Professional Documents

Culture Documents

Interim Results June 2008

Uploaded by

Huseyin BozkinaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interim Results June 2008

Uploaded by

Huseyin BozkinaCopyright:

Available Formats

Islamic Bank of Britain PLC

Interim Report

6 month period ended 30 June 2008 Registered number 4483430

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

Contents

Chairmans statement Income statement Balance sheet Statement of changes in equity Cash flow statement Notes to the financial statements Independent auditors review report 1 2 3 4 5 6-9 10

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

Chairmans Statement

I am pleased to present the Interim Report of Islamic Bank of Britain PLC for the six months ended 30 June 2008. This has been a period where, despite adverse market conditions, the Bank continued to show steady growth in customer numbers, deposits and financing and to reduce operating expenses compared to the same period last year. Some performance highlights: Growth in customer numbers of 5.5% Growth in deposits of 7.2% Growth in customer financing of 13.3%

The operating loss for the half year was reduced by 21% to 3.1 million compared to the same period last year (6 month period ended 30 June 2007: 3.9 million). This was achieved through an increase in operating income of 22% to 2.6 million, and a 6% reduction in operating expenses to 5.7 million. Home Purchase Plan On 1 July 2008, the Bank launched its Home Purchase Plan product. This product represents a major investment in the Banks future and will become a key product in the Banks forthcoming marketing and sales initiatives. The product follows the Banks commitment to provide Sharia-compliant, innovative products, with the Home Purchase Plan being the only product of its kind that allows customers to fully apply online. This extends the Banks reach to customers nationwide. The technology used in this flagship project will be utilised with other products in the Banks existing, and forthcoming portfolio. Other accomplishments April 2008 saw the launch of the Banks Wakala treasury deposit account, which has enjoyed a strong early performance whilst reducing the costs of treasury transactions. The Direct Savings account also performed well during the period, following a successful marketing campaign, increasing the Banks diversified deposit base. In addition to the Home Purchase Plan IT developments noted above, the Banks IT infrastructure has been significantly upgraded since the beginning of the year. This included construction of a new state-of-the-art data centre, providing enhanced security and capacity for future growth, and upgrading the core banking platform, to improve performance and enable further upgrades. The Smart Banking channels continue to grow, with the number of customers using online banking increasing 4% during the half year to reach 28%, while the ratio of customers using automated telephone banking services advanced to 23.5%. This is in accordance with the Banks strategy to grow service delivery through efficient, user-friendly channels. I would like to thank Islamic Bank of Britains customers, shareholders, and staff for their continued support and commitment to the Bank. I am encouraged by the progress we made in this challenging banking environment. I look forward to continued improvement and growth.

Mohsen Moustafa Chairman 17 September 2008

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

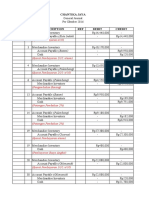

Income Statement

for the 6 month period ended 30 June 2008

Note 6 month period ended 30 June 2008 6 month period ended 30 June 2007 6 month period ended 31 Dec 2007

Income receivable from Islamic financing transactions Returns payable to customers and banks Net income from Islamic financing transactions Fee and commission income Fee and commission expense Net fee and commission income Operating income Net impairment loss on financial assets Personnel expenses General and administrative expenses Depreciation Amortisation Total operating expenses 6

4,284,281 (1,859,492) 2,424,789 250,843 (51,345) 199,498 2,624,287 (180,277) (2,385,682) (2,244,490) (399,805) (473,869) (5,684,123)

3,400,002 (1,369,220) 2,030,782 124,207 (7,746) 116,461 2,147,243 (311,347) (2,395,095) (2,371,646) (383,753) (561,734) (6,023,575)

4,404,288 (1,839,651) 2,564,637 115,855 (130,873) (15,018) 2,549,619 (332,724) (2,743,281) (1,607,346) (362,600) (544,340) (5,590,291)

Loss before income tax Income tax expense Loss for the period 4

(3,059,836) (3,059,836)

(3,876,332) (3,876,332)

(3,040,672) (3,040,672)

Loss per ordinary share Basic and diluted (pence) 3 (0.73) (0.93) (0.73)

The notes on pages 6 to 9 form part of these financial statements.

