Professional Documents

Culture Documents

Draft For Phone Revisions

Uploaded by

Hualu ZhaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Draft For Phone Revisions

Uploaded by

Hualu ZhaoCopyright:

Available Formats

Questions From The Reading

1. Appraise the results of operations of Prestige Data Services. Is the subsidiary really a problem to Prestige Telephone Company? Consider carefully the differences between reported costs and costs relevant for decisions that Daniel Rowe is considering.

When all the facts given are taken into account, one will note that the statements are only for a short-term outlook only. If a projection is to take place on the numbers, it is clear to see that the loss is shrinking Jan ($41,472), Feb ($40,341), and Mar ($21,438) and will eventually turn into gains with possible substantial gains for the company. The main point that shall be considered will be that the reader is only given a very short-term look at the financials (January March). This will indicate that the marketing or word of mouth must have been working due to the percent usage that went up every month. Opening costs for that division are not included. Therefore, there is a need to project when you can get it paid off to leave the company with complete profit. As stated above, there is currently a loss shown but the loss keeps lowering itself. Therefore, if the trend keeps moving in this direction, the division is bound to start to make money. There is no guarantee of this but trends do help project for a division or company. If the company is to try to use an outside source to provide data service, it will cost $164,000. However, why shall this be done when Prestige Phone is paying $82,000 to Prestige Data. When the math is done, this is showing that by using Prestige Data they are saving approximately $82,000 by holding a

separate division. If I am correct, both also provide money to each others division that will help their individual income statements. How can this be considered a problem? They need to keep Prestige Data Services since it may become a cash cow for the company in the future.

2. Assuming the company demand for service will average 205 hours per month, what level of commercial sales of computer use would be necessary to break even each month?

In order to determine the break even each month for the company it is important to make a few distinct assumptions. First it will be assumed the company demand for service will average 205 hours per month. This will lead to the $82,000 cost limit to Prestige Telephone Company. Secondly, it will be assumed the variable cost per unit is $189.02 and is the same for both commercial and intercompany hours. $189.02 is determined by taking the average variable cost per month divided by the average total hours per month. It will also be assumed the Other Income will be held constant at $10,370. $10,370 is derived from taking the average monthly Other Income for the months of January, February, and March. Finally, it will be assumed that Prestige Data Services can produce a sale that does not equal a full hour. With these assumptions it has been determined that Prestige Data Services needs to have 187.24 hours of commercial sales in order to break even. Therefore, 187.24 hours equates to $149,792 in sales.

3. Please See The Excel Sheets on the next page for the answers to question 3.

4. Can you suggest changes in the accounting and reporting system now used for operations of Prestige Data Services which would result in more useful information for Rowe and Bradley?

It seems like the company is losing money from the results in the accounting and reporting system. Here are some aspects that you cannot ignore when you analyze if it's profitable or not. First, in the first Quarter 2003, we can easily tell that the total revenue is in the trend of increasing and the decreasing of loss of net income. It is absolutely a good sign that the subsidiary is doing a better job month after month. Second, from the first question we have already shown that the subsidiary is actually not a problem because of the break-even, which means that the company can cover all the cost including the fixed cost and the variable cost, and it can work as a virtuous circle. Third, as mentioned above, there are some costs that will still exist even if there is no such subsidiary, as shown in the 2nd chart, the lease, maintenance, computer equipment and so on. Given you drop the subsidiary, the managers are in the charge of these payment. So, I suggest the absolute profitability to Prestige Company. A lot of managers are adopting this method to help them make the crucial decisions whether or not to drop the segments or the subsidiary. This method measures the impact on the organization's overall profits of adding or dropping a particular segment such as a product or customer without making any other changes. More specifically, when considering a new potential segment, compare the additional revenues from adding the segment to the additional costs that will be incurred. Only

the additional costs that shall actually be avoided or incurred will be included. All other costs are irrelevant and shall be ignored.

Questions From Instructor 1.) Why is Prestige continuing to report operating losses?

