Professional Documents

Culture Documents

Duea v. County of San Diego, No. D058333 (Feb. 29, 2012)

Uploaded by

RHTOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Duea v. County of San Diego, No. D058333 (Feb. 29, 2012)

Uploaded by

RHTCopyright:

Available Formats

Filed 2/29/12 Certified for publication 3/27/12 (order attached)

COURT OF APPEAL, FOURTH APPELLATE DISTRICT DIVISION ONE STATE OF CALIFORNIA

DAVID J. DUEA, as Trustee, etc., Plaintiff and Appellant, v. COUNTY OF SAN DIEGO, Defendant and Respondent.

D058333

(Super. Ct. No. 37-2008-00076417CU-JR-CTL)

APPEAL from a judgment of the Superior Court of San Diego County, Jeffrey B. Barton, Judge. Affirmed.

Article XIIIA of the California Constitution, adopted by voters in 1978 as Proposition 13, limits the ad valorem tax on real property to one percent of the property's "full cash value." (Art. XIIIA, 1, subd. (a).) The term "full cash value" means the "county assessor's valuation of real property as shown on the 197576 tax bill," or, as relevant here, "thereafter, the appraised value of real property when purchased, newly constructed, or a change in ownership has occurred after the 1975 assessment." (Id., 2, subd. (a), italics added.)

As also relevant here, on a change of ownership the property is reassessed at a new base year value (e.g., revalued at current fair market value) as of the date of the transfer. (Art. XIIIA, 1, subd. (a); see also Rev. & Tax. Code,1 110.1, subd. (a)(2) ["For purposes of subdivision (a) of Section 2 of Article XIIIA . . . , 'full cash value' of real property . . . means the fair market value as determined pursuant to Section 110 . . . .: [] (2) [f]or property which . . . changes ownership after the 1975 lien date . . . ."].) The California Constitution exempts certain transfers that otherwise would be a change in ownership for tax assessment purposes. As applicable here, subdivision (d) of section 2 of article XIIIA (hereinafter, section 2, subdivision (d)), added in 1982, excludes from the term "change in ownership" real property acquired as a replacement for comparable property following the exercise of "eminent domain proceedings" and real property acquired by a "public entity." Appellant David J. Duea, as trustee of the David J. Duea & Mary J. Duea Revocable Trust No. 1 (Duea), appeals a real property tax assessment by the San Diego County Assessment Appeals Board (Board). The Board rejected Duea's claim that no change of ownership occurred after Duea, under "threat of condemnation," sold real property located at 266 11th Avenue, San Diego, California (original property), to private party JMIR-Downtown Acquisition, LLC, a Delaware Limited Liability Company

All statutory references are to the Revenue and Taxation Code. 2

(AMIR-ACQ), and purchased new property located at 2146 Main Street, San Diego, California (replacement property), that was assessed with a new "base year" value. The trial court found that substantial evidence supported the Board's finding that the original property was sold to a private party, that Duea did not exhaust his administrative remedies on the issue of whether JMIR-ACQ acted as an agent for a "public entity" within the meaning of section 2, subdivision (d), and that, in any event, the evidence did not support an agency finding. As we explain, we affirm the judgment. FACTUAL AND PROCEDURAL BACKGROUND2 Duea purchased the original property in 1988 and operated a business on that property and an adjacent property owned by SDG&E. In November 1998, the voters of the City of San Diego (City) approved a memorandum of understanding (MOU) between the City, San Diego Redevelopment Agency (Agency), Centre City Development

2 Unless otherwise noted, the facts are taken from the Board's decision rejecting Duea's claim there was no change of ownership for purposes of section 2, subdivision (d). In connection with Duea's opening brief, Duea filed a motion to augment/correct the record on appeal to include exhibits 1, 6, 7 and 8 and a request for judicial notice of exhibits 2, 3, 4, 5, 9 and 10. Respondent County of San Diego (County) opposed the motion to augment as it relates to pages 7 through 29 of exhibit 1, the entirety of exhibit 7 and the last two pages of exhibit 8 because those pages and exhibits were not presented to the trial court. County did not oppose augmentation of the record to include the balance of documents in exhibit 1 (e.g., the administrative record) or the entirety of exhibit 6 (e.g., the memorandum of understanding). County opposed the request for judicial notice in its entirety because it contends none of these documents were part of the administrative record and because the documents in any event are not the proper subject of judicial notice. We address these contentions post. 3

