Professional Documents

Culture Documents

Plastics Statics

Uploaded by

Jaswindersingh BhatiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Plastics Statics

Uploaded by

Jaswindersingh BhatiaCopyright:

Available Formats

CIPET - Plastics Industry - Statistics

Page 1 of 6

National Policy on Petrochemicals Petroleum, Chemicals & Petrochemical Investment Regions Policy Plastics Industry - Statistics Plastics & Environment Growth of plasic Industries GLOBAL SCENARIO Last few years have been tumultuous for plastics and petrochemical sector due to steep rise in oil prices, which has adversely affected the global economies. However, considering the feed stock advantage and abundance of oil reserves newer petrochemical complexes are being established in Middle-east countries. i.e. Oman, Saudi Arabia, UAE, etc. It is projected that by the end of 2010, Ethylene capacity in Middle-East would reach to about 35 million tons per annum and Polypropylene (PP) capacity to touch about 7 million tonnes per annum. The US Petrochemical sector may lose Export competitiveness as most of the Ethylene capacities in USA are Ethane based, which are not cost competitive and are capable to produce only Polyethylene (PE). Similarly, the revamping of European Petrochemical Complexes would be imperative as they are based on old and expensive technology and are not cost competitive with the MiddleEast companies having the biggest advantage of raw material at their door-step. China, MiddleEast and India would be the major global players, where expansion and augmentation of existing petrochemical capacity would take place in the next 5 years.

Worldwide Plastics Industry witnessed a steady growth in the year 2007 which is reflected in the increased consumption figures of all types of Plastics materials. Asia has been worlds largest plastics consumer for several years, accounting for about 30% of the global consumption excluding Japan, which has share of about 6.5%. Next to Asia is North America with 26% share, then Western Europe with 23% share in the global market. The key growth segment remains Packaging which accounted for over 35% of the global consumption. Amongst the individual Plastics Materials, Polyolefin accounted for 53% of the total consumption, (PE with 33.5%, PP with 19.5%) followed by PVC 16.5%, PS-8.5%, PET & PU - 5.5%, Styrene copolymers (ABS, SAN, etc) 3.5% other engineering & high performance & speciality plastics, blends, alloys, thermosetting plastics 13%. In recent years, significant aspect of plastics material growth globally has been the innovation of newer application areas for plastics such as increasing plastics applications in automotive field, rail, transport, defence & aerospace, medical and healthcare, electrical & electronics, telecommunication, building & infrastructure, furniture, etc. Plastics have become the key drivers of innovations & application development. PolymerElectronics is one such area which has opened up new avenues for plastics; from organic light emitting diodes to electro-optical and bio-electrical complements, from low-cost plastic chips to flexible solar cells. New plastics can conduct electricity and emit light. While polymers will not replace silicon as semiconductors, they do offer completely new opportunities for low-priced mass-manufactured products. Radio-frequency identification (RFID) tags in smartcards for identification and access control, payment and ticket systems, price labels, product tracking systems in the logistics chain or packaging that monitors product quality many things are in offing. Growth-trend of plastics has proved that there has been a quiet Plastics revolution taking place in the material sector.

Global Per capita consumption of Plastics is ( in Kgs)

World Average North America West Europe East Europe China India South East Asia

26 90 65 10 12 5.0

10

http://cipet.gov.in/plastics_statics.html

24-04-2012

CIPET - Plastics Industry - Statistics

Page 2 of 6

L. America

18

World-wide, the plastics and polymer consumption will have an average growth rate of 5% and it will touch a figure of 227 million tons by 2015. Globally, it is projected that PET (Bottle grade) will have the highest growth rate of about 11% AAGR.

(Annual Average Growth Rate) amongst all polymers, followed by PP, PE, PVC and PS in the descending order, as depicted in the Figure. Furthermore, the grades of PE(HDPE, LLDPE, LDPE) are expected to grow about GDP growth annually up to 2020. The forecast about global polyethylene demand is as follows:

Global polyethylene demand is estimated to grow an average 4.4% annually through 2020.

This is about 1% above the expected global GDP growth.

LLDPE is expected to experience the fastest growth, with an average annual growth rate of

6.2 percent. This comes at the expense of LDPE, which is expected to grow only 1.8% during the same period.

HDPE growth is estimated to average 4.6 percent.

