Professional Documents

Culture Documents

Dragonwave AR

Uploaded by

Perry TannerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dragonwave AR

Uploaded by

Perry TannerCopyright:

Available Formats

D R A G O N W A V E I N C

F O R M 4 0 - F

QuickLinks -- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on May 3, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

OR

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 29, 2012

Commission file number: 001-34491

411 Legget Drive, Suite 600, Ottawa, Ontario, Canada, K2K 3C9

(613) 599-9991

(Address and Telephone Number of Registrant's Principal Executive Offices)

Copies to:

Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, Delaware, 19808

(800) 927-9800

(Name, address (including zip code) and telephone number

(including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Securities registered or to be registered pursuant to Section 12(g) of the Act: N/A

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: N/A

For annual reports, indicate by check mark the information filed with this form:

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: As at

DRAGONWAVE INC.

(Exact Name of Registrant as Specified in its Charter)

Canada

(Province or other jurisdiction of

incorporation or organization)

4812

(Primary Standard Industrial

Classification Code)

Not Applicable

(I.R.S. Employer Identification No.)

Title of Each Class:

Common Shares, no par value

Name of Each Exchange On Which Registered:

The NASDAQ Stock Market LLC

Toronto Stock Exchange

Annual Information Form Audited Annual Financial Statements

February 29, 2012, 35,586,206 common shares of the Registrant were issued and outstanding.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months

(or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes No

EXPLANATORY NOTE

DragonWave Inc. ("we", "us", "our", the "Company" or the "Registrant") is a Canadian issuer eligible to file its annual report pursuant to Section 13 of the Securities

Exchange Act of 1934, as amended, or the Exchange Act, on Form 40-F pursuant to the multi-jurisdictional disclosure system of the Exchange Act. We are a "foreign

private issuer" as defined in Rule 3b-4 under the Exchange Act. Our equity securities are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange

Act pursuant to Rule 3a12-3.

INCORPORATION BY REFERENCE

This Annual Report on Form 40-F shall be incorporated by reference into the Registrant's Form S-8, SEC File No. 333-167806, filed on June 25, 2010.

FORWARD-LOOKING STATEMENTS

This annual report on Form 40-F and the documents incorporated herein by reference, contain forward-looking statements and forward-looking information within the

meaning of applicable securities laws. Such forward-looking statements or forward-looking information include, but are not limited to statements with respect to strategic

plans and corporate goals and objectives.

Forward-looking statements, which involve assumptions and describe the future plans, strategies and expectations of the Company, are generally identifiable by use of

the words "may", "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "plan" or "project" or the negative of these words or other variations on

these words or comparable terminology. Forward-looking statements include, without limitation, statements regarding strategic plans, and corporate goals and objectives.

There can be no assurance that forward-looking statements will prove to be accurate and actual results such as the goals and objectives of the Company's compensation

programs for executives and directors, performance, achievements or developments and future events could differ materially from those expressed or implied in such

statements. The following are some of the important risk factors relating to DragonWave and its business that could cause actual results, performance, achievements or

developments to differ materially from those discussed in the forward-looking statements:

ability to successfully complete and integrate acquisitions of products or businesses, including the proposed acquisition of Nokia Siemens Networks, into our

existing product lines and businesses and other risks associated with acquisitions;

dependence on the development and growth of the market for high-capacity wireless communications services;

reliance on a small number of customers for a large percentage of revenue;

intense competition from several competitors;

competition from indirect competitors;

dependence on the ability to develop new products and enhance existing products;

ability to successfully manage growth;

a history of losses;

dependence on establishing and maintaining relationships with channel partners;

quarterly revenue and operating results which are difficult to predict and can fluctuate substantially;

impact that the recent general economic downturn may still be having on customers;

disruption resulting from economic and geopolitical uncertainty;

currency fluctuations;

exposure to credit risk for accounts receivable;

pressure on DragonWave's pricing models;

the allocation of radio spectrum and regulatory approvals for DragonWave's products;

the ability of DragonWave's customers to secure a license for applicable radio spectrum;

changes in government regulation or industry standards that may limit the potential market for DragonWave's products;

risks associated with the possible loss of DragonWave's foreign private issuer status;

risks and expenses associated with DragonWave's status as a public company;

reliance on outsourced manufacturing;

reliance on suppliers of components;

ability to protect its own intellectual property and potential harm to DragonWave's business if it infringes the intellectual property rights of others;

risks associated with software licensed by DragonWave;

a lengthy and variable sales cycle;

dependence on DragonWave's ability to recruit and retain management and other qualified personnel;

exposure to risks resulting from its international sales and operations, including the requirement to comply with export control and economic sanctions

laws; and

product defects, product liability claims, or health and safety risks relating to wireless products.

The risks and uncertainties related to the risk factors listed above, and the materializing of such risk and uncertainties, may be materially increased by the completion of

the anticipated acquisition by us of the microwave transport business of Nokia Siemens Networks. In particular, material risks and uncertainties following and contingent

upon closing of the acquisition will include, without limitation:

reliance on Nokia Siemens Networks for a large percentage of our revenues;

increased cash requirements to fund acquired operations, and associated requirements to comply with debt financing covenants with our lenders, which

should be understood in light of our history of losses noted above;

increased exposure to global currency fluctuations;

increased regulatory compliance obligations, including financial reporting obligations associated with completing a significant acquisition; and

risks associated with acquisitions generally as detailed on in our most recently filed Annual Information Form, or AIF.

Although we have attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements

and forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Forward-looking statements

and forward-looking information are based upon management's beliefs, estimates and opinions at the time they are made and we undertake no obligation to update forward-

looking statements and forward-looking information if these beliefs, estimates and opinions or circumstances should change, except as required by applicable law. There can

be no assurance that forward-looking statements and forward-looking information will prove to be accurate, as actual results and future events could differ materially from

those anticipated in such statements and information. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information.

The list above is not exhaustive of the factors that may affect our forward-looking statements and forward-looking information. Some of the important risks and

uncertainties that could affect forward-looking statements and forward-looking information are described further in the exhibits attached to this annual report on Form 40-F.

In light of these risks, uncertainties and assumptions, the forward looking events discussed in this annual report on Form 40-F and the documents incorporated herein by

reference, including, without limitation, our published financial guidance, may not occur.

CURRENCY

Unless specifically stated otherwise, all dollar amounts in this annual report on Form 40-F are in U.S. dollars. The exchange rate of U.S. dollars into Canadian dollars,

based upon the closing rate of exchange on February 29, 2012 as reported by the Bank of Canada for the conversion of U.S. dollars into Canadian dollars, was US$1.00

= CAD$0.9895.

