Professional Documents

Culture Documents

Calculate Taxable Income and Losses After Corporate Acquisition

Uploaded by

jahcavemanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculate Taxable Income and Losses After Corporate Acquisition

Uploaded by

jahcavemanCopyright:

Available Formats

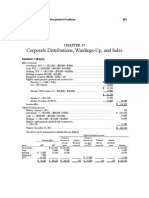

CHAPTER 11

Computation of Taxable Income and Tax after

General Reductions for Corporations

Problem 1

[ITA: 3; 110.1112]

The following data summarizes the operations of Red Pocket Limited for the years of 2002 to 2005 ended

September 30.

2002

2003

2004

2005

Income (loss) from business...... $ 54,000 $ 32,000 $ (75,000) $ 62,500

Dividend income Taxable

42,500

22,500

18,000

10,500

Canadian corporations............

Taxable capital gains..................

11,000

2,500

5,000

9,000

Allowable capital losses.............

2,000

4,500

3,500

Allowable business investment

3,750

loss..........................................

Charitable donations..................

23,000

9,000

3,000

13,000

The corporation has a net capital loss balance of $13,500 which arose in 1998.

REQUIRED

Compute the taxable income for Red Pocket Limited for the years indicated and show the amounts that are

available for carryforward to 2006. (Deal with each item line-by-line across the years, rather than computing

income one year at a time.)

229

Introduction to Federal Income Taxation in Canada

230

Solution 1

Par. 3(a)

Income from business.......................

Income from property.......................

Par. 3(b)

Taxable capital gains.........................

Allowable capital losses....................

2002

54,000

42,500

$ 96,500

11,000

(2,000)

$

2003

32,000

22,500

$ 54,500

2,500

(2,500)

2004

$

$

2005

62,500

10,500

$ 73,000

9,000

Nil

Nil

18,000

18,000

5,000

(3,500)

19,500

n/a

(75,000)

Nil

Nil

Par. 3(c)

Par. 3(d)

ABIL.................................................

Business loss.....................................

Income from Division B....................

Inter-company dividends...................

Par. 3 (e)

Sec. 112

Sec. 110.1

Par. 111(1)(b)

Charitable donations2:

Carryover....................................

Current........................................

Net capital losses3..............................

Par. 111(1)(a)

Non-capital losses4............................

Taxable income................................................................

$ 105,500

(3,750)

n/a

$ 101,750

(42,500)

$ 59,250

54,500

n/a

n/a

$ 54,500

(22,500)

$ 32,000

n/a

(23,000)

$ 36,250

(9,000)

$ 27,250

(27,250)

Nil

(9,000)

$ 23,000

$ 23,000

(23,000)

Nil

Nil

(1,500)

Nil

Nil

82,000

n/a

n/a

$ 82,000

(10,500)

$ 71,500

(3,000)

(13,000)

$ 55,500

(500)

$ 55,000

(24,750)

$ 30,250

NOTES TO SOLUTION

(1) A maximum of $2,500 can be deducted in 2003.

(2) Charitable donations:

2002: Lesser of:

(a) 75% of $101,750 = $76,313

(b) $23,000

Carryforward: Nil

2003: Lesser of:

(a) 75% of $54,500 = $40,875

(b) $9,000

Carryforward: Nil

2004: Lesser of:

(a) 75% of Nil = Nil

(b) $3,000

Carryforward: $3,000

2005: Lesser of:

(a) 75% of $82,000 = $61,500

(b) $3,000 + $13,000 = $16,000

Carryforward: Nil

(3) Net capital losses

1998 net capital loss converted to 2002 rates: $13,500 1/2/3/4...........................................

Net capital loss deducted in 2002 to the extent of net taxable capital gains.........................

2003 net capital loss not utilized..........................................................................................

2004 net capital loss deducted to the extent of net taxable capital gains..............................

2005 remaining net capital loss deducted in 2005 to the extent of net taxable capital gains

Available for carryforward...................................................................................................

9,000

(9,000)

Nil

$ 2,000

(1,500)

$

500

(500)

Nil

Solutions to Chapter 11 Assignment Problems

231

(4) Non-capital losses

Par. 3(d) Loss from business in 2004........................................................... $ 75,000

Dividends deducted under sec. 112...............................................

18,000

Add: net capital loss deducted............................................................................................

Less: sec 3(c): par. 3(a) dividends.................................................................

par. 3(b) taxable capital gain.................................................

$ 18,000

1,500

Losses utilized: 2002..................................................................................... $ 27,250

2003.....................................................................................

23,000

2005.....................................................................................

24,750

Closing balance..................................................................................................................

$ 93,000

1,500

$ 94,500

19,500

$ 75,000

75,000

Nil

Introduction to Federal Income Taxation in Canada

232

Problem 2

[ITA: 111(4), (5), (5.1); 249(4)]

On November 1, 2005, Chris purchased all the issued shares of Transtek Inc. from an acquaintance, Tom.

Transtek carries on a transmission repair business and has done so since its incorporation on January 1, 2004. In

addition to the transmission repair business, Transtek rents out a small building it owns. Neither the transmission

repair business nor the rental endeavour has been successful.

When Chris purchased Transtek, his financial projections indicated that Transtek would have significant

income within two years. Chris credited Transteks failure to Toms brash personality and laziness. Chris, on the

other hand, has a strong work ethic and has many contacts in the automotive industry to refer work to him.

The values of the capital assets owned by Transtek at the time of purchase by Chris are as follows:

Repair shop

Rental property

Land

Building

Land

Building

F.M.V...................... $ 140,000 $ 230,000 $ 70,000 $ 120,000

Cost/A.C.B..............

80,000

150,000

90,000

120,000

U.C.C......................

147,000

120,000

Chris selected June 30, 2006, as the first fiscal year-end for Transtek after his purchase. The following is a

schedule of Transteks income (and losses) from its inception, January 1, 2004, through June 30, 2007.

Period

Jan. 1/2004Dec.

31/2004....................

Jan. 1/2005Oct.

31/2005....................

Nov. 1/2005June

30/2006....................

July 1/2006June

30/2007....................

Transmission

repair business

Rental

income (loss)

Capital

Loss

$ (40,000)

$ (2,000)

$ (10,000)

(60,000)

(5,000)

(25,000)

6,000

54,000

11,000

REQUIRED

(A) Discuss the tax implications of the acquisition of Transtek Inc. on November 1, 2005, ignoring all

possible elections/options.

(B) Determine the tax consequences of the acquisition of Transtek Inc. under the assumption that:

(i) the maximum amount of all elections/options is utilized; and

(ii) the partial amount of all elections/options is utilized so that only enough income is generated to offset

most or all of the losses which would otherwise expire on the acquisition of control.