Corporation (CCDC) and the Padres, L.P., concerning a ballpark district, the construction of a baseball park and a redevelopment project (together, ballpark project). The original property owned by Duea was designated for acquisition and redevelopment as a boutique hotel within the ballpark project. Parcels of real property adjacent to the original property were acquired by one or more public entities after formal condemnation actions were initiated. However, acquisition of the original property by formal condemnation proceedings was either stopped or delayed as a result of a series of third-party lawsuits filed against the ballpark project. In June 2000, the adjacent parcel that Duea leased from SDG&E was sold to JMI Realty, Inc. (JMI Realty), the master developer of the commercial redevelopment associated with the ballpark project. As a condition of that sale, JMI Realty required SDG&E to terminate the lease with Duea. CCDC reimbursed Duea for reasonable moving expenses in connection with the relocation of his business inventory. As found by the Board, "[i]n August 2000, JMI Realty, Inc., approached [Duea] to purchase [the original property] in order to carry out the MOU. [] On September 29, 2000, [Duea] sold the property to [JMIR-ACQ]. As part of the acquisition of the [original] property, [Duea] received compensation and reimbursement or payment for the business, the termination of the leaseback, and as a consequence the redevelopment of the premises. The sale property of the [original] property was $1,100,000.00. On or about October 3, 2000, a Grant Deed was recorded with the San Diego Recorder[']s Office, transferring title of the [original] property to [JMIR-ACQ]. 4

"On May 10, 2002, [Duea] purchased the property located at 2146 Main Street [in] San Diego . . . as replacement property for the property sold to [JMIR-ACQ]. The purchase price for the replacement property was $535,000.00. "On November 22, 2002, [Duea] filed with the San Diego County Assessor a Claim for Base Year TransferAcquisition by Public Entity, in order to transfer the tax base of the original property to the replacement property. The combined reassessed values of the original property for the 2000 tax year was $202,719.00. "On December 23, 2002, the Assessor notified [Duea] in writing that [his] application to transfer the base year value of the [original] property to the replacement property had been denied because the replaced property was not acquired by a public entity. "On April 19, 2003, [Duea] filed an application for equalization with the [Board]. [Duea] claimed [he] was entitled to a base year transfer because [he] had been displaced from the [original] property by eminent domain proceedings or their functional equivalent. "In June, 2003, the CCDC wrote to [Duea] and confirmed that the transfer of ownership of the [original] property to [JMIR-ACQ] was for use in connection with the Ballpark and Ancillary Projects, and that it would have condemned the property under its power of eminent domain if [Duea] had failed to execute the sale." A. Proceedings before the Board

David Duea testified and his legal counsel argued at the hearing before the Board that Duea was entitled to a transfer of base year value from the original to the replacement property because he was "displaced from the [original] property by the functional equivalent of eminent domain." (Italics added.) After receiving oral and documentary evidence and considering the arguments of the parties and their legal counsel, the Board in mid-December 2003 ruled as follows: "1. The above-referenced appeal application challenges the denial of [Duea's] Claim for Base Year Value Transfer-Acquisition By Public Entity by the [Assessor]. "2. [Duea] transferred/sold the [original] property to a private party and not to a public entity as required by the California Constitution, the Revenue and Taxation Code and the Property Tax Rules in order to transfer the base year value from the [original] property to a replacement property. "3. [Duea's] transfer/sale of the [original] property to a private party, even if made under the threat of eminent domain, is not one of the situations recognized by the California Constitution, the Revenue and Taxation Code and the Property Tax Rules allowing a transfer of the base year value of [the original] property to a replacement property. "4. The Assessor correctly followed Article XIIIA, Section 2(d) of the California Constitution, Section 68 of the Revenue and Taxation Code, and Property Tax Rule 462.500 in denying [Duea's] Claim.

"5. [Duea] is not entitled to have his Claim for Base Year Value Transfer granted as a result of the threat of the use of eminent domain by [CCDC]." B. Trial Court Proceedings Duea in 2008 filed an action in San Diego County Superior Court challenging the Board's ruling and seeking a refund of property taxes for 2002 and 2003. According to the trial court, Duea for the first time argued that when private party JMIR-ACQ acquired the original property it did so as an agent for the City, CCDC and/or the Agency, such that a sale of the original property to JMIR-ACQ was in fact a sale to a "public entity" within the meaning of section 2, subdivision (d). On Duea's motion, the trial court allowed the parties to waive trial and have the case decided by a motion for judgment procedure. The court granted Duea's request for judicial notice only with respect to the administrative record and the MOU,3 and concluded that Duea did not meet his burden to show the original property "was acquired by eminent domain [or] . . . by a public entity." The court reasoned as follows: "[P]laintiff [Duea] has not pled an exhaustion of remedies, nor has he shown that he has exhausted his remedies. . . . [P]laintiff never presented [his] legal theory that the sale to [JMIR-ACQ] is exempt under Revenue and Taxation Code section 68[] because [JMIR-ACQ] is the agent for a public entity under threat of condemnation. Generally,

