Professional Documents

Culture Documents

Telecom Law Assignment

Uploaded by

Aisha KlccOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Telecom Law Assignment

Uploaded by

Aisha KlccCopyright:

Available Formats

TELECOM LAW & REGULATIONS

ASSIGNMENT

COUNTRY STUDY:

ARGENTINA

HAFSA USMANI 08-0253 AISHA 08-0308

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

TABLE OF CONTENTS

TELECOM MARKET OF ARGENTINA: ................................................................................................................ 3 TELECOM LAW OF ARGENTINA: ....................................................................................................................... 4 Licensing Rules for Telecommunications Services: ...................................................................................... 4 Equipment:................................................................................................................................................... 5 Frequency Spectrum Allocation: .................................................................................................................. 6 REGULATORY FRAMEWORK:............................................................................................................................ 7 INTERCONNECT REGIME: ................................................................................................................................. 8 TARIFF POLICIES ............................................................................................................................................... 9 USER PROTECTION ......................................................................................................................................... 10 UNIVERSAL SERVICE ACCESS FUND (UASF) .................................................................................................... 11 Sources for funding .................................................................................................................................... 11 Fund Administrator .................................................................................................................................... 11 Type of services.......................................................................................................................................... 11 QUALITY OF SERVICE ...................................................................................................................................... 12 REFERENCES ................................................................................................................................................... 13

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

TELECOM MARKET OF ARGENTINA:

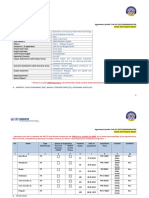

Argentina has been savvy at adapting new technology faster than other Latin American nations. When the telecommunication industry grew exponentially in the 1990s, Argentina was among the first countries in the region to privatize its state monopoly followed by complete deregulation of the telecom industry by the end of 2000. Traditional telecommunication companies have put their investment plans on hold due to the current economic climate, but there was tempered optimism for a return to expansion in 20032004. After following privatization in the 1990s and, more recently, market deregulation, the Argentine telephone system is now more modern. Deregulation included regulations for licensing, interconnection, universal service and spectrum management. This new framework has opened the market to a full range of communications services and has been intended to create a level playing field for new entrants. The regulatory framework of Decree 764/2000 opened up the full range of telecommunications services, including IP telephony. [1] As of January 2010, there are 9.2 million land lines, 50 million cellular phones and 143,000 public phones in the country. The domestic telephone trunk network is served by microwave radio relay and a domestic satellite system with 40 earth stations. It carries a monthly traffic of about 1.3 billion local calls, 400 million inter-city calls and around 24 million outgoing international calls. A brief summary of the above statistics is given in the following table as [2]:

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

TELECOM LAW OF ARGENTINA:

In September 2000, a new set of regulations was approved under Decree No. 764/2000 (the New Regulations), providing for a deregulated legal framework for Argentine telecommunications. The New Regulations were enacted for the deregulation of basic telephony services and international services after 8 November 2000, opening up the Argentine telecommunications market to free competition, and consisted of four new sets of rules, namely: (i) Licensing Rules for Telecommunications Services. (ii) Universal Service General Rules. (iii) National Interconnection Rules. (iv) Rules of Administrations, Management and Control of the Radio Spectrum. [3]

Licensing Rules for Telecommunications Services:

A national license is required, together with the filing of the registry (service to be provided). Decree 764/2000 establishes a single license called Unique License for Telecommunications Services (ULTS). All the telecommunications operators must obtain a ULTS license, regardless of the services they want to provide or their business ISP, local or long distance telephony, cellular telephony etc. but it is the responsibility of each operator to carefully detail in its license application the list of services it wishes to provide to the public. The ULTS is a flexible authorization. At any time after having obtained a license, operators are entitled to upgrade their license. The SECOM grants the ULTS licenses. SECOM is the application authority of telecommunication regulation in Argentina. The CNC is in charge of the reception and the review of the application for an ULTS. As a result of the liberalization, Argentina has more than 200 ISPs and companies with the ULTS. This competitive market offers great possibilities for the users and the Internet in general because more sites were created that are accessed for all Spanish speaking in the world. However, there are many external factors that influence this liberalized and convergent telecom market. The process should not take longer than 3 months.