Solutions to Chapter 11 Assignment Problems

233

Solution 2

The data given in the problem statement can be summarized as follows:

Note that if no election is made, there is no income to offset the current business loss of $60,000 or the noncapital loss carryforward of $40,000. Therefore the non-capital loss available to carry forward from October 31,

2005 is $100,000 (i.e., $60,000 + $40,000). Note that the $2,000 of non-capital loss carryforward from a property

loss expires.

If the maximum election is made, the $3,000 of recapture offsets the business loss, leaving $57,000 (i.e.,

$60,000 $3,000) of net business loss. The $70,000 of taxable capital gain offsets the $22,000 of expiring losses,

leaving $48,000 (i.e., $70,000 $22,000) to offset the remaining $57,000 of business loss. There is no remaining

taxable capital gain to offset some of the $40,000 non-capital loss carryforward. As a result, the non-capital loss

available for carry forward from October 31, 2005 is $40,000.

If only a partial election is made, it should be enough to offset only $20,000 of the $22,000 of expiring

losses. The other $2,000 of expiring loss is the property loss carryforward which can only be utilized if enough

Division B income is elected, resulting in the elimination of the current business loss, as was the case with the

maximum election. If a partial election of only $20,000 of taxable capital gain is made, the current business loss

of $60,000 is not offset and, hence, is available to carry forward, along with the $40,000 of business non-capital

losses, from October 31, 2005 for a total of $100,000.

Part A (Ignoring all possible elections)

An acquisition of control occurred when Chris acquired more than 50% of the voting shares of Transtek Inc.

from an unrelated person, Tom.

The taxation year of Transtek is deemed to end immediately before the acquisition of control, October 31,

2005 [ssec. 249(4)].

Tax returns are required to be filed for this short year (i.e., 10 months) and amounts, such as C.C.A. (if

claimed), will have to be prorated.

It is assumed that any accrued losses in inventory and accounts receivable have been recognized in

calculating the business loss of $60,000.

Introduction to Federal Income Taxation in Canada

234

There are no accrued losses on the depreciable property. Therefore, there is no adjustment required [ssec.

111(5.1)].

There is a $20,000 accrued loss on the rental property land that must be recognized. The A.C.B. of the land

is reduced from $90,000 to $70,000 [par. 111(4)(c)]. The $20,000 reduction is deemed to be a capital loss

[par. 111(4)(d)].

The income (loss) for the taxation year ended October 31, 2005 is computed below.

Par. 3(a)

Par. 3(b)

Business income.......................................................................................................

Nil

Property income........................................................................................................

Nil

Net capital gains:

Taxable capital gains......................................................................

Nil

Allowable capital loss: rental property ($20,000 1/2)..................

$ (10,000)

Par. 3(c)

Par. 3(d)

Nil

Nil

Business loss......................................................................................

$ (60,000)

Property loss.......................................................................................

(5,000)

$ (65,000)

Division B income....................................................................................................

Nil

The net capital losses (($10,000 1/2) + $10,000 = $15,000) expire immediately following the October 31,

2005 year-end [par. 111(4)(a)].

The non-capital loss balance at November 1, 2005 is computed as follows:

Balance, Jan. 1, 2005................................................................................................................... $ 42,000

Loss for taxation year ended Oct. 31, 2005:

from business.................................................................................................

from property.................................................................................................

5,000

$

Less Par. 3(c) amount determined above..............................................................

60,000

65,000

0

65,000

Balance, Oct. 31, 2005................................................................................................................

$ 107,000

Less: unutilized losses about to expire:

non-capital property losses..........................................................

$ 2,000

current property loss....................................................................

5,000

Balance, Nov. 1, 2005.................................................................................................................

7,000

$ 100,000

Only the portion of the non-capital loss that may reasonably be regarded as a loss from carrying on a

business ($40,000 + $60,000 = $100,000) is deductible after October 31, 2005. Thus, the rental losses ($2,000 +

$5,000 = $7,000) expire immediately following the October 31, 2005 year-end [par. 111(5)(a)].

The $100,000 non-capital loss will be deductible only if the following condition is met the transmission

repair business is carried on for profit or with a reasonable expectation of profit throughout the taxation year in

which the losses are to be claimed [spar. 111(5)(a)(i)]. The condition appears to be met for the June 30, 2006 and

the June 30, 2007 taxation years. The transmission repair business was carried on throughout each of the years. It

was carried on for profit for the taxation year ended June 30, 2007. Due to Chriss work ethic and contacts in the

industry, it is reasonable to assume that it was carried on with a reasonable expectation of profit for the taxation

year ended June 30, 2006, despite the loss that was actually realized.

The $100,000 non-capital loss is deductible only to the extent of income from the transmission repair

business and income from a business selling similar products or providing similar services [spar. 111(5)(a)(ii)].

Thus, $54,000 of the non-capital loss incurred prior to November 1, 2005 is deductible for the June 30, 2007

taxation year. None of it is deductible for the June 30, 2006 taxation year due to the loss in that year. The

remainder ($100,000 $54,000 = $46,000) can be carried forward to 2008 subject to these same restrictions.

Solutions to Chapter 11 Assignment Problems

235

These restrictions do not apply to the non-capital loss ($25,000 $6,000 = $19,000) incurred in the taxation

year ended June 30, 2006. Thus $11,000 of the 2006 non-capital loss is deductible in 2007, in addition to the

$54,000 mentioned above.

Part B (i) (Maximum election)

Paragraph 111(4)(e) allows Transtek to elect to be deemed to have disposed of the repair shop land for

proceeds of $140,000 (maximum) and the repair shop building for proceeds of $230,000 (maximum). If Transtek

makes this election, the A.C.B. of the land on November 1, 2005 will be $140,000 and the A.C.B. of the building

will be $230,000. The new undepreciated capital cost for the building will be limited by paragraph 13(7)(1) to

$150,000 + 1/2 ($230,000 150,000) = $190,000.

The income for the taxation year ended October 31, 2005 will be as follows:

Par. 3(a): Business income........................................................................................................

Property income........................................................................................................

Par. 3(b): Net capital gains:

Taxable capital gains:

Repair shop land ($140,000 $80,000) 1/2................................. $ 30,000

40,000

Repair shop building ($230,000 $150,000) 1/2.........................

$ 70,000

(10,000)

Allowable capital loss ($20,000 1/2)................................................

Par. 3(c)

Par. 3(d)

............................................................................................................

Business loss.......................................................................................

Less: recapture building ($147,000 $150,000)...........................

Nil

Nil

60,000

60,000

$ (60,000)

3,000

$ (57,000)

Property loss.......................................................................................

(5,000)

Division B income.......................................................................................................................

Division C deductions:

Par. 111(1)(a) Net capital loss from 2004..................................................... $ (5,000)

Par. 111(1)(b) Non-capital loss:

Business.......................................................... $(

Nil)

Property...........................................................

(Nil)

(Nil)

Taxable income...........................................................................................................................

