Professional Documents

Culture Documents

Employer's ANNUAL Federal Tax Return: Who Must File Form 944

Uploaded by

imimranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employer's ANNUAL Federal Tax Return: Who Must File Form 944

Uploaded by

imimranCopyright:

Available Formats

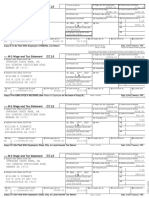

Form 944 for 2007: Employer’s ANNUAL Federal Tax Return

Department of the Treasury — Internal Revenue Service OMB No. 1545-2007

Who Must File Form 944

—

Employer identification number (EIN)

You must file annual

Name (not your trade name)

Form 944 instead of filing

quarterly Forms 941

Trade name (if any)

only if the IRS notified

you in writing.

Address

Number Street Suite or room number

City State ZIP code

Read the separate instructions before you fill out this form. Please type or print within the boxes.

Part 1: Answer these questions for 2007.

1 Wages, tips, and other compensation 1 .

2 Total income tax withheld from wages, tips, and other compensation 2 .

3 If no wages, tips, and other compensation are subject to social security or Medicare tax 3 Check and go to line 5.

4 Taxable social security and Medicare wages and tips:

Column 1 Column 2

4a Taxable social security wages . 3 .124 = .

4b Taxable social security tips . 3 .124 = .

4c Taxable Medicare wages & tips . 3 .029 = .

4d Total social security and Medicare taxes (Column 2, lines 4a + 4b + 4c = line 4d) 4d .

5 Total taxes before adjustments (lines 2 + 4d = line 5) 5 .

6 TAX ADJUSTMENTS (Read the instructions for line 6 before completing lines 6a through 6f.):

6a Current year’s adjustments (see instructions) 6a .

6b Prior years’ income tax withholding adjustments (see

instructions). Attach Form 941c 6b .

6c Prior years’ social security and Medicare tax adjustments

(see instructions). Attach Form 941c 6c .

6d Special additions to federal income tax (see instructions).

Attach Form 941c 6d .

6e Special additions to social security and Medicare taxes (see

instructions). Attach Form 941c 6e .

6f TOTAL ADJUSTMENTS (Combine all amounts: lines 6a through 6e.) 6f .

7 Total taxes after adjustments (Combine lines 5 and 6f.) 7 .

8 Advance earned income credit (EIC) payments made to employees 8 .

9 Total taxes after adjustment for advance EIC (line 7 – line 8 = line 9) 9 .

10 Total deposits for this year, including overpayment applied from a prior year 10 .

11 Balance due (If line 9 is more than line 10, write the difference here.) Make your check payable

to the United States Treasury and write your EIN, Form 944, and 2007 on the check 11 .

12 Overpayment (If line 10 is more than line 9, write the difference here.) 12 . Check one Apply to next return.

Send a refund.

© You MUST fill out both pages of this form and SIGN it.

Next ©

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Cat. No. 39316N Form 944 (2007)

Name (not your trade name) Employer identification number (EIN)

Part 2: Tell us about your tax liability for 2007.

13 Check one: Line 9 is less than $2,500. Go to Part 3.

Line 9 is $2,500 or more. Enter your tax liability for each month. If you are a semiweekly depositor or you accumulate

$100,000 or more of liability on any day during a deposit period, you must complete Form 945-A instead of the boxes below.

Jan. Apr. Jul. Oct.

13a

Feb.

. 13d

May

. 13g

Aug.

. 13j

Nov.

.

13b . 13e . 13h . 13k .

Mar. Jun. Sep. Dec.

13c . 13f . 13i . 13l .

Total liability for year (Add lines 13a through 13l). Total must equal line 9. 13m

If you made deposits of taxes reported on this form, write the state abbreviation for the state where you

.

14 made your deposits OR write MU if you made your deposits in multiple states.

Part 3: Tell us about your business. If question 15 does NOT apply to your business, leave it blank.

15 If your business has closed or you stopped paying wages...

Check here and enter the final date you paid wages. / /

Part 4: May we speak with your third-party designee?

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? (See the instructions

for details.)

Yes. Designee’s name

Select a 5-digit Personal Identification Number (PIN) to use when talking to IRS.

No.

Part 5: Sign here. You MUST fill out both pages of this form and SIGN it.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best

of my knowledge and belief, it is true, correct, and complete.

