Professional Documents

Culture Documents

Residential Status&Scope of T.income

Uploaded by

euroinfotekOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Residential Status&Scope of T.income

Uploaded by

euroinfotekCopyright:

Available Formats

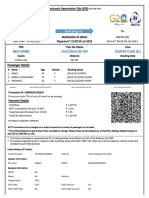

Residential Status & scope of total Income RESIDENTIAL STATUS & SCOPE OF TOTAL INCOME [SEC 5 TO 9) Residential Status

of an Individual Sec 6(1) An individual is resident in India if he satisfies any one of the following two conditions: i. He is in India for 182 days or more in the relevant previous year or ii. He is in India for 60 days or more during the relevant previous year and for 365 days or more during 4 years immediately preceding the previous year. If he does not satisfy any one of the conditions above, he shall be non-resident. Condition (ii) above is not applicable in following cases (means in following cases a person shall be resident of India only when he is in India for 182 days or more in the previous year): a. If Indian Citizen leaves India during the previous year for employment outside India or as a member of crew of an Indian Ship b. If Indian citizen or person of Indian origin visits India during previous year. Other points: Residential status is determined for every year separately India includes territorial waters of India. Employment includes self-employment In computing the period of 180 days, the day of entry into India and the day of exit from India shall be included. Person of Indian origin is a person who himself or any of his parents or any of his grandparents was born in undivided India before 15th August 1947. After determining the residential status of individual/HUF, these persons are further checked whether they are ordinarily resident or not ordinarily resident. An individual who is resident in India shall be resident and ordinarily resident (ROR) in India if he satisfies both the following conditions: i. He has been resident in India for at least 2 out of 10 previous years immediately preceding the relevant previous year And ii. He has been in India for 730 days or more during 7 previous years immediately preceding the relevant previous year. If he does not satisfy any or both of the above conditions, he shall be resident but not ordinarily resident (RNOR) in India.

Residential Status of HUF Sec 6(2) A HUF is said to be resident in India when during that year control and management is situated wholly or partly in India. In other words it will be non-resident in India if no part of the control and management of affairs is situated in India. Control and management lies at the place where decision regarding the affairs of the HUF are taken. A resident HUF is said to be resident and ordinarily resident in India if the karta of the HUF satisfies both the following conditions: i. He has been resident in India for at least 2 out of 10 previous years immediately preceding the relevant previous year And ii. He has been in India for 730 days or more during 7 previous years immediately preceding the relevant previous year. If the karta of HUF does not satisfy any or both of the above conditions, then HUF shall be resident but not ordinarily resident in India. Residential Status of Firms, AOP, BOI etc Sec 6(2), 6(4) A Firm, AOP, BOI etc is said to be resident in India when during that year control and management is situated wholly or partly in India. In other words it will be non-resident in India if no part of the control and management of affairs is situated in India. Control and management lies at the place where decision regarding the affairs of the firms etc are taken. Residential Status of Companies Sec 6(3) Indian Company is always resident in India Foreign Company is resident in India if control and management of its affairs is situated wholly in India during relevant previous year i.e. if all the board meetings of the foreign company is held in India, then it shall be resident, otherwise non-resident. Scope of Total Income/ Incidence of Tax [Sec 5) Scope of total income is according to residential status of assessee. 1. Resident in India/ ordinarily resident in India A person is assessable to tax in respect of income which i. Is received or deemed to be received in India by him or on his behalf ii. Accrues or arises or deemed to accrue or arise to him in India iii. Accrues or arises to him outside India 2. Resident but not ordinarily resident in India

A person is assessable to tax in respect of income which i. Is received or deemed to be received in India by him or on his behalf ii. Accrues or arises or deemed to accrue or arise to him in India iii. Accrues or arises to him outside India from a business controlled in or profession set up in India. 3. Non-resident in India A person is assessable to tax in respect of income which i. Is received or deemed to be received in India by him or on his behalf ii. Accrues or arises or deemed to accrue or arise to him in India Other points: Received in India means first receipt in India. If an income is received first outside India and then subsequently remitted to India, it shall be treated as received outside India. Past untaxed profits shall not be considered to be income of the current year in any case. Particulars of Income Income received or deemed to be received in India ROR Taxable Taxable RNOR Taxable Taxable NR Taxable Taxable

Income accrue or arises or deemed to accrue or arises in India Income earned outside India

Taxable Taxable (only which Not Taxable is earned from a business/profession controlled from India)

Income received or deemed to be received in India [Sec 7) Income received in India: Any income which is received in India is liable to tax in India, whether the person receiving income is resident or non- resident. Received in India means first receipt. Income deemed to be received in India: Following incomes shall be deemed to be received in India even in the absence of actual receipt: i. Contribution by employer to recognized provident fund in excess of 12% of salary of employee ii. Interest credited to RPF in excess of 9.5% iii. Transferred balance from unrecognized PF to RPF iv. Contribution by Government/Employer to notified pension scheme Dividend Income (Sec 8 ) Dividends from Indian company shall always be deemed to accrue or arise in India. However, as per Sec 10(34), such dividend is exempt in the hands of shareholder. Income deemed to accrue or arise in India (Sec 9)