Non-capital loss balance, Nov. 1, 2005:

Balance, Jan. 1, 2005...............................................................

Added in taxation year ended Oct. 31/05

($60K $5K $5K $57K....................................................

Utilized in taxation year ended Oct. 31, 2005 or expired........

Remaining...............................................................................

Business

$ 40,000

Property

$

2,000

7,000

(Nil)

47,000

Nil

(2,000)

Nil

(62,000)

Nil

(5,000)

Nil

$

Total

42,000

7,000

(2,000)

47,000

The $47,000 remaining may reasonably be regarded as a loss from carrying on business and thus is

deductible in a taxation year after October 31, 2005, subject to the restrictions discussed in Part A.

By making the maximum elections possible, the non-capital loss balance of Transtek at November 1, 2005

has been significantly reduced.

Part B (ii) (Minimum election to utilize expiring losses)

The following losses will expire October 31, 2005, if not utilized:

The 2004 net capital loss..............................................................................................

The Oct. 31, 2005 allowable capital loss......................................................................

The rental loss portion of the 2004 non-capital loss.....................................................

The Oct. 31, 2005 rental loss........................................................................................

5,000

10,000

2,000

5,000

$ 22,000

It is impossible to utilize the rental loss portion of the 2004 non-capital loss of $2,000 without triggering

sufficient income under paragraph 3(c) to utilize the entire October 31, 2005 business loss. This would not be

beneficial. Therefore, only $20,000 of the expiring losses will be used.

Introduction to Federal Income Taxation in Canada

236

To utilize these losses in the taxation year ending October 31, 2005, a capital gain of 2 $20,000 = $40,000

is needed. To avoid recapture, the election should be made on the land, not the building.* Thus, Transtek will

elect under paragraph 111(4)(e) to be deemed to have disposed of the repair shop land for proceeds of $120,000,

i.e., (2 $20,000) + 80,000. The A.C.B. of the land at November 1, 2005 will be $120,000.

* An alternative is considered below.

The income for the taxation year ended October 31, 2005 will be as follows:

Par. 3(a)

Business income........................................................................................................

Property income........................................................................................................

Par. 3(b) Net capital gains:

Taxable capital gain:

Repair shop land ($120,000 $80,000) 1/2..................................... $ 20,000

(10,000)

Allowable capital loss ($20,000 1/2)................................................

Par. 3(c).......................................................................................................................................

Par. 3(d) Business loss....................................................................................... $ (60,000)

Property loss.......................................................................................

(5,000)

Division B income.......................................................................................................................

Nil

Nil

$ 10,000

$ 10,000

(65,000)

Nil

Division C deductions:

Par. 111(1)(a) Net capital loss from 2004............................................................................

Taxable income............................................................................................................................

$ (5,000)

Nil

The net capital loss claimed has no effect on taxable income, but it will increase the non-capital loss balance.

The non-capital loss balance at November 1, 2005 is computed as follows:

Balance, Jan. 1, 2005...................................................................................................................

Par. 3(d) Loss for taxation year ended Oct. 31, 2005:

from business........................................................................................ $ 60,000

from property........................................................................................

5,000

$ 65,000

Add: Net capital loss deducted..............................................................................

5,000

$ 70,000

Less: Par. 3 (c) amount determined above............................................................

10,000

Balance, Oct. 31, 2005................................................................................................................

Less: the unutilized non-capital property loss.............................................................................

Balance, Nov. 1, 2005.................................................................................................................

$ 42,000

60,000

*

$ 102,000

2,000

$ 100,000

* Exactly equal to the business loss above.

Only the portion of the non-capital loss that may reasonably be regarded as a loss from carrying on a

business ($40,000 + $60,000 = $100,000) is deductible after October 31, 2005. It is subject to the restrictions

discussed in Part A.

Summary:

The three alternatives presented above are summarized as follows for comparative purposes:

Taxable Income for the Deemed Taxation Year Ended October 31, 2005:

No election

Par. 3(a) Income from non-capital sources ( 0).......................

Par. 3(b) Net taxable capital gains ( 0):

Deemed taxable capital gains (elective):

land.....................................................

Nil

building..............................................

Nil

Accrued allowable capital loss

(automatic):

rental land........................................... $ (10,000)

Par. 3(c) Par. 3(a) + par. 3(b).....................................................

Maximum election

Nil

Nil

$

Nil

Nil

30,000

40,000

(10,000)

Partial election

Nil

$ 20,000

Nil

$ 60,000

$ 60,000

(10,000)

$ 10,000

$ 10,000

Solutions to Chapter 11 Assignment Problems

Par. 3(d) Losses from non-capital sources and

ABILs:

Loss from business operations....................

Recapture (elective): building.....................

Loss from property......................................

$ (60,000)

Nil

(5,000)

237

(65,000)

Division B income......................................................................

Optional net capital loss deducted........................

Nil

Non-capital loss deducted:

From property..............................................

Nil

From business..............................................

Nil

Nil

Taxable income..........................................................................

Nil

$ (60,000)

3,000

(5,000)

(62,000)

(65,000)

Nil

(5,000)

Nil

$(60,000)

Nil

(5,000)

Nil

Nil

Nil

(5,000)

(Nil)

Nil

Nil

Nil

Nil

Nil

Non-Capital Losses Available for Carryforward at Deemed Taxation Year Ended Oct. 31, 2005:

No election

Balance from Jan. 1, 2005.......................................................... $ 42,000

Non-capital loss Oct. 31, 2005:

Par. 3(d) losses see above........................ $ 65,000

Add: net capital losses deducted...................

Nil

Less: par. 3(c) income see above.............

$ 65,000

Nil

65,000

Maximum election

$ 42,000

$ 62,000

5,000

$ 67,000

60,000

$ 107,000

Less: losses utilized at Oct. 31, 2005.....................

losses not utilized but expired:

Current property loss............................

Carryforward property loss..................

Nil

Partial election

$ 42,000

$ 65,000

5,000

7,000

$ 70,000

10,000

$ 49,000

Nil

Nil

2,000

60,000

$ 102,000

Nil

$ 5,000

2,000

7,000

Available for carryforward from Nov. 1, 2005..........................

$ 100,000

$ 47,000

$ 100,000

Net Capital Losses available for Carryforward..........................

Nil

Nil

Nil

2,000

Nil

2,000

2,000

The results of the above comparison of the three alternatives are further summarized as follows:

Alternatives

(A)

(B)(i)

(B)(ii)

Taxable income.................................................................

Nil

Nil

Nil

Net capital loss deducted...................................................

Nil $

5,000 $

5,000

Non-capital loss balance, Nov. 1, 2005............................. $ 100,000

47,000

100,000

A.C.B. of repair shop land.................................................

80,000

140,000

120,000

A.C.B. of repair shop building..........................................

150,000

230,000

150,000

U.C.C. of repair shop building..........................................