The Global PE Demand in terms of1000 tons per year upto 2020 is projected in Figure :

Similarly, Polyethylene (PE) dominates the future capacity addition amongst different polymers by 2008, which is evident from the Global Commodity Polymer Capacity Additions between 2004 2008.

http://cipet.gov.in/plastics_statics.html

24-04-2012

CIPET - Plastics Industry - Statistics

Page 3 of 6

INDIAN PLASTICS INDUSTRIES PERSPECTIVE Over the years, India has made significant progress in the industrial world with healthy economic growth. On purchase power parity basis, it is one of the top five global economics and is expected to be the third largest by the turn of this decade. Plastics, one of the fastest growing industries in India, have a vital role to play. Indian Plastics Industry is expanding at a phenomenal pace. Major international companies from various sectors such as automobiles, electronics, telecommunications, food processing, packing, healthcare etc. have set-up large manufacturing bases in India. Therefore, demand for plastics is rapidly increasing and soon India will emerge as one of the fastest growing markets in the world. The next two decades are expected to offer unprecedented opportunities for the plastic industry in India. This would necessitate industry initiatives to foster investments, grow the market, upgrade quality standards, enhance global participation, encourage Indian industry, to adopt and adapt to world class technology and manufacturing practices Despite instability in International prices of polymer materials in 2006 - 07, plastics industry in the country has consolidated its performance by consuming about 5.0 million tonnes of polymers, as compared to Chinese consumption of about 30 million tonnes in 2007. Indian plastics industries are enthusiastic about the acceleration of the growth engine in the next 3 to 5 years due to capacity expansion of existing petrochemical complexes and setting up of new crackers in the country currently. Reliance Industries Ltd., (RIL) has about 75% share of Indian Petrochemical Cracker capacity, followed by medium sized capacity of Gas Authority of India Ltd. (GAIL) and Haldia Petrochemicals Ltd., (HPL). RIL has ambitious plan of augmenting its PP capacity from 1010 KT to 2600 KT by the year 2010. Indian Oil Corporation (IOC) has also planned an 800 K tonnes naphtha cracker at Panipat at an investment of Rs.6300 crores to produce 800 KT of PE and PP each at Panipat. IOC would also be setting up a production capacity 150 KT PP at Chennai by year 2009 as well as styrene, which is not being produced in India. These positive factors of availability of polymeric materials would infallibly be harbinger in accelerating the growth of plastics sector in the near future. The capacities of current petrochemicals producers are given in Table 1

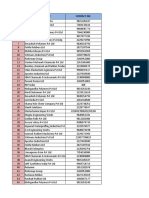

TABLE 1- Current Indian Petrochemicals Capacities (in KT)

Producer & Location RIL, Hazira RIL, Jamnagar RIL Patalganga IPCL, Nagothane IPCL, Vadodara IPCL, Gandhar GAIL, Auriya HPL, Haldia BRPL, Bongaigaon Finolex, Pisranpar LG Poly, Vizag Supreme, Mumbai Chem Plast, Metturdam DCW, Sahupuram DCM, Shriram, Kota PP 350 600 60 60 75 210 HDPE 160 100 200 LDPE 80 80 HD/LL 400 220 160 260 PTA 800 300 400 PS 80 240 PVC 300 55 150 130 60 60 35

http://cipet.gov.in/plastics_statics.html

24-04-2012

CIPET - Plastics Industry - Statistics

Page 4 of 6

RPRL, Abu BASF Styrenics, Bharuch Mitsubishi, Haldia TOTAL Grand Total

1355

460

160

1040 5665

1500

16 60 360

790

Typical Polymer consumption pattern of different polymers

Polymer LDPE/EVA LLDPE HDPE PP PVC PS PET Film Bottle SAN/ABS Polyamide Polycarbonate Polyacetal PET/PBT Others Thermoset Total 4820 35 72 8 7 3 100 125 135 100 235 90 275 550 920 1300 1000 225 1745 KT

To manufacture finished products, polymers are processed through various types of techniques namely extrusion, injection moulding, blow moulding and rotomoulding. Various products manufactured through these processes are highlighted in the following exhibit.

Classification of Plastic Products by Type of process used

Extrusion Films and Sheets, Fibre and Filaments Pipes, Conduits and profiles, Miscellaneous applications Industrial Injection Moulding, Household Injection Moulding and Thermo-ware/ Moulded luggage Bottles, containers, Toys and Housewares Large circular tanks such as water tanks

Injection Moulding Plastic Products Blow Moulding Roto moulding

The polymer consumption in India according to various processes is provided as follows :

Process Extrusion Injection Moulding Blow Moulding / Stretch Moulding Rotomoulding Other Processes

(%) Share in Total consumption in India 60.0 25.0 06.0 01.0 08.00

The Indian plastic processing industry is highly fragmented and comprises 25,000 firms. Barring 10% - 15% of the firms, which can be classified as medium scale operations, all the units operate on a small-scale basis.

http://cipet.gov.in/plastics_statics.html

24-04-2012

CIPET - Plastics Industry - Statistics

Page 5 of 6

The top 100 players account for just 20% of the industry turnover. The total number of players in the sector is more than 25,000. However, the degree of fragmentation, worldwide, is a large and despite the small size of operations of the players, they are able to operate profitably. Further, the high growth in demand ensures that the market is able to absorb the excess capacity in quick time. Overall, the degree of competition can be considered high in the Indian plastic processing industry. The sector has a significant presence of the unorganised sector, which accounts for more than 70% of the industry turnover. More than 95% of the firms in the industry are partnership, proprietorship or private limited companies. Further, these small companies get significant advantages in taxes. These firms thus provide significant level of competition to the organised sector companies, which combined together are making losses. The organised sector companies thus need to build up significant brand image to survive against the competition from the unorganised sector. The key organised sector players include Nilkamal Plastics Limited and Supreme Industries Limited.