3 As noted ante, the administrative record Duea lodged in the trial court ostensibly did not include pages 7 through 29 in exhibit 1, exhibit 7 and the last two pages of exhibit 8, all of which are included in Duea's motion to augment pending before this court. 7

issues not presented at an administrative hearing cannot be raised on review. [Citations.] More importantly, whether there is an agency relationship is a question of fact. [Citation.] "Even if the court ignored that plaintiff had not exhausted his remedies, there is substantial evidence to support the determination by the [Board] that plaintiff 'transferred/sold the [original] property to a private party and not to a public entity as required by the California Constitution, the Revenue and Taxation Code and the Property Tax Rules in order to transfer the base year value from the replaced property to a replacement property.['] [Citation.] Plaintiff asserts that under the [MOU], the Padres[,] LP, in conjunction with [CCDC] and the [Agency,] acquired plaintiff's land through its agent, [JMIR-ACQ], a limited liability company formed by JMI Realty . . . . "Plaintiff attaches the complete MOU, which was not part of the administrative record. This is improper, but even if the court reviews [the MOU it does] not assist plaintiff. . . . [] . . . . Significantly, plaintiff has shown no supplemental documents or documents within the administrative record which establishes that JMIR[-ACQ] was an agent for the City [of San Diego], the Agency or CDCC. There are no documents which establish that these public entities had any control over JMIR[-ACQ]." The trial court's order and judgment thereon also cited evidence from the administrative record in which CCDC, just two weeks before Duea sold the original property to JMIR-ACQ, described the transaction as a "private sale."

DISCUSSION As noted ante, section 2, subdivision (d), as implemented by section 684 and rule 462.500 of the Property Tax Rules and Regulations, 18 California Administrative Code (rule 462.500), exclude from the definition of "change in ownership" purchases of comparable replacement property if the taxpayer is displaced by "eminent domain proceedings, by acquisition by a public entity, or governmental action which has resulted in a judgment of inverse condemnation." The administrative record (even as augmented) clearly shows Duea relied solely on the "eminent domain proceedings," and not the "public entity," exception when he filed his claim with the Assessor for transfer of the base tax value from the original to the replacement property and when he appealed the Assessor's denial to the Board. The record also shows Duea at no time during the administrative proceedings alleged that JMIR-ACQ was acting as an "agent" for a "public entity" when JMIR-ACQ acquired the original property. A. The Trial Court Properly Refused to Conduct a Trial De Novo on the Facts

4 Section 68 provides in relevant part: "For purposes of Section 2 of Article XIIIA of the Constitution, the term 'change in ownership' shall not include the acquisition of real property as a replacement for comparable property if the person acquiring the real property has been displaced from property in this state by eminent domain proceedings, by acquisition by a public entity, or by governmental action which has resulted in a judgment of inverse condemnation." 9

On appeal, Duea does not challenge the Board's finding that JMIR-ACQ was in fact a private party, a finding that in any event is amply supported by evidence in the administrative record. (See Kaiser Center, Inc. v. County of Alameda (1987) 189 Cal.App.3d 978, 983.) Duea also does not challenge the legal conclusion of the Board, which rejected Duea's argument that the threat of eminent domain is the functional equivalent of "eminent domain proceedings" for purposes of section 2, subdivision (d). Duea instead argues the trial court erred when it refused to conduct a trial de novo on the facts pursuant to section 1605.5 and find JMIR-ACQ was an agent of the City, CCDC and/or the Agency when he acquired the original property. We reject Duea's argument that the trial court was required to conduct a trial de novo on the facts pursuant to section 1605.5. Indeed, subdivision (a)(1) of section 1605.5 provides in part that the county board "shall hear applications for a reduction in an assessment in cases in which the issue is whether or not property has been subject to a change in ownership . . . ." Subdivision (a)(3) of section 1605.5, on which Duea relies, states that subdivision (a) "shall not be construed to alter, modify, or eliminate the right of an applicant under existing law to have a trial de novo in superior court with regard to the legal issue of whether or not that property has undergone a change in ownership . . . ." (Italics added.) Section 1605.5 therefore does not, as Duea argues, entitle a party to a trial de novo on the facts. Moreover, our courts have addressed the scope of judicial review in cases such as the instant one: " 'The duty of determining the value of the property and the fairness of 10