Print your

Sign your name here

name here Print your

title here

Date / / Best daytime phone ( ) –

Part 6: For paid preparers only (optional)

If you were PAID to prepare this return and are not an employee of the business that is filing this return, you may complete Part 6.

Paid Preparer’s Preparer’s

name SSN/PTIN

Paid Preparer’s

signature Date / /

Check if you are self employed.

Firm’s name Firm’s EIN

Address

City State ZIP code

Page 2 Form 944 (2007)

Form 944-V,

Payment Voucher

Purpose of Form Caution. Use Form 944-V when making any payment

with Form 944. However, if you pay an amount with

Complete Form 944-V, Payment Voucher, if you are

Form 944 that should have been deposited, you may

making a payment with Form 944, Employer’s ANNUAL

be subject to a penalty. See Deposit Penalties in

Federal Tax Return. We will use the completed voucher

section 11 of Pub. 15 (Circular E).

to credit your payment more promptly and accurately,

and to improve our service to you. Specific Instructions

If you have your return prepared by a third party and Box 1—Employer identification number (EIN). If you

make a payment with that return, please provide this do not have an EIN, apply for one on Form SS-4,

payment voucher to the return preparer. Application for Employer Identification Number, and

write “Applied For” and the date you applied in this

Making Payments With Form 944 entry space.

To avoid a penalty, make your payment with your 2007 Box 2—Amount paid. Enter the amount paid with

Form 944 only if one of the following applies. Form 944.

● Your net taxes for the year (line 9 on Form 944) are Box 3—Name and address. Enter your name and

less than $2,500 and you are paying in full with a address as shown on Form 944.

timely filed return.

● Enclose your check or money order made payable to

● You already deposited the taxes you owed for the the “United States Treasury” and write your EIN, “Form

first, second, and third quarters of 2007, and the tax 944,” and “2007” on your check or money order. Do

you owe for the fourth quarter of 2007 is less than not send cash. Do not staple Form 944-V or your

$2,500, and you are paying, in full, the tax you owe for payment to the return (or to each other).

the fourth quarter of 2007 with a timely filed return.

● Detach Form 944-V and send it with your payment

● You are a monthly schedule depositor making a and Form 944 to the address provided in the

payment in accordance with the Accuracy of Instructions for Form 944.

Deposits Rule. See section 11 of Pub. 15 (Circular E),

Employer’s Tax Guide, for details. Your payment may Note. You must also complete the entity information

be $2,500 or more. above Part 1 on Form 944.

Otherwise, you must deposit your payment at an

authorized financial institution or by Electronic Federal

Tax Payment System (EFTPS). See section 11 of Pub.

15 (Circular E) for deposit instructions. Do not use

Form 944-V to make federal tax deposits.

Detach Here and Mail With Your Payment and Form 944. ✃

✁ Ä Ä

944-V

OMB No. 1545-2007

Payment Voucher

Form

Department of the Treasury

Internal Revenue Service

© Do not staple or attach this voucher to your payment. 2007

1 Enter your employer identification 2 Dollars Cents

number (EIN).

Enter the amount of your payment. ©

3 Enter your business name (individual name if sole proprietor).

Enter your address.

Enter your city, state, and ZIP code.

Form 944 (2007)

Privacy Act and Paperwork Reduction Act Notice. Justice for civil and criminal litigation, and to cities,

We ask for the information on this form to carry out the states, and the District of Columbia for use in

Internal Revenue laws of the United States. We need it administering their tax laws. We may also disclose this

to figure and collect the right amount of tax. Subtitle C, information to other countries under a tax treaty, to

Employment Taxes, of the Internal Revenue Code federal and state agencies to enforce federal nontax

imposes employment taxes on wages, including criminal laws, or to federal law enforcement and

income tax withholding. This form is used to determine intelligence agencies to combat terrorism.

the amount of the taxes that you owe. Section 6011

The time needed to complete and file Form 944 will

requires you to provide the requested information if the

vary depending on individual circumstances. The

tax is applicable to you. Section 6109 requires you to

estimated average time is:

provide your employer identification number (EIN). If

you fail to provide this information in a timely manner, Recordkeeping 12 hrs., 12 min.

you may be subject to penalties and interest. Learning about the law or the form 40 min.

