Professional Documents

Culture Documents

24 Outline

Uploaded by

_toasteeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

24 Outline

Uploaded by

_toasteeCopyright:

Available Formats

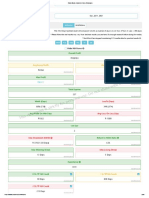

Business Law 24

Study online at quizlet.com/_6hw4i

1.

What are the two types of negotiable instruments?

1. Promissory Notes (promise to pay) 2. Drafts and Checks (Order to pay) Negotiable instrument

8.

A draft in which the seller is both the drawer and payee. The draft orders the buyer to pay a specified sum of money to the seller, at a stated time in the future.

Trade Acceptance (draft) This is typically seen in sales of goods--supplier extending credit to its buyer, for example. Banker's acceptance (draft)

2.

A signed writing (or record) that contains an unconditional promise or order to pay an exact amount, either on demand or at a specific future time. In addition, it must be easily transferable without danger of being uncollectible. A draft involves three parties. What are the three?

9.

"An order to pay an exact amount"--key statement 1. Drawer-signs or makes an order to pay 2. Drawee-whom the order is made (ie: bank receives the order to make payment to...) 3. Payee-whom "payment" is ordered to

10.

A draft drawn by a creditor against his or her debtor, who must pay it at maturity. Typically, the term is short. In other words, when a draft orders the buyer's bank to pay. A draft drawn on a bank and payable on demand. There are two parties to a promissory note--a written promise by one party to pay money to another party. Identify the parties.

3.

Check (draft) 1. Maker--the person who promises to pay 2. Payee--the person to whom the promise is made to

11.

12.

A note made by a bank promising to repay a deposit of funds with interest on a certain date. List the requirements for negotiability.

Certificate of Deposits (CDs) (note) 1. In written form 2. Signed by the maker (note) or drawer (draft) 3. An unconditional promise or order 4. An order or promise to pay a "fixed" amount of money 5. Payable on demand or at a definite time 6. Payable to order or to bearer, unless it is a check

13.

4.

In a draft, the drawee must be obligated to the drawer either by an 1.___________ or 2.__________ relationship to honor the order. This draft is payable at a definite future time This draft is payable when presented for payment. Can a draft be both time and sight draft? If yes, how?

1. Agreement 2. Debtorcreditor Time Draft Sight Draft Yes. When the draft is payable at a stated time (time) after one presents it (sight).

5.

6.

7.

14.

For an instrument to be negotiable, it must contain an ________ promise (note) or order (draft) to pay

Express (must be "affirmative" and cannot imply a promise or order) Thus, on exam, always be mindful to see whether express words are used, such as "I promise to pay" or similar.

17.

Is a variable interest rate note negotiable? Does it violate the "fixed amount" requirement of negotiability? Why or why not?

No, it does not violate the fixed amount requirement because the requirement applies only the principal. Thus, even variable rate of interest--often fluctuates as a result of market conditions--can be negotiable. We just need the principal to be fixed and explicitly stated.

15.

Associated with three-party instruments, this directs a third party to pay the instrument as drawn. It must show command.

Order IE: On a typical check, the word "pay" (to the order of a payee (one who payment is made for)) is a command to the drawee bank to pay the check when presented, and thus, it is an order 1. "References" to another writing (referring to another document is allowed, but if the promise or order is subjected to another writing conditions, this is conditional) 2. Payments only out of a particular fund or source (although it appears unattractive but it does not impair unconditional status)

18.

A drawee who has accepted, or agreed to pay, an instrument when it is presented later for payment A requirement of negotiability is that the instrument must be payable on demand or at a definite time. This is very important! An instrument is payable on (1) a specified date, (2) within a definite period of time (such as 30 days), or (3) on a date or time readily ascertainable at the time the promise or order is issued. Thus, it is very important that on the note or draft (instrument), it is properly Allows a holder to demand payment of entire amount, plus any interests up to the date, if a certain event occurs without affecting negotiability.

