Professional Documents

Culture Documents

Market Outlook 2nd April 2012

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Outlook 2nd April 2012

Uploaded by

Angel BrokingCopyright:

Available Formats

Market Outlook

India Research

April 2, 2012

Dealers Diary

Domestic Indices Chg (%) (Pts) (Close)

The Indian markets are expected to open flat with a negative bias tracking cues from SGX Nifty which is trading marginally in the red. However, most of the Asian indices are trading higher in the range of 0.2-0.8%. The economic data released by various US agencies was a mixed bag. While on a positive note, personal spending in February 2012 was better than estimates at 0.8%, personal income growth came in below estimates at 0.2% for the month. Further, consumer sentiment has showed an unexpected improvement in the month of March. Thus, while Dow Jones and S&P 500 closed higher by 0.5% and 0.4% respectively, Nasdaq closed marginally lower by 0.1%. The major European markets edged up higher on Friday. On the domestic front, the Indian markets surged higher on Friday following the Finance Ministers clarification that Participatory Note holders would not be taxed. Further, the RBIs purchase of `10,000cr worth of bonds through open market operations (OMOs), too buoyed market sentiments. Meanwhile the markets will be keenly tracking the EXIM data to be released for the month of February 2012.

BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei

2.0 2.3 2.4 2.0 1.8 2.6 2.6 2.3 2.6 2.8 2.2

Chg (%)

345.6 17,404 116.7 145.5 132.6 119.9 183.5 5,296 6,346 6,629 6,626 7,311

292.5 11,751 225.2 10,135 285.5 11,346 222.0 130.7

(Pts)

8,088 6,082

(Close)

0.5 (0.1) 0.5 (0.3) (0.3) 0.6 0.5

66.2 13,212 (3.8) 26.4 3,092 5,768

(31.2) 10,084 (53.8) 20,556 16.4 10.6 3,010 2,263

Markets Today

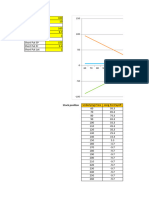

The trend deciding level for the day is 17,316 / 5,269 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 17,527 17,651 / 5,334 5,372 levels. However, if NIFTY trades below 17,316 / 5,269 levels for the first half-an-hour of trade then it may correct up to 17,193 16,982 / 5,230 5,165 levels.

Indices SENSEX NIFTY S2 16,982 5,165 S1 17,193 5,230 PIVOT 17,316 5,269 R1 17,527 5,334 R2 17,651 5,372

Hang Seng Straits Times Shanghai Com

Indian ADRs

Chg (%)

(Pts)

(Close)

INFY WIT IBN HDB

1.0 1.7 2.6 2.8

0.6 0.2 0.9 0.9

$57.0 $11.0 $34.9 $34.1

News Analysis

Advances / Declines Advances Declines Unchanged

BSE

NSE

NTPC commissions Unit IV of Simhadri STPP L&T bags order worth `1,875cr

Refer detailed news analysis on the following page

1,971 928 108

1,145 323 48

Net Inflows (March 29, 2012)

` cr FII MFs Purch 3,948 641 Sales 5,248 634 Net (1,299) 7 MTD 7,731 (1,409) YTD 44,028 (5,436)

Volumes (` cr) BSE NSE

3,683 12,053

FII Derivatives (March 30, 2012)

` cr

Index Futures Stock Futures

Purch 2,858 1,754

Sales 3,359 1,643

Net (501) 111

Open Interest 9,661 21,813

Gainers / Losers

Gainers Company

Mangalore Ref Bosch OIL INDIA Jain Irrigation JUBL FOOD

Losers Company

Suzlon Energy Coromandel Intl Amtek Auto United Brew Apollo Hosp

Price (`)

68 8,251 515 99 1,168

chg (%)

11.7 8.6 8.4 8.4 8.1

Price (`)

25 285 132 541 639

chg (%)

(3.3) (1.7) (1.7) (1.6) (1.2)

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

NTPC commissions Unit IV (500MW) of Simhadri Super Thermal Power Project

NTPC commissioned Unit IV (500 MW) of Simhadri Super Thermal Power Project on March 30, 2012. With this, the total capacity of NTPC Group has become 37,014MW. In all, NTPC Group has commissioned 2,820MW of capacity in FY2012 till date, which is below the initial target of 4,320MW. At the CMP, the stock is trading at 1.6x FY2013E P/BV. We maintain our Buy recommendation on the stock with a target price of `199.

