Professional Documents

Culture Documents

IFRS Implementation Services

Uploaded by

Oluwole Timothy BamikoleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFRS Implementation Services

Uploaded by

Oluwole Timothy BamikoleCopyright:

Available Formats

IFRS implementation services

Implications of an accelerating global trend

IFRS is rapidly gaining acceptance globally, spurring companies throughout the world to assess the potential implications and benefits of adopting these standards. Implementing IFRS can have an impact on almost all aspects of a company, including financial reporting systems, internal controls, taxes, treasury, management compensation, cash management, and legal, among others. While implementation of high-quality financial reporting standards is challenging, when planned and managed properly, the conversion can bring substantial improvements in the performance of the finance function, streamline the statutory financial reporting process globally, enhance controls, and reduce costs, as it affords:

Mapping the change: IFRS implementation guide

Conversion experience in Europe, as well as Asia and Australia, shows that conversion projects often take more time and resources than anticipated. Historically, that has led some companies to rush and risk mistakes or outsource more work than necessary, driving up costs and hindering the embedding of IFRS knowledge within the company. At the same time, conversion brings a one-time opportunity to comprehensively reassess financial reporting and take "a clean sheet of paper" approach to financial policies and processes. Such an approach recognizes that major accounting and reporting changes may have a ripple effect impacting many aspects of a company's organization. This implementation guide is intended to jumpstart strategic thinking about an IFRS conversion. It provides an outline for a suggested IFRS conversion approach, highlighting objectives, timelines, key considerations, and insights. It is not a comprehensive "how-to" manual, because each company will proceed according to its own unique needs. Rather, its intent is to provide a framework for understanding the scope of the conversion process, encourage strategic thinking, and help companies identify where they may need more information, resources or experience. This publication is part of our "IFRS readiness series" and is intended for a company

Nigeria to Begin Implementation of IFRS Jan 2012

NIGERIA is to begin the implementation of International Financial Reporting Standards (IFRS) with effect from January, 2012. To this effect, Senator Jubril Martins-Kuye, minister of commerce and industry, has directed the Nigerian Accounting Standards Board (NASB) to ensure efficient action plan and framework for compliance by all stakeholders with effect from January 1st, 2012. Speaking at the launch of a roadmap for the adoption of IFRS in Abuja, Martins-Kuye noted the

importance of compliance as world economies are more interconnected and symbiotic and nations are desirous of moving forward by freeing themselves from the limits of the present system of financial reporting standards. He noted that as a result of globalization, a number of Nigerian companies have raised capital from international stock markets and others established presence in other jurisdictions while a good number of Nigerians hold the securities of non-Nigeria issuers. The minister said for a better understanding and appreciation of the risks and consequently, making decisions about the flow of economic capital, it makes sense that financial statements prepared in Nigeria use global financial reporting benchmarks. He listed some of the programmes expected to be executed by the NASB to ensure smooth transition to IFRS by all stakeholders such as creating awareness on potential impact of the conversion, identifying regulatory synergies to be derived and communicating the temporary impact of the transition on business performance. Other programmes include education and training, public sector financial reporting and applicable financial reporting standards and the future role of the NASB after the adoption of the IFRS. On the phased implementation of the IFRS, Martin-Kuye said publicly listed entities and significant public interest entities are to prepare their financial statements using applicable IFRS by January 1, 2012. The choice of this date is anchored on the need to effectively transit to IFRS over a three year period.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Consolidation AccountingDocument42 pagesConsolidation AccountingAliBerrada100% (2)

- Solution Manual For Financial Accounting Tools For Business Decision Making 6th Canadian Edition by KimmelDocument60 pagesSolution Manual For Financial Accounting Tools For Business Decision Making 6th Canadian Edition by Kimmela5279965660% (3)

- Chapter 7Document45 pagesChapter 7JohnNo ratings yet

- Introduction To Ind ASDocument8 pagesIntroduction To Ind ASAnand bhangariyaNo ratings yet

- CF Objective of Financial ReportingDocument6 pagesCF Objective of Financial Reportingpanda 1No ratings yet

- Abu Dhabi Annual Report 2011 Electricity and WaterDocument50 pagesAbu Dhabi Annual Report 2011 Electricity and WaterranasherdilNo ratings yet