Statistics of Plastics Industries in India : Current Status

Major Raw Material Producers Processing Units Turnover (Processing Industry) Capital Asset (Polymer Industry) Raw Material Produced approx Raw Material Consumed approx Employed Direct/Indirect Export Value approx Revenue to Government approx. 15 Nos. 25,000 Nos. Rs.85,000 Crores Rs.55,000 Crores 5.3 MMT 5.1 MMT 3.3 Million US $ 1.90 Billion Rs.7300 Crores

By 2011 - 12

Demand Potential Additional Employment Investment Potential 12.5 MMT 4.0 Million Rs.84,000 Crores

VISION 2015 Indian Plastics Industry :

Consumption of Polymers @ 15% CARG Turnover of plastics Industries Additional Employment Generation Requirement of Additional Plastics Processing Machines Additional Capital Investment In Machines (2004-2015) 18.9 Million tonnes Rs.1,33,245 crores 7 Million 68113 Nos

Rs.45,000 crores

For more information on Indian Plastics Industry, please visit

Plastindia Foundation - www.plastindia.org All India Plastics Manufacturers Association - www.aipma.net Indian Plastic Federation - www.plasticfederation.org Organization of Plastics Processors of India - www.oppindia.org The Plastics Export Promotion Council - www.plexconcil.org

http://cipet.gov.in/plastics_statics.html

24-04-2012

CIPET - Plastics Industry - Statistics

Page 6 of 6

Home | About Us | Academics | Technology | Research | Industry Programs | Management | Collaboration

Copyrights 2012 CIPET.Privacy Policy

http://cipet.gov.in/plastics_statics.html

24-04-2012

You might also like

- Airmax - Air Seperation UnitDocument8 pagesAirmax - Air Seperation UnitJaswindersingh BhatiaNo ratings yet

- Screw Compressor Units: For Sodium Carbonate Production (Soda Ash)Document2 pagesScrew Compressor Units: For Sodium Carbonate Production (Soda Ash)Jaswindersingh BhatiaNo ratings yet

- Forward Thinking: Advanced Compression Solutions For CO, N, Propylene and VaporDocument20 pagesForward Thinking: Advanced Compression Solutions For CO, N, Propylene and VaporJaswindersingh BhatiaNo ratings yet

- Hofim: Hermetically-Sealed Motor-Compressor SystemDocument6 pagesHofim: Hermetically-Sealed Motor-Compressor Systemdvcher78No ratings yet

- Hofim For Upstream Gas: CompressionDocument8 pagesHofim For Upstream Gas: CompressionJaswindersingh BhatiaNo ratings yet

- Fluid Catalytic Cracking (FCC) : Main Air Blowers and Wet Gas Compressor TrainsDocument6 pagesFluid Catalytic Cracking (FCC) : Main Air Blowers and Wet Gas Compressor TrainsJaswindersingh BhatiaNo ratings yet

- Gas Transport-Mallnow-Natural-Gas-Compressor-Station PDFDocument8 pagesGas Transport-Mallnow-Natural-Gas-Compressor-Station PDFJaswindersingh BhatiaNo ratings yet

- Oil Plant SolutionsDocument10 pagesOil Plant SolutionsMarcus MihaiNo ratings yet

- Fuelgas CompressorsDocument2 pagesFuelgas CompressorsMANIU RADU-GEORGIANNo ratings yet

- Turbomachinery: For Ammonia and Urea PlantsDocument14 pagesTurbomachinery: For Ammonia and Urea PlantsJaswindersingh BhatiaNo ratings yet

- Screw Compressors Engineered For The Process IndustryDocument8 pagesScrew Compressors Engineered For The Process Industryshyam_anupNo ratings yet

- Rikt71 Produkt e A4 Web Final PDFDocument6 pagesRikt71 Produkt e A4 Web Final PDFJaswindersingh BhatiaNo ratings yet

- ONGC Hydrates Discovery May Be 4 Times Bigger Than RIL's Gas Find - Times of India PDFDocument3 pagesONGC Hydrates Discovery May Be 4 Times Bigger Than RIL's Gas Find - Times of India PDFJaswindersingh BhatiaNo ratings yet

