Professional Documents

Culture Documents

TG Guingona Decision Impeachment)

Uploaded by

SunStar Philippine NewsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TG Guingona Decision Impeachment)

Uploaded by

SunStar Philippine NewsCopyright:

Available Formats

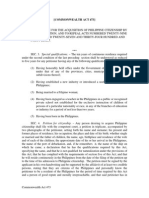

Republic of the Philippines Congress of the Philippines Senate Sitting as an Impeachment Court IN THE MATTER OF THE IMPEACHMENT OF RENATO

C. CORONA AS CHIEF JUSTICE OF THE SUPREME COURT OF THE PHILIPPINES CASE NO. 002-2011 REPRESENTATIVES NIEL C. TUPAS, JR, JOSEPH EMILIO A. ABAYA, LORENZO R. TAADA III, REYNALDO V. UMALI, ARLENE BAG-AO, ET. AL.

DECISION of Teofisto TG Guingona III Senator-Judge

The Senate, duly constituted as the Impeachment Court, has the constitutional duty of judging the acts or omissions of the respondent, Renato C. Corona. To discharge this duty, the Senate must answer only two questions:

1. 2.

Did the Chief Justice commit an impeachable offense? Must he be removed from office?

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

Article XI, section 2 of the 1987 Constitution enumerates the grounds for impeachment and states:

The President, the Vice-President, the Members of the Supreme Court, the Members of the Constitutional Commissions, and the Ombudsman may be removed from office, on impeachment for, and conviction of, culpable violation of the Constitution, treason, bribery, graft and corruption, other high crimes, or betrayal of public trust. All other public officers and employees may be removed from office as provided by law, but not by impeachment.

The judgment of the Senate is not a judgment against inconsistent claims: it is not a judgment on the issue of a simple life versus actual ownership of multi-million condominiums. Nor should it be a judgment against a man who claims that he has not meddled in the dispute of his wifes family and yet has allowed the transfer of disputed family money into his own bank account. It cannot even be a judgment on the character of a man who maligns in public a dead person who can no longer defend himself.

The judgment of the Senate is a judgment based on the facts and the law. In this case, the facts and law lead to one conclusion: Renato C. Corona, Chief Justice of the Republic of the Philippines, must be removed from office because he has committed a culpable violation of the Constitution and has betrayed the public trust.

Page 2 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

DISCUSSION of FACTS and the LAW

Article II of the Articles of Impeachment alleges:

Respondent has committed culpable violation of the Constitution and/or betrayed the public trust when he failed to disclose to the public his statement of assets, liabilities, and net worth as required under Section 17, Article XI of the 1987 Constitution.

In this case, the vital questions to be answered are: I. Is non-disclosure of the statement of assets, liabilities, and net worth an impeachable offense? II. Did the Chief Justice fail to disclose to the public his true and complete statement of assets, liabilities, and net worth?

III. If it is an impeachable offense and if the Chief Justice is guilty, should he be punished with the penalty of removal?

For all three questions, the answer is Yes.

Page 3 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

I.

Non-disclosure of SALN is an impeachable offense

A.

Willfull non-diclosure of ones SALN is a culpable violation of a clear and mandatory Constitutional duty

As early as August 17, 1960, the duty to prepare and file a true detailed and sworn statement of assets and liabilities was imposed on every public officer by the Anti-Graft and Corrupt Practices Act.1 The law treated the violation of this duty as a grave and serious offense which, if proven in a proper administrative proceeding, shall sufficiently cause the removal or dismissal of the officer concerned. 2

The duty did not just remain as a statutory edict because through the intervention of Serafin V.C. Guingona, it was, in effect, elevated to a sacred Constitutional duty. Found in the Journal of the 1986 Constitution is the following record of a discussion made on July 26 of that year:

Referring to Mr. Tadeos concern on modest lives, Mr. Guingona suggested that impeachable officers submit their statements of assets and liabilities upon assumption to office.3

Republic Act 3019, section 7. Statement of assets and liabilities. Every public officer, within thirty days after the approval of this Act or after assuming office, and within the month of January of every other year thereafter, as well as upon the expiration of his term of office, or upon his resignation or separation from office, shall prepare and file with the office of the corresponding Department Head, or in the case of a Head of Department or chief of an independent office, with the Office of the President, or in the case of members of the Congress and the officials and employees thereof, with the Office of the Secretary of the corresponding House, a true detailed and sworn statement of assets and liabilities, including a statement of the amounts and sources of his income, the amounts of his personal and family expenses and the amount of income taxes paid for the next preceding calendar year: Provided, That public officers assuming office less than two months before the end of t he calendar year, may file their statements in the following months of January. 2 Republic Act 3019, section 9 (b). Penalties for Violations. (b) Any public officer in violation of any of the provisions of Section 7 of this Act shall be punished by a fine of not more than one thousand pesos, or by imprisonment not exceeding one year, or by both such fine and imprisonment, at the discretion of the Court. The violation of said section proven in a proper administrative proceeding shall be sufficient cause for removal or dismissal of a public officer, even if no criminal prosecution is instituted against him. 3 Journal of the 1986 Constitutional Commission, July 26, 1986, page. 439

Page 4 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

Two days later, it was clarified that the duty to submit a SALN should apply to all public officers of the government. The Journal of the 1986 Constitutional Commission states:

Thereafter, Mr. Ople proposed to add a new section to be denominated as Section 15 to read as follows: A PUBLIC OFFICER SHALL UPON ASSUMPTION OF HIS OFFICE DECLARE HIS ASSETS AND LIABILTIES. THE PRESIDENT, THE VICE-PRESIDENT, MEMBERS OF THE CABINET, MEMBERS OF CONGRESS, THE HEADS AND DIRECTORS OF GOVERNMENT-OWNED OR CONTROLLED CORPORATIONS AND FLAG OFFICERS OF THE ARMED FORCES SHALL DISCLOSE TO THE PUBLIC THEIR NET WORTH AT THE BEGINNING OF THEIR TERMS AND EVERY TWO (2) YEARS THEREAFTER.

Mr. Ople stated that the principle had been discussed in the Committee on the Legislative but that it was made to apply only to Members of Congress. He stated that it was Messrs. Guingona and Davide who had called his attention to the fact that the principle should be applied universally by extending it to all public officers of the government (emphasis ours).

As a result of the discussion among the members of the 1986 Constitutional Commission, Article XI, section 17 now reads:

Page 5 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

A public office or employee shall, upon assumption of office and as often thereafter as may be required by law, submit a declaration under oath of his assets, liabilities, and net worth. In the case of the President, the VicePresident, the Members of the Cabinet, the Congress, the Supreme Court, and the Constitutional Commissions and other constitutional offices, and officers of the armed forces with general or flag rank, the declaration shall be disclosed to the public in the manner provided by law.

From the mandate of the Constitution, section 8 of the Code of Ethical Standards for Public Officials and Employees, enacted on February 20, 1989, again emphasized the duty to disclose ones assets, liabilities, and net worth. In part, it states:

Statements and Disclosure. - Public officials and employees have an obligation to accomplish and submit declarations under oath of, and the public has the right to know, their assets, liabilities, net worth and financial and business interests including those of their spouses and of unmarried children under eighteen (18) years of age living in their households.

