Professional Documents

Culture Documents

Ara Asset Management: Analyst Research Report

Uploaded by

hi_chrisleeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ara Asset Management: Analyst Research Report

Uploaded by

hi_chrisleeCopyright:

Available Formats

ARA ASSET MANAGEMENT

Analyst Research Report

Rusmin 11 April 2012

Fast Grower

ARA Asset management

| Contents

Table of Contents

Disclaimer............................................................................................................................................................. 1 Business ................................................................................................................................................................ 1 About the Company ........................................................................................................................................ 1 Core Businesses ............................................................................................................................................... 1 Corporate Structure ........................................................................................................................................ 5 Competitive Advantage .................................................................................................................................. 9 Business Risks ................................................................................................................................................11 Key Growth Driver .........................................................................................................................................12 Management......................................................................................................................................................13 Board of Directors Profile ............................................................................................................................13 Remuneration ................................................................................................................................................14 Shareholding Statistic ...................................................................................................................................15 Insider Trading ...............................................................................................................................................16 Numbers.............................................................................................................................................................17 Income Statement .........................................................................................................................................17 Balance Sheet Statement..............................................................................................................................18 Cash Flow Statement ....................................................................................................................................20 Financial Ratios ..............................................................................................................................................21 Industry ..............................................................................................................................................................25 Value Chain of REITs......................................................................................................................................25 Competitors ...................................................................................................................................................26 Valuation ............................................................................................................................................................28 Historical Growth Rate (CAGR) .....................................................................................................................28 Historical Share Price ....................................................................................................................................28 Discounted Earnings Model..........................................................................................................................29 PE / PEG / PTB ................................................................................................................................................29 Analytical Summary...........................................................................................................................................30

All Rights Reserved

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Disclaimer

Disclaimer

This report and its contents contain the opinions and ideas of the authors. It is not a recommendation to purchase or sell the securities of any of the companies or investments herein discussed. The report is distributed with the understanding that the trainers, analysts and their associates are not engaged in rendering legal, accounting, investment or other professional services. If the participant requires expert financial or other assistance or legal advice, a competent professional should be consulted. Neither the trainers, analysts nor the associates can guarantee the accuracy of the information contained herein the report and its contents. The trainers, analysts and associates specifically disclaim any responsibility for any liability, loss, or risk, professional or otherwise, which is incurred as a consequence, directly or indirectly, of the use and application of any of the contents of the report. This report is meant solely for use by the recipient and is not for circulation. All rights reserved.

All Rights Reserved

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Business

Business

About the Company

ARA ASSET MANAGEMENT

Incorporated in IPO Date Exchange Market Cap 1 July 2002 2 November 2007 Singapore Stock Exchange S$1180 million (as at 10 Apr 2012)

No. of Employees 800 Employees Website www.ara-asia.com Source: Annual Report, Company Website & Third Party Research

ARA Asset Management Limited is an Asian real estate fund management company focused on the management of public-listed real estate investment trusts (REITs) in Singapore, Hong Kong and Malaysia; private real estate funds investing in Asia and other service providers such as property management, convention & exhibition and corporate finance advisory. It has asset under its management which totaling to S$20.2 billion as of 31 Dec 2011.

Core Businesses

REITs Private Real Estate Funds Real Estate Management Services Corporate Finance Advisory Service

REITs management of public-listed REITs companies

Fund management investing in properties

Property management services provider Convention & Exhibition service provider Advisory on setting up REITs Asset acquisition by REITs & Financing

All Rights Reserved

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Business

Core Business #1: REITs Management ARA is currently managing six public-listed REITs, namely, Fortune REIT (SGX-ST & SEHK listed with retail assets in Hong Kong), Suntec REIT (SGX-ST-listed with office and retail assets in Singapore), Prosperity REIT (SEHK listed with office and industrial assets in Hong Kong), CACHE Logistics Trust (SGX-ST listed with industrial assets in Singapore), AmFIRST REIT (Bursa Malaysialisted with office assets in Malaysia) and Hui Xian (SEHK listed with office asset in China). As of 31 Dec 2011, real estate assets under management were S$14.9 billion. The Table 1 below summarised the Asset Under Management (AUM) by ARA Asset Management.

REITs Exchange Type Property Valuation as of Dec 2011 Property Locations Fortune Singapore Retail HK$16.4 billion Hong Kong Suntec Singapore Retail & Office Prosperity Hong Kong Industrial & Office HK$6.99 billion Hong Kong CACHE Logs Singapore Industrial AmFIRST Malaysia Office RM1.16 billion Malaysia Hui Xian Hong Kong Office RMB31.4 billion China

S$7.7 billion

S$843 million

Singapore

Asia Pacific

Table 1 Asset Under Management by ARA

From the Table 1, prior to the listing of ARA in 2007, it is only managing 4 REITs. Over the span of 3 years, ARA has new REITs under its umbrella - Cache REITs (2010) and Hui Xian (2011).

2003 Fortune

2004 Suntec

2005 Prosperity

2006 AmFIRST

2010 CACHE

2011 Hui Xian

Figure 1 REITs - Year of IPO

REIT management fees, comprising base and performance fees, are derived from the management of REITs and are determined based on the value of the real estate assets or total gross assets under management and net property income of the REITs managed, respectively. These fees are recognised on an accrual basis. Source of Revenue is from Annual Report and it can be summarised in Table 2 below.

Revenue Recognition #1 Fees Rate Base fees (Gross Property Value) 0.3% to 0.4% p.a. of property values Performance / variable fees (Net Property 3% to 4.5% p.a. of Net Property Income Income) Acquisition fees (1% of property value) Acquisition / divestment fees (Gross Property Divestment fees (0.5% of property value) Value) Table 2 Summary of Revenue Recognition from REITs management Remarks Recurring Recurring One-off

All Rights Reserved

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Business

Core Business #2: Private Real Estate Funds ARA is also managing real estate funds investing in Asia. These funds are unlisted and privately managed by ARA with AUM of S$4.9 billion as at 31 Dec 2011. There are 3 private real estate fund divisions under its wings which summarised in the table below. The Group is currently forming a new fund ARA Asia Dragon Fund II which targeted to raise fund size of US$1 billion.

ARA Asia Dragon Fund Asia All kind of assets such as Residential, retail, office and green field (tie up with developer who has lack of capital to develop empty plot) in Real Estate Public Pension Funds Foundations Global Institutional Investors ARA Harmony Fund Singapore Retail and Office in Real Estate APN Property Group1 Australia Real estate securities funds, private equity real estate funds, a listed REIT and unlisted property funds

Investment Region Focus

Fund Source / Investors

ARA Asset Management holds 80% in Suntec Convetion & Exhibition. The other 20% is held by Suntec REITs S$400m (Gross Asset Value) -

Strategic shareholder between ARA (14.1%) and APN

Fund Size Lifespan

US$1.1 billion (Committed Capital) 7 Years (mature in 2014)

Table 3 Summary of Private Real Estate Funds

Portfolio management fees are derived from the management of private real estate funds and are determined based on committed capital, portfolio value or invested capital. These fees are recognised on an accrual basis. Performance fees relate to fees earned in relation to private real estate funds where the returns of the private real estate funds exceed certain specified hurdles. Acquisition fees relate to fees earned in relation to the acquisition of properties by REITs and private real estate funds managed and also include corporate financial advisory fees earned in relation to the acquisition of properties by REITs. The acquisition fees are determined based on the value of the properties acquired and are recognised when the services have been rendered. Source of Revenue is from Annual Report and it can be summarised in the table below.