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

The information and or documentation to be filed consist generally of the following, in addition to corporate and personal documentation of the person or entity requesting the license: a) Description of the services to be rendered; b) Technical plan and schedule including the description and location of the network for the first 3 years of service; and c) Investment plan consistent with the technical plan.

Equipment:

For decades, Siemens was by far the leading supplier in the Argentine telecommunications equipment market. Privatization and deregulation, in addition to the presence of new technologies, created a real competitive environment among equipment providers. Almost 90 percent of equipment is imported from Brazil or Mexico. There is no significant domestic production of telecommunications equipment. [4] Import duties on equipment are low. They vary between 2 and 10 percent. Per Resolution 08/01, import duties for much telecom equipment has been lowered to zero. Protests from Brazil, the main exporter of cellular terminals to Argentina, brought about through Resolution 27/01 extra zone import duties of 22 percent for cellular handsets. All imported telecom equipment needs approval from the Comision Nacional de Comunicaciones (CNC). In general, FCC approval guarantees CNCs approval and certification of equipment. American companies should be prepared to provide telecommunication equipment in the electric current A.C. 50 Hz - 220 V (one phase) and A.C. 50 Hz - 380 V (three phase). Telecommunications systems must conform to ITU-T standards, which limits U.S. participation. Handbooks, operations manuals, and instructions should be in Spanish. Because of the explosive growth of the Argentine telecommunications services, the telecommunications equipment market will continue to grow. Imports have traditionally supplied about one-third of the telecommunications equipment market; however, privatization and increased competition have increased the ratio of imports close to one half of the total market. IT manufacturing in Argentina is an open area for investment because of the growing demands for information technology and telecommunications equipment. Most of the investment in this market is coming from international sources. Because of the technical transfer that will occur, Argentina will slowly grow their domestic IT manufacturing.

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

Frequency Spectrum Allocation:

The radio frequency spectrum is specifically regulated and the corresponding authority is the CNC. The SECOM shall authorize the use of frequency bands to provide telecommunication services through: (i) (ii) Public bidding processes or auctions Upon request.

Authorizations and/or permits to use radio spectrum frequencies will be granted on a revocable basis. The SECOM may fully or partially replace, modify or cancel such frequencies without the authorized party involved having any right to an indemnity in respect of any such modification or cancellation. Argentina liberalized its radio spectrum on 5 September 2004, as planned in the Regulation for the Administration, Management and Control of the Radio Electrical Spectrum. As of this date, service providers are able to request spectrum without waiting for the government to launch an action. The regulation, included in the Decree 764/200, provided a four-year exclusivity period to all four cellular operators in consideration of their license payments. According to Article 28 of the 5 September 2004 regulation, any company interested in providing services using a frequency band must request an authorization from the Ministry of Communications. The Ministry will then publish the request in the Official Gazette, giving a fifteen-day period to other companies to express their interest, and participate in a public auction for the frequency band. In the absence of any competing interest, the authorization will be directly issued to the original applicant.

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

REGULATORY FRAMEWORK:

The countrys regulatory framework encourages competition and supports smaller telecom players. The Universal Service General Rules govern the provision of telecommunications services to each inhabitant in Argentina, taking into account their different circumstances. The Universal Service is a defined set of telecommunications services that must be provided with a specific quality and must be accessible at affordable prices for all users, regardless of their geographic location. It is aimed for the provision to the entire population to have access to essential telephony services, notwithstanding regional, social and economic differences and physical disabilities. Decree 764/2000 (New Regulations) is the backbone of the legal communications framework. This regulation opened the market to competition; thus, the market is opened to competition, providing for a deregulated legal framework for Argentine telecommunications. The provision of telecommunications services is regulated by the Secretary of Communications (hereinafter the SECOM) and supervised by the Comision Nacional de Comunicaciones (the National Communications Commission) (CNC). The CNC is responsible for the general oversight and supervision of telecommunications services. The Department of Communications has the authority to develop, suggest and implement policies; to ensure that these policies are applied; to review the applicable legal regulatory framework; to act as the enforcer of major technical plans; and to resolve administrative appeals filed against CNC resolutions. The regulatory framework index of Argentina is shown as [5]:

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

INTERCONNECT REGIME:

