Professional Documents

Culture Documents

Second-hand Panamax vs Newbuild Dry Bulk Carrier Investment

Uploaded by

Nikos NoulezasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Second-hand Panamax vs Newbuild Dry Bulk Carrier Investment

Uploaded by

Nikos NoulezasCopyright:

Available Formats

Second-hand Panamax Dry Bulk Carrier vs Newbuilding

The decision making process Shipping participants, whether speculative or not, often come before the vital decision of selecting the proper investment project. For shipping companies the final decision of acquiring a vessel is so crucial as the survival of the company, since the vessel may not merely be just an asset (depending on the size and net-position of the company), but the whole business itself. Dry bulk shipping, a historically low-growth and low-margin business till 2002, has exceeded all expectations and forecasts, resulting in six straight years of extraordinary growth, thanks mainly to steel manufacturers who are moving higher volumes of feedstock such as iron ore and metallurgical coal, besides dry bulk commodities. The electricity generation based on steam coal too has been growing rapidly, opening up opportunities for intercontinental movement of steam coal. During this six-year period, 80% of the growth has been driven by China, followed by India, South East Asia, West Asia and Africa, which must continue to remain high-growth regions in the near future in order to maintain the high freight rates currently prevailing in the bulk trade market. Beside the estimated growth in the bulk trade market, we must bear in mind that the scheduled newbuilding deliveries in 2009 and 2010 are seen as staggering, possibly disrupting freight rates as more modern vessels are potentially made available to charterers. The price of transporting dry bulk commodities, referred to as dry bulk charter rates, is set in highly competitive markets and depends on the demand and supply of tonnage in a given market. So, along with fundamentals, freight rates are also influenced by seasonal variations, changes in trade patterns and productivity factors such as ballasting, slow steaming and port congestion. It is self evident that investment decisions in the shipping industry bear a significant element of business uncertainty, since varying and persistent volatility in freight rates creates risks for both, entrepreneur and the financing bank, while intensive capital resources tied-up in the underlying real assets (such as a panamax dry bulker) can induce tremendous financial risk that, at times, may led to adverse outcomes. As a result, a number of core issues are important for a shipping investment in order to enter the bulk carrier trade. Financing a panamax dry bulk vessel should come up to a level and term-horizon (length of repayment period) that the prospective investment cash flows, either newbuilding or second-hand, can sufficiently meet financing expenses, since the bank would be interested in securing the repayment of the capital she lends. Obviously this is interrelated to newbuilding price trends, second-hand vessel price prospects and freight rates trends. Newbuilding vs Second-Hand While both newbuilding and second-hand prices are supply/demand driven, it is nonetheless true that newbuilding prices are more driven by supply factors (ie the potential supply from other shipyards) and cost factors (labour, raw materials, equipment, design, supervision, debt, interest rates, exchange rates etc.) than second-hand prices that are in turn more driven by normal market forces and not at all by supply and cost factors. So, in simple terms, newbuilding prices represent a cost plus figure whereas second-hand prices are realization of values not costs. We can argue that what matters to the investment decision of the speculative shipowner whether to buy second-hand or newbuilding panamax vessel (SH/NB), is not the second-hand price and its determinants per se (taking for granted sufficient charter contracts), but more important is the ratio SH price over the NB price and its movement, especially in such a high

