bait and switch or tease

and sell a second deal. BEST

SHORT SALE TRAINING I

HAVE SEEN TO DATE!

~Bob Deschnor

short sale money machine

11

process when a buyer is trying to buy a property and the purchase price will not cover the payoff

of the mortgages in full. Most often these properties are bought and sold after the foreclosure

process has started but before the process is completed through a sheriffs or trustees auction

sale. This stage is called the pre-foreclosure

stage.

Lenders and mortgage companies have

departments of loss mitigation whose

responsibility is to deal with properties

in foreclosure. The main assignment

of this department is to fnd solutions

for homeowners and for lenders to the

foreclosure problem. Foreclosing on a

property is a problem for everyone the

lender, the homeowner and the community. Lenders who own mortgages on houses in foreclosure

do not want to foreclose and repossess the property. They would prefer the homeowner make

themortgagepayments.Mortgagecompaniesproftgreatlybylendingmoneyoutandreceiving

interest payments in return. Once a homeowner stops paying the mortgage the underlying lender

has no choice but to foreclose. This is the only way the lender can get their original loan back. By

forcing the property to be sold at auction the proceeds from the sale will go back to the lender. If

the property is not sold to a third party the lender will repossess the property and then sell it as a

bank owned property through a real estate agent. Once the

property is sold to an end buyer the original lender receives

whatever monies are left after the sale. The proceeds paid

to the mortgage company are almost never the full amount

they originally loaned. In most cases lenders lose about

$60,000 to $80,000 per foreclosure. In addition, lenders

The reason that I am with SREC is because

they get things done When you have a

good plan and you do the things you say

youre going to do, good things happen.

Thats exactly what Greg and Josh do. If

there is an event that you go to, make it the

SREC event!

~Jake Jordan, Ft. Worth TX

short sale money machine

12

only recover about 50 percent of their original loan amount.

Because lenders lose money during the foreclosure process they will entertain alternative

measures. One alternative is to sell the property during the foreclosure process even if they

do not receive the full loan balance, otherwise known as a short sale. If a lender calculates

that a short sale will provide them more money than repossessing the property the lender will

approve the short sale. They willingly accept a loss on the sale (short

sale)becausetheyperceivethistobeabetterfnancialdecisionthan

foreclosing.

The best way to explain a short sale opportunity is to provide this

example:

The homeowner owns a property valued at $250,000. 1.

Lender(s) has a mortgage(s) against the property which were 2.

recordedwhenthehomeownereitherboughtorrefnanced

the property.

The homeowner owes a total of $240,000 on a 1 3.

st

and 2

nd

mortgage.

The homeowner loses job and is experiencing a divorce. 4.

The homeowner misses the 1 5.

st

mortgage payment because of a lack of funds to pay

the mortgage.

The payoffs on the underlying mortgages increase each month a payment is not 6.

made.

Thehomeownerisunabletofndabuyerwhowillpayenoughtocoverthefullpayoffs 7.

on all the mortgages.

The homeowner misses 3 8.

rd

payment.

The underlying mortgage company fles the foreclosure lawsuit and starts the 9.

foreclosing process.

Josh and Greg are very good

speakers; providing (us with)

much detail and they really

retain (our) interest. Their

honesty and integrity shines

through the presentations

and the work they do. It is

obvious that they spend

much time preparing for the

weekly coaching calls and

have a deep commitment to

their coaching students. They

are innovative and they think

outside the box!

~Mary Ann Heindorf:

short sale money machine

13

The homeowner receives notice in the mail that the underlying lender is trying to 10.

repossess the property by foreclosing.

The Foreclosure notice is posted in public records. 11.

The pre-foreclosure stage has begun and property can be bought through a short sale 12.

negotiation.

The homeowner continues to miss additional payments. 13.

Thelenderreceivesfnalapprovaltoforecloseonthepropertyandauctiondateis 14.

set.

The sheriff or trustee (depending on state law) completes exterior drive-by appraisal 15.

to obtain value of subject property.

The sheriff or trustee sets opening bid price at 2/3 of exterior appraisal. 16.

The property is auctioned off at public foreclosure or sheriffs auction to highest 17.

bidder with bidding starting at 2/3 of sheriffs exterior appraisal.

When public foreclosure or sheriffs auction has been completed the opportunity 18.

to complete the short sale purchase has ended (Exception: certain states have a

redemption period permitting the sale of the property through a short sale for an

additional time).

The investor buys the property at 19.

auction OR the foreclosing lender buys

property back if bids fail to be high

enough to satisfy lender requirements.

The redemption period begins, providing 20.

a last chance for the homeowner to

retain possession of the property (varies

from state to state).

During redemption period, the homeowner can pay off back payments or entire loan 21.

amount and keep the property (depends on state law).

short sale money machine

14

The redemption period ends and property is transferred back to the bank through a 22.

sheriffs deed.

The property becomes Real Estate Owned (REO) by the bank. 23.

The bank sells property through real estate agent to end buyer or investor. 24.

The lenders net proceeds from REO sale are the total proceeds they receive back from 25.

the original loan amount. (On average 50 percent of original loan amount.)

Note & Mortgage

Every time a property is either bought with a loan or

refnancedwithaloanthetitleorescrowcompanyhandling

the closing is responsible for recording a note and mortgage

that describes the terms of the loan. Immediately after a

closing the title company records the note and mortgage in

the public record for all to see. This note and mortgage is attached to the property so that when

thepropertyissoldorrefnancedlater,theexistingnoteandmortgagewillhavetobepaidin

full.

Terms are included in the mortgage allowing the mortgage company to foreclose on the property

if the mortgage payments are not made on time. This is what allows the mortgage company to

pursue foreclosure as a means of forcing the loan balance to be paid off.