the assessment is confided to the appropriate county board of equalization. Furthermore, in discharging this duty, the board's determination upon the merits of the controversy is conclusive; the taxpayer has no right to a trial de novo in the superior court to resolve conflicting issues of fact as to the taxable value of his property. [Citations.] The question presented to the superior court in such an action is whether there was evidence of sufficient substantiality before the board to justify the finding . . . .' 'The determination of the board will not be rejected by the reviewing court if there is in the record substantial evidence to support the board's determination.' [Citations.] "From a long and continuous line of California decisions, it is manifest that in a judicial review of the findings of a county board of equalization or a board of assessment appeals, the superior court is not permitted to independently weigh the evidence, but is required to apply the substantial evidence rule." (Hunt-Wesson Foods, Inc. v. County of Alameda (1974) 41 Cal.App.3d 163, 169.) In applying that rule, the "trial court does not weigh the evidence in the administrative record nor does it exercise its independent judgment; rather it reviews the entire record to determine if there is substantial evidence to support the findings of the administrative agency." (Ibid.) Thus, we conclude the trial court did not err when it applied the substantial evidence standard of review to the findings of the Board and refused to conduct a trial de novo on the facts. B. Duea's Requests to Supplement the Administrative Record

11

Duea argues the trial court erred when it granted Duea's request to supplement the record only with respect to the MOU and the administrative record, and denied that request with respect to all other documents. We are unable to review that decision for abuse of discretion (see Willis v. State of California (1994) 22 Cal.App.4th 287, 291) because Duea neither included that request nor the documents attached to it in the appellate record. (See Mountain Lion Coalition v. Fish & Game Com. (1989) 214 Cal.App.3d 1043, 1051, fn. 9 ["[I]f the record is inadequate for meaningful review, the appellant defaults and the decision of the trial court should be affirmed."].) Duea also argues this court should grant his request to supplement the record on appeal. We need not decide whether to grant or deny all or a portion of that request because even if we independently consider the supplemental documents not considered by the Board or the trial court, we still would conclude the Board properly denied Duea's claim there was no change in ownership for purposes of section 2, subdivision (d). To support his "public entity" argument, Duea primarily relies on exhibits 3, 4 and 5 in his motion to augment and argues these exhibits provide the legal authority on which this court should find that JMIR-ACQ acquired the original property as an agent of a public entity for purposes of section 2, subdivision (d). Briefly, exhibit 3 is a July 21, 2004 legal opinion by the chief counsel of the Board of Equalization (BOE) examining the issue of conforming then-rule 462.500 to the federal and state income tax laws governing tax relief for property subject to involuntary conversion under the threat of eminent domain. Exhibit 4 is a January 14, 2005 memorandum from BOE to county 12

assessors discussing changes to rule 462.500. Finally, exhibit 5 is a June 22, 2005 advisory opinion from BOE to Duea's legal counsel discussing new rule 462.500 and how that new rule could apply to Duea. As is clear from the record, exhibits 3, 4 and 5 address changes to rule 462.500 that became operative on December 18, 2004, and that apply only "to replacement property acquired on or after this date." (Italics added.) To the extent these exhibits discuss new rule 462.500, they clearly are not relevant to the issue at hand, where the original property was acquired in 2000. To the extent these exhibits discuss former rule 462.500, they are of limited utility in this appeal because these exhibits at best are ambiguous regarding "the law" as it existed before rule 462.500 was revised, including in 2002 when the Assessor denied Duea's claim under section 2, subdivision (d), and in 2003 when the Board affirmed that denial.5

5 Moreover, of the three exhibits the only one prepared by BOE is the January 14, 2005 memorandum to county assessors discussing the changes to rule 462.500 effective December 2004 (e.g., exhibit 4). In contrast, exhibit 3 was authored by chief counsel of BOE and discusses some of the proposed changes to former rule 462.500, including changes recommended by Duea's counsel in this appeal; and exhibit 5 was authored by tax counsel of BOE and expressly states that the views expressed in that letter are "advisory in nature," "not binding on any person or public entity" and are "based on present law" (e.g., new rule 462.500). (Italics added.) 13