freight market conditions, as well as the creditworthiness of rock solid charterers (investment grade charterers) in order to avoid contract defaults which could result devastating outcomes. A low SH/NB ratio implies that ship owners expect in the future a strong market and can afford to wait for another two or three years until the delivery of the new build vessel, under the assumption that current freight market is not on its peak. Further, regulations and quality standards for ships caused the gap of the condition of hull and tanks between a second-hand vessel and a new build vessel to be eliminated, so the choice of acquisition for the prospective panamax buyer between the two categories sets a dilemma as 5 year old ships can be delivered really soon on the SP market, but the owner of new vessels contract has to wait for a couple of years due to increased activity in the shipyards in the last years. An increase in freight rates and new building prices leads to an increase in the premium across ship sizes, and therefore the ratio under examination and related to our case (SH vs NB panamax dry bulker) rises. This correlation (high freight rates-high SH prices) is reflected with prevailing strongly increased prices for modern SH vessels, well above newbuilding prices, while even 10 year old vessels are obtaining prices similar to newbuilding prices. Currently, newbuilding prices for panamax vessels with delivery in 2-3 years are at about $52 mio, prompt newbuilding resales at about $95 mio and 5 year old second-hand at approx. $82 mio. It is clear that at present market prices, second-hand or resales contract values for vessels deviate from underlying fundamentals. But, is this something new to the shipping community? If we look back at the year 1970, similar was the situation with VLCCs. The newbuilding contract price for a 250.000 dwt tanker was climbing from $17/18 mio to $30 mio with delivery in 4 years time and for resale contracts buyers had to pay around $42 mio. This price was two and a half times higher than before. As we can see, already 38 years ago market prices for vessels were irrational high during periods of high volatility and strong freight expectations. Subsidies

Risks and operating costs The major risks related to the operation/profitability of such a panamax vessel are the following: Charter hire rates in the spot and/or time charter market may decrease in the future, affecting negatively revenue and consequently the net financial position. Changes in the shipping industry may reduce the demand for panamax vessels, which our shipowner is seeking to acquire, and thereby reduce the profitability for this investment decision. The acquired panamax vessel must be inspected and classed by authorized classification societies, and the failure to maintain class certifications (especially for older vessels) would affect the ability to employ such a vessel, which could negatively impact the results of operations. The acquired vessel must protect the safety and condition of their cargoes and any failure to do so may expose the shipowner to claims for loss or damage. Environmental, safety and other increasingly strict governmental regulations expose the shipowner to liability, and compliance with current and future regulations could require significant additional expenditures and could have a material adverse effect on his business and financial results.

Downturns in general economic and market conditions in the countries and regions where the vessel will operate could negatively affect the financial position. Failure to attract, hire, train and retain qualified personnel to manage and operate growing business and possibly further acquired fleet.

The younger the vessel, the lesser the operating cost for the shipowner. The key components of the operating costs are things like crew wages-travel-victualling (which would make up 35%-50% of the operating budget), spares-drydock-maintenance-survey (somewhere in the region of 20%-30%), insurances for H&M or P&I Club (about 10%-20%), lubricants (about 6%-8%) and administration (about 7%-8% of the operating budget). Risks related with the fleet trend The ordering of bulk carrier newbuildings has continued in 2008, reaching levels of almost 17 million dwt in September-October, as against only 1.4 mdwt for oil tankers in the same period. Over the first ten months of the year, new bulk carrier orders amounted to as much as 100 mdwt, compared to 24 mdwt for oil tankers. The bulk carrier fleet at the beginning of October 2007 stood at 385.8 million dwt, up 6,1% from 363.6 million dwt one year before. At the same time, the bulk carrier orderbook increased by about 114% from 77.9 million dwt to 166.7 million dwt. This means that the order book share compared to the existing fleet has risen from about 21% to 43% over the past twelve months. These are astonishing numbers, but a closer look at the size ranges shows very large differences with regard to order book shares. Thus, the order book for 10-50.000 dwt corresponds to just 12% of the existing fleet (with 2% for 10-25.000 dwt, 7% for 25-40.000 dwt and 3% for 40-50.000 dwt). Going up in sizes, it appears that the order book for supramaxes of 50-60.000 dwt was as high as 95%, whereas the same share for panamax/kasmarmax vessels of 60-100.000 dwt was relatively modest at 32%, which in turn can be seen as encouraging news in future/tonnage terms for our panamax investor. Because, for example, among larger vessels, small capesize vessels of 100-150.000 dwt had an order book share of 22%, whereas large capesize vessels of 150-200.000 dwt had a strongly increased share of 64% and the order book for very large bulk carriers over 200.000 dwt was as much as 139% compared to the existing fleet. In general, the orderbook stands at historical high levels. However the total fleet is growing older, and this is also a key factor when looking at the orderbook. In short, 30% of the dry bulk fleet is above 20 years, and 15% above 25 years old today. 18% of the current capesize fleet is above 20 years (140 vessels), and in 2010 there will be 105 capesizes above 25 years. 22% of the panamax fleet is above 20 years (325 vessels), and an estimated 245 vessels will be above 25 years in 2010.