AUDITED ANNUAL FINANCIAL STATEMENTS

Our audited consolidated financial statements for the years ended February 29, 2012 and February 28, 2011, including the report of our independent auditor with

respect thereto, are filed as Exhibit 99.1 and incorporated by reference in this annual report on Form 40-F.

MANAGEMENT'S DISCUSSION AND ANALYSIS

Our management's discussion and analysis, or MD&A, for the year ended February 29, 2012 is filed as Exhibit 99.2 and incorporated by reference in this annual report

on Form 40-F.

TAX MATTERS

Purchasing, holding, or disposing of our securities may have tax consequences under the laws of the United States and Canada that are not described in this annual

report on Form 40-F.

2

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

At the end of the period covered by this annual report for the fiscal year ended February 29, 2012, an evaluation was carried out under the supervision of, and with the

participation of, our management, including our Chief Executive Officer, or CEO, and Chief Financial Officer, or CFO, which are our principal executive officer and

principal financial officer, respectively, of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) of the

Exchange Act). Based upon that evaluation, our CEO and CFO have concluded that our disclosure controls and procedures were effective as at February 29, 2012, to give

reasonable assurance that the information we are required to disclose in reports that we file or submit under the Exchange Act is (i) recorded, processed, summarized and

reported within the time periods specified in the SEC's rules and forms, and (ii) accumulated and communicated to management, including our principal executive and

principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Management's Report on Internal Control over Financial Reporting

Our management is also responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act

Rules 13a-15(f) and 15d-15(f) as well as National Instrument 52-109 of the Canadian Securities Administration. These controls are designed to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes. Under the supervision and with the participation of our

management, including our principal executive officer and principal financial officer, we conducted an evaluation of the effectiveness of our internal control over financial

reporting based on the framework in Internal Control Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based

on our evaluation under the framework in Internal Control Integrated Framework, our management concluded that our internal control over financial reporting was

effective as of February 29, 2012.

Attestation Report of Independent Registered Public Accounting Firm

The attestation report of Ernst & Young LLP ("EY") is included in EY's report, dated May 2, 2012, to the shareholders of the Company, which accompanies the

Registrant's audited consolidated financial statements for the fiscal year ended February 29, 2012, which is attached as Exhibit 99.1 to this annual report on Form 40-F

and incorporated by reference herein.

Changes in Internal Control over Financial Reporting

During the period covered by this Annual Report on Form 40-F, no changes occurred in our internal control over financial reporting that have materially affected, or are

reasonably likely to materially affect, our internal control over financial reporting.

AUDIT COMMITTEE

Audit Committee

We have a separately designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act and NASDAQ Rule 5605(c)(2).

Our Audit Committee is composed of Tom Manley (Chair), Claude Haw, and Jean-Paul Cossart, each of whom, in the opinion of the directors, is financially literate and

independent as determined under National Instrument 52-110 (Audit Committees) ("NI 52-110"), Rule 10A-3 of the Exchange Act and NASDAQ Rule 5605(a)(2).

Information regarding the members of our Audit Committee can be found under "Audit Committee" in our most recently filed AIF.

The Audit Committee assists the board of directors in fulfilling its responsibilities for oversight of financial and accounting matters. In addition to recommending the

auditors to be nominated and reviewing the compensation of the auditors, the Audit Committee is responsible for overseeing the work of the auditors and pre-approving non-

audit services. The Audit Committee also reviews our annual and interim financial statements and news releases containing information taken from our financial statements

prior to their release. The Audit Committee is responsible for reviewing the acceptability and quality of our financial reporting and accounting standards and principles and

any proposed material changes to them or their application.

The Audit Committee has a published charter, which is available at www.sedar.com and on our website, www.dragonwaveinc.com .

3

Audit Committee Financial Expert

Our Board of Directors has determined that Thomas Manley qualifies as an "audit committee financial expert" within the meaning of the SEC's rules and each of the

members of the audit committee is independent as determined under Exchange Act Rule 10A-3 and NASDAQ Rule 5605(a)(2). Information regarding each audit committee

member's qualifications and experience can be found under "Audit Committee" in our most recently filed AIF.

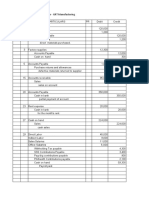

PRINCIPAL ACCOUNTING FEES AND SERVICES INDEPENDENT AUDITORS

The following table sets out the fees billed to us by Ernst & Young LLP and its affiliates for professional services for the year ended February 29, 2012 and the year

ended February 28, 2011. During these years, E&Y was our only external auditor.

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT AUDITORS

In addition to recommending the auditors to be nominated and reviewing the compensation of the auditors, the Audit Committee is responsible for overseeing the work

of the auditors and pre-approving non-audit services. As a matter of practice, the Audit Committee, and/or the Audit Committee Chairman acting on behalf of the Audit

Committee, will generally pre-approve all audit and permitted non-audit services to be performed by our external auditors. None of the fees reported above under the

heading "External Auditor Service Fees" that were paid to Ernst & Young LLP were approved by our Audit Committee pursuant to the de minimus exception provided by

Section (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

OFF-BALANCE SHEET ARRANGEMENTS

Information about our off-balance sheet arrangements can be found under "Off-Balance Sheet Arrangements" in our management's discussion and analysis, or MD&A,

for the year ended February 29, 2012 which section is incorporated herein by reference.

CODE OF ETHICS

We have adopted a Code of Business Conduct and Ethics (the "Code of Ethics") that is applicable to each of our employees, including our principal executive officer,

principal financial officer, principal accounting officer or controller. Our Code of Ethics is available at on our website at www.dragonwaveinc.com .

4

Year Ended

February 29, 2012

Year Ended

February 28, 2011

Audit Fees

(1)

324,098 281,773

Audit Related Fees

(2)

59,816 58,014

Tax Fees

(3)

107,440 43,139

All Other Fees and Administrative Charges

(4)

108,245 86,989

TOTAL 599,599 469,915

(1) Includes audit services.

(2) Includes quarterly review, assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and that are not included in "Audit Fees".

(3) Includes services for regulatory tax compliance and planning, and tax services related to public filings.

(4) Includes services for advice regarding acquisition related activity.

Any amendments to our Code of Ethics, and all waivers of the Code of Ethics with respect to any of the officers covered by it, will be posted on our website within five

business days of such amendment or waiver and shall be provided in print to any shareholder who requests them.

