Professional Documents

Culture Documents

PS2

Uploaded by

julio_cess2102Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PS2

Uploaded by

julio_cess2102Copyright:

Available Formats

14.

123 Spring 2001

Peter Diamond Page 1 of 2

PROBLEM SET #2 Due: Tuesday, February 20 1. Consider the following social choice problem in the setting of consumption of two goods by two consumers. The two goods are called tillip and quillip and the two consumers are called 1 and 2. Consumer 1 has utility function U1(t,q) = 6 + .4 ln(t) + .6 ln(q) (where t is the amount of tillip 1 consumes and q is the amount of quillip). Consumer 2 has utility function U2(t,q) = 8 + ln(t) + ln(q). The social endowment consists of 15 units of tillip and 20 units of quillip. What is the set of all feasible, Pareto efficient allocations of the consumption good for this society? (Kreps, 5.2b.) 2. In a perfectly competitive pure exchange economy, there are two types of persons, denoted by A and B, with equal numbers of each. They consume goods X and Y, with utility functions: UA = X - 100 e-Y/10 + 47 for type A UB = Y - 100 e-X/10 + 100 for type B and they have endowments of 40 of X for type A and 50 of Y for type B. (i) (ii) 3. Writing p for the relative price of Y, derive the demand functions of the two groups, and comment on their properties. (Watch for corner solutions.) Graphically, or otherwise, show that there are multiple competitive equilibria. (Hint: consider the local behavior of excess demand at p=1.)

There are two goods X and Y and two consumers A and B with the following utility functions and endowments: UA = a ln XA + (1-a) ln YA, UB = min (XB,YB), EA = (0,1), 0<a<1. EB = (1,0).

Calculate the competitive equilibrium prices and allocation. (Varian 17.4)

14.123 Spring 2001

Peter Diamond Page 2 of 2

4.

We have two agents with indirect utility functions: vA(p1,p2,yA) = ln yA -a ln p1 - (1-a) ln p2 vB(p1,p2,yB) = ln yB -a ln p1 - (1-a) ln p2 and initial endowments EA = (1,1), EB = (1,1). Calculate the competitive market clearing prices. (Varian 17.6)

5.

Consider an economy with 15 consumers and 2 goods. Consumer 3 has a Cobb-Douglas utility function U3 = ln X + ln Y. At a certain Pareto efficient allocation, consumer 3 has an allocation (10,5). What are the competitive prices that support this Pareto optimal allocation? (Varian 17.9.) Either prove or find a counterexample to the following proposition: In an economy with identical consumers, an increase in the endowment of one good will lead to a reduction in the price of that good relative to all other goods.

6.

7.

Consider a competitive exchange economy with a continuum of consumers. There is a unit measure of these consumers, indexed by j, with j being uniformly distributed in the interval between 1 and 2. Consumer j has utility function Uj = x + jy and initial endowment Ej = ((1+j)-2, (1+j)-2). Describe the competitive equilibrium prices and allocation.

You might also like

- Methods of Microeconomics: A Simple IntroductionFrom EverandMethods of Microeconomics: A Simple IntroductionRating: 5 out of 5 stars5/5 (2)

- Microeconomics II Problem Set 1 SolutionsDocument2 pagesMicroeconomics II Problem Set 1 Solutionsboja-bojaNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Micro Problem SetDocument5 pagesMicro Problem SetAkshay JainNo ratings yet

- Homework 2 411 2018Document2 pagesHomework 2 411 2018Masooma NaqviNo ratings yet

- 1 Assignment 1 (General Equilibrium) : I I I I I I IDocument2 pages1 Assignment 1 (General Equilibrium) : I I I I I I IAnindita DeyNo ratings yet

- Public Economics General Equilibrium Exercises1Document3 pagesPublic Economics General Equilibrium Exercises1GasimovskyNo ratings yet

- Ef 501 Problem Set 1Document1 pageEf 501 Problem Set 1Burak SeçkinNo ratings yet

- Econ ExaminationDocument8 pagesEcon ExaminationjayalakshmyvjpNo ratings yet

- Exchange: ECO201 - Intermediate MicroeconomicsDocument41 pagesExchange: ECO201 - Intermediate MicroeconomicsChloë ChambatNo ratings yet

- Exercises Mid 07Document6 pagesExercises Mid 07100111No ratings yet

- 3Document2 pages3intel6064No ratings yet

- 629 ProbSet01 F05 PDFDocument4 pages629 ProbSet01 F05 PDFAmanda RosarioNo ratings yet