Trading patterns and causes Much of the recent increase in demand for tonnage is a consequence of a changed trading pattern for some of the key commodities. The main driver has been taxations on Indian iron ore, forcing China to import bigger volumes from Australian and especially from Brazil. The increased distance every tonne has to be transported, has lead to a dramatic increase in tonne-mile demand. Tonne-mile increased an estimated 8% last year, and the trend is

expected to continue as more iron ore and coal needs to be shipped from increasingly distant sources, under the assumption that economies are maintaining the growth. Australia is still the biggest exporter, accounting for 127mt into China and 109mt to other Asia. Iron ore from Brazil to China is currently 80mt and 53mt for other Asia, and have been increasing dramatically the last years. On the top of this China is becoming a net importer of coal, with the surrounding countries coal exports in decline. Australian coal miners are experiencing capacity pressure, and a larger part may come from South Africa or even the US. When these increased sailing distances are added up, the effect on dry bulk rates are significant though hard to estimate. The increased demand for commodities has lead to higher congestion in the ports. Currently (February 2008) there are 150 dry bulk vessels waiting outside Australian ports, and only 60 of these are capesize vessels. In most cases the owners are being paid by the charterers despite of this congestion. The rates have been positive influence by these problems, since a larger part of the fleet is retracted from the market. Though trying for years to expand ports little has changed. One might wonder what will happen if the orderbook is released into this market, only increasing congestion overall. Also, other factors such as the booming Chinese coastal trade has added further pressure to the dry bulk sector by rising higher freight rates, because more handy/handymaxes and panamaxes have been taken out of international trade and put into a locked trade. It is worrying, whether the prevailing high freight rates for our panamax investor would remain unchanged in the coming years, taking in consideration that the massive supercycle in the dry bulk sector has not been driven purely by increased demand for merchandise all over the world. Is second-hand or newbuilding the better investment for the speculative shipowner? Buying or selling ships involves risks, and when it comes to the decision either newbuild or second-hand panamax vessel, optimal timing is everything especially if the vessel should be a second-hand one. The shipping industry is cyclical with attendant volatility in charter hire rates and profitability. Crystal ball gazers are becoming numerous in vessel sale and purchase markets, as our speculative shipowner grapples with trade-offs surrounding paying up, now, in the secondhand market, for tonnage immediately available, or, placing order for a newbuilding that will earn revenues in 2010-2011. Older vessels give usually a lot of expenses on the maintenance account, so one older vessel will have a much higher impact on the shipowners net earnings than a newbuild one, in order to keep it up to standard. Should although the vessel be a modern 5 year old panamax, this variable is not a high risk factor since such a young vessel is generally considered close to excellent condition, taking as given good specs and a proven shipbuilders quality standards. Our speculative shipowner has to consider exactly the fact that the dry bulk market is already for about six years now in an uptrend and that the most critical factor for the dry bulk market will be a more significant setback in the world economy than generally expected. A second-hand panamax vessel comprises at current price levels a lot of optimism and further word trade growth without any significant economic slow-down, not to mention the fleet expansion due to new deliveries. Off course, a readily available panamax will earn immediately a strong freight income whereas a newbuild one takes about two years only to be build. Also, should the freight market go down, the second-hand vessel will lose much faster in value and the premium paid from our speculative shipowner for the second-hand panamax will vanish overnight. A risky bet on the future.

