Professional Documents

Culture Documents

Analysis

Uploaded by

qatil93Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis

Uploaded by

qatil93Copyright:

Available Formats

Ratio Analysis:

Ratio analyses are the most popular form of analyses all over the world and the trusted one also. In ratio analyses as the name suggests ratios are used in analyzing the financial standings of the organization. We by using the ratio analyses try to find out the various ratios such as Current Ratio. Debt- Equity Ratio, Debt-Assets Ratio etc to find out the real financial standings of the company.

Liquidity Ratio: Current Ratio = Current Assets / Current Liabilities Current Ratio = 568261749/ 503187735 Current Ratio = 1.1293

This ratio is calculated to analyze that how many current assets are owned by the NBP and how much are current liabilities. Here figure of 1.1293, to pay one rupee of current liabilities, NBP has 1.293 current assets.

Turnover Ratio: Total Assets Turnover = Net Sales / Total Assets = 53824632 / 817,758,326 Total Assets Turnover = 0.0658 or 6.58%

This ratio guides the financial analysts how the resources are used efficiently, it is basically a summary of all other turn over ratios, like; inventory turn over, fixed assets turn over, so here 9.316% shows that 817,758,326 used and gain 53824632 revenue generated during the year.

Debt Ratios: Debt to Asset Ratio Debt to Assets Ratio = Total Debt / Total Assets =503,378,402 / 817,758,326 Debt to Assets Ratio = 0.6155 or 61.55%

NBP is one of the profiteer contributors in financial sector of Pakistan; here the debt to assets ratio shows that the creditors, investors, and other stakeholders interpret this ratio as implying 61 paisa of debt is backed by every one rupee of asset. So it is worthiness of the NBP to keep considerable assets to cover the debt obligations.

Equity capital to total debt ratio:

Equity capital to total debt ratio = Total Equity/Total debt Equity capital to total debt ratio =102,459,218 /503378402 Equity capital to total debt ratio = 0.2035 or 20.35%

Here the Equity capital to total debt ratio shows that the creditors, investors, and other stakeholders interpret this ratio as implying every one rupee of debt is backed by 87 paisa of share capital.

Profitability Ratios: Gross Profit Margin

Markup and non markup interest income markup and non markup expense/ Net Sales

=23311967 11456637 / 23311967 Gross Profit Margin = 0.50855 or 50.855%

NBPs profitability ratio indicates that being a financial institution, to maintain 50% gross profit margin ratio is spectacular, and the investors willingly purchase the stock.

Net Profit Margin

Net Profit Margin = Net Income / Net Sales

=21914412 / 53824632 Net Profit Margin = 0.40714 or 40.714%

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- EJP Resolutionsheft NAS Wiesbaden 2017Document32 pagesEJP Resolutionsheft NAS Wiesbaden 2017margriet1971No ratings yet

- Trade Union Act 1926Document28 pagesTrade Union Act 1926Sanjeet Kumar33% (3)

- Excursion Parent Consent Form - 2021 VSSECDocument8 pagesExcursion Parent Consent Form - 2021 VSSECFelix LeNo ratings yet

- India Delhi NCR Office Marketbeat Q1 2023 Ver2Document2 pagesIndia Delhi NCR Office Marketbeat Q1 2023 Ver2jaiat22No ratings yet

- Calculus Early Transcendentals 2nd Edition Briggs Solutions ManualDocument12 pagesCalculus Early Transcendentals 2nd Edition Briggs Solutions Manualcrenate.bakshish.7ca96100% (28)

- Wright PDFDocument21 pagesWright PDFmipalosaNo ratings yet

- Papua Case Report 2021Document78 pagesPapua Case Report 2021Lucielle ParuNo ratings yet

- Petition For Habeas Corpus PleadingDocument4 pagesPetition For Habeas Corpus PleadingRaeNo ratings yet

- THE FEAST OF TABERNACLES - Lighthouse Library International PDFDocument16 pagesTHE FEAST OF TABERNACLES - Lighthouse Library International PDFEnrique RamosNo ratings yet

- Take Home Quiz 1Document9 pagesTake Home Quiz 1Akira Marantal Valdez100% (1)

- Case Study and Mind Map Health Psychology - 2Document4 pagesCase Study and Mind Map Health Psychology - 2api-340420872No ratings yet

- Case Digest No. 3Document3 pagesCase Digest No. 3Faye Allen MatasNo ratings yet

- Class 12 Accountancy Project Important Points To Be ConsideredDocument2 pagesClass 12 Accountancy Project Important Points To Be ConsideredRitaNo ratings yet

- Barrazona V RTC City of Baguio - EjectmentDocument9 pagesBarrazona V RTC City of Baguio - Ejectmentdoc dacuscosNo ratings yet

- Incoterms 2012Document60 pagesIncoterms 2012roberts79No ratings yet

- CL-173 Product Sheet - 3T3-L1Document7 pagesCL-173 Product Sheet - 3T3-L1Andreas HaryonoNo ratings yet

- Imex CaseDocument17 pagesImex Caseipsita pandaNo ratings yet

- Cultural, Social and Political InstitutionsDocument26 pagesCultural, Social and Political InstitutionsNica de los SantosNo ratings yet

- Wine South Africa 2011-04Document84 pagesWine South Africa 2011-04alejandroNo ratings yet

- Enlightenment and The French RevolutionDocument20 pagesEnlightenment and The French RevolutionBKumrNo ratings yet

- Bidding Documents (Two Stage Two Envelopes-TSTE) TorgharDocument63 pagesBidding Documents (Two Stage Two Envelopes-TSTE) TorgharEngr Amir Jamal QureshiNo ratings yet

- Continuing Professional DevelopmentDocument20 pagesContinuing Professional DevelopmentLorenz Ardiente100% (1)

- 1 What Is TortDocument8 pages1 What Is TortDonasco Casinoo ChrisNo ratings yet

- Co-Ownership AgreementDocument2 pagesCo-Ownership Agreementkarl anthony villanuevaNo ratings yet

- Liberalism and The American Natural Law TraditionDocument73 pagesLiberalism and The American Natural Law TraditionPiguet Jean-GabrielNo ratings yet

- Entrepreneurship DevelopmentDocument12 pagesEntrepreneurship DevelopmentRohit ShindeNo ratings yet

- Choose A Plan - ScribdDocument1 pageChoose A Plan - ScribdUltraJohn95No ratings yet

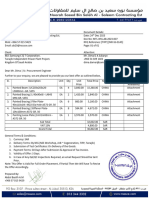

- 007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145Document1 page007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145abasithamNo ratings yet

- Shweta Tech RecruiterDocument2 pagesShweta Tech RecruiterGuar GumNo ratings yet

- Assign Law of MotionDocument2 pagesAssign Law of MotionRodesa Delos SantosNo ratings yet