Revenue Recognition #2 Portfolio management fees Performance fees (IRR above hurdle) Fees Rate Arrangement fees: 1% - 2% of committed capital Management fees: 0.25% p.q. or 1% p.a. of property value 15% of the annual IRR in excess of 13.0% 40% of the annual IRR in excess of 17.0%. Remarks One-time Recurring One-off One-off

Return on seed capital Table 4 Summary of Revenue Recognition from Funds Management

1

Listed in Australian Securities Exchange 8 INVESTMENT PTE LTD

All Rights Reserved

ARA ASSET MANAGEMENT

| Business

Core Business #3: Real Estate Management Services The third division is mainly involved in operations, sales and marketing services provider & consultant for convention, exhibition, meeting and event facilities. The properties under their management are Suntec Singapore International Convention and Exhibition Centre, it is one of the leading MICE venues in the world who won over 3 awards for consecutives Best Convention & Exhibition Centre. Suntec City Mall and Offices are under the management of APM Property Management. Real estate management service fees are derived from the Figure 2 Source: Company provision of property management services and convention and exhibition services rendered. These fees include marketing services fees, advertising fees and commissions and promotion commissions, and are recognised on an accrual basis. Source of Revenue is from Annual Report and it can be summarised in the table below.

Revenue Recognition #3 Property management fees (Property Management Fees) Fees Rate 3% per annum of gross revenue (excluding commissions) Convention & Exhibition Service fees Advisory/Consultation fees Table 5 Summary of Revenue Recognition from Management Services Remarks Recurring

Recurring One-off

Core Business #4: Corporate Finance Advisory Service This division currently provides advisory services on asset acquisitions to the REITs managed by the Group and advises the Group on the establishment of REITs, partnerships and joint venture as well as mergers and acquisitions. This division comes in whenever there is transaction of properties. Corporate finance advisory fees are determined based on contracted terms and are recognised when the services have been rendered. Source of Revenue is from Annual Report and it can be summarised in the table below.

Revenue Recognition #4 Remarks One-off Advisory/Consultation fees Table 6 Summary of Revenue Recognition from Corporate Advisory

All Rights Reserved

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Business

Corporate Structure

ARA Asset Management

Real Estate Management Services

REITs

Private Real Estate Funds

Corporate Finance Advisory

ARA Asset Management (Fortune) Limited 100% ARA Trust Management (Suntec) Limited 100% ARA Asset Management (Prosperity) Limited 100%

ARA Asia Dragon Fund 1 100%

APM Property Management 100%

ARA Financial Pte Ltd 100%

ARA Asia Dragon Fund 2 100%

Suntec Singapore Int. & Exhibition Services Pte Ltd 100%

ARA Harmony Fund 80% REITs Am ARA REIT Managers is 70% owned by Am Bank and ARA Asset. ARA-CWT Trust Management (Cache) is 40% owned by CACHE REIT. Hui Xian Asset Management is 70% owned by Hui Xian REIT. Private Real Estate Funds ARA Harmony is 20% owned by Suntec REIT. APN Property Group is a public listed company where ARA held 14.1% interest as of Dec 2010.

Am ARA REIT Managers Sdn Bhd 30%

APN Property Group 14.1%

ARA-CWT Trust Management (Cache) Limited 60%

Hui Xian Asset Management Limited 30%

Figure 3 ARA's Corporate Structure

All Rights Reserved

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Business

Under the REITs segment, Figure 3, the group has an structure in such; Each REIT has its own manager, which is also a wholly owned subsidiary of ARA. For instance, Suntec REIT is managed by ARA Trust Management (Suntect) Limited, Prosperity REIT is managed by ARA Asset Management (Prosperity) Limited (Prosperity), etc.

Real Estate Assets Under Management by Region 2010 of S$16.2 billion

4% 18% Singapore Hong Kong 53% 25% China Malaysia

Figure 4 Asset Under Management by Region in 2010

From the Table above, in China, the breakdown of the properties under management are scattered across Beijing, Dalian, Tianjin, Nanjing, Shanghai and Guangzhou. As for Malaysia, the properties are in Kuala Lumpur and Malacca. P.S. No data can be found on FY2011. Therefore, FY2010 is used instead

All Rights Reserved

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Business

Financial Highlights in 2010

Sales by Segment 2010

7% 11% REIT Private Real Estate Funds 53% 29% Real Estate Management Corporate Finance Advisory

EBIT by Segment

REIT 4% 9% Private Real Estate Funds 56% Real Estate Management Corporate Finance Advisory

EBIT margin by Segment

70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% 65.6% 65.3% 50.9% 40.5%

31%

Figure 5 Financial Highlights

From the Figure 5, nearly half of the revenue and profit in 2010 is mainly from REITs management division. On top of that, the margin earns are very high, not only on one division, but across the other three divisions. Corporate Finance Advisory contributed the least to the groups revenue and profit. Nevertheless, all the divisions are very profitable at Earnings Before Income Tax margin around 40% to 65%. P.S. No data can be found on FY2011. Therefore, FY2010 is used instead

All Rights Reserved

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Business

Financial Highlights in 2006 - 2010

Historical Segment by Sales

100 90 80 70 60 50 40 30 20 10 0 Corporate Finance Advisory Real Estate Management Private Funds REIT US$ mil

2006 0.2 0 0.7 17.7

2007 2.1 0 10.2 28.9

2008 3.3 0 19.2 30.3

2009 4.7 0.8 23.9 33.8

2010 5.8 10 25.2 46.6

Figure 6 Historical Sales by Segment

Segment by Sales (%)

120.0% 100.0% Percentage 80.0% 60.0% 40.0% 20.0% 0.0% Corporate Finance Advisory Real Estate Management Private Funds REIT 2006 1.0% 0.0% 3.9% 95.1% 2007 5.1% 0.0% 25% 70.1% 2008 6.2% 0.0% 36% 57.5% 2009 7.5% 1.3% 38% 53.5% 2010 6.7% 11.4% 29% 53.2%

Figure 7 Percentage Sales by Segment 2006 - 2010

Referring to the Figure 6, REITs management and real estate funds are the two biggest contributors when it was listed in 2007. Whereas, with the intention to move into different REITs value chain, the management start to venture into property management for Suntec Convention & Exchibition Centre in 2009. In the Figure 7, one can see that the percentage of each individual segment growth with respect to their revenue in that year. Property management only starts to grow in 2009. Whereas, Corporate Finance is the smallest contributor to the group revenue as it is the front end for them to become the REITs manager if it is successfully start up a REIT by third party.

8 8 INVESTMENT PTE LTD

All Rights Reserved

ARA ASSET MANAGEMENT

| Business

Competitive Advantage

Niche #1: Strong management track record in managing real estates Since the inception of the ARA Asset Management, the group has strong growth in Asset Under Management from 2003 2011 of all the divisions. It successfully establishes and managing REITs and brought them to listing. The growth has been significant from S$600 million to S$20.2 billion assets or growing at compounded growth rate of 55% (CAGR). Of all these assets, it is very profitable under their stewardship. Therefore, raising more private real estate funds or managing more new REITs, it should not be a problem to them. As a result, the base fees, performances fees and acquisitions fees are likely to increase as well. This translates to more profit to the shareholders.