Traditional Real Estate Investing

Traditionalrealestateisbasedaroundtheideaoffndingandbuyingpropertiesatadiscount:

buying right in other words. Typically, buying right means buying the property at around 65

percent of the as-is value. The as-is value is determined by taking the after repaired value and

short sale money machine

15

subtracting the repairs needed.

Example

Mortgage Amount: $210,000

House Value: $200,000 after its been fully repaired (ARV).

House Needs: $20,000 in repairs.

ARV: $200,000 repairs = $180,000 as is value

Buy Price 65% of 180,000 = $117,000

Thenextstepinthetraditionalrealestateinvestingmodelistorehabandfxthoseproperties

to get them back to full market value. The last step is either to sell the property for a handsome

proftortocreatecashfowbyrentingthepropertytoatenant.

Traditional real estate requires several skill sets. The three most

important skill sets include marketing to acquire properties,

structuring the deal and selling properties. The traditional real

estate investing market is competitive. Many new investors

believe the process is simple and the transactions easy. Hence

they gravitate towards this model because it has a low barrier to

entry. Buy, Fix, and Sell sounds simple, but a new investor needs

to put together a solid team for a good start.

Short Sale Real Estate Investing

Like the traditional real estate investing model, short sale investing is based around the idea of

fndingandbuyingpropertiesatadiscount.Moreover,buyingrightisalsoimportantintheshort

sale business. The primary difference between the two models concerns the exit strategy used to

proftonthedeal.Themostcommonexitstrategyintheshortsalebusinessisadoubleclosing

The event was GREAT! I learned

a lot and I have been implementing

a lot of this into my business. A

breakthrough that I have had is that

Im learning to systemize everything,

which is AWESOME because

youre not just quitting your job and

becoming a business owner and

working IN your business, but youre

learning how to get yourself OUT of

your business and that is the real

spirit of a true entrepreneur.

~Melissa Carver, Michigan

short sale money machine

16

where a property is bought and sold in the same day. This reduces the need to buy at 65 percent

of the as-is value because there are no rehab or holding costs. As a result, investors are left with

more options regarding properties that can be pursued and therefore have more opportunities to

generate more business.

Heres an example: the subject property is in

foreclosure and the mortgages are equal to or

close to the ARV.

Example

Mortgage Payoffs: $210,000

ARV: $200,000

Repairs: $20,000

Offer price: $130,000

Accepted offer: $140,000 (what the lender accepts and the investor pays)

Resale price: $168,000

Proft: $28,000 minus closing costs

In this example you can see that the property was not bought at 65 percent of the as-is value

($200,000 $20,000 x 65% = $117,000) because the exit strategy allows for transactions to be

completed at higher levels through a double closing. This may be the single most important

characteristic about short sales. If the property can be bought at roughly 65 percent then an

investor can make the decision to buy, fx and sell. If a property cannot be discounted to 65

percent, a proftable transaction can still be completed that the investor would not normally

pursue. The use of a double close allows this potential deal to happen and the investor to

capitalize on a deal they otherwise would pass.

short sale money machine

17

One attractive aspect of short sales is the limited exposure they offer the investor in the terms of

risk. The reason is because the primary exit strategy (or selling strategy) for short sales investing

is through the purchase and sale of the property in the same day, otherwise known as a double

closing. This eliminates holding costs and the uncertainty of buying a property with the hopes of

sellingforaproft.Ifstructuredcorrectlyashortsalepropertycanbeacquired,negotiatedand

sold in such a way that the investors risk level is minimal. In essence, a property is bought only

when its already being sold, meaning that the risk to the investor is nearly eliminated!

Traditionally, investors looked for properties with equity to be bought at a steep discount,

rehabbed and sold. Properties that are candidates for short sales are in foreclosure and have no

equity and thus most investors do not pursue them. The opportunity to buy and sell properties

in foreclosure through short sale negotiations is huge. With the

collapseofsub-primelending,thepossibilityoffndinghousesto

buy using the short sale method have never been more plentiful.

For this reason short sales have become a buzzword in the real

estate industry. Take away the risks associated with traditional

investingtheholdingcosts,contractors,rehab,fnancingandaddtoittheabilitytoquickturn

properties and its no surprise that short sales have become so rewarding.

The Foreclosure Process

Documents

Each state and county has their own rules and laws pertaining to real property. Likewise, each state

also processes a foreclosure according to their procedures and laws; however, some uniformity

does exist. Most investors live and work in a judicial foreclosure state while some work exclusively

in a non-judicial foreclosure state. A judicial foreclosure state is one where a lawsuit (called a

complaint) is required to start the foreclosure process. Attached to the complaint are other

You always have fresh, new

content at every event! The

information is always on point.

THANK YOU for the Property

Launch Formula info!

~John H. Grant:

short sale money machine

18

documents that are also served on the homeowner. These additional documents include a copy

of the promissory note signed by the borrower or homeowner, along with the mortgage signed

by the borrower or homeowner. Promissory notes are the IOUs: this is what is really valuable.

The mortgage backs up the IOU as collateralized by the real estate. The promissory note and

mortgage are exhibits on the foreclosure complaint. If you

are working a short sale, get those papers. Information such

as the interest rate, when the loan was originated, and all

sorts of other valuable information are on those papers.

Thelawsuitstartswhenfledatthecourthouse,butcannot

move forward until the homeowner, or borrower are served

with the complaint and other papers. This is usually done

by certifed mail, a sheriffs deputy or a process server. Once the papers have been served,

the lawsuits clock begins to tick. The bank prefers to move quicklyusually 20 to 28 days but

investors will need additional time to negotiate a deal with the lender.

Appraisal

Appraisals are more than a shot in the dark, but they are hardly accurate.

Hire any three appraisers to evaluate a property and you will be given

three different values that end up representing a broad range.