There have been no waivers or implicit waivers to the Code of Ethics during the fiscal year ended February 29, 2012.

CONTRACTUAL OBLIGATIONS

The following table presents a breakdown of our known outstanding contractual obligations by maturity as of February 29, 2012:

The amounts in the table above do not reflect the future tax consequences attributable to such amounts because we are unable to reasonably estimate the amount of such

tax consequences.

NOTICES PURSUANT TO REGULATION BTR

We did not send any notices to directors and executive officers during the period covered by this annual report as required by Rule 104 of Regulation BTR concerning

any equity securities in a pension or retirement plan subject to a blackout period and, generally, these requirements are inapplicable to us.

NASDAQ CORPORATE GOVERNANCE

Our common shares are quoted for trading on the NASDAQ Global Select Market under the symbol DRWI. NASDAQ Marketplace Rule 5615(a)(3) permits a foreign

private issuer to follow its home country practice in lieu of certain of the requirements of the Rule 5600 Series. A foreign private issuer that follows a home country practice

in lieu of one or more provisions of the Rule 5600 Series is required to disclose in its annual report filed with the SEC, or on its website, each requirement of the Rule 5600

Series that it does not follow and describe the home country practice followed by the issuer in lieu of such NASDAQ corporate governance requirements.

We do not follow Marketplace Rule 5620(c), but instead follow our home country practice. The NASDAQ minimum quorum requirement under Rule 5620(c) for a

meeting of shareholders is 33.33% of the outstanding common shares. In addition, Rule 5620(c) requires that an issuer listed on NASDAQ state its quorum requirement in

its governing documents. Our quorum requirement is set forth in our by-laws. A quorum for a meeting of our shareholders is two persons present in person or by proxy who,

in the aggregate, hold at least 25% of the issued shares entitled to be voted at the meeting. The foregoing is consistent with the laws, customs and practices in Canada and the

rules of the Toronto Stock Exchange.

INTERACTIVE DATA FILE

Concurrent with this filing, we have submitted to the SEC and posted on our corporate website, an Interactive Data File.

UNDERTAKING

We undertake to make available, in person or by telephone, representatives to respond to inquiries made by the SEC's staff, and to furnish promptly, when requested to

do so by the SEC staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on

Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

We previously filed an Appointment of Agent for Service of Process and Undertaking on Form F-X with the SEC on May 6, 2010, with respect to the class of securities

in relation to which the obligation to file this annual report on Form 40-F arises.

5

Payment due by period

(Figures are in thousands of U.S. Dollars)

Contractual Obligations Total

Less than 1

year 1-3 years 3-5 years

More than 5

years

Operating Lease Obligations $ 8,227 $ 1,983 $ 1,564 $ 2,680

Total $ 8,277 $ 1,983 $ 1,564 $ 2,680

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual

report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: May 3, 2012

DRAGONWAVE INC.

By:

/s/ RUSSELL FREDERICK

Name: Russell Frederick

Title: Chief Financial Officer

EXHIBIT INDEX

Incorporated by Reference

Exhibit

No Exhibit Title

Filed

Herewith Form

Exhibit

No.

File

No.

Filing

Date

23.1 Consent of Independent Registered Public Accounting Firm of

Ernst & Young LLP dated May 2, 2012

X

31.1

Certification of Principal Executive Officer required by

Rule 13a-14(a) of the Securities Exchange Act of 1934, as

adopted pursuant to Section 302 of the Sarbanes-Oxley Act of

2002, dated May 3, 2012

X

31.2

Certification of Principal Financial Officer required by

Rules 13a-14(a) of the Securities Exchange Act of 1934, as

adopted pursuant to Section 302 of the Sarbanes-Oxley Act of

2002, dated May 3, 2012

X

32.1

Certification of Chief Executive Officer pursuant to 18 USC.

1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley

Act of 2002, dated May 3, 2012

X

32.2

Certification of Chief Financial Officer pursuant to 18 USC.

1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley

Act of 2002, dated May 3, 2012

X

99.1

Audited consolidated financial statements and notes thereto for

the years ended February 29, 2012 and February 28, 2011

X

99.2

Management's Discussion and Analysis for the year ended

February 29, 2012

X

99.3

Press Release dated May 3, 2012 DragonWave Announces

Financial Results for Fourth Quarter and Full Fiscal Year 2012

X

101

Interactive Data File

X

QuickLinks

EXPLANATORY NOTE

INCORPORATION BY REFERENCE

FORWARD-LOOKING STATEMENTS

CURRENCY

AUDITED ANNUAL FINANCIAL STATEMENTS

MANAGEMENT'S DISCUSSION AND ANALYSIS

TAX MATTERS

CONTROLS AND PROCEDURES

AUDIT COMMITTEE

PRINCIPAL ACCOUNTING FEES AND SERVICES INDEPENDENT AUDITORS

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY INDEPENDENT AUDITORS

OFF-BALANCE SHEET ARRANGEMENTS

CODE OF ETHICS

CONTRACTUAL OBLIGATIONS

NOTICES PURSUANT TO REGULATION BTR

NASDAQ CORPORATE GOVERNANCE

INTERACTIVE DATA FILE

UNDERTAKING

CONSENT TO SERVICE OF PROCESS

SIGNATURES

EXHIBIT INDEX

QuickLinks -- Click here to rapidly navigate through this document

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We hereby consent to the reference to our firm under the caption "Experts" and to the incorporation by reference in DragonWave Inc.'s Annual Report on Form 40-F of

our reports dated May 2, 2012 with respect to the consolidated financial statements of DragonWave Inc. (the "Company") for the years ended February 29, 2012 and

February 28, 2011, and the effectiveness of internal control over financial reporting of the Company as at February 29, 2012.

We also consent to the incorporation by reference in the Registration Statement on Form S-8 No. 333-167806 pertaining to the Company's Fifth Amended and Restated

Key Employee Stock Option Plan of DragonWave Inc. of our reports dated May 2, 2012 with respect to the consolidated financial statements of DragonWave Inc. for the

years ended February 29, 2012 and February 28, 2011, and the effectiveness of internal control over financial reporting of the Company as at February 29, 2012.