What's more, portions of these exhibits actually support the Board's 2003 decision denying Duea relief under section 2, subdivision (d).6 Assuming arguendo the law as it existed before rule 462.500 was revised in December 2004 provided Duea the relief he seeks in this appeal (e.g., the acquisition of real property by a private party under threat of condemnation satisfies section 2, subdivision (d) if the private party was found to be an agent of a public entity), we decline on this record to make an agency finding. Initially, we agree with the trial court that generally issues not presented at an administrative hearing cannot be raised for the first time on review. (See Niles Freeman Equipment v. Joseph (2008) 161 Cal.App.4th 765, 787; see also Alameida v. State Personnel Bd. (2004) 120 Cal.App.4th 46, 52 [failure to raise defense of statute of limitations at the administrative hearing waives the issue on review of the administrative proceedings]; Hooks v. State Personnel Bd. (1990) 111 Cal.App.3d 572, 578 [in judicial review of decision by state agency upholding termination of employee, employee's failure to raise at the administrative hearing that employee's conviction was unexpungeable after lapse of two-year period barred employee from raising it in court].)

6 By way of example only, in exhibit 3 the chief counsel of BOE compared the federal and state income tax laws governing tax relief for property subject to involuntary conversion under the threat of eminent domain with former rule 462.500 and found that when a taxpayer is faced with the threat or imminence of eminent domain proceedings, the Internal Revenue Code "affords income tax relief to a taxpayer who sells real property to a third party unrelated to the public entity with the power of condemnation", but "a sale to such a third party would not qualify for the transfer of the base year value of the property sold under California law." (Italics added.) 14

Here, the record shows that during the administrative proceedings Duea did not raise agency or argue that JMIR-ACQ acted as an agent of one or more of the public entities involved in the ballpark project when he acquired the original property. Clearly, the Board, with its expertise and its ability to exercise quasi-judicial powers delegated to it by the California Constitution (see Steinhart v. County of Los Angeles (2010) 47 Cal.4th 1298, 1307), was in a far superior position than the trial court and this court to apply the then-applicable law on this issue and make all necessary factual determinations from the evidence in the administrative record. (See Citizens for Open Government v. City of Lodi (2006) 144 Cal.App.4th 865, 874 [the "primary purpose" of the exhaustion of administrative remedies doctrine " 'is to afford administrative tribunals the opportunity to decide in a final way matters within their area of expertise prior to judicial review.' "].) Duea contends, albeit confusingly, that the exhaustion of administrative remedies doctrine is inapplicable here because Duea allegedly was entitled under section 1605.5 to a trial de novo on the facts and because the interpretation of section 2, subdivision (d) involves a pure question of law. However, as we noted ante a party is not entitled under section 1605.5 to a trial de novo on the facts. In addition, agency is generally a question of fact that must be decided by a trier of fact. (See Garlock Sealing Technologies, LLC v. NAK Sealing Technologies Corp. (2007) 148 Cal.App.4th 937, 965.) Given the uncertainty in the law as it existed before rule 462.500 was amended in 2004, and given the evidence in the record (including the supplemental documents) 15

showing there are conflicting inferences on the issue of whether JMIR-ACQ was acting as the agent of one or more public entities when it acquired the original property from Duea in 2000, we conclude Duea was required to exhaust his administrative remedies on this issue before seeking relief in court.7 (See Citizens for Open Government v. City of Lodi, supra, 144 Cal.App.4th at p. 874 [" 'The essence of the exhaustion doctrine is the public agency's opportunity to receive and respond to articulated factual issues and legal theories' " prior to judicial review], italics added.)8

7 For example, in an August 24, 2000 letter (e.g., exhibit 8) JMIR-ACQ informed Duea that JMI Realty was the master developer of the commercial redevelopment associated with the ballpark project and that JMIR-ACQ was "working with" JMI Realty to "implement the overall development plan." While this letter may, on the one hand, support the inference of an agency relationship between JMIR-ACQ and JMI Realty, on the other hand it also supports the opposite inference, namely: there was no agency relationship between the two entities, inasmuch as JMIR-ACQ was merely "working with" JMI Realty. 8 Given our decision, we conclude it is unnecessary to reach the issue of whether Duea timely filed his claim for refund of taxes paid in 2002. 16

DISPOSITION The judgment for County is affirmed. County is entitled to its costs of appeal.

BENKE, Acting P. J. WE CONCUR:

HALLER, J.

McINTYRE, J.