All telecommunications service providers are required to grant interconnection to other telecommunications service providers on a non-discriminatory, transparent and proportional basis, based on objective criteria. The parties may agree on the specific interconnection terms and conditions. However, should the parties fail to reach any agreement, or should a third party be affected, or if the SECOM considers it appropriate for public policy reasons, it is empowered to determine these terms and conditions. All interconnection agreements must be filed with the SECOM. The National Interconnection Rules provide that costs for essential facilities by providers with dominant power are to be calculated on the basis of the Long Run Incremental Costs. Until the mechanism to determine such a cost is established, the SECOM may apply the interconnection referential prices contained in the National Interconnection Rules. A provider will be deemed to have a dominant power in connection with any given service where the revenues derived from its services exceed 75% of the aggregate revenues generated by all providers of the same service, in a given area or nation-wide, as the case may be. Traditionally, only public switched network operators (fixed or mobile) were subject to interconnection obligations. However, there has been some ambiguity regarding other operators, such as cable networks or ISPs. As convergence blurs the traditional difference between networks, regulators are introducing a symmetrical interconnection regime in which any operator, regardless of the type of network it has, is obliged to interconnect with any other operator. In Argentina, new legislation implemented a symmetrical interconnection regime where all operators are obliged to interconnect upon request. However, some jurisdictions have maintained asymmetrical interconnection.

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

TARIFF POLICIES

Objectives of the Ministry of Communications is to 6.- Assist in schemes linked to rates, charges, tariffs and rates of privatized or franchised areas of competence of the Secretariat*8+

As of Q211, Cablevision offered its entry level service Fiber 640 with 640 Kbps download speed for ARS 99.90 per month. In the same period Telecom Argentina charged ARS 109.90 for its entry level DSL service with a 1 Mbps download speed. Telefonica de Argentinas entry level service with 1 Mbps download speed was priced at ARS 95 over a promotional period of 12 months. On the other end of the scale, very high-speed services with downstream speeds at 10 Mbps are much more expensive - Cablevision charged ARS 500 per month for this service. Tariffs are a sensitive issue, both for politicians and for users, and are generally subject to some sort of regulation. There are basically three types of tariff controls: Cost of living The tariff is allowed to rise (or fall) in relation to the cost of living. Rate of return The tariff is set to produce a target rate of return based on the value of the operators assets or shareholders equity. Mandated reduction The tariff must be reduced by a specified percentage over a period of time. This has been adopted when licenses are issued for newly privatized operators. For example, in Argentina, installation charges for residential and business users must be reduced to 250 USD by 1996 (see Figure below).

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

USER PROTECTION

Argentina adheres to various treaties and International agreements on intellectual property and Belongs to the World Intellectual Property Organization (WIPO) and the World Trade Organization (WTO). The argentine congress ratified the Uruguay Round Agreements, including the provisions on Intellectual property, as law 24.425 on January 5, 1995. The lack of full intellectual property protection; particularly the lack of modern patent protection encourages "pirating" of inventions patented in other countries, hurts Argentina's reputation, and discourages high-tech investment in the country. However, the trend is toward less piracy, as efforts are stepped up to identify and punish offenders; lawsuits have been filed against over 100 firms. With recent amendments that extended Argentina's 1933 copyright law to cover software and computer databases, the legal regime is considered adequate by international standards.

PIRACY RATE: 74 percent LAW: Copyright Law (1933), as amended and supplemented by special laws, including Presidential decree 165/94 (2/94) TERM: Life of the author + 30 years SCOPE: Computer programs are explicitly protected as literary works; data bases are also explicitly protected SANCTIONS: Civil and criminal remedies AGREEMENTS: Berne--Brussels (1967); UCC--Geneva (1958); Bilateral (1934); GATT (1967)

The Argentinean Congress is considering a law to extend copyright protection to life of the author + 50 years; registration is voluntary; computer programs are not patentable; on Special 301 Watch List (1989-1992); on Special 301 Priority Watch List (1993 and 1994); BSA estimates that the software publishing and distribution industries lost $111.5 million in 1993 due to application software piracy in Argentina. As is the case in most Asian and African countries, there are few laws in South American countries that restrict trans-border data flows. However, computerization in South American countries lags behind, and does not allow efficient and effective collection of individual data by private organizations. Almost all of the recorded private data are in government data bases. The governments of these countries are unlikely to release personal data for use by foreign corporations.