Ottawa, Canada,

May 2, 2012

/s/ Ernst & Young LLP

Chartered Accountants

Licensed Public Accountants

QuickLinks

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

QuickLinks -- Click here to rapidly navigate through this document

Exhibit 31.1

CERTIFICATION PURSUANT TO

RULE 13a-14(a)

I, Peter Allen, certify that:

1. I have reviewed this annual report on Form 40-F of DragonWave Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in

light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial

condition, results of operations and cash flows of the issuer as of, and for, the periods presented in this report;

4. The issuer's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-

15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the issuer and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that

material information relating to the issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the

period in which this report is being prepared;

b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to

provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles;

c) Evaluated the effectiveness of the issuer's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the

disclosure controls and procedures; as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the issuer's internal control over financial reporting that occurred during the period covered by the annual report that

has materially affected, or is reasonably likely to materially affect, the issuer's internal control over financial reporting; and

5. The issuer's other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the issuer's auditors and

the audit committee of the issuer's board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to

adversely affect the issuer's ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the issuer's internal control over financial

reporting.

Date: May 3, 2012

/s/ PETER ALLEN

Peter Allen

Chief Executive Officer

QuickLinks

Exhibit 31.1

CERTIFICATION PURSUANT TO RULE 13a-14(a)

QuickLinks -- Click here to rapidly navigate through this document

Exhibit 31.2

CERTIFICATION PURSUANT TO

RULE 13a-14(a)

I, Russell Frederick, certify that:

1. I have reviewed this annual report on Form 40-F of DragonWave Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in

light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial

condition, results of operations and cash flows of the issuer as of, and for, the periods presented in this report;

4. The issuer's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-

15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the issuer and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that

material information relating to the issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the

period in which this report is being prepared;

b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to

provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles;

c) Evaluated the effectiveness of the issuer's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the

disclosure controls and procedures; as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the issuer's internal control over financial reporting that occurred during the period covered by the annual report that

has materially affected, or is reasonably likely to materially affect, the issuer's internal control over financial reporting; and

5. The issuer's other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the issuer's auditors and

the audit committee of the issuer's board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to

adversely affect the issuer's ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the issuer's internal control over financial

reporting.

Date: May 3, 2012

/s/ RUSSELL FREDERICK

Russell Frederick

Chief Financial Officer

QuickLinks

Exhibit 31.2

CERTIFICATION PURSUANT TO RULE 13a-14(a)

QuickLinks -- Click here to rapidly navigate through this document

Exhibit 32.1

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Annual Information Report of DragonWave Inc. (the "Company") on Form 40-F for the fiscal year ended February 29, 2012 as filed with the

Securities and Exchange Commission on the date hereof (the "Report"), I, Peter Allen, President and Chief Executive Officer of the Company, certify, pursuant to 18 U.S.C.

Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

1. The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

2. The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

This certification accompanies the annual report pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and shall not, except to the extent required by the

Sarbanes-Oxley Act of 2002, be deemed filed by the issuer for purposes of Section 18 of the Securities Exchange Act of 1934.

Dated: May 3, 2012

/s/ PETER ALLEN

Peter Allen

Chief Executive Officer

QuickLinks

Exhibit 32.1

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

QuickLinks -- Click here to rapidly navigate through this document

Exhibit 32.2

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Annual Information Report of DragonWave Inc. (the "Company") on Form 40-F for the fiscal year ended February 29, 2012 as filed with the

Securities and Exchange Commission on the date hereof (the "Report"), I, Russell Frederick, Chief Financial Officer of the Company, certify, pursuant to 18 U.S.C.

Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

1. The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

2. The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

This certification accompanies the annual report pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and shall not, except to the extent required by the

Sarbanes-Oxley Act of 2002, be deemed filed by the issuer for purposes of Section 18 of the Securities Exchange Act of 1934.

Dated: May 3, 2012

/s/ RUSSELL FREDERICK

Russell Frederick

Chief Financial Officer

QuickLinks

Exhibit 32.2

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.1

INDEPENDENT AUDITORS' REPORT OF REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of

DragonWave Inc.

We have audited the accompanying consolidated financial statements of DragonWave Inc. , which comprise the consolidated balance sheets as at February 29, 2012

and February 28, 2011, and the consolidated statements of operations and comprehensive income (loss), changes in shareholders' equity and cash flows for each of the years

in the two-year period ended February 29, 2012, and a summary of significant accounting policies and other explanatory information.

Management's responsibility for the consolidated financial statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with United States generally accepted

accounting principles, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from

material misstatement, whether due to fraud or error.

Auditors' responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with Canadian

generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we comply with

ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected

depend on the auditors' judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In

making those risk assessments, the auditors consider internal control relevant to the entity's preparation and fair presentation of the consolidated financial statements in order

to design audit procedures that are appropriate in the circumstances. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in

the consolidated financial statements, evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as

well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained in our audits is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of DragonWave Inc. as at February 29, 2012 and

February 28, 2011, and the results of its operations and its cash flows for each of the years in the two-year period ended February 29, 2012 in accordance with United States

generally accepted accounting principles.

Other matter

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), DragonWave's internal control over

financial reporting as of February 29, 2012, based on the criteria established in Internal Control Integrated Framework issued by the Committee of Sponsoring

Organizations of the Treadway Commission and our report dated May 2, 2012 expressed an unqualified opinion on DragonWave Inc.'s internal control over financial

reporting.

Ottawa, Canada

May 2, 2012

/s/ Ernst & Young LLP

Chartered Accountants

Licensed Public Accountants

1 -- Page

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of:

DragonWave Inc.

We have audited DragonWave Inc.'s internal control over financial reporting as of February 29, 2012, based on criteria established in Internal Control Integrated

Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (the COSO criteria). DragonWave Inc.'s management is responsible for

maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting included in the

accompanying reports from management. Our responsibility is to express an opinion on the company's internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and

perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included

obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating

effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit

provides a reasonable basis for our opinion.

A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the

preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting

includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions

of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with

generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and

directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company's

assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of

effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the

policies or procedures may deteriorate.

In our opinion, DragonWave Inc. maintained, in all material respects, effective internal control over financial reporting as of February 29, 2012 based on the

COSO criteria.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of

DragonWave Inc. as of February 29, 2012 and February 28, 2011 and the related consolidated statements of operations and comprehensive income (loss), changes in

shareholders' equity and cash flows for each of the two years in the period ended February 29, 2012 of DragonWave Inc. and our report dated May 2, 2012 expressed an

unqualified opinion thereon.