Couched in mandatory language in both the Constitution and the law, it is thus very clear that the duty of each public officer/employee to disclose ones assets, liabilities, and net worth occupies a sacred position in the hierarchy of duties imposed on all public officers and employees.

Page 6 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

It is important to note that when one reads Article XI of the Constitution on Accountability of Public Officers, there are only three (3) sections out of eighteen (18) that impose mandatory duties on all public officers and employees:

1. Section 1: Public office is a public trust. Public officers and employees must at all times be accountable to the people, serve them with utmost responsibility, integrity, loyalty, and efficiency, act with patriotism and justice, and lead modest lives.

2. Section 17: A public officer or employee shall, upon assumption of office and as often thereafter as may be required by law, submit a declaration under oath of his assets, liabilities, and net worth. In the case of the President, the Vice-President, the Members of the Cabinet, the Congress, the Supreme Court, and the Constitutional Commissions and other constitutional offices, and officers of the armed forces with general or flag rank, the declaration shall be disclosed to the public in the manner provided by law.

3. Public officers and employees owe the State and this Constitution allegiance at all times, and any public officer or employee who seeks to change his citizenship or acquire the status of an immigrant of another country during his tenure shall be dealt with by law.

Page 7 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

As a Constitutional duty, it must be read to include the necessary obligation to ensure that the contents of the SALN are correct and complete, and that the disclosure is timely. Thus, the criteria of correctness and timeliness must be met before the Constitutional duty can be considered as completely performed. Otherwise, considering an incorrect, untruthful, or incomplete SALN as substantial compliance would defeat the function of the provision.

The duty to disclose ones true and complete SALN is a Constitutional duty and its non-performance is a culpable violation of the Constitution. One must not equate this sacred Constitutional duty with the statutory obligation to throw garbage in the proper disposal bins; or to observe traffic rules and not commit the act of jaywalking. The failure to disclose ones SALN is not an ordinary breach of law: its deliberate non-performance is an assault and defiance of a mandatory duty imposed by the highest law of the land: the Philippine Constitution.

B.

Non-disclosure of SALN is a betrayal of public trust.

Betrayal of public trust, as a ground for impeachment, does not require the commission of a criminal act. The discussions of the 1986 Constitutional Commission provides an explanation of this ground:

Mr. de los Reyes explained that in the last Regular Batasan when there was a move to impeach President Marcos there were arguments that there was no ground for impeachment inasmuch as there was no proof that the former President committed criminal acts which could be considered penal offenses. He affirmed that the phrase betrayal of public trust as

Page 8 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

explained by Mr. Romulo is a catch-all phrase to include all acts which are not punishable by statutes or penal offenses but would nonetheless render the officer unfit to continue in office. 4 (emphasis ours)

Betrayal of public trust as a ground for impeachment was further elucidated as follows:

At this juncture, in reply to Mr. Maambongs request for reaction on certain citations, Mr. Romulo agreed, 1) that while there need not be a showing of the criminal character of the act, it must be of sufficient seriousness as to justify the belief that there was grave violation of trust, imposed on the official.

Why does non-disclosure of ones SALN amount to a betrayal of public trust?

Non-disclosure of the SALN, which includes incorrect and/or incomplete disclosures, and late disclosures, violates the trust of the public in public officers who are supposed to be persons of integrity who must serve them with integrity. Two provisions of the Constitution reflect this view:

1.

Article VIII, section 7(3). A Member of the Judiciary must be a person of proven

Journal of the 1986 Constitutional Commission, July 26, 1986, page 434.

Page 9 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

competence, integrity, independence.

2.

probity,

and

Article XI, section 1. Public office is a public trust. Public officers and employees must at all times be accountable to the people, serve them with utmost responsibility, integrity, loyalty, and efficiency, act with patriotism and justice, and lead modest lives.

The virtue of integrity encompasses the virtue of honesty. 5 As such, the people expect their public officers to make honest declarations in the statements of assets, liabilities, and net worth. This expectation is intertwined with the expectation of the people that public service is discharged by government officers and employees to serve the people and not to unjustly profit from the office. Because of this, failure to declare and/or to honestly declare ones assets, liabilities, and net worth not only violates the Constitution, it also betrays the public trust.

The case of Ombudsman v. Valeroso, 6 where the respondent concurred with the decision of the Supreme Court en banc, explains the intricate relationship between the duty to disclose ones SALN and the primordial duty of accountability and integrity: ...Section 7 [of RA 6713], which mandates full disclosure of wealth in the SALN, is a means of preventing said evil and is aimed particularly at curtailing and minimizing the opportunities for

5

Journal of the 1986 Constitutional Commission, July 26, 1986, page 445. On page 1, line 9, between integrity and efficiency, Mr. Davide proposed to insert a comma (,) and the word HONESTY, to which Mr. Romulo replied that integrity includes honesty. Mr. Davide desisted from pursuing his proposed amendment.

6

G.R. No. 167828, April 2, 2007.

Page 10 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

official corruption and maintaining a standard of honesty in the public service. "Unexplained" matter normally results from "non-disclosure" or concealment of vital facts. SALN, which all public officials and employees are mandated to file, are the means to achieve the policy of accountability of all public officers and employees in the government (emphasis ours).

In his failure to fully discharge his constitutional mandate to fully disclose his assets, liabilities, and net worth, Renato Corona betrayed the public trust.

II.

The Chief Justice failed to disclose to the public his true and complete statement of assets, liabilities, and net worth.

To fully perform the duty to disclose ones statement of assets, liabilities, and net worth, two requirements must be met:

A. The SALN must be made available for public inspection. B. The SALN must contain correct and complete entries.

Failure to meet any of the requirements stated above violates the letter and spirit of the Constitutional provision. In the case before this Impeachment Court, the evidence proves two indisputable facts:

Page 11 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

1. The Chief Justice did not disclose his SALN to the public. 2. The SALNs of the Chief Justice do not contain true and complete entries.

A.

The Chief Justice did not disclose his SALN to the public.

For an exhaustive list of public officials, the Constitutional duty is to disclose the SALN to the public. For other public officers and employees, submission of the SALN fulfills the requirement of the provision. The difference in the requirement is apparent. Note again the provision of the Constitution:

A public office or employee shall, upon assumption of office and as often thereafter as may be required by law, submit a declaration under oath of his assets, liabilities, and net worth. In the case of the President, the VicePresident, the Members of the Cabinet, the Congress, the Supreme Court, and the Constitutional Commissions and other constitutional offices, and officers of the armed forces with general or flag rank, the declaration shall be disclosed to the public in the manner provided by law. 7 (emphasis ours)

The rationale for the distinction was explained by Blas Ople, Member of the 1986 Constitutional Commission when he declined the proposal of another member, Hilario Davide Jr, to impose the duty of disclosure to all public officials. Mr. Davide accepted Mr. Oples proposal

Article XI, section 17, 1987 Constitution.

