Professional Documents

Culture Documents

Michigan Estate Recovery Brochure

Uploaded by

AJLCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Michigan Estate Recovery Brochure

Uploaded by

AJLCopyright:

Available Formats

WHERE CAN I GET MORE INFORMATION?

For more detailed information about Estate Recovery, please contact: HMS, Inc. Estate Recovery Unit 1-877-791-0435 Or visit the website at: www.michigan.gov/estaterecovery Or email questions to: miestaterecovery@hms.com

YOUR GUIDE TO

ESTATE RECOVERY

IN MICHIGAN

Please note that this brochure is only a summary of Michigan Estate Recovery and does not contain all relevant information.

Rick Snyder, Governor Olga Dazzo, Director

The Michigan Department of Community Health is an equal opportunity employer, services and programs provider.

Cost of printing 10,000 copies: $922.16 or $.09 each.

DCH-3895 Rev. 6/27/11

WHAT IS ESTATE RECOVERY?

The Medicaid program pays for health care services for people who meet the income and asset rules. Medicaid is funded by both state and federal government. The federal government requires Medicaid to recover money that it paid for services from the estates of Medicaid beneficiaries who have died. This is called Estate Recovery. Medicaid will only recover the amount Medicaid paid for a beneficiary. Medicaid will not recover more than was paid.

ARE THERE EXCEPTIONS TO ESTATE RECOVERY?

Yes, the state may decide not to recover money if it creates an Undue Hardship or if any of the following people lawfully live in the beneficiarys home:

The estate is a home of modest value; or A survivor would become or remain HOW DOES ESTATE RECOVERY WORK?

eligible for Medicaid if recovery occurred.

Beneficiarys spouse; Beneficiarys child who is under the

age of 21, blind, or permanently disabled;

Beneficiarys sibling who has an

When a Medicaid beneficiary age 55 or older dies, the state sends an estate recovery notice to the estate representative or heirs. The estate recovery notice tells them:

equity interest in the home and was living in the home for at least 1 year immediately before the beneficiarys death; was living in the beneficiarys home for at least 2 years immediately before the beneficiary went into a medical facility; and provided care so the beneficiary could stay at home during that period.

the state plans to file a claim; how much the state will claim; how to apply for an Undue Hardship

Waiver.

A survivor who:

u

HOW DO I APPLY FOR AN UNDUE HARDSHIP WAIVER?

You need to fill out and send in an Undue Hardship Application. You can get an application:

WHAT IS AN ESTATE?

An estate includes all property and assets that pass through probate court. Examples are homes, cars, insurance money, and bank accounts.

u

by calling 1-877-791-0435; by sending an email to

WHO IS SUBJECT TO ESTATE RECOVERY?

Estate Recovery only applies to:

The state will not seek recovery of certain Medicare cost-sharing benefits.

miestaterecovery@hms.com.

WHAT IS AN UNDUE HARDSHIP?

An undue hardship exists when:

Medicaid beneficiaries age 55 or older

who received long-term care services after the effective date of the statute.

The estate is the sole source of income

for the survivors, such as a family farm or business; or

You need to send the completed application to the address on the application no later than 60 days from the date on the letter that accompanies the application. You must also send copies of any documents the application tells you to send. The state will tell you if you qualify for a waiver.

You might also like

- Seven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)From EverandSeven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)No ratings yet

- Eligibility Review: WWW - Dshs.wa - GovDocument7 pagesEligibility Review: WWW - Dshs.wa - GovJosh CopelandNo ratings yet

- Notice of Monetary RedeterminationDocument4 pagesNotice of Monetary RedeterminationDennisNo ratings yet

- COVID-19 Resource Guide For Residents 3.27Document10 pagesCOVID-19 Resource Guide For Residents 3.27CBS 11 NewsNo ratings yet

- MillerTrusts WEBDocument23 pagesMillerTrusts WEBBro Nkosi Gray EL100% (1)

- Medicaid Asset Protection LadyBirdDeedsinTexasDocument12 pagesMedicaid Asset Protection LadyBirdDeedsinTexasLISHA STONENo ratings yet

- On-Site Guide (BS 7671 - 2018) (Electrical Regulations)Document4 pagesOn-Site Guide (BS 7671 - 2018) (Electrical Regulations)Farshid AhmadiNo ratings yet

- Understanding The Consumer Complaint ProcessDocument2 pagesUnderstanding The Consumer Complaint ProcessTitle IV-D Man with a planNo ratings yet

- MUMMY'S KITCHEN NEW FinalDocument44 pagesMUMMY'S KITCHEN NEW Finalanon_602671575100% (4)

- Dynasty TrustDocument4 pagesDynasty Trustapi-246909910No ratings yet

- Vice President Quality Operations in Greater Chicago IL Resume Kevin FredrichDocument2 pagesVice President Quality Operations in Greater Chicago IL Resume Kevin FredrichKevin Fredrich1No ratings yet

