Professional Documents

Culture Documents

Gann’s Square of Nine Tool

Uploaded by

Dilip ValunjOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gann’s Square of Nine Tool

Uploaded by

Dilip ValunjCopyright:

Available Formats

Ganns Square of Nine

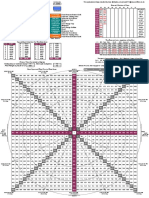

By Jason Sidney Ganns Square of Nine is one of the more exotic tools he incorporated in his trading, and while this is a relatively daunting tool that requires a fare amount of practice to master, it can certainly add a whole new dimension to your analysis. Gann never claimed to be the inventor of this tool; however he certainly developed it and refined it to be used in conjunction with financial markets. The Square of Nine has origins that date back to early Egyptian days, and when looking at it one gets the impression your actually viewing a pyramid looking down from its very top or apex and then looking down further to its actual base. It is said Gann actually discovered the Square of Nine during his travels in India, which he saw being used as a calculator by traders in the region selling their goods. Gann being someone with a mathematical mind recognised its value and saw its potential to be used in conjunction with financial markets. He then refined it specifically for that purpose, and what great job he did! The Square of Nine is mainly used to confirm the significance of recent high and low points in whatever market you might be interested in. It should never be used to pick tops and bottoms; however it can provide additional evidence to help confirm the significance of a recent high or low point in the market when a break of trend is then later confirmed. The Square of Nine is similar to a wheel or a circle, it starts with the number one in the centre of the circle and then radiates out to the first square of nine. Starting with the number two to the left of the centre or the number one. It then spirals clockwise to the number nine, to form its first rotation around the Square of Nine. This rotation then continues by shifting one unit to the left of nine and will commence the next rotation at the number ten and then around to the number twenty. This spiralling expansion of numbers just continues out until you end up with a grid of numbers, relevant in price to the market your trading. The Square of Nine is essentially a time and price calculator, and calculates the square root of numbers, both odd and even numbers as well as their midpoints. It also looks for both time and price alignments from a specific starting point or price level E.g. a significant high or low point in a market. If you were to look at the numbers on the grid running down to the bottom left hand corner on the Square of Nine, you will find they are the square root of odd numbers E.g. 5x5 = 25. If you were to look at the numbers running up to the top right hand corner on the Square of Nine you will find they are the square root of even numbers e.g. 4x4 = 16. If you then look at the numbers running down to the bottom right hand corner on the Square of Nine you would find the midpoint between the squares of odd and even numbers. Using the numbers 16 and 25 as an example of our odd and even numbers you will find the number 21 representing their midpoint.

The numbers that fall on the blue lines form whats known as the Cardinal Cross and the numbers that fall on the red lines running into the corners of the square, form whats known as the Ordinal Cross. Any numbers that fall on these lines are said to act as significant support and resistance levels. So the Square of nine is an interesting arrangement of numbers that have a specific order and can be used in many different ways. The interesting thing is that with the use of a simple Excel spreadsheet you can also change the value of the middle or centre number to represent the exact value of an actual high or low price for whatever market youre interested in. This number can be a positive number for lows which will spiral upwards in price or a negative number for highs which will spiral downwards in price. In this example Im going to be using the all time high of the Australian SPI 200 as the middle number in the centre of the square which is 3500, and it occurred on the 7/3/2002. What Im going to show you now is how we can use the square of nine to help qualify the significance of two of the major lows that occurred as part of this major bear market we have all been witnessing. The following chart is a weekly chart and the points of interest on this chart have been labelled with the relevant prices and dates marked on the chart, please make a note of these because I will be discussing them in more detail shortly.

The following chart is the Square of Nine using the all time high of the Australian SPI 200 as the middle number in the centre of the square which is 3500, and it occurred on the 7/3/2002. Because its a high, this will be a negative number and will be entered as -3500 and will spiral down in value. What I have done here is colour the square where the first significant low occurred which was 2889 - 10/10/2002, and what we are looking for here is to see where the price of the low sits in relation to the Square of Nine. In this example we can see that the price of 2889 sits only one square away from the Cardinal Cross which are the numbers highlighted in blue. As mentioned previously all numbers that fall on the Ordinal Cross or the Cardinal Cross are considered to be important support and resistance levels. So the Square of Nine in this example is suggesting that the price of 2889 is likely to be an important support level and a reasonably important low.