Page 12 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

to impose the duty to submit a SALN on other public offers and the duty to disclose for certain officers:

Mr. Ople declined the proposed amendment stating that Mr. Davides proposal is already embodied in the Anti-Graft and Corrupt Practices Act which applies to all government employees. He stated that together with Mr. Bennagen, the proposed amendment they have presented would not require every government employee to disclose his net worth to the public as no one would really care about such information, unlike the President, Vice-President, Members of the Cabinet, Congress, heads or directors of government-owned or controlled corporations and officers of the Armed Forces, who have to set a good example to their subordinates. He cited that fact that in the United States, comparable officers are required by law to make such disclosure. He stressed that for all other government employees, the requirement to submit a report of net worth should be left to the law.8

Furthermore, the Journal of the Constitutional Commission further instructs: 9

In reply to Mr. Fozs query on whether the enumeration of the public officials is inclusive, Mr. Ople explained that the disclosure would be

8 9

Journal of the 1986 Constitutional Commission, July 28, 1986, page 454. July 28, 1986, page 455

Page 13 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

mandatory for the officers enumerated therein and that for ordinary government employees, they are as a rule already required to file their statements of assets and liabilities, not for public disclosure, but for purposes of examination by their superiors.

To give life to the Constitutional duty to disclose, the Code of Ethical Standards for Public Officials and Employees 10 provides the procedure for the disclosure of said declarations. Section 8 (c) states:

(C)

Accessibility of documents. (1) Any and all statements filed under this Act, shall be made available for inspection at reasonable hours. Such statements shall be made available for copying or reproduction after ten (10) working days from the time they are filed as required by law. Any person requesting a copy of a statement shall be required to pay a reasonable fee to cover the cost of reproduction and mailing of such statement, as well as the cost of certification.

(2)

(3)

(4) Any statement filed under this Act shall be available to the public for a period of ten (10) years after receipt of the statement. After such period, the statement may be destroyed unless needed in an ongoing investigation.

10

Republic Act 6713, February 20, 1989.

Page 14 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

Neither the Constitution nor Section 8 (c) of the Code of Ethical Standards for Public Officials and Employees imposes a duty to actively publicize ones SALN. Rather, it simply provides that it be disclosed to the public. The duty is to make it available to the public, regardless of where it was submitted in accordance with law. Section 8 (c) provides that statements filed shall be made available for inspection. This means that the repository of these statements must make it available to the public. Therefore, the owner of the SALN has no right to restrict or obstruct the disclosure of the same. In the case before this Impeachment Court, it is apparent that the Chief Justice did not disclose his SALN to the public. The following circumstances were observed and used to arrive at this conclusion: First, despite being accused of the failure to disclose his statement of assets, liabilities, and net worth (SALN) and continuous calls for him to disclose the same, Renato Corona has never disclosed his SALN to the public before it was subpoenaed by the Impeachment Court and presented by the Clerk of Court of the Supreme Court, Atty. Enriquieta Vidal, on January 18, 2012. The Chief Justice submitted his SALN but to fully comply with the Constitutional provision, he should have disclosed and made it available to the public for inspection. He only authorized the release of the SALN after these were already presented before the Impeachment Court. As the head of the Supreme Court, he should not have exposed his own Clerk of Court to the pressure of having to decide whether she should wait for the authorization of the Court or obey the lawful subpoena of the Senate sitting as an Impeachment Court. Second, as the final arbiter on questions of law, the Chief Justice appears to have a continuing incorrect but convenient belief that he has to authorize the disclosure of his SALN before it can be released to the public: that it is his privilege and not his absolute Constitutional duty. In his own words, delivered before the Impeachment Court on May 22, 2012, he said:

Page 15 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

I am likewise authorizing the Clerk of Court of the Supreme Court en banc, with permission from the Supreme Court en banc, to immediately release to the public my SALN for the years 2002 to 2012.11 The Chief Justice cannot hide behind a Supreme Court resolution which allows the disclosure of the Justices SALNs only upon the approval of the Supreme Court en banc. When requested to disclose his SALN, the Chief Justice should have done it without hesitation because that is a duty that he must perform.

B.

The SALNs of the Chief Justice do not contain correct and complete entries.

From the evidence presented before the Impeachment Court, the irregularities in the Chief Justices SALNs for the years 2003-2011 can be summarized are as follows:

Undisclosed cash deposits (peso) Undisclosed cash deposits (dollar) Undisclosed peso investments Belatedly disclosed properties Undisclosed properties

11

Record of the Senate sitting as an Impeachment Court, May 22, 2012, page 29.

Page 16 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

1.

Undisclosed cash deposits [peso and dollar] and investments

The SALN form requires the employee to state his a) assets, liabilities, and net worth; b) business interests and financial connections; and c) identification of relatives in the government service, as of December 31 of the year before the SALN is submitted.

Hence, it is irrelevant to note the deposits of the Chief Justice during any other date in the year. For this impeachment proceeding, the relevant evidence would be his year-end balances.

A careful look at the facts and evidence on record reveals the following discrepancies in the declared amount of cash and investments and actual year-end cash balances in the Chief Justices bank deposit accounts: SALN (YEAR) 2007 2009 Declared in the SALN P2,500,000 P2,500,000 Undeclared Actual Year-end Cash Balances (peso) 1. 5,018,255.2612 2. 5,069,711.1813 1. 687,501.8314 2. 8,500,00015 2010 P3,500,000 1. 7,148,238.8316 2. 12,580,316.5617 3. 12,024,067.7018

12 13

PS Bank Account No.089121011957 BPI Account No. 144R-0107-803061 14 BPI Account No. 144R-0107-803061 15 PS Bank Account No. 089121019593 16 PS Bank Account No. 089121021681 17 PS Bank Account No. 089121019593 18 BPI Account No. 144R-0109-803051

Page 17 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

Based on admissions made by Corona himself on the 25 th of May 2012, he has approximately Php 80 million and $2.4 million in his bank accounts- a figure enormously greater than his declared cash and investments totaling to P2.5-P3.5 million a year.

Corona explained that he did not declare these amounts because these deposit accounts contained commingled funds, including funds from the proceeds of the sale of the Basa Guidote land, his childrens savings, his mothers money, and his sick brothers money as well.

However, contrary to the required diligence and behavior of an ordinary lawyer, Corona marched into the Impeachment Court without a single piece of evidence to support his claims. For this, what has been entered into the record of the case is a tall tale told by a man accused of not disclosing funds that are presumptively his. Chief Justice Corona has presented an unsupported and barely credible claim that must, pursuant to law, be rejected.

