Professional Documents

Culture Documents

Buffet Checklist v4 PDF

Uploaded by

apluOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buffet Checklist v4 PDF

Uploaded by

apluCopyright:

Available Formats

A Warren Buffet styled Investment checklist

(extract from Conquest Management - a guide to the top. available from www.davidparmenter.com By David Parmenter Warren Buffet, called by many as the greatest investor alive today has always been vey open about the way Berkshire Hathaway invests. The annual reports are said by many to be compulsory reading to anybody who wants to improve their investment success rate. Many books have been written outlining Warren Buffets approach. I originally developed this checklist to help me gain an insight into Warren Buffets approach. I hope it clarifies the approach to you as the checklist has done for me. Whilst this checklist needs fine tuning I am confident that it represents an 80/20 fit to the great mans philosophy. This checklist is designed for: Individuals who are investing part of their savings in the stock market Fund managers, who know they do not know all the answers Companies who are contemplating an investment takeover I need to clarify what I mean by a investment takeover. I believe there are two basic types of takeover and merger. One is where you buy an organisation and leave it alone (an investment takeover) and the other is where you buy it on the assumption that a merged entity will produce synergies (a synergy merger). For companies contemplating a synergy merger, please read my article Why TOMs (takeovers or mergers) go bad. A Warren Buffet styled Investment checklist Business tenets 1. Is the business understandable? 2. Do you know how the money is made? 3. Does the business have a consistent operating history? 4. Does the company have favourable long term prospects? 5. Is there a big moat around the business (a high threshold of entry) ? 6. Is it a business that even a dummy could make money in? 7. Can current operations be maintained without too much needing to be spent? 8. Is the company free to adjust prices to inflation? 9. Have you read the annual reports of the main competitors? t Yes t Yes t Yes t Yes t Yes t Yes t Yes t Yes t Yes t No t No t No t No t No t No t No t No t No Is it covered? Whitepaper

Prepared by David Parmenter parmenter@waymark.co.nz Copyright 2009

Management tenets 10.Has the management demonstrated a high degree of integrity (honesty)? 11.Has the management demonstrated a high degree of intelligence? 12.Has the management demonstrated a high degree of energy? 13.Is management rational? 14.Is management candid with shareholders (evidence in the past of open disclosure to the shareholders when there have been problems)? 15.Has management resisted the temptation to grow quickly by merger? 16.Has management the strength not to follow the institutional imperatives ( avoid following current business and sector fads)? 17.Has the business been free of a major merger in the last 3 years ( many merger failures come out of the woodwork within this period) ? 18.Are stock options tied to SMT performance rather organisations performance (if your team wins you do not pay a .35 hitter the same as a .15 hitter.) ? 19.Are stock options treated as an expense? t Yes t Yes t Yes t Yes t Yes t No t No t No t No t No

t Yes t Yes

t No t No

t Yes

t No

t Yes

t No

t Yes

t No

Financial tenets 20.Is the return on equity adequate? 21.Is the company conservatively financed? 22.Has the company had a track record of earnings growth in most years above the stock market average? 23.Are the profit margins attractive (better than industry)? 24.Has the company created at least one dollar of market value for every dollar of earnings retained? t Yes t Yes t Yes t Yes t Yes t No t No t No t No t No

Value tenets 25.Is the value of discounted earnings greater than the current market value? 26.Have you discounted at a rate equal or greater than the 10 year bond rate (risk free rate) ? 27.Have cash flows been based on net income, plus t Yes t Yes t Yes t No t No t No

Prepared by David Parmenter parmenter@waymark.co.nz Copyright 2009

depreciation, depletion, and amortization, less capital expenditure and additional working capital requirements? 28.Has the company been temporarily punished for a specific risk that is not a long term risk (the market tends to over punish the share price)? t Yes t No

Commonly Referred To Sayings of Warren Buffett The critical investment factor is determining the intrinsic value of a business and paying a fair or bargain price. Never invest in a business you cannot understand. Risk can be greatly reduced by concentrating on only a few holdings. Stop trying to predict the direction of the stock market, the economy, interest rates, or elections. You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right. Be fearful when others are greedy and greedy only when others are fearful. Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market. It is optimism that is the enemy of the rational buyer. As far as you are concerned, the stock market does not exist. Ignore it. It is more important to say "no" to an opportunity, than to say "yes". Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell. Lethargy, bordering on sloth should remain the cornerstone of an investment style. An investor should act as though he had a lifetime decision card with just twenty punches on it. Wild swings in share prices have more to do with the "lemming- like" behaviour of institutional investors than with the aggregate returns of the company they own. "Turnarounds" seldom turn. Do not take yearly results too seriously. Instead, focus on four or five-year averages.