But the Square of Nine can go even further to help qualify the significance of a high or low point. We have already established the price of 2889 as being reasonably significant as a possible support level. What we can do now is check to see if the Date of this low is also important using the Square of Nine. So in order to do that all we need to do is select the Time page on the Square of Nine spreadsheet and then simply enter the date of the high of 3500 which occurred on the 7/3/2002 into the centre, or middle of the Square of Nine. Now that we have done that, all we need to do is check to see if the date of the low of 2889 - 10/10/2002 sits anywhere interesting in relation to the square of nine. So, on the following Square of Nine Time chart we can see the date of 10/10/2002 is sitting rite on the Cardinal Cross and is therefore representing a significant time frame at our significant support level of 2889. This is known as an alignment in both time and price, and suggests a high probability turning point. If we were to now look at the most recent low that has occurred on the Australian SPI 200 you will find a reasonably significant low of 2679 13/3/2003. Looking at the same Square of Nine Time chart we can see the date of this low occurring on the 13/3/2003 can also be found on the Cardinal Cross, and is only one square out! So the Square of Nine Time chart is suggesting the time frame in which this low occurred is significant, and is therefore a low to watch for a potential change in trend.

Ideally always look for both a time and a price alignment to come together to produce a higher probability turning point as per the first example given. However individual price levels or time frames found occurring on the Ordinal Cross or Cardinal Cross should also be noted and watched for potential turning points. Learning to use the Square of Nine can get a whole lot more complicated than that, and Ive really just given you a simple lesson on it here in this article. Some of the other, more advanced techniques you can apply to the Square of Nine may very well become the subject of a future lesson. Best Regards, Jason Sidney Managing Director Market Insight Pty Ltd http://www.marketinsight.com.au

DISCLAIMER: Market Insight Pty Ltd believes the information provided within the Analyst Insight newsletter is reliable. While every care has been taken to ensure accuracy, the information is furnished to recipients, with no warranty as to the completeness and accuracy of its contents, and on the condition that any errors or omissions shall not be made the basis for any claim, demand or cause for action. All rights are reserved. No part of the text contained within Analyst Insight may be reproduced in any form or by any means without the permission of the author. All information provided by Market Insight Pty Ltd is for educational purposes only. Neither Market Insight Pty Ltd, or anyone else involved in the production of the information found within the Analyst Insight newsletter, will be liable for any liability, loss or damage directly or indirectly caused, or believed to be caused, by this information. It should also be noted that prior examples are not indicative of, and have no bearing or guarantee of the future performance of the techniques outlined within the Analyst Insight newsletter. The techniques outlined within Analyst Insight may result in large losses and no assurances are given that you will not incur such losses. No part of the Analyst Insight newsletter contains specific trading advice, stated or implied, nor is it an invitation to trade. Market Insight Pty Ltd is an organization designed to assist traders and investors to become more knowledgeable and independent. The giving of advice is therefore contrary to the objectives of the company. Traders requiring such advice should contact a licensed advisor. The directors and associates of Market Insight Pty Ltd are NOT licensed trading or investment advisors. By maintaining your subscription to Analyst Insight, you acknowledge that you understand and accept the contents of this disclaimer.