10

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

UNIVERSAL SERVICE ACCESS FUND (UASF)

The terms Universal Service and Universal Access are used interchangeably although they hold different meanings. Universal service is aimed at increasing the number of individual residences with telecommunications services and providing telecommunications services to all households within a country, including those in rural, remote and high cost locations. They also focus on ensuring that the cost of telephone services remains affordable to individual users or to targeted groups of users (e.g. low-income families and people living in uneconomic areas). Universal access policies work to increase access to telecommunications services on a shared basis, such as on a community or village-wide level. Universal access programs typically promote the installation of public payphones or public call offices in rural areas, remote villages or lowincome urban areas with the aim of providing a basic and initial connection to the public telecommunications network. Universal access & service funds receive financing from various sources and provide targeted subsidies to encourage the provision of telecommunications services by private operators in otherwise uneconomic regions. These funds can be distinguished based on three key features: Sources for funding UASFs can be distinguished by their sources for funding. The sources for funding include national budgets of government, charges on interconnecting services, levies on a widely based range of telecommunications services (as opposed to only from specific, high margin services, like LDI). In Argentina, USAF entitles 1% of all operators' gross revenues Argentine operators can contribute either by paying 1% of revenues to the fund or by proving that they are installing service in under-served areas. Fund Administrator UASFs can differ in their management. Funds in Argentina are administered by government ministries. Fondo Fiduciario de Servicio Universal (FFSU) or Universal Service Fund The Reglamento General del Servicio Universal (RGSU) states that the Fund is to be administered by a council made up of 10 people selected by various levels of government, operators and consumers. Type of services UASFs are distinguished by the types of services they support. Developing country funds in the past have placed greater emphasis on ensuring basic public access. With the growing importance of the Internet to national economies however, many of todays newer funds also support public access to value-added services, including Internet access. Argentine government determines disbursement based on its tele-density goals. The 2000 market liberalisation law established this fund but it was not implemented for years because there was no public organisation to administer it. In July 2008 Banco Itau was selected by the industry as the administrator of the fund, subject to government approval. In January 2009, the regulator SECOM approved the structure of the fund.

11

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

QUALITY OF SERVICE

Quality of service indicators attempt to measure the reliability and efficiency of telecom networks. There are a number of areas for measuring quality of service.

Delivery Precision This measures the ability of the licensee to meet customer requests for service. It can be measured by the percentage of customer requests for installation that are met on time. For developing countries with long waiting lists, average waiting time for connection may be a more meaningful indicator Measures the percentage of calls which fail for technical reasons (e.g. network congestion). Can be broken down by local, national and international calls. Measures the number of technical main line faults. It is usually calculated in terms of the number of faults for the year per 100 main lines Measures the percentage of faults which are cleared within a certain period of time, usually by the end of the next working day. Measures the number of seconds from completion of dialling of call until the operator answers for operator-assisted calls, directory enquiries and other services

Call Failure

Fault Reports

Fault Clearance

Operator Assistance

In Argentina, two new companies, Telecom Argentina and Telefnica de Argentina were created out of the former state-owned telecom operator in November 1990. The two new operators were obligated to meet a number of targets relating to the efficiency and quality of service provided such as fault clearance. Progress in improving quality of service is shown in Figure

12

ARGENTINA

AISHA 080308

HAFSA USMANI 080253

REFERENCES

[1]http://en.wikipedia.org/wiki/Communications_in_Argentina [2]http://web.ita.doc.gov/ITI/itiHome.nsf/9b2cb14bda00318585256cc40068ca69/d7f651070ff63 5c78525788b0069d104/$FILE/telecom%20market%20snapshot-argentina.pdf [3]http://www.iclg.co.uk/index.php?area=4&country_results=1&kh_publications_id=157&chapte rs_id=3870 [4]http://web.ita.doc.gov/ITI/itiHome.nsf/9b2cb14bda00318585256cc40068ca69/d7f651070ff63 5c78525788b0069d104/$FILE/telecom%20market%20snapshot-argentina.pdf [5] http://warrington.ufl.edu/purc/purcdocs/papers/9921_Gutierrez_An_Index_of.pdf [6] http://gurukul.ucc.american.edu/initeb/dh7566a/argentin.htm [7] http://point-topic.com/content/operatorSource/profiles2/argentina-broadband-overview.htm [8] http://www.infoleg.gov.ar/infolegInternet/anexos/85000-89999/85594/texact.htm

translated by google

[9] http://lirne.net/resources/tr/chapter20.pdf [10] http://www.inteleconresearch.com/pages/documents/UASFFunds2009update-Oct2009.pdf