Once the ordered appraisal has been completed, the property is scheduled

for public auction with the minimum bid being two-thirds of the appraised

value. One of two things will happen at the public auction: 1) The house

will be sold; or 2) It wont. If the house is sold, its either the bank or

somebody else whos buying it it cannot be the homeowner. Homeowners

are legally prevented from being a bidder at the sale. An investor ready to

put 10 percent down, cash, may make an offer on the property being auctioned. Usually what

I have been a real estate

investor for about four

years and I have chosen

SREC because a lot of

people have said that the

riches are in the niches

and with all of the sub-

primes and the amount

of mortgages that are

defaulting its something

that I HAD to add to my

business model. This is

another great tool in my

toolbox!

~Michael Moulten,

Charlotte NC

short sale money machine

19

happensisthatarepresentativeofthefrstmortgagebidsonthepropertyanddrivestheprice

up.Thefrstmortgagordoesnotneedtoputanymoneydowniftheirbidisaccepted.They

simply take the property back and hire a Realtor to list it as a real estate owned (REO) property

for sale.

Sometimes a foreclosure or a house will go to sale with no bidders. This means that either

nobody was at the sale or that the lender wanted too much money for the house. Usually, its the

latter. What does the court do? They will go back and get a new order of sale, a new appraisal

at a lower value, and then they run it through the auction process, again. This can happen two,

three, even four times before the house is fnally bought back by

the bank. For a while, some lenders were using a strategy whereby

theydrefusetobidthefrsttimeinthehopethattheymightfnd

a buyer and recover all of their money. With the downturn of the

housing market nationwide, this strategy is no longer effective. In

the North lenders will often ask the court to postpone the sale,

if during the winter months, because they want somebody in the

house. A vacant houses in the winter usually means ruptured water pipes.

Foreclosure Options for Lenders & Homeowners

Once a homeowner misses a payment and then moves on to missing a second and then a third,

thelenderflestheforeclosurenotice.Whenthishappensthelenderandthehomeownerhave

a few options.

Sell

If the property has equity the homeowner can simply sell the property outright and keep whatever

equity is left over after closing costs and real estate agent commissions are deducted. In most

What I enjoyed the most

The concept of revealing

the nuts and bolts of your

company, the idea of not

holding any facet of this

business back, and the

feeling that you want us to

SUCCEED!

~Dania Fadeley

short sale money machine

20

foreclosure cases the homeowner has no equity.

Short Sale

The homeowner could sell the property to a buyer and negotiate a short sale on the mortgages

and liens provided the purchase price is not enough to cover the full loan balances or all mortgages

and liens. The amount owed on these liens might have to be negotiated to allow the property

to transfer. Otherwise the full payoffs of the loans would cause the homeowner to be up side

down on the loan balance. In this case the homeowner or seller would have to bring funds to the

closing table to pay off the loan in full.

Remember, a short sale takes place any time a property sells for less than

what is owed and the lender accepts a discounted settlement payment, even

though it may not be enough to cover the full loan balance. A short sale

must be an arms length transaction. In most cases the homeowner is not

allowed to receive any money from the short sale. In a few selective cases

the homeowner may receive compensation from the foreclosing lender. The

short sale approval letter issued by the mortgage company will stipulate if

the homeowner is allowed to receive any money at closing.

Repayment Plan

The third option for the lender is to work out a repayment plan of some kind. Forbearance plans

andloanmodifcationsaretypicalrepaymentsplans.

Forbearance

A forbearance plan would consist of a written plan to repay the back payments (arrears) that

are owed based on the mortgagors ability to pay the new installment payment. A forbearance

plan payment typically includes the current planned payment plus a percent of the arrears owed.

Through SREC I learned

many, many different ideas

about marketing, BPOs,

negotiations, selling the

properties and running

the short sale business

as a true business where

I can actually have a life,

freedom, and (just) grow

my business to the next

level.

~Rafal Zawistowski,

New Jersey

short sale money machine

21

In almost every case the homeowners payment will increase dramatically. Most forbearance

plans fail. Homeowners simply do not have the extra money to make the larger payment.

LoanModifcation

Anotherformofrepaymentplanisaloanmodifcation.Aformalloanmodifcationisapermanent

change in the terms of the mortgagors loan. An example would include a change in the interest

rateoftheloan.Anotherexamplewouldbeanextensionoftheloanterm.Loanmodifcations

cause a re-amortization of the loan with a new payoff

schedule. It structures the loan is such a way as to give the

homeowner a payment they can afford. Lenders do this to

allow the homeowner to get back on their feet and begin

the mortgage payments again.

Partial Claim

A partial claim is an advance of money to the homeowner or mortgagor for the payment of the

arrears. This money would be applied to the past due balance and reinstate the delinquent loan.

A subordinate mortgage and note in the amount of the loan is then attached to the property as a

junior lien. This option is only available for HUD loans. (See www.hud.gov for additional details)

Deed-in-Lieu

Another Option for the lender is to pursue a deed-in-lieu of foreclosure. A deed inlieu is a plan

whereby the homeowner gives the deed to the property back to the foreclosing lender. This

program ends the civil lawsuit against the homeowner. In some cases the homeowner will receive

compensation from the foreclosing lender for participating in this plan. A written report of the

condition of the property must also be signed off by both parties. In the deed-in-lieu program the

foreclosinglenderisabletosaveasignifcantamountoftimeandmoneybecausetheforeclosure

process ends quickly. The disadvantage for the homeowner is that this program is still considered

EXCELLENT INFORMATION! Youre

approachable, and thats cool. Thanks

for sharing so much real and applicable

info, strategies, and energy. Youre all

GREAT!

~Paul Vyhnalek

short sale money machine

22

a foreclosure and will damage their credit report. A deedinlieu is truly a last option if a short

sale fails.

Foreclosure Auction

If all of those options dont work, the lender can force the

auction of the property and liquidate the house to the highest

bidder. This is typically done through a sheriffs or trustees

sale. In most areas of the country these auction style sales

are conducted on a monthly basis. In major markets these

auction sales are done weekly. The bidding starts at 2/3 of the sheriffs or trustees appraised

value in most areas. The value is determined by an exterior drive-by appraisal.