17

Filed 3/27/12

CERTIFIED FOR PUBLICATION COURT OF APPEAL, FOURTH APPELLATE DISTRICT DIVISION ONE STATE OF CALIFORNIA

DAVID J. DUEA, as Trustee, etc., Plaintiff and Appellant, v. COUNTY OF SAN DIEGO, Defendant and Respondent. THE COURT:

D058333

(Super. Ct. No. 37-2008-00076417CU-JR-CTL)

By order of March 13, 2012, this court denied a request for publication of the opinion filed February 29, 2012. Upon reconsideration, the court wishes to certify the opinion for publication. The attorneys of record are: James Ellis Schneider, LL.M., Inc., and James Ellis Schneider for Plaintiff and Appellant. Thomas E. Montgomery, County Counsel, and Walter Joseph DeLorrell III, Deputy County Counsel, for Defendant and Respondent. ________________ BENKE, Acting P.J. Copies to: All parties

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- BMG Monroe I, LLC v. Village of Monroe, No. 22-1047 (2d Cir. Feb. 16, 2024)Document21 pagesBMG Monroe I, LLC v. Village of Monroe, No. 22-1047 (2d Cir. Feb. 16, 2024)RHTNo ratings yet

- Petition For Writ of Certiorari, G-Max MGMT, Inc. v. State of New York, No. 23-1148 (U.S. Apr. 18, 2024)Document46 pagesPetition For Writ of Certiorari, G-Max MGMT, Inc. v. State of New York, No. 23-1148 (U.S. Apr. 18, 2024)RHTNo ratings yet

- Petition For A Writ of Certiorari, Romero v. Shih, No. 23-1153 (U.S. Apr. 23, 2024)Document296 pagesPetition For A Writ of Certiorari, Romero v. Shih, No. 23-1153 (U.S. Apr. 23, 2024)RHTNo ratings yet

- Lyman v. Lanser, No. 23-P-73 (Mass. App. Ct. Mar. 7, 2024)Document20 pagesLyman v. Lanser, No. 23-P-73 (Mass. App. Ct. Mar. 7, 2024)RHTNo ratings yet

- Ontario Inc. v. City of Stratford, No. OLT-22-002455 (Ont. Land Trib. Jan. 11, 2024)Document64 pagesOntario Inc. v. City of Stratford, No. OLT-22-002455 (Ont. Land Trib. Jan. 11, 2024)RHTNo ratings yet

- Petition For A Writ of Certiorari, Sawtooth Mountain Ranch, LLC v. U.S. Forest SVC., No. 22-1103 (U.S. Apr. 9, 2024)Document71 pagesPetition For A Writ of Certiorari, Sawtooth Mountain Ranch, LLC v. U.S. Forest SVC., No. 22-1103 (U.S. Apr. 9, 2024)RHTNo ratings yet

- Nicholson v. United States, No. 23-843 (Fed. Cl. Mar. 13, 2024)Document16 pagesNicholson v. United States, No. 23-843 (Fed. Cl. Mar. 13, 2024)RHTNo ratings yet

- HBC Victor LLC v. Town of Victor, No. 23-01347 (N.Y. App. Div. Mar. 22, 2024)Document4 pagesHBC Victor LLC v. Town of Victor, No. 23-01347 (N.Y. App. Div. Mar. 22, 2024)RHTNo ratings yet

- Brief of Amicus Curiae Pacific Legal Foundation, Town of Apex v. Rubin, No. 206PA21 (N.C. Feb. 8, 2024)Document25 pagesBrief of Amicus Curiae Pacific Legal Foundation, Town of Apex v. Rubin, No. 206PA21 (N.C. Feb. 8, 2024)RHTNo ratings yet

- Devillier v. Texas, No. 22-913 (U.S. Apr. 16, 2023)Document9 pagesDevillier v. Texas, No. 22-913 (U.S. Apr. 16, 2023)RHTNo ratings yet

- Romero v. Shih, No. S275023 (Cal. Feb. 1, 2024)Document33 pagesRomero v. Shih, No. S275023 (Cal. Feb. 1, 2024)RHTNo ratings yet

- Petition For Review, Mojave Pistachios, LLC v. Superior Court, No. S284252 (Cal. Mar. 19, 2024)Document84 pagesPetition For Review, Mojave Pistachios, LLC v. Superior Court, No. S284252 (Cal. Mar. 19, 2024)RHTNo ratings yet

- Bar OrderDocument39 pagesBar OrderShea CarverNo ratings yet

- Agency of Transportation v. Timberlake Associates, LLC, No. 23-AP-059 (Vt. Mar. 2024)Document14 pagesAgency of Transportation v. Timberlake Associates, LLC, No. 23-AP-059 (Vt. Mar. 2024)RHTNo ratings yet