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

Balance Sheet

At 30 June 2008

Note 30 June 2008 30 June 2007 31 Dec 2007

Assets Cash Commodity Murabaha and Wakala receivables and other advances due from banks Consumer finance accounts and other advances to customers Net investment in commercial property finance Property and equipment Intangible assets Other assets Total assets

596,072 146,747,433 9,262,838 8,523,880 3,361,790 912,938 2,310,996 171,715,947

273,772 119,745,351 9,249,857 5,386,012 3,694,825 1,431,447 1,060,224 140,841,488

509,769 141,768,471 9,663,295 6,091,882 3,443,355 1,262,231 2,197,824 164,936,827

Liabilities and equity Liabilities Deposits from banks Deposits from customers Other liabilities Total liabilities Equity Called up share capital Share premium Retained deficit Profit stabilisation reserve Total equity Total equity and liabilities

7 8

6,241,907 140,744,059 2,930,263 149,916,229

4,988,977 105,988,967 2,008,589 112,986,533

2,498,304 134,640,612 2,972,602 140,111,518

4,190,000 48,747,255 (31,188,401) 50,864 21,799,718 171,715,947

4,190,000 48,747,255 (25,082,300) 27,854,955 140,841,488

4,190,000 48,747,255 (28,137,072) 25,126 24,825,309 164,936,827

These financial statements were approved by the Board of Directors on 17 September 2008 and were signed on its behalf by:

Gerry Deegan Managing Director

The notes on pages 6 to 9 form part of these financial statements.

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

Statement of Changes in Equity

for the 6 month period ended 30 June 2008

Share capital Balance at 1 July 2007 Loss for the period Credit in respect of share based payments charge Transfer to profit stabilisation reserve Balance at 31 December 2007 4,190,000 4,190,000 Share premium account 48,747,255 48,747,255 Profit and loss account (25,082,300) (3,040,672) 11,026 (25,126) (28,137,072) Profit stabilisation reserve 25,126 25,126 Total

27,854,955 (3,040,672) 11,026 24,825,309

Balance at 1 January 2008 Loss for the period Credit in respect of share based payments charge Transfer to profit stabilisation reserve Balance at 30 June 2008

4,190,000 4,190,000

48,747,255 48,747,255

(28,137,072) (3,059,836) 34,245 (25,738) (31,188,401)

25,126 25,738 50,864

24,825,309 (3,059,836) 34,245 21,799,718

The notes on pages 6 to 9 form part of these financial statements

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

Cash Flow Statement

for the 6 month period ended 30 June 2008

Note 6 month period ended 30 June 2008 6 month period ended 30 June 2007 6 month period ended 31 Dec 2007

Cash flows from operating activities Loss for the period Adjustments for: Depreciation Amortisation Net impairment loss on financial assets Share Based Payment Charge Change in Commodity Murabaha and Wakala receivables and other advances due from banks Change in consumer finance accounts and other advances to customers Change in net investment in commercial property finance Change in other assets Change in deposits from banks Change in deposits from customers Change in other liabilities Net cash (used in)/from operating activities Cash flows from investing activities Purchase of property, plant and equipment Purchase of intangible assets Net cash used in investing activities Net (decrease)/increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at the end of the period 5

(3,059,836) 399,805 473,869 180,277 34,245

(3,876,332) 383,753 561,734 311,347 -

(3,040,672) 362,600 544,340 332,724 11,026

(7,682,833) 220,180 (2,431,998) (113,172) 3,743,603 6,103,447 (42,339) (2,174,752)

(18,984,286) (1,468,878) (3,047,611) (76,954) 4,748,813 22,135,584 (178,672) 508,498

(19,081,574) (746,162) (705,870) (1,137,600) (2,490,673) 28,651,645 964,013 3,663,797

(318,240) (124,576) (442,816) (2,617,568) 5,664,506 3,046,938

(113,208) (98,909) (212,117) 296,381 2,190,582 2,486,963

(111,130) (375,124) (486,254) 3,177,543 2,486,963 5,664,506

The notes on pages 6 to 9 form part of these financial statements

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

Notes

(forming part of the financial statements) 1 Accounting policies and basis of preparation

Islamic Bank of Britain PLC (the Company) is a company incorporated in the UK. The annual financial statements of the Company are prepared in accordance with IFRSs as adopted by the EU. The interim financial information included in this half-yearly report has been prepared in accordance with the recognition and measurement requirements of IFRSs as adopted by the EU, applying the accounting policies and presentation that were applied in the preparation of the Companys published financial statements for the year ended 31 December 2007. The directors anticipate that these accounting policies will be used in the preparation of the Companys annual financial statements for the year ended 31 December 2008.