It is also established, and the Chief Justice likewise admits, that he has significant dollar deposits which are undisclosed in this SALNs for the years 2003-2010. Some of his undeclared year-end balances in dollar deposits include the following:

[refer to the following page for a tabular summary]

Page 18 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

SALN year

2004 2005

Amounts declared Undeclared Actual in the SALN Year-end Cash Balances (dollar) Php 3.3 million $90,144.2119 (BPI) Php 3.3 million $700,265.1220 (Allied/PS Bank) $189,144.21 (BPI)21 $700,265.1222 (Allied/PS Bank) $378,334.6723 (BPI) $1,014,549.0524 (Allied/PS Bank) $1,580,311.3725 (Allied/PS Bank) $770,724.6826 (Allied/PS Bank) $1,425,453.9327 (Allied/PS Bank)

2006

Php 2.5 million

2007 2008 2009 2010

Php 2.5 million Php 2.5 million Php 2.5 million Php 3.5 million

19

BPI (Tandang Sora)- 02022380000002388005036-$10,000/0200223800000002388004811$20,103.74/02002238000000002388004765-$30,000/BPI (Acropolis) 0200243300000004338113949-$30,040.47. 20 PS Bank (Cainta) 0141008145-$563,265.12/PS Bank (Katipunan) 0141007469-$80,000/PS Bank (Katipunan) 0141007129$57,000. 21 BPI (Tandang Sora) 0200223800000002388006148-$21,000/0200223800000002388006083$15,000/0200223800000002388005974-$12,000/0200223800000002388005427-$11,000/020223800000002388005222$40,000/ 21 BPI (Tandang Sora)- 02022380000002388005036-$10,000/0200223800000002388004811$20,103.74/02002238000000002388004765-$30,000/BPI (Acropolis) 0200243300000004338113949 22 PS Bank (Cainta) 0141008145-$563,265.12/PS Bank (Katipunan) 0141007469-$80,000/PS Bank (Katipunan) 0141007129$57,000. 23 BPI (Tandang Sora) 02002238000000002388006334-$12,091.19/0200223800000002388006261$16,000/020223800000002388005222-$40,000/ 23 BPI (Tandang Sora)- 02022380000002388005036$10,000/0200223800000002388004811-$20,103.74/02002238000000002388004765-$30,000/BPI (SFDM) 020023240000000248269188-$26,455.95/022324400000003248269366-$131,643.32/0200232400000003248268955-$62,000. 24 PS Bank (Cainta)0141017659-$299,937.86/PS Bank (Cainta) 0141008145-$277,611.19/PS Bank (Cainta) 0141016962$300,000/PS Bank (Katipunan) 0141007469-$80,000/PS Bank (Katipunan) 0141007129-$57,000 25 PS Bank (Katipunan) 0141019678-$455,210.07/PS Bank (Katipunan) 0191000373-$768,733.96/Allied Bank (Kamias) 1588004023-$356,367.34 26 PS Bank (Katipunan) 0191000373-$768,733.96/Allied Bank (Kamias) 1582002676-$1,990,72. 27 PS Bank (Katipunan) 0191000373-$768,733.96/PS Bank (Katipunan) 0141022046-$254,729.25/Allied Bank (Kamias) 1582002676-$1,970.72/Allied Bank (Kamias) 1588021386-$400,000.

Page 19 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

Also undeclared were the following investments: o Philam Bonds (peso) P12,000,000 which should have been declared in 2003.28 P11,478,370.28 which should have been declared in 2004.29 o Philam Dollar Bond Fund P27,933,000 which should have been declared in 200430

The analysis of the bank accounts of Chief Justice Renato Corona (CJ Corona) was made possible on the basis of the AMLC Report (Exhibit wwwwwwwwwww). Taking into consideration the allegations in the impeachment complaint, there is a need to analyze CJs Coronas bank accounts to determine whether or not the same were reported in his SALN for the period December 31, 2003 to December 31, 2010. Thus, said bank analysis was conducted to determine, among others, the following: (1) the number of bank accounts opened/maintained and/or closed by CJ Corona for the period 2003 to 2012; and (2) yearly ending balances of the said bank accounts for the said period. Records showed that CJ Corona opened/maintained and/or closed several bank accounts (dollar and peso accounts) in certain banks such as: Bank of the Philippine Islands (BPI), Philippine Savings Bank (PSB); Allied Banking Corporation; and Citibank, N.A.

28 29

Account Number 1505/Transaction Code BYMF/10-14-2003 Account Number 1505/Transaction Code SLMF/10-13-2004 ($521,629.72),1-31-2005 ($2,000,000),4-6-2005 ($10,153,377.41), 4-6-2005 ($1,549,286.27) 30 Account Number 16874/Transaction Code BYMF/5-17-2004

Page 20 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

Records further showed that CJ Corona has substantial amount of money deposited in the aforementioned banks as reflected in their yearly ending balances. The following activities were performed for the purpose of determining the yearly ending balances in the said bank accounts, to wit: (a) (b) Analyze the nature of the transactions in the said bank accounts; Reconstruct the monthly transactions per bank account/s by classifying and/or identifying the transaction whether it is a deposit or withdrawal. (Note: credit memos are considered as deposit while debit memos and miscellaneous transactions are considered as withdrawal); and Compute the bank yearly ending balance by deducting the balance of the withdrawals from the balance of the total deposits in the said bank account/s.

(c)

Based on the analysis conducted on the matter, there is no doubt that CJ Corona has substantial amount of money deposited in several bank accounts which were not reported in his SALN for the period 2003 to 2010. We must reject the Chief Justices absurd claim that despite evidence showing that he had significant balances in dollar deposit accounts, he was not obliged to disclose the same because Republic Act 6426 or the Foreign Currency Deposit Act of the Philippines provides for the absolute secrecy of foreign currency deposits. The absurdity of the Chief Justices assertion will be explained in the succeeding section, but it must hastily be noted, that this absurdity is a blaring warning bell on the fitness of the respondent to remain as the highest magistrate of the Supreme Court of the Philippines. If he used this argument knowing fully well that it is incorrect, he reveals himself to be a member of the bar and the bench who has lost his integrity and responsibility to defend the Constitution. If he truly believes that his argument is correct, he

Page 21 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

reveals himself to be a member of the bar and the bench who has lost his intellectual competence to lead the Supreme Court.

The 1987 Constitution, when it imposes the duty to disclose ones SALN, does not distinguish between different types of assets; whether these assets are foreign or peso deposits. It is lamentable that the highest magistrate of the land would forget a fundamental lesson every freshman law student knows by heart: Where the law does not distinguish, we ought not to distinguish. To accept the justification of the Chief Justice would be a perversion of the letter and spirit of the Constitution.

The law that implements the SALN provision in the Constitution, Republic Act 6713, also does not distinguish between peso and foreign deposits- all assets and liabilities must be declared.

In an attempt to justify his Constitutional violation, the Chief Justice noted that the Constitution allows for exceptions to the duty to disclose. He notes the last paragraph of Article XI, section 17, which states: In the case of the President, the Vice-President, the Members of

the Cabinet, the Congress, the Supreme Court, the Constitutional Commissions and other constitutional offices, and officers of the armed forces with general or flag rank, the declaration shall be disclosed to the public in the manner provided by law.

Thus, the Chief Justice points to the Foreign Currency Deposit law as the exception to the duty to disclose. Sadly, the Chief Justice is gravely mistaken, because the phrase, in the manner provided by law simply means that a law may be passed to describe the manner of disclosure and does not in any way, provide for an exception to the duty to disclose. In the same provision, the phrase, as may be required by

Page 22 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

law also appears in the first paragraph and this simply means that a law can provide for the frequency of disclosureagain, it does not mean that the Constitution allows a law to create an exception to the duty to disclose.

Renato Coronas invocation of the Foreign Currency Deposit Act further reveals his lack of good faith and judicial integrity because he himself knows that the law, in fact, allows the depositor himself to disclose information about his own foreign currency deposit accounts. There was nothing in the law that prevented him from disclosing these accounts especially because he had the Constitutional duty to disclose these accounts. In fact, he did not even have to enumerate the account numbers of these dollar deposits. He could have simply converted the value of his foreign deposits into Philippine pesos and already, he would have been compliant with the duty to disclose.