You are not required to provide the information Preparing the form 1 hr., 49 min.

requested on a form that is subject to the Paperwork Copying, assembling, and sending

Reduction Act unless the form displays a valid OMB the form to the IRS 16 min.

control number. Books and records relating to a form

or instructions must be retained as long as their If you have comments concerning the accuracy of

contents may become material in the administration of these time estimates or suggestions for making Form

any Internal Revenue law. 944 simpler, we would be happy to hear from you. You

can write to: Internal Revenue Service, Tax Products

Generally, tax returns and return information are Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111

confidential, as required by section 6103. However, Constitution Ave. NW, IR-6526, Washington, DC

section 6103 allows or requires the IRS to disclose or 20224. Do not send Form 944 to this address. Instead,

give the information shown on your tax return to others see Where Should You File? on page 4 of the

as described in the Code. For example, we may Instructions for Form 944.

disclose your tax information to the Department of

You might also like

- Employer's QUARTERLY Federal Tax Return: Report For This Quarter of 2007Document4 pagesEmployer's QUARTERLY Federal Tax Return: Report For This Quarter of 2007IRS100% (1)

- US Internal Revenue Service: f941m AccessibleDocument2 pagesUS Internal Revenue Service: f941m AccessibleIRSNo ratings yet

- 941 1st QTR 2010Document2 pages941 1st QTR 2010Larry BartonNo ratings yet

- US Internal Revenue Service: f941 - 2000Document4 pagesUS Internal Revenue Service: f941 - 2000IRSNo ratings yet

- US Internal Revenue Service: f941 - 2003Document4 pagesUS Internal Revenue Service: f941 - 2003IRSNo ratings yet

- Employer's ANNUAL Federal Tax Return: Who Must File Form 944Document4 pagesEmployer's ANNUAL Federal Tax Return: Who Must File Form 944Rafael PolancoNo ratings yet

- US Internal Revenue Service: f941ss - 2006Document4 pagesUS Internal Revenue Service: f941ss - 2006IRSNo ratings yet

- US Internal Revenue Service: f941 06Document4 pagesUS Internal Revenue Service: f941 06IRSNo ratings yet

- US Internal Revenue Service: f941 - 2005Document4 pagesUS Internal Revenue Service: f941 - 2005IRSNo ratings yet

- Employer's Annual Railroad Retirement Tax ReturnDocument4 pagesEmployer's Annual Railroad Retirement Tax ReturnIRSNo ratings yet

- US Internal Revenue Service: I941 - 2002Document4 pagesUS Internal Revenue Service: I941 - 2002IRSNo ratings yet

- Employer's Annual Federal Tax Return For Agricultural EmployeesDocument2 pagesEmployer's Annual Federal Tax Return For Agricultural EmployeesIRSNo ratings yet

- US Internal Revenue Service: f8919Document2 pagesUS Internal Revenue Service: f8919IRSNo ratings yet

- US Internal Revenue Service: f943 - 1991Document4 pagesUS Internal Revenue Service: f943 - 1991IRS100% (1)

- US Internal Revenue Service: I941 - 2000Document4 pagesUS Internal Revenue Service: I941 - 2000IRSNo ratings yet

- US Internal Revenue Service: I941 - 2004Document4 pagesUS Internal Revenue Service: I941 - 2004IRSNo ratings yet

- US Internal Revenue Service: f4137 - 1997Document2 pagesUS Internal Revenue Service: f4137 - 1997IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1993Document2 pagesUS Internal Revenue Service: f5884 - 1993IRSNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnRepeat BeatsNo ratings yet

- Uncollected Social Security and Medicare Tax On WagesDocument2 pagesUncollected Social Security and Medicare Tax On Wagesnujahm1639No ratings yet

- US Internal Revenue Service: F940ez - 1992Document4 pagesUS Internal Revenue Service: F940ez - 1992IRSNo ratings yet

- US Internal Revenue Service: F2106ez - 1996Document2 pagesUS Internal Revenue Service: F2106ez - 1996IRSNo ratings yet

- Annual Return of Withheld Federal Income Tax: Sign HereDocument2 pagesAnnual Return of Withheld Federal Income Tax: Sign HereimimranNo ratings yet

- US Internal Revenue Service: f943 - 1994Document4 pagesUS Internal Revenue Service: f943 - 1994IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1995Document2 pagesUS Internal Revenue Service: f5884 - 1995IRSNo ratings yet

- 941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnDocument4 pages941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnFrancis Wolfgang UrbanNo ratings yet

- US Internal Revenue Service: I941Document8 pagesUS Internal Revenue Service: I941IRSNo ratings yet

- US Internal Revenue Service: F940ez - 1994Document4 pagesUS Internal Revenue Service: F940ez - 1994IRSNo ratings yet