Segmental Reporting

The company has one class of business and all other services provided are ancillary to this. All business is conducted from the United Kingdom.

Earnings per ordinary share

Basic and diluted earnings per ordinary share are calculated by dividing the loss for the financial period attributable to equity shareholders by the weighted average number of ordinary shares in issue in the 6 month period ended 30 June 2008 of 419,000,000 (6 month period ended 30 June 2007: 419,000,000, 6 month period ended 31 December 2007: 419,000,000). The Company has established an HMRC approved Company Share Option Plan (CSOP) under which options to subscribe for the Companys ordinary shares of 1p each have been awarded to certain employees. At 30 June 2008 3,200,469 options remain outstanding (30 June 2007: nil, 31 December 2007: 3,200,469). Diluted loss per share is the same as basic loss per share since the outstanding share options have not been taken into account due to their anti-dilutive effect. This arises since the Company is currently loss making.

Income tax expense

There were no taxable profits or recoverable losses for the 6 month period ended 30 June 2008 (6 month period ended 30 June 2007: nil, 6 month period ended 31 December 2007: nil) and, accordingly, the Company has not provided for a tax charge or a tax debtor. As at 30 June 2008, the Company had potential deferred tax assets in respect of tax losses carried forward of 6,855,212 (30 June 2007: 5,234,252, 31 December 2007: 6,156,185) and in respect of timing differences on capital allowances of 1,251,716 (30 June 2007: 1,218,045, 31 December 2007: 1,147,840). In respect of the recognition of deferred tax assets, for the purposes of applying the requirements of IAS 12 (Income Taxes), it has been considered that the Company is not currently at a sufficiently advanced stage in its development to confidently assert future offsetting tax liabilities. The capital allowances to be claimed are being finalised and therefore the level of the potential asset shown above may change. The corporation tax rate used to calculate potential deferred tax assets was 28%.

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

Notes (continued)

5 Cash and cash equivalents

30 June 2008 Cash Other advances to banks Total cash and cash equivalents 596,072 2,450,866 3,046,938 30 June 2007 273,772 2,213,191 2,486,963 31 Dec 2007 509,769 5,154,737 5,664,506

Impairment allowance

30 June 2008 30 June 2007 357,081 (302,938) 35,459 89,602 31 Dec 2007 89,602 104,707 194,309

Specific allowances for impairment Balance at beginning of period Transfer to collective allowances for impairment Charge for the period Amount written off during the period Balance at end of period Collective allowances for impairment Balance at beginning of period Transfer from specific allowances for impairment Charge for the period Amounts written off during the period Balance at end of period

194,309 50,373 (112,825) 131,857

818,708 129,904 (86,166) 862,446

140,076 302,938 275,888 718,902

718,902 228,017 (128,211) 818,708

Total allowances for impairment Balance at beginning of period Charge for the period Amount written off during the period Balance at end of period

1,013,017 180,277 (198,991) 994,303

497,157 311,347 808,504

808,504 332,724 (128,211) 1,013,017

This impairment allowance relates to consumer finance accounts and other advances to retail customers. Following a review of the impairment calculation during the 6 month period ended 30 June 2007, a transfer was made from the specific allowance to the collective allowance, as shown in the table above.

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

Notes (continued)

7 Deposits from banks

30 June 2008 Repayable on demand 3 months or less but not repayable on demand 1 year or less but over 3 months Total deposits from banks Comprising: Non profit sharing Profit sharing/paying accounts Total deposits from banks 6,175 6,000,000 235,732 6,241,907 30 June 2007 246,092 4,742,885 4,988,977 31 Dec 2007 14,820 2,247,752 235,732 2,498,304

6,000 6,235,907 6,241,907

6,000 4,982,977 4,988,977

6,000 2,492,304 2,498,304

Deposits from customers

30 June 2008 30 June 2007 66,754,673 23,500,047 15,734,247 105,988,967 31 Dec 2007 77,626,003 47,586,495 9,428,114 134,640,612

