Professional Documents

Culture Documents

Fdi in Multi Brand Retail in India

Uploaded by

Rajni GargOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fdi in Multi Brand Retail in India

Uploaded by

Rajni GargCopyright:

Available Formats

INT. J. NEW. INN.

, 2012, 1(1), 248-252

ISSN:2277-4459

FDI IN MULTI BRAND RETAIL IN INDIA

Vineeta Agrawal1

1

D.D.U.University Gorakhpur (U.P.)

ABSTRACT

Retail sector in India has been hailed as one of the sunrise sectors of the Indian economy. India has been recognized as leading Retail destination and whole world is eyeing on it. On 24th November 2011 union cabinet stipulated that FDI in multi-brand retail will be allowed up to 51% foreign equity through the government approval route, subject to adequate safeguards for domestic stakeholders. Currently, FDI is permitted up to 26 per cent under the automatic route in wholesale or so-called cash-and-carry operations and 100% per cent with government approval in single-brand stores. Foreign retailers have welcomed this step and have also shown interest in entering Indian market. There has been a lot of debate around the industrial and political circles, although for now this proposal has been postponed. Given the WTO regime India is party to, it is inevitable to prevent foreign players from entering in the Indian market, although the timing of entry has yet to be decided. The present study aims to understand and analyze the challenges and opportunities faced by FDI in Multi Brand Retail Sector. It concludes that allowing FDI can enhance competition and accelerate the process of development of Indian economy.

KEYWORDS: Foreign Direct Investment, Multi Brand Retail, Investment and Productivity

1. INTRODUCTION

Foreign Direct Investment (FDI) is seen to complement scarce domestic financial resources. It is also expected to modernize production by transferring know-how and technology while increasing domestic productivity and competition and inprint international competitiveness. Till now each sector that has been opened to private investment, such as insurance, banking, civil aviation etc. has grown and the consumer has benefited every time. A study by Luis Guasch (2002), Clive Harris (2003), and the McKinsey Global Institute (2003) have shown that inalmost all cases FDI had a largely positive impact on productivity (the key criterion for assessing long-term economic performance) and on the coverage of services. A study of India by the McKinsey Global Institute (2001) showed that the removal of FDI restrictions in the automotive sector unleashed competition and investments, resulting in a threefold increase in productivity that translated into a threefold increase in output due to falling prices. Employment also rose. So, once adjusted for the one-time events and government shortcomings, the fundamental picture of FDI is quite positive. The benefit to the Indian economy through FDI 248

has been quite positive. Indias economy has more than doubled in real terms since reforms began in 1991, and shows no signs of cooling. The commitment to the new policy of Liberalization, Privatization and Globalization has demonstrated unprecedented growth and opportunity both for local companion and for foreign ones thinking about entering the subcontinent for the first time. Till now all the sectors that have been opened for foreign players such as Insurance, Telecom, Banking and Automobile have contributed in the growth of GDP and given employment to millions of people. Domestic players are doing well along with foreign players are competitive enough. There has been a lot of debate around the industrial and political circles regarding the FDI issue. The Government decision is an outcome of well thought plan to lead India on the path of growth and the issue was in waiting line for quite some time. We need to be very cautious while analyzing the implication attached with the issue of course we have the example of many developed and developing countries that have gained and implemented the policies successfully.

International Journal of New Innovations

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- TMA01 Handout Planner For Final Work 1Document11 pagesTMA01 Handout Planner For Final Work 1Eland ExamsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Vinamilk International Business StrategyDocument33 pagesVinamilk International Business StrategyThuận BùiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pay For Performance Enhances Employee Management at Scripps HealthDocument1 pagePay For Performance Enhances Employee Management at Scripps HealthMymie Maandig0% (1)

- Itec 7500 - Capstone Experience Portfolio 1Document10 pagesItec 7500 - Capstone Experience Portfolio 1api-574512330No ratings yet

- Financial Innovations: Changing Rural Financial System in IndiaDocument1 pageFinancial Innovations: Changing Rural Financial System in IndiaRajni GargNo ratings yet