A newbuilding panamax presents at current prices a more opportune case in terms of total price and also related to newest building standards and security regulations for future employment. In any case, no one can be 100% sure how the freight market will behave in 2-3 years time in order to choose a newbuilding vessel, due to the fact that dry bulkers are highly correlated with world trade, but in the case of a second-hand vessel at current highly speculative purchase prices we have to consider exactly if the breakeven level at which the vessel is financed is sustainable with solid investment grade charterers, in order really to consider as given the income. Finally, we must consider the fact that the operating results and thus the profitability of this investment are dependent on the shipowners ability to successfully control the operating expenses. However, there are risks in the operating expenses which probably will be beyond the shipowners control, including unexpected increases in costs for crews, insurance or spare parts for the acquired vessel, unexpected drydock repairs, mechanical failures or even human error (including revenue lost in off-hire days), arrest action against the vessel due to failure to pay possible debts, disputes with creditors or claims by third parties, labour strikes, severe weather conditions and any quarantines of the vessel. In addition, to the extent that the acquired vessel is employed under voyage charters, the expenses may be impacted by increases in bunker costs and by canal costs, including the cost of canal-related delays incurred by employment of the vessel on certain routes. Unlike time charters in which the charterer bears all bunker and canal costs, in voyage charters the shipowner bear these costs. Because it is not possible to predict the future price of bunkers or canal-related costs when fixing voyage charters, a significant rise in these costs could have an adverse impact on the costs associated with any voyage charters he enters into and hence the earnings and loan repayment ability. Nikolaos Noulezas

You might also like

- Argus: Tanker FreightDocument25 pagesArgus: Tanker FreightIvan OsipovNo ratings yet

- Voyage EstimationDocument10 pagesVoyage EstimationMohamed Salah El DinNo ratings yet

- Shipping PracticeDocument11 pagesShipping PracticeMr. BuffyNo ratings yet

- Marsoft Valuation Methodology Case StudyDocument8 pagesMarsoft Valuation Methodology Case StudymekulaNo ratings yet

- THE MEDIUM SHAPES THE MESSAGEDocument56 pagesTHE MEDIUM SHAPES THE MESSAGELudovica MatildeNo ratings yet

- Shipping Practice - With a Consideration of the Law Relating TheretoFrom EverandShipping Practice - With a Consideration of the Law Relating TheretoNo ratings yet

- Top 12 ship broking firms in the worldDocument2 pagesTop 12 ship broking firms in the worldjikkuabraham2No ratings yet

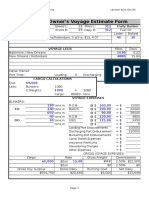

- Owner's Voyage Estimate Form: Daily Bunker ConsumptionDocument2 pagesOwner's Voyage Estimate Form: Daily Bunker ConsumptionJuan Ramón FuentesNo ratings yet

- Laytime EssayDocument14 pagesLaytime Essayogny0No ratings yet

- Basics of Chartering: Negotiation - Compatibility - Decision MakingFrom EverandBasics of Chartering: Negotiation - Compatibility - Decision MakingNo ratings yet

- NFPA 99 Risk AssessmentDocument5 pagesNFPA 99 Risk Assessmenttom ohnemusNo ratings yet

- Guide To Market Benchmarks Ver2.1Document102 pagesGuide To Market Benchmarks Ver2.1algeriacandaNo ratings yet

- Current Shipping EnvironmentDocument261 pagesCurrent Shipping EnvironmentRavikiranNo ratings yet

- ShipbrokerDocument46 pagesShipbrokerMohamed Salah El DinNo ratings yet

- Differences Between Bulk and Break Bulk CargoDocument17 pagesDifferences Between Bulk and Break Bulk CargoHarun Kınalı0% (1)