- Pareto EfficiencyDocument23 pagesPareto EfficiencyAbhisek DashNo ratings yet

- U (X, Y) X + 154y: EC 501/zenginobuz Fall 2021Document3 pagesU (X, Y) X + 154y: EC 501/zenginobuz Fall 2021Tayhan OzenNo ratings yet

- PS2 GE - Opt QsDocument7 pagesPS2 GE - Opt QsnitchieNo ratings yet

- Topic 1.3 ConsolidationDocument1 pageTopic 1.3 ConsolidationFariha KhanNo ratings yet

- 2011 Micro Homework3 PDFDocument4 pages2011 Micro Homework3 PDFEdmund Zin100% (1)

- Microeconomics Problem SetsDocument13 pagesMicroeconomics Problem SetsAvijit PuriNo ratings yet

- Harvard Economics 2020a Problem Set 2Document2 pagesHarvard Economics 2020a Problem Set 2J100% (2)

- Analyzing Consumer's Behaviour in Risk and Uncertainty SituationsDocument7 pagesAnalyzing Consumer's Behaviour in Risk and Uncertainty SituationsIJEPT Journal100% (1)

- Problem Sets Micro1 2019Document7 pagesProblem Sets Micro1 2019Milad MohamadiNo ratings yet

- Exercise Sheet 3Document1 pageExercise Sheet 3Khadija RaffatNo ratings yet

- Consumer Theory QuestionsDocument9 pagesConsumer Theory QuestionsJigisha SinghNo ratings yet

- ECO101: Introduction To Economics (Summer Semester, 2019) Tutorial Problem Set - 02Document2 pagesECO101: Introduction To Economics (Summer Semester, 2019) Tutorial Problem Set - 02Shubham KumarNo ratings yet

- Microeconomics Problem SetDocument2 pagesMicroeconomics Problem SetGasimovskyNo ratings yet

- Master Problem Set 091123 Ecv5J1sEHlDocument5 pagesMaster Problem Set 091123 Ecv5J1sEHlMeenal ChaturvediNo ratings yet

- Micro Question 1Document4 pagesMicro Question 1QuasarNo ratings yet

- Msqe Peb 2016Document5 pagesMsqe Peb 2016blahblahNo ratings yet

- Exercises Part2Document9 pagesExercises Part2christina0107No ratings yet

- Assignment 1Document3 pagesAssignment 1Jonny VroobelNo ratings yet

- HW1Document3 pagesHW1s05xo100% (1)

- Solution 1Document10 pagesSolution 1rajan20202000No ratings yet

- Advanced Micro Revision NotesDocument23 pagesAdvanced Micro Revision NotesRufus MillmanNo ratings yet

- Assignment TwoDocument1 pageAssignment Twoibrahim abdiNo ratings yet

- Team 1 Micro Topic 5Document10 pagesTeam 1 Micro Topic 5Đan KimNo ratings yet

- Consumer Theory ExercisesDocument8 pagesConsumer Theory ExercisesIrina AlexandraNo ratings yet

- Bec 221 CatDocument1 pageBec 221 CatPhelixNo ratings yet

- HW1Document4 pagesHW1Prashanth BhaskaranNo ratings yet

- 02problem Set 2005Document5 pages02problem Set 2005vinibarcelosNo ratings yet

- Tutorial/Class 1: General EquilibriumDocument18 pagesTutorial/Class 1: General Equilibriumbob100% (1)

- General Equilibrium Theory Examples and EquilibriaDocument22 pagesGeneral Equilibrium Theory Examples and EquilibriavolcomptNo ratings yet

- Fall 2020-21 ECON 262 QUIZ 5Document1 pageFall 2020-21 ECON 262 QUIZ 5Sheikh Sahil MobinNo ratings yet

- x02 Workout1aDocument7 pagesx02 Workout1aThiago HenriqueNo ratings yet

- Programare LiniaraDocument13 pagesProgramare LiniaraAna FloreaNo ratings yet

- Classical ModelDocument4 pagesClassical ModelSam BettaNo ratings yet

- 1 Unconstrained Optimization On Open SetDocument2 pages1 Unconstrained Optimization On Open SetMatos DanielNo ratings yet

- MEC-001 ENG-D13 CompressedDocument6 pagesMEC-001 ENG-D13 CompressedTamash MajumdarNo ratings yet

- Applied Math C1-2Document13 pagesApplied Math C1-2HưngNo ratings yet

- Economics Study Guide Chapter Summary Varian For Midterm 2Document6 pagesEconomics Study Guide Chapter Summary Varian For Midterm 2Josh SatreNo ratings yet

- Microeconomics Group Assignment ReportDocument12 pagesMicroeconomics Group Assignment ReportMeselu TegenieNo ratings yet