147,000

190,000

147,000

*

* $147,000 + $3,000 + 1/2 ($230,000 $150,000)

Alternative B (ii) is better if the non-capital loss can be offset by income generated in the next seven years.

The resultant lower A.C.B. of the land and building under this option is only relevant on a disposition. The lower

U.C.C. on the building only represents an opportunity loss of C.C.A. at a 4% declining balance rate.

Consider the alternative of electing deemed proceeds of disposition of $190,000 (i.e., (2 $20,000) +

$150,000) on the repair shop building. Income under paragraph 3(b) would be the same as for Part B (ii).

However, the business loss under paragraph 3(d) would be only $57,000 (i.e., $60,000 $3,000 recapture), since

recapture would be triggered. This would reduce the non-capital loss balance at November 1, 2005 by $3,000 to

$97,000. However, the UCC of the repair shop building could be increased from $147,000 to $170,000 (i.e., +

$3,000 of recapture + $20,000 of taxable capital gain). The increased CCA base would begin to shelter income

from tax, in this case, in the year ended June 30, 2006, when the corporation earns a profit. If, for example, the

corporation uses a discount rate of 10% and faces a tax rate of 20%, the present value of the tax shield on the

incremental UCC base of $23,000 (i.e., $170,000 $147,000) is:

$23,000 .04 .20

= $1,314

.04 + .10

The value of the extra $3,000 in the non-capital loss balance in the same year and at the same assumed tax

rate of 20% is $600 (i.e., 20% of $3,000).

238

Introduction to Federal Income Taxation in Canada

Problem 3

[ITA: 111(4), (5), (5.1); 249(4)]

In 2002, a chain of bakeries, called Buscat Ltd., commenced operation. The industry is highly competitive

and because of Mr. Buscats lack of marketing skills, the corporation incurred losses in the first three taxation

years of operations as follows:

Taxation year-end

Dec. 31, 2002..................................................

Dec. 31, 2003..................................................

Dec. 31, 2004..................................................

Non-capital

losses

$ 60,000

45,000

25,000

Capital

losses

$ 12,000

8,000

4,000

On July 1, 2005, Mr. Buscat decided to sell 75% of his common shares to Mr. Bran, owner of Buns Plus

Ltd. Mr. Bran has been in the business of supplying bread dough, pastry dough and bun bags for ten years and

has been very successful. Buns Plus Ltd. has two divisions: a bakery and a coffee shop, which it intends to

transfer to Buscat Ltd.

The following income tax data relates to Buscat Limiteds operations from January 1, 2005 to June 30,

2005:

(a) Business loss (before inventory valuation).. $ 10,000

(b) Allowable capital loss.................................

2,000

(c) Property loss................................................

5,500

(d) Assets at June 30, 2005:

Inventory.............................

Land....................................

Building..............................

Bakery equipment...............

Cost/A.C.B.

$ 85,000

155,000

65,000

100,000

U.C.C.

$ 45,000

86,000

F.M.V.

$ 65,000

195,000

75,000

70,000

During the later part of the 2005 calendar year, the bakery/coffee shop of Buns Plus Ltd. was transferred to

Buscat Ltd. For the six-month period ending on December 31, 2005, Buscat Limited had net income of $90,000

from all its businesses.

The net income earned was as follows:

Buscat bakery..................................................... $ (55,000)

Buns Plus bakery................................................

130,000

Coffee shop........................................................

15,000

$ 90,000

In the 2006 taxation year, Buscat Ltd. expects to earn $250,000, of which $65,000 will be from the original

Buscat bakery business and $20,000 from the coffee shop business.

REQUIRED

Prepare an analysis of the income tax implications of the acquisition of shares. In your analysis, consider the

two election options from which an election choice is most likely to be made.

Solutions to Chapter 11 Assignment Problems

239

Solution 3

The data given in the problem statement can be summarized as follows:

The two election options to consider are the maximum election and the partial election.

If the maximum election is made, the $20,000 of recapture offsets the business loss, leaving $26,000 (i.e.,

$46,000 $20,000) of net business loss. The $25,000 of taxable capital gain offsets the $19,500 of expiring

losses, leaving $5,500 (i.e., $25,000 $19,500) to offset the remaining $26,000 of business loss, leaving $20,500

of that business loss. As a result, the non-capital loss available for carry forward from June 30, 2005 is $150,500

(i.e., $20,500 + $130,000).

If only a partial election is made to offset the $19,500 of expiring losses, the current business loss of

$46,000 is not offset and, hence, is available to carry forward, along with the $130,000 of non-capital losses,

from June 30, 2005 for a total of $176,000. If the election is made on the land, the ACB of the land can be

increased without a tax cost.

Note that if no election is made there is no income to offset the current business loss of $46,000 or the noncapital loss carryforward of $130,000. Therefore, the non-capital loss available to carry forward from June 30,

2005 is $176,000 (i.e., $46,000 + $130,000), which is the same as in the partial election, but there is no increase

in any cost value..

Deemed Year-end

Buscat Ltd. is deemed to have a taxation year ending June 30, 2005, immediately before the acquisition of

control by Buns Plus Ltd. on July 1, 2005 [ssec. 249(4)]. Tax returns will have to be filed for this short taxation

year (i.e., 6 months) and amounts such as C.C.A. will have to be prorated. In addition, the short taxation year will

cause the counting of a carryforward year for the non-capital losses from 2002, 2003 and 2004.

240

Introduction to Federal Income Taxation in Canada

Loss from Non-capital Sources

Losses from non-capital sources for the deemed taxation year ended June 30, 2005, before any elections and

options are computed as follows:

Loss from business....................................................................................................... $ 10,000

Add: Inventory loss [ssec. 10(1)] ($85,000 $65,000)..............................................

20,000

Bakery equipment Deemed CCA ($86,000 $70,000)................................

16,000

Total business losses..................................................................................................... $ 46,000

Add: Property loss (will expire unless utilized by June 30, 2005)..............................

5,500

Total losses from non-capital sources........................................................................... $ 51,500

Maximum Election

Division B income and taxable income

Par. 3(a) Income from non-capital sources................................................................................

Par. 3(b) Net taxable capital gains:............................................................................................

Election on land [($195,000 $155,000) 1/2]..................................................

Election on building [($75,000 $65,000) 1/2]................................................

Less: Allowable capital loss................................................................................

Par. 3(c) Sum of par. 3(a) plus par. 3(b) less any Subdivision e deductions (nil)......................

Par. 3(d) Property loss........................................................................................... $ 5,500

Business losses.......................................................................................

46,000

$ 51,500

Less: Building recapture.........................................................................

20,000

Sec. 3 income................................................................................................................................

Division C deductions:

Net capital losses: 2002..................................................................................... $ 6,000

2003.....................................................................................

4,000

2004.....................................................................................

2,000

Taxable income.............................................................................................................................