Acceptor

19.

Dated. However, no date affects negotiability if the date is necessary to determine a definite time for payment. For example, if undated, then the statement "made payable one month after date" cannot be determined and clearly nonnegotiable. So, no date does not always mean negotiability is destroyed or impaired! Acceleration Clause IE: A note has an acceleration provision that if Martin defaults on his payment, the holder of the note or payee can demand full payment, plus any accrued interests. So, if Martin defaults, the full amount and interests will be payable in full. No, because it is allowed under the "extension clause" and the extension period is clearly and expressly stated. However, after January 1, the instrument will be a demand instrument.

16.

One requirement of negotiability is the note or draft is unconditional. In order for payment to be unconditional, payment or order CANNOT be subject to or governed by another writing, or be subject to rights or obligations stated in another writing. However, negotiability is not affected by--

20.

21.

"The holder of this note at the date of maturity, January 1, 2012, can extend the time of payment until the following June 1 or later, if the holder so wishes." Does this affect negotiability?

22.

Why is a freedom to transfer so essential to a negotiable instrument?

Because one of its function is to serve as a substitute to cash. Therefore, it must be transferable. "Payable to order or to bearer"

30.

Unspecified interest rate does not affect negotiability. If unspecified, the Codes provides what rate to be used?

Judgment rate (a rate of interest fixed by a statue)

23.

The payment must be _____________ at the time it is issued or first comes into the possession of the holder. Define order instrument.

24.

"Payable to the order of an identified person" or to "an identified person or order" The person must be identified with certainty.

25.

What does it mean that the maker of a note or drawer of a draft is agreeing to pay either the person specified on the instrument or whomever that person might designate? This term refers to a person in possession of an instrument that is payable to bearer or endorsed in blank with a signature only. This type of instrument can, thus, be negotiated merely by a change in possession, that is, by "delivery."

Because the identified person of an order instrument may transfer the instrument to whomever he wishes Bearer instrument Endorsed in blank-the holder's name is signed on the back without any accompanying instruction. Bearer instrument But an instrument payable to a nonexistent entity is not bearer paper

26.

27.

This is an instrument that does not designate a specific payee.

28.

Does post-dating or antedating an instrument affect negotiability?

No. Antedating occurs when a party puts a date on an instrument that precedes the actual calendar date

29.

On an instrument, handwritten words prevail 1._________, and 2._________ prevails __________.

1. Typewritten 2. Typewritten 3. Printed (preprinted on forms, etc.)

You might also like

- Business - Law - Marks 5Document14 pagesBusiness - Law - Marks 5Server IssueNo ratings yet

- Notes in Negotiable Instruments Law: Rights of Holders Where Parts Are Negotiated SeparatelyDocument7 pagesNotes in Negotiable Instruments Law: Rights of Holders Where Parts Are Negotiated SeparatelyLorelei B RecuencoNo ratings yet

- Ni Act.Document64 pagesNi Act.Saurabh SumanNo ratings yet

- Notes On Negotiable Intruments Law Part 1Document13 pagesNotes On Negotiable Intruments Law Part 1JurilBrokaPatiño100% (1)

- X'Chapter I SECTION 1: Form of Negotiable InstrumentsDocument13 pagesX'Chapter I SECTION 1: Form of Negotiable InstrumentsKloie SanoriaNo ratings yet

- Commercial Paper OutlineDocument4 pagesCommercial Paper Outlinezumieb100% (2)

- Negotiable InstrumentsDocument9 pagesNegotiable InstrumentsAndrolf CaparasNo ratings yet

- Negotiable Instruments 1st SessionDocument50 pagesNegotiable Instruments 1st SessionRM Mallorca100% (2)

- Banking LawDocument33 pagesBanking LawAnsh VeerNo ratings yet

- Basic Principles of Negotiable InstrumentsDocument37 pagesBasic Principles of Negotiable InstrumentsAndrea IvanneNo ratings yet