- Ocean State Tactical, LLC v. Rhode Island, No. 23-1072 (1st Cir. Mar. 7, 2024)Document34 pagesOcean State Tactical, LLC v. Rhode Island, No. 23-1072 (1st Cir. Mar. 7, 2024)RHTNo ratings yet

- Maunalua Bay Beach Ohana 28 v. State of Hawaii, No. CAAP-19-0000776 (Haw. App. Mar. 18, 2024)Document24 pagesMaunalua Bay Beach Ohana 28 v. State of Hawaii, No. CAAP-19-0000776 (Haw. App. Mar. 18, 2024)RHTNo ratings yet

- Kingston Rent Control Appellate Court DecisionDocument9 pagesKingston Rent Control Appellate Court DecisionDaily FreemanNo ratings yet

- Statement of Justice Thomas Respecting The Denials of Certiorari, 74 Pinehurst, LLC v. New York, No. 23-1130 (U.S. Feb. 202, 2024)Document2 pagesStatement of Justice Thomas Respecting The Denials of Certiorari, 74 Pinehurst, LLC v. New York, No. 23-1130 (U.S. Feb. 202, 2024)RHTNo ratings yet

- Gerlach v. Rokita, No 23-1792 (7th Cir. Mar. 6, 2024)Document12 pagesGerlach v. Rokita, No 23-1792 (7th Cir. Mar. 6, 2024)RHTNo ratings yet

- Back To The Future of Land Use Regulation, 7 Brigham-Kanner Prop. Rts. Conf. J. 109 (2018)Document18 pagesBack To The Future of Land Use Regulation, 7 Brigham-Kanner Prop. Rts. Conf. J. 109 (2018)RHTNo ratings yet

- Arlington Heights Police Pension Fund Et Al. v. Pritzker Et Al.Document11 pagesArlington Heights Police Pension Fund Et Al. v. Pritzker Et Al.CrainsChicagoBusinessNo ratings yet

- Call For Papers: "Too Far: Imagining The Future of Regulatory Takings"Document2 pagesCall For Papers: "Too Far: Imagining The Future of Regulatory Takings"RHTNo ratings yet

- State Ex Rel. AWMS Water Solutions, LLC v. Mertz, No. 2023-0125 (Ohio Jan. 24, 2024)Document12 pagesState Ex Rel. AWMS Water Solutions, LLC v. Mertz, No. 2023-0125 (Ohio Jan. 24, 2024)RHTNo ratings yet

- Watson Memorial Spiritual Temple of Christ v. Korban, No. 2023-CA-0293 (La. Ct. App. Dec. 13, 2023)Document17 pagesWatson Memorial Spiritual Temple of Christ v. Korban, No. 2023-CA-0293 (La. Ct. App. Dec. 13, 2023)RHTNo ratings yet

- Watson Memorial Spiritual Temple of Christ v. Korban, No. 2023-CA-0293 (La. Ct. App. Dec. 13, 2023)Document17 pagesWatson Memorial Spiritual Temple of Christ v. Korban, No. 2023-CA-0293 (La. Ct. App. Dec. 13, 2023)RHTNo ratings yet

- City and Cnty. of Honolulu v. Victoria Ward, LTD., No. SCAP-22-0000335 (Haw. Dec. 29, 2023)Document92 pagesCity and Cnty. of Honolulu v. Victoria Ward, LTD., No. SCAP-22-0000335 (Haw. Dec. 29, 2023)RHTNo ratings yet

- Brief For Petitioner, Sheetz v. County of El Dorado, No. 22-1074 (U.S. Nov. 13, 2023)Document57 pagesBrief For Petitioner, Sheetz v. County of El Dorado, No. 22-1074 (U.S. Nov. 13, 2023)RHTNo ratings yet

- Agnis v. City of TubronDocument9 pagesAgnis v. City of TubronSAI CHAITANYA YEPURINo ratings yet

- Et Al.Document28 pagesEt Al.RHTNo ratings yet

- Gideon Kanner, Eminent Domain Projects That Didn't Work Out, 12 Brigham-Kanner Property Rts. J. 171 (2023)Document62 pagesGideon Kanner, Eminent Domain Projects That Didn't Work Out, 12 Brigham-Kanner Property Rts. J. 171 (2023)RHT100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Rs-2n Midterm Exam 2nd Semester 2020-2021Document4 pagesRs-2n Midterm Exam 2nd Semester 2020-2021Norhaina AminNo ratings yet

