Professional Documents

Culture Documents

Fee Base

Uploaded by

Monika JoshiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fee Base

Uploaded by

Monika JoshiCopyright:

Available Formats

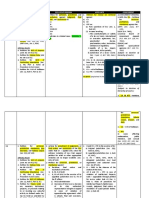

1.

This memorandum is intended to help Bank units respond appropriately and consistently to requests for fee-based servicesthat is, services provided as a direct response to requests from, and partly or fully paid for [1] by, the recipient of the service, under a legal agreement. 2. The principles set out in this memorandum apply to fee-based services provided by Regions and [2] Sectors. Purpose 3. In providing fee-based services, the Banks purpose is to expand the options and services available to clients beyond those that it can fully fund through the administrative budget. A clients request for fee-based [3] services does not affect the administrative budget for work in that country. General Principles 4. Strategic Objectives. Fee-based services, like any services provided by the Bank, must fall within the purposes of the Bank as set out in its Articles of Agreement and must contribute to achieving the Banks mission of poverty reduction and sustainable economic growth. Fee-based services must be consistent with the Banks strategic priorities, includingfor borrowing countriesthose set out in the Banks Country Assistance Strategy (CAS) or Country Partnership Strategy (CPS). 5. Alignment with Institutional Mandate. The Bank provides only fee-based services that Management considers to be fully aligned with the Banks development mandate. In providing such services, the Bank does not enter into competitive bidding. 6. Types of Services. The fee-based services the Bank may provide are analytic and advisory activities (AAA) that the client requests and that the Bank cannot fund in full within the existing administrative budget envelope. This includes economic and sector work, non-lending technical assistance, donor aid coordination, impact evaluation, research services and external training. Subject to appropriate safeguards and risk management, the Bank may provide technical assistance directly in support of project preparation, implementation, or supervisionexcept for advice directly related to engineering or final design. 7. Role of the Bank. Staff ensure that the provision of fee-based services does not involve a conflict of [4] interest for the Bank or associate the Bank with any activity inconsistent with its operational policies. The Bank does not provide services to assist one member country in advancing its interests over those of another member country. Before taking on the provision of any fee-based service, staff and management explicitly consider the risks, including liability or reputational risks, and judge whether they are acceptable by the Bank, taking into consideration any risk mitigation measures to be put in place. 8. Clients. The Bank may provide fee-based services to the following types of clients, all subject to legal due diligence and the agreement of the country director concerned: (a) governments and government institutions of the Banks member countries, including those that have graduated from the Bank; (b) subnational governments; (c) nongovernmental organizations and other not-for-profit private sector associations (such as chambers of commerce); and (d) multilateral institutions, including development banks and regional organizations.

[5]

The Bank does not provide fee-based services to commercial entities, except in the context of training programs. 9. Quality Control. Fee-based tasks are subject to all applicable Bank operational policies and to the same quality control practices as AAA handled through the administrative budget. The applicable safeguards policies and procedures provide guidance to Bank staff involved in providing fee-based services. Bank staff ensure that the clients rules and procedures are consistent with the Banks operational policies, not just for the fee-based service itself, but also for the underlying projects on which the client is seeking the Banks advice. If the recipient of Bank advice fails to respect important safeguards, the Bank reserves the right to terminate the agreement. 10. Costing. For all clients, the costs of fee-based services are calculated using the methodology of uniform pricingthat is, the recovery of direct and indirect costs (salary and associated benefits, travel, and subsistence) [7] as well as overhead costs associated with providing the service. Indirect and overhead costs are represented by [8] a markup factor derived from data for previous years and reconsidered every two years; for FY09-FY10, the factor is set at 50 percent. 11. Sources of Funds. To meet the cost of fee-based advisory services, clients may use their own budgetary resources or third-party resources. Under some circumstances, the Bank may also contribute, via its own budget, [9] to funding some percentage of the cost of the services delivered to the client under the fee-based umbrella. Processing 12. Staff may obtain additional detailed guidance on the Fee-Based Services page on the OPCS website.