- Commercial Law ReviewDocument22 pagesCommercial Law ReviewKatrine ManaoNo ratings yet

- Law On SalesDocument4 pagesLaw On SalesCarie Joy CabilloNo ratings yet

- Define negotiability and requisites of negotiable instrumentsDocument7 pagesDefine negotiability and requisites of negotiable instrumentsLourdes May Flores ParmanNo ratings yet

- Negotiable IntstrumentDocument2 pagesNegotiable IntstrumentJayson AbadNo ratings yet

- THIRD OUTLINE NotesDocument4 pagesTHIRD OUTLINE NotesnoneNo ratings yet

- Negotiable-Instruments - Pattern of SyllabusDocument34 pagesNegotiable-Instruments - Pattern of SyllabusGel Barr0% (1)

- Features of Negotiable InstrumentDocument3 pagesFeatures of Negotiable InstrumentUnEeb WaSeemNo ratings yet

- Nego TerminologiesDocument15 pagesNego TerminologiesLee SomarNo ratings yet

- Negotiable Instruments Qanda NotesDocument20 pagesNegotiable Instruments Qanda NotesRamon Joma BungabongNo ratings yet

- NegoIn Section 1-10Document13 pagesNegoIn Section 1-10Aries James67% (3)

- Nego Finals ReviewerDocument22 pagesNego Finals ReviewerAnna Katrina VistanNo ratings yet

- Negotiable Instruments Law (Act No. 2031Document39 pagesNegotiable Instruments Law (Act No. 2031Hei Nah MontanaNo ratings yet

- NI-Full NotesDocument27 pagesNI-Full NotesArchana PurohitNo ratings yet

- Negotiable InstrumentsDocument9 pagesNegotiable InstrumentsMary May NavarreteNo ratings yet

- Bankingtheorylawpracticeunitiiippt 240307181015 7e5977faDocument29 pagesBankingtheorylawpracticeunitiiippt 240307181015 7e5977fadharshan0425No ratings yet

- 11 Accountancy Notes Ch06 Accounting For Bills of Exchange 02Document28 pages11 Accountancy Notes Ch06 Accounting For Bills of Exchange 02Anonymous NSNpGa3T93100% (1)

- Negotiable InstrumentsDocument5 pagesNegotiable InstrumentsJinky MartinezNo ratings yet

- The Function and Creation of Negotiable InstrumentsDocument12 pagesThe Function and Creation of Negotiable InstrumentsEdward MokweriNo ratings yet

- Kinds of Negotiable Instruments (1)Document19 pagesKinds of Negotiable Instruments (1)theashu022No ratings yet

- Commercial Law Guide to Negotiable InstrumentsDocument16 pagesCommercial Law Guide to Negotiable InstrumentsMJ BotorNo ratings yet

- Governing Law: - The Negotiable Instruments Law (ACT No. 2031)Document7 pagesGoverning Law: - The Negotiable Instruments Law (ACT No. 2031)Leilani WeeNo ratings yet

- Negotiable Instrument: Promissory Note, Bill of Exchange, or Cheque Payable Either To Order or To The Bearer"Document5 pagesNegotiable Instrument: Promissory Note, Bill of Exchange, or Cheque Payable Either To Order or To The Bearer"Amandeep Singh Manku100% (1)

- Bills of ExchangeDocument2 pagesBills of ExchangeSachin TiwariNo ratings yet

- Banking Law B.com - Docx LatestDocument38 pagesBanking Law B.com - Docx LatestViraja GuruNo ratings yet

- Negotiable Instruments and Related Laws in BangladeshDocument11 pagesNegotiable Instruments and Related Laws in BangladeshNazmul100% (4)

- Chapter Three BankingDocument57 pagesChapter Three BankingGammachiis QaddiimNo ratings yet

- Negotiable InstrumentsDocument17 pagesNegotiable InstrumentsJeaner AckermanNo ratings yet