Ottawa, Canada

May 2, 2012

/s/ Ernst & Young LLP

Chartered Accountants

Licensed Public Accountants

2 -- Page

CONSOLIDATED BALANCE SHEETS

Expressed in US $000's except share amounts

On behalf of the Board:

See accompanying notes

3 -- Page

Note

As at

February 29,

2012

As at

February 29,

2011

(Note 2)

Assets

Current Assets

Cash and cash equivalents 4 52,798 77,819

Restricted cash 4 177 714

Short term investments 4 11,181

Trade receivables 5 9,850 11,579

Inventory 6 26,994 28,204

Other current assets 7 5,501 5,306

Future income tax asset 16 69 553

95,389 135,356

Long Term Assets

Property and equipment 8 5,280 7,560

Future income tax asset 16 1,308 808

Intangible assets 9 6,217 14,929

Goodwill 9 11,927 11,927

24,732 35,224

Total Assets 120,121 170,580

Liabilities

Current Liabilities

Accounts payable and accrued liabilities 10 12,720 15,967

Deferred revenue 723 1,453

Contingent royalty 14 372 622

Contingent consideration 22 1,884 14,622

15,699 32,664

Long Term Liabilities

Contingent royalty 14 1,292 3,290

Other long term liabilities 11 1,063 1,999

2,355 5,289

Commitments 14

Shareholders' equity

Capital stock 12 172,264 171,570

Contributed surplus 12 4,606 2,642

Deficit 12 (65,448 ) (31,967 )

Accumulated other comprehensive loss 12 (9,695 ) (9,618 )

Total Shareholder's equity 101,727 132,627

Non-controlling interests 3 340

Total Equity 102,067 132,627

Total Liabilities and Shareholder's equity 120,121 170,580

Shares issued & outstanding 12 35,586,206 35,421,893

(Signed) GERRY SPENCER

Director

(Signed) TOM MANLEY

Director

CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME (LOSS)

Expressed in US $000's except share and per share amounts

See accompanying notes

4 -- Page

Year ended

Note

February 29,

2012

February 28,

2011

(Note 2)

REVENUE 19, 20 45,656 118,010

Cost of sales 6 29,255 67,460

Gross profit 16,401 50,550

EXPENSES

Research and development 24,023 19,056

Selling and marketing 15,307 17,303

General and administrative 16,528 11,785

Government assistance 14 (902 ) (390 )

54,956 47,754

Income (loss) before amortization of intangible assets and other items (38,555 ) 2,796

Amortization of intangible assets 9 (1,986 ) (893 )

Accretion expense (650 ) (393 )

Interest income 393 233

Investment gain 67 7

Impairment of intangible assets 9 (8,315 )

Gain on change in estimate of contingent liabilities 14, 22 15,146

Foreign exchange gain 100 678

Income (loss) before income taxes (33,800 ) 2,428

Income tax expense (recovery) 16 (104

) 421

Net Income (loss) (33,696 ) 2,007

Net Loss Attributable to Non-Controlling Interest 215

Net Income (loss) applicable to shareholders (33,481 ) 2,007

Foreign currency translation differences for foreign operations 77

Comprehensive Income (Loss) applicable to shareholders (33,558 ) 2,007

Income (loss) per share

Basic 13 (0.94 ) 0.06

Diluted 13 (0.94 ) 0.05

Weighted Average Shares Outstanding

Basic 13 35,506,689 35,812,507

Diluted 13 35,506,689 36,741,961

CONSOLIDATED STATEMENTS OF CASH FLOWS

Expressed in US $000's

See accompanying notes

5 -- Page

Year ended

Note

February 29,

2012

February 28,

2011

(Note 2)

Operating Activities

Net Income (Loss) (33,696 ) 2,007

Items not affecting cash

Amortization of property and equipment 3,370 2,895

Amortization of intangible assets 1,986 893

Accretion expense 650 393

Non cash royalty amortization (490 ) (266 )

Impairment of intangible assets 8,315

Gain on change in estimate of contingent liabilities (15,146 )

Stock-based compensation 1,964 1,410

Unrealized foreign exchange loss 38 134

Non cash future income tax expense (recovery) (42 ) 358

Inventory impairment 2,020 3,285

(31,031 ) 11,109

Changes in non-cash working capital items 15 (3,437

) (12,301

)

(34,468 ) (1,192 )

Investing Activities

Acquisition of property and equipment (1,090 ) (3,839 )

Acquisition of intangible assets (1,589 ) (867 )

Acquisition of Axerra Networks Inc., net of cash acquired (8,700 )

Purchase of short term investments (22,432 ) (135,480 )

Maturity of short term investments 33,613 132,378

8,502 (16,508 )

Financing Activities

Share repurchase (10,738 )

Initial formation contribution by non-controlling interest in DW-HFCL 555

Issuance of common shares net of issuance costs 505 1,115

1,060 (9,623 )

Effect of foreign exchange on cash and cash equivalents (115 ) (134 )

Net decrease in cash and cash equivalents (25,021

) (27,457

)

Cash and cash equivalents at beginning of period 77,819 105,276

Cash and cash equivalents at end of period 52,798 77,819

Cash paid during the period for interest 194

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

[ Expressed in US $000's except common share amounts ]

6 -- Page

Common

Shares

Capital

Stock

Contributed

Surplus Deficit AOCL

Non-

Controlling

Interest

Shareholder's

Equity

Balance at

February 28, 2009 28,559,297 $ 108,153 $ 1,301 $ (60,075 ) $ (15,305 ) $ 0 $ 34,074

Equity financing 7,493,562 $ 68,615 $ 68,615

Stock-based

compensation $ 952 $ 952

Exercise of stock

options 753,443 $ 1,812 $ (692 ) $ 1,120

Warrant exercises 114,594 $ 379 $ 379

Other comprehensive

income $ 164 $ 5,687 $ 5,851

Other 14,021 $ 51 $ 51

Net earnings $ 27,804 $ 27,804

Balance at

February 28, 2010 36,934,917 $ 179,174 $ 1,561 $ (32,271 ) $ (9,618 ) $ 0 $ 138,846

Stock-based

compensation $ 1,389 $ 1,389

Exercise of stock

options 311,254 $ 1,126 $ (285 ) $ 841

Share repurchase (1,865,549 ) $ (9,035 ) $ (1,703 ) $ (10,738 )

Other 41,271 $ 305 $ (23 ) $ 282

Net Earnings $ 2,007 $ 2,007

Balance at

February 28, 2011

(Note 2) 35,421,893 $ 171,570 $ 2,642 $ (31,967 ) $ (9,618 ) $ 0 $ 132,627

Stock-based

compensation $ 1,914 $ 1,914

Exercise of stock

options 113,940 $ 452 $ (141 ) $ 311

Stock option benefit $ 189 $ 189

Other 50,373 $ 242 $ 2 $ 244

Other comprehensive

loss $ (77 ) $ (77 )

Initial formation

contribution by non-

controlling interest

in DW-HFCL

(Note 3) $ 555 $ 555

Net Loss $ (33,481 ) $ (215 ) $ (33,696 )

Balance at

February 29, 2012 35,586,206 $ 172,264 $ 4,606 $ (65,448 ) $ (9,695 ) $ 340 $ 102,067

DragonWave Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

[Expressed in US $000's except share and per share amounts]

1. NATURE OF BUSINESS AND BASIS OF PRESENTATION

DragonWave Inc. [the "Company"], incorporated under the Canada Business Corporations Act in February 2000, is in the business of developing next-generation

broadband wireless backhaul and pseudowire equipment.