Prestige Data Services continues to show operating losses because the charge to Prestige Telephone does not fully show the value the company is providing them and because they are not generating enough outside sales. Due to the restrictions put in place, there is a limit placed as to what Prestige Data Services can charge the parent company, Prestige Telephone Company, for hours of service. On average, $82,000, is all that is allowed to be charged and that is set by the Public Service Commission. Based on the averages, this equals $400 per hour of intercompany service which is half of what is charged for commercial sales. Unfortunately, the $400 per hour does not show the true value that Prestige Data Services provides Prestige Telephone Company. If they are charging closer to the market rate, they will be showing an operating gain. Prestige Data Services is providing the same service at the same cost of doing business, but only receiving half the income from it. Currently, this accounts for the majority of their sales as well. Combined these has created a negative net income on the financial statements. Since there is a limit as to what Prestige Data Services can charge the parent company, the next issue to address shall be the amount of available hours that are not producing any revenue while still having costs associated to them. On average there are approximately 177 hours that are still available. If those 177 hours are commercial sales, instead of wasted hours,

then they can produce $141,333 of revenue. Unless an improvement on how many of those hours are sold or perhaps the amount of hours the company is operating is decreased, the company will continue to show operating losses.

2. Based on your appraisal of the results of operations of Prestige Data Services in the first quarter of 2003, what would you recommend to Mr. Rowe?

In our opinion, Prestige Data Services suffers financial losses because of many reasons. That they do not operate well is not the only cause; nevertheless, some book-keeping inappropriateness shall also be taken into considerations. From the data revealed in the two exhibits, there are several changes for Prestige to consider. First, as being informed by Mr. Rowe, maintenance is carried out by outside contractors every week for eight hours, testing and upkeep. However, there are also maintenance activities inside the company by their programming staff. They count for the system development and maintenance wages and salaries. In this scenario, the money seems to be spent on different people for the same reasons. Mr. Rowe needs to choose between all jobs done by outside contractors and all done by inside technical support. In this way, money can be saved, expenses decrease, and responsibility can be more clearly defined for both technical staff and other employees. Second, as mentioned in the last sentence of the case, Mr. Rowe definitely shall consider going to two-shift workplace instead of 24-hour operation. Twenty-four hour operations are exhausting for all employees, and will lower their efficiency and effectiveness. Also, 24-hour operations mean higher salary for employees because of the intense work load. By changing this

situation into two-shifts, employees work fewer hours, every time they go to work. Their basic salaries can be lowered due to lighter work load. They will lose the bargaining leverage for higher wages. Third, available hours, which do not generate revenue, are too high every month. They count as one third of total hours. This condition may reveal two problems. As they are not able to retain current customers and obtain new ones, operation employees are delayed from performing their duties. Another possible problem is that operations staff is not fully performing their responsibilities. They may not have enough communication with customers, or some other excuses. Either scenario, Mr. Rowe will find out the true reason for all those 500 plus available hours and make these hours into profit-generating time. Last but not the least, since rent and custodial services, along with all the payroll, billing, collections, and accounting costs are provided to Prestige Telephone Company; Mr. Rowe needs to start thinking of the subsidiary as part of his company. Because of money collected from Prestige Data Services, the Telephone Company will earn extra revenues; while the subsidiary suffers some losses.

3. What specific suggestions for improving the accounting system and report format would you suggest to Mr. Rowe and Ms. Bradley so that they might more easily understand how well Prestige Data Services is performing?