- 13th Week-Negotiable Instruments (Repaired)Document39 pages13th Week-Negotiable Instruments (Repaired)Muhammad WasifNo ratings yet

- Jannel Yza S. Gunida Bsba - Iv Negotiation Lecture I. Preliminary Subject - Matter On Negotiation A. Most Common Forms of Negotiable InstrumentDocument6 pagesJannel Yza S. Gunida Bsba - Iv Negotiation Lecture I. Preliminary Subject - Matter On Negotiation A. Most Common Forms of Negotiable Instrumentyza gunidaNo ratings yet

- Commercial Law Notes by RMV (Summary Version)Document4 pagesCommercial Law Notes by RMV (Summary Version)Ronn Michael Manalo VillanuevaNo ratings yet

- Unit II Banking and Insurance Law Study NotesDocument12 pagesUnit II Banking and Insurance Law Study NotesSekar M KPRCAS-CommerceNo ratings yet

- Payments Guaranteed: Understanding Negotiable InstrumentsDocument12 pagesPayments Guaranteed: Understanding Negotiable InstrumentsSneha OchaniNo ratings yet

- Legal Aspects of Business AssignmentDocument8 pagesLegal Aspects of Business AssignmentSkNo ratings yet

- Negotiable Instrument Act, 1881Document25 pagesNegotiable Instrument Act, 1881Viney VermaNo ratings yet

- Banking Law B.com - Docx LatestDocument69 pagesBanking Law B.com - Docx LatestViraja GuruNo ratings yet

- Negotiable Instruments: Department of Management SciencesDocument10 pagesNegotiable Instruments: Department of Management SciencesSamil MusthafaNo ratings yet

- Negotiable InstrumentsDocument50 pagesNegotiable InstrumentsMj Panciles100% (3)

- Negotiable Instruments Laws Carlos Hilado Memorial State University Submitted By: Atty. Jul Davi P. SaezDocument26 pagesNegotiable Instruments Laws Carlos Hilado Memorial State University Submitted By: Atty. Jul Davi P. SaezJellie ElmerNo ratings yet

- Negotiable Instruments ReviewerDocument18 pagesNegotiable Instruments ReviewerMary Joyce Lacambra AquinoNo ratings yet

- Negotiable Instruments Act, 1881Document23 pagesNegotiable Instruments Act, 1881Arvind Mallik100% (1)

- Nego NotesDocument10 pagesNego NotesChristian Paul Pinote100% (1)

- Negotiable Instruments Non-Negotiable InstrumentsDocument8 pagesNegotiable Instruments Non-Negotiable InstrumentsJason LewisNo ratings yet

- Negotiable Instruments (Word)Document74 pagesNegotiable Instruments (Word)MaanNo ratings yet

- Negotiable InstrumentsDocument17 pagesNegotiable InstrumentsShamaarajShankerNo ratings yet

- Nego ReviewerDocument10 pagesNego ReviewersigfridmonteNo ratings yet

- Handout On N I Act 1881Document5 pagesHandout On N I Act 1881zakiNo ratings yet

- Negotiable Instruments: Legal Aspects of BusinessDocument25 pagesNegotiable Instruments: Legal Aspects of BusinessArun Sharma100% (2)

- RFBT Negotiable Instruments LawDocument8 pagesRFBT Negotiable Instruments LawKatzkie Montemayor Godinez100% (1)

- Negotiable Instruments:: PRLG 701 Fall 2014Document34 pagesNegotiable Instruments:: PRLG 701 Fall 2014Lola ThomsonNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Depreciation AccountingDocument78 pagesDepreciation AccountingNiladri KumarNo ratings yet

- ISJ009Document100 pagesISJ0092imediaNo ratings yet

- Backtest Index Strategies Performance Over Monthly Periods 2017-2021Document95 pagesBacktest Index Strategies Performance Over Monthly Periods 2017-2021ThE BoNg TeChniCaLNo ratings yet