The Company's common shares are traded on the Toronto Stock Exchange under the trading symbol DWI and on NASDAQ Global Market under the symbol DRWI.

These consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, DragonWave Corp., incorporated in the state of

Delaware, USA, DragonWave PTE Limited, incorporated in Singapore, 4472314 Canada Inc., incorporated in Canada, Axerra Networks Inc., incorporated in the state of

Delaware, USA, DragonWave Networks Ltd., incorporated in Israel, DragonWave S.r.l, incorporated in Italy, DragonWave S.A.R.L., incorporated in Luxembourg,

DragonWave LTDA, incorporated in Brazil, Axerra GMBH, incorporated in Germany, Axerra Networks Asia Pacific Limited, incorporated in Hong Kong, and its majority

owned subsidiary, DragonWave HFCL India Private Limited. All intercompany accounts and transactions have been eliminated upon consolidation.

The consolidated financial statements of the Company have been prepared in United States dollars following United States Generally Accepted Accounting Principles

["U.S. GAAP"], as further discussed in note 2.

In the opinion of management, the consolidated financial statements reflect all adjustments, which consist only of normal and recurring adjustments, necessary to

present fairly the financial position as at February 29, 2012 and February 28, 2011 and the results of operations, cash flows and changes in equity for the years ended

February 29, 2012 and February 28, 2011.

2. SIGNIFICANT ACCOUNTING POLICIES

Adoption of United States Generally Accepted Accounting Principles

In February 2008, the Canadian Accounting Standards Board confirmed the transition from Canadian GAAP to International Financial Reporting Standards ["IFRS"]

for all publicly accountable entities no later than fiscal years commencing on or after January 1, 2011. As a result, management undertook a detailed review of the

implications of the Company having to report under IFRS and also examined the alternative available to the Company, as a Foreign Private Issuer in the United States, of

filing its primary financial statements in Canada using U.S. GAAP, as permitted by the Canadian Securities Administrators' National Instrument 51-102, "Continuous

Disclosure Obligations".

As a result of this analysis, management determined that the Company would adopt U.S. GAAP as its primary basis of financial reporting commencing March 1, 2011

on a retrospective basis. All comparative financial information contained in the consolidated financial statements has been revised to reflect the Company's results as if they

had been historically reported in accordance with U.S. GAAP.

The adoption of U.S. GAAP did not have a material change on the Company's accounting policies or financial results. An adjustment in the amount of $154 was made

to increase deficit as calculated by Canadian GAAP as at February 28, 2011 due to the adoption of U.S. GAAP.

Under Canadian GAAP, Investment Tax Credits (ITC's) were recognized as a reduction to the Company's Research and development expense. Under US GAAP, ITC's

are recognized as a reduction to Income tax expense. During fiscal 2011, under Canadian GAAP, the Company recognized $380 as a reduction to research and development

expense. Under US GAAP, the prior year results were impacted as follows: the Company's Income before taxes was adjusted $2,428 and the Company's tax expense was

$421 as opposed to $2,808 and

7 -- Page

DragonWave Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

[Expressed in US $000's except share and per share amounts]

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

$801 respectively as was stated under Canadian GAAP. The GAAP difference had no impact on the Company's consolidated Net and Comprehensive Income in the prior

fiscal year.

Use of accounting estimates

The preparation of the consolidated financial statements in conformity with GAAP requires the Company's management to make estimates that affect the reported

amounts of assets and liabilities and disclosure of contingent amounts of assets and liabilities as at the date of the consolidated financial statements and the reported amounts

of revenues and expenses during the reporting periods presented. Actual results could differ from the estimates made by management.

The following include estimates by management: allowance for doubtful accounts, inventory allocations, inventory provisions, accrued liabilities, warranty provisions,

contingent royalty, tax valuation allowance, impairment of intangible assets and goodwill, vendor specific objective evidence, estimated selling price and estimated returns

as it relates to revenue recognition, and stock-based compensation.

These estimates and assumptions are based on management's historical experience, best knowledge of current events and conditions and actions that the Company may

undertake in the future. Certain of these estimates require subjective or complex judgments by management about matters that are uncertain and changes in those estimates

could materially impact the amounts reported in the consolidated financial statements and accompanying notes.

Foreign currency translation

The Company's operations and balances denominated in foreign currencies, including those of its foreign subsidiaries which are considered financially and

operationally integrated, are translated into US dollars (USD) using the temporal method of translation: monetary assets and liabilities are translated at the period end

exchange rate, non-monetary assets are translated at the historical exchange rate, and revenue and expense items are translated at the average exchange rate. Gains or losses

resulting from the translation adjustments are included in income (loss).

The cumulative foreign currency translation adjustment included under accumulated other comprehensive loss within shareholders' equity on the consolidated balance

sheets relates to the Company's adoption of USD as the functional and reporting currency which was effective March 1, 2010 and unrealized foreign currency translation

gains or losses of our self-sustaining foreign subsidiary which are translated into USD using the current rate method. Under the current rate method, assets and liabilities are

translated at the rate of exchange prevailing at the balance sheet date. Revenue and expenses are translated at the average exchange rate prevailing during the period.

Revenue recognition

The Company derives revenue from the sale of broadband wireless backhaul equipment which includes embedded software and a license to use said software and

extended product warranties. Software is considered to be incidental to the product. Services range from installation and training to basic consulting. Revenue is recognized

when persuasive evidence of an arrangement exists, delivery has occurred and there are no significant remaining vendor obligations, collection of receivables is reasonably

assured and the fee is fixed and determinable. Where final acceptance of the product is specified by the customer, revenue is deferred until acceptance criteria have

been met.

