Professional Documents

Culture Documents

Moodys

Uploaded by

RevconomicsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Moodys

Uploaded by

RevconomicsCopyright:

Available Formats

United Kingdom - Bank Rating Actions - 21 June 2012

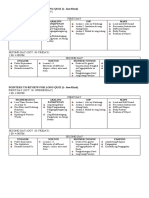

BFSR (BCA) Former Bank Name Lloyds Banking Group Lloyds TSB Bank Plc HBOS plc Bank of Scotland plc BOS (Ireland) Funding Plc Bank of Scotland Capital Funding L.P. Bank of Scotland plc, Australia Branch Cheltenham & Gloucester plc HBOS Capital Funding No. 1 L.P HBOS Capital Funding No. 2 L.P HBOS Capital Funding No. 3 L.P HBOS Capital Funding No. 4 L.P HBOS Group Euro Finance (Jersey) HBOS Group Sterling Finance L.P. HBOS Treasury Services Plc HBOS Treasury Services plc, Sydney Branch Halifax plc LBG Capital No 1 plc LBG Capital No 2 plc Leeds Permanent Building Society Lloyds TSB Capital 2 L.P. Scotland International Finance No. 2 B.V Lloyds TSB Bank plc (Australia) Lloyds TSB Bank plc Hong Kong Branch Lloyds TSB Offshore Ltd Scottish Widows plc Clerical Medical Finance plc Clerical Medical Investment Group Limited Rating C- (baa1) D+ (baa3) Outlook RuR down Stable Rating C- (baa2) D+ (baa3) Rating action June 2012 Outlook Stable Stable Rating A2 A1 A2 A1 Former Outlook RuR down RuR down RuR down RuR down Rating A3 A2 A3 A2 LT rating Rating action June 2012 Outlook Negative Negative Negative Negative Rating Baa2/ (P) Baa3 Baa2 (*) Baa3 Baa2 Former Outlook RuR down RuR down RuR down RuR down Dated subordinated debt rating Rating action June 2012 Rating Outlook Baa3/ (P) Ba1 Stable Baa3 (*) Stable Ba1 Stable Baa3 Stable Former Rating Baa3 (hyb) Ba1 (hyb)/ Ba2 (hyb) Ba2 (hyb)/ Baa3 (hyb) Outlook RuR down RuR down RuR down Rating Ba1 (hyb) Ba2 (hyb) Ba1 (hyb) Junior subordinated debt rating Rating action June 2012 Outlook Stable Stable Stable Rating B3 (hyb) Ba2(hyb) Ba1 (hyb) Ba1 (hyb) A1 RuR down A2 Negative Baa3 (hyb) RuR down Ba1 (hyb) Stable Ba2 (hyb) Ba2 (hyb) B3 (hyb) B3 (hyb) Ba2 (hyb) Ba2 (hyb) A1 A1 RuR down RuR down A2 A2 Negative Negative Baa2 RuR down Baa3 Stable B3 (hyb)/ Ba1 (hyb) Ba3 Ba2 B3 (hyb) RuR down RuR down RuR down Stable Ba2 (hyb) B1 Ba3 Ba2 (hyb) Stable Stable Stable Stable B1 (hyb) A1 C (A3) IFSR: A1 IFSR: A1 Negative RuR down RuR down C- (baa2) IFSR: A2 IFSR: A2 Stable Stable Stable A2 RuR down RuR down A2 A2 Negative Negative Baa1 (hyb) RuR down Baa2 (hyb) Stable Baa1 (hyb) Baa1 (hyb) RuR down RuR down Baa2 (hyb) Baa2 (hyb) Stable Stable Baa2 (P) Baa2 RuR down RuR down Baa3 (P) Baa3 Stable Stable Stable Ba2 (hyb) Stable (P) P-1 P-1 P-1 RuR down RuR down RuR down (P) P-1 P-1 P-1 Confirmed Confirmed Confirmed RuR down RuR down Stable Stable RuR down RuR down Ba3 Ba3 Ba3 Ba3 Ba3 Ba3 (hyb) (hyb) (hyb) (hyb) (hyb) (hyb) Stable Stable Stable Stable Stable Stable Former Outlook Stable Stable RuR down RuR down Rating Ba3 (hyb) Ba1 (hyb) Ba2 (hyb) Ba2 (hyb) Preference shares rating Rating action June 2012 Outlook Stable Stable Stable Stable P-1 RuR down P-1 Confirmed Rating P-1 P-1 P-1 P-1 Former Outlook RuR down RuR down RuR down RuR down Rating P-1 P-2 P-1 P-1 ST rating Rating action June 2012 Outlook Confirmed Confirmed Confirmed Releasing office Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd. Moody's Investors Service Ltd.