Figure 8 Total Asset Under Management from 2003 to 2011 (Source: Company)

Niche #2: Good working relationship with Cheung Kong It has strong business relationship with the Cheung Kong Group as Cheung Kong is one of their founding shareholders and one of the largest property developers of residential, commercial and industrial properties in Hong Kong. Tapping on Cheung Kongs strong network, the group has access to their portfolio of real estates properties in Asia. A lot of business opportunities will be available in the future such as any REITs being established by Cheung Kong are likely to be managed by ARA since it is also the shareholder of the ARA Asset Management. Comments on Competitive Advantage Other than good working relationship with Li Ka Shing, the group has also strong relationship with institutional investors as such the group has access to sovereign funds and funds from the bank. This will allow us them to raise funds more easily in the future.

All Rights Reserved

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Business

Niche #3: High Percentage of Recurring Income from its core businesses

Figure 9 Percentage of Recurring Income (Source: Company)

From Figure 9, ARA has a high percentage of around 71% that its income is recurring. Through the REITs management business, it has base fees and performance fees. As fund manager managing

private real estate equity, they are also entitled to the management fees. On top of that, Convention & Exhibition Service fees from managing Suntec Singapore International Convention and Exhibition

Centre. It allows them to have feasibility earnings which makes the prediction of future cash flow much more accurate (as compared to the project based company).

All Rights Reserved

10

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Business

Business Risks

Risk #1: Real Estate Risks As real estate industry is affected by factors such as economic downturn, inability to renew leases, inability to collect rental and any defects of the buildings managed by them or changes in real estate cycles, it will affect value of the assets under their management and net property income. Moreover, other factors such as global market and economic climate may deteriorate from terrorism, political uncertainty and rising inflation rate. Therefore, it will affect their revenue and profitability. Risk #2: Ties with Cheung Kong Having the honour to work together with Cheung Kong is a blessing, but it is a double-edged sword. Once the relationship with Cheung Kong were to worsen, ARA is likely to be greatly affected since Fortune REIT and Prosperity REIT are sponsored by Cheung Kong. They might withdraw these REITs and change the manager. The success of ARA today is mainly contributed by this company with strong network through Li Ka Shing who is the owner of the Cheung Kong. Nevertheless, Cheung Kong has 15.6% stake in ARA. So, the chances are very slim. Early 2011, ARA announced that it has a new REIT, Hui Xian REIT, under its management. This is one of the REIT that is injected by Li Ka Shing. Risk #3: Strong Upcoming Competition With increase competition in the REITs management industry, the group is constantly facing pressure to reduce the fees. It happened in 2005 where the group waived the acquisition fees of a REITs managed by them. However, the group ceased the waiver system in 2007 and charging the fees according the new assets being acquired. One great advantage about ARA is that, all the REITs assets managed by them, the risks are bourned by unit holders. Technically, they do not need to gear up that much when acquiring new assets to its clients. In lay man term, unit holders provide the resource such as money, And ARA managers provide the skill, in return, they get higher fees when the AUM increases. Since the services provided to different countries on the REIT management and private real equity in countries like Malaysia, Hong Kong and Malaysia, the group is subjected to foreign exchange risks. There are other risks such country risks, regulations, political instability, etc. which are uncontrollable events. On regulation - With the recent K-REITs case on the acquisition of Ocean Financial Centre from its parent company Keppel Corp, critics say the acquisition price was too high with only 99 years old leasehold. To worsen the case, during the EGM, there was misalignment between units holders and REIT managers when the poll voting system was carried out (instead of show-hands system). It prompts the authority (MAS) to look at the REITs industry to further safeguard the interests of minority unitholders. The culprit, critics pointed out, was the incentive system for REITs. Should MAS revised the incentive system, ARA will be greatly affected where their main source of revenue is derived.

All Rights Reserved

11

8 INVESTMENT PTE LTD

ARA ASSET MANAGEMENT

| Business

Key Growth Driver

Growth Plan #1: Acquisition and Enhancing Assets through existing REITs REITs under their management will continue to seek acquisition, therefore, it will increase their asset under management which will directly increase their management fees. On every transaction, they are also entitled to acquisition fees. Growth Plan #2: Established of new private real estate funds Through its strong track record in managing private real estate funds, tt has potential for upside such as establishment of new private real estate funds in the future. When the fund performed, they are entitled to the base and performance fees in the form of profit participation. Recently, the group has set up a new fund called Asian Dragon Fund 2 securing US$400 million of capital commitment which they intend to increase the fund size to US$1 billion by 2012. Growth Plan #3: Establishment of new REITs Through this division, Corporate Advisory Finance Group, if ARA successfully established a new REIT to their clients, the chances for them to manage the new REIT are higher as compared to those REIT set up by other companies or by itself. Therefore, it will contribute to the revenue significantly as REITs set up are usually with assets of at least a billion dollar.

All Rights Reserved

12

8 INVESTMENT PTE LTD

ARA Asset management

| Management

Management

Board of Directors Profile

Justin Chiu Kwok Hung (Founder) Job Title Age : Chairman and Non-Executive Director : 61

Elected Since : July 2002 Experiences : More than 30 years of international experience in real estate industry, joined Cheung Kong Limited in 1997 and Executive Director since 2000. From 1979 to 1997, he is with Sino Land Company Limited and Hang Lung Group Limited and responsible for the leasing and property management in both companies (listed in Hong Kong)

Source: Company

Qualifications : Bachelor degrees in Sociology and Economics from Trent University in Ontario, Canada John Lim Hwee Chiang (Founder) Job Title Age : CEO and Executive Director : 55

Elected Since : July 2002 Experiences : 30 years experience in real estate. Independent Director of Techwah Industrial (Audit Committee). Qualifications : Bachelor of Engineering (First Class Honours) in Mechanical Engineering, a Master of Science in Industrial Engineering, as well as a Diploma in Business Administration, each from the National University of Singapore

Source: Company

One interesting facts about ARA Asset management is, the entire board of directors remain unchanged since its listing in 2007. It seems like the culture instills in the company is vibrant which motivates the member of the boards to stay with them and grow the company.

All Rights Reserved

13

8 INVESTMENT PTE LTD

ARA Asset management

| Management

Audit Committee Member Lee Yock Suan (Chairman) Non-Executive Director Lim How Teck Non-Executive Director Colin Stevens Russel Non-Executive Director Cheng Mo Chi Moses Non-Executive Director

Table 7 Audit Committee Member

Auditor is KPMG since its listing in 2007.

Comments on the Management, Audit Committee and Auditor The success of ARA today is mainly driven by John Lim (group CEO) where he paired up with Li Ka Shing to form the company in 2002. He was in the Singapores Riches Forbes list ranked #38 in 2010 with $200 million of net worth. You can rest assure that the financial numbers you are looking at are real results generated from its core businesses. This can be supported by the Audit committee member where all the members are outsiders (non-executive). Therefore, the chances are very minimal to fraud the data. In addition, its auditor remains unchanged since its listing. The attendance of all the board meetings is 100%!