- Ssy WorldscaleDocument24 pagesSsy WorldscaleFnu JoefrizalNo ratings yet

- Susan Abbotson - Critical Companion To Arthur Miller - A Literary Reference To His Life and Work-Facts On File (2007) PDFDocument529 pagesSusan Abbotson - Critical Companion To Arthur Miller - A Literary Reference To His Life and Work-Facts On File (2007) PDFTaha Tariq0% (1)

- CharteringDocument338 pagesCharteringSAIGAL TANKER100% (1)

- CEMEX Global Strategy CaseDocument4 pagesCEMEX Global Strategy CaseSaif Ul Islam100% (1)

- Chartering Terms ExplainedDocument70 pagesChartering Terms ExplainedProject manNo ratings yet

- Ship Operations AssignmentDocument9 pagesShip Operations AssignmentBruno MadalenoNo ratings yet

- West of England P&i GuidelinesDocument48 pagesWest of England P&i GuidelinesParthiban Nagarajan100% (1)

- Offshore Support Journal Industry Leaders 2016Document36 pagesOffshore Support Journal Industry Leaders 2016edmondo dantiniNo ratings yet

- Bunker Calculation Excel SheetDocument1 pageBunker Calculation Excel SheetJay Narayan TiwariNo ratings yet

- The Shipping Business: Tramp & Liner Trade Chartering & Brokering Freight RatesDocument22 pagesThe Shipping Business: Tramp & Liner Trade Chartering & Brokering Freight RatesfaridNo ratings yet

- Common Chartering TermsDocument5 pagesCommon Chartering TermsNuman Kooliyat IsmethNo ratings yet

- Affinity Research Crude Oil Tanker Outlook 2016-11-16Document64 pagesAffinity Research Crude Oil Tanker Outlook 2016-11-16LondonguyNo ratings yet

- PPG Chartering TermsDocument70 pagesPPG Chartering TermskhabiranNo ratings yet

- ChevronTexaco Shipping Co. LLC General Terms and Charter Party Clauses (2004Document21 pagesChevronTexaco Shipping Co. LLC General Terms and Charter Party Clauses (2004nikoskarandinosNo ratings yet

- Liner Trade ManagementDocument52 pagesLiner Trade ManagementZizzo AhmedNo ratings yet

- Interview HintsDocument4 pagesInterview HintsAgnes Llanes CruzNo ratings yet

- 180k Bulk Carrier ReportDocument173 pages180k Bulk Carrier ReportAdrian Gilby100% (1)

- Week 34Document18 pagesWeek 34notaristisNo ratings yet

- Shipping Market OrganisationDocument5 pagesShipping Market Organisationyesuplus2No ratings yet

- Habawel V Court of Tax AppealsDocument1 pageHabawel V Court of Tax AppealsPerry RubioNo ratings yet

- Marine Salvage LawDocument16 pagesMarine Salvage Lawmvijayk3No ratings yet

- Owner's Voyage Estimate Form: Daily Bunker ConsumptionDocument1 pageOwner's Voyage Estimate Form: Daily Bunker ConsumptionYudi DarmawanNo ratings yet

- Vessel CharacteristicDocument7 pagesVessel CharacteristicAlvin AlfiyansyahNo ratings yet

- Shipping Business Entities and RolesDocument5 pagesShipping Business Entities and Rolestahhan3107No ratings yet

- Socomec EN61439 PDFDocument8 pagesSocomec EN61439 PDFdesportista_luisNo ratings yet

- Second-Hand Vs New Building - The Better OptionDocument5 pagesSecond-Hand Vs New Building - The Better OptionNikos Noulezas100% (2)

- JVS, Shipping Pools & Consortia 24.10.2014Document22 pagesJVS, Shipping Pools & Consortia 24.10.2014johndmariner123No ratings yet

- Adobe Photoshop 9 Cs2 Serial + Activation Number & Autorization Code ADocument1 pageAdobe Photoshop 9 Cs2 Serial + Activation Number & Autorization Code ARd Fgt36% (22)