L&T bags order worth `1,875cr

Larsen & Toubro (L&T) Construction bagged orders worth `1,875cr from various segments during March 2012. The Power Transmission and Distribution IC secured new orders in domestic as well international markets from reputed customers. Domestic orders worth `701cr include a major order from Tamil Nadu Electricity Board for the construction of 148km, 400kV DC (Quad) transmission line from Pugalur to Pandiankuppam in Tamil Nadu. The project will be completed in 18 months. The company has bagged two additional orders for the construction of substations at Malaysendra from Karnataka Power Transmission Corporation and at Jind, Haryana, from Power Grid Corporation of India Limited. International orders, valued at `194cr, include those for construction of a 220/33kV substation and various orders for ongoing projects at UAE. The Building and Factories IC has bagged new orders aggregating `841cr. This includes construction of residential apartments in Chennai and Mumbai from leading developers. Another new order has been received for the construction of a mall in Bangalore. In the Solar Business Unit, L&T Construction has secured orders worth `139cr from reputed developers for the construction of a 5.75 MW Solar PV plant on EPC basis in Rajasthan and general civil works for 1x125 MW solar thermal power project in Gujarat. At the CMP of `1,307, the stock is trading at PE of 18.5x FY2013E earnings, which is below the historical trading multiple for L&T. We have used the SOTP methodology to value the company to capture all its business initiatives and investments/stakes in different businesses. Ascribing separate values to its parent business on P/E basis and investments in subsidiaries on P/E, P/BV and mcap basis, our target price works out to `1,607, which provides 23.0% upside from current levels. Hence, we maintain our Buy recommendation on the stock.

April 2, 2012

Market Outlook | India Research

Economic and Political News

Brent rises towards US$123 on tighter US gasoline market India's fiscal deficit during April to February was `4.94 lakh crore Need to tackle inflation for high growth: RBI No tax liability on P-Notes, says FM

Corporate News

ONGC ropes in ConocoPhillips for exploration CIL asked to provide 80% assured delivery to power firms NTPC to invest `17,000cr on two projects Unitech seeks injunction against Telenor on biz transfer

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

April 2, 2012

Market Outlook | India Research

Research Team Tel: 022 - 39357800

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

April 2, 2012

You might also like

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingNo ratings yet

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingNo ratings yet

- Market Outlook 30th March 2012Document3 pagesMarket Outlook 30th March 2012Angel BrokingNo ratings yet

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Market Outlook 9th January 2012Document3 pagesMarket Outlook 9th January 2012Angel BrokingNo ratings yet

- Market Outlook 20th March 2012Document3 pagesMarket Outlook 20th March 2012Angel BrokingNo ratings yet

- Market Outlook 28th March 2012Document4 pagesMarket Outlook 28th March 2012Angel BrokingNo ratings yet

- Market Outlook 26th March 2012Document4 pagesMarket Outlook 26th March 2012Angel BrokingNo ratings yet

- Market Outlook 27th December 2011Document3 pagesMarket Outlook 27th December 2011Angel BrokingNo ratings yet

- Market Outlook 27th March 2012Document4 pagesMarket Outlook 27th March 2012Angel BrokingNo ratings yet

- Market Outlook 9th April 2012Document3 pagesMarket Outlook 9th April 2012Angel BrokingNo ratings yet

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingNo ratings yet

- Market Outlook 13th March 2012Document4 pagesMarket Outlook 13th March 2012Angel BrokingNo ratings yet

- Market Outlook 23rd February 2012Document4 pagesMarket Outlook 23rd February 2012Angel BrokingNo ratings yet

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingNo ratings yet

- Market Outlook 1st March 2012Document4 pagesMarket Outlook 1st March 2012Angel BrokingNo ratings yet

- Market Outlook 21st March 2012Document3 pagesMarket Outlook 21st March 2012Angel BrokingNo ratings yet