13

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Digital Basic Channels and HD IncludedDocument2 pagesDigital Basic Channels and HD IncludedJamaal BakerNo ratings yet

- IEEE 802.16 Standards and Amendments: Standard / Amendment CommentsDocument6 pagesIEEE 802.16 Standards and Amendments: Standard / Amendment CommentsmugilankNo ratings yet

- Frequency Response of Low Pass & High Pass Filters ExplainedDocument9 pagesFrequency Response of Low Pass & High Pass Filters ExplainedHarish Reddy100% (1)

- SM HourlyDocument71 pagesSM HourlyZeeshan MukhiNo ratings yet

- MKT GPDocument16 pagesMKT GPsafimujnabin100% (1)

- DEH-1300MP OwnersManual0607 PDFDocument27 pagesDEH-1300MP OwnersManual0607 PDFVickyNo ratings yet

- 31 Ways of Marketing Your Business - UpdatedDocument48 pages31 Ways of Marketing Your Business - UpdatedGeeAays TEAM REAL ZERONo ratings yet

- Idsb TDocument27 pagesIdsb TAmante Rivera JrNo ratings yet

- Shipping Company Group 7 NagapasaDocument33 pagesShipping Company Group 7 NagapasaRokhmatuSivaNo ratings yet

- WERMA Hazmat CatalogueDocument370 pagesWERMA Hazmat CataloguenajiruddinshaikNo ratings yet

- Hdca-10 TVDocument2 pagesHdca-10 TVDaniel ManoleNo ratings yet

- 2000 Mister ManualDocument16 pages2000 Mister ManualJavier CobianNo ratings yet

- Oak Park Arms 90 Years, 2012Document7 pagesOak Park Arms 90 Years, 2012wednesdayjournalNo ratings yet

- More Than 2 Decision VarsDocument3 pagesMore Than 2 Decision Varsshona75No ratings yet

- Goods and Property Report (English)Document7 pagesGoods and Property Report (English)nafisa shahNo ratings yet

- Saudi ArabiaDocument15 pagesSaudi ArabiaArman Ul NasarNo ratings yet

- 2 4GHzAntennaDocument15 pages2 4GHzAntennakrkamaldevnlm4028No ratings yet

- National Telecommunications Commission: Legal BasisDocument4 pagesNational Telecommunications Commission: Legal BasisElliz VenturinaNo ratings yet

- Optis Wireless Technology LLC Vs AppleDocument113 pagesOptis Wireless Technology LLC Vs AppleMacRumors on Scribd100% (3)

- RFID Based Chalan SystemDocument7 pagesRFID Based Chalan Systemفہد رضاNo ratings yet

- 45° Quad Port Split Beam Panel AntennaDocument3 pages45° Quad Port Split Beam Panel AntennaLuis Alfonso Lopez ArroyabeNo ratings yet

- 7050 XXXDocument1 page7050 XXXshaker76No ratings yet

- Sculpture 2013 01-02Document84 pagesSculpture 2013 01-02Dragan Cvetkovic100% (1)

- Pemetel: Priit RoosipuuDocument18 pagesPemetel: Priit RoosipuuGourav BhardwajNo ratings yet

- Mapping The Landscape of Media Industry in Contemporary IndonesiaDocument155 pagesMapping The Landscape of Media Industry in Contemporary IndonesiaIndoplacesNo ratings yet

- Siemens Euroset 815 SDocument25 pagesSiemens Euroset 815 SMakis75% (8)

- Akio Morita Failure To SuccesDocument4 pagesAkio Morita Failure To SuccesLesterNo ratings yet

- Artificial Hand Uisng Embedded Systemslandslide Detection Using Raspberry PiDocument64 pagesArtificial Hand Uisng Embedded Systemslandslide Detection Using Raspberry PiSAHITHINo ratings yet

- Sagem d10tDocument2 pagesSagem d10tm0gaNo ratings yet

- Snvu128 13W Isolated Flyback LED Driver With PFCDocument7 pagesSnvu128 13W Isolated Flyback LED Driver With PFCPhạm Văn TưởngNo ratings yet