The suggestion for improving the accounting system and report format that we will like to suggest to the managers will be a system that focuses on incremental cash flow, which is, the difference of cash flows that it will generate if Prestige Data Services is run or not. Calculating the incremental cash flow, generally speaking, is to calculate the difference between running and not running Prestige Data Services. Assuming the president of Prestige Company, caring the value created for the whole company, he will use this method to value the business, because Prestige Date Services, though seeming not well run, can create value for the company as a whole, but the contribution is simply neglected if we use stats of Prestige Data Services separately. Moreover, the use of incremental cash flow can; in fact, change the situation that the subsidiary is not well operated even without looking into the value it creates for the whole business. For example, if we count on incremental cash flow, $26,180 depreciation for January is no longer an expense, rather, it helps the company to reduce, assuming a tax rate of 40%, $10,472 tax payable, and this will immediately make a difference of $36,652 comparing to the current accounting and reporting system. Managers shall appreciate this method, because it provides more accurate information for them to evaluate business value. Finally, we will know how to do the overall calculation. Because such an investment is usually viewed in the long run, as in this case, the equipment is rent for 4 years and is not cancellable, therefore we assume that it will last at least 4 years, it will be inaccurate to use a short-term statistics to predict its performance in a long run. As for implementation of incremental cash flow, we have means to more accurately predict the performance of a business that is, calculating its net present value (NPV). First we have to figure out a discount rate, which represents the expected rate of return of the company. For example, if the initial investment of the project, or the cash outflow, is $10,000, and the company generates a $10,500 cash inflow at

the end of the year, is the company doing well? Literally, the company earns $500, assuming an inflation of 2%, the company generates profit. The fact is, unfortunately, for most investors, a 3% return is not good enough. If we use a discount rate to discount the cash inflow of year one, it can be totally different. If we assume the investors will like to earn 10%, and discount the year one cash flow, we can see that it only generates $10,500/ (1+10%) =$9,545. Combining these numbers together, we can calculate the NPV of the project as -$10,000+$9,545=-$455, a negative NPV, which indicates the project is not creating value, thus we will reject it. Notice that for the second year, the denominator will be 1.21, because the investors will like the return to represent the value created for two years, and (1+10%)*(1+10%)=1.21, so, if the cash inflow of year two is 12,100, when calculating the NPV, it will be divided by 1.21, and the result will be 10,000, and in this case, the NPV will be -$10,000+$9,545+$10,000=$9,545, which means if the project requires only one initial investment of $10,000, and can generate profit of $10,500 at the end of year one and $12,100 at the end of year two, investors will be happy to invest if their rate of return is 10%. All in all, what we suggest the managers to do is first calculate the incremental cash flows of the subsidiary, then figure out a reasonable discount rate to represent their required rate of return, and finally calculate the projects NPV to decide if the project is acceptable or not.

4. Would you recommend that Ms. Bradley and Mr. Rowe adopt any of the options which are discussed in the case and reviewed in the questions shown at the end of the case description?

The options in the case are as follows: estimate the possible effects on profits of increasing the price to customers other than Prestige Telephone, reducing prices, increasing sales efforts and promotions, and of going to two-shift rather than 24-hour operations (Prestige Telephone Company Case 9-197-097). As shown in the Excel Spreadsheets regarding question number three and the above listed options it is very clear to see that all but one of the options will cost the company significant losses. Therefore, the only option that will be recommended for them to review will be the option to increase sales efforts and promotions. The reason being this option will show a breakeven or profit depending upon how the option is handled and launched by the company. The more sales they obtain, the better off the company will be financially. If they try to reduce costs by any means this will not help since they cannot cut there or anywhere else. A large chunk of their money goes to fixed costs that cannot be altered. Therefore, as one could see, the best and only option will be to increase sales. This will make the company very valuable and an asset to Prestige Telephone Company, as long as they structure based upon the recommendations of this option. If any other options are used, they will suffer loss and may have to close Prestige Data Services. Let us hope they choose wisely and ensure that both ends of the company thrive for many more years to come.