Remuneration

Boards of Directors in the Remuneration Bands Name of Director S$500,000 and above John Lim $250,000 to below $500,000 Justin Chiu Below $500,000 Lee Yock Suan Lim How Teck Cheng Mo Chi Mose Colin Stevens Russel Salary Bonus (%) (%) 100 Fees (%) 100 100 100 100 100 Allowances and other Benefits (%) Total (%) 100 100 100 100 100 100

Table 8 Remuneration Bands in 2010

Referring the Table 8, the total compensation to the board of directors are estimated at $3 million. With respect to the profit generated by the boards is $63.8 million (4.7% of profit). It seems like boards are not overpaying themselves for making so much money as compared to a lot of companies out there. It is telltale sign that the boards are aligned with shareholders interest. One of the key reasons could he John Lim, CEO, has a 36.45 % stake in this company as of Dec 2010.

8 INVESTMENT PTE LTD

All Rights Reserved

14

ARA Asset management

| Management

Top Key Executives remuneration Total Compensation Bands in FY2010 S$500,000 to below S$750,000 S$250,000 to below S$500,000 Below S$250,000 Total Number of Employees 5 10 5 20

Table 9 Remuneration Band of Key Executives in 2010

In the Table 9, the losses of key executive managing the funds are severe. Therefore, executives name are confidential due to competitive conditions in the fund management industry. The best part is there is no share options issued as of Dec 2010.

Shareholding Statistic

No. 1 2 3 4 5 6 7 8 9 10 Name of Shareholder JL Investment Group Cheung Kong Investment Limited Citibank Nominees Singapore Pte Ltd DBS Nominees Pte Ltd HSBC (Singapore) Nominees Pte Ltd United Overseas Bank Nominees Raffl es Nominees (Pte) Ltd DBSN Services Pte Ltd Morgan Stanley Asia (Singapore) Securities Pte Ltd DBS Vickers Securities (S) Pte Ltd

Table 10 Shareholding Statistic 2010

No. of Shares 254,570,400 109,101,600 76,113,674 74,162,212 36,690,200 22,307,920 17,241,000 16,280,837 14,796,600 8,859,200

% 36.45 15.62 10.90 10.62 5.25 3.19 2.47 2.33 2.12 1.27

From the table above, John Lim (under JL Investment Group) has the highest stake of 36.45% in ARA Asset Management. This is one of the key reasons why he did not need to get high salaries. In addition, John Lim has a deem interest of 1 million shares which he held through his trust account, Citibank Nominees. Second runner up is Cheung Kong which Li Ka Shing also holds the stake in that company.

All Rights Reserved

15

8 INVESTMENT PTE LTD

ARA Asset management

| Management

Insider Trading

Table 11 Insider Trading from Jan 2010 to Jan 2011 (Source: ShareInvestor.com)

Comments on Insider Trading During the Europe debt crisis, John Lim has been buying back the shares through his personal funds. In the Table 11, he increased his stake from 36.99% to 37.27% which is equivalent to around $4 million in the month of Aug and Sept 2011! As the share price goes lower, he buys more. On 13 Jan 2012, John had a married deal with Ng Beng Tiong, Chief Executive Officer of ARA Private Funds, at a market price of S$1.25 per share. Another signs that shown John has confident in his own company in the future to come. (Take note: management buying back shares does not mean the company is undervalued, you will still need to calculate your own intrinsic value to determine the real value of a stock)

All Rights Reserved

16

8 INVESTMENT PTE LTD

ARA Asset management

| Number

Numbers

Income Statement

Revenue ($ mil)

150.0 100.0 50.0 0.0 2007 2008 2009 Revenue 2010 2011 62.1 70.0 86.3 112.5 122.8 40.0 20.0 0.0 16.2

COGS ($ mil)

30.8 19.2 21.9 33.8

2007

2008

2009

2010

2011

Cost of Goods Sold

Since they are a service firm, the Cost of Goods Sold (COGS) is mainly the manpower costs. Administrative expenses is taken instead, otherwise, COGS would be equal to zero. Revenue YoY increases by 18.85%, from S$62.1 million to $122.8 million which also sees the YoY COGS increases by 20.19% from S$16.2 million to S$33.8 million. Both of the figures grow in tandem except that COGS grow slightly faster by 2%.

Gross Profit ($ mil)

100.0 45.9 50.0 0.0 2007 2008 2009 2010 2011 50.9 64.4 81.7 89.0 15.0 10.0 5.0 0.0

SGA Expenses

10.5 6.6 9.9 7.8 6.7

2007

2008

2009

2010

2011

Gross Profit

Selling, General and Admin Expenses

Selling, General and Admin expenses (SGA) are mainly their operating lease expenses and other expenses which can be seen from the chart above is decreasing as compared to their increasing profit growth of 18% YoY (in tandem is revenue growth).

All Rights Reserved

17

8 INVESTMENT PTE LTD

ARA Asset management

| Number

Net Profit ($ mil)

100.0 50.0 0.0 2007 2008 2009 2010 Net Profit 2011 34.0 36.7 48.2 63.8 74.3 0.150 0.100 0.050 0.000 2007

EPS (cents)

0.058 0.063 0.083 0.091 0.097

2008

2009

2010

2011

Net Profit

EPS (cents)

Net Profit is growing proportionately at 21.58% YoY. In addition, EPS growth is at 1.72% YoY due to bonus shares issued 5-for-1. Excluding the bonus shares, EPS YoY would have been 21.58%. The growth is still in tandem with the groups revenue. ARA has quality earnings since its listing in 2007 till present.

Balance Sheet Statement

Cash ($ mil)

100.0 50.0 0.0 2007 2008 2009 2010 2011 74.5 41.9 42.3 46.2 57.3 30.0 20.0 10.0 0.0

Total Debts ($ mil)

19.7 19.3 18.6 19.4 0.4 2007 2008 2009 2010 2011

Cash ($ mil)

Total Debt ($ mil)

The group managed to raise S$75.6 million when it went IPO. It then moved on to deployed the cash to start up private real estate funds such as ARA Asia Dragon Fund which causes the cash to decline from $74.5 million in 2007 to 41.9 million in 2009. Nevertheless, the cash maintains at level above S$40 million for the past four years. Total Debts is around S$19 million since its listing. This loans secured is provided to Jadeline Capital Sdn. Bhd. to partly finance its acquisition of the units in AmFIRST REIT. Without that, ARA would have been debt-free given its strong cash flow generation in the past. The interests charged by bank are at 1% per annum which is relative low. As at Dec 2011, the loans drops to $0.4 million.

All Rights Reserved

18

8 INVESTMENT PTE LTD

ARA Asset management

| Number

Receivables ($ mil)

40.0 20.0 0.0 2007 2008 2009 2010 2011 24.8 16.1 22.5 26.4 30.6 30.0 20.0 10.0 0.0

Payables($ mil)

16.1 17.8 11.1 20.2 17.3

2007

2008

2009

2010

2011

Receivables ($ mil)

Payables($ mil)

Retained Profit ($ mil)

200.0 99.9 100.0 0.0 2007 2008 2009 2010 74.7 171.5 126.9

187.4 200.0 100.0 0.0 2011

Total Equity ($ mil)

172.9 101.1 128.0 75.9

188.9

2007

2008

2009

2010

2011

Retained Profit ($ mil)

Total Equity ($ mil)

Total Assets ($ mil)

300.0 200.0 100.0 0.0 2007 2008 2009 2010 2011 141.5 108.4 169.1 221.6 214.6 60.0 40.0 20.0 0.0

Total Liabilities ($ mil)

40.5 32.8 41.4 48.1 25.0

2007

2008

2009

2010

2011

Total Assets ($ mil)

Total Liabilities ($ mil)

Receivables are rising at 5.39% YoY from 2007 to 2011 with comparison to revenue which growing at 18.85%. In other words, ARA has been efficient in collecting the money from their clients as soon revenue is recognised. Total Equity and Retained Profit increased by approximately 16.9% YoY. The network of the company has been growing pretty soundly in the past as part of the earnings are retained back to finance the growth. With the total assets increased by as much as 10.97% YoY, ARA is reducing their liability from $40.5 million to $25 million.