- Form 941X-745287Document7 pagesForm 941X-745287Catori-Dakoda Eil100% (1)

- US Internal Revenue Service: fw4s - 1995Document2 pagesUS Internal Revenue Service: fw4s - 1995IRSNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterFrancis Wolfgang UrbanNo ratings yet

- US Internal Revenue Service: F940ez - 1995Document4 pagesUS Internal Revenue Service: F940ez - 1995IRSNo ratings yet

- US Internal Revenue Service: I941ss - 2005Document6 pagesUS Internal Revenue Service: I941ss - 2005IRSNo ratings yet

- ACC 105 Lesson 4 Assignment 1 3-11bDocument4 pagesACC 105 Lesson 4 Assignment 1 3-11bJennifer BaileyNo ratings yet

- Documents (942,202212311058, F99NEE)Document2 pagesDocuments (942,202212311058, F99NEE)LertoraNo ratings yet

- F 941 SsDocument4 pagesF 941 SsBilboDBagginsNo ratings yet

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 pagesEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelNo ratings yet

- US Internal Revenue Service: I941 - 2003Document4 pagesUS Internal Revenue Service: I941 - 2003IRSNo ratings yet

- Employee Retention Credit For Employers Subject To Closure Due To COVID-19 CrisisDocument6 pagesEmployee Retention Credit For Employers Subject To Closure Due To COVID-19 CrisisMoni ShafiqNo ratings yet

- US Internal Revenue Service: fw4s - 1994Document2 pagesUS Internal Revenue Service: fw4s - 1994IRSNo ratings yet

- US Internal Revenue Service: f8404 - 2001Document2 pagesUS Internal Revenue Service: f8404 - 2001IRSNo ratings yet

- Solution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, HigginsDocument2 pagesSolution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, Higginsa882650259No ratings yet

- Instructions For Form 941: (Rev. July 2020)Document20 pagesInstructions For Form 941: (Rev. July 2020)Kugilan BalakrishnanNo ratings yet

- U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDocument4 pagesU.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSNo ratings yet

- Schedule D (Form 941) :: Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or ConsolidationsDocument2 pagesSchedule D (Form 941) :: Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or ConsolidationsFrancis Wolfgang UrbanNo ratings yet

- US Internal Revenue Service: f4137 - 1999Document2 pagesUS Internal Revenue Service: f4137 - 1999IRSNo ratings yet

- Corporation Application For Tentative Refund: Sign HereDocument1 pageCorporation Application For Tentative Refund: Sign HereIRSNo ratings yet

- US Internal Revenue Service: f943 - 1996Document4 pagesUS Internal Revenue Service: f943 - 1996IRSNo ratings yet

- US Internal Revenue Service: f8404 - 2000Document2 pagesUS Internal Revenue Service: f8404 - 2000IRSNo ratings yet

- US Internal Revenue Service: F940ez - 1991Document4 pagesUS Internal Revenue Service: F940ez - 1991IRSNo ratings yet

- Instructions For Form 943: Pager/SgmlDocument4 pagesInstructions For Form 943: Pager/SgmlIRSNo ratings yet

- US Internal Revenue Service: fw4s - 2005Document2 pagesUS Internal Revenue Service: fw4s - 2005IRSNo ratings yet

- Form 941 SummaryDocument5 pagesForm 941 SummaryCatori-Dakoda Eil100% (1)

- US Internal Revenue Service: f5884 - 1992Document2 pagesUS Internal Revenue Service: f5884 - 1992IRSNo ratings yet

- AdamDocument2 pagesAdamtnt4101No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Instructions For Form 944: Pager/SgmlDocument8 pagesInstructions For Form 944: Pager/SgmlimimranNo ratings yet

- US Internal Revenue Service: I941Document8 pagesUS Internal Revenue Service: I941IRSNo ratings yet

- Instructions For Form 940: Pager/SgmlDocument12 pagesInstructions For Form 940: Pager/SgmlimimranNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)Document4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)imimranNo ratings yet

- Annual Return of Withheld Federal Income Tax: Sign HereDocument2 pagesAnnual Return of Withheld Federal Income Tax: Sign HereimimranNo ratings yet

- Lyft 1099K 1239385631162661398 2019 PDFDocument1 pageLyft 1099K 1239385631162661398 2019 PDFJohn Matthew Cruel100% (1)