Bank Owned

Last, the bank can repossess the property if the

auction does not generate a high bid. In this

case the lender would repossess the property

or buyback the property at auction. The

property is then considered real estate owned

by the bank or an R.E.O. The lender would

then hire a real estate agent to sell the property. In

most cases the buyer of these REOs is an investor willing to take on the

risk of rehabbing the property.

Contracts

Taking advantage of real estate as an investment depends largely on the way the transaction is

I love outsourcing (because) I dont want to

negotiate the short sales, so I hand it all over

to them. They lay it all out there, nothing is

held back, all questions (are) answered and

easy access to them for any questions or

problems that you may be having.

~Julia Jordan, Dallas TX

short sale money machine

23

structured. Transactions are made through purchase and sales agreements

that allow the buyer or seller certain rights. The preferred contract to use

during the short sale process is a special version of an option contract. This

option contract gives the buyer certain rights and privileges. Some of those

rights and privileges provided during the short sale process include: the

abilitytoinspecttheproperty,negotiatethefnalshortsalepricewiththe

lender, ways to back out of the deal if the investor cannot buy at the right

price, list and sell the subject property to another buyer and close on the

property if the price is right.

The option contract for purchase and sale of a foreclosure property is the tool used to structure

the short sale purchase and the resale of the property when using a simultaneous close as the

exit strategy.

The option contract method is useful on many levels that will be discussed later. It provides to

the investor the option of buying the house if the bank approves the initial offer. If the bank

agrees to a discount, but the price is still too high to make sense to the investor to buy and hold,

the investor has the option to market and sell that property to an end buyer who is willing to

paymore,creatingaproftspreadbetweenthepurchaseandresale.

Theabilitytomakeachoicegivestheinvestorfexibility.Weonceworkedwithanationalcompany

that was adamant about buying property at an extremely low discount. When the banks failed

to approve their offers, the investors were stuck and had to move onto the next deal. That lead

was wasted and the homeowner left with few options. In the above scenario, the investor makes

an offer that he or she hopes that bank will approve, while understanding that as long as the

bank provides a reasonable discount (dependent upon local market conditions), the investor has

another avenue to bring revenue into their business.

I am so excited and happy

that I came to be a part of

the SREC event. They are

really hands on and they

tell you everything that

they know about short

sales. Everybody on the

team is outstanding and

I know that anyone who

gets involved with SREC

WILL BE PLEASED!

~Rhonda Cook,

Detroit MI

short sale money machine

24

Sellers Market Versus Buyers Market

Certain economic criteria will show whether a market is a buyers or a

sellers market. For instance, in a sellers market good deals are hard to

fnd; interest rates are falling; and consumer confdence leads to a rise

in demand with increased spending due to an increase in discretionary

income. Likewise, there are relaxed lending guidelines and more buyers

than properties. This was the case from 2000 through 2005 when average

people with no real estate experience or training

begantofoodthemarket.Theywerelookingfor

the quick dollar and the easiest way into real estate

and would buy almost anything with the hopes of

resellingquicklyforahandsomeproft.Wehaveall

seen or read countless stories of how get-rich-quick

schemers bought condos and beachfront property

at full market value just hoping that the market

would continue to appreciate. Many investors were

lured into buying properties during pre-construction

phases hoping to sell once the construction was complete and lost their money.

In a buyers market the economic criteria is the exact opposite: rising interest rates, reduced

discretionaryincome,reducedconsumerconfdence;housessitwithlittleornoactivity;tighter

lendingguidelines;andmorepropertiesthanbuyers.Todaysmarketin2008qualifesasabuyers

market.

Markets tend to shift quickly. When investors realize that they are in a certain market they may

It was great that Josh and

Greg were up on stage

often to teach the material.

It was also great to have a

loss mitigator from a bank

join us. You really leave the

seminar more equipped to be

successful in the short sale

business. I loved this seminar.

The SREC team RULES!

~Florissa Regnoso

short sale money machine

25

fndthatthemarketisabouttochangeagain.Makingafortuneinrealestatethankfullydoesnot

depend on shifts in the market place. Its not like stock investing in which most people only make

money when the market goes up. In the case of foreclosure investing and short sales the market

does not determine success. You do. Your creativity and drive will determine the outcome of your

real estate investing practice.

Revenue Producing Activities

In any business there are activities that produce revenue and then there are all the other

necessary tasks to perform. After identifying what revenue producing activities are important, it

is important to structure your business so that those activities are the focus. Revenue producing

activities drive the business and create new opportunity. Often, young businesses struggle

because a large amount of effort is devoted to ancillary activities that while necessary, may not

be crucial. Real estate involves a great deal of paperwork, and organizing the clutter can take

precedence over more important tasks.

The four most important revenue producing activities in the short sale investing business are the

following:

Seeing properties and meeting with homeowners 1.

Successfully managing a BPO appointment 2.

Marketing and selling house 3.

Problem-solvingwaystoachievegreatereffciency 4.

Understand that theres a big difference between working in your business as opposed to

working on your business: the latter gives a much better shot at success, while the former

will cause a business to wane.

I have found that Greg, Josh and

the whole team are THE most

committed people that I have been

involved with. Whenever they tell

us that they have a new tool, they

make it available for us. I just dont

think that the timing could be any

better than right now to get involved

in the short sale business.

~Rogie Robinson, San Diego CA

short sale money machine

26

Three people types are necessary to the create an effective business: task oriented people,

project oriented people and process oriented people. All are essential to the success of any

business, but its good to know who falls into each category if there are two or more individuals

in a real estate investing business. An entrepreneur is more inclined to focus on the big picture

by identifying the steps needed to grow the business in a certain direction. Conversely, someone

who is project-focused is good at managing

several tasks at once. As a result, think

abouteventuallyhiringanoffcecoordinator

to handle all the non-revenue producing

activities that are distracting (i.e., all the

administrative work).