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument3 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 21st February 2012Document4 pagesMarket Outlook 21st February 2012Angel BrokingNo ratings yet

- Market Outlook 29th September 2011Document3 pagesMarket Outlook 29th September 2011Angel BrokingNo ratings yet

- Market Outlook 29th March 2012Document3 pagesMarket Outlook 29th March 2012Angel BrokingNo ratings yet

- Market Outlook 6th September 2011Document4 pagesMarket Outlook 6th September 2011Angel BrokingNo ratings yet

- Market Outlook 7th September 2011Document3 pagesMarket Outlook 7th September 2011Angel BrokingNo ratings yet

- Market Outlook 6th March 2012Document3 pagesMarket Outlook 6th March 2012Angel BrokingNo ratings yet

- Market Outlook 28th September 2011Document3 pagesMarket Outlook 28th September 2011Angel BrokingNo ratings yet

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingNo ratings yet

- Market Outlook 11th January 2012Document4 pagesMarket Outlook 11th January 2012Angel BrokingNo ratings yet

- Market Outlook 26th September 2011Document3 pagesMarket Outlook 26th September 2011Angel BrokingNo ratings yet

- Market Outlook 24th August 2011Document4 pagesMarket Outlook 24th August 2011Angel BrokingNo ratings yet

- Market Outlook 30th Decmber 2011Document3 pagesMarket Outlook 30th Decmber 2011Angel BrokingNo ratings yet

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingNo ratings yet

- Market Outlook 27th September 2011Document3 pagesMarket Outlook 27th September 2011angelbrokingNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Market Outlook 9th March 2012Document4 pagesMarket Outlook 9th March 2012Angel BrokingNo ratings yet

- Market Outlook 16th February 2012Document4 pagesMarket Outlook 16th February 2012Angel BrokingNo ratings yet

- Market Outlook 8th September 2011Document4 pagesMarket Outlook 8th September 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Marudyog 20110607Document3 pagesMarudyog 20110607hemen_parekhNo ratings yet

- Market Outlook 12th March 2012Document4 pagesMarket Outlook 12th March 2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17214) / NIFTY (5227)Document4 pagesDaily Technical Report: Sensex (17214) / NIFTY (5227)Angel BrokingNo ratings yet

- Market Outlook 07.07Document3 pagesMarket Outlook 07.07Nikhil SatamNo ratings yet

- Market Outlook 26th August 2011Document3 pagesMarket Outlook 26th August 2011Angel BrokingNo ratings yet

- Market Outlook 10th January 2012Document4 pagesMarket Outlook 10th January 2012Angel BrokingNo ratings yet

- Market Outlook 22nd November 2011Document4 pagesMarket Outlook 22nd November 2011Angel BrokingNo ratings yet

- Market Outlook 24th February 2012Document4 pagesMarket Outlook 24th February 2012Angel BrokingNo ratings yet

- Market Outlook 23rd August 2011Document3 pagesMarket Outlook 23rd August 2011angelbrokingNo ratings yet

- Market Outlook 30th September 2011Document3 pagesMarket Outlook 30th September 2011Angel BrokingNo ratings yet

- Market Outlook 20th September 2011Document4 pagesMarket Outlook 20th September 2011Angel BrokingNo ratings yet

- Market Outlook 24th November 2011Document3 pagesMarket Outlook 24th November 2011Angel BrokingNo ratings yet

- Market Outlook 12th January 2012Document4 pagesMarket Outlook 12th January 2012Angel BrokingNo ratings yet

- Market Outlook 16th March 2012Document4 pagesMarket Outlook 16th March 2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16913) / NIFTY (5114)Document4 pagesDaily Technical Report: Sensex (16913) / NIFTY (5114)Angel BrokingNo ratings yet

- Market Outlook 7th December 2011Document4 pagesMarket Outlook 7th December 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17033) / NIFTY (5165)Document4 pagesDaily Technical Report: Sensex (17033) / NIFTY (5165)Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16897) / NIFTY (5121)Document4 pagesDaily Technical Report: Sensex (16897) / NIFTY (5121)Angel BrokingNo ratings yet