Repayable on demand 3 months or less but not repayable on demand 1 year or less but over 3 months Total deposits from customers Comprising: Non profit sharing Profit sharing/paying accounts Total deposits from customers

87,885,144 43,097,222 9,761,693 140,744,059

26,237,158 114,506,901 140,744,059

22,027,110 83,961,857 105,988,967

27,094,505 107,546,107 134,640,612

Related party disclosures

Transactions with directors Mr Shabir Randeree resigned as a director of the Company on 6 February 2008. During the current and comparative periods, Mr Shabir Randeree was a director of the following companies that held bank accounts with Islamic Bank of Britain Plc under normal customer terms and conditions. As at 6 February 2008, Pelham Incorporated Limited deposit balances amounted to 86,341 (30 June 2007: 1,719,881, 31 December 2007: 622,949) and the highest balance during the period to 6 February 2008 was 625,602 (30 June 2007: 6,626,311, 31 December 2007: 1,749,887). Returns paid on these deposits during the period to 6 February 2008 totalled 2,654 (30 June 2007: 52,030, 31 December 2007: 13,121). As at 30 June 2008, the deposit balances amounted to 635,563. As at 6 February 2008, DCD Properties Limited deposit balances amounted to 2,048 (30 June 2007: 84,400, 31 December 2007: 86,543) and the highest balance during the period to 6 February 2008 was 87,173 (30 June 2007: 526,291, 31 December 2007: 86,453). Returns paid on these deposits during the period to 6 February 2008 totalled 391 (30 June 2007: 1,644, 31 December 2007: 2,143). As at 30 June 2008, the deposit balances amounted to 2,048.

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

Notes (continued)

9 Related party disclosures (continued)

As at 6 February 2008, European Islamic Investment Bank PLC deposit balances amounted to 244,552 (30 June 2007: 240,092, 31 December 2007: 244,552) and the highest balance during the period to 6 February 2008 was 244,567 (30 June 2007: 5,284,929, 31 December 2007: 244,552). Returns paid on these deposits during the period to 6 February 2008 totalled 15 (30 June 2007: 53,483, 31 December 2007: 4,460). As at 30 June 2008, the deposit balances amounted to 235,907. At 30 June 2008, directors of the Company and their immediate relatives controlled 0.04% of the voting shares of the Company (30 June 2007: 7.41%, 31 December 2007: 7.21%). Transactions with key management personnel Key management of the Company are the Board of Directors and Management Committee members. The compensation of key management personnel, including the directors, is as follows:

6 month period ended 30 June 2008 Key management emoluments including social security costs Company contributions to pension plans Total 788,216 21,950 810,166 6 month period ended 30 June 2007 586,638 17,450 604,088 6 month period ended 31 Dec 2007 477,717 21,530 499,247

Deposit balances, operated under standard customer terms and conditions, held by key management personnel, including directors, totalled 162,379 as at 30 June 2008 (30 June 2007: 157,049, 31 December 2007: 116,664). The highest balance during the 6 month period ended 30 June 2008 was 279,043 (6 month period ended 30 June 2007: 233,445, 6 month period ended 31 December 2007: 143,305). Total returns paid on these accounts for the 6 month period ended 30 June 2008 totalled 1,664 (6 month period ended 30 June 2007: 724, 6 month period ended 31 December 2007: 220). Outstanding consumer finance account balances relating to key management personnel, including directors, totalled 63,638 as at 30 June 2008 (30 June 2007: 19,874, 31 December 2007: 51,994). Returns recognised on these accounts for the 6 month period ended 30 June 2008 totalled 1,941 (6 month period ended 30 June 2007: 683, 6 month period ended 31 December 2007: 1,721). All consumer finance account facilities taken by key management personnel and directors were offered in line with standard customer terms and conditions.

10

Interim Report and statutory accounts

The comparative figures for the financial year ended 31 December 2007 are not the company's statutory accounts for that financial year. Those accounts have been reported on by the company's auditors and delivered to the registrar of companies. The report of the auditors was (i) unqualified, (ii) did not include a reference to any matters to which the auditors drew attention by way of emphasis without qualifying their report, and (iii) did not contain a statement under section 237(2) or (3) of the Companies Act 1985.