All Rights Reserved

19

8 INVESTMENT PTE LTD

ARA Asset management

| Number

Cash Flow Statement

60 50 40 $ million 30 20 10 0 CF CAPEX FCF

Cash Flow Generation

2007 9.87 0.32 9.55

2008 52.23 0.32 51.91

2009 47.96 0.65 47.31

2010 56.07 1.02 55.05

2011 49.4 0.44 48.96

One of the greatest strength of ARA is lower capex is required to maintain and grow the business. This makes the group a CASHCOW generator to the shareholders.

80.00 60.00 $ million 40.00 20.00 0.00 2007 34.01 22.12

Dividend to Net Profit ($ mil)

63.81 48.2 36.73 25.67 27.94 33.53

74.30

38.42

2008 Total Dividend

2009 2010 Net Profit to Shareholders

2011

The group also has been paying high dividend of S$74.3 million in 2011 against its profit attributable to shareholders of S$38.4 million. Its a growing trend. As such, ARA also retained nearly 40% - 50% of its profit to grow the business as part of their seed capital in any new investment.

All Rights Reserved

20

8 INVESTMENT PTE LTD

ARA Asset management

| Number

Dividend ($)

60.00 40.00 20.00 0.00 2007 2008 2009 2010 2011 22.12 25.67 27.94 33.53 38.42

Dividend per Share (c)

0.060 0.040 0.020 0.000 2007 2008 2009 2010 2011 0.038 0.044 0.048 0.048 0.050

Dividend ($)

Dividend per Share (cents)

The dividend per share (including bonus issues) also grows steadily at 14.8% YoY in the past five years. In other words, $1000 dividends received per year will grow into approximately $1500 within 4 years!

Financial Ratios

Gross Profit & Net Profit Margin

80.00% 70.00% Profitablity Ratio 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% 2007 2008 Gross Margin 2009 Net Margin 2010 2011 73.86% 54.78% 72.60% 52.44% 74.66% 55.86% 72.61% 56.71% 72.47% 60.52%

Gross profit and net profit margin is maintained 72% and 55%, respectively. ARA is well-managed in term of its profitability margin. It is very consistent!

All Rights Reserved

21

8 INVESTMENT PTE LTD

ARA Asset management

| Number

Debt to Equity (x)

0.30 0.20 0.10 0.00 2007 2008 2009 2010 2011 0.20 0.25 0.15 0.11 0.00 0.00 4.00 2.00

Cash Ratio (x)

3.57 3.01 1.85 0.97 2.33

2007

2008

2009

2010

2011

Debt to Equity (x)

Cash Ratio (x)

Decreased in cash ratio, in 2011, is mainly due to a loans repayable in full of RM44.9 million at maturity in May 2011. This is the loan that used to finance acquisition of units in AmFIRST REIT and fully paid as at 30 June 2011. In the latest result, the cash ratio has bounced back to 2.3x.

Current Ratio (x)

6.00 4.00 2.00 0.00 2007 2008 2009 2010 2011 5.28 4.16 3.68 1.53 4.58

Return on Equity (%)

60.0% 40.0% 20.0% 0.0% 2007 2008 2009 2010 2011 48.4% 33.7% 37.6% 36.9% 39.3%

Current Ratio (x)

Return on Equity (%)

In 2010, Current Ratio decreases which also due to the RM44.9 million debts (fully paid). Return on Equity has been consistently high at 33.7% and 39.3% in 2007 and 2011, respectively. A stable business which generated consistent return back to shareholders.

Return on Asset (%)

40.0% 20.0% 0.0% 2007 2008 2009 2010 2011 33.9% 24.0% 28.5% 28.8% 34.6%

CAPEX to Profit (%)

3000.0% 2000.0% 1000.0% 0.0% 2007 2008 2009 2010 2011 2020.0% 1776.0% 1734.0% 1613.0% 1106.0%

Return on Asset (%)

CAPEX to Profit (%)

With high ROE, ARA also has high Return on Assets above 24% for the past five years. Moreover, CAPEX to Profit ratio has been relatively low or fluctuates around 20%.

22 8 INVESTMENT PTE LTD

All Rights Reserved

ARA Asset management

| Number

Debt to Net Profit (x)

1.00 0.50 0.00 2007 2008 2009 2010 2011 0.58 0.53 3.00 0.39 0.30 0.01 2.00 1.00 0.00

Debt to Cash Flow (x)

2.00 0.37 0.39 0.35 2010 0.01 2011

2007

2008

2009

Debt to Net Profit (x)

Debt to Cash Flow (x)

Debt to Net Profit and Cash Flow is very safe which requires them not more than 5 months to fully paid the total debts using its cash flow and profit.

Payable Days

300.00 200.00 100.00 0.00 2007 2008 2009 2010 2011 245.13 258.58 240.61 224.78 202.69 150.00 100.00 50.00 0.00

Receivable Days

95.34 106.39 81.48 79.19 84.72

2007

2008

2009

2010

2011

Payable Days

Receivable Days

Payables days, mainly due to the accrual of staff-related expenses and strategic advisors fee, are as high as 224 days. And Receivables are at 80 days. The mains reason could be due to lower COGS (service company) which resulting the number of payables and receivables to be very high.

Inventory Days

1.00 0.50 0.00 0.00 2007 2008 2009 2010 0.00 0.00 0.00

Inventory to Sales (x)

100.0% 50.0% 0.0% 0.0% 2007 2008 2009 2010 0.0% 0.0% 0.0%

Inventory Days

Inventory to Sales (x)

Inventory is zero as there is no inventory needed.

All Rights Reserved

23

8 INVESTMENT PTE LTD

ARA Asset management

| Number

Dividend Ratio

80.00% Dividend Payout Ratio 70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% 2007 2008 2009 2010 Dividend Yield 2011 3.20% 65.03% 7.60% 11.03% 10.00% 57.96% 52.54% 3.81% 51.70% 8.00% 6.00% 3.31% 4.00% 2.00% 0.00% Dividend Yield 69.89% 12.00%

Dividend Payout Ratio

There is no dividend policy in this company. However, historically, the group has been paying out more than 50% of the profit back to the shareholders as dividends.

All Rights Reserved

24

8 INVESTMENT PTE LTD

ARA Asset management

| Industry

Industry

Value Chain of REITs

Figure 10 Structure of REITs (Source: Value Investing in REITs book by Attlee Hue)

Unitholders are the real owner of the REITs except that they tapped on the REIT managers expertise to manage the REITs for them. Referring to the Figure 10, Structure of REITs, ARA Asset Management is the REIT Manager. What the group does is to provide the management services to the related REITs assets for the REITs under their management and charge them management fees such as acquiring and divesting of assets or asset enhancements to optimise the full value of the assets and increase the accretive yield which in turn higher profit generated to shareholders. For those who do not under REITs, or not your circle of competence, I strongly suggest you to attend REITs conducted by Attlee before looking at this company. Currently, REITs are undervalued which one could easily get an attractive yield of 7% to 10%!