- Marcela S. Velandres: To: Address: !Document3 pagesMarcela S. Velandres: To: Address: !Honeybunch MelendezNo ratings yet

- Letter of Intent and Company ProfileDocument5 pagesLetter of Intent and Company ProfileKeith Castillo100% (1)

- Accounting Entries in SAP: S No Transaction T Code Other Info GL Account Accounting Entry RemarksDocument8 pagesAccounting Entries in SAP: S No Transaction T Code Other Info GL Account Accounting Entry Remarksnanduri.aparna161No ratings yet

- Sharpe's Ratio - A Powerful Tool for Portfolio EvaluationDocument12 pagesSharpe's Ratio - A Powerful Tool for Portfolio EvaluationVaidyanathan RavichandranNo ratings yet

- Unit II - Audit of Intangibles and Other Assets - Final - t31314Document9 pagesUnit II - Audit of Intangibles and Other Assets - Final - t31314Jake BundokNo ratings yet

- Consolidation TheoryDocument22 pagesConsolidation TheorySmruti RanjanNo ratings yet

- Factsheet NIFTY AA Category Corporate Bond IndicesDocument1 pageFactsheet NIFTY AA Category Corporate Bond IndicesGrimoire HeartsNo ratings yet

- 10 - Financial AssetsDocument2 pages10 - Financial AssetsROMAR A. PIGA100% (1)

- Last Minute Lecture HO No 5 Commercial Law PDFDocument15 pagesLast Minute Lecture HO No 5 Commercial Law PDFRoseanne MateoNo ratings yet

- Tech TP PrudenceDocument6 pagesTech TP PrudenceAgus WijayaNo ratings yet

- Stock Market Outlook 2022: What Investors Can ExpectDocument8 pagesStock Market Outlook 2022: What Investors Can Expectmassimo borrioneNo ratings yet

- Chapter8-Mean SD CAPM APTDocument49 pagesChapter8-Mean SD CAPM APTEdwin LawNo ratings yet

- Far 610 Group Project 1: InstructionsDocument6 pagesFar 610 Group Project 1: InstructionsSiti Rafidah DaudNo ratings yet

- Diagnostic Test General MathematicsDocument4 pagesDiagnostic Test General MathematicsMa Crestyl Tandugon Alcoser100% (1)

- Real Estate Terms DictionaryDocument4 pagesReal Estate Terms DictionaryRon Simenton100% (1)

- Emerson Electric Financial Statement AnalysisDocument6 pagesEmerson Electric Financial Statement Analysismwillar08No ratings yet

- Merchant BankingDocument29 pagesMerchant BankingramrattangNo ratings yet

- NRB Directives To Microfinance FIs, - 2074Document104 pagesNRB Directives To Microfinance FIs, - 2074NarayanPrajapatiNo ratings yet

- Auditor Independence and Audit Quality PDFDocument22 pagesAuditor Independence and Audit Quality PDFadamNo ratings yet

- Corpo Notes 2018 PrelimsDocument14 pagesCorpo Notes 2018 PrelimsCzara DyNo ratings yet

- Chapter 7 PDFDocument4 pagesChapter 7 PDFMISRET 2018 IEI JSCNo ratings yet

- BirpowerDocument236 pagesBirpowerRajesh KumarNo ratings yet

- Religare Mutual FundDocument73 pagesReligare Mutual FundpopNo ratings yet

- Problem Overview:: 2B PeopleDocument5 pagesProblem Overview:: 2B PeopleSebastian AlexNo ratings yet

- CA StatementDocument3 pagesCA Statementapi-3698382No ratings yet

- Exam1 FIN370 Winter 2009 - A KeyDocument25 pagesExam1 FIN370 Winter 2009 - A KeyPhong NguyenNo ratings yet

- Form No. 16-ADocument1 pageForm No. 16-AJay100% (6)