Prepared by David Parmenter parmenter@waymark.co.nz Copyright 2009

The advice "you never go broke taking a profit" is foolish. Always invest for the long term. Remember that the stock market is manic-depressive. Buy a business, don't rent stocks. Wide diversification is only required when investors do not understand what they are doing. An investor should ordinarily hold a small piece of an outstanding business with the same tenacity that an owner would exhibit if he owned all of that business.

riters biography

David Parmenter is the CEO of waymark solutions. Besides helping organisations implement their winning KPIs David also helps organisations to: streamline their month-end reporting and annual planning processes, implement quarterly rolling forecasts, adopt the principles of beyond budgeting, and develop decision based reports. His speaking engagements included Scotland, Ireland, England, South Africa, Iran, Czech Republic, Malaysia, Singapore, Johannesburg, Australia and New Zealand. John Wiley & Sons Inc. published two of his books in 2007: Key Performance Indicators developing, implementing and using winning KPIs and Pareto's 80/20 Rule for the Corporate Accountant better practices from winning finance teams. He has written over 30 articles for the accounting and management Journals in Australia, Malaysia, Ireland, England and New Zealand. His articles published include: quarterly rolling planning - removing the barriers to success, Throw away the annual budget, Maybe its time to look at your KPIs, seven time wasters, and quick month end reporting, Beware corporate mergers, Implementing a Balanced Scorecard in 16 weeks not 16 months, Convert your monthly reporting to a management tool, Smash through the performance barrier, Is your board reporting process out of control? David has also worked for Ernst & Young, BP Oil Ltd, Arthur Andersen, and Price Waterhouse. David is a fellow of the Institute of Chartered Accountants in England and Wales. He can be contacted at parmenter@waymark.co.nz or telephone +64 4 499 0007 He has recently completed a series of white papers which can be purchased from his website http://www.waymark.co.nz.His recent thinking is accessible from www.DavidParmenter.Com

Prepared by David Parmenter parmenter@waymark.co.nz Copyright 2009

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 04b Economic Risk Capital (2011)Document13 pages04b Economic Risk Capital (2011)apluNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Single Name Credit DerivativesDocument32 pagesSingle Name Credit DerivativesapluNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Allowance For Risk in Market Consistent Embedded Value (MCEV)Document12 pagesAllowance For Risk in Market Consistent Embedded Value (MCEV)apluNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- CFO-Forum MCEV Basis For Conclusions April 2016Document40 pagesCFO-Forum MCEV Basis For Conclusions April 2016apluNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Eev Disclosures PDFDocument6 pagesEev Disclosures PDFapluNo ratings yet

- ForecastingPortfolioVaR 02Document42 pagesForecastingPortfolioVaR 02apluNo ratings yet

- CFO-Forum EEV Principles and Guidance April 2016Document22 pagesCFO-Forum EEV Principles and Guidance April 2016apluNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Bank Liquidity Policy StatementDocument19 pagesBank Liquidity Policy StatementapluNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Liquidity Risk ALM Policy - ALCODocument28 pagesLiquidity Risk ALM Policy - ALCOaplu100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- CFO-Forum MCEV Principles and Guidance April 2016Document31 pagesCFO-Forum MCEV Principles and Guidance April 2016apluNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- A Bond Market Primer For New IssuersDocument4 pagesA Bond Market Primer For New IssuersapluNo ratings yet

- Incorporating Liquidity Risk Into Funds Transfer PricingDocument30 pagesIncorporating Liquidity Risk Into Funds Transfer PricingapluNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- TAS Data Transfer Files SpecsDocument55 pagesTAS Data Transfer Files SpecsapluNo ratings yet

