Professional Documents

Culture Documents

Questions On Shareholders' Equity

Uploaded by

Alloysius ParilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions On Shareholders' Equity

Uploaded by

Alloysius ParilCopyright:

Available Formats

Chapter 2

Questions and Problems

1. Building a Balance Sheet Swedish Pucks AB has current assets of 35,000 kroner, net fixed assets of 161,000 kroner, current liabilities of 30,100 kroner, and long-term debt of 91,000 kroner. What is the value of the shareholders' equity account for this firm? How much is net working capital?

1.

To find owners equity, we must construct a balance sheet as follows: Balance Sheet CA NFA TA SEK 35,000 161,000 SEK 196,000 CL LTD OE SEK 30,100 91,000 ?? TL & OESEK 196,000

2. Building an Income Statement Papa Roach Exterminators, Inc., has sales of $527,000, costs of $280,000, depreciation expense of $38,000, interest expense of $15,000, and a tax rate of 35 percent. What is the net income for this firm?

2.

The income statement for the company is: Income Statement Sales Costs Depreciation EBIT Interest EBT Taxes(35%) Net income $527,000 280,000 38,000 $209,000 15,000 $194,000 67,900 $126,100

3. Dividends and Retained Earnings Suppose the firm in Problem 2 paid out $48,000 in cash dividends. What is the addition to retained earnings?

3. One equation for net income is: Net income = Dividends + Addition to retained earnings Rearranging, we get: Addition to retained earnings = Net income Dividends = $126,100 48,000 = $78,100

4. Per-Share Earnings and Dividends Suppose the firm in Problem 3 had 30,000 shares of common stock outstanding. What is the earnings per share, or EPS, figure? What is the dividends per share figure?

4. EPS= Net income / Shares = $126,100 / 30,000 = $4.20 per share DPS= Dividends / Shares = $48,000 / 30,000 = $1.60 per share

5. Market Values and Book Values Taipei Widgets purchased new machinery three years ago for 7 million Taiwanese dollars. The machinery can be sold to an outside firm today for TWD 3.2 million. Taipei's current balance sheet shows net fixed assets of TWD 4,000,000, current liabilities of TWD 2,200,000, and net working capital of TWD 900,000. If all the current assets were liquidated today, the company would receive TWD 2.8 million cash. What is the book value of Taipei's assets today? What is the market value?

To find the book value of current assets, we use: NWC = CA CL. Rearranging to solve for current assets, we get:

CA = NWC + CL = TWD 900K + 2.2M = TWD 3.1M The market value of current assets and fixed assets is given, so:

Book value CA

= TWD 3.1M

Market value CA Market value NFA

= TWD 2.8M = TWD 3.2M

Book value NFA = TWD 4.0M Book value assets Market value assets

= TWD 3.1M + 4.0M = TWD 7.1M = TWD 2.8M + 3.2M = TWD 6.0M

8. Calculating OCF Ranney NV has sales of 13,500, costs of 5,400, depreciation expense of 1,200, and interest expense of 680. If the tax rate is 35 percent, what is the operating cash flow, or OCF?

8.

To calculate OCF, we first need the income statement: Income Statement Sales Costs Depreciation EBIT Interest Taxable income Taxes (35%) Net income 13,500 5,400 1,200 6,900 680 6,220 2,177 4,043

OCF = EBIT + Depreciation Taxes = 6,900 + 1,200 2,177 = 5,923

9. Calculating Net Capital Spending Gordon Driving School's 2004 balance sheet showed net fixed assets of $4.2 million, and the 2005 balance sheet showed net fixed assets of $4.7 million. The company's 2005 income statement showed a depreciation expense of $925,000. What was Gordon's net capital spending for 2005 ?

9. Net capital spending = NFAend NFAbeg + Depreciation= $4.7M 4.2M + 925K = $1.425M

10. Calculating Additions to NWC The 2004 balance sheet of Cape Town Records, showed current assets of ZAR 9,400 and current liabilities of ZAR 5,600. The 2005 balance sheet showed current assets of ZAR 10,240 and current liabilities of ZAR 8,400. What was the company's 2005 change in net working capital, or NWC?