- University of Lagos: Akoka Yaba School of Postgraduate Studies PART TIME 2017/2018 SESSIONDocument5 pagesUniversity of Lagos: Akoka Yaba School of Postgraduate Studies PART TIME 2017/2018 SESSIONDavid OparindeNo ratings yet

- Online Learning Module ACCT 1026 (Financial Accounting and Reporting)Document7 pagesOnline Learning Module ACCT 1026 (Financial Accounting and Reporting)Annie RapanutNo ratings yet

- Sponsor and Commercial Partner - Stadium Naming Rights: BackgroundDocument1 pageSponsor and Commercial Partner - Stadium Naming Rights: BackgroundRiza El HakimNo ratings yet

- Changes in Group StructureDocument11 pagesChanges in Group StructureTinashe ZhouNo ratings yet

- An Internship Report On International Financial Reporting Standards (IFRS) Practices and Its Implementation at BRAC UniversityDocument37 pagesAn Internship Report On International Financial Reporting Standards (IFRS) Practices and Its Implementation at BRAC UniversityShahid MahmudNo ratings yet

- Lava Sad RaftDocument460 pagesLava Sad RaftHarshit AroraNo ratings yet

- Accounting Standard 22Document12 pagesAccounting Standard 22Rupesh MoreNo ratings yet

- IAS 20 - Accounting For Government Grants and Disclosure of Government Assistance (Detailed Review)Document8 pagesIAS 20 - Accounting For Government Grants and Disclosure of Government Assistance (Detailed Review)Nico Rivera CallangNo ratings yet

- SAP Asset Retirement Obligation ManagementDocument2 pagesSAP Asset Retirement Obligation Managementjpalana0% (1)

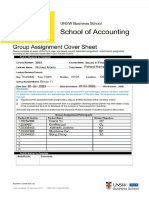

- ACCT3563 Group AssignmentDocument18 pagesACCT3563 Group AssignmentstephanieNo ratings yet

- IFRS 9 Impairment Where Do I Start March 2018Document9 pagesIFRS 9 Impairment Where Do I Start March 2018DerickBrownThe-GentlemanNo ratings yet

- Finals, Reviewer. PFRSDocument17 pagesFinals, Reviewer. PFRSg.canoneo.59990.dcNo ratings yet

- Article 16 The Impact of The Application of Fair Value AccountingDocument13 pagesArticle 16 The Impact of The Application of Fair Value AccountingindahmuliasariNo ratings yet

- Gul Ahmed 2009Document125 pagesGul Ahmed 2009Qoumal HashmiNo ratings yet

- Chapter 21 - Employee Benefits IFRS (IAS 19) and Then ASPE (Section 3462), Minor Difference Flashcards - QuizletDocument1 pageChapter 21 - Employee Benefits IFRS (IAS 19) and Then ASPE (Section 3462), Minor Difference Flashcards - QuizletcathNo ratings yet

- Get Ready For Ifrs 17 ADocument70 pagesGet Ready For Ifrs 17 Aالخليفة دجوNo ratings yet

- Bachelor of Science (Honours) : Accounting Accounting and FinanceDocument12 pagesBachelor of Science (Honours) : Accounting Accounting and FinanceBryan SingNo ratings yet

- IAS 23 - Borrowing CostDocument4 pagesIAS 23 - Borrowing CostMuhammad QamarNo ratings yet

- Al KhadashDocument21 pagesAl Khadashmohammad aladwanNo ratings yet

- Prospectus Standalone - Bfbf30ab A103 478e Bc61 8649a4a3e942Document233 pagesProspectus Standalone - Bfbf30ab A103 478e Bc61 8649a4a3e942MohamedDidi0% (1)

- Determinants of Foreign Direct Investments in Emerging Markets: A Case Study of NigeriaDocument174 pagesDeterminants of Foreign Direct Investments in Emerging Markets: A Case Study of NigeriaLauren LivingstonNo ratings yet

- 5 Environmental Accounting - Chapter 1Document30 pages5 Environmental Accounting - Chapter 1Wilma VillanuevaNo ratings yet

- Baf Sem 5Document8 pagesBaf Sem 5api-292680897No ratings yet

- Financial ReportingDocument6 pagesFinancial ReportingDumisani NyirendaNo ratings yet