- Assets & Liabilities Management AT The Union Co-Operative Bank LTDDocument21 pagesAssets & Liabilities Management AT The Union Co-Operative Bank LTDapluNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- TKM CH 18Document103 pagesTKM CH 18apluNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Locking The BoxDocument1 pageLocking The BoxapluNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Pros and Cons of EVA 013-08Document6 pagesPros and Cons of EVA 013-08apluNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Mamis Last LetterDocument10 pagesMamis Last LetterTBP_Think_Tank100% (3)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- UntitledDocument3 pagesUntitledapi-234474152No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- RE 01 11 Pre Sold Condo Units SolutionsDocument5 pagesRE 01 11 Pre Sold Condo Units SolutionsAnonymous bf1cFDuepPNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Transfer Pricing II: Rajan Baa 3257Document15 pagesTransfer Pricing II: Rajan Baa 3257Rajan BaaNo ratings yet

- South Asia TechDocument6 pagesSouth Asia TechA M FaisalNo ratings yet

- CISI Exam Booking Instructions-1Document4 pagesCISI Exam Booking Instructions-1simon.dk.designerNo ratings yet

- Relevance of Questions From Past Level III Essay Exams: Use IFT Prep To Ace The Level III ExamDocument3 pagesRelevance of Questions From Past Level III Essay Exams: Use IFT Prep To Ace The Level III ExamHasan KhanNo ratings yet

- Engineering Economy1Document13 pagesEngineering Economy1Roselyn MatienzoNo ratings yet

- Beauhurst Crowdfunding Index Q1 2017Document5 pagesBeauhurst Crowdfunding Index Q1 2017CrowdfundInsiderNo ratings yet

- Audit of Property, Plant and Equipment: Auditing ProblemsDocument5 pagesAudit of Property, Plant and Equipment: Auditing ProblemsLei PangilinanNo ratings yet

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocument14 pagesUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter TenDocument29 pagesSolutions For End-of-Chapter Questions and Problems: Chapter Tenester jofreyNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- InstaSummary Report of Mantra Softech (India) Private Limited - 30-06-2020Document10 pagesInstaSummary Report of Mantra Softech (India) Private Limited - 30-06-2020RajiNo ratings yet

- Welcome To Momentum Trading SetupDocument12 pagesWelcome To Momentum Trading SetupSunny Deshmukh0% (1)

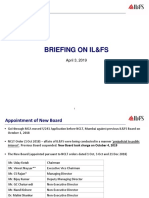

- ILFS Briefing (April 2019)Document15 pagesILFS Briefing (April 2019)Richard DierdreNo ratings yet

- Akuntansi 11Document3 pagesAkuntansi 11Zhida PratamaNo ratings yet

- HDFC Amc PDFDocument8 pagesHDFC Amc PDFRahul JaiswalNo ratings yet

- EPF Circular On Pension For Full Salary 23.3.17Document11 pagesEPF Circular On Pension For Full Salary 23.3.17Vishal IngleNo ratings yet

- Dispute FormDocument1 pageDispute Formuzair muhdNo ratings yet

- Week 012-Presentation Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Document18 pagesWeek 012-Presentation Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Alleona EmbolodeNo ratings yet

- A 2021MBA010 NiraliOswal Case Scenarios RBCDocument3 pagesA 2021MBA010 NiraliOswal Case Scenarios RBCmohammedsuhaim abdul gafoorNo ratings yet

- NIB Annual Report 2015Document216 pagesNIB Annual Report 2015Asif RafiNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IA2 Chapter 20 ActivitiesDocument13 pagesIA2 Chapter 20 ActivitiesShaina TorraineNo ratings yet

- Exam 1 - Econ 380 - Fall 2016 - KEYDocument4 pagesExam 1 - Econ 380 - Fall 2016 - KEYAlexNo ratings yet

- Pifra Business Finance ProjectDocument17 pagesPifra Business Finance ProjectWaqas AhmedNo ratings yet

- CV Rudi Pasaribu UpdateDocument5 pagesCV Rudi Pasaribu UpdateDitto Dwi PurnamaNo ratings yet

- CH 08Document51 pagesCH 08Daniel NababanNo ratings yet

- Annuity DueDocument2 pagesAnnuity DueJsbebe jskdbsj50% (2)

- Business Plan For FloristDocument26 pagesBusiness Plan For Floristmohammed hajiademNo ratings yet

- NEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsDocument168 pagesNEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsAkash MalikNo ratings yet

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthFrom EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthRating: 4 out of 5 stars4/5 (20)