All Rights Reserved

25

8 INVESTMENT PTE LTD

ARA Asset management

| Industry

Competitors

Most of the REITs management companies are privately held which most of the REITs do. Hence, there are no listed-peers to do direct comparison of their financial health in Singapore. One way to ascertain whether ARA, as REIT manager, performance is up to market standard is to compare them with its peers. In the Table 12 below, management fees paid to ARA of the 6REITs are highlighted in grey color. REITs Type Currency Net Property Income (NPI) 298.98 93.03 67.31 56.53 119.57 193.09 130.36 85.27 399.15 80.05 319.53 77.22 29.87 73.63 115.07 101.35 41.36 212.53 Managem Property ent Fees Valuation (Base + Performa nce) 18.94 5475.4 12.47 1906.35 15.07 1025.63 4.93 1024 11.98 2826.36 27.93 6490 12.97 2654.46 6.42 1082.04 36.03 7271.5 6.47 1439 21.57 15688 4.9 1215.09 3.03 612.8 7.14 1302.56 10.16 1787.1 8.92 2577.62 3.35 28.63 744 5934 Management Fees (Base + Performance) / Property Valuation 0.35% 0.65% 1.47% 0.48% 0.42% 0.43% 0.49% 0.59% 0.50% 0.45% 0.14% 0.40% 0.49% 0.55% 0.57% 0.35% 0.45% 0.48% Property Yield

CapitaComm Frasers Comm K-REIT AmFIRST Hui Xian2 MapletreeCom SuntecReit Starhill Gbl LippoMalls CapitaMall FrasersCT Fortune Reit CapitaRChina First REIT PLife REIT CDL Htrust AscottREIT CACHE Prosperity

Office Office Office Office Office Retail & Office Retail & Office Retail & Office Retail Retail Retail Retail Retail Healthcare Healthcare Hospitality Hospitality Industrial Industrial & Office

S$ million S$ million S$ million RM million RMB million S$ million S$ million S$ million S$ million S$ million S$ million HK$ million S$ million S$ million S$ million S$ million S$ million S$ million HK$ million

5.46% 4.88% 6.56% 5.52% 4.23% 2.98% 4.91% 7.88% 5.49% 5.56% 2.04% 6.36% 4.87% 5.65% 6.44% 3.93% 5.56% 3.75%

Table 12 Management Fees and Property Yield (%) as of Dec 2010

Insufficient data to calculate as it is only listed in Early 2011. 8 INVESTMENT PTE LTD

All Rights Reserved

26

ARA Asset management

| Industry

Aside real estate private funds, they are few public listed companies in Singapore as stated below. Global Investments Limited Managed by ST Asset Management Ltd (STAM), wholly owned by Temasek Limited Investment in Operating Lease Assets, Loan Portfolio and Securitisation Assets and Alternative Assets

Macarthurcook prop Sec Fund Diversified, listed property fund that invests in a range of listed property trusts, unlisted property trusts and listed property-related companies registered in Australia. Investments in over 1,200 underlying properties under management across office, retail and industrial sectors as well as non-traditional sectors like healthcare and childcare. The properties are located in Australia, the United States, Europe and New Zealand.

Year 2010 ARA Asset Mgmt Macarthurcook Global Investments

Exchange SGX SGX SGX

Consistent (5 Years) Yes No No

Market Cap(S$) 768 m 26.5m 76.4m

PTB 5.38 x 0.36x 0.63 x

Debt/Equity Ratio 0.11x 0.57x 0.15x

Table 13 Peers Comparison (Real Estate Funds only)

Comparison in the Table 13, is not an apple-to-apple comparison but it serves as a guide on how fund Management Company is performing in the market. Macarthurcook is the closest peers in their private real estate fund investing in Australia. The financial ratios being compared are not applicable as most of them are the fund management companies. There, the ranking system is also removed.

All Rights Reserved

27

8 INVESTMENT PTE LTD

ARA Asset management

| Summary

Valuation

Historical Growth Rate (CAGR)

Figure 11 Historical CAGR (2006 - 2011)

From the historical CAGR, ARA has shown a strong growth momentum since its listing with the compounded growth rate at nearly 20% for the past three years in revenue, profit and cash flow. Even in 08/09 crisis, they are not affected by economic downturn.

Historical Share Price

Figure 12 Historical Share Price from Nov 2007 Apr 2012 '(Source: Yahoo!Finance)

All Rights Reserved

28

8 INVESTMENT PTE LTD

ARA Asset management

| Summary

Discounted Earnings Model

IPO Price: S$1.15 IPO Market Cap: S$585 million Year Historical EPS Net Cash per Share Book Value per Share 20103 $0.132 $0.038 $0.246 2011 $0.097 $0.052 $0.234

Table 14 Datas used to compute the Intrinsic Value

Figure 13 Discounted Earning Model

PE / PEG / PTB

Figure 14 Other Valuation Ratios In the Figure 13, as of Apr 2012, the Intrinsic Value is around $1.20 which calculated based on 8% growth rate. With that, using the share price of $1.38, the margin of safety is negative or overvalued by 26%. For investors who like to include cash per share in the calculation, the Intrinsic Value is S$1.27or slightly overvalued by 18%. Referring to the Figure 14, ARA is trading at 14 times against its FY11s earnings. In addition, PTB and PEG ratio is 5.6x and 1.78x, respectively. It seems like the market has slightly higher expectation on ARA with P/FCF of 21x. Even though, ARA is trading at around of their IPO price, one must understand that there are few bonus issues (stock-split) given to the shareholders without raising additional capital in the past.

Based on 698.472 million of shares as of Dec 2010 8 INVESTMENT PTE LTD

All Rights Reserved

29

ARA Asset management

| Summary

Analytical Summary

Business If I can summarise this company into a word, it will be stable. A very stable business where the management collects the fees from managing properties, be it publicly or privately. Aside to that, the investments are allocated across the Southeast Asia region which poses a very stable portfolio under their stewardship. Personally, I feel that this company can be treated as a blue chip company with nearly 70% of their revenue is recurring! In an article interviewed with Straits times, John mentioned that, internally, ARA planned to double its AUM in the next five years. Management It is obvious that the management put shareholders interest first. First, CEO has stake of 36% as of Dec 2010. Through his big stake in ARA, he is not going for fanciful pays as shown in the remuneration band, but rather he rewarded himself through dividends. As a shareholder, you will benefit from it as well. Secondly, the management has strong track record in real estate industry since its start up in 2002. Its a success story and went through the economic cycles. In addition, it is also backed by Cheung Kong which billionaire investor, Li Ka Shing. Interestingly, all the management in the boards stays the same since its IPO in 2007. The culture of the company is likely to be strong that motivates them to stay and grow together with the company. Number It is so strong that, during its growing state, it doesnt need any additional capital from shareholders (except bonus shares issued) as compared to other growth companies need to raise additional capital to fund the massive growth. However, the group can fund internally through its cashflow generation, cash cow! On top of that, almost all the financial ratios such as ROE, ROA, CAPEX ratio, Net Profit Margin speak by itself, SUPERB result! Industry As most of the REITs manager is privately held, it is difficult to do the comparison. There is less competitors in the industry except those are held privately. They are one of the largest REIT managers in Asia (excluding Japan) who operating in the niche market. Valuation In the similar interview with ST, John said The minimum we should be able to do though is to grow AUM by an average of S$2billion a year for the next five years. That translates into 8% YoY growth. Therefore, my own intrinsic value is around $1.20 to around $1.30 inclusive of net cash per share at estimated growth rate of 8%. This is the stock which exactly fits the criteria of Warren Buffetts quote- "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." Though the PE suggests 14x, I believe the future earnings of ARA is much more predictable than project-basis companies where one can see the amount of free cash flow being generated since IPO. Its unbelievable! In my opinion, a wonderful stock would hardly sell at undervalued price.