Nil

$ 20,000

5,000

$ 25,000

2,000

$ 23,000

31,500

Nil

$ 12,000

Nil

Non-capital losses available for carryforward after acquisition of control:

Balance July 1, 2005

2002 non-C.L.....................................................................................................

2003 non-C.L.....................................................................................................

2004 non-C.L.....................................................................................................

Non-C.L. from deemed taxation year before acquisition of control:

Total par. 3(d) loss (see above calculation).......................................................

Add: Net capital loss deducted..........................................................................

$ 60,000

45,000

25,000

$ 130,000

$ 31,500

12,000

$ 43,500

Less: Par. 3(c) income above.............................................................................

23,000

Total non-capital losses.................................................................................................................

20,500

$ 150,500

The $150,500 loss carryforward balance must reasonably be regarded as its loss from carrying on a

business.

2002, 2003 and 2004 loss carryforwards from a business as stated in the question............... $ 130,000

June 30, 2004 business loss net of recapture..................................................... $ 26,000

Less portion of this loss used against par. 3(c) income*...................................

5,500

20,500

$ 150,500

* Par. 3(c) income........................................................................................................

Less:

Property losses....................................................................... $ 5,500

Net capital losses restored as business losses.......................

12,000

$ 23,000

17,500

$

5,500

Solutions to Chapter 11 Assignment Problems

241

The non-capital losses will expire as follows, assuming that Buscat Ltd.s fiscal year-end after the

acquisition of control returns to December 31.

2002 non-C.L. on December 31, 2008

2003 non-C.L. on December 31, 2009

2004 non-C.L. on December 31, 2013

2005 deemed taxation year on December 31, 2014

The adjusted cost base/capital cost of the properties which were deemed to be sold at their fair market values

would be:

Capital

U.C.C.

Adjusted

cost

cost base

Bakery equipment................................................................... $ 100,000

$ 70,000

$ 100,000

Land........................................................................................

n/a

n/a

195,000

Building*................................................................................

70,000

70,000

75,000

* $65,000 + 1/2 ($75,000 $65,000).

In order for these non-capital losses to be deductible in subsequent fiscal periods, two conditions in

subparagraph 111(5)(a)(i) must be met:

(a) the bakery business which generated the loss must be carried on throughout the taxation year in which

the non-capital loss is deducted; and

(b) the bakery business must be carried on for profit or with a reasonable expectation of profit.

It would appear that both conditions will be met, since the Buscat business is being carried on and Buns Plus

expects that the Buscat bakery business will earn a profit of $65,000 in 2006.

If the conditions of subparagraph 111(5)(a)(i) are met, then the non-capital losses may be deducted from

income of the bakery business that generated the loss plus the income from the sale of similar products or

services. If it can be assumed that the bakery business, transferred to Buscat Ltd., sells similar products and/or

services as the Buscat bakery business, then the maximum $90,000 of non-capital losses can be deducted on

December 31, 2005 as follows:

Lesser of:

(a) Net income for year...................................................................................................... $ 90,000

(b) Income from: the loss business...............................................................

Nil

the sale of similar products.............................................. $ 130,000

$ 130,000

The remaining $60,500 ($150,500 $90,000) of non-capital losses can be carried forward to 2006 subject to

the deductibility tests discussed above.

Partial election

The minimum amount to be elected upon under paragraph 111(4)(e) (i.e., proceeds of disposition) should be

an amount equal to 2 times the sum of:

(a) the allowable capital loss of $2,000 which is about to expire,

(b) the net capital losses of $12,000 which would otherwise expire, and

(c) the property loss of $5,500 which otherwise expires plus the adjusted cost base of the property to be

elected upon.

If the land was chosen as the asset to trigger all of the taxable capital gain, then the deemed proceeds would

be determined as:

[2 ($2,000 + $5,500 + $12,000) + $155,000] or $194,000

The resulting taxable income computation would be:

Par. 3(a)

Par. 3(b)

Par. 3(c)

Non-capital sources of income

Net taxable capital gain:

Land, 1/2 ($194,000 $155,000)......................................................... $ 19,500

Allowable capital loss.........................................................................

(2,000)

Sum of par. 3(a) plus par. 3(b) less any Subdivision e deductions (nil)....................

Nil

$ 17,500

$ 17,500

Introduction to Federal Income Taxation in Canada

242

Par. 3(d)

Property loss.......................................................................................

Business loss.......................................................................................

5,500

46,000

$ 51,500

Less: Building recapture.....................................................................

Nil

Sec. 3 income..............................................................................................................................

Division C

Net capital loss............................................................................................................................

Taxable income...........................................................................................................................

Non-capital losses available for carryforward after the acquisition of control:

Balance, July 1, 2005...................................................................................................................

Non-capital losses from the deemed taxation year ended June 30, 2004.............. $ 51,500

Add: Net capital losses deducted above................................................................

12,000

$ 63,500

Less: Par. 3(c) income above................................................................................

17,500

Total non-capital losses...............................................................................................................

51,500

Nil

$ 12,000

Nil

$ 130,000

46,000

*

$ 176,000

* Exactly equal to the business loss above.

Summary

The two alternatives presented above are summarized as follows for comparative purposes:

Taxable Income for the Deemed Taxation Year Ended June 30, 2005:

Maximum

Partial

election

election

Par. 3(a) Income from non-capital sources ( 0)................................

Nil

Nil

Par. 3(b) Net taxable capital gains ( 0):

Deemed taxable capital gains (elective):

land.................................................... $ 20,000

$ 19,500

building..............................................

5,000

Nil

Allowable capital loss...............................

(2,000) $ 23,000

(2,000) $ 17,500

Par. 3(c) Par. 3(a) + par. 3(b)............................................................. $ 23,000

$ 17,500

Par. 3(d) Losses from non-capital sources and ABILs:

Loss from business.................................... $ (46,000)

$ (46,000)

Recapture (elective): building...................

20,000

Nil

Loss from property....................................

(5,500)

(31,500)

(5,500)

(51,500)

Division B income...............................................................................

Nil

Nil

Optional net capital loss deducted........................................................

(12,000)

(12,000)

Non-capital loss deducted....................................................................

Nil

Nil

Taxable income....................................................................................

Nil

Nil

Non-Capital Losses available for Carryforward at Deemed Taxation Year ended June 30, 2005:

Maximum election

Partial election

Balance, Jan. 1, 2005............................................................................ $ 130,000

$ 130,000

Non-capital loss June. 30, 2005:

Par. 3(d) losses see above.................................... $ 31,500

$ 51,500

Add: net capital losses deducted...............................

12,000

12,000

$ 43,500

$ 63,500

Less: par. 3(c) income see above.........................

23,000

20,500

17,500

46,000

$ 150,500

$ 176,000

Less: losses utilized at June 30, 2005.............................

Nil

Nil

losses not utilized but expired...............................

