Professional Documents

Culture Documents

E 8202

Uploaded by

Girlie GarciaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E 8202

Uploaded by

Girlie GarciaCopyright:

Available Formats

Prepared by VP for Administration UNIVERSITY OF HAWAII EXECUTIVE POLICY - ADMINISTRATION April 1981 P 1 of 8 E8.

202 - Repair and Maintenance and Capital Improvement Projects I. Introduction Section 8.3 of the University of Hawaii Board of Regents By-Laws and Policies provides for the formulation and execution of the biennial operating and capital improvement budgets. In the formulation and execution of the operating and capital budgets, there is a need to establish a uniform and consistent basis for managing repair and maintenance and capital improvement projects for budget formulation, execution and analysis purposes. The Objectives, definitions and criteria described below are consistent with the Governor's Executive Memorandum 1980-2 dated February 22, 1980, (Attachment A). II. Objectives This administrative policy has two objectives: 1. 2. To provide definitions for the purpose of identifying projects to be included in the operating and capital budgets. To establish criteria for distinguishing between a capital improvement and a repair and maintenance project.

III. Definitions Capital Improvement Budget. This budget covers the development and execution of the University's capital improvement program including the acquisition and development of land, the planning, design and construction of new facilities and the making of renovations or additions to existing facilities. Capital improvement projects are budgeted under the capital improvement budget. Capital improvement projects are defined as expenditures necessary to provide a tangible asset which will be used and is capable of accruing benefits in future periods. The intent of the project may be either to provide new facilities or to increase the value of an existing fixed asset by increasing its capacity, efficiency or extending the original useful life.

E8.202 P 2 of 8 Operating Budget. This budget covers the costs of operating, supporting and maintaining authorized programs, including costs for personnel, salaries and wages, employee fringe benefits, supplies, materials, equipment and motor vehicles. Repair and maintenance projects are budgeted under the operating budget. Repair and maintenance projects are defined as expenditures necessary for preventative and routine maintenance purposes and preservation or restoration of an existing facility to a good condition. A restoration which must be repeated or does not extend the original useful life of the facility is considered a repair and maintenance project. Criteria for Distinguishing between Capital Improvement Projects and Repair and Maintenance Projects A. Capital improvement projects: 1. Criteria a. Advance planning for specific complexes, including the development of cost estimates and other support activities (feasibility study, site selection, master plan, long-range facility-related plan, etc.). Acquisition of land and other related expenses, such as appraisal fee and cadastral engineering. Architectual and engineering design, including the preparation of an environmental impact statement and other necessary building permits and zoning clearances. Construction of facilities, including built-in equipment and fixtures to make the facility operable and other related engineering services. Projects which would renovate existing facilities that: o o Extend or add to a facility to accommodate program growth. Modify a facility in order to Comply with standards which have been adopted since the construction of the facility (OSHA, EPA, programmatic, etc.) or to Change its usage and utility. Provide for significant improvements to a facility for better functional or operational efficiency.

b. c.

d.

e.

E8.202 P 3 of 8 f. Initial furnishings and equipment essential for the proper functioning of the facility that Cannot be provided by the existing inventory. Art-in-state buildings, as stipulated by Section 103-8, HRS.

g. 2.

Funding a. Capital improvement projects may utilize either Cash or bond funds. If bond funds are used to finance a project, the life expectancy of the facility must be as long or greater than the bond amortization period. Capital projects proposed to be funded through special funds or through proceeds from revenue undertakings shall be approved by the President and the Board of Regents before implementation of design and Construction.

B.

Repair and maintenance projects: 1. Criteria a. Any project involving the replacement or rehabilitation of part of an existing facility due to normal deterioration, usage or accidents, unless the Construction Cost exceeds 40 percent of the replacement value for the entire facility. Capital improvements including renovation projects where the Construction cost of the project is less than $15,000.

b.

2.

Examples of repair and maintenance projects a. b. c. d. e. f. Repairs to standard classroom and research facilities such as blackboards, tables, chairs and benches. Repairs to structure and utilities distribution system: gas, electric, steam, water, drainage and sewer systems. Interior and exterior painting and masonry repairs and treatment. Maintenance and repair of roofs, gutters and downspouts. Repairs to handrails, stairs, buildings due to termite damage, and fences. Replacement of windows, lighting systems, alarm systems, ceilings, fire escapes and hydrants, transformers, and sidings.

E8.202 P 4 of 8 g. h. Fumigation and resurfacing. Maintenance and repair of roads, sidewalks, sprinkler systems, building ventilation and air conditioning systems. Maintenance and repairs of floors, floor coverings, and shutter and door hardware.

i. 3.