- ISKCON Desire Tree - Brahma Vimohana LeelaDocument34 pagesISKCON Desire Tree - Brahma Vimohana LeelaISKCON desire treeNo ratings yet

- VW Golf 8 Variant WD EngDocument664 pagesVW Golf 8 Variant WD EngLakhdar BouchenakNo ratings yet

- N202669852876 Template012 131071016 09 22 2020 05 19 17 ENDocument8 pagesN202669852876 Template012 131071016 09 22 2020 05 19 17 ENmaraki2012No ratings yet

- Lesson 3.3 Inside An AtomDocument42 pagesLesson 3.3 Inside An AtomReign CallosNo ratings yet

- Hookah Bar Business PlanDocument34 pagesHookah Bar Business PlanAbdelkebir LabyadNo ratings yet

- Electric Vehicle in IndonesiaDocument49 pagesElectric Vehicle in IndonesiaGabriella Devina Tirta100% (1)

- Covid-19 Resource PDFDocument5 pagesCovid-19 Resource PDFCat SalazarNo ratings yet

- Supreme Court Ruling On ACA & Its Impact On New YorkDocument29 pagesSupreme Court Ruling On ACA & Its Impact On New YorkjspectorNo ratings yet

- Booklet Basic Rules of Medicaid EligibilityDocument15 pagesBooklet Basic Rules of Medicaid EligibilitySean ConstableNo ratings yet

- 17 Benefits For Seniors at NYDocument24 pages17 Benefits For Seniors at NYAbu HudaNo ratings yet

- Nursing Fac Elig 134653 7Document8 pagesNursing Fac Elig 134653 7Rahmanu ReztaputraNo ratings yet

- Https Doc-08-6k-Docsviewer - GoogleusercontentDocument8 pagesHttps Doc-08-6k-Docsviewer - GoogleusercontentGastromanNo ratings yet

- Rep - Cuellar Covid 19 HandbookDocument11 pagesRep - Cuellar Covid 19 HandbookJonathan SalinasNo ratings yet

- Dfcs - Abd Medicaid 5.12Document3 pagesDfcs - Abd Medicaid 5.12j millerNo ratings yet

- Cares Act Eng - SpanDocument4 pagesCares Act Eng - SpanSEIU Local 1No ratings yet

- GOP Healthcare Policy Briefing: Repeal and ReplaceDocument19 pagesGOP Healthcare Policy Briefing: Repeal and ReplacePBS NewsHour100% (3)

- Medicaid HCBS and Stimulus ChecksDocument2 pagesMedicaid HCBS and Stimulus ChecksIndiana Family to FamilyNo ratings yet

- Presentation BIDocument26 pagesPresentation BIMatthew BollmanNo ratings yet

- California Edition: Providers Line Up Against InitiativeDocument7 pagesCalifornia Edition: Providers Line Up Against InitiativePayersandProvidersNo ratings yet

- A Reprint From Tierra Grande Magazine © 2014. Real Estate Center. All Rights ReservedDocument5 pagesA Reprint From Tierra Grande Magazine © 2014. Real Estate Center. All Rights Reservedapi-251198534No ratings yet

- Midwest Edition: Illinois Swings Machete at Safety NetDocument6 pagesMidwest Edition: Illinois Swings Machete at Safety NetPayersandProvidersNo ratings yet

- Binder Materials Legal Issues in Time of DisasterDocument36 pagesBinder Materials Legal Issues in Time of DisasterkitkatchaiosNo ratings yet

- CTN Talking PointsDocument1 pageCTN Talking PointsProgressTXNo ratings yet

- Disability Tax CreditDocument72 pagesDisability Tax CreditJose GonzalezNo ratings yet

- NIHOE PPT - Tribal Leaders Series IIDocument20 pagesNIHOE PPT - Tribal Leaders Series IINIHOE3No ratings yet

- State ManualDocument31 pagesState ManualKEILYBNo ratings yet

- Lillycares Application PDFDocument3 pagesLillycares Application PDFRuben TorresNo ratings yet

- Doh 4495aDocument6 pagesDoh 4495aPrekelNo ratings yet

- Guidelines For The Administration of Social Assistance For Persons Who Experience Loss or Reduced Income in Respect of The Covid-19 VirusDocument3 pagesGuidelines For The Administration of Social Assistance For Persons Who Experience Loss or Reduced Income in Respect of The Covid-19 VirusA_triniNo ratings yet

- Your 2019 Social Security Cost of Living IncreaseDocument4 pagesYour 2019 Social Security Cost of Living IncreasetugwareNo ratings yet

- Nursing Home Residents and Stimulus ChecksDocument2 pagesNursing Home Residents and Stimulus ChecksDavid BlevingsNo ratings yet