You might also like

- A Complete Payroll & Bookkeeping Service Business Plan: A Key Part Of How To Start A Payroll & BookkeepingFrom EverandA Complete Payroll & Bookkeeping Service Business Plan: A Key Part Of How To Start A Payroll & BookkeepingNo ratings yet

- How To Start A Payroll & Bookkeeping Service: A Complete Payroll & Bookkeeping Service Business PlanFrom EverandHow To Start A Payroll & Bookkeeping Service: A Complete Payroll & Bookkeeping Service Business PlanNo ratings yet

- CVP Analysis of Prestige Data Services CaseDocument4 pagesCVP Analysis of Prestige Data Services CaseNur Al Ahad92% (12)

- A Mobile Computer & Electronics Repair Service Business Plan: To Start with Little to No MoneyFrom EverandA Mobile Computer & Electronics Repair Service Business Plan: To Start with Little to No MoneyNo ratings yet

- Accounting Report - Prestige Telephone CompanyDocument15 pagesAccounting Report - Prestige Telephone CompanyMuhaizarMarkamNo ratings yet

- A Complete Auto Body (Dent & Paint) Repair Center Business Plan: How To Start An Auto Body Repair CenterFrom EverandA Complete Auto Body (Dent & Paint) Repair Center Business Plan: How To Start An Auto Body Repair CenterRating: 4.5 out of 5 stars4.5/5 (4)

- A Complete Computer Repair Shop Business Plan: A Key Part Of How To Start A Computer & Electronics Repair StoreFrom EverandA Complete Computer Repair Shop Business Plan: A Key Part Of How To Start A Computer & Electronics Repair StoreRating: 3 out of 5 stars3/5 (2)

- How To Start A Mobile Computer Repair Business: A Complete Computer & Electronics Mobile Tech Business PlanFrom EverandHow To Start A Mobile Computer Repair Business: A Complete Computer & Electronics Mobile Tech Business PlanNo ratings yet

- Mastering Operational Performance : The Ultimate KPI HandbookFrom EverandMastering Operational Performance : The Ultimate KPI HandbookNo ratings yet

- A Complete Mobile Computer & Electronics Repair Business Plan: A Key Part Of How To Start A Computer & Electronics Mobile Tech BusinessFrom EverandA Complete Mobile Computer & Electronics Repair Business Plan: A Key Part Of How To Start A Computer & Electronics Mobile Tech BusinessNo ratings yet

- A Complete Television & Electronics Repair Center Business Plan: A Key Part Of How To Start A TV & Electronics Repair ShopFrom EverandA Complete Television & Electronics Repair Center Business Plan: A Key Part Of How To Start A TV & Electronics Repair ShopNo ratings yet

- Case 16 2 - Prestige 4343 Additional NotesDocument3 pagesCase 16 2 - Prestige 4343 Additional NotesFedro SusantanaNo ratings yet

- A Complete Automotive Repair Center Business Plan: A Key Part Of How To Start A Vehicle Maintenance & Repair ShopFrom EverandA Complete Automotive Repair Center Business Plan: A Key Part Of How To Start A Vehicle Maintenance & Repair ShopNo ratings yet

- How To Start A Computer Repair Shop: A Complete Computer & Electronics Repair Business PlanFrom EverandHow To Start A Computer Repair Shop: A Complete Computer & Electronics Repair Business PlanRating: 4 out of 5 stars4/5 (2)

- Managerial Accounting Homework on Variable and Fixed CostsDocument6 pagesManagerial Accounting Homework on Variable and Fixed CostsMatt Moench100% (2)

- Case FinalDocument11 pagesCase FinalshakeelsajjadNo ratings yet

- Smash The Bottleneck: How To Improve Critical Process Efficiencies For Dramatically Increased Key ResultsFrom EverandSmash The Bottleneck: How To Improve Critical Process Efficiencies For Dramatically Increased Key ResultsNo ratings yet

- How To Start An Automotive Repair Center: A Complete Vehicle Maintenance & Repair Center Business PlanFrom EverandHow To Start An Automotive Repair Center: A Complete Vehicle Maintenance & Repair Center Business PlanRating: 4 out of 5 stars4/5 (2)

- 16-2 Prestige Telephone CompanyDocument3 pages16-2 Prestige Telephone CompanyYJ26126100% (5)

- How To Start A TV & Electronics Repair Center: A Complete Television & Electronics Repair Center Business PlanFrom EverandHow To Start A TV & Electronics Repair Center: A Complete Television & Electronics Repair Center Business PlanRating: 5 out of 5 stars5/5 (4)