8 -- Page

DragonWave Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

[Expressed in US $000's except share and per share amounts]

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

The Company's business agreements may also contain multiple elements. Accordingly, the Company is required to determine the appropriate accounting, including

whether the deliverables specified in a multiple element arrangement should be treated as separate units of accounting for revenue recognition purposes, the fair value of

these separate units of accounting and when to recognize revenue for each element. For arrangements involving multiple elements, the Company allocates revenues to each

element based on a selling price hierarchy. The selling price for a deliverable is based on its vendor specific objective evidence ("VSOE") if available, third party evidence

("TPE") if VSOE is not available, or estimated selling price ("ESP") if neither VSOE nor TPE is available. In multiple element arrangements, revenues are allocated to each

separate unit of accounting for each of the deliverables using the relative estimated selling prices of each of the deliverables in the arrangement based on the aforementioned

selling price hierarchy. The Company has determined the selling price for the undelivered items using VSOE and the delivered items using ESP.

The Company generates revenue through direct sales and sales to distributors. The Company defers the recognition of a portion of sales to distributors based estimated

sale returns and stock rotation granted to customers on products in the same period the related revenues are recorded. These estimates are based on historical sales returns;

stock rotations and other known factors. During the current fiscal year the Company determined that there was sufficient history to base its estimates on and adapted our

policy accordingly.

Revenue associated with extended warranty and advanced replacement warranty is recognized rateably over the life of the contracted service.

Revenue from engineering services or development agreements is recognized according to the specific terms and acceptance criteria as services are rendered.

The Company accrues estimated potential product liability as warranty costs when revenue on the sale of equipment is recognized. Warranty costs are calculated on a

percentage of revenue per month based on current actual warranty costs and return experience.

Shipping and handling costs borne by the Company are recorded in cost of sales. Shipping and handling costs charged to customers are recorded as revenue, if billed at

the time of shipment. Costs charged to customers after delivery are recorded in cost of sales.

The Company generates revenue through royalty agreements as a result of the use of its Intellectual Property. Royalty revenue is recognized as it is earned.

Cash and cash equivalents

The Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents.

Short term investments

The Company has classified its short term investments as held for trading, which are carried at fair value with both realized and unrealized gains and losses included in

net income (loss).

Financial instruments

The Company classifies its financial instruments as held-for-trading, held-to-maturity, available-for-sale, loans and receivables and other financial liabilities. The

classification depends on the purpose for which the financial instruments were acquired, their characteristics and management's intent. Management determines the

classification of financial assets and liabilities at initial recognition and the classification is not changed

9 -- Page

DragonWave Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

[Expressed in US $000's except share and per share amounts]

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

subsequent to initial recognition. The Company designated its cash and cash equivalents and short term investments as held-for-trading which are measured at fair value,

with changes in fair value being recorded in net earnings. Trade receivables and other receivables have been classified as loans and receivables which are measured at

amortized cost. Accounts payable and accrued liabilities have been classified as other financial liabilities, which are measured at amortized cost.

Transaction costs directly attributable to the acquisition of financial assets are recorded in net income (loss)in the period in which they are incurred.

Inventory

Inventory is valued at the lower of cost and net realizable value ["NRV."] The cost of inventory is calculated on a standard cost basis, which approximates average

actual cost. NRV is determined as the market value for finished goods, replacement cost for raw materials, and finished goods market value less cost to complete for work in

progress inventory. Indirect manufacturing costs and direct labour expenses are allocated systematically to the total production inventory.

Income taxes

Income taxes are accounted for using the liability method of accounting for income taxes. Under this method, deferred income tax assets and liabilities are determined

based on differences between the tax and accounting bases of assets and liabilities as well as for the benefit of losses available to be carried forward to future years for tax

purposes that are more likely than not to be realized. Deferred income tax assets and liabilities are measured using enacted tax rates that apply to taxable income in the years

in which temporary differences are expected to be recovered or settled. The Company provides a valuation allowance against its deferred tax assets when it believes that it is

more likely than not that the assets will not be realized.

The Company determines whether it is more likely than not that an uncertain tax position will be sustained upon examination by the tax authorities. The tax benefit of

any uncertain tax position that meets the more-likely-than-not recognition threshold is calculated as the largest amount that is more than 50% likely of being realized upon

successful resolution. To the extent a full benefit is not expected to be realized, an income tax liability is effectively established. The Company recognizes accrued interest

and penalties on unrecognized tax benefits as interest expense.

Management periodically reviews the Company's provision for income taxes and valuation allowance to determine whether the overall tax estimates are reasonable.

When management performs its quarterly assessments of the provision and valuation allowance, it may be determined that an adjustment is required. This adjustment may

have a material impact on the Company's financial position and results of operations.

10 -- Page

DragonWave Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

[Expressed in US $000's except share and per share amounts]

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

Property and equipment

Property and equipment are stated at cost. Amortization is calculated using the straight-line method over the anticipated useful lives of the assets as follows:

Management evaluates the carrying value of its property and equipment assets whenever events or changes in circumstances indicate that the carrying value may not be

recoverable. To the extent the estimated undiscounted future net cash inflows attributable to the asset are less than the carrying amount, an impairment loss is recognized.

The amount of impairment loss to be recorded is the difference between the asset's carrying value and the net discounted estimated future cash flows.

Goodwill and intangible assets

Intangible assets include computer software, infrastructure systems software, customer relationships and developed technology, and are amortized over their estimated

useful lives of 2 years, 3 years, 8 years, and 6 years respectively. Management evaluates the carrying value of its intangible assets whenever events or changes in

circumstances indicate that the carrying value may not be recoverable. To the extent the estimated undiscounted future net cash inflows attributable to the asset are less than

the carrying amount, an impairment loss is recognized. The amount of impairment loss to be recorded is the difference between the asset's carrying value and the net

discounted estimated future cash flows.

Goodwill represents the excess of the purchase price over the estimated fair value of net tangible and intangible assets acquired in business combinations. The

Company reviews the carrying value of goodwill on an annual basis or more frequently if circumstances indicate that it is more likely than not that the fair value of the

goodwill is below its carrying amount. The goodwill impairment test is a three-step process which requires management to make judgmental assumptions regarding fair

value. The first step in the impairment test is to assess qualitative factors to determine whether it is necessary to perform the subsequent two steps of the goodwill

impairment test. The second step consists of estimating the fair value of our aggregated reporting unit. When the fair value of our reporting unit exceeds its carrying amount,

goodwill of the reporting unit is considered not to be impaired and the third step of the impairment test is unnecessary. If the fair value is less than the carrying amount, the

Company compares the implied fair value of the goodwill, determined as if a purchase had just occurred, to the carrying amount to determine the amount of impairment

charge to be recorded. Changes in the estimates and assumptions used in assessing the projected cash flows could materially affect the results of management's evaluation.