Thus, because it is clearly established that the Chief Justice repeatedly failed to disclose substantial peso and foreign deposits in the Statements of Assets, Liabilities, and Net worth for the years 2003 to 2010, he has committed a blatant and indisputable violation of the Constitution.

2. Undeclared properties: 3 parking lots at the Bellagio

Renato Coronas SALN for 2010 lists down a condominium located in Taguig, with an assessed value of P3,496,320 and a current fair market value of 6,800,000. The defense, without any objection from the prosecution, admits that this is the Bellagio 1 condominium. This

Page 23 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

Condominium Certificate of Title 31 for this property was issued on January 25, 2010.

However, it appears that while the condominium was declared, three parking lots, covered by separate Condominium Certificates of Title, 32 all issued on January 25, 2010, were left undeclared. As mentioned, the condominium unit and the three parking lots were covered by separate titles and thus it is incorrect for the defense to invoke the general civil code principle of accessory follows the principle.33 In this case, all four properties- the condominium unit and the three parking lots- are all principals within the contemplation of the law.

3. Belatedly declared properties

Two properties were belatedly declared in the Chief Justices SALN:

a. Unit 31B, Columns, Ayala Avenue: The Deed of Sale was executed on October 1, 2004. Its Condominium Certificate of Title was issued on November 3, 2004 in the name of Cristina Corona. It was not declared in the Chief Justices SALNs for the years 2004 to 2009.

b. Unit 1902 Bonifacio Ridge: The Deed of Sale was executed on October 14, 2005. Its Condominium Certificate of Title was issued on November 29, 2005 in the name of Cristina

31 32

Condominium Certificate of Title 19497 Condominium Certificates of Title Nos. 19651, 19652, 19653. 33 Statement of Defense Counsel, Dennis Manalo during the oral arguments, May 28, 2012.

Page 24 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

Corona. It was not declared in the Chief Justices SALNs for the years 2005 to 2009. The respondent attempted to justify the late disclosure by saying that these properties were accepted by them only in later years. The New Civil Code of the Philippines is very clear when it provides that the ownership of the thing passes upon the actual delivery thereof, whether the delivery is actual or constructive in the form of a public instrument like a deed of sale. The Civil Code provides:

Article 1477. The ownership of the thing sold shall be transferred to the vendee upon the actual or constructive delivery thereof.

Article 1498. When the sale if made through a public instrument, the execution thereof shall be equivalent to the delivery of the things which is the object of the contract, if from the deed the contrary does not appear or cannot clearly be inferred.

The respondent, in his own SALN of 2010, admits that the Bonifacio Ridge property was acquired in 2004 and yet, it is strange that it was only declared in 2010. Even the defenses own evidence belies their position that ownership of this property only vested in 2010, upon their acceptance thereof.

o Exhibit 244 of the Defense is a letter from Cristina Corona where she requested for the waiver of association dues, and the corresponding interest and penalties on the ground that the unit still had defects which the developer should fix. It

Page 25 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

must, however, be emphasized that nowhere in this letter is the refusal to acknowledge ownership over the property because of its defects. In fact, Mrs. Cristinas act of requesting for a waiver of association dues is an act that can performed by an owner who has the duty to pay such fees. o Exhibit 247 of the Defense also clearly indicates that Mrs. Corona declined to acknowledge any liability for association dues but did not deny ownership of this same property.

For the two properties that were belatedly disclosed, the respondent should have known that the execution of the deed sale was the ultimate act that conveyed ownership to the property and not the actual acceptance thereof. This legal concept should not have been alien to the mind of the Chief Justice because on February 2, 2010, he himself decided a case 34 where he affirmed a clear legal principle, to wit:

In a contract of sale, the seller conveys ownership of the property to the buyer upon the perfection of the contract. Settled is the rule that the seller is obliged to transfer title over the properties and deliver the same to the buyer. In this regard, Article 1498 of the Civil Code provides that, as a rule, the execution of a notarized deed of sale is equivalent to the delivery of a thing sold.

34

De Leon v. Ong, GR No. 170405, February 2, 2010.

Page 26 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

In this instance, petitioner executed a notarized deed of absolute sale in favor of respondent. Moreover, not only did petitioner turn over the keys to the properties to respondent, he also authorized RSLAI to receive payment from respondent and release his certificates of title to her. The totality of petitioners acts clearly indicates that he had unqualifiedly delivered and transferred ownership of the properties to respondent. Clearly, it was a contract of sale the parties entered into.

Therefore, following the respondents own interpretation of the law, the two properties that were belatedly declared should have been disclosed on the year they were acquired, not on the year they were accepted.

III. For failure to disclose his SALN, Renato Corona committed an impeachable offense which warrants the penalty of removal.

The Record of the 1986 Constitutional clearly reveals that if an impeachable officer committed any of the impeachable offenses, he/she must be removed from office through impeachment. For other public officials and employees, he/she can be removed through ways provided by law. Article XI, section 2 is clear:

SECTION 2. The President, the Vice-President, the Members of the Supreme Court, the Members of the Constitutional Commissions, and

Page 27 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

the Ombudsman may be removed from office, on impeachment for, and conviction of, culpable violation of the Constitution, treason, bribery, graft and corruption, other high crimes, or betrayal of public trust. All other public officers and employees may be removed from office as provided by law, but not by impeachment (emphasis ours).

To answer the question of whether the failure to disclose a SALN should result to the removal from office of an impeachable officer, a simple test is proposed: if it can be a ground to remove an ordinary public official, it should be a ground to remove an impeachable officer like the Chief Justice of the Supreme Court.

Impeachment is a method of removing from office a select group of public officials on grounds that may be used to remove an ordinary public officer or employee who in turn are removed through other means provided by law. By providing for a separate section on Accountability of Public Officers, the Constitution recognizes distinctions in rank which may justify the differences in the manner of removal, but it has no intention whatsoever of creating distinctions in accountability. Thus, at its minimum, acts or omissions that may lead to the removal of an ordinary public officer or employee should likewise result to the removal of an impeachable officer.

Both Code of Conduct and Ethical Standards of Public Officers and Employees and the Anti-Graft and Corrupt Practices mete out the penalty of removal on public officers who fail to comply with the SALN provisions in these laws.

Page 28 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

Republic Act 3019 provides: Sec. 9. Penalties for violations. - (b) Any public officer violation any of the provisions of Section 7 of this Act shall be punished by a fine of not less than one thousand pesos nor more than five thousand pesos, or by imprisonment not exceeding one year and six months, or by both such fine and imprisonment, at the discretion of the Court. The violation of said section proven in a proper administrative proceeding shall be sufficient cause for removal or dismissal of a public officer, even if no criminal prosecution is instituted against him (emphasis ours).

