Professional Documents

Culture Documents

Vendor GL Accts

Uploaded by

sreekanthtummepalliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vendor GL Accts

Uploaded by

sreekanthtummepalliCopyright:

Available Formats

Vendor Invoice Verification Accounting Entries:SAP Account Posting

By: rekha | 13 Aug 2010 10:34 am Vendor Invoice Verification Accounting Entries: VENDOR INVOICE VERIFICATION The detail process related to invoice verification is documented in Materials Management Document. On receipt of vendor bill the following entry will be passed: GR/IR Account DR Freight Clearing Account DR Cenvat Clearing Account DR Vendor Account CR Invoice Verification for Foreign Vendor On receipt of vendor bill the following entry will be passed: GR/IR Account Vendor Account DR CR

Invoice Verification for Custom vendor On receipt of Vendor bill the follo wing entry will be passed: 1) RG 23A/RG 23C Part 2 A/c (CVD) A/c DR Cenvat Clearing A/c CR 2) G/R I/R A/c DR Cenvat Clearing A/c DR Vendor A/c CR 3) Cost of Material A/c DR Vendor A/c (Customs) CR Invoice Verification for Freight / Clearing Agent Cost of Material A/c DR Vendor A/c (Clearing Agent) CR Invoice Verification for Octroi Expenses Cost of Material DR Vendor A/c (Octroi) CR TDS (Work Contract Tax) for Service Orders shall be calculated and deducted accordingly.

The following entry will be passed on bill passing: Expenses Account DR Vendor Account CR TDS Account CR The material shall be returned to the vendor using the Return to vendor movement type in SAP Creating a Return PO These transactions will be processed in the MM module. The accounting entries will be : Returns after GRN GR/IR A/c Dr Stock A/c Cr The accounting in respect of debit / credit memos for FI vendors, the process will be similar to that of invoice processing. The accounting entries will be: On issue of debit note Vendor Account DR Expenses Account CR In respect of import vendor - capital goods exchange differences are to be accounted manually through a Journal Voucher for capitalization. Exchange rate differences will be accounted at HO. An example of the accounting entry in this case shall be: Invoice entry @ 40 INR: 1 USD Asset / Expense A/c DR 100 Vendor A/c CR 100 Payment Entry @ 41 INR: 1 USD Vendor A/c DR 100 Bank A/c CR 110 Exchange rate loss Capital A/c DR Asset A/c DR 10 Exchange rate loss Capital A/c

10

CR 10

A new G/L account shall be created for the special G/L transactions. The accounting entry for making the down payment shall be: Advance to supplier account Debit Bank A/c Credit When the invoice is booked the following entry is passed GR/IR account Debit

Vendor account Credit Clearing of Invoice against Down Payment Vendor A/c Debit Vendor down payment account Credit Wherever, TDS is applicable, the TDS will be deducted at the time of down-payment to the vendor. Down Payment for Capital (tangible) Assets Down payment to vendors for capital acquisitions is to be reported separately in the Balance Sheet under the head Capital Work in Progress. Hence down payment for capital goods would be tracked through a separate special general ledger indicator. The procedure to be followed is: Definition of alternative reconciliation accounts for Accounts Payable for posting down payments made for Capital assets Clearing the down payment in Accounts Payable with the closing invoice. A new G/L account shall be created for the special G/L transactions. The accounting entry for making the down payment shall be: Vendor Advance for Capital Goods Account Debit Bank A/c Credit When the invoice is booked the following entry is passed Asset A/c / Asset WIP Vendor A/c Credit Debit

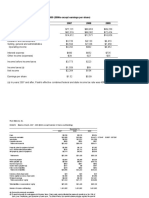

Clearing of Invoice against Down Payment Vendor A/c Debit Vendor Advance for Capital Goods Account Credit The Following are the TDS Rates (to be confirmed with the recent changes) Particulars Tax Rate Surcharge Rate Total Contractors 194 C 2% 5% 2.10% Advertising 194 C 1% 5% 1.05% Prof. Fees 194 J 5% 5% 5.25% Rent Others 194 I 15% 5% 15.75% Rent Company 194 I 20% 5% 21% Commission 194H 5% 5% 5.25% Interest - Others 194 A 10% 5% 10.50% Interest Company 194 A 20% 5% 21% Special Concessional Tax Works Contract Tax