10. Change in NWC = NWCend NWCbeg Change in NWC = (CAend CLend) (CAbeg CLbeg) Change in NWC = (ZAR 10,240 8,400) (ZAR 9,400 5,600) Change in NWC = ZAR 1,840 3,800 = ZAR 1960

11. Cash Flow to Creditors The 2004 balance sheet of Anna's Tennis Shop showed long-term debt of 2.8 million rubles, and the 2005 balance sheet showed long-term debt of 3.1 million rubles. The 2005 income statement showed an interest expense of 340,000 rubles. What was the firm's cash flow to creditors during 2005 ?

11. Cash flow to creditors = Interest paid Net new borrowing = RUR 340K (LTDend LTDbeg) Cash flow to creditors = RUR 340K (RUR 3.1M 2.8M) = RUR 340K 300K = RUR 40K

12. Cash Flow to Stockholders The 2004 balance sheet of Anna's Tennis Shop showed 820,000 rubles in the common stock account and 6.8 million rubles in the additional paid-in surplus account. The 2005 balance sheet showed 855,000 rubles and 7.6 million rubles in the same two accounts, respectively. If the company paid out 600,000 rubles in cash dividends during 2005, what was the cash flow to stockholders for the year?

12. Cash flow to stockholders = Dividends paid Net new equity Cash flow to stockholders = RUR 600K [(Commonend + APISend) (Commonbeg + APISbeg)] Cash flow to stockholders = RUR 600K [(RUR 820K + 6.8M) (RUR 855K + 7.6M)] Cash flow to stockholders = RUR 600K [RUR 7.62M 8.455M] = RUR 235K Note, APIS is the additional paid-in surplus.

13. Calculating Total Cash Flows Given the information for Anna's Tennis Shop in Problems 11 and 12, suppose you also know that the firm's net capital spending for 2005 was 760,000 rubles, and that the firm reduced its net working capital investment by 165,000 rubles. What was the firm's 2005 operating cash flow, or OCF?

13. Cash flow from assets= Cash flow to creditors + Cash flow to stockholders= RUR 40K 235K = RUR 195K Cash flow from assets= RUR 195K = OCF Change in NWC Net capital spending= OCF (RUR 165K) 760K = RUR 195K Operating cash flow = RUR 195K 165K + 760K = RUR 400K

14. Calculating Total Cash Flows Bedrock Gravel Corp. shows the following information on its 2005 income statement: sales = $145,000; costs == $86,000; other expenses = $4,900; depreciation expense = $7,000; interest expense = $15,000; taxes = $12,840; dividends = $8,700. In addition, you're told that the firm issued $6,450 in new equity during 2005, and redeemed $6,500 in outstanding long-term debt. a. What is the 2005 operating cash flow? b. What is the 2005 cash flow to creditors? c. What is the 2005 cash flow to stockholders? d. If net fixed assets increased by $5,000 during the year, what was the addition to NWC?

14.

To find the OCF, we first calculate net income. Income Statement Sales Costs Depreciation Other expenses EBIT Interest Taxable income Taxes (34%) Net income Dividends Additions to RE $10,560 $145,000 86,000 7,000 4,900 $47,100 15,000 $32,100 12,840 $19,260 $8,700

a. OCF = EBIT + Depreciation Taxes = $47,100 + 7,000 12,840 = $41,260 b. CFC = Interest Net new LTD = $15,000 $6,500 = $21,500. Note that the net new long-term debt is negative because the company repaid part of its long-term debt. c. CFS = Dividends Net new equity = $8,700 6,450 = $2,250

d. We know that CFA = CFC + CFS, so: CFA = $21,500 + 2,250 = $23,750 CFA is also equal to OCF Net capital spending Change in NWC. We already know OCF. Net capital spending is equal to: Net capital spending = Increase in NFA + Depreciation = $5,000 + 7,000 = $12,000.