You might also like

- Jeff Cooper Square of 9 EbookDocument57 pagesJeff Cooper Square of 9 EbookKitNo ratings yet

- How to analyze financial markets using Gann's Square of Nine techniqueDocument20 pagesHow to analyze financial markets using Gann's Square of Nine techniquemy690717No ratings yet

- Double in A Day Excel Model: Input SettingsDocument2 pagesDouble in A Day Excel Model: Input SettingsAndry Novandri As'ariNo ratings yet

- Google Book Search ProjectDocument275 pagesGoogle Book Search Project5ofthemNo ratings yet

- Ashman, Terry (Article 1998) Trend Changes and Market Entries According To GannDocument9 pagesAshman, Terry (Article 1998) Trend Changes and Market Entries According To GannhofrathNo ratings yet

- Trading Days or Calendar Days Allow Upto 4 Degrees Price Range CTC, HTL, CTH or CTLDocument3 pagesTrading Days or Calendar Days Allow Upto 4 Degrees Price Range CTC, HTL, CTH or CTLpalharjeetNo ratings yet

- P&F Wyckoff Price ProjectionsDocument4 pagesP&F Wyckoff Price ProjectionsUma MaheshwaranNo ratings yet

- 4 Angles de Gann (2x3) English 27Document6 pages4 Angles de Gann (2x3) English 27Borsa SırlarıNo ratings yet

- Gann - Enthios CalculatorDocument13 pagesGann - Enthios CalculatorRaghavendra KNo ratings yet

- TTTDocument13 pagesTTTTrader YesNo ratings yet

- Gann High-Low Activator HistogramDocument6 pagesGann High-Low Activator HistogramNeoHoodaNo ratings yet

- Everything You Need To Know About Moving AveragesDocument24 pagesEverything You Need To Know About Moving Averagesmohd haiqalNo ratings yet

- The Tunnel Method BY VegasDocument12 pagesThe Tunnel Method BY VegasFotis Papailias100% (2)

- Saurabh Gann PDFDocument11 pagesSaurabh Gann PDFArmJAXDNo ratings yet

- FTI Fibonacci LevelsDocument6 pagesFTI Fibonacci LevelsSundaresan SubramanianNo ratings yet

- Gann Breadth PDFDocument12 pagesGann Breadth PDFukxgerardNo ratings yet

- Show PDFDocument61 pagesShow PDFelisaNo ratings yet

- Gann Grids Ultra 5.0 Charting ApplicationDocument116 pagesGann Grids Ultra 5.0 Charting ApplicationvanajaNo ratings yet

- The Tillman Cycle Projection MethodDocument5 pagesThe Tillman Cycle Projection MethodssNo ratings yet

- Gann Fans PDFDocument5 pagesGann Fans PDFAnonymous yPWi8p3KkANo ratings yet

- MurreyMathCalculator, Version 1.3Document3 pagesMurreyMathCalculator, Version 1.3ChomoolungmaNo ratings yet

- Fibonaccicalculater 1Document1 pageFibonaccicalculater 1Gaurav GargNo ratings yet

- Tradesignal Info EN PDFDocument39 pagesTradesignal Info EN PDFSaeed EbrahimijamNo ratings yet

- Compass directions and angles over timeDocument16 pagesCompass directions and angles over timeMukesh BhambhaniNo ratings yet

- Gann Theory and Support and ResistanceDocument4 pagesGann Theory and Support and ResistanceChung NguyenNo ratings yet

- Understanding the Gann Theory and Its Technical Analysis ToolsDocument1 pageUnderstanding the Gann Theory and Its Technical Analysis ToolsRON 7No ratings yet

- FIBONACCI Retracement Calculator - NiftyGlobalDocument3 pagesFIBONACCI Retracement Calculator - NiftyGlobalpraschNo ratings yet

- 5 Min 4R SystemDocument10 pages5 Min 4R SystemdiglemarNo ratings yet

- Gann 2Document9 pagesGann 2shanmugamNo ratings yet

- North wind direction and speed chartDocument1 pageNorth wind direction and speed chartMahen DiranNo ratings yet

- Wave Pattern - Elliot WayDocument14 pagesWave Pattern - Elliot WayAshok Kumar100% (1)

- Gann CalculationDocument3 pagesGann Calculationindra sharmaNo ratings yet

- Gann Hilo MA Cross EA Strategy GuideDocument6 pagesGann Hilo MA Cross EA Strategy GuidebenNo ratings yet