Likewise, Republic Act 6713 provides: Section 11. Penalties. - (a) Any public official or employee, regardless of whether or not he holds office or employment in a casual, temporary, holdover, permanent or regular capacity, committing any violation of this Act shall be punished with a fine not exceeding the equivalent of six (6) months' salary or suspension not exceeding one (1) year, or removal depending on the gravity of the offense after due notice and hearing by the appropriate body or agency. If the violation is punishable by a heavier penalty under another law, he shall be prosecuted under the latter statute. Violations of Sections 7, 8 or 9 of this Act shall be punishable with imprisonment not exceeding five (5) years, or a fine not exceeding five thousand pesos (P5,000), or both, and, in the discretion of the

Page 29 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

court of competent jurisdiction, disqualification to hold public office. (b) Any violation hereof proven in a proper administrative proceeding shall be sufficient cause for removal or dismissal of a public official or employee, even if no criminal prosecution is instituted against him (emphasis ours). (c) Private individuals who participate in conspiracy as co-principals, accomplices or accessories, with public officials or employees, in violation of this Act, shall be subject to the same penal liabilities as the public officials or employees and shall be tried jointly with them.

The Supreme Court itself dismissed a court interpreter for her failure to disclose in her SALN the fact that she had a stall in the market: a business interest, while meager, which should have been disclosed in her SALN.35

If the Supreme Court itself can remove from office a lowly court interpreter with a tiny market stall, the Senate sitting as an Impeachment Court is likewise Constitutionally bound to remove the Chief Justice of the Philippines with multi-million dollar and peso accounts, and expensive condominiums scattered around the metropolis which he failed to disclose in his statement of assets, liabilities, and net worth.

35

Rabe vs. Flores, AM No. P-97-1247, May 14, 1997.

Page 30 of 31

Decision of Senator-Judge Teofisto Guingona III 29 May 2012

CLOSING NOTE

The facts are indisputable, the applicable laws are clear, and the Constitution leaves no room for perverted interpretations. Renato C. Corona failed to comply with a Constitutional duty. He has failed to present convincing evidence to support his acts and omissions. He brazenly presented a twisted interpretation of the Constitution to justify his violations.

While the highest law of the land recognizes distinctions in rank, it must not be read to create distinctions in accountability. For this reason, Renato Corona, Chief Justice of the Supreme Court of the Republic of the Philippines, must be removed from office after having been found guilty of two serious and impeachable offenses: culpable violation of the Constitution and betrayal of public trust.

TEOFISTO GUINGONA III Senator-Judge

Page 31 of 31

You might also like

- G.R. No. 97898 August 11, 1997 FLORANTE F. MANACOP, Petitioner, COURT OF APPEALS and E & L MERCANTILE, INC., Respondents. FactsDocument16 pagesG.R. No. 97898 August 11, 1997 FLORANTE F. MANACOP, Petitioner, COURT OF APPEALS and E & L MERCANTILE, INC., Respondents. FactsBiel Angelo BatiNo ratings yet

- 9bd0 PDFDocument16 pages9bd0 PDFRocel BarbadilloNo ratings yet

- 4th Quarter QA - Final Research ManuscriptDocument23 pages4th Quarter QA - Final Research ManuscriptariNo ratings yet

- Psba V. CaDocument2 pagesPsba V. CaEman RodriguezNo ratings yet

- Amendments and RevisionsDocument2 pagesAmendments and RevisionsANSELMO MADEUS ADRIANONo ratings yet

- Magna Carta of Persons With Disability: RA No. 7277Document28 pagesMagna Carta of Persons With Disability: RA No. 7277Darlene GanubNo ratings yet

- Court Holds City Liable for Damages from Defective SidewalkDocument9 pagesCourt Holds City Liable for Damages from Defective SidewalkJohn Paul VillaflorNo ratings yet

- Consti II Case Digest: EDISON SO, Petitioner, vs. REPUBLIC OF THE PHILIPPINES, RespondentDocument26 pagesConsti II Case Digest: EDISON SO, Petitioner, vs. REPUBLIC OF THE PHILIPPINES, RespondentRichard BalaisNo ratings yet

- Project Proposal EditDocument2 pagesProject Proposal Editapi-540580821100% (1)

- Disini v. Secretary of JusticeDocument2 pagesDisini v. Secretary of JusticeNickoNo ratings yet

- Provisional RemediesDocument10 pagesProvisional RemediesMary Nathalie ManesNo ratings yet

- Agustin - de Facto Separation Relations With Children - Divorce NaturalizationDocument6 pagesAgustin - de Facto Separation Relations With Children - Divorce NaturalizationPouǝllǝ ɐlʎssɐNo ratings yet

- Garcia Vs SantiagoDocument2 pagesGarcia Vs Santiagoangelica po100% (1)

- IDEAS and TERMS: Classification and PropertiesDocument48 pagesIDEAS and TERMS: Classification and PropertiesCalamdag Monzales Jhon MarkNo ratings yet

- Consti 1 ReviewerDocument9 pagesConsti 1 ReviewerRuth CastilloNo ratings yet

- Informal SettlersDocument21 pagesInformal SettlersXyrille TayaNo ratings yet

- Critical Analysis of Machiavelli's Argument in The PrinceDocument5 pagesCritical Analysis of Machiavelli's Argument in The PrinceHaneen AhmedNo ratings yet

- Perez v. de La TorreDocument1 pagePerez v. de La TorreAbbyElbamboNo ratings yet

- 288 - Ebralinag Vs Division SuperintendentDocument9 pages288 - Ebralinag Vs Division SuperintendentCharm Divina LascotaNo ratings yet

- Same Sex Civil UnionDocument6 pagesSame Sex Civil UnionVal Justin DeatrasNo ratings yet

- Argumentative EssayDocument6 pagesArgumentative Essayapi-30137950767% (3)

- Legres MemorandumDocument5 pagesLegres MemorandumZaira Gem GonzalesNo ratings yet

- Rules of Procedure On Impeach... Senate of The Philippines NewDocument11 pagesRules of Procedure On Impeach... Senate of The Philippines NewFeBrluado0% (1)

- Notes: A.M. No. 19-10-20-SCDocument88 pagesNotes: A.M. No. 19-10-20-SCVal CortesNo ratings yet

- Cases For Search and SeizureDocument23 pagesCases For Search and SeizureICTS BJMPRO 7No ratings yet

- Sereno Case DigestDocument4 pagesSereno Case DigestWingmannuuNo ratings yet

- Aquilino Q. Pimentel, Et. Al., vs. Senate Committee of The Whole Represented by Senate Presindent Juan Ponce Enrile G.R. No. 187714, March 8, 2011Document2 pagesAquilino Q. Pimentel, Et. Al., vs. Senate Committee of The Whole Represented by Senate Presindent Juan Ponce Enrile G.R. No. 187714, March 8, 2011Kyle DionisioNo ratings yet

- The Sensationalized Reality: A Critical Analysis of The Depictions of Pinoy Big BrotherDocument5 pagesThe Sensationalized Reality: A Critical Analysis of The Depictions of Pinoy Big BrotherChelsea MagtotoNo ratings yet

- 10 - San Jose Homeowners V RomanillosDocument7 pages10 - San Jose Homeowners V RomanillosOdette JumaoasNo ratings yet

- Code of Ethics - Philippine Computer SocietyDocument9 pagesCode of Ethics - Philippine Computer SocietyJames Patrick GalvanNo ratings yet

- Dumlao vs. COMELEC examines equal protectionDocument3 pagesDumlao vs. COMELEC examines equal protectionSteve UyNo ratings yet