Now we can use: CFA = OCF Net capital spending Change in NWC $23,750 = $41,260 12,000 Change in NWC. Solving for the change in NWC gives $5,510, meaning the company increased its NWC by $5,510.

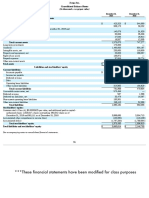

16. Preparing a Balance Sheet Prepare a 2005 balance sheet for Tim's Couch Corp. based on the following information: cash = $175,000; patents and copyrights =$720,000; accounts payable = $430,000; accounts receivable = $140,000; tangible net fixed assets = $2,900,000; inventory = $265,000; notes payable = $180,000; accumulated retained earnings = $1,240,000; long-term debt = $1,430,000.

16.

The balance sheet for the company looks like this: Balance Sheet Cash Accounts receivable Inventory Current assets Intangible net fixed assets Total assets $175,000 140,000 265,000 $580,000 720,000 $4,200,000 Accounts payable Notes payable Current liabilities Long-term debt Total liabilities Common stock Accumulated ret. earnings Total liab. & owners equity $430,000 80,000 $610,000 1,430,000 $2,040,000 ?? 1,240,000 $4,200,000

Total liabilities and owners equity is: TL & OE = CL + LTD + Common stock Solving for this equation for equity gives us: Common stock = $4,200,000 1,240,000 2,040,000 = $920,000

19. Net Income and OCF During 2005, Sun Shade Partners, a Saudi Arabian firm, had sales of 1,950,000 riyals. Cost of goods sold, administrative and selling expenses, and depreciation expenses were SAR 1,430,000, SAR 920,000, and SAR 515,000, respectively. In addition, the company had an interest expense of SAR 500,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.) a. What is Sun Shade's net income for? b. what is its operating cash flow? c. Explain your results in (a) and (b).

19. Sales

Income Statement SAR 1,950,000 1,430,000 920,000 515,000 (SAR 915,000) 500,000 0 (SAR 1,415,000) COGS A&S expenses Depreciation EBIT Interest Taxes (35%) a. Net income

Taxable income(SAR 1,415,000)

b. OCF = EBIT + Depreciation Taxes = (SAR 915,000) + 515,000 0 = (SAR 400,000) c. Net income was negative 1.415 million riyals because of the tax deductibility of depreciation and interest expense. However, the actual cash flow from operations was just negative 400,000 riyals because depreciation is a non-cash expense and interest is a financing expense, not an operating expense.

You might also like

- Chapter 2 - Q&PDocument36 pagesChapter 2 - Q&PHuyền ĐàoNo ratings yet

- Solutions Unit 2,8,9,10,11,16,19Document58 pagesSolutions Unit 2,8,9,10,11,16,19Thảo TrangNo ratings yet

- Financial Reporting & AnalysisDocument9 pagesFinancial Reporting & AnalysisNuman Rox0% (1)

- Concepts Review and Critical Thinking Questions 4Document6 pagesConcepts Review and Critical Thinking Questions 4fnrbhcNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- CF-A#1 - Waris - 01-322221-024Document8 pagesCF-A#1 - Waris - 01-322221-024Waris 3478-FBAS/BSCS/F16No ratings yet

- Financial Economic1Document7 pagesFinancial Economic1biancaftw90No ratings yet

- Problem Sets Solutions 1 Accounting Statements and Cash FlowDocument5 pagesProblem Sets Solutions 1 Accounting Statements and Cash FlowYaoyin Bonnie ChenNo ratings yet

- Finance 2Document7 pagesFinance 2Vũ Hải YếnNo ratings yet

- CH 02 - Financial Stmts Cash Flow and TaxesDocument32 pagesCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- MK Cap Budgeting CH 9 - 10 Ross PDFDocument17 pagesMK Cap Budgeting CH 9 - 10 Ross PDFSajidah PutriNo ratings yet

- Exercise 3. Cash Flows Statements and WorkingDocument8 pagesExercise 3. Cash Flows Statements and WorkingQuang Dũng NguyễnNo ratings yet