- 2008 Tax Table Form 1040NR H1B F1 J1 Visa TaxesDocument12 pages2008 Tax Table Form 1040NR H1B F1 J1 Visa TaxesNon Resident Tax Expert100% (2)

- Advanced Scenario 7 - Austin Drake (2018)Document8 pagesAdvanced Scenario 7 - Austin Drake (2018)Center for Economic Progress100% (2)

- Form 24QDocument1 pageForm 24QASANTA SWAINNo ratings yet

- Response To Dishonor of ProcessDocument2 pagesResponse To Dishonor of ProcessMikeDouglas100% (1)

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- Proviso PPP DatabaseDocument8 pagesProviso PPP DatabaseMichaelRomainNo ratings yet

- 1112 Dependent Verification Worksheet-1Document2 pages1112 Dependent Verification Worksheet-1Mikey NguyenNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument14 pagesU.S. Individual Income Tax Return: Filing StatusDavid Dautel100% (1)

- Official Authorization List DocumentsDocument3 pagesOfficial Authorization List DocumentsJohn WallaceNo ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- 2019 W2 2020120235817 PDFDocument3 pages2019 W2 2020120235817 PDFJamyia Nowlin Kirts100% (3)

- W-2 Wage and Tax Statement: J-EE Ret - 1983.18Document1 pageW-2 Wage and Tax Statement: J-EE Ret - 1983.18what is thisNo ratings yet

- Miscellaneous Income: US - 2019 - 1099MISC - 1003104696 - 0Document2 pagesMiscellaneous Income: US - 2019 - 1099MISC - 1003104696 - 0Mark JamesNo ratings yet

- Joint Astronomy Centre - Birthday Stars - FinalDocument2 pagesJoint Astronomy Centre - Birthday Stars - Finalhail2pigdumNo ratings yet

- Tax Formula and Tax Determination An Overview of Property TransactionsDocument23 pagesTax Formula and Tax Determination An Overview of Property TransactionsJames Riley Case100% (1)

- IRS 3500a Form For California Tax-ExemptionDocument1 pageIRS 3500a Form For California Tax-ExemptionjhbjhbkjhNo ratings yet

- Declaration of Tax Representative: TB Refund LTD., Ida Business & Technology Park, Ring Road Kilkenny, IrelandDocument9 pagesDeclaration of Tax Representative: TB Refund LTD., Ida Business & Technology Park, Ring Road Kilkenny, Irelandfacundo59No ratings yet

- Joint Explanatory StatementDocument570 pagesJoint Explanatory Statementacohnthehill50% (4)

- 2009 Form 990 For Harvard Management CompanyDocument55 pages2009 Form 990 For Harvard Management CompanyresponsibleharvardNo ratings yet

- Application For Property Tax Reduction For 2017: L L L L L LDocument1 pageApplication For Property Tax Reduction For 2017: L L L L L LO'Connor AssociateNo ratings yet

- United States Gift (And Generation-Skipping Transfer) Tax ReturnDocument4 pagesUnited States Gift (And Generation-Skipping Transfer) Tax ReturnHazem El SayedNo ratings yet

- Nar 1 PDFDocument2 pagesNar 1 PDFAbhishek PareekNo ratings yet

- Oregon Income Tax Instructions and SchedulesDocument36 pagesOregon Income Tax Instructions and SchedulesStatesman JournalNo ratings yet

- IRS Form 1040Document2 pagesIRS Form 1040fox43wpmt50% (2)

- Rus To Sunset-Lenowisco of 02-25-2011 Cpp560603Document1 pageRus To Sunset-Lenowisco of 02-25-2011 Cpp560603StimulatingBroadband.comNo ratings yet

- U.S. Individual Income Tax Return: Boddu 629-68-1309 SAIDocument3 pagesU.S. Individual Income Tax Return: Boddu 629-68-1309 SAIssi bodduNo ratings yet

- CertainGovernmentPayments1099G JamesSmith-654202001310815Document4 pagesCertainGovernmentPayments1099G JamesSmith-654202001310815ireaditallNo ratings yet

- ECONOMIC BENEFIT THEORY - BIR Ruling No. 123-97 (Retirement and Separation Benefits Paid To Employees)Document2 pagesECONOMIC BENEFIT THEORY - BIR Ruling No. 123-97 (Retirement and Separation Benefits Paid To Employees)KriszanFrancoManiponNo ratings yet

- Editable IRS Form 8879 For 2017-2018Document2 pagesEditable IRS Form 8879 For 2017-2018PDFstockNo ratings yet