- MEC-001-D15 - ENG - Compressed PDFDocument6 pagesMEC-001-D15 - ENG - Compressed PDFTamash MajumdarNo ratings yet

- Economics ExercisesDocument10 pagesEconomics ExercisesBatuhan BarlasNo ratings yet

- HW4Monopoly, Game TheoryDocument3 pagesHW4Monopoly, Game TheoryShivani GuptaNo ratings yet

- Ec 701 Final Exam F03Document3 pagesEc 701 Final Exam F03fego2008No ratings yet

- Assignment: Intermediate Microeconomics-II: Attempt Any 4 Questions. Each Question Carries 5 MarksDocument2 pagesAssignment: Intermediate Microeconomics-II: Attempt Any 4 Questions. Each Question Carries 5 Marksbhartisingh0812No ratings yet

- Consumer Behaviour BasicsDocument15 pagesConsumer Behaviour Basicskrishna murariNo ratings yet

- Econ 301 Final ExamDocument133 pagesEcon 301 Final ExamHằng MinhNo ratings yet

- GRIPS Macroeconomics II Lecture 1: Classical and Keynesian Theories of National IncomeDocument5 pagesGRIPS Macroeconomics II Lecture 1: Classical and Keynesian Theories of National Incomeprasadpatankar9No ratings yet

- Equilibrium WelfareDocument41 pagesEquilibrium WelfareNiagara RodriguesNo ratings yet

- Measuring Resilience: A Triple-Difference ApproachDocument2 pagesMeasuring Resilience: A Triple-Difference Approachjulio_cess2102No ratings yet

- IMF Working PapersDocument67 pagesIMF Working Papersjulio_cess2102No ratings yet

- Lecture 15Document4 pagesLecture 15KonkmanNo ratings yet

- Kirkendall Effect and Darken's Equation: Lecture 6: Diffusion in Binary Substitutional Materials (Alloys)Document6 pagesKirkendall Effect and Darken's Equation: Lecture 6: Diffusion in Binary Substitutional Materials (Alloys)KonkmanNo ratings yet

- Efectos Del Crecimientos y Volatilidad Del Gasto PublicoDocument2 pagesEfectos Del Crecimientos y Volatilidad Del Gasto Publicojulio_cess2102No ratings yet

- Lecture 4: Diffusion: Fick's Second Law: DX X DC) ADocument7 pagesLecture 4: Diffusion: Fick's Second Law: DX X DC) ALloyd R. PonceNo ratings yet

- Econometria EspacialDocument13 pagesEconometria Espacialjulio_cess2102No ratings yet

- Lecture 9Document5 pagesLecture 9KonkmanNo ratings yet

- Lecture 5: Diffusion Coefficient (Diffusivity) : LN LNDocument6 pagesLecture 5: Diffusion Coefficient (Diffusivity) : LN LNKrishnadev Madhavan NairNo ratings yet

- Lecture 2Document4 pagesLecture 2RYRTYNo ratings yet

- 20factor SPSS PDFDocument71 pages20factor SPSS PDFTodd MartinezNo ratings yet

- Thermo Vs KineticDocument6 pagesThermo Vs KineticPrathamesh DashNo ratings yet

- Laying Out and Exporting Maps PDFDocument62 pagesLaying Out and Exporting Maps PDFjulio_cess2102No ratings yet

- Guide OECD Data AnalysisDocument30 pagesGuide OECD Data Analysisjulio_cess2102No ratings yet

- PS4Document4 pagesPS4julio_cess2102No ratings yet

- Alternative TaxDocument33 pagesAlternative Taxjulio_cess2102No ratings yet

- PS1Document3 pagesPS1julio_cess2102No ratings yet

- Czech BenoniDocument8 pagesCzech BenoniRathna MaruffNo ratings yet

- Analysis of Private Tutoring Decisions in Korea: A Game Theory ApproachDocument15 pagesAnalysis of Private Tutoring Decisions in Korea: A Game Theory ApproachRaniel R BillonesNo ratings yet

- Evolution and The Theory of Games PDFDocument2 pagesEvolution and The Theory of Games PDFKristina0% (4)

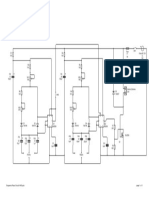

- Esquema Placa Circuit HHODocument1 pageEsquema Placa Circuit HHOPezhyNo ratings yet

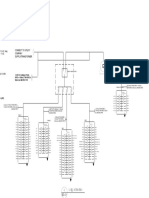

- Sample Riser DiagramDocument1 pageSample Riser DiagramRoner AbanilNo ratings yet