Following income shall be deemed to accrue or arise in India: i. Income from any property, asset or source of income in India ii. Income from the transfer of any capital asset situated in India iii. Any income from salary if it is payable for services rendered in India iv. Salary (not allowances) payable by the government of India to an Indian citizen for services rendered outside India v. Interest payable by a. Government or b. Resident in India if money is used by the borrower for the purpose of business or profession or earning any income from any source in India or c. Non-resident in India if money is used by the borrower for the purpose of business or profession in India vi. Royalty payable by a. Government or b. Resident in India if services are utilized for the purpose of business or profession or earning any income from any source in India or c. Non-resident in India if services are utilized for the purpose of business or profession or earning any income from any source in India vii. Fees for technical services payable by a. Government or b. Resident in India it services are utilized for the purpose of business or profession or earning any income from any source in India or c. Non-resident in India it services are utilized for the purpose of business or profession or earning any income from any source in India viii. Income from a business connection in India Any income which arises, directly or indirectly, from any activity or a business connection in India is deemed to be earned in India. If all business activities are not carried out in India, then only such part of income, as is reasonably attributable to the operations carried out in India, is taxable Examples of business connection includes i. branch office in India, ii. agent of non-resident entering into contracts,

iii. Subsidiary in India iv. maintaining stocks etc However in case of non-resident, following shall not be treated as business connection in India: i. Purchase of goods in India for purpose of exports ii. Collection of news and views for transmission outside India by non-resident who is engaged in the business of running news agency or of publishing newspapers, magazines or journals iii. Shooting of films in India if a. In case of individual he is not a citizen of India b. In case of Firm none of the partner is citizen or resident of India c. In case of company none of the shareholder is citizen or resident of India CA Rahul Jain Ph: +91-9811613999

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Navajo Silversmiths.: IllustrationsDocument18 pagesNavajo Silversmiths.: IllustrationsGutenberg.orgNo ratings yet

- Civil Procedure 2017Document181 pagesCivil Procedure 2017freegalado100% (3)

- Mullane vs. Central Hanover Bank & Trust Co., Trustee, Et AlDocument20 pagesMullane vs. Central Hanover Bank & Trust Co., Trustee, Et AlAngelica LeonorNo ratings yet

- Misha Regulatory AffairsDocument26 pagesMisha Regulatory AffairsGULSHAN MADHURNo ratings yet

- Work Without Your Laptop.: Samsung Dex ProductivityDocument2 pagesWork Without Your Laptop.: Samsung Dex ProductivityBtakeshi1No ratings yet

- Tonog Vs CADocument2 pagesTonog Vs CAAllen So100% (1)

- United Coconut Planters Bank vs. Planters Products, Inc.Document4 pagesUnited Coconut Planters Bank vs. Planters Products, Inc.Arah Salas PalacNo ratings yet

- PDMS - Example For New Equipment Creation Using Copy Offset FunctionDocument6 pagesPDMS - Example For New Equipment Creation Using Copy Offset FunctionMuthu KumarNo ratings yet

- 18th SCM New Points 1 JohxDocument55 pages18th SCM New Points 1 JohxAnujit Shweta KulshresthaNo ratings yet

- Quezon City District IV - Project of Precinct - 2Document73 pagesQuezon City District IV - Project of Precinct - 2bobituchi100% (1)

- Sirat AsriDocument58 pagesSirat AsriAbbasabbasiNo ratings yet

- Code of Business Conduct For Suppliers To The Coca-Cola CompanyDocument1 pageCode of Business Conduct For Suppliers To The Coca-Cola CompanyMonicaNo ratings yet

- DENR confiscation caseDocument347 pagesDENR confiscation caseRyan BalladaresNo ratings yet

- MC - Form MC:F002 - Tenant Interview v1.1 (18 Oct 2019)Document8 pagesMC - Form MC:F002 - Tenant Interview v1.1 (18 Oct 2019)Rohit DeshpandeNo ratings yet

- G.O.MS - No. 578 Dt. 31-12-1999Document2 pagesG.O.MS - No. 578 Dt. 31-12-1999gangaraju88% (17)

- Armstrong BCE3 Install 507120-01Document18 pagesArmstrong BCE3 Install 507120-01manchuricoNo ratings yet

- I. True or FalseDocument5 pagesI. True or FalseDianne S. GarciaNo ratings yet

- Common SealDocument3 pagesCommon SealPrav SrivastavaNo ratings yet

- UKLSR Volume 2 Issue 1 Article 3 PDFDocument34 pagesUKLSR Volume 2 Issue 1 Article 3 PDFIbrahim SalahudinNo ratings yet

- Sample Business Plans - UK Guildford Dry CleaningDocument36 pagesSample Business Plans - UK Guildford Dry CleaningPalo Alto Software100% (14)

- Barangay Hearing NoticeDocument2 pagesBarangay Hearing NoticeSto Niño PagadianNo ratings yet

- Create PHP CRUD App DatabaseDocument6 pagesCreate PHP CRUD App DatabasearyaNo ratings yet

- SALAZAR WrittenDocument3 pagesSALAZAR WrittenJustin SalazarNo ratings yet

- 14312/BHUJ BE EXP Sleeper Class (SL)Document2 pages14312/BHUJ BE EXP Sleeper Class (SL)AnnuNo ratings yet

- Full Download Sociology Your Compass For A New World Canadian 5th Edition Brym Solutions ManualDocument19 pagesFull Download Sociology Your Compass For A New World Canadian 5th Edition Brym Solutions Manualcherlysulc100% (25)

- The Moral Logic of Survivor's GuiltDocument5 pagesThe Moral Logic of Survivor's GuiltKeyton OwensNo ratings yet

- Understanding Cyber Ethics and Responsible Online BehaviorDocument16 pagesUnderstanding Cyber Ethics and Responsible Online BehaviorDeepali RaniNo ratings yet

- Got - Hindi S04 480pDocument49 pagesGot - Hindi S04 480pT ShrinathNo ratings yet

- Pieterson v. INS, 364 F.3d 38, 1st Cir. (2004)Document9 pagesPieterson v. INS, 364 F.3d 38, 1st Cir. (2004)Scribd Government DocsNo ratings yet

- Tanveer SethiDocument13 pagesTanveer SethiRoshni SethiNo ratings yet