- Gap UP (Intraday)Document51 pagesGap UP (Intraday)pk singhNo ratings yet

- Arend, Douglas - Gann Analysis On Point and Figure ChartsDocument6 pagesArend, Douglas - Gann Analysis On Point and Figure Chartsezmerelda0% (1)

- How To Calculate Tomorrow's Probable Trading RangeDocument6 pagesHow To Calculate Tomorrow's Probable Trading RangeChenanda ChengaNo ratings yet

- 03.the I3t3 Mega Webinar 2018 - Student ReviewDocument50 pages03.the I3t3 Mega Webinar 2018 - Student ReviewRohit Sharma100% (1)

- GannDocument29 pagesGannThiru ShankarNo ratings yet

- Power of OptionsDocument11 pagesPower of OptionsNilayNo ratings yet

- Spectrum & CicliDocument106 pagesSpectrum & CicliDinesh CNo ratings yet

- Beat the Market by Knowing What Stocks to Buy and SellDocument9 pagesBeat the Market by Knowing What Stocks to Buy and SellPrashantKumarNo ratings yet

- Glycemic Index of Foods: A Physiological Basis For Carbohydrate Exchange3Document5 pagesGlycemic Index of Foods: A Physiological Basis For Carbohydrate Exchange3brutalnaprepelicaNo ratings yet

- Bitcoin Price PredictionDocument3 pagesBitcoin Price PredictionAlaa' Deen ManasraNo ratings yet

- 360 Degree Price Analysis: 180 Degrees 1/2 110.68Document3 pages360 Degree Price Analysis: 180 Degrees 1/2 110.68kselvakumaran9917No ratings yet

- Volume by PriceDocument26 pagesVolume by PriceshivasharesNo ratings yet

- Dcast Capital DSTDocument21 pagesDcast Capital DSTGerVNo ratings yet

- Key Market Reversal Times During Regular Trading HoursDocument2 pagesKey Market Reversal Times During Regular Trading HoursGer DonnellyNo ratings yet

- Profitable Mathematical Trading That Works in The Market Including BitcoinDocument3 pagesProfitable Mathematical Trading That Works in The Market Including BitcoinGann TradingNo ratings yet

- Fortune+manual FinalDocument109 pagesFortune+manual FinalZendu BalmNo ratings yet

- Currency 101 - Safal NiveshakDocument4 pagesCurrency 101 - Safal NiveshakArjun GhoseNo ratings yet

- Secrets of Financial Astrology by Kenneth MinDocument2 pagesSecrets of Financial Astrology by Kenneth MinaachineyNo ratings yet

- Full Guide On Support and Resistance: by Crypto VIP SignalDocument11 pagesFull Guide On Support and Resistance: by Crypto VIP SignalSaroj PaudelNo ratings yet

- CURRENT PRICE 31211 175 GANN ANGLEDocument5 pagesCURRENT PRICE 31211 175 GANN ANGLEHARSHAD BHANGDIYANo ratings yet

- FIBODocument27 pagesFIBOPragnesh ShahNo ratings yet

- Gann LevelDocument44 pagesGann LevelViji SambasivamNo ratings yet

- Astro Based Turning Points Known in AdvanceDocument31 pagesAstro Based Turning Points Known in AdvanceAnonymous Xr543oEDCZ100% (1)

- How Money Is Made in Security Investments by Henry HallDocument253 pagesHow Money Is Made in Security Investments by Henry Hallraimulis1No ratings yet

- Cbse Test Paper-03: MATHEMATICS (Class-10) Chapter 15. ProbabilityDocument1 pageCbse Test Paper-03: MATHEMATICS (Class-10) Chapter 15. ProbabilitySulaiman KhanNo ratings yet

- Mathematics Form 1 Chapter 1Document7 pagesMathematics Form 1 Chapter 1Muhd Naqib67% (27)

- Miaa 320 Question AnalysisDocument3 pagesMiaa 320 Question Analysisapi-245619457No ratings yet