Baa2

RuR down

Baa3

Stable

* The following subordinated debt instruments have a substitution clause and are downgraded to Ba1 : CUS:539473AP3, ISIN: AU3CB0187201, XS0717735400, XS0717735582, XS0717735822, XS0744444588 The person approving the credit rating for Lloyds Banking Group and its subsidiaries is Johannes Wassenberg, Managing Director - Banking, except Scottish Widows plc, Clerical Medical Finance plc & Clerical Medical Investment Group Limited, JOURNALISTS: 44 20 7772 5456 SUBSCRIBERS: 44 20 7772 5454 The person approving the credit rating for Scottish Widows plc, Clerical Medical Finance plc & Clerical Medical Investment Group Limited is Simon Harris, Managing Director - Financial Institution, JOURNALISTS: 44 20 7772 5456 SUBSCRIBERS: 44 20 7772 5454 **PLEASE SEE "DISCLAIMER" TAB FOR IMPORTANT LEGAL INFORMATION**

2012 Moodys Investors Service, Inc. and/or its licensors and affiliates (collectively, MOODYS). All rights reserved. CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. (MIS) AND ITS AFFILIATES ARE MOODYS CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCH PUBLICATIONS PUBLISHED BY MOODYS (MOODYS PUBLICATIONS) MAY INCLUDE MOODYS CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES. MOODYS DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODYS OPINIONS INCLUDED IN MOODYS PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. CREDIT RATINGS AND MOODYS PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS AND MOODYS PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS NOR MOODYS PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODYS ISSUES ITS CREDIT RATINGS AND PUBLISHES MOODYS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE. ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODYS PRIOR WRITTEN CONSENT. All information contained herein is obtained by MOODYS from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided AS IS without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODYS is not an auditor and cannot in every instance independently verify or validate information received in the rating process. Under no circumstances shall MOODYS have any liability to any person or entity for (a) any loss or damage in whole or in part caused by, resulting from, or relating to, any error (negligent or otherwise) or other circumstance or contingency within or outside the control of MOODYS or any of its directors, officers, employees or agents in connection with the procurement, collection, compilation, analysis, interpretation, communication, publication or delivery of any such information, or (b) any direct, indirect, special, consequential, compensatory or incidental damages whatsoever (including without limitation, lost profits), even if MOODYS is advised in advance of the possibility of such damages, resulting from the use of or inability to use, any such information. The ratings, financial reporting analysis, projections, and other observations, if any, constituting part of the information contained herein are, and must be construed solely as, statements of opinion and not statements of fact or recommendations to purchase, sell or hold any securities. Each user of the information contained herein must make its own study and evaluation of each security it may consider purchasing, holding or selling. NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODYS IN ANY FORM OR MANNER WHATSOEVER. MIS, a wholly-owned credit rating agency subsidiary of Moodys Corporation (MCO), hereby discloses that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by MIS have, prior to assignment of any rating, agreed to pay to MIS for appraisal and rating services rendered by it fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address the independence of MISs ratings and rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold ratings from MIS and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading Shareholder Relations Corporate Governance Director and Shareholder Affiliation Policy. Any publication into Australia of this document is by MOODYS affiliate, Moodys Investors Service Pty Limited ABN 61 003 399 657, which holds Australian Financial Services License no. 336969. This document is intended to be provided only to wholesale clients within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODYS that you are, or are accessing the document as a representative of, a wholesale client and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to retail clients within the meaning of section 761G of the Corporations Act 2001. Notwithstanding the foregoing, credit ratings assigned on and after October 1, 2010 by Moodys Japan K.K. (MJKK) are MJKKs current opinions of the relative future credit risk of entities, credit commitments, or debt or debt-like securities. In such a case, MIS in the foregoing statements shall be deemed to be replaced with MJKK. MJKK is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly owned by Moodys Overseas Holdings Inc., a wholly-owned subsidiary of MCO. This credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors. It would be dangerous for retail investors to make any investment decision based on this credit rating. If in doubt you should contact your financial or other professional adviser.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pointers To Review For Long QuizDocument1 pagePointers To Review For Long QuizJoice Ann PolinarNo ratings yet