SECURITY DEPOSITS /EARNEST MONEY DEPOSIT RECEIVED FROM VENDORS Bank A/c DR Security Deposit Vendor CR EMD to give the age so as to enable the same to be transferred to unclaimed EMD account. PAYMENT OF TOUR ADVANCE DOMESTIC TOURS Employee Advances will be paid by the Accounts Department unit wise based on the requisition or recommendation of the respective departmental head. Employee Travel Advance A/c DR Cash / Bank Account CR

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Governmental and Nonprofit Accounting EnvironmentDocument6 pagesGovernmental and Nonprofit Accounting EnvironmentAnonymous XIwe3KK67% (3)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Advacc Midterm AssignmentsDocument11 pagesAdvacc Midterm AssignmentsAccounting MaterialsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Atty. Gerry: Sebastian, CpaDocument4 pagesAtty. Gerry: Sebastian, CpaVertine Paul Fernandez BelerNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Assessment Task 2 - Workbook SP53 2020Document16 pagesAssessment Task 2 - Workbook SP53 2020Minh Y VoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Stracoma FinalssDocument53 pagesStracoma FinalssAeron Arroyo IINo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Rental Property Business PlanDocument27 pagesRental Property Business PlanSharif Abd Rahman100% (10)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Cambridge International AS & A Level: Accounting 9706/12Document12 pagesCambridge International AS & A Level: Accounting 9706/12Aimen AhmedNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Taxation Principles ExplainedDocument135 pagesTaxation Principles ExplainedCMBDB100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- RCM Expenses List Under GSTDocument5 pagesRCM Expenses List Under GSTAnonymous O3P3qkNo ratings yet

- COC MODEL LEVEL IV CHOICE SELECTIONDocument22 pagesCOC MODEL LEVEL IV CHOICE SELECTIONBeka Asra100% (3)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Household Budget SummaryDocument6 pagesHousehold Budget SummaryBleep NewsNo ratings yet

- PRACTICE Quiz 1 - CFASDocument8 pagesPRACTICE Quiz 1 - CFASLing lingNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Islamic Econ Journal Article ReviewedDocument7 pagesIslamic Econ Journal Article ReviewedDiaz HasvinNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Lumentum Company OverviewDocument19 pagesLumentum Company OverviewEduardoNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Tuguegarao CPA Review HandoutsDocument35 pagesTuguegarao CPA Review HandoutsICPA ReviewNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Pre-Qualification Exam in LawDocument4 pagesPre-Qualification Exam in LawSam MieNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Definition of TaxDocument3 pagesDefinition of TaxAbdullah Al Asem0% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- CIR Vs Semirara MiningDocument2 pagesCIR Vs Semirara MiningRalph Honorico100% (3)

- Revenue Recognition Policies of 4 Indian CompaniesDocument2 pagesRevenue Recognition Policies of 4 Indian CompaniesMohan BishtNo ratings yet

- AUDIT OF INVESTMENTS - AssociateDocument4 pagesAUDIT OF INVESTMENTS - AssociateJoshua LisingNo ratings yet

- RESA First Pre-Board ExamDocument14 pagesRESA First Pre-Board ExamMark LagsNo ratings yet

- Acl 2017Document136 pagesAcl 2017RiyasNo ratings yet

- Chapter 3 Adjusting The AccountsDocument28 pagesChapter 3 Adjusting The AccountsfuriousTaherNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Balakrishnan 2011Document67 pagesBalakrishnan 2011novie endi nugrohoNo ratings yet

- Flash Memory Income Statements 2007-2009Document10 pagesFlash Memory Income Statements 2007-2009sahilkuNo ratings yet

- Accounting Cycle Prob 14Document24 pagesAccounting Cycle Prob 14Mc Clent CervantesNo ratings yet

- Midterm F13 Partial Final f13 For Posting Fall 14 7Document13 pagesMidterm F13 Partial Final f13 For Posting Fall 14 7Miruna CiteaNo ratings yet

- The Inefficient Stock Market WhatDocument148 pagesThe Inefficient Stock Market WhatPedro100% (1)

- Reviewer - Cash & Cash EquivalentsDocument5 pagesReviewer - Cash & Cash EquivalentsMaria Kathreena Andrea Adeva100% (1)

- 25 CFR Part 20 Regulations PDF FormatDocument41 pages25 CFR Part 20 Regulations PDF FormatacooninNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)