Islamic Bank of Britain PLC Interim Report 6 month period ended 30 June 2008

Independent review report by KPMG Audit Plc to Islamic Bank of Britain PLC

Introduction We have been engaged by the company to review the condensed set of financial statements in the half-yearly report for the six months ended 30 June 2008 which comprises the Income statement, Balance sheet, Statement of changes in equity and Cash flow statement and the related explanatory notes. We have read the other information contained in the half-yearly report and considered whether it contains any apparent misstatements or material inconsistencies with the information in the condensed set of financial statements. This report is made solely to the company in accordance with the terms of our engagement. Our review has been undertaken so that we might state to the company those matters we are required to state to it in this report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company for our review work, for this report, or for the conclusions we have reached. Directors' responsibilities The half-yearly report is the responsibility of, and has been approved by, the directors. The directors are responsible for preparing the half-yearly report in accordance with the AIM Rules. As disclosed in note 1, the annual financial statements of the company are prepared in accordance with IFRSs as adopted by the EU. The condensed set of financial statements included in this half-yearly report has been prepared in accordance with the recognition and measurement requirements of IFRSs as adopted by the EU. The accounting policies that have been adopted in preparing the condensed set of financial statements are consistent with those that the directors currently intend to use in the next annual financial statements. There is, however, a possibility that the directors may determine that some changes to these policies are necessary when preparing the full annual financial statements in accordance with IFRSs as adopted by the EU. Our responsibility Our responsibility is to express to the company a conclusion on the condensed set of financial statements in the half-yearly report based on our review. Scope of review We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410 Review of Interim Financial Information Performed by the Independent Auditor of the Entity issued by the Auditing Practices Board for use in the UK. A review of interim financial information consists of making enquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing (UK and Ireland) and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion. Conclusion Based on our review, nothing has come to our attention that causes us to believe that the condensed set of financial statements in the half-yearly report for the six months ended 30 June 2008 is not prepared, in all material respects, in accordance with the recognition and measurement requirements of IFRSs as adopted by the EU and the AIM Rules.

KPMG Audit Plc Chartered Accountants One Canada Square London E14 5AG

17 September 2008

10

You might also like

- Unaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)Document2 pagesUnaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)nayanghimireNo ratings yet

- ANNUAL REPORT 2008 CHAIRMAN'S REVIEW ECONOMIC CHALLENGESDocument145 pagesANNUAL REPORT 2008 CHAIRMAN'S REVIEW ECONOMIC CHALLENGESWaqas NawazNo ratings yet

- COMPARATIVE FINANCIAL POSITIONDocument4 pagesCOMPARATIVE FINANCIAL POSITIONशिशिर ढकालNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Annual Report 07 08Document142 pagesAnnual Report 07 08jagat_sabatNo ratings yet

- Banking Survey 2010Document60 pagesBanking Survey 2010Fahad Paracha100% (1)

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Kaspi Bank 21Document4 pagesKaspi Bank 21Serikkizi FatimaNo ratings yet

- Premier BankDocument14 pagesPremier Bankanower.hosen61No ratings yet

- Desco Final Account AnalysisDocument26 pagesDesco Final Account AnalysiskmsakibNo ratings yet

- 5322150311Document276 pages5322150311Nikita GuptaNo ratings yet

- Consolidated Profit and Loss Account For The Year Ended December 31, 2008Document16 pagesConsolidated Profit and Loss Account For The Year Ended December 31, 2008madihaijazNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadNo ratings yet

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- FY 2012-13 First Quarter Results: Investor PresentationDocument31 pagesFY 2012-13 First Quarter Results: Investor PresentationSai KalyanNo ratings yet

- National Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Document36 pagesNational Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Ghulam AkbarNo ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- Procredit Alb 2018Document64 pagesProcredit Alb 2018Thomas SzutsNo ratings yet

- Pakistan Synthetics Limited Condensed Interim Balance Sheet AnalysisDocument8 pagesPakistan Synthetics Limited Condensed Interim Balance Sheet AnalysismohammadtalhaNo ratings yet