Besides helping run the offce, an offce

coordinator can spend time on research

going to the courthouse to obtain a list of

names of people in foreclosure, or working with the list provider to get all the leads into the

computerasspreadsheets.Offcecoordinatorsarealsoresponsibleformarketingprogramsand

mailing campaigns, paperwork, listings, communicating with sellers.

Forparttimeinvestorsattemptingtomanageashortsalebusiness,anoffcecoordinatormight

notmakesense;however,forfulltimeinvestorsanoffcecoordinatorisessentialtokeepthe

gears moving, especially if you are depending solely on your business for income. While the costs

associatedwithanoffcecoordinatormayseemprohibitive,theupsideofhavingmoretimeto

address those aspects of the business that produces revenue should not be understated.

Ifyouareaparttimeinvestor,runningalargerbusinessbyyourselfmaybecomediffcultunlessyou

short sale money machine

27

canhireparttimehelp,oryouhaveRealefow(seewww.realefow.com).WedesignedRealefow

tostreamlineanddefnerevenueproducingactivitiesandnon-revenueproducingactivities.

Realefow

Asmentionedabove,wedesignedRealefowtohelpinvestorsstayfocusedonrevenueproducing

activities.RealefowcombinesseveralhelpfulproductsapowerfulCRManddatabasemanager,

a comprehensive marketing system, an automated forms creator, a virtual business advisor, a

robust project manager, and high quality lead generation websites to create the worlds most

powerful real estate business management system.

Realefow brings some exciting new products to the industry. As such, they are pioneering

creative ways to think, manage and execute a real estate investment business.

Sophisticatedandsmart,Realefowintroducesasimpleandeasytouseinterfacewithatabbed

flingsystem,intuitivecontrolsandabeautifuldesign;itletsyouhaveaccesstotheinformation

you need, when and where you need it. Never has the real estate investment industry had a tool

soeffcient,sobroadinscope,andsopowerful.Realefowwillnotonlyredefnethebusinessyou

have,butthebusinessyouareworkingtocreate.(ForademovisitRealefow.com)

Chapter 2: Lead & Property Acquisition

One of the many advantages that a short sale business has over conventional real estate companies

is the limited amount of dollars it takes to create an effective marketing campaign.

The number one reason why businesses falter is a failure to control costs. Dont assume that

just because you are going to spend thousands on advertising that the business generated will

short sale money machine

28

beconsistentandproftable.Beultraconservativeanddeterminewhereyourdollarisgoingto

have the most affect.

When we started our real estate company, we knew from prior experience in other industries

that we would need to determine a couple of things:

What kind of business did we want to have; and 1)

What systems would we need to have in place to achieve our objectives? 2)

Initially, my business partner, Greg, and I did a little of everything. Of course, our duties

overlapped and we butted heads. We found ourselves making some of the same mistakes that

we had made earlier, so we decided to clearly

defne what our roles and responsibilities would

be. Greg took responsibility for the front end

of our business the marketing and advertising

as well as acquisition of properties, while I took

responsibility for the back end the short sale

negotiation, reselling the properties, and working

with the title company to manage closings. The

results were immediate; within a couple months

Greg had us working on 35 deals and I could focus

solely on negotiating those deals and getting them sold and closed. That one decision, the

willingnesstoacceptcertaindefnedroleshasmadeallthedifference.Insodoing,weallowed

ourselves to become experts in one or two areas, instead of several while we quadrupled our

businessinthesecondhalfofourfrstyear.

short sale money machine

29

Choosing a Proactive or Passive Approach

A highly effective marketing plan will need to be developed with the

purpose of separating your business from your competition and providing

asteadystreamofqualifedleads.Twotypesofapproacheswilldefne

your strategy: passive lead acquisition and proactive lead acquisition.

Passive lead acquisition is exactly that: Money is spent on television, radio

and billboards and leads just come in. This form of lead generation is costly, but

it saves time and allows the investor to address other areas of the business.

Developing a marketing campaign based on the cheapest form of advertising,

direct mail, combined with referrals, cold calling, and door knocking is the smart

approach.

The framework that we use in our approach to marketing is called

The Helping Hand Positioning Process. It positions us as the leader

in our area for helping people with problem properties, such as

those with houses in default.

Step 1: Information Mining

Identifyandimplementtechnologicaltoolstofllyourpipelinewithqualityleads.

The overall philosophy to marketing the pre-foreclosure list is analogous to what advertisers refer

toastheshotgunversustherifeapproach.Withpostcardsbroadswathscanbetargeted,as

ifusingashotgun,togeneratedleads.Thefrststepistoidentifytheareasinwhichyouwant

to acquire houses. Keep in mind those regions in the market where youll have the best chance

short sale money machine

30

to sell property once negotiations with the

lender are resolved.

When we began our business we were forced

by a lack of funds to minimize our expenses.

We also understood that by investing in

television, radio or billboard advertising we

would have less control of where our leads

were generated. Hone your focus more

specifcally.Focusonthebestpartsoftowntobuyandsellhouses(identifyyoursweetspot).

Research your market. Talk to neighbors and look into school systems. Look for areas in which

people are trying to move. What parts of town have development planned? What areas are the

best parts to live? Once you decide the best areas to sell houses then deciding where to acquire

houses is easy: Its the same area.

Referrals, cold calling and door knocking are tactics that should be implemented to aggressively

pursue houses that are golden opportunities. Through these approaches youll be able to

successfully target area markets, keep costs down and brand your name. Referrals are also an

important source of leads. The more business you do, the more chances your company has of

being referred from one distressed homeowner to another, but you still need to wait for the

phone to ring, in other words, you will still be stuck in that passive lead acquisition mindset. A

great goal would be for your company to obtain 50 percent of your new short sale leads from

referrals. The best referral sources are real estate agents, attorneys and mortgage brokers.