- Stock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingFrom EverandStock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Stock Verifications Part 2Document26 pagesStock Verifications Part 2Anand DubeyNo ratings yet

- Deprival Value Lecture NotesDocument7 pagesDeprival Value Lecture NotesTosin YusufNo ratings yet

- FM MCQ Paper I 2Document8 pagesFM MCQ Paper I 2LakshmiRengarajan83% (6)

- Lista Abreviações Oficial Completa 01.06.2022Document22 pagesLista Abreviações Oficial Completa 01.06.2022Walber SoaresNo ratings yet

- LEE v. CADocument3 pagesLEE v. CAVon Lee De LunaNo ratings yet

- Ebook PDF Financial Markets Institutions 13th EditionDocument61 pagesEbook PDF Financial Markets Institutions 13th Editionollie.rutland183100% (39)

- Dokumen - Tips Oliver Velez Swing Core Guerrilla Options Trading Tactics (1) (001 078)Document78 pagesDokumen - Tips Oliver Velez Swing Core Guerrilla Options Trading Tactics (1) (001 078)Sergio MoralesNo ratings yet

- AudtheoDocument3 pagesAudtheokath grangerNo ratings yet

- CrowdStrike Holdings, Inc. Class ADocument132 pagesCrowdStrike Holdings, Inc. Class AJose AntonioNo ratings yet

- The NASDAQ Stock MarketDocument3 pagesThe NASDAQ Stock MarketlulavmizuriNo ratings yet

- XRP Is Probably A Security, Don't at Me - The BlockDocument24 pagesXRP Is Probably A Security, Don't at Me - The BlockfleckaleckaNo ratings yet

- Tutorial 1.solutionsDocument5 pagesTutorial 1.solutionsabcsingNo ratings yet

- Random Walk TheoryDocument17 pagesRandom Walk TheorylostNo ratings yet

- Fu-Wang Foods LTDDocument4 pagesFu-Wang Foods LTDalinbobyNo ratings yet

- Credit Facility FormDocument2 pagesCredit Facility FormarrendraNo ratings yet

- Eva DisneyDocument4 pagesEva DisneyherybertoNo ratings yet

- 0 10 Full Company Update 20230227Document31 pages0 10 Full Company Update 20230227Contra Value BetsNo ratings yet

- Gitman pmf13 ppt03Document68 pagesGitman pmf13 ppt03CARLOS ANDRESNo ratings yet

- Lettre Hassan Moussa AbdoulayeDocument1 pageLettre Hassan Moussa AbdoulayeOmarNo ratings yet

- Financial Management - Grinblatt and TitmanDocument68 pagesFinancial Management - Grinblatt and TitmanLuis Daniel Malavé RojasNo ratings yet

- Financial Accounting Vol. 2 Example QuestionsDocument8 pagesFinancial Accounting Vol. 2 Example QuestionsMarisolNo ratings yet

- 14BWorker's PreferenceDocument88 pages14BWorker's PreferenceJoshua OuanoNo ratings yet

- Bear Spread Payoff Strategy CalculationDocument3 pagesBear Spread Payoff Strategy CalculationMukund KumarNo ratings yet

- Republic of The Philippines Citibank, N.A. and Bank of America, S.T. & N.A.Document14 pagesRepublic of The Philippines Citibank, N.A. and Bank of America, S.T. & N.A.CristineNo ratings yet

- Manufacturing A/c For The Year Ended .31.03.2016: XXX XXXDocument2 pagesManufacturing A/c For The Year Ended .31.03.2016: XXX XXXsubhash dalviNo ratings yet

- EntropyDocument81 pagesEntropyManish SharmaNo ratings yet

- Business Failure, Reorganization, and LiquidationDocument12 pagesBusiness Failure, Reorganization, and LiquidationApril BoreresNo ratings yet

- Banking Project - Indian Financial SystemDocument16 pagesBanking Project - Indian Financial SystemAayush VarmaNo ratings yet

- Interest Rate FuturesDocument103 pagesInterest Rate FuturesSumit SinghNo ratings yet

- Vardhman Polytex LimitedDocument11 pagesVardhman Polytex Limitedvicky mehtaNo ratings yet