- 25 Questions on DCF ValuationDocument4 pages25 Questions on DCF ValuationZain Ul AbidinNo ratings yet

- Incremental Cost Analysis of Shutting Down Prestige Data ServicesDocument5 pagesIncremental Cost Analysis of Shutting Down Prestige Data ServicesCylver RoseNo ratings yet

- Profit Center ApproachDocument5 pagesProfit Center ApproachKunal ThakurNo ratings yet

- How To Start A Housekeeping Service Business: A Complete Housekeeping/ Cleaning/ Maid Business PlanFrom EverandHow To Start A Housekeeping Service Business: A Complete Housekeeping/ Cleaning/ Maid Business PlanNo ratings yet

- A Mobile Vacuum Cleaner Repair Service Business Plan: To Start with Little to No MoneyFrom EverandA Mobile Vacuum Cleaner Repair Service Business Plan: To Start with Little to No MoneyNo ratings yet

- Outsourcing for Your Business: Everything You Need to Know About Successful OutsourcingFrom EverandOutsourcing for Your Business: Everything You Need to Know About Successful OutsourcingNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Example Thesis On Financial Ratio AnalysisDocument8 pagesExample Thesis On Financial Ratio Analysisejqdkoaeg100% (1)

- The Case For Outsourcing: by Jessie C. CarpioDocument3 pagesThe Case For Outsourcing: by Jessie C. CarpioSeanKeithNeriNo ratings yet

- Lec MT 06 Financial ManagementDocument12 pagesLec MT 06 Financial Managementjohnpaul mosuelaNo ratings yet

- Corporate Valuation 7Document7 pagesCorporate Valuation 7Bhumika KrishnaniNo ratings yet

- The Value of Business Outsourcing: How to Do More in Less TimeFrom EverandThe Value of Business Outsourcing: How to Do More in Less TimeNo ratings yet

- 1971 - Spring - Profit Planning or Management Accounting - 0Document4 pages1971 - Spring - Profit Planning or Management Accounting - 0Anonymous yd515BW6No ratings yet

- Income Statement Case StudyDocument18 pagesIncome Statement Case StudyToto100% (1)

- A Complete Maid Service Business Plan: A Key Part Of How To Start A Commercial & Residential Cleaning Service BusinessFrom EverandA Complete Maid Service Business Plan: A Key Part Of How To Start A Commercial & Residential Cleaning Service BusinessRating: 5 out of 5 stars5/5 (1)

- Financial Analysis MethodsDocument9 pagesFinancial Analysis MethodseliasNo ratings yet

- Financial Management in Architecture - AR-PP4Document12 pagesFinancial Management in Architecture - AR-PP4israel bayag-oNo ratings yet

- Chapter 1 Warm-Up ExercisesDocument2 pagesChapter 1 Warm-Up Exercisesahmedknight100% (1)

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookFrom EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookNo ratings yet

- FAIS Assignment 1 - Mariam Jabbar PDFDocument4 pagesFAIS Assignment 1 - Mariam Jabbar PDFMariamNo ratings yet

- Accounting Information Systems: An Overview: Suggested Answers To Discussion QuestionsDocument18 pagesAccounting Information Systems: An Overview: Suggested Answers To Discussion QuestionsBayoe AjipNo ratings yet

- Case Study Salem TelephoneDocument3 pagesCase Study Salem TelephoneahbahkNo ratings yet

- A Patio Installation Business Plan: To Start with Little to No MoneyFrom EverandA Patio Installation Business Plan: To Start with Little to No MoneyNo ratings yet

- Home Assignment 1Document3 pagesHome Assignment 1AUNo ratings yet

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- ManzManzana Insurance Fruitvale BranchDocument7 pagesManzManzana Insurance Fruitvale BranchChihab EL Alaoui0% (1)