- People vs. Nadera, JR.: 490 Supreme Court Reports AnnotatedDocument11 pagesPeople vs. Nadera, JR.: 490 Supreme Court Reports AnnotatedFatzie MendozaNo ratings yet

- Read MeDocument21 pagesRead MeSyafaruddin BachrisyahNo ratings yet

- Role of Room RatesDocument5 pagesRole of Room RatesJonathan JacquezNo ratings yet

- Tafseer: Surah NasrDocument9 pagesTafseer: Surah NasrIsraMubeenNo ratings yet

- Office of The Divisional Forest Officer, Durgapur DivisionDocument30 pagesOffice of The Divisional Forest Officer, Durgapur Divisionrchowdhury_10No ratings yet

- Material Cost 01 - Class Notes - Udesh Regular - Group 1Document8 pagesMaterial Cost 01 - Class Notes - Udesh Regular - Group 1Shubham KumarNo ratings yet

- Skate Helena 02-06.01.2024Document1 pageSkate Helena 02-06.01.2024erkinongulNo ratings yet

- 131RGApplication PDFDocument2 pages131RGApplication PDFMuhammad FarhanNo ratings yet

- Osayan - Argumentative Essay - PCDocument2 pagesOsayan - Argumentative Essay - PCMichaela OsayanNo ratings yet

- Yasser ArafatDocument4 pagesYasser ArafatTanveer AhmadNo ratings yet

- Pyp As Model of TD LearningDocument30 pagesPyp As Model of TD Learningapi-234372890No ratings yet

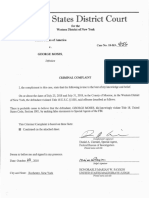

- George Moses Federal ComplaintDocument11 pagesGeorge Moses Federal ComplaintWXXI NewsNo ratings yet

- Senate Bill No. 982Document3 pagesSenate Bill No. 982Rappler100% (1)

- Madhu Limaye Vs The State of Maharashtra On 31 October, 1977Document13 pagesMadhu Limaye Vs The State of Maharashtra On 31 October, 1977Nishant RanjanNo ratings yet

- Portable IT Equipment PolicyDocument3 pagesPortable IT Equipment PolicyAiddie GhazlanNo ratings yet

- The Technical University of KenyaDocument46 pagesThe Technical University of KenyaBori GeorgeNo ratings yet

- The Role of Service in The Hospitality IndustryDocument24 pagesThe Role of Service in The Hospitality IndustryhdanesanNo ratings yet

- Govt Influence On Exchange RateDocument40 pagesGovt Influence On Exchange Rategautisingh100% (3)

- As-1 Disclosure of Accounting PoliciesDocument7 pagesAs-1 Disclosure of Accounting PoliciesPrakash_Tandon_583No ratings yet

- Digital Platforms Report 2015 v2 PDFDocument23 pagesDigital Platforms Report 2015 v2 PDFВладимир КоровкинNo ratings yet

- Blockchain in ConstructionDocument4 pagesBlockchain in ConstructionHasibullah AhmadzaiNo ratings yet

- Toll BridgesDocument9 pagesToll Bridgesapi-255693024No ratings yet

- The Effect of Big-Data On The HEC of ChinaDocument9 pagesThe Effect of Big-Data On The HEC of ChinaAbdulGhaffarNo ratings yet

- Resort Operations ManagementDocument15 pagesResort Operations Managementasif2022coursesNo ratings yet

- Gerund Infinitive ParticipleDocument4 pagesGerund Infinitive ParticiplemertNo ratings yet

- Open Book Contract Management GuidanceDocument56 pagesOpen Book Contract Management GuidanceRoberto AlvarezNo ratings yet

- Business PlanDocument36 pagesBusiness PlanArun NarayananNo ratings yet

- CNT A HandbookDocument276 pagesCNT A Handbookv_singh28No ratings yet

- Hip Self Assessment Tool & Calculator For AnalysisDocument14 pagesHip Self Assessment Tool & Calculator For AnalysisNur Azreena Basir100% (9)