- Topic 4 - Bulk and Liner Service - Abril23Document58 pagesTopic 4 - Bulk and Liner Service - Abril23Kawtar El Mouden DahbiNo ratings yet

- Tugs - Developments For PDFDocument28 pagesTugs - Developments For PDFP Venkata SureshNo ratings yet

- Port Information CHILEDocument70 pagesPort Information CHILENikos Noulezas100% (2)

- Double Hull Tankers - Are They The Answer?Document10 pagesDouble Hull Tankers - Are They The Answer?ManmadhaNo ratings yet

- Tnker Operator Magazine 09-2015 PDFDocument52 pagesTnker Operator Magazine 09-2015 PDFyyxdNo ratings yet

- Shipping Solutions:: Technological and Operational Methods Available To Reduce CoDocument28 pagesShipping Solutions:: Technological and Operational Methods Available To Reduce CoCvitaCvitić100% (1)

- WAREHOUSE TO WAREHOUSE CLAUSESDocument5 pagesWAREHOUSE TO WAREHOUSE CLAUSEStinhcoonlineNo ratings yet

- ASM Masters Solved Past Question Papers Solved Numericals From Sept16 Till Nov21Document302 pagesASM Masters Solved Past Question Papers Solved Numericals From Sept16 Till Nov21arivarasanNo ratings yet

- Shipping World & Shipbuilder, May 2010 DNV QuantumDocument57 pagesShipping World & Shipbuilder, May 2010 DNV Quantumgnd100No ratings yet

- DNV Unveils LNG-Fueled VLCC..Document3 pagesDNV Unveils LNG-Fueled VLCC..VelmohanaNo ratings yet

- Stena Panamax Tanker FlexibilityDocument6 pagesStena Panamax Tanker Flexibilityzebega100% (1)

- Latin America WireDocument3 pagesLatin America WirepacocardenasNo ratings yet

- Pricing of Port ServicesDocument130 pagesPricing of Port ServicesvenkateswarantNo ratings yet

- Shipping Courses PDFDocument2 pagesShipping Courses PDFNico GoussetisNo ratings yet

- DRY CARGO CHARTERING CAPITAL MARKETS DAYDocument23 pagesDRY CARGO CHARTERING CAPITAL MARKETS DAYestotalNo ratings yet

- AMWELSH 93 Charter PartyDocument8 pagesAMWELSH 93 Charter Partyahong1000% (1)

- Weekly Shipping Intelligence ReportDocument20 pagesWeekly Shipping Intelligence ReportleejingsongNo ratings yet

- TKC Exam April 2016 PRDocument2 pagesTKC Exam April 2016 PRSofi NikolopoulouNo ratings yet

- Ship Chartering Sevices: Kanta OCEAN 303 Ocean Caspian 1Document3 pagesShip Chartering Sevices: Kanta OCEAN 303 Ocean Caspian 1dashNo ratings yet

- Deviation StatementDocument2 pagesDeviation StatementnikoskarandinosNo ratings yet

- Shipping Finance and Credit InstitutionsDocument3 pagesShipping Finance and Credit InstitutionsNikos NoulezasNo ratings yet

- Exxonvoy 84Document8 pagesExxonvoy 84Kaptan LeventcumNo ratings yet

- Fixation of JLPL & VSPL Tariff by PNGRB: An Overview of Gail'S Submissions To The BoardDocument10 pagesFixation of JLPL & VSPL Tariff by PNGRB: An Overview of Gail'S Submissions To The BoardSanjai bhadouriaNo ratings yet

- Charter Types: Chartering Is An Activity Within TheDocument3 pagesCharter Types: Chartering Is An Activity Within ThestamatisNo ratings yet

- Builders Risks Insurance ExplainedDocument2 pagesBuilders Risks Insurance ExplainedIndra SatriaNo ratings yet

- Shipping Finance and Credit InstitutionsDocument3 pagesShipping Finance and Credit InstitutionsNikos NoulezasNo ratings yet