- Impeachment PrimerDocument14 pagesImpeachment PrimeranakpawispartylistNo ratings yet

- People V Manalili PDF FreeDocument1 pagePeople V Manalili PDF FreeAGNo ratings yet

- Article 25 & 26 Case Digest: Hing vs. ChoachuyDocument3 pagesArticle 25 & 26 Case Digest: Hing vs. ChoachuyGabriel DominguezNo ratings yet

- Essay 2 Kant's Categorical ImperativeDocument7 pagesEssay 2 Kant's Categorical ImperativeBest Sontipat SupanusontiNo ratings yet

- Legal PositivismDocument4 pagesLegal PositivismjaiprabhaNo ratings yet

- People vs. Villanueva ruling on private practice of city attorneyDocument1 pagePeople vs. Villanueva ruling on private practice of city attorneyM. CoCoNo ratings yet

- Digest Cayetano Vs MonsodDocument1 pageDigest Cayetano Vs MonsodSORITA LAWNo ratings yet

- Geluz Vs CA, G.R. No. L-16439, July 20, 1961 (2 SCRA 801)Document3 pagesGeluz Vs CA, G.R. No. L-16439, July 20, 1961 (2 SCRA 801)Lester AgoncilloNo ratings yet

- Philippine citizenship requirements and naturalization process under Commonwealth Act 473Document2 pagesPhilippine citizenship requirements and naturalization process under Commonwealth Act 473Joanne Alyssa Hernandez LascanoNo ratings yet

- LIBERY TO ABODE: A review of key Philippine Supreme Court cases on personal libertiesDocument12 pagesLIBERY TO ABODE: A review of key Philippine Supreme Court cases on personal libertiesElieNo ratings yet

- Arciga v. ManiwangDocument6 pagesArciga v. ManiwangJuan Lorenzo Maria CastricionesNo ratings yet

- Delgado Vs HRETDocument7 pagesDelgado Vs HRETBrylle DeeiahNo ratings yet

- Professional Client RelationshipsDocument1 pageProfessional Client RelationshipsMaggieNo ratings yet

- Emilio A. Gonzales III vs. Office of The President, G.R. Nos. 196231 & 196232 September 4, 2012Document3 pagesEmilio A. Gonzales III vs. Office of The President, G.R. Nos. 196231 & 196232 September 4, 2012Kang MinheeNo ratings yet

- Judicial Power and Composition of the Philippine Supreme CourtDocument7 pagesJudicial Power and Composition of the Philippine Supreme Courtjoseph dave pregonerNo ratings yet

- Reconsideration Was Likewise Denied With Finality by The DOJ - Respondent HSBC Then Went To The Court of Appeals by Means of ADocument7 pagesReconsideration Was Likewise Denied With Finality by The DOJ - Respondent HSBC Then Went To The Court of Appeals by Means of AJMX100% (1)

- Criminal Procedure Rules SummaryDocument2 pagesCriminal Procedure Rules SummaryMaria Elizabeth De GuzmanNo ratings yet

- Atty Fule's Appearance as Private Prosecutor UpheldDocument4 pagesAtty Fule's Appearance as Private Prosecutor UpheldJezreel CorpuzNo ratings yet

- Pichay, Jr. v. Office of The Deputy Executive Secretary FR Legal Affairs-Investigative and Adjudicatory DivisionDocument12 pagesPichay, Jr. v. Office of The Deputy Executive Secretary FR Legal Affairs-Investigative and Adjudicatory DivisionJD greyNo ratings yet

- Sandiganbayan Jurisdiction Over Estafa Case Against UP Student RegentDocument12 pagesSandiganbayan Jurisdiction Over Estafa Case Against UP Student RegentEmerson NunezNo ratings yet

- 18 - in Re. Atty. Tranquilino Rovero, A.M. No. 126 December 29, 1980Document2 pages18 - in Re. Atty. Tranquilino Rovero, A.M. No. 126 December 29, 1980Bae IreneNo ratings yet

- Liberty of Abode and Travel Constitutional ProvisionsDocument4 pagesLiberty of Abode and Travel Constitutional ProvisionscedieNo ratings yet

- Tenchavez v. EscanoDocument2 pagesTenchavez v. EscanoMarie Claire T. InductivoNo ratings yet

- Geluz v. CADocument2 pagesGeluz v. CAMarjorieFranzNo ratings yet

- (Puboff) (Sept 30 Compit 30 Compilalation)Document21 pages(Puboff) (Sept 30 Compit 30 Compilalation)HomerNo ratings yet

- Santos Vs CA 240 Scra 20Document1 pageSantos Vs CA 240 Scra 20Boni AcioNo ratings yet

- 9 - DECS v. CuananDocument8 pages9 - DECS v. CuananGia MordenoNo ratings yet

- Biraogo V Truth CommissionDocument21 pagesBiraogo V Truth CommissionPepa V. PontillasNo ratings yet

- Executive CasesDocument112 pagesExecutive CasesAlice Marie AlburoNo ratings yet

- DILG Good Financial Housekeeping ReportDocument5 pagesDILG Good Financial Housekeeping ReportSunStar Philippine NewsNo ratings yet

- Unofficial List of Bar PassersDocument68 pagesUnofficial List of Bar PassersTheSummitExpress100% (2)

- DOH Circular On Price Cap For Covid-19 Rapid Antigen TestingDocument3 pagesDOH Circular On Price Cap For Covid-19 Rapid Antigen TestingSunStar Philippine NewsNo ratings yet

- List of Nominees For Mindanao LEG (In No Particular Order)Document5 pagesList of Nominees For Mindanao LEG (In No Particular Order)SunStar Philippine NewsNo ratings yet

- Notice of The Davao Doctors Hospital's Annual Stockholders Meeting 2020Document1 pageNotice of The Davao Doctors Hospital's Annual Stockholders Meeting 2020SunStar Philippine NewsNo ratings yet

- Tentative List of Aspirants For National Posts in The 2022 ElectionsDocument15 pagesTentative List of Aspirants For National Posts in The 2022 ElectionsRappler100% (1)

- Office of The Governor: JL (Epuhlit of Tqe Jqilippines Jro&ince of C!IehuDocument1 pageOffice of The Governor: JL (Epuhlit of Tqe Jqilippines Jro&ince of C!IehuSunStar Philippine NewsNo ratings yet

- LIST OF NOMINEES FOR VISAYAS LEG (In No Particular Order)Document8 pagesLIST OF NOMINEES FOR VISAYAS LEG (In No Particular Order)SunStar Philippine NewsNo ratings yet

- Office of The Governor: JL (Epuhlit of Tqe Jqilippines Jro&ince of C!IehuDocument1 pageOffice of The Governor: JL (Epuhlit of Tqe Jqilippines Jro&ince of C!IehuSunStar Philippine NewsNo ratings yet

- Res 1125 2021 Ord. No. 2021 04Document9 pagesRes 1125 2021 Ord. No. 2021 04SunStar Philippine NewsNo ratings yet

- Letter To SunStar CebuDocument2 pagesLetter To SunStar CebuSunStar Philippine NewsNo ratings yet

- 2019 SALN Table Summary Senate WebsiteDocument2 pages2019 SALN Table Summary Senate WebsiteSunStar Philippine NewsNo ratings yet