- Texas Public Benefits Guide 2016Document5 pagesTexas Public Benefits Guide 2016treb treb100% (1)

- New York Health Act PresentationDocument9 pagesNew York Health Act PresentationrooseveltislanderNo ratings yet

- Short Brief - Continuing Care Retirement CommunitiesDocument5 pagesShort Brief - Continuing Care Retirement CommunitiesRobert SerenaNo ratings yet

- Vet State Benefits - MI 2019Document13 pagesVet State Benefits - MI 2019DonnieNo ratings yet

- FairTax Prebate Explained (Jan 2015)Document4 pagesFairTax Prebate Explained (Jan 2015)Daar FisherNo ratings yet

- Unit #9 Assessment ReviewsDocument10 pagesUnit #9 Assessment ReviewsHazmina WadivalaNo ratings yet

- Rebate Outreach Plan: Rick Homans, Cabinet Secretary N.M. Taxation and Revenue DepartmentDocument8 pagesRebate Outreach Plan: Rick Homans, Cabinet Secretary N.M. Taxation and Revenue DepartmentTom FranklinNo ratings yet

- Basic Rules of Medicaid in Missouri August 2016Document7 pagesBasic Rules of Medicaid in Missouri August 2016api-329599807No ratings yet

- En 05 11015Document36 pagesEn 05 11015Kenneth GarrisonNo ratings yet

- CSS Healthcare Marketplace PresentationDocument12 pagesCSS Healthcare Marketplace PresentationState Senator Liz KruegerNo ratings yet

- An Open Letter To Kentucky LegislatorsDocument3 pagesAn Open Letter To Kentucky LegislatorsWKMS NewsNo ratings yet

- Version KJ SomiyaDocument26 pagesVersion KJ SomiyaSezad MeharNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument21 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- MetLife Basic GTL CertificateDocument63 pagesMetLife Basic GTL Certificatereddyraj036No ratings yet

- 252-1 File 0Document5 pages252-1 File 0Sidharth KoulNo ratings yet

- Medicaid and MedicareDocument5 pagesMedicaid and MedicareKelvin FundiNo ratings yet

- Your 2020 Social Security Cost of Living Increase 2019Document4 pagesYour 2020 Social Security Cost of Living Increase 2019henryNo ratings yet

- Beyond Earth Reseach Packet 2Document13 pagesBeyond Earth Reseach Packet 2Slaine Saazbaum TroyardNo ratings yet

- $203 Billion and Counting: Total Debt For State and Local Retirement Benefits in IllinoisDocument35 pages$203 Billion and Counting: Total Debt For State and Local Retirement Benefits in IllinoisIllinois PolicyNo ratings yet

- California Edition: Blue Cross Backs Off Some IncreasesDocument6 pagesCalifornia Edition: Blue Cross Backs Off Some IncreasesPayersandProvidersNo ratings yet

- 2019 21 Budget Request Advocacy Letter OutlineDocument2 pages2019 21 Budget Request Advocacy Letter OutlineAlbertNo ratings yet

- Patient-Centered Care Solution PresentationDocument10 pagesPatient-Centered Care Solution Presentationapackof2No ratings yet

- Mdhhs Phe Medicaid Renewals BrochureDocument3 pagesMdhhs Phe Medicaid Renewals Brochureapi-737184619No ratings yet

- American Funds - Investment Insight - September 2013 - Active Vs Passive Investing.Document12 pagesAmerican Funds - Investment Insight - September 2013 - Active Vs Passive Investing.AJLNo ratings yet

- Lakeman Financial Launches The Lakeman Financial FoundationDocument2 pagesLakeman Financial Launches The Lakeman Financial FoundationAJLNo ratings yet

- State of Michigan Senate Bill 1040Document20 pagesState of Michigan Senate Bill 1040AJLNo ratings yet

- State of Michigan Senate Bill 1040Document20 pagesState of Michigan Senate Bill 1040AJLNo ratings yet

- Effective Tax RateDocument3 pagesEffective Tax RateAJLNo ratings yet

- Effective Tax RateDocument3 pagesEffective Tax RateAJLNo ratings yet

- Ivy Funds - China at A CrossroadsDocument8 pagesIvy Funds - China at A CrossroadsAJLNo ratings yet

- Bow and Spear Fishing MichiganDocument1 pageBow and Spear Fishing MichiganAJLNo ratings yet

- Snapshot of The Week - Market StatisticsDocument2 pagesSnapshot of The Week - Market StatisticsAJLNo ratings yet

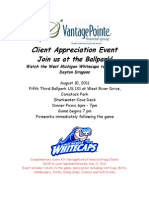

- Whitecaps 2012 InviteDocument1 pageWhitecaps 2012 InviteAJLNo ratings yet

- Michigan School Districts MapDocument1 pageMichigan School Districts MapAJLNo ratings yet