Nil

Nil

Nil

Nil

Available for carryforward from June. 30, 2005.................................. $ 150,500

$ 176,000

Net Capital Losses available for Carryforward...................................

Nil

Nil

Solutions to Chapter 11 Assignment Problems

243

The results of the above comparison of the two alternatives are further summarized as follows:

Alternatives

Taxable income.........................................................................

Net capital loss deducted..........................................................

Total non-capital losses available for carryforward..................

A.C.B. of land...........................................................................

U.C.C. of building.....................................................................

A.C.B. of building.....................................................................

(a)

0

$ 12,000

150,500

195,000

70,000

75,000

(b)

0

$ 12,000

176,000

194,000

45,000

65,000

Difference

0

0

$ 25,500

(1,000)

(25,000)

(10,000)

Alternative (b) is better if the additional $25,500 of non-capital loss can be offset by income generated in the

next 10 years. The resultant lower A.C.B. of the land under this option is only relevant on a disposition. The

lower U.C.C. on the building only represents a loss of C.C.A. at a 4% declining balance rate. On the other hand,

if an additional $25,500 of income cannot be generated in the next seven years (i.e., business losses continue),

Alternative (a) is better.

244

Introduction to Federal Income Taxation in Canada

Problem 4

[ITA: 920; 3855; 110.1112]

The controller of Video Madness Inc. has prepared the accounting income statement for the year ended

April 30, 2005:

VIDEO MADNESS INC.

INCOME STATEMENT

FOR THE YEAR ENDED APRIL 30, 2005

Sales..................................................................

Cost of sales...................................................... $ 523,000

Administrative expenses...................................

185,000

Operating income..............................................

Other income and expenses..............................

Provision for income taxes................................

Net income........................................................

$ 995,000

708,000

$ 287,000

55,000

$ 342,000

102,000

$ 240,000

Other Information

(1) Included in the calculation of Administrative expenses:

(a) Interest on late income tax payments.............................

(b) Depreciation and amortization (maximum capital cost

allowance of $149,500)..................................................

(c) Club dues for the local Country Club.............................

(d) Federal political contributions........................................

(e) Donations to registered charities....................................

(f) Property tax with respect to vacant land not being used

in the course of the business...........................................

(g) Life insurance premium with respect to the president

(the company is the beneficiary; not required for

financing).......................................................................

(2) Included in the calculation of Other income and

expenses:

(a) Landscaping of ground around new premise.................

(b) Fees paid with respect to the investigation of a suitable

site for the companys manufacturing plant...................

(c) Dividends received from taxable Canadian corporation

of $42,800 and foreign corporation dividends received

(not from a foreign affiliate) of $5,500 (Cdn.)...............

(d) Gain from the sale of another piece of land, used in the

business, sold for $200,000 in March (purchased for

$73,800).........................................................................

(e) Loss on sale of investments held as capital property

purchased for $85,000 and sold for $75,000..................

(3) Loss carryforwards from 2004 are:

(a) Non-capital losses..........................................................

(b) Net capital losses (realized in 1999)..............................

435

104,900

1,750

2,500

22,500

3,000

1,950

4,800

5,500

48,300

126,200

10,000

73,800

75,000

REQUIRED

Prepare a schedule reconciling the accounting net income to income for tax purposes and taxable income.

Indicate the appropriate statutory reference for your inclusions or exclusions.

Solutions to Chapter 11 Assignment Problems

245

Solution 4

Net income before income taxes..................................................................................................

Add: Loss on the sale of investment [ssec. 9(3)]................................................. $ 10,000

Depreciation and amortization [par. 18(1)(b)]...........................................

104,900

Interest on income tax payments [par. 18(1)(t)].........................................

435

Club dues [par. 18(1)(l)]............................................................................

1,750

Political contributions [par. 18(1)(n)]........................................................

2,500

Charitable donations [par. 18(1)(a)]...........................................................

22,500

Property tax on vacant land [ssec. 18(2)]...................................................

3,000

Life insurance premium [pars. 18(1)(a), (b), (c)].......................................

1,950

Subtotal......................................................................................................

Deduct: Capital cost allowance [par. 20(1)(a)].................................................... $ 149,500

Gain on sale of land [ssec. 9(3)].............................................................

126,200

Add: Taxable capital gain on business land [sec. 38]: 1/2 ($200,000

$73,800).................................................................................................

Allowable capital loss on investments [sec. 38]: 1/2 ($75,000

$85,000):................................................................................................

Net income under Division B................................................................................

Less Division C deductions:

Charitable donations [sec. 110.1]...................................................................

Dividends [sec. 112]......................................................................................

Non-capital loss [par. 111(1)(b)]...................................................................

Net capital loss [par. 111(1)(a)]: $75,000 4/3 1/2.....................................

Taxable income.....................................................................................................

The following items were correctly included on the accounting income statement:

(a) Landscaping costs [par. 20(1)(aa)];

(b) Site investigation fees [par. 20(1)(dd)];

(c) Dividends from taxable Canadian corporations [par. 12(1)(j)]; and

(d) Dividends from foreign corporations [par. 12(1)(k)].

147,035

$ 489,035

275,700

$ 213,335

63,100

(5,000)

$ 342,000

22,500

42,800

73,800

50,000

58,100

$ 271,435

189,100

$ 82,335

246

Introduction to Federal Income Taxation in Canada

Problem 5

[ITA: 124; ITR: 400]

The taxpayer, whose head office was in Manitoba, manufactured and sold various fans. Local sales agencies

were maintained in Ontario and in Quebec. At the Ontario agency, two qualified representatives handled business

under the company name. They were authorized to sign quotations. Contracts could be made, terms of payment

arranged and credit given without reference to the head office in Winnipeg. The company name was displayed

for public visibility, was used on calling cards, and was listed in the telephone directory. The Ontario agency,

occupying one-half of a building with warehouse facilities, maintained an inventory worth about $6,000. Orders

for standard-sized fans were filled from stock-in-trade. Orders for large fans were filled from the head office in

Winnipeg. The Quebec agency was substantially similar to that in Ontario.

REQUIRED

Determine whether or not the company has a permanent establishment in the provinces of Ontario and

Quebec. In reaching a conclusion, compare this situation with the case of M.N.R. v. Sunbeam discussed in this

chapter.

Solutions to Chapter 11 Assignment Problems

247

Solution 5

[Reference: Chicago Blower (Canada) Ltd. v. M.N.R., (T.A.B.) 66 DTC 471]

(A) Facts fall within Regulation 400(2)(b)

(i) the company carried on business in each province through an agent,

the agent was established in a particular place, clearly identified to the public,

occupied building with various warehouse facilities,

the agent had general authority to contract,

the agent had a stock of merchandise from which he filled orders,

the exception to this was on orders for larger fans,

thus, the condition was met at least in part,

(ii) therefore, the company does have a permanent establishment in the provinces indicated.