Remember that the best anyone achieves with most direct mailing is a 1-2 percent response rate.

What has proven to be effective in most short sale real estate investing marketing programs

is not any individual approach, but rather the whole of all methods combined. Be consistent.

short sale money machine

31

Send out postcards. Make cold calls to houses in good neighborhoods regularly.

Stop by some houses and door knock. Build your business and

reputation. Network with other professionals and referrals will

begin to come your way.

The List

The fastest approach to acquiring leads of those individuals in

foreclosure is to buy a list. Many list companies will sell the names

and addresses of people going into foreclosure. The trouble is accuracy:

How old is the list? Likewise, one can never be sure how comprehensive

the list is for their area; perhaps the list is only providing half of all the

foreclosures in that region? Access to lists of individuals in foreclosure will

vary from county to county and state to state.

The Courthouse

The most accurate approach to acquire a list of prospects

is to take names directly from the courthouse foreclosure

list. In most cases the information is either online at a

countywebsitedesignedspecifcallytolistthenewforeclosuresorin

thephysicalfleatthecourthouse.

Checkthecivilcaseflings.Inmoststatestheforeclosureprocessisacivillawsuitbetweenthe

foreclosing lender and the homeowner who has missed their payments.

The information needed to obtain an accurate list is the following:

name

address

short sale money machine

32

city

state

zip code

lender

datetheforeclosurewasfled

If loan amounts are recorded, copy that, too. However, searching for the name of people who

have been served a lawsuit is not the only list to be generated. Investors would be wise to

develop a list of those individuals who have received their sale notice and have an auction

date set. The order of sale

isthefnalnoticethatthe

foreclosure process has

already run its course and

the foreclosure auction

date has already been set.

These people tend to be

highly motivated once they

realize that the auction is

going to take place in the

next few weeks.

In conclusion, one of the most attractive elements of a real estate business is that it requires

little in the way of sophisticated marketing and expense. When investors master the basics

of generating lists, developing a direct mail campaign, cold calling and door knocking, their

businesses will begin to thrive. Of course, its important to recognize that each area has its own

skill set. For instance, some individuals may be more comfortable working the telephone, while

others like to get in front of people and really enjoy knocking on doors.

short sale money machine

33

Investors whove made the commitment to have a business probably have the social skills and

discipline necessary to perform these tasks. If not, then its important to hire a buyer who can.

Acompanysapproachtomarketingneedstorefectthetypeofcompanythattheywanttobe:

Itneedstobeorganized;itneedstobeconsistent.Mostimportantly,itneedstobespecifcto

the areas where the investor has the greatest chance of success. This means the areas with the

greatest chance to sell the house.

Referrals

Referrals are the number one most preferred way of obtaining new leads to pre-foreclosures. By

obtaining a favorable introduction to a seller in default you bypass the need to build credibility.

By being introduced to someone you are already brought into the situation as credible because

you are being introduced as the expert. If a real estate investment business is set up the right

way opportunities to buy properties will consistently present themselves through referrals.

Many times a referral source will be compensated at closing. Please verify with your attorney

the best way to pay a referral or consulting fee. If you are able to buy and sell the property

for a proft usually a referral fee will be paid at closing if the source of the referral is not a

real estate agent. As mentioned above, the normal referral fee is between $500-$2,000. This

depends on a few things: The relationship between the investor and the referral source and the

expectations of the referral source. Setting the expectations up front is necessary so that there

isnt a miscommunication when the deal closes. If a referral source could bring multiple deals

to an investor the investor should be sure to compensate the referral source at a rate that will

ensure that they will refer again: $500-$2,000 is usual and customary.

OurapproachtoobtainingreferralsonaconsistentbasisiscalledCentersofInfuence.What

CentersofInfuence would be helpful to you in building your business? How might you use their

short sale money machine

34

knowledge, skills and contacts? What techniques do you need to develop to get what you want?

Illgiveyouahint:attorneys,Realtors,andmortgagebrokerscouldfllyourpipelinesofullof

leads that you would literally have to turn the faucet off to control the chaos. We have developed

a complete system based on this approach. Note: Real estate agents cannot receive a consulting/

referral fee. They must receive a commission on the HUD.

Step 2: The Multiple Medium Approach

Capture consumers in default based on varied responses in different advertising mediums.

Customize your message and apply it to several forms of advertising as a way to ensure a greater

reach. Homeowners will think of your company when they are ready to take action.

The bottom-line, learn what blend of strategies to rely on to keep a steady stream of leads

coming in. Dont just depend on one source.

Direct Mail

Sending out direct mail is an effective way to market to the pre-foreclosure list. Direct mail

includes postcards and letters and generally achieves and average response

rate of 1-3 percent. Not exactly fantastic, but as a backdrop to

other marketing campaigns direct mail is useful in bringing

in an assortment of leads each month.

Postcards

Sending postcards to your list is the most

common method found in direct mailing,

and the one that will be most used by your

competition. Each needs to have a targeted message and a call to action for the recipient.

short sale money machine

35

The postcard colors and graphics are not nearly as important as the message it conveys to the

seller. The postcard calls the homeowner to action and tells them they need to do something

immediately.

The frequency of the mailings will depend greatly on the time it takes to foreclose in your target

market. In a target market where the foreclosure period is only three months its necessary to

send out postcards more frequently. Sending out seven pieces of mail over three months would

include sending out a postcard about every other week.

In a target market where the foreclosure period is longer its more important to send out postcards

at the beginning of the process. Then follow up monthly until it gets closer to the auction date.

Continue to send postcards when the auction date has been posted.

Letters

Sending letters to homeowners in foreclosure is another great

way to acquire favorable leads on potential short sales. The

idea of letters is a little different from postcards. The letters

that get the best response are the ones that appear to be

handwritten and personal in nature. The envelope needs to

appeartohavebeenhandwrittenaswell.Thesetypesoflettersgetopened,whichisthefrst

step. Letters that do not appear to have been handwritten typically do not get opened because

they appear to be junk mail. Letters with labels and type written print will be confused with all

the other junk mail individuals receive.