- Chinese ChessDocument3 pagesChinese ChessSamuel Garfield TeoNo ratings yet

- Chess The Complete Beginner's Guide by Henry IngramDocument83 pagesChess The Complete Beginner's Guide by Henry IngramAhmed Talaat100% (1)

- Jurnal SkripsiDocument8 pagesJurnal SkripsiAulia R DhantyNo ratings yet

- Anexa 12 Cladiri ExpertizateDocument5 pagesAnexa 12 Cladiri Expertizatevlad dscNo ratings yet

- DEMO A0-C9 Clean and Crunch SettingsDocument10 pagesDEMO A0-C9 Clean and Crunch Settingsscaricone71100% (1)

- Iterative Dominance in Game TheoryDocument19 pagesIterative Dominance in Game TheorySundaramali Govindaswamy GNo ratings yet

- One Badly Placed Piece Makes Your Whole Position BadDocument258 pagesOne Badly Placed Piece Makes Your Whole Position BadAnatoly Bologs100% (2)

- Algebraic Chess NotationDocument9 pagesAlgebraic Chess NotationXu HanNo ratings yet

- Weld Inspection Report (Weld Traceability Report)Document3 pagesWeld Inspection Report (Weld Traceability Report)Senthil Kumaran100% (1)

- Mating The Castled King Danny Gormally: Quality Chess WWW - Qualitychess.co - UkDocument9 pagesMating The Castled King Danny Gormally: Quality Chess WWW - Qualitychess.co - UkJoshua Fernandez0% (1)

- Chess RulesDocument2 pagesChess Rulesapi-236960349No ratings yet

- Queens Indian Defence Kasparov System - Gurevich - 1991Document116 pagesQueens Indian Defence Kasparov System - Gurevich - 1991Hakan DemirNo ratings yet

- Adrian Mikhachishin - BreakDocument7 pagesAdrian Mikhachishin - Breakpavel_janda_3No ratings yet

- Recruitment StrategyDocument17 pagesRecruitment StrategyNabeel LoneNo ratings yet

- ECON 233 – Game Theory Quiz SolutionsDocument8 pagesECON 233 – Game Theory Quiz SolutionsZain AftabNo ratings yet

- Kosten - Easy Guide To The Najdorf PDFDocument130 pagesKosten - Easy Guide To The Najdorf PDFmanijaiNo ratings yet

- Sicilian Defence Najdorf Variation PDF DownloadDocument3 pagesSicilian Defence Najdorf Variation PDF DownloadJackSleep0% (3)

- Super Chess KidDocument18 pagesSuper Chess KidStans Wole0% (1)

- Robot Monty: Carte de CommandeDocument1 pageRobot Monty: Carte de CommanderommelgasparNo ratings yet

- Python ChessDocument72 pagesPython ChessAdireddy SatyatrinadhNo ratings yet

- Adversarial SearchDocument43 pagesAdversarial SearchDUDEKULA VIDYASAGARNo ratings yet

- Duncan Suttles Wins With White (78 Games)Document29 pagesDuncan Suttles Wins With White (78 Games)navaro kastigiasNo ratings yet

- Las Bobinas Ing. Daniel Pérez LW1ECPDocument7 pagesLas Bobinas Ing. Daniel Pérez LW1ECPDiego García MedinaNo ratings yet

- Solucionario Games and Information RasmusenDocument106 pagesSolucionario Games and Information RasmusenByron Bravo GNo ratings yet

- Kleptopia: How Dirty Money Is Conquering the WorldFrom EverandKleptopia: How Dirty Money Is Conquering the WorldRating: 3.5 out of 5 stars3.5/5 (25)

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldFrom EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldRating: 4 out of 5 stars4/5 (16)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Second Class: How the Elites Betrayed America's Working Men and WomenFrom EverandSecond Class: How the Elites Betrayed America's Working Men and WomenNo ratings yet

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsFrom EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsRating: 5 out of 5 stars5/5 (2)

- The Lords of Easy Money: How the Federal Reserve Broke the American EconomyFrom EverandThe Lords of Easy Money: How the Federal Reserve Broke the American EconomyRating: 4.5 out of 5 stars4.5/5 (69)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistFrom EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistRating: 4.5 out of 5 stars4.5/5 (37)

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineFrom EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineRating: 4.5 out of 5 stars4.5/5 (36)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyFrom EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyRating: 4.5 out of 5 stars4.5/5 (263)

- How an Economy Grows and Why It Crashes: Collector's EditionFrom EverandHow an Economy Grows and Why It Crashes: Collector's EditionRating: 4.5 out of 5 stars4.5/5 (102)