Funding a. Repair and maintenance costs are to be included in the operating budget.

C.

Items not included in the Capital Improvement Budget 1. Examples a. Planning studies which must be continually updated or not related to a specific facility, such as functional plans, development of standards, identification of needs. Equipment for personnel positions, such as calculators, typewriters. Maintenance equipment, such as vacuum cleaners, ladders. Small replaceable equipment items which are used for programmatic purposes and have a life expectancy of less than 20 years (slide projectors, weighing scales, cameras, portable microphones, etc.). Items which will replace existing equipment. Books. Motor vehicles for programmatic purposes.

b. c. d.

e. f. g. 2.

Funding a. The above examples are considered to be operating budget expenses.

E8.202 P 5 of 8 Attachment A

EXECUTIVE CHAMBERS HONOLULU

GEORGE R. ARIYOSHI Governor

February 22 1980 EXECUTIVE MEMORANDUM TO: SUBJECT: All Department Heads Criteria for Distinguishing Between a Capital Improvements Project and a Repairs and Maintenance Project MEMO 1980-2

The purpose of this memorandum is to clarify the distinction between a capital improvements project and a repairs and maintenance project. This memorandum supersedes Appendix I of Memorandum 1978-15 issued on July 1 1978 which identified qualifying and non qualifying capital improvement projects which may be implemented. The Department of Budget and Finance may be consulted to clarify the following criteria before requests for authorizations are considered. Any implementation questions should be referred to the Department of Planning and Economic Development. Guiding Principles: A capital improvements project (CIP) is defined as expenditures necessary to provide a tangible asset which still he use and is capable of accruing benefits in future periods. The intent of the project may be either to provide new facilities or to increase the value of an existing fixed asset by increasing its capacity efficiency, or extending the original useful life. A repairs and maintenance project (R&M) is defined as expenditures necessary for preventative and routine maintenance purposes, preservation or restoration of an existing facility to a good condition. A restoration which must be repeated or does not extend the original useful life of the facility must be considered a R&M project.

E8.202 P 6 of 8 Memo To All Department Heads Page 2 February 22, 1980 Financing Considerations: CIP may utilize either cash or bond funds. However, if bond funds are used to finance the project, the life expectancy of the facility must be as long as or greater than the bond amortization period. Cash financing must be used for R&M purposes and should be included in the operating budget. Other Considerations: 1. Any project involving the replacement or rehabilitation of part of an existing facility due to normal deterioration, usage or accidents, must be considered a R&M project, unless the construction cost exceeds 40 per cent of the replacement value for the entire facility. Any CIP which construction cost (basic bid or contract) is less than $15,000 may be considered as a R&M project. Exceptions can be made on a case-by-case basis, depending upon public urgency or the impact which would be created by health and safety deficiencies. Research and development projects should adhere to the same criteria allowed for capital expenditures.

2.

3.

4.

Specific Guidance: For Allowable CIP 1. Advance planning for specific complexes, including the development of cost estimates and other support activities (feasibility study, site selection, master plan, long-range facility-related plan, etc.). Acquisition of land and other related expenses, such as appraisal fee and cadastral engineering. Architectual and engineering design, including the preparation of an environmental impact statement and other necessary building permits and zoning clearances.

2. 3.

E8.202 P 7 of 8 Memo To All Department Heads Page 3 February 22, 1980 4. Construction of facilities, including built-in equipment and fixtures to make the facility operable and other related engineering services. Projects which would renovate existing facilities and qualify as CIP are as follows: Extend or add to a facility to accommodate program growth. : Modify a facility in order to comply with standards which have been adopted since the construction of the facility (OSHA, EPA, programmatic, etc.) or to change its usage and utility. Significant improvements to a facility for better functional or operational efficiency.

5.

6.

Initial furnishings and equipment essential for the proper functioning of the facility and cannot be provided by the existing inventory. Art-in-state buildings, as stipulated by Section 103-8, HRS.

7.

For Non-Allowable CIP 1. Planning studies which must be continually updated or not related to a specific facility, such as functional plans, development of standards, identification of needs Equipment for personnel positions, such as calculators, typewriters. Maintenance equipment, such as vacuum cleaners, ladders. Small replaceable equipment items which are used for programmatic purposes and have a life expectancy of less than 20 years (slide projectors, weighing scales, cameras, portable microphones, etc.).

2. 3. 4.