The best way to differentiate direct marketing letters is to send a letter that appears personal

and handwritten. Ask yourself, What mail do I open? The letters that look personal you probably

open just like everyone else.

short sale money machine

36

Door Knocking

The ultimate in proactive lead acquisition is door knocking. If a real estate

investorwhoisinterestedindevelopingashortsalebusinesswantstofllup

their deal pipeline fast, and cheap, this is by far the most effective approach:

for some, its also the most terrifying. The skill needed to successfully approach

distressed sellers by going to their front door is not an easy thing to learn.

Generally, the process is the same as that found in any other sales approach:

build rapport, identify pain, and provide an easy way out. The goal of the real

estate investor is to create an opportunity to introduce to the homeowner the

services provided by their company. The actual appointment to inspect the

property will take place later. Listed below are some key ideas. Each one by themselves could

be a one-day class. This list is meant to provide a constructive framework for those investors

interested in adding door knocking to their marketing repertoire.

Rejection: 1) Investors who brave the front door will be rejected, so they need to prepare

themselves mentally. If the investor or the buyer theyve hired is sensitive or easily

offended, then the responsibility should be given to someone else in the organization.

Otherwise, excuses will be made and success doubtful.

A Numbers Game: 2) Simple rules of sales apply. The real estate investor should set a

goal each time he or she hits the streets to door knock. Buyers that we have worked

with often try at least 20 properties that theyve approached. For every ten contact

points made (where the homeowner responds), if the buyer is able to walk away with

two appointments or follow-ups, he or she is doing well. Likewise, having situational

awareness while out in neighborhoods keeping an eye out for vacant properties, a

FSBO, or a neighbor can result in a few extra deals, too.

Invading the Prospects Space: 3) To be successful at door knocking, the buyer must

short sale money machine

37

understand that he or she is invading someones safe haven. Building rapport with

someoneinadistressedstateisdiffcult.Yourgoalshouldbetopresentyourselfasnon-

threatening, understanding that for many people being confronted at their front door

aboutanembarrassingissueisnotpleasant.Yourpresencemaybethefrsttimethatthe

realityofthehomeownerssituationisbeingconfrmed:respecttheirpain.

What new investors will often do is go over the top in providing information either on the phone

or in their drop off packets. Never attempt to impress the seller with information: Remember

that less is more. Your goal is to have the seller call . . . it is not to answer every question they

may have concerning foreclosure before they call you.

Another common mistake is that new investors will often create a one page description of their

company and attempt to personalize it by either emphasizing their religious affliation or that

they have a family. Potential sellers dont care if you are an Eagle Scout or if youre involved in

the PTA. They arent looking for a friend, they are looking for someone to help them out of their

situation. Keep any company one page you develop professional and on point.

Cold Calling

Cold calling may be another source of leads. What makes cold calling so

diffcult is that most homeowners have the technology to screen

their calls either with caller ID or with voice mail, so just getting

throughtosomeoneissomuchmorediffcultthaninyears

past. Moreover, there is a natural awkwardness in

contacting a stranger concerning an issue as personal

as foreclosure. Having the right mindset counts for

everything. Remember, you are calling to see if the

homeowner is willing to sell their house. Through the

short sale money machine

38

sale of the house, you are also presenting the homeowner with a way to resolve the foreclosure

inamannerthatwillcausetheleastamountoffnancialdamagetothem.Manyinvestorsare

concerned that by cold calling they are violating Do Not Call Lists. Keep in mind that those lists

were designed to limit the number of sales calls consumers were receiving. As a homebuyer, you

are not selling anything you simply want to buy their house!

Witheachpersonthatyoutalktoitsimportanttofndoutexactlywhatitistheyaretryingto

accomplish. Ask them open-ended questions. Qualify them and learn about their situation. Once

a homeowner has contacted you or you contact them they are now able to become educated on

their options.

Here are the rules of engagement when it comes to cold calling:

Gather 30-40 names off of your pre-foreclosure list.

Call between 6-8 p.m. on Mondays or Tuesdays.

Call by 8 p.m.

Expect to reach 20 percent with good phone numbers.

Remember that its a numbers game.

Heres the target ration: call 40; reach 8; set appointments with 4; view 4

properties; convert 3 to potential deals; obtain 3 short sale packages; and close

1-2 deals.

Objective is to qualify homeowner, qualify property and set an appointment with

the homeowner to view the property.

Ask open-ended questions.

Example:

I was calling to see if you received my letter. Did you receive it?

I wrote you about buying your house and I thought you might be interested in

short sale money machine

39

selling it. Are you interested in potentially selling?

I noticed the bank is giving you a hard time about your house. Have you thought

about selling?

I drove past your house the other day I am potentially interested in buying it.

The most common objections are as follows:

I have it all taken care of.

IamflingBK.

My attorney is handling it.

I am working on a repayment plan.

Whats in it for me?

I am not in foreclosure.

Voice Broadcast

Voice broadcast is a technique that typically would not be used singularly; however, it is an

excellent way to reinforce your other marketing plans. What is voice broadcast? Record a message

that youd like all the people on your list to hear. Then send out the recorded message to each

person at the same time. The voice message is only played once. When the homeowners voice

mail picks up it will leave the following message:

Hi,thisisToddStuffebean.Irecentlysentyousomeinformationaboutyourhouse.I

also drove by the other day and I am interested in potentially buying it . . . if you are

interested in selling it. If you are, please call me at 555-1234. Thanks.