- Bringing RFID For YouDocument1 pageBringing RFID For YouRajni GargNo ratings yet

- Future of Plastic Money in IndiaDocument1 pageFuture of Plastic Money in IndiaRajni GargNo ratings yet

- Women Entrepreneurs - A Mirage of Indian WomenDocument1 pageWomen Entrepreneurs - A Mirage of Indian WomenRajni GargNo ratings yet

- Performance Melioration in Wlan Using CSMA/ECA: A ReviewDocument1 pagePerformance Melioration in Wlan Using CSMA/ECA: A ReviewRajni GargNo ratings yet

- India's Opportunities & Challenges With EUDocument1 pageIndia's Opportunities & Challenges With EURajni GargNo ratings yet

- Women Empowerment in India at Present ScenarioDocument1 pageWomen Empowerment in India at Present ScenarioRajni Garg86% (7)

- BinderDocument1 pageBinderRajni GargNo ratings yet

- Gender Discrimination at Work Place - An Obstacle in Organisation DevelopmentDocument1 pageGender Discrimination at Work Place - An Obstacle in Organisation DevelopmentRajni GargNo ratings yet

- BinderDocument1 pageBinderRajni GargNo ratings yet

- Gender and Age Perspective: A Study Among Employees in Automotive Industries With Special Reference To MaduraiDocument1 pageGender and Age Perspective: A Study Among Employees in Automotive Industries With Special Reference To MaduraiRajni GargNo ratings yet

- Representation of Image Compression Using WaveletsDocument1 pageRepresentation of Image Compression Using WaveletsRajni GargNo ratings yet

- Mutual Funds in Indian PerspectiveDocument1 pageMutual Funds in Indian PerspectiveRajni GargNo ratings yet

- Recession and Recent Counter TechniquesDocument1 pageRecession and Recent Counter TechniquesRajni GargNo ratings yet

- Communication As A Key Contributor in IT Project ManagementDocument1 pageCommunication As A Key Contributor in IT Project ManagementRajni GargNo ratings yet

- An Evolutionary Approach To Minimize FunctionsDocument1 pageAn Evolutionary Approach To Minimize FunctionsRajni GargNo ratings yet

- Neural Networks in Data MiningDocument1 pageNeural Networks in Data MiningRajni GargNo ratings yet

- Data Mining and Web MiningDocument1 pageData Mining and Web MiningRajni GargNo ratings yet

- Intelligent Tutoring Systems in School Education: An OverviewDocument1 pageIntelligent Tutoring Systems in School Education: An OverviewRajni GargNo ratings yet

- Digital Watermarking: A Safety Tag Against Human HumbugDocument1 pageDigital Watermarking: A Safety Tag Against Human HumbugRajni GargNo ratings yet

- Agile Software Development: Existing and New Development MethodologiesDocument1 pageAgile Software Development: Existing and New Development MethodologiesRajni GargNo ratings yet

- Role of Information Technology in Anti-CorruptionDocument1 pageRole of Information Technology in Anti-CorruptionRajni GargNo ratings yet

- QOS Solutions For Mpeg-4 Fgs Video Streaming Over Wired NetworkDocument1 pageQOS Solutions For Mpeg-4 Fgs Video Streaming Over Wired NetworkRajni GargNo ratings yet

- A Review To Image Registration MethodsDocument1 pageA Review To Image Registration MethodsRajni GargNo ratings yet

- Cloud Computing: A New Era in ComputingDocument1 pageCloud Computing: A New Era in ComputingRajni GargNo ratings yet

- Analysis of Intelligent Cloud ComputingDocument1 pageAnalysis of Intelligent Cloud ComputingRajni GargNo ratings yet

- A Secure Private Key Encryption Technique For Data Security in Modern CryptosystemDocument1 pageA Secure Private Key Encryption Technique For Data Security in Modern CryptosystemRajni GargNo ratings yet

- Zigbee and Bluetooth: A Comparative StudyDocument1 pageZigbee and Bluetooth: A Comparative StudyRajni GargNo ratings yet