- Marketing Environment - MCQsDocument25 pagesMarketing Environment - MCQsMaxwell;No ratings yet

- What Source You Adopt To Source CandidatesDocument5 pagesWhat Source You Adopt To Source CandidatesAnil KumarNo ratings yet

- Canadian Solar 401 Individual ProjectDocument7 pagesCanadian Solar 401 Individual ProjecthaneenNo ratings yet

- ĐỀ 16.HSDocument5 pagesĐỀ 16.HSlehoa.spanhNo ratings yet

- International Distribution ContractDocument3 pagesInternational Distribution ContractGlobal Negotiator100% (1)

- Proposal Golf Event Management ServicesDocument38 pagesProposal Golf Event Management ServicesVivekMandalNo ratings yet

- Client Data Sheet For BusinessesDocument5 pagesClient Data Sheet For BusinessesMatt TupperNo ratings yet

- Accounting Textbook Solutions - 6Document19 pagesAccounting Textbook Solutions - 6acc-expertNo ratings yet

- TATA DoCoMo Corporate PlanDocument18 pagesTATA DoCoMo Corporate PlanSrikanth Kumar KonduriNo ratings yet

- Transforming Basketball in Britain TogetherDocument16 pagesTransforming Basketball in Britain TogetherJayNo ratings yet

- Dossier Armand BrignacDocument15 pagesDossier Armand BrignacAnonymous 2Buf6xOegSNo ratings yet

- Group Assignment 2 English ProfesionalDocument13 pagesGroup Assignment 2 English ProfesionalNurfadilla ZahraNo ratings yet

- Tea - The Past, The Present and The FutureDocument66 pagesTea - The Past, The Present and The FutureSimranjeet SinghNo ratings yet

- Faree2y's "ForsaDocument12 pagesFaree2y's "ForsaSawa SportNo ratings yet

- E - Business Chapter 4Document6 pagesE - Business Chapter 4James MorganNo ratings yet

- New Microsoft Office Word DocumentDocument4 pagesNew Microsoft Office Word DocumentHaleem.No ratings yet

- Marketing Plan (Autosaved)Document19 pagesMarketing Plan (Autosaved)JayanneNo ratings yet

- Magnik Final - Docx 1 PDFDocument37 pagesMagnik Final - Docx 1 PDFKate WintersNo ratings yet

- 100 Days White PaperDocument15 pages100 Days White Paperalbundy2No ratings yet

- Market Gardening: A Start-Up GuideDocument16 pagesMarket Gardening: A Start-Up GuideGreater Charlotte Harbor Sierra ClubNo ratings yet

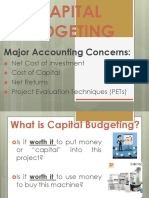

- Capital BudgetingDocument13 pagesCapital BudgetingBridge VillacuraNo ratings yet

- PlanogramDocument17 pagesPlanogramSrishti VasdevNo ratings yet

- Interbrand's Brand Valuation SDM AssignmentDocument3 pagesInterbrand's Brand Valuation SDM Assignmenttaran.bhasinNo ratings yet

- Principles of Corporates CommunicationDocument29 pagesPrinciples of Corporates CommunicationLan Nhi NguyenNo ratings yet

- Ch-2 - Production Planning SystemDocument48 pagesCh-2 - Production Planning SystemRidwanNo ratings yet

- Implementing Dania Beach's Rebranding StrategyDocument5 pagesImplementing Dania Beach's Rebranding Strategykalin kalevNo ratings yet

- Dubai Fawad Abdulwaheed KasuDocument3 pagesDubai Fawad Abdulwaheed KasushakbeeNo ratings yet

- Swot AnalysisDocument38 pagesSwot AnalysisAnis Lisa Ahmad100% (1)

- Platform Power - Sangeet Paul ChoudaryDocument84 pagesPlatform Power - Sangeet Paul ChoudaryMrBombasticN57No ratings yet

- Business Ethics PUPDocument22 pagesBusiness Ethics PUPLenkath GalasaoNo ratings yet