Contingent royalty

In the event of an acquisition, the Company identifies any contingent royalties and recognizes the fair value of those liabilities based on the discounted expected cash

outflows. Subsequent to the initial recognition and until the liabilities are settled, cancelled or expire, the Company accretes the liabilities using the initial discount

11 -- Page

Test equipment 4 years

Research and development equipment 5 years

Computer hardware 2 years

Production fixtures 3 years

Leasehold improvements 5 years

Furniture and fixtures 5 years

Communication equipment 3 years

Other 3 - 5 years

DragonWave Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

[Expressed in US $000's except share and per share amounts]

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

rate and subsequently amortizes the liability into cost of sales based on the forecasted sales over the liability's expected life.

Stock option plan and employee share purchase plan

The Company has a stock option plan and an employee share purchase plan which is described in note 12. The Company accounts for stock options granted to

employees using the fair value method. In accordance with the fair value method, the Company recognizes estimated compensation expense related to stock options over the

vesting period of the options granted, with the related credit being charged to contributed surplus.

The Company launched an employee share purchase plan on October 20, 2008. The plan includes provisions to allow employees to purchase Common shares. The

Company will match the employees' contribution at a rate of 25%. Proceeds from employees and the cost of the matching shares are recorded in share capital and

contributed surplus at the time the shares are issued. The shares contributed by the Company will vest 12 months after issuance with a corresponding compensation expense

recognized in income (loss).

Expenses

The Company defined general and administration expenses to be administrative, finance, and operational costs. Sales and marketing expenses are defined as costs

related to worldwide sales, marketing and product management. Research and development costs are defined as costs related to research and development related activities.

Research and development

Research costs are expensed as incurred. Development costs are expensed as incurred unless they meet generally accepted accounting criteria for deferral and

amortization. Development costs incurred prior to establishment of technological feasibility do not meet these criteria, and are expensed as incurred.

Income per share

Basic income per share is calculated by dividing net income available to Common shareholders by the weighted average number of Common shares outstanding during

the period. For all periods presented, the net income available to Common shareholders equates to the net income (loss).

In the computation of diluted earnings per share, the Company includes the number of additional common shares that would have been outstanding if the dilutive

potential equity instruments had been issued.

Non-controlling interest

Non-controlling interest consists of the minority owned portion of the Company's 50.1% owned subsidiary, DragonWave HFCL India Private Limited.

ACCOUNTING POLICIES ADOPTED IN THE CURRENT FISCAL YEAR

Non-Controlling Interest

The Company adopted ASC 810-10-65, Non-controlling Interests in Consolidated Financial Statements, which governs the accounting for and reporting of (1) non-

controlling interest in partially owned consolidated subsidiaries and (2) the loss of control of subsidiaries. Significant changes to the accounting for non-controlling interests

include (a) the inclusion of non-controlling interests in the equity section of the controlling entity's

12 -- Page

DragonWave Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

[Expressed in US $000's except share and per share amounts]

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

consolidated balance sheets rather than in the mezzanine section and (b) the requirement that changes in the controlling entity's interest in the non-controlling interest,

without a change in control, be recognized in the controlling entity's equity rather than being accounted for by the purchase method, which accounting under the purchase

method would have given rise to goodwill.

Additionally, the adoption of ASC 810-10-65 requires that net income, as previously reported prior to the adoption of ASC 810-10-65, be adjusted to include the net

income attributable to the non-controlling interest, and that a new separate caption for net income attributable to common shareholders of the Company be presented in the

consolidated statements of operations. ASC 810-10-65 also requires similar disclosure regarding comprehensive income (loss). The Company has disclosed the consolidated

balance sheets and consolidated statements of operations and comprehensive income (loss) in accordance with this ASC.

Multiple-deliverable revenue arrangements

In November 2009, the FASB issued ASU 2009-13, which amends the guidance in ASC 605-25 on multiple element revenue arrangements. The amendment eliminates

the residual method of allocation and requires that any arrangement consideration be allocated to all deliverables using the relative selling price method with any discounts

allocated proportionally to each deliverable. The amendment also establishes a selling price hierarchy for determining the selling price of each deliverable. The selling price,

formally referred to as fair value, will be based on vendor-specific objective evidence if available, third-party evidence if vendor specific objective evidence is not available,

or estimated selling price if neither vendor-specific objective evidence nor third-party evidence is available. For the Company, this ASU is effective for revenue

arrangements entered into or materially modified on or after March 1, 2011. This change did not have any material impact on the consolidated financial statements.

Impairment of goodwill

On December 17, 2010, the FASB issued ASU 2010-28, the new standard requires entities with a zero or negative carrying value to assess, considering qualitative

factors such as those listed in ASC 350, whether it is more likely than not that a goodwill impairment exists. If an entity concludes that it is more likely than not that a

goodwill impairment exists, the entity must perform step 2 of the goodwill impairment test. This change did not have any material impact on the consolidated financial

statements.

Intangible assets, goodwill and other

In August 2011, the FASB issued Accounting Standards Update No. 2011-08, Intangibles Goodwill and Other, which discusses the new Qualitative Assessment

Option for testing goodwill impairment. Under this update, the Company may first assess qualitative factors to determine whether it is necessary to perform the two-step

goodwill impairment test. If the assessment resulted in more than 50% likelihood that the fair value of a reporting unit is less than the carrying amount, then the Company

must continue to apply the two-step impairment test. If the fair value exceeds the carrying amount, then neither of the two steps in the current Goodwill impairment test is

required. The Company adopted the standard, effective February 29, 2012. The impact of the adoption has been described in Note 9.

Fair value measurements

In January 2010, the Financial Accounting Standards Board (the "FASB") issued authoritative guidance to improve disclosures about fair value measurements. This

new authoritative guidance became effective for interim and annual periods beginning after December 15, 2009, except for the requirement to separately disclose

13 -- Page

DragonWave Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

[Expressed in US $000's except share and per share amounts]

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

purchases, sales, issuances, and settlements in the Level 3 reconciliation, which became effective for interim and annual periods beginning after December 15, 2010. The

Company adopted the authoritative guidance to improve disclosures about fair value measurements and the authoritative guidance requiring separate disclosure on

purchases, sales, issuances, and settlements in the Level 3 reconciliation in the first quarter of fiscal 2012. The adoption did not have a material impact on the Company's

results of operations, financial condition or the Company's disclosures.

FUTURE ACCOUNTING CHANGES

Fair value measurements

In May 2011, the FASB, as a result of work performed with the International Accounting Standards Board ["IASB"], issued authoritative guidance to achieve common