- Shipping Cycles Are Difficult To PredictDocument4 pagesShipping Cycles Are Difficult To PredictNikos NoulezasNo ratings yet

- The Difference Between Risk of Default and Risk of LossDocument4 pagesThe Difference Between Risk of Default and Risk of LossNikos NoulezasNo ratings yet

- Investment Equity and Shipping IPOsDocument6 pagesInvestment Equity and Shipping IPOsNikos NoulezasNo ratings yet

- PH Measurement TechniqueDocument5 pagesPH Measurement TechniquevahidNo ratings yet

- CP Exit Srategy Plan TemplateDocument4 pagesCP Exit Srategy Plan TemplateKristia Stephanie BejeranoNo ratings yet

- G.R. No. 122039 May 31, 2000 VICENTE CALALAS, Petitioner, Court of Appeals, Eliza Jujeurche Sunga and Francisco Salva, RespondentsDocument56 pagesG.R. No. 122039 May 31, 2000 VICENTE CALALAS, Petitioner, Court of Appeals, Eliza Jujeurche Sunga and Francisco Salva, RespondentsJayson AbabaNo ratings yet

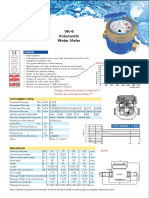

- Baylan: VK-6 Volumetric Water MeterDocument1 pageBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaNo ratings yet

- BS en 12951-2004Document26 pagesBS en 12951-2004Mokhammad Fahmi IzdiharrudinNo ratings yet

- Flex VPNDocument3 pagesFlex VPNAnonymous nFOywQZNo ratings yet

- StarletDocument16 pagesStarletMohsen SirajNo ratings yet

- Chapter FiveDocument12 pagesChapter FiveBetel WondifrawNo ratings yet

- Journal of Petroleum Science and Engineering: Bin Yuan, David A. WoodDocument13 pagesJournal of Petroleum Science and Engineering: Bin Yuan, David A. Woodarash7495No ratings yet

- TSM V5.3 Technical GuideDocument456 pagesTSM V5.3 Technical GuideparifsNo ratings yet

- WebquestDocument3 pagesWebquestapi-501133650No ratings yet

- Black Box Components and FunctionsDocument9 pagesBlack Box Components and FunctionsSaifNo ratings yet

- Panameterics GF 868 Flare Gas Meter PDFDocument8 pagesPanameterics GF 868 Flare Gas Meter PDFDaniel DamboNo ratings yet

- Model 200-30A200P-31-21A Solenoid ValveDocument4 pagesModel 200-30A200P-31-21A Solenoid Valveemuno008No ratings yet

- CASE FLOW AT REGIONAL ARBITRATIONDocument2 pagesCASE FLOW AT REGIONAL ARBITRATIONMichael Francis AyapanaNo ratings yet

- Best Practices For SAP-PM History DocumentationDocument8 pagesBest Practices For SAP-PM History DocumentationLaammeem Noon100% (1)

- COA (Odoo Egypt)Document8 pagesCOA (Odoo Egypt)menams2010No ratings yet

- TV/VCR Tuner Ic With DC/DC Converter: FeaturesDocument21 pagesTV/VCR Tuner Ic With DC/DC Converter: FeaturesEdsel SilvaNo ratings yet

- Engineered Cementitious Composites: Practical ApplicationsDocument26 pagesEngineered Cementitious Composites: Practical Applicationsmubashir ahmedNo ratings yet

- 2012 NAPTIN DocumentDocument48 pages2012 NAPTIN DocumentbenaikodonNo ratings yet

- Assignment # 4 26 CH 22Document6 pagesAssignment # 4 26 CH 22Ibrahim AbdallahNo ratings yet

- Corephotonics Dual-Camera LawsuitDocument53 pagesCorephotonics Dual-Camera LawsuitMikey CampbellNo ratings yet

- Manual Mue Home RGBDocument8 pagesManual Mue Home RGBJason OrtizNo ratings yet