All Rights Reserved

30

8 INVESTMENT PTE LTD

You might also like

- A Study ON "Working Capital Management" AT Sterlite Technologies LTDDocument55 pagesA Study ON "Working Capital Management" AT Sterlite Technologies LTDZankhana PatelNo ratings yet

- Analysis of Financial StatementsDocument18 pagesAnalysis of Financial StatementsEasymoney Usting100% (1)

- Financial and Managerial Accounting For Mbas 4th Edition Easton Test Bank 191001163059Document32 pagesFinancial and Managerial Accounting For Mbas 4th Edition Easton Test Bank 191001163059josh100% (1)

- THESISDocument56 pagesTHESISbless erika lendroNo ratings yet

- Chapter 5Document37 pagesChapter 5Sherlyn MamacNo ratings yet

- Ar 2011Document112 pagesAr 2011centaurus553587No ratings yet

- Annual Report 2011Document127 pagesAnnual Report 2011Nooreza PeerooNo ratings yet

- Proposed Divestment of 9 Bukit Batok Street 22Document3 pagesProposed Divestment of 9 Bukit Batok Street 22JoshKernNo ratings yet

- Makalah Tentang Asset (Bahasa Inggris)Document5 pagesMakalah Tentang Asset (Bahasa Inggris)Ilham Sukron100% (1)

- A Study On The Financial and Operational Efficiency of Sakthi Finance LimitedDocument88 pagesA Study On The Financial and Operational Efficiency of Sakthi Finance LimitedmaheswariNo ratings yet

- Alset International LimitedDocument13 pagesAlset International LimitedSieng MenghongNo ratings yet

- 顺丰控股:2018年年度报告(英文版) PDFDocument281 pages顺丰控股:2018年年度报告(英文版) PDFHoward DalioNo ratings yet

- Executive Summary ReportDocument26 pagesExecutive Summary Reportsharan ChowdaryNo ratings yet

- CMT Ar 2008Document176 pagesCMT Ar 2008Sassy TanNo ratings yet

- Lion Asiapac Limited: A Wright Investors' Service Research ReportDocument44 pagesLion Asiapac Limited: A Wright Investors' Service Research Reportinsideout123No ratings yet

- Angel Broking ProjectDocument35 pagesAngel Broking ProjectAnand VyasNo ratings yet

- Wealth Management ReportDocument41 pagesWealth Management Reportagrawal.ace9114No ratings yet

- Financial Statement Analysis of Ashok Leyland Limited, IndiaDocument9 pagesFinancial Statement Analysis of Ashok Leyland Limited, IndiaShubham NamdevNo ratings yet

- Annual Report 2010-11 APILDocument140 pagesAnnual Report 2010-11 APILraju4444No ratings yet

- A Synopsis On: Submitted To: Submitted byDocument6 pagesA Synopsis On: Submitted To: Submitted byHimanshu BhutnaNo ratings yet

- Fundamental Analysis of Iron and Steel Industry and Tata Steel (Indiabulls) ...Document77 pagesFundamental Analysis of Iron and Steel Industry and Tata Steel (Indiabulls) ...chao sherpa100% (1)

- Religare Asset Management: June 2012Document37 pagesReligare Asset Management: June 2012Navjyotsingh JagirdarNo ratings yet

- Equity ResearchDocument84 pagesEquity Researchtulasinad123100% (1)

- Factor InvestingDocument16 pagesFactor InvestingRicardo BregaldaNo ratings yet

- Portfolio ManagementDocument43 pagesPortfolio ManagementNiket DattaniNo ratings yet

- Vypracované Témy Na Odbornú Skúšku Z Cudzieho Jazyka - Anglický JazykDocument25 pagesVypracované Témy Na Odbornú Skúšku Z Cudzieho Jazyka - Anglický Jazykvo559emNo ratings yet

- Fortune 2010Document138 pagesFortune 2010Bryan LiNo ratings yet

- AppleDocument75 pagesAppleAbhisek MohantyNo ratings yet

- SPC ArticleDocument3 pagesSPC ArticleThanapoom BoonipatNo ratings yet

- Financial Statement Analysis 2019Document28 pagesFinancial Statement Analysis 2019ALPASLAN TOKERNo ratings yet

- SIFMA Insights:: US Equity Capital Formation PrimerDocument47 pagesSIFMA Insights:: US Equity Capital Formation PrimermayorladNo ratings yet

- Pakistan's First Successful Launch of A Real Estate Investment Trust-Dolmen City (REIT) - (Shariah Compliant Rental REIT Scheme)Document18 pagesPakistan's First Successful Launch of A Real Estate Investment Trust-Dolmen City (REIT) - (Shariah Compliant Rental REIT Scheme)waqar mansoorNo ratings yet

- Op Ales Que Singapore RoundtableDocument25 pagesOp Ales Que Singapore RoundtableOpalesque PublicationsNo ratings yet

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingNo ratings yet

- Austrade - Investment Management Industry in AustraliaDocument47 pagesAustrade - Investment Management Industry in Australiappt46No ratings yet

- Rea Group Ltd. ReportDocument8 pagesRea Group Ltd. ReportAnkit BhattraiNo ratings yet

- FADocument46 pagesFANishant JainNo ratings yet

- TCS 2010 AnalysisDocument22 pagesTCS 2010 AnalysisDilip KumarNo ratings yet

- Accounting PrincipleDocument22 pagesAccounting PrincipleCrystalPingNo ratings yet

- Strategic Business Reporting - UIA20502J: Unit 3Document22 pagesStrategic Business Reporting - UIA20502J: Unit 3MohanrajNo ratings yet

- Thesis Ratio AnalysisDocument8 pagesThesis Ratio Analysisclaudiabrowndurham100% (2)

- Stanlib Fahari I-Reit Note 04112015 PDFDocument3 pagesStanlib Fahari I-Reit Note 04112015 PDFGeorgeNo ratings yet

- Investment Management Industry in AustraliaDocument48 pagesInvestment Management Industry in AustraliaStephen John-Michael EmmanuelNo ratings yet

- International Financial ManagementDocument20 pagesInternational Financial ManagementKnt Nallasamy GounderNo ratings yet

- Real Estate Investment Trust (Reit)Document15 pagesReal Estate Investment Trust (Reit)Norain Md TarmiziNo ratings yet

- Ascend Hedge Fund Investment Due Diligence Report 0811redactedDocument17 pagesAscend Hedge Fund Investment Due Diligence Report 0811redactedJoshua ElkingtonNo ratings yet