(B) This conclusion differs from that in the Sunbeam case which can be distinguished on its facts,

(i) in the Sunbeam case, the taxpayers representatives in Quebec did not have authority to make contracts

on the companys behalf,

(ii) there was no telephone listing in the companys name and that name did not appear on any business

signs.

248

Introduction to Federal Income Taxation in Canada

Problem 6

[ITA: Part I.3]

Larger Than Life Inc., a public corporation in the service industry, had the following balance sheet as at

December 31, 2005:

Cash..........................................................................................

Accounts receivable (net) ........................................................

Inventory ..................................................................................

Investment in Canadian subsidiary ..........................................

Unsecured demand loan to Mr. Filth E. Rich ...........................

Future income taxes (debit) .....................................................

Total assets ...............................................................................

Accounts payable .....................................................................

Bank indebtedness (due on demand) ........................................

Mortgage due to Mrs. Low N. Shark .......................................

Common shares ........................................................................

Retained earnings .....................................................................

Total liabilities and equity .......................................................

($ 000s)

40,000

50,000

60,000

120,000

60,000

20,000

350,000

55,000

75,000

35,000

65,000

120,000

350,000

The investment has been accounted for using the equity basis with the carrying value being computed as

follows:

Original cost of shares..............................................................

Accumulated share of subsidiarys earnings.............................

Accumulated dividends received..............................................

Carrying value..........................................................................

$ 110,000

20,000

(10,000)

$ 120,000

Larger Than Lifes taxable income for its taxation year ended December 31, 2005, was $9,000,000 with

82% of its income being earned in a province. Larger Than Life grew significantly during 2005. In 2004, the

corporation was not even subject to Part I.3 tax and its taxable income was only $800,000 (all earned in the

province of Ontario). The corporation had no taxable income in the prior six years.

REQUIRED

Determine Larger Than Lifes Part I.3 tax liability for its 2005 tax year. Assume that Larger Than Life is

allocated $40,000,000 of the capital deduction in its related group of corporations.

Solutions to Chapter 11 Assignment Problems

249

Solution 6

Capital

Capital stock [par. 181.2(3)(a)]...............................................................................

Retained earnings [par. 181.2(3)(a)].......................................................................

Bank debt [par. 181.2(3)(c)]....................................................................................

Mortgage payable [par. 181.2(3)(d)].......................................................................

Future income taxes (debit) [par. 181.2(3)(h)]........................................................

Total capital....................................................................................................................

Investment allowance2

Investment in subsidiary [par. 181.2(4)(a)].............................................................

Taxable capital ($265,000,000 $110,000,000)............................................................

Taxable capital employed in Canada (82% of $155,000,000)........................................

Capital deduction (as allocated in related group)...........................................................

Amount subject to Part I.3 tax........................................................................................

Part I.3 tax @ 0.175%....................................................................................................

2005 surtax (4% of 28% of $9,000,000).........................................................................

2005 Canadian surtax payable (82% of $100,800).........................................................

2005 Part I.3 tax liability (A) minus (B)....................................................................

2004 surtax (4% 28% 100% $800,000).............................................................

Part I.3 tax payable ($69,769 $8,960) ([sec. 181.1(4)]................................................

65,000,000

110,000,000

75,000,000

35,000,000

(20,000,000)

$ 265,000,000

$ 110,000,000 1

$ 155,000,000

$ 127,100,000

40,000,000

$ 87,100,000

$

152,425 (A)

$

100,800

$

82,656 (B)

$

69,769

$

8,960

$

60,8093

NOTES TO SOLUTION

(1) Subsection 181(3) requires that the equity method not be used in determining amounts to be included in

capital and the investment allowance. Therefore, $10,000,000 has been subtracted from both the carrying value

of the investment and retained earnings in order to remove the effect of the equity method of accounting.

(2) The demand loan receivable does not qualify for the investment allowance since it is neither owing

from a corporation [par. 181.2(4)(b)] nor a bond, debenture, note, mortgage, hypothec, or similar obligation of

another corporation [par. 181.2(4)(c)].

(3) This amount can be offset by Canadian surtax payable in the following three years. No further unused

surtax credits exist from the preceding seven years.

250

Introduction to Federal Income Taxation in Canada

Problem 7

[ITA: 125.1]

One of your manufacturing clients, Mano-Pac Limited, a public company, provides you with the following

information in order to calculate their manufacturing and processing profit deduction:

(a) Salary expenses are represented by:

Accounting staff........................................................... $ 200,000

Quality control staff.....................................................

150,000

Plant staff.....................................................................

800,000

Plant supervisors and maintenance...............................

90,000

Distribution staff (responsible for distribution of

finished products).................................................

65,000

Receiving department staff (responsible for receiving

and storing raw materials)....................................

45,000

Clerk responsible for purchasing raw materials...........

35,000

$ 1,385,000

(b) Fixed assets of Mano-Pac Ltd.:

Data processing equipment........................................... $

50,000

Manufacturing equipment............................................

900,000

Office equipment..........................................................

100,000

Vending machines etc. in employee cafeteria..............

10,000

$ 1,060,000

(c) Taxable income is comprised of:

Manufacturing income................................................. $ 375,000

Investment income.......................................................

65,000

Division B income....................................................... $ 440,000

Less: charitable donations............................................

15,000

Taxable income............................................................ $ 425,000

REQUIRED

Calculate the manufacturing and processing profit deduction Mano-Pac Ltd. can claim.

Solutions to Chapter 11 Assignment Problems

251

Solution 7

Calculation of manufacturing and processing profits deduction from tax:

7% of lesser of:

(a) Canadian manufacturing and processing profits..................................................

(b) Taxable income...................................................................................................

7% of $374,970 = $26,248

$ 374,970 1

$ 425,000

NOTE TO SOLUTION

(1) Calculation of Canadian manufacturing and processing profits:

MP =

=

=

MC + ML

ADJUBI

C+L

$105,882 + $1,385,000

$375,000

$106,000 + $1,385,000

$374,970

(a) ADJUBI (Adjusted Business Income):

Division B income......................................................................................................

Less: Investment income.............................................................................................

(b) C (Cost of Capital):

10% of gross capital cost of assets ($1,060,000) =.....................................................

(c) MC (Cost of Manufacturing and Processing Capital):

10% of manufacturing assets ($900,000)....................................................................

100/85 of total (100/85 $90,000) =.........................................................................

Lesser of: (i) cost of capital (C)..................................................................................

(ii) cost of manufacturing and processing capital (MC).............................

(d) L (Cost of Labour):

Total salary expenses..................................................................................................

(e) ML (Cost of Manufacturing and Processing Labour):

Portion of total salary expenses used in qualified activities:

Total salary expenses...........................................................................................

Less*: Accounting......................................................................... $ 200,000

Distribution........................................................................

65,000

Raw materials clerk...........................................................

35,000

100/75 of $1,085,000...........................................................................................