E8.202 P 8 of 8 Memo To All Department Heads Page 4 February 22, 1980 5. 6. 7. 8. 9. 10. Items which the Department of Accounting and General Services classify as expendable items and need not be inventoried. Items which will replace existing equipment. Lease or rental of facilities and equipment. Consumable materials and supplies. Books. Motor vehicles for programmatic purposes.

George R. Ariyoshi

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Nairobi Stock Exchange (NSE) Sectors ReconfiguredDocument5 pagesThe Nairobi Stock Exchange (NSE) Sectors ReconfiguredPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

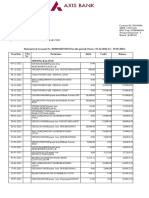

- Garima Axis Bank SDocument3 pagesGarima Axis Bank SSajan Sharma100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Incred AIFDocument20 pagesIncred AIFvarunNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- INV2001082Document1 pageINV2001082Bisi AgomoNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter 1 History and Development of Banking System in MalaysiaDocument18 pagesChapter 1 History and Development of Banking System in MalaysiaMadihah JamianNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- PUP Review Handout 3 OfficialDocument2 pagesPUP Review Handout 3 OfficialDonalyn CalipusNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- VALUATION TABLE TITLESDocument8 pagesVALUATION TABLE TITLESAndre Mikhail ObierezNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Risk and Return FundamentalsDocument60 pagesRisk and Return FundamentalsasmaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- RFBT-04: LAW ON Credit Transactions: - T R S ADocument10 pagesRFBT-04: LAW ON Credit Transactions: - T R S AAdan Nada100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Donor's Tax QuizDocument2 pagesDonor's Tax Quizsujulove foreverNo ratings yet

- Financial Accounting P 1 Quiz 3 KeyDocument6 pagesFinancial Accounting P 1 Quiz 3 KeyJei CincoNo ratings yet

- Berlin School Final Exam - Financial Accounting and MerchandisingDocument17 pagesBerlin School Final Exam - Financial Accounting and MerchandisingNarjes DehkordiNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- StatementOfAccount 3092378518 Jul17 141113.csvDocument49 pagesStatementOfAccount 3092378518 Jul17 141113.csvOur educational ServiceNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Influence of Microfinance On Small Business Development in Namakkal District, TamilnaduDocument5 pagesInfluence of Microfinance On Small Business Development in Namakkal District, Tamilnaduarcherselevators100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Harshad Mehta CaseDocument16 pagesHarshad Mehta Casegunjan67% (3)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Philippine Health Care Providers Dispute Over Documentary Stamp Tax AssessmentDocument2 pagesPhilippine Health Care Providers Dispute Over Documentary Stamp Tax AssessmentGeralyn GabrielNo ratings yet

- Limited Companies Financial StatementsDocument4 pagesLimited Companies Financial Statementskaleem khanNo ratings yet

- COMPARISON OF TAKAFUL AND INSURANCEDocument9 pagesCOMPARISON OF TAKAFUL AND INSURANCEHusna FadzilNo ratings yet

- International Taxation of Hybrid EntitiesDocument11 pagesInternational Taxation of Hybrid EntitiesNilormi MukherjeeNo ratings yet

- Dawood Habib GroupDocument3 pagesDawood Habib GroupShuja HussainNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A Study On Analysis of Cash ManagementDocument73 pagesA Study On Analysis of Cash ManagementchetanNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- DR Stanisław Kubielas: International FinanceDocument4 pagesDR Stanisław Kubielas: International FinanceGorana Goga RadisicNo ratings yet

- Barrons 3.8Document3 pagesBarrons 3.8alireza shahinNo ratings yet

- Bajaj Auto Annual Report - Secc - grp6Document11 pagesBajaj Auto Annual Report - Secc - grp6Varun KumarNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- HOME DEPOT - Debt StructureDocument3 pagesHOME DEPOT - Debt Structureluxi0No ratings yet

- Dnata Campus To Corporate ProgramDocument28 pagesDnata Campus To Corporate ProgramAmit Kushwaha100% (1)

- ArticlesDocument1 pageArticlesBayrem AmriNo ratings yet

- Public Expert - Trend IndicatorsDocument21 pagesPublic Expert - Trend Indicatorsrayan comp100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- FCO Swiss Procedure SampleDocument2 pagesFCO Swiss Procedure SamplePeter Huffman70% (10)

- Topic 6 - Inventories Lecture Illustrations: RequiredDocument4 pagesTopic 6 - Inventories Lecture Illustrations: RequiredMitchell BylartNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)