- RenataDocument48 pagesRenataTheAgents107No ratings yet

- Apex Tannery Limited: Submitted To: Md. Hashibul HassanDocument18 pagesApex Tannery Limited: Submitted To: Md. Hashibul Hassananon_294717796No ratings yet

- Introduction To Financial Statements - Views On News From EquitymasterDocument4 pagesIntroduction To Financial Statements - Views On News From EquitymasterPrakash JoshiNo ratings yet

- Assignment 2: Company Name: Tata Consultancy ServicesDocument15 pagesAssignment 2: Company Name: Tata Consultancy ServicesPooja talrejaNo ratings yet

- Spice Jet Consultancy ReportDocument27 pagesSpice Jet Consultancy ReportNitin Lahoti100% (1)

- Finibrain Sip ReportDocument36 pagesFinibrain Sip Reportaruna puppalaNo ratings yet

- Financial Analysis of Singer (Sri Lanka) PLC For The Financial Years From 2012-2016Document22 pagesFinancial Analysis of Singer (Sri Lanka) PLC For The Financial Years From 2012-2016Shyamila RathnayakaNo ratings yet

- Original Research Paper Commerce: A Study On Financial Performance Analysis of Indian Tobacco Corporation LimitedDocument4 pagesOriginal Research Paper Commerce: A Study On Financial Performance Analysis of Indian Tobacco Corporation Limitedemmanual cheeranNo ratings yet

- A Project Report On Ratio Analysis at Il&Fs Invest Smart Mba Project FinanceDocument88 pagesA Project Report On Ratio Analysis at Il&Fs Invest Smart Mba Project Financesatish pawarNo ratings yet

- Finance ProjectDocument58 pagesFinance ProjectVijaya ThoratNo ratings yet

- Draft Treasury & Investment Manual of AsasahDocument39 pagesDraft Treasury & Investment Manual of AsasahMuhammad MinhajNo ratings yet

- A Project Report On Analysis of Stock Price Movement at ANAGRAM STOCK BROKING LTDDocument60 pagesA Project Report On Analysis of Stock Price Movement at ANAGRAM STOCK BROKING LTDBabasab Patil (Karrisatte)0% (1)

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Kotak International REIT FOF: India's First Global REIT Fund of FundDocument27 pagesKotak International REIT FOF: India's First Global REIT Fund of FundVinit ShahNo ratings yet

- Determinant Factors of Profitability in Malaysia's Real Estate Investment Trusts (M-REITS)Document14 pagesDeterminant Factors of Profitability in Malaysia's Real Estate Investment Trusts (M-REITS)LeeZhenXiangNo ratings yet

- Associated British FoodsDocument16 pagesAssociated British FoodsMohd Shahbaz Husain100% (1)

- Guide to Management Accounting Inventory turnover for managersFrom EverandGuide to Management Accounting Inventory turnover for managersNo ratings yet

- Rss02 LeadDocument6 pagesRss02 Leadhi_chrisleeNo ratings yet

- RSS01 LearnDocument3 pagesRSS01 Learnhi_chrisleeNo ratings yet

- 3 Powerful Stock Strategies For BeginnersDocument11 pages3 Powerful Stock Strategies For Beginnershi_chrislee100% (2)

- Tapping Into Ultimate Success by Jack Canfield and Pamela Bruner ExcerptDocument35 pagesTapping Into Ultimate Success by Jack Canfield and Pamela Bruner Excerpthi_chrislee75% (8)

- Army Institute of Business Administration (AIBA) : Term Paper OnDocument30 pagesArmy Institute of Business Administration (AIBA) : Term Paper OnFahimNo ratings yet

- Abbott Laboratories (ABT)Document8 pagesAbbott Laboratories (ABT)Riffat Al ImamNo ratings yet

- Profitability Ratios: Strategic Financial Management - SFM (S5) Topic: Financial Ratio AnalysisDocument8 pagesProfitability Ratios: Strategic Financial Management - SFM (S5) Topic: Financial Ratio AnalysisAhmed RazaNo ratings yet

- Value Based ManagementDocument9 pagesValue Based ManagementSivaSankarKatariNo ratings yet

- HGHGKJDocument66 pagesHGHGKJHuyenDaoNo ratings yet

- Financial Analysis Services For Small and Mid-Sized CompaniesDocument4 pagesFinancial Analysis Services For Small and Mid-Sized Companiesbarakkat72No ratings yet

- Fin433 ReportDocument30 pagesFin433 ReportShàhríàrõ Dã Ràkínskì100% (1)

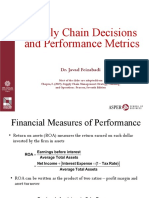

- 3-Supply Chain Decisions and Performance Metrics (A)Document21 pages3-Supply Chain Decisions and Performance Metrics (A)eeman kNo ratings yet

- Foreign Exchange Activities of Exim Bank of Bangladesh LTDDocument40 pagesForeign Exchange Activities of Exim Bank of Bangladesh LTDNeamul Nis100% (1)

- Ankit Gupta Pgma2009 Asingment2Document39 pagesAnkit Gupta Pgma2009 Asingment2ANKIT GUPTANo ratings yet

- RCDC SWOT Analysis - Tech Manufacturing FirmsDocument6 pagesRCDC SWOT Analysis - Tech Manufacturing FirmsPaul Michael AngeloNo ratings yet

- KeppelT&T - 2010 Annual ReportDocument144 pagesKeppelT&T - 2010 Annual ReportDaxx83No ratings yet

- Factors Affecting Bank Profitability in IndonesiaDocument7 pagesFactors Affecting Bank Profitability in IndonesiaArdi GunardiNo ratings yet

- Radio AnalysisDocument100 pagesRadio Analysisabhayjain686No ratings yet

- Aquarium Services Business PlanDocument30 pagesAquarium Services Business PlanZuzani MathiyaNo ratings yet

- Chapter 4 Financial Statement AnalysisDocument54 pagesChapter 4 Financial Statement AnalysisDemelash Agegnhu BeleteNo ratings yet

- FABM Week 6 - Financial RatioDocument35 pagesFABM Week 6 - Financial Ratiovmin친구No ratings yet

- Ashok Leyland Valuation - ReportDocument17 pagesAshok Leyland Valuation - Reportbharath_ndNo ratings yet

- Quick RatioDocument15 pagesQuick RatioAin roseNo ratings yet

- My Trading StrategyDocument2 pagesMy Trading StrategypradeephdNo ratings yet

- CH03 TQ HW 7eDocument26 pagesCH03 TQ HW 7eAnbang Xiao100% (2)

- Forecasting Unbalanced Balance SheetsDocument8 pagesForecasting Unbalanced Balance SheetsSiddhu SaiNo ratings yet

- Fsa 2012 16Document190 pagesFsa 2012 16Muhammad Shahzad IjazNo ratings yet

- Fundamental Analysis of PNB Ltd.Document19 pagesFundamental Analysis of PNB Ltd.Ashutosh Gupta100% (1)

- FM Revision - MaterialDocument217 pagesFM Revision - MaterialSri HariniNo ratings yet

- Uts Manajemen KeuanganDocument8 pagesUts Manajemen KeuangantntAgstNo ratings yet

- Analysis of The Loan Provided by Citizen Bank Limited: A Project Work ReportDocument34 pagesAnalysis of The Loan Provided by Citizen Bank Limited: A Project Work ReportHem Raj JoshiNo ratings yet