Lesser of: (i) cost of labour (1)...................................................................................

(ii) cost of manufacturing and processing labour (ML)..............................

* Regulation 5202: definition of qualified activities.

$

$

440,000

65,000

375,000

106,000

$

$

90,000

105,882

$

$

106,000

105,882

$ 1,385,000

$ 1,385,000

$

$

$

$

(300,000)

1,085,000

1,446,667

1,385,000

1,446,667

252

Introduction to Federal Income Taxation in Canada

Problem 8

[ITA: 123; 124; 126]

Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller

provided you with the following information related to its 2005 taxation year ended December 31:

Income under Division B from consulting business including

$100,000 earned in U.S. operations (before deducting

$16,000 U.S. tax paid).......................................................

Canadian investment royalty income........................................

U.K. non-foreign affiliate income (before $3,000 tax

withheld)............................................................................

Taxable dividend received from non-connected Canadian

corporations.......................................................................

Taxable capital gains................................................................

Charitable donations.................................................................

Unused foreign tax credit in respect of U.S..............................

Net capital losses carried forward arising in 1999....................

$ 264,000

10,000

20,000

5,000

6,000

100,000

3,000

12,000

Barltrop Limited has permanent establishments in the U.S., B.C. and Alberta. Its gross revenues and salaries

and wages data have been allocated as follows:

Gross revenues.....................

Salaries and wages................

British

Columbia

$ 3,000,000

500,000

Alberta

$ 3,000,000

300,000

U.S.

$ 4,000,000

200,000

Assume that the British Columbia corporation tax rate is 13.5% and the Alberta rate is 11.5%. Also, assume

that taxable income for Alberta is computed on the same basis as federal taxable income.

Gross revenues exclude income from property not used in connection with the principal business operation

of the corporation.

REQUIRED

Compute the total tax payable by the company for the 2005 taxation year, including provincial tax. Show all

calculations.

Solutions to Chapter 11 Assignment Problems

253

Solution 8

Income under Division B from consulting business....................................................................

Canadian investment royalty income...........................................................................................

U.K. non-foreign affiliate income...............................................................................................

Taxable dividend received from non-connected Canadian corporations.....................................

Taxable capital gains...................................................................................................................

Income under Division B.............................................................................................................

Deduct:

Charitable donations (not exceeding 75% $305,000 = $228,750)....................................

Canadian dividends received................................................................................................

1999 net capital loss ($12,000 1/2 / 3/4; limited to taxable capital gains of $6,000)...........

Taxable income...........................................................................................................................

Basic federal tax at 38% of $194,000..........................................................................................

Deduct: Abatement from federal tax (see Schedule 1)................................................................

Net...............................................................................................................................................

Add: Federal surtax @ 4% of 28% $194,000..........................................................................

Deduct:

Non-business foreign tax credit (see Schedule 2).................................................................

Business foreign tax credit (see Schedule 3)........................................................................

Tax reduction (7% of $194,000)...........................................................................................

Part I tax payable (federal)..........................................................................................................

Provincial tax:

British Columbia 13.5% of $77,600.....................................................................................

Alberta rate 11.5% of $58,200.............................................................................................

Total tax.......................................................................................................................................

$ 264,000

10,000

20,000

5,000

6,000

$ 305,000

(100,000)

(5,000)

(6,000)

$ 194,000

$ 73,720

(13,580)

$ 60,140

2,173

(3,000)

(19,000)

(13,580)

$ 26,733

10,476

6,693

43,902

Schedule 1: Abatement from federal tax

B.C.

Gross revenues......................................

% gr. revenues (1).................................

Salaries and wages................................

% S&W (2)............................................

(1) + (2)

................................................

2

Alberta

$3,000K

30%

$500K

50%

$3,000K

30%

$300K

30%

Total

Cdn.

$6,000K

60%

$800K

80%

40%

30%

70%

U.S.

Total

$4,000K

40%

$200K

20%

$10,000K

100%

$1,000K

100%

30%

100%

Abatement: 10% of 70% of $194,000 = $13,580

Allocation of income to: B.C. 40% $194,000 = $77,600

Alberta 30% $194,000 = $58,200

Schedule 2: Non-business foreign tax credit (U.K. income)

Lesser of:

(i) tax paid

$ 3,000

income from U.K.

tax otherwise payable after

(ii) income less dividends and abatement plus surtax minus

net capital loss carryover

general tax reduction

$20,000

$305,000 $5,000 $6,000

($60,140 + $2,173 $13,580)

$20,000

$294,000

$48,733 =.....................................................................

Lesser amount is $3,000.

$ 3,315

Introduction to Federal Income Taxation in Canada

254

Schedule 3: Business foreign tax credit (U.S. income)

Least of:

(i) tax paid ($16,000 + $3,000)..............................................................................................

tax otherwise payable

income from U.S.

(ii) income less dividends and plus surtax minus

general tax reduction

net capital loss carryover

$ 19,000

$100,000

$305,000 $5,000 $6,000

($73,720 + $2,173 $13,580)

$100,000

$294,000

$62,313 =.....................................................................

$ 21,195

(iii) tax otherwise payable before any reduction or credits plus surtax less non-business tax

credit ($73,720 + $2,173 $13,580 $3,000)..................................................................

Lesser amount is $19,000.

$ 59,313

Solutions to Chapter 11 Assignment Problems

255

Problem 9

[ITA: 12(1)(t); 37; 127(5)(11); ITR:2900]

Infotech is a public company in its first year of business in the information technology industry. It operates

out of a plant in Ottawa, Ontario. In 2005, it incurred $2,200,000 of scientific research and experimental

development expenditures (SR&ED) which qualify for deduction under subsection 37(1) of the Act. The breakdown of these expenses is as follows:

Current SR&ED expenditures [par. 37(1)(a)]...............................

Capital SR&ED expenditures [spar. 37(1)(b)(i)]

new equipment.............................................. $ 300,000

200,000

used equipment.............................................

$ 1,700,000

Total SR&ED expenditures...........................................................

$ 2,200,000

500,000

Infotechs federal income tax rate after abatement is 22.12%. Its taxable income before deducting the

$2,200,000 claim under section 37 is $3,200,000.

REQUIRED

(A) Compute the maximum investment tax credit available to Infotech in 2005.

(B) Compute the companys net federal Part I tax payable after the investment tax credit, assuming a

maximum section 37 deduction is claimed.

(C) What is the amount, if any, of the investment tax credit carryover?

(D) Compute the companys deduction or income inclusion in the following year if no further SR&ED

expenditures are made.

Introduction to Federal Income Taxation in Canada

256

Solution 9

(A) The maximum investment tax credit is

20% [$1,700,000 + $300,000] = $400,000

Note that the used equipment is not a qualified expenditure for the purposes of sec. 127(9)

because it is not new property [Reg. 2902(2)(iii)].