Theideaofvoicebroadcastiseffciency.Itwouldbegreattobeabletocalleachhomeowner

on your pre-foreclosure list, but that is nearly impossible. Instead of calling everyone, use voice

broadcast. Record a message, upload your list of phone numbers once they have been skip traced

short sale money machine

40

and have one message sent out to all the homeowners on your list. Other examples of voice

broadcast messages:

The Voice Broadcast provider that we recommend is Automatic Response Technologies (ART).

Their website is www.automaticresponse.com.

CentersofInfuence:Referrals

Marketing through postcards, direct mail, cold calling and door knocking are effective; however,

the best form of marketing, and the least

expensive, is the referral.

Once a lead is obtained through a referral,

credibility has already been established. If

you are introduced as the expert who can lead

the homeowner or seller in the right direction

then the seller already views you as the right

choice.

Several different types of real estate professionals exist who can refer homeowners in foreclosure.

Networking with other real estate professionals can bring in a multitude of leads with little or no

marketing expenses.

Below is a list of potential referral sources.

Real estate agents

Attorneys: bankruptcy, divorce and real estate

Title Companies

Construction crews

short sale money machine

41

Friends

Family

Other investors

Real Estate Investment Associations, Groups and Clubs (REAIs)

Others in foreclosure

Step 3: The Consistency Formula

Being consistent is an important trait that will separate high performers from everyone else.

Streamlining your message and delivering it in a consistent and repetitive way will establish your

brand quality and trust. By maintaining the same steady outreach, your marketing will position

your business to dominate the market.

The key is being consistent. Dont send out mailers and wait three months. Implement a program

and give it time. After tracking its affect, you can adjust with better insight later.

To achieve this, business owners need a system that will automate the complex task of maintaining

multiple levels of marketing. This marketing needs to be implemented in an organized manner so

that all strands work together to generate as many true contacts as possible.

Step 4: Deal Filter

You need to be able to check out your leads quickly and see if they are worth your time. The

DealFilterisatoolinRealefowthatprovidesashortsalescoringmodelandaproftanalyzer.

The scoring model provides a formula that helps investors identify what deals to pursue and what

deals to avoid. Likewise, the proft analyzer provides information useful in exploring possible

exit strategies while identifying the one that makes the most sense. ( See www.realefow.com

short sale money machine

42

fora demo)

The Deal Filter is a point and click interface that provides answers at a moments notice. The

purpose of this tool is to teach Realefow users how to differentiate between time consuming

deals that dont payoff versus deals which offer the best chances of closing with the most lucrative

results.

It is important to develop formulas and tools that can be used as both a means of evaluation and

identifcationofpotentialdeals.

Properties with the following characteristics tend NOT to be good short sale opportunities:

Condos of any kind

Townhouses located in a subdivision by themselves

Brand new construction with new construction being developed nearby

Houses with loans that are 12 months old or less

Houses in the tough parts of town

Properties with the following characteristics tend to be better short sale

opportunities.

Houses in solid resale neighborhoods

FHA loans

Comparable sales near low offer price

A 1

st

and 2

nd

mortgage

The 2

nd

mortgage is 30k or more

The loan is 6-years-old or older

The house is vacant

Anendbuyerhasalreadybeenidentifed

short sale money machine

43

Step 5: The Credibility Filter

In the frst 90 secondsof meeting someone new, both parties form an opinion that is hard to

break.Wecallthistheanchoringprinciplebecausefrstimpressionscanweighyoudownlikean

anchor. This is why its so important to come across as professional, knowledgeable and credible

immediately. The marketing you use, the clothing you wear, and the words from your mouth will

measure your credibility. Whether its setting response times or general estimates, your clients

will be evaluating and determining their faith and trust in your abilities.

When you are setting up your day, consider whom you might be interacting. What parts of town

will you be passing through? What appointments are scheduled? How well you dress should

depend on what parts of town you are working in that day.

You need to monitor and adjust your behavior based upon the actions and mannerisms of the

seller. Investors should present themselves as a source of information that can help the seller get

theirarmsaroundtheprocessandmakeitlessdiffcult.Beabletoanswertheirquestionsand

alleviate some of their stress.

A big factor in achieving credibility is setting the right expectations with the seller. We dont

promise the world, but we do commit to trying to help homeowners resolve their real estate

issue in a way that will best meet their needs. We also try hard to contact each homeowner we

are working with every week to give them an update on the status of their case. This consistent

efforttoestablishandmaintaincommunicationisessentialtoreaffrmingthecredibilitywehave

established. In addition, a great way to establish credibility is to join the Better Business Bureau

(BBB).

short sale money machine

44

The Credibility Factor: Seller Script

The seller script is a series of questions to ask the homeowner to qualify them

and their house. Once a seller is engaged through the phone, cold calling or

doorknockingitisimportanttogetafrmunderstandingoftheopportunity.

By asking the questions on the below seller script the investor can evaluate the

potential of the property.

Whatareyoumostinterestedindoing?Selling,refnancingor

keeping the house?

How much is the property worth?

Are you in foreclosure?

Whatdatewastheforeclosurefled?

Who is your 1st mortgage lender?

What type of loan do you have? FDMC, FNMA, FHA, VA or conventional?

Do you have PMI? Y/N

Roughly what is owed on your 1st mortgage?

How many payments are you behind?

How much are your payments?

Do you have a second mortgage?

Who is your 2nd Mortgage Lender?

Roughly what is owed on your 2nd mortgage?

Would you sell the property for what you owe?

If I buy your house, how long would it take you to move?

Appointment Date:

Repairs needed?

Has the property been listed with a realtor? Y/N

Have you declared bankruptcy?

Chapter 7 Bankruptcy?

short sale money machine

45

Chapter 13 Bankruptcy?

Discharge Date:

Has an auction date been set? Y/N

Step 6: The Positive Results Conversation

Identifying the need of the homeowner or seller and creating a compelling and actionable solution

that is valuable to both is critical to cementing a deal. You must discover the key need of the

homeownerorsellerandspecifcallywhatismostimportanttothem.Onceestablished,youcan