- 5 Brothers 1 Mother AlphaDocument4 pages5 Brothers 1 Mother Alphavelo67% (3)

- Acc Topic 8Document2 pagesAcc Topic 8BM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- Texas City, TX: Amanda EnglerDocument27 pagesTexas City, TX: Amanda EnglerPrajay ShahNo ratings yet

- Chapter 2-Futurecast Applied To TourismDocument5 pagesChapter 2-Futurecast Applied To TourismAsya KnNo ratings yet

- TFL Fares StudyDocument33 pagesTFL Fares StudyJohn Siraut100% (1)

- RHP Final Reviewer Galing Sa PDF Ni SirDocument37 pagesRHP Final Reviewer Galing Sa PDF Ni SirAilene PerezNo ratings yet

- Module 1 - Basic Topology and Router Setup: The Following Will Be The Common Topology Used For The First Series of LabsDocument9 pagesModule 1 - Basic Topology and Router Setup: The Following Will Be The Common Topology Used For The First Series of LabsHassan AwaisNo ratings yet

- OB Case Study Jack StackDocument12 pagesOB Case Study Jack StackPratik Sharma100% (1)

- Assessment WPS OfficeDocument17 pagesAssessment WPS OfficeMary Ann Andes CaruruanNo ratings yet

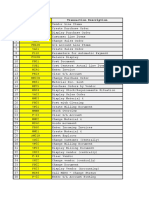

- # Transaction Code Transaction DescriptionDocument6 pages# Transaction Code Transaction DescriptionVivek Shashikant SonawaneNo ratings yet

- Network Protocol Analyzer With Wireshark: March 2015Document18 pagesNetwork Protocol Analyzer With Wireshark: March 2015Ziaul HaqueNo ratings yet

- Digest-China Banking Corp. v. CIRDocument9 pagesDigest-China Banking Corp. v. CIRjackyNo ratings yet

- MKT4220 JAN2021 Individual Assessment 30%Document3 pagesMKT4220 JAN2021 Individual Assessment 30%suvendran MorganasundramNo ratings yet

- WT Unit IDocument69 pagesWT Unit ISreenivasulu reddyNo ratings yet

- Study Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Document1 pageStudy Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Rajib Dahal50% (2)

- Sartre On FreedomDocument32 pagesSartre On Freedomolmhrs libraryNo ratings yet

- Chapter TwoDocument2 pagesChapter TwoQuilay Noel LloydNo ratings yet

- Skate Helena 02-06.01.2024Document1 pageSkate Helena 02-06.01.2024erkinongulNo ratings yet

- Tes Sharing Agreement 1Document2 pagesTes Sharing Agreement 1Chesca UrietaNo ratings yet

- Eugene and John Jilka v. Saline County, Kansas, Agricultural Stabilization and Conservation Committee, Its Review Committee, and United States of America, 330 F.2d 73, 10th Cir. (1964)Document2 pagesEugene and John Jilka v. Saline County, Kansas, Agricultural Stabilization and Conservation Committee, Its Review Committee, and United States of America, 330 F.2d 73, 10th Cir. (1964)Scribd Government DocsNo ratings yet

- Same Tractor Silver 80-85-90 105 160 180 Parts CatalogDocument17 pagesSame Tractor Silver 80-85-90 105 160 180 Parts Catalogalicebrewer210188ktm100% (64)

- 5.2.1 List of Placed Students VESIT NAAC TPCDocument154 pages5.2.1 List of Placed Students VESIT NAAC TPCRashmi RanjanNo ratings yet

- 2.-A-Journal & Ledger - QuestionsDocument3 pages2.-A-Journal & Ledger - QuestionsLibrarian 19750% (1)

- Indira Gandhi BiographyDocument4 pagesIndira Gandhi BiographySocial SinghNo ratings yet

- Front Desk Staff-Giezel Bell Staff - Marc Client - Augustus Friend - AthenaDocument4 pagesFront Desk Staff-Giezel Bell Staff - Marc Client - Augustus Friend - Athenagener magbalitaNo ratings yet

- Essential Intrapartum and Newborn CareDocument25 pagesEssential Intrapartum and Newborn CareMaria Lovelyn LumaynoNo ratings yet

- Introduction To Marketing - KotlerDocument35 pagesIntroduction To Marketing - KotlerRajesh Patro0% (1)

- ABC SCURP - Course OverviewDocument22 pagesABC SCURP - Course OverviewMaru PabloNo ratings yet

- IRA Green BookDocument26 pagesIRA Green BookJosafat RodriguezNo ratings yet