- A Review: Security Issues of Adhoc NetworksDocument1 pageA Review: Security Issues of Adhoc NetworksRajni GargNo ratings yet

- Validity LetterDocument7 pagesValidity LetterAngela MalabananNo ratings yet

- Kagawaran NG Edukasyon: School-Based Feeding Program 2021 UPDATEDocument4 pagesKagawaran NG Edukasyon: School-Based Feeding Program 2021 UPDATESharon YangaNo ratings yet

- Ielts Reading Gap FillDocument7 pagesIelts Reading Gap FillMinh Hac VoNo ratings yet

- CMR - PatentsDocument5 pagesCMR - PatentsChristian RoqueNo ratings yet

- A Software Engineering PerspectiveDocument25 pagesA Software Engineering PerspectiveNalog RaznoNo ratings yet

- Case Study Ent530Document26 pagesCase Study Ent530sarah abdullahNo ratings yet

- Atlas Pathfinder Assignment #1Document3 pagesAtlas Pathfinder Assignment #1Juliana CerviniNo ratings yet

- Template Business PlanDocument12 pagesTemplate Business PlanReghie SantosNo ratings yet

- B. The Causative Variable in Second Language AcquisitionDocument11 pagesB. The Causative Variable in Second Language Acquisitionhesti rindhiNo ratings yet

- Lincoln and Guba CriteriaDocument2 pagesLincoln and Guba CriteriaKim SunooNo ratings yet

- Online Marketing Workshop PDFDocument20 pagesOnline Marketing Workshop PDFWan KamaruzzuliNo ratings yet

- Faculty of Engineering Technology: Lesson PlanDocument6 pagesFaculty of Engineering Technology: Lesson PlanAdam KNo ratings yet

- Anh 10 - CuoikiDocument12 pagesAnh 10 - CuoikiThế PhongNo ratings yet

- Rail Transit Capacity: Transit Capacity and Quality of Service Manual-2 EditionDocument134 pagesRail Transit Capacity: Transit Capacity and Quality of Service Manual-2 EditionkhanNo ratings yet

- I-Xxiv 001-328 r4nk - Indd IDocument352 pagesI-Xxiv 001-328 r4nk - Indd IadirenaldiNo ratings yet

- Problems of Psychology in The 21st Century, Vol. 7, 2013Document105 pagesProblems of Psychology in The 21st Century, Vol. 7, 2013Scientia Socialis, Ltd.No ratings yet

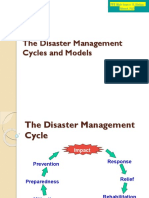

- 3 The Disaster Management Cycle and Models 1Document35 pages3 The Disaster Management Cycle and Models 1triratna100% (1)

- National Policy Related To Child CareDocument16 pagesNational Policy Related To Child CareSANANo ratings yet

- TQM Final Exam 2019Document2 pagesTQM Final Exam 2019Frederic YuloNo ratings yet

- Reaction PaperDocument2 pagesReaction Paperapi-3701307100% (3)

- New York State Testing Program Grade 7 English Language Arts TestDocument53 pagesNew York State Testing Program Grade 7 English Language Arts TestCameron JohanningNo ratings yet

- The Art of ShopliftingDocument8 pagesThe Art of ShopliftingTruco El MartinezNo ratings yet

- Solidaridad Case Study - Text Only - FOR REVIEW Com CIDocument4 pagesSolidaridad Case Study - Text Only - FOR REVIEW Com CIcarlosisazaNo ratings yet

- Communication Modes and the Rise of Social MediaDocument2 pagesCommunication Modes and the Rise of Social MediaMelchorCandelariaNo ratings yet

- SITXFSA001 Assessment C2 Part A Practical Demo V1-0Document5 pagesSITXFSA001 Assessment C2 Part A Practical Demo V1-0Omar FaruqueNo ratings yet

- Characteristics Key Features Small BusinessesDocument25 pagesCharacteristics Key Features Small BusinessesKey OnNo ratings yet