- State of MI W4PDocument2 pagesState of MI W4PAJL0% (1)

- Snapshot of The Week - Market StasticsDocument2 pagesSnapshot of The Week - Market StasticsAJLNo ratings yet

- 2010 Callan Chart - The Periodic Table of InvestmentsDocument2 pages2010 Callan Chart - The Periodic Table of InvestmentsAJLNo ratings yet

- Whitecaps 2011Document1 pageWhitecaps 2011AJLNo ratings yet

- Rotating Driver S Workstation and Rotating Cab: Reliable Solutions For More Ergonomic and Effective WorkingDocument12 pagesRotating Driver S Workstation and Rotating Cab: Reliable Solutions For More Ergonomic and Effective WorkingEduardo CapeletiNo ratings yet

- 2013 Medigate Profile PDFDocument26 pages2013 Medigate Profile PDFGabriel Duran DiazNo ratings yet

- JSA - Bolt TensioningDocument5 pagesJSA - Bolt TensioningRaju KhalifaNo ratings yet

- Challenges in The Functional Diagnosis of Thyroid Nodules Before Surgery For TSH-producing Pituitary AdenomaDocument5 pagesChallenges in The Functional Diagnosis of Thyroid Nodules Before Surgery For TSH-producing Pituitary AdenomaAthul IgnatiusNo ratings yet

- Megapower: Electrosurgical GeneratorDocument45 pagesMegapower: Electrosurgical GeneratorAnibal Alfaro VillatoroNo ratings yet

- AGRO 101 Principles of Agronomy - Acharya NG Ranga Agricultural PDFDocument133 pagesAGRO 101 Principles of Agronomy - Acharya NG Ranga Agricultural PDFShalini Singh100% (1)

- J Jacadv 2022 100034Document14 pagesJ Jacadv 2022 100034Rui FonteNo ratings yet

- Main Group Oganometallics: Shriver and Atkins, Chapter 15Document24 pagesMain Group Oganometallics: Shriver and Atkins, Chapter 15José Augusto VillarNo ratings yet

- Parenting Styles and Social Interaction of Senior Secondary School Students in Imo State, NigeriaDocument10 pagesParenting Styles and Social Interaction of Senior Secondary School Students in Imo State, NigeriaInternational Educational Applied Scientific Research Journal (IEASRJ)No ratings yet

- Put The Verbs in Brackets Into The - Ing Form or The InfinitiveDocument10 pagesPut The Verbs in Brackets Into The - Ing Form or The InfinitiveThao DaoNo ratings yet

- Connection Manual: BNP-B2203D (ENG)Document122 pagesConnection Manual: BNP-B2203D (ENG)Allison CarvalhoNo ratings yet

- Pay Slip SampleDocument3 pagesPay Slip SampleJoseph ClaveriaNo ratings yet

- Pathological Anatomy IntroDocument27 pagesPathological Anatomy IntroJoiya KhanNo ratings yet

- AT-502 - AT-504 - OM-0-Introduction-1 - 10-12-2019Document6 pagesAT-502 - AT-504 - OM-0-Introduction-1 - 10-12-2019Vinicius RodriguesNo ratings yet

- AFC Refereeing Fitness Training Guidelines - FinalDocument42 pagesAFC Refereeing Fitness Training Guidelines - FinalAPH FARM BONDOWOSONo ratings yet

- Standardization 1 PDFDocument7 pagesStandardization 1 PDFmazharul HasanNo ratings yet

- Joey Agustin (Price Tag)Document2 pagesJoey Agustin (Price Tag)AGUSTIN JOENALYN MAE M.No ratings yet

- 01 05 Justin Capouch CBI PresentationDocument18 pages01 05 Justin Capouch CBI PresentationprabhuarunkumarNo ratings yet

- MAUS Catalogue PDFDocument10 pagesMAUS Catalogue PDFCarolina Garcés MoralesNo ratings yet

- How To Self-Decontaminate After A Radiation Emergency - CDCDocument2 pagesHow To Self-Decontaminate After A Radiation Emergency - CDCZankanotachiNo ratings yet

- Modelling The Effects of Condensate Banking On High CGR ReservoirsDocument11 pagesModelling The Effects of Condensate Banking On High CGR ReservoirslikpataNo ratings yet

- Composition Solidus Temperature Liquidus Temperature: (WT% Si) (°C) (°C)Document7 pagesComposition Solidus Temperature Liquidus Temperature: (WT% Si) (°C) (°C)Muhammad Ibkar YusranNo ratings yet

- Jurnal Aquaponik Jada BahrinDocument36 pagesJurnal Aquaponik Jada BahrinbrentozNo ratings yet