- Republic Act 11458Document2 pagesRepublic Act 11458SunStar Philippine NewsNo ratings yet

- Central Visayas Center For Health Development: Osmeña Boulevard, Sambag II, Cebu City, 6000 PhilippinesDocument2 pagesCentral Visayas Center For Health Development: Osmeña Boulevard, Sambag II, Cebu City, 6000 PhilippinesSunStar Philippine NewsNo ratings yet

- SunStar Paywall User GuideDocument9 pagesSunStar Paywall User GuideSunStar Philippine NewsNo ratings yet

- Official Time Results of All-Women Ultra Marathon 2019Document5 pagesOfficial Time Results of All-Women Ultra Marathon 2019SunStar Philippine NewsNo ratings yet

- Notice of The Davao Doctors Hospital's Annual Stockholders Meeting 2020Document1 pageNotice of The Davao Doctors Hospital's Annual Stockholders Meeting 2020SunStar Philippine NewsNo ratings yet

- 2019 Bar Exam ResultsDocument39 pages2019 Bar Exam ResultsSunStar Philippine NewsNo ratings yet

- March 2019 Pharmacist Licensure Examination ResultsDocument42 pagesMarch 2019 Pharmacist Licensure Examination ResultsRappler100% (1)

- Projects For Implementation in Cebu City North District in 2020Document7 pagesProjects For Implementation in Cebu City North District in 2020SunStar Philippine NewsNo ratings yet

- Election HotspotsDocument27 pagesElection HotspotsSunStar Philippine NewsNo ratings yet

- Speech On A Question of Personal and Collective Privilege by Cebu Rep. Raul V. Del MarDocument5 pagesSpeech On A Question of Personal and Collective Privilege by Cebu Rep. Raul V. Del MarSunStar Philippine NewsNo ratings yet

- IRR of RA 11203 or The Rice Liberalization Act (RLA) - SignedDocument31 pagesIRR of RA 11203 or The Rice Liberalization Act (RLA) - SignedSunStar Philippine NewsNo ratings yet

- Official Time Results of All-Women Ultra Marathon 2019 On March 9-10, 2019 in CebuDocument6 pagesOfficial Time Results of All-Women Ultra Marathon 2019 On March 9-10, 2019 in CebuSunStar Philippine NewsNo ratings yet

- Copernicus Programme Fact SheetDocument2 pagesCopernicus Programme Fact SheetSunStar Philippine NewsNo ratings yet

- Judicial Affidavit Complaint Vs Paul FarolDocument23 pagesJudicial Affidavit Complaint Vs Paul FarolSunStar Philippine News100% (8)

- PHYS0319 AlphaDocument25 pagesPHYS0319 AlphaRappler100% (1)

- Chem1118 AlphaDocument15 pagesChem1118 AlphaRapplerNo ratings yet

- Judicial Affidavit Complaint Vs Paul FarolDocument23 pagesJudicial Affidavit Complaint Vs Paul FarolSunStar Philippine News100% (8)

- Mid1118 AlphaDocument24 pagesMid1118 AlphaRapplerNo ratings yet

- Billy Earley For Congress Request DEA Corruption Investigation Into MisconductDocument4 pagesBilly Earley For Congress Request DEA Corruption Investigation Into MisconductBilly EarleyNo ratings yet

- Arta IrrDocument13 pagesArta Irrapi-234555728No ratings yet

- Anti Corruption Manual 2007Document116 pagesAnti Corruption Manual 2007Cristina Joy Vicente Cruz83% (6)

- Adarsh Housing Society ScamDocument5 pagesAdarsh Housing Society ScamsatishbahirNo ratings yet

- Advincula vs. MacabataDocument1 pageAdvincula vs. MacabataTom SumawayNo ratings yet

- CASE OF TELBIS AND VIZITEU v. ROMANIADocument24 pagesCASE OF TELBIS AND VIZITEU v. ROMANIAMihai CeanNo ratings yet

- Free and Fair ElectionsDocument7 pagesFree and Fair Elections67yqhNo ratings yet

- Legal Ethics Case Digest SummariesDocument20 pagesLegal Ethics Case Digest SummariesChristopher G. Halnin100% (1)

- Effective Measures To Combat Transnational Organized Crime: New Security ChallengesDocument2 pagesEffective Measures To Combat Transnational Organized Crime: New Security ChallengesS. M. Hasan ZidnyNo ratings yet

- Apdaite One Thesis Book UNISO 7Document56 pagesApdaite One Thesis Book UNISO 7Mohamed Salad SiadNo ratings yet

- Effect of Whistle Blowing On Fraud Prevention and Detection in Nigeria Public SectorDocument14 pagesEffect of Whistle Blowing On Fraud Prevention and Detection in Nigeria Public SectorEfosaNo ratings yet

- Venn Diagram - FA1 LAGUMENDocument2 pagesVenn Diagram - FA1 LAGUMENKassy LagumenNo ratings yet

- CPE Reading Part 3 - The Do-GoodersDocument2 pagesCPE Reading Part 3 - The Do-GoodersElaine Mc AuliffeNo ratings yet

- Important Committees in IndiaDocument3 pagesImportant Committees in Indiavivek bhagatNo ratings yet

- The Presidency of Gloria Macapagal-ArroyoDocument9 pagesThe Presidency of Gloria Macapagal-ArroyoJOSCINE NIPALESNo ratings yet

- Ombudsman Act of 1989 constitutionalityDocument4 pagesOmbudsman Act of 1989 constitutionalityadrixulet100% (2)

- Padrino System in Philippine BureaucracyDocument20 pagesPadrino System in Philippine BureaucracyAMNA100% (1)

- Gangster Lee Kuan YewDocument48 pagesGangster Lee Kuan Yewsgvotes100% (1)

- Loksabha 2019 PDFDocument107 pagesLoksabha 2019 PDFKrushik DhadukNo ratings yet

- AssignmentDocument5 pagesAssignmentayub shahNo ratings yet

- All India Trinamool Congress PDFDocument35 pagesAll India Trinamool Congress PDFIndrani RoyNo ratings yet

- Oral Literature of Kashmiri LanguageDocument70 pagesOral Literature of Kashmiri LanguageabujeNo ratings yet

- Topic5 Pad320Document25 pagesTopic5 Pad320gurl0% (1)

- Future of Democracy in PakistanDocument10 pagesFuture of Democracy in PakistansabaahatNo ratings yet

- Best Memorial APPELLANT 2nd RGNUL National Moot Court 2013Document40 pagesBest Memorial APPELLANT 2nd RGNUL National Moot Court 2013Vidushi TrehanNo ratings yet

- WNYPD HistoryDocument27 pagesWNYPD Historyal_crespoNo ratings yet

- SpeechDocument2 pagesSpeechAnshumanmodiNo ratings yet

- Indonesia Military Business Takeover, Master Degree Dissertation For ITBDocument138 pagesIndonesia Military Business Takeover, Master Degree Dissertation For ITBFitri Bintang Timur100% (1)

- Little Scarlet EssayDocument12 pagesLittle Scarlet EssayAndrew KnoxNo ratings yet

- 301 Rahul Mehta RTRDocument548 pages301 Rahul Mehta RTRAdam JensenNo ratings yet