[6]

13. Proposal. For each fee-based task, the task manager (TM), in consultation with the assigned lawyer, prepares a brief proposal that sets out (a) the kinds of services to be provided, (b) the proposed area of analysis or advice, (c) the link with the Banks mandate and strategic priorities (including the CAS/CPS, if applicable) and the value-added of providing the services, (d) risks to be considered and any mitigation measures to be put in [10] place, (e) consistency with the other requirements of this Op Memo, (f) the names of the staff who will provide the services, (g) the length and value of the contract, and (h) the expected outcome of the task. The relevant [11] country director and sector director both approve the proposal. 14. When the provision of services to subnational entities is proposed, staff seek the endorsement of the central government, either on a case-by-case basis or via a general agreement for subnational entities to contract [12] such services . Proposals for the provision of fee-based services to subnational and other nonsovereign [13] entities are subject to legal due diligence. 15. Contracting. Once the proposal is approved, the lawyer will prepare the agreement or, if the TM and lawyer agree, the TM can prepare and submit it for clearance by the lawyer. The contract negotiated with the client serves as the legal basis for providing the services. The decision authority rests with the country director once clearance by the lawyer has been obtained. OPCS can provide guidance on request.

16. Budgeting and Accounting. After negotiating the contract with the client, the TM submits to the Regions chief administrative officer (CAO) a billing information form that gives the essential details of the contract: the name of the providing unit and the billing address of the client. The CAO then sends a copy of the form to Accounting (ACTBC). At the intervals agreed with the client in the contract, but at least once each quarter, the providing unit bills the client for services and sends details of such billing to Accounting. As part of the normal budget monitoring process, the providing unit requests a budget transfer, based on the fees it has billed for its services as shown in its quarterly progress report to Corporate Resource Management (CSRRM).

17. Activity Completion. Within six months after the close of the task, the TM prepares an Activity Completion Summary (ACS) including feedback from the client. As part of the ACS, the sector leader assesses the quality of the services, and the lead economist or resident representative evaluates their impact. Program Monitoring 18. The TM sends a copy of the approved proposal, the contract, and the ACSas each document is completedto OPCOS. Queries

19. General questions about this memorandum may be addressed to the Corporate Strategy Group, Strategy and Resource Management, or to the Operations Services Department in OPCS; questions that arise during the preparation or provision of fee-based services may be addressed to opmanual@worldbank.org; questions about the legal aspects of providing fee-based services may be addressed to the chief counsel concerned or to LEGOP (Frank Fariello, ext.87782); questions about costing and budgeting arrangements may be addressed to CSRRM (Marie Bakker, ext. 39285); and questions about billing and accounting may be addressed to ACTRT.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Ceniza Bar Notes 2022Document38 pagesCeniza Bar Notes 2022Fasa Mufa100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Family Code Cases Article 68 To 148 Case DigestDocument14 pagesFamily Code Cases Article 68 To 148 Case DigestvepetergaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- RTC orders upheld in dispute over leased vehiclesDocument13 pagesRTC orders upheld in dispute over leased vehiclesAnna NicerioNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Case Brief on Enforcing Kharch-i-Pandan AgreementDocument5 pagesCase Brief on Enforcing Kharch-i-Pandan AgreementRaghavendra NadgaudaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- PNOC v. Keppel PhilippinesDocument16 pagesPNOC v. Keppel Philippinesjagabriel616No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Supreme Court Decision on Right of First Refusal CaseDocument9 pagesSupreme Court Decision on Right of First Refusal CaseMarizPatanaoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Passion For Justice: Lord Denning, Christianity and The LawDocument20 pagesA Passion For Justice: Lord Denning, Christianity and The LawCacia PimentelNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Doctrine of Past PerformanceDocument22 pagesThe Doctrine of Past PerformanceNiten Chopra100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- CIAC Jurisdiction Over Construction DisputeDocument3 pagesCIAC Jurisdiction Over Construction DisputeDave Froilan EsperilaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Acing Civ Pro - Personal JurisdictionDocument19 pagesAcing Civ Pro - Personal JurisdictionJess100% (3)