- UntitledDocument376 pagesUntitledpoobalanipbNo ratings yet

- BM&F Bovespa 3Q08 Earnings Conference Call November 12Document32 pagesBM&F Bovespa 3Q08 Earnings Conference Call November 12BVMF_RINo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Growing Sustainably: Hindustan Unilever LimitedDocument164 pagesGrowing Sustainably: Hindustan Unilever LimitedFarid PatcaNo ratings yet

- IGB Corporation Berhad Interim Financial Report for H1 2009Document14 pagesIGB Corporation Berhad Interim Financial Report for H1 2009James WarrenNo ratings yet

- Unconsolidated Condensed Interim Financial Statements of Allied Bank LimitedDocument44 pagesUnconsolidated Condensed Interim Financial Statements of Allied Bank LimitedenkashmiriNo ratings yet

- Company Financial StatementsDocument49 pagesCompany Financial StatementsStar ShinnerNo ratings yet

- Abl Half Yearly 2009Document44 pagesAbl Half Yearly 2009ibrahim978No ratings yet

- Investor Presentation: Q2FY13 & H1FY13 UpdateDocument18 pagesInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjNo ratings yet

- June Financial Soundness Indicators - 2007-12Document53 pagesJune Financial Soundness Indicators - 2007-12shakira270No ratings yet

- Balance Sheet2006Document50 pagesBalance Sheet2006malikzai777No ratings yet

- Development Credit Bank Limited: February, 2008Document35 pagesDevelopment Credit Bank Limited: February, 2008Ashutosh TiwariNo ratings yet

- 2Q10 ITR Free Translation FIBRIADocument74 pages2Q10 ITR Free Translation FIBRIAFibriaRINo ratings yet

- Capitec Group AR 2010Document152 pagesCapitec Group AR 2010John WilsonNo ratings yet

- FS Final March31 2009Document29 pagesFS Final March31 2009beehajiNo ratings yet

- Standalone Accounts 2008Document87 pagesStandalone Accounts 2008Noore NayabNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- MCB Bank Limited Consolidated Financial Statements SummaryDocument93 pagesMCB Bank Limited Consolidated Financial Statements SummaryUmair NasirNo ratings yet

- HDFCDocument78 pagesHDFCsam04050No ratings yet

- Interim Condensed: Sanofi-Aventis Pakistan LimitedDocument13 pagesInterim Condensed: Sanofi-Aventis Pakistan LimitedawaisleoNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- Analyze Dell's FinancialsDocument18 pagesAnalyze Dell's FinancialsSaema JessyNo ratings yet

- ABL Half Yearly 2015Document52 pagesABL Half Yearly 2015hamzaNo ratings yet

- Bajaj Auto LTD: Presented By: Hitesh RameshDocument15 pagesBajaj Auto LTD: Presented By: Hitesh RameshnancyagarwalNo ratings yet

- Capitec Interim2004Document1 pageCapitec Interim2004naeemrencapNo ratings yet

- SIEMENS Analysis of Financial StatementDocument16 pagesSIEMENS Analysis of Financial StatementNeelofar Saeed100% (1)

- Procredit Alb 2019Document62 pagesProcredit Alb 2019Thomas SzutsNo ratings yet

- Q1 FY09 TablesDocument3 pagesQ1 FY09 TablesPerminder Singh KhalsaNo ratings yet

- Ual Jun2011Document10 pagesUal Jun2011asankajNo ratings yet

- Kingsbury AR - 2012 PDFDocument52 pagesKingsbury AR - 2012 PDFSanath FernandoNo ratings yet

- CBN 5 Year Financial StatementsDocument2 pagesCBN 5 Year Financial StatementsNiaz Mohammad MaliarNo ratings yet

- 1st Quarterly Report 2009Document38 pages1st Quarterly Report 2009Muhammad Salman ShahNo ratings yet

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Document11 pagesProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniNo ratings yet

- Foreign Exchange MGT of Uttara BankDocument21 pagesForeign Exchange MGT of Uttara BankTanim XubayerNo ratings yet

- 2015 Interim Results PresentationDocument30 pages2015 Interim Results PresentationAnonymous 6tuR1hzNo ratings yet

- 2011 Annual ReportDocument96 pages2011 Annual ReportOsman SalihNo ratings yet

- SAMADHAAN Case StudyDocument7 pagesSAMADHAAN Case StudyharshNo ratings yet

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Positive Behavioral Interventions and SupportsDocument32 pagesPositive Behavioral Interventions and SupportsAbhimanyu SinghNo ratings yet