- Logical Reasoning Practice Questions (Ag Extra-1) SolutionsDocument19 pagesLogical Reasoning Practice Questions (Ag Extra-1) SolutionsHimanshu NishadNo ratings yet

- Number System and Counting Atreya RoyDocument26 pagesNumber System and Counting Atreya RoyPramod BeriNo ratings yet

- DeloitteDocument17 pagesDeloitteKARTHIKEYAN100% (1)

- Computer Architecture PDFDocument69 pagesComputer Architecture PDFAbhishekNo ratings yet

- C.C++ - Assignment - Problem ListDocument7 pagesC.C++ - Assignment - Problem ListKaushik ChauhanNo ratings yet

- F.Y.M.Sc. (CS) Sem-I AI Pract SlipDocument22 pagesF.Y.M.Sc. (CS) Sem-I AI Pract Slipsatishkokane.ydpNo ratings yet

- PermutationDocument3 pagesPermutationAshok PradhanNo ratings yet

- Olympiad Training For Individual Study: Syllabus: Last Updated May 8, 2018Document11 pagesOlympiad Training For Individual Study: Syllabus: Last Updated May 8, 2018YahooNo ratings yet

- Grade 8 Mathematics Answer Key: WWW - Nces.ed - Gov/nationsreportcard/itmrlsDocument39 pagesGrade 8 Mathematics Answer Key: WWW - Nces.ed - Gov/nationsreportcard/itmrlsJoyce MontimanNo ratings yet

- SCMHRD Mock-1 (Solutions and Answer Keys)Document16 pagesSCMHRD Mock-1 (Solutions and Answer Keys)catxclusiveNo ratings yet

- Arithmetic Sequence Arithmetic Sum Arithmetic Mean: Maricel T. Mas T-I/ Lipay High SchoolDocument31 pagesArithmetic Sequence Arithmetic Sum Arithmetic Mean: Maricel T. Mas T-I/ Lipay High SchoolDominic Dalton CalingNo ratings yet

- Competitive C ProgramsDocument36 pagesCompetitive C ProgramsNAYAN SHIVAMNo ratings yet

- 2009 June, P1 MSDocument12 pages2009 June, P1 MSMohammed Salman100% (3)

- Problem Set 1 SolutionsDocument6 pagesProblem Set 1 SolutionsBenjamin MullenNo ratings yet

- Ml8 CH 8 SolutionsDocument75 pagesMl8 CH 8 Solutionshk2784leeNo ratings yet

- Worksheet 1. Speaking MathematicallyDocument1 pageWorksheet 1. Speaking MathematicallyLara Ysabel PleñagoNo ratings yet

- Guide To Series and Sequences... Arithmetic and Geometric - GMAT Math QuestiDocument10 pagesGuide To Series and Sequences... Arithmetic and Geometric - GMAT Math QuestiAloma FonsecaNo ratings yet

- Year 2 and 3 Mixed Age Spring Block 1 DivisionDocument32 pagesYear 2 and 3 Mixed Age Spring Block 1 DivisionGuenNo ratings yet

- 2nd Grade Math Lesson 1Document5 pages2nd Grade Math Lesson 1api-278561941No ratings yet

- Apti QuestionsDocument6 pagesApti Questionsamit govilkarNo ratings yet

- Odd NumbersDocument2 pagesOdd NumbersandrewscottpersonsNo ratings yet

- Binary CodeDocument53 pagesBinary CodeMohit SharmaNo ratings yet

- Mathematical ReasoningDocument16 pagesMathematical ReasoningRafidah RamliNo ratings yet

- Parity bit generator and checker circuit explainedDocument16 pagesParity bit generator and checker circuit explainedPrateek YadavNo ratings yet

- Diktat Olimpiade Matematika IDocument154 pagesDiktat Olimpiade Matematika IDidik Krisdiyanto100% (2)

- TOP 50 Input-Output Questions For Clerk Mains ExamsDocument17 pagesTOP 50 Input-Output Questions For Clerk Mains ExamsSiddharth Gupta100% (3)