- RIKT Isothermal Turbocompressors PDFDocument6 pagesRIKT Isothermal Turbocompressors PDFJaswindersingh BhatiaNo ratings yet

- RG Integrally Geared Compressors PDFDocument6 pagesRG Integrally Geared Compressors PDFJaswindersingh BhatiaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IQP Final Report 2Document81 pagesIQP Final Report 2Mohamed NasrNo ratings yet

- Plastivision India 2020 Mumbai - Gateway to Plastic Industry GrowthDocument6 pagesPlastivision India 2020 Mumbai - Gateway to Plastic Industry GrowthAbhisek PadhiNo ratings yet

- Ensinger Manual 01Document100 pagesEnsinger Manual 01MichaeluiNo ratings yet

- Multicomponent Polymeric Materials, 2016 PDFDocument411 pagesMulticomponent Polymeric Materials, 2016 PDFCosmin TăbăcaruNo ratings yet

- FORMULARIO Per Lo Stampaggio Della PlasticaDocument78 pagesFORMULARIO Per Lo Stampaggio Della PlasticaAhsan RiazNo ratings yet

- Everything You Need To Know About Polycarbonate (PC) : Tony RogersDocument6 pagesEverything You Need To Know About Polycarbonate (PC) : Tony RogersBabarKhanNo ratings yet

- Mould Questions QuizDocument6 pagesMould Questions QuizRupesh KamatNo ratings yet

- (English) Plastics 101 - National Geographic (DownSub - Com)Document5 pages(English) Plastics 101 - National Geographic (DownSub - Com)Via ResvianaNo ratings yet

- Kafrit BoppDocument8 pagesKafrit BoppJoe SyahNo ratings yet

- Mould Theory Questions PaperDocument10 pagesMould Theory Questions PaperSaurabh Kumar 53No ratings yet

- A Review of Plastic Waste BiodegradationDocument9 pagesA Review of Plastic Waste BiodegradationMillennia RischaPurwantiNo ratings yet

- Koe00006 002 PDFDocument42 pagesKoe00006 002 PDFZuriel AzametiNo ratings yet

- Astm d1785Document5 pagesAstm d1785Shiyam RajNo ratings yet

- Polymers Questions With AnswerDocument2 pagesPolymers Questions With AnswerAnonymous s6xbqCpvSWNo ratings yet

- C Aj 2294Document2 pagesC Aj 2294vhin84No ratings yet

- Smooth-Cast® 300, 300Q, 305, 310 Product Information - Smooth-On PDFDocument4 pagesSmooth-Cast® 300, 300Q, 305, 310 Product Information - Smooth-On PDFsecnetNo ratings yet

- Thermoforming & Die Cutting of Recycled/Virgin PET SheetDocument34 pagesThermoforming & Die Cutting of Recycled/Virgin PET SheetOspreyNo ratings yet

- Daily Fit-Up/Welding Inspection ReportDocument7 pagesDaily Fit-Up/Welding Inspection ReportRichard PeriyanayagamNo ratings yet

- Guia Colombiatex 2017 PDFDocument806 pagesGuia Colombiatex 2017 PDFanastasiaNo ratings yet

- Sprues, Runners and Gates of Plastic MoldDocument13 pagesSprues, Runners and Gates of Plastic Moldprashant_cool_4_uNo ratings yet

- Rubber IndiaDocument6 pagesRubber IndiaBizvin OpsNo ratings yet

- Cables: June 2015Document27 pagesCables: June 2015Pedro GarcíaNo ratings yet

- PC-13667.1 LaminatingAdhesives DigitalDocument18 pagesPC-13667.1 LaminatingAdhesives DigitalChetal Bhole100% (1)

- Best SpeakersDocument19 pagesBest SpeakersAvram StefanNo ratings yet

- Lecture 4 Material ExtrusionDocument29 pagesLecture 4 Material Extrusionshanur begulajiNo ratings yet

- DPE Pipe SizesDocument3 pagesDPE Pipe Sizeszewdu mekonnen100% (1)

- Althusser Freud and LacanDocument3 pagesAlthusser Freud and LacanSHAMPA SINHAROYNo ratings yet

- CBSE Class 12 Chem Notes Question Bank Polymers PDFDocument15 pagesCBSE Class 12 Chem Notes Question Bank Polymers PDFMakuset1100% (1)

- Polymer Module PDFDocument23 pagesPolymer Module PDFZeba HasanNo ratings yet

- List of Profitable Plastic Products Manufacturing Business. Small Business Manufacturing Ideas.-808728Document79 pagesList of Profitable Plastic Products Manufacturing Business. Small Business Manufacturing Ideas.-808728Muralidhar k cNo ratings yet