- Accounting 26th Edition Warren Test BankDocument13 pagesAccounting 26th Edition Warren Test Bankmellow.duncical.v9vuq100% (28)

- PDF Online Activity - Gerunds and InfinitivesDocument3 pagesPDF Online Activity - Gerunds and InfinitivesJORDY ALEXANDER MONTENEGRO ESPEJONo ratings yet

- ERP ImplementationDocument47 pagesERP Implementationattarjaved100% (1)

- REXTAR User and Service GuideDocument58 pagesREXTAR User and Service GuidewellsuNo ratings yet

- Impact of Digitalisation Online FinalDocument72 pagesImpact of Digitalisation Online FinalBanon KekeNo ratings yet

- Detailed Bank StatementDocument4 pagesDetailed Bank StatementJavita CertificationsNo ratings yet

- Opposition To Motion For InjunctionDocument29 pagesOpposition To Motion For InjunctionBasseemNo ratings yet

- Informatica Administrator Interview Questions and AnswersDocument3 pagesInformatica Administrator Interview Questions and Answersatoztarget100% (2)

- Clinical ChemistryDocument23 pagesClinical ChemistryRezzy Mae Panadero OraNo ratings yet

- Web TPI MDF-TC-2016-084 Final ReportDocument35 pagesWeb TPI MDF-TC-2016-084 Final ReportKrishnaNo ratings yet

- A Tidy GhostDocument13 pagesA Tidy Ghost12345aliNo ratings yet

- Crack Detection & RepairDocument5 pagesCrack Detection & RepairHaftay100% (1)

- PT Amar Sejahtera General LedgerDocument6 pagesPT Amar Sejahtera General LedgerRiska GintingNo ratings yet

- Contrafund 31-07-2020Document12 pagesContrafund 31-07-2020b1OSphereNo ratings yet

- Approved Term of Payment For Updating Lower LagunaDocument50 pagesApproved Term of Payment For Updating Lower LagunaSadasfd SdsadsaNo ratings yet

- الصراع التنظيمي وأثره...Document25 pagesالصراع التنظيمي وأثره...mohmod moohNo ratings yet

- Leak Proof Engineering I PVT LTDDocument21 pagesLeak Proof Engineering I PVT LTDapi-155731311No ratings yet

- The Quadrifilar Helix Antenna: Sec 22.1 IntroductionDocument20 pagesThe Quadrifilar Helix Antenna: Sec 22.1 Introductionenmanuel enmanuel silva zaldivarNo ratings yet

- CIA Interview GuideDocument14 pagesCIA Interview GuideCody ToebbickeNo ratings yet

- Calculus Early Transcendentals 10th Edition Anton Solutions ManualDocument35 pagesCalculus Early Transcendentals 10th Edition Anton Solutions Manualcrenate.bakshish.7ca96100% (16)

- ZRO List 3.17Document4 pagesZRO List 3.17Com22No ratings yet

- Dr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawDocument9 pagesDr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawVimal SinghNo ratings yet

- Field Attachment Report Format For All Third Year Students - Final For Use by StudentsDocument2 pagesField Attachment Report Format For All Third Year Students - Final For Use by StudentsJoseph Kayima50% (2)

- Research Methodology MCQ 400Document190 pagesResearch Methodology MCQ 400dhanusiya balamurugan67% (18)

- Nadig Reporter Newspaper Chicago June 19 2013 EditionDocument20 pagesNadig Reporter Newspaper Chicago June 19 2013 EditionchicagokenjiNo ratings yet

- PAS Install Lab Guide - v11.2Document145 pagesPAS Install Lab Guide - v11.2Muhammad Irfan Efendi SinulinggaNo ratings yet

- Nanotechnology Applications in Viscoelastic Surfactant Stimulation FluidsDocument10 pagesNanotechnology Applications in Viscoelastic Surfactant Stimulation FluidsNircarlomix OrtegaNo ratings yet

- Best Practices in Non-Revenue Water en FinalDocument96 pagesBest Practices in Non-Revenue Water en FinalEddiemtonga100% (1)

- Wind Energy Potential in BangladeshDocument10 pagesWind Energy Potential in BangladeshAJER JOURNALNo ratings yet