- Jurisdiction of Philippine CourtsDocument15 pagesJurisdiction of Philippine CourtsLorie Jean UdarbeNo ratings yet

- 9257GGBS CorrigendumDocument22 pages9257GGBS Corrigendumkselvan_1No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Cronico vs TuasonDocument2 pagesCronico vs TuasondheekaeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Soto Melendez V Banco Popular de Puerto RicoDocument45 pagesSoto Melendez V Banco Popular de Puerto RicoErick A. Velázquez Sosa100% (2)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Victor Barrett and Jeanette Barrett, His Wife v. Prudential Property and Casualty Insurance Company, 790 F.2d 842, 11th Cir. (1986)Document5 pagesVictor Barrett and Jeanette Barrett, His Wife v. Prudential Property and Casualty Insurance Company, 790 F.2d 842, 11th Cir. (1986)Scribd Government DocsNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Ethics Wave 2 Excluding RenomeronDocument90 pagesEthics Wave 2 Excluding RenomeronADNo ratings yet

- Importers Find Quality Grind GaugesDocument8 pagesImporters Find Quality Grind GaugesEduardo Franklin Vasquez HuamanNo ratings yet

- Supply of Clinker To Alangulam Cement Works, Virudhunagar DistrictDocument29 pagesSupply of Clinker To Alangulam Cement Works, Virudhunagar DistrictTHANGAVEL S PNo ratings yet

- The Courtesy Trap - Fidic'S Sub-Clause 20.5 - Amicable Settlement and Emirates TradingDocument15 pagesThe Courtesy Trap - Fidic'S Sub-Clause 20.5 - Amicable Settlement and Emirates TradingPriyank KulshreshthaNo ratings yet

- Global vs. MetrobankDocument1 pageGlobal vs. MetrobankRosh LepzNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Memorandum For PDocument19 pagesMemorandum For PPriyasHa Rye75% (4)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- G.R. No. 196020, April 18, 2018 Meralco, Et - Al V. Nordec Philippines And/Or Marvex Industrial G.R. No. 196116, April 18, 2018 Nordec Philippines And/Or Marvex Industrial V. Meralco, Et - Al. FactsDocument2 pagesG.R. No. 196020, April 18, 2018 Meralco, Et - Al V. Nordec Philippines And/Or Marvex Industrial G.R. No. 196116, April 18, 2018 Nordec Philippines And/Or Marvex Industrial V. Meralco, Et - Al. FactsLara CacalNo ratings yet

- International Law Obligation of States to Enact Legislation to Fulfill Treaty TermsDocument17 pagesInternational Law Obligation of States to Enact Legislation to Fulfill Treaty TermsFbarrsNo ratings yet

- KPMG Zuma Report The State Versus Jacob G Zuma Andothers Forensic Investigation Draft Report On Factual Findings For Review OnlyDocument490 pagesKPMG Zuma Report The State Versus Jacob G Zuma Andothers Forensic Investigation Draft Report On Factual Findings For Review OnlyAndré Le RouxNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Confirmation of AgreementDocument2 pagesConfirmation of AgreementLegal Forms100% (1)

- Cordia ComplaintDocument107 pagesCordia ComplaintKyle CollierNo ratings yet

- Construction Contracts - Key Issues Regarding Liquidated Damages, Delay Claims and Limitation PeriodDocument10 pagesConstruction Contracts - Key Issues Regarding Liquidated Damages, Delay Claims and Limitation PeriodVVRAONo ratings yet

- SEO-Optimized Title for Project Management Ethics Exam ResultsDocument15 pagesSEO-Optimized Title for Project Management Ethics Exam ResultsRaja Sundaram100% (3)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Test Bank 3 - Ia 3Document25 pagesTest Bank 3 - Ia 3Xiena67% (3)

- CHUA V CSC G.R. No. 88979Document5 pagesCHUA V CSC G.R. No. 88979Ariza ValenciaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)