- Corporate Finance Final ExamDocument30 pagesCorporate Finance Final ExamJobarteh FofanaNo ratings yet

- Solution Manual For Corporate Finance Canadian 7th Edition by Ross Westerfield Jaffe Robertsl ISBN 0071339574 9780071339575Document36 pagesSolution Manual For Corporate Finance Canadian 7th Edition by Ross Westerfield Jaffe Robertsl ISBN 0071339574 9780071339575stephanievargasogimkdbxwn100% (18)

- Solution Manual For Fundamentals of Corporate Finance Canadian 9th Edition by Ross ISBN 1259087581 9781259087585Document36 pagesSolution Manual For Fundamentals of Corporate Finance Canadian 9th Edition by Ross ISBN 1259087581 9781259087585lauriedavisqdnxfetycj100% (24)

- FIN2704 Tutorial 1 Question 3 SolutionDocument5 pagesFIN2704 Tutorial 1 Question 3 SolutionAndrew TungNo ratings yet

- Calculate Owners Equity from Balance SheetDocument4 pagesCalculate Owners Equity from Balance SheetHoang MinhNo ratings yet

- Corporate Finance Exercises: Calculating OCF, NWC, Net Income & MoreDocument7 pagesCorporate Finance Exercises: Calculating OCF, NWC, Net Income & MoreNelson NofantaNo ratings yet

- Financial Statements ExplainedDocument36 pagesFinancial Statements ExplainedTakouhiNo ratings yet

- Accounting Statements, Taxes, and Cash Flow: Answers To Concepts Review and Critical Thinking Questions 1Document15 pagesAccounting Statements, Taxes, and Cash Flow: Answers To Concepts Review and Critical Thinking Questions 1RabinNo ratings yet

- Answers (مبادئ مالية) Ch.2and3Document11 pagesAnswers (مبادئ مالية) Ch.2and3moon lightNo ratings yet

- BT-Chap 2Document11 pagesBT-Chap 2Diệu Quỳnh100% (1)

- Question - FS and FADocument6 pagesQuestion - FS and FANguyễn Thùy LinhNo ratings yet

- Liquidity, Revenue, and Cash Flow ConceptsDocument3 pagesLiquidity, Revenue, and Cash Flow ConceptsThắng ThôngNo ratings yet

- Question - BS and FADocument6 pagesQuestion - BS and FANguyễn Thùy LinhNo ratings yet

- Solution Manual For Fundamentals of Corporate Finance Canadian Canadian 8Th Edition by Ross Isbn 0071051600 9780071051606 Full Chapter PDFDocument35 pagesSolution Manual For Fundamentals of Corporate Finance Canadian Canadian 8Th Edition by Ross Isbn 0071051600 9780071051606 Full Chapter PDFnancy.rodriguez985100% (10)

- Chapter 2 - Concept Questions and Exercises StudentDocument9 pagesChapter 2 - Concept Questions and Exercises StudentVõ Lê Khánh HuyềnNo ratings yet

- RWJJ Chapter 2 SolutionsDocument9 pagesRWJJ Chapter 2 SolutionsvzzrNo ratings yet

- Solution Manual For Fundamentals of Corporate Finance 10Th Edition by Ross Westerfield Jordan Isbn 0078034639 9780078034633 Full Chapter PDFDocument33 pagesSolution Manual For Fundamentals of Corporate Finance 10Th Edition by Ross Westerfield Jordan Isbn 0078034639 9780078034633 Full Chapter PDFjudy.pierce330100% (12)

- Financial Statement Analysis and ROE CalculationDocument4 pagesFinancial Statement Analysis and ROE CalculationPhương NhungNo ratings yet

- BU7300 - Corporate Finance Capital Budgeting Week 1Document21 pagesBU7300 - Corporate Finance Capital Budgeting Week 1Moony TamimiNo ratings yet

- Financial Management-Financial Statements-Chapter 2Document37 pagesFinancial Management-Financial Statements-Chapter 2Bir kişi100% (1)

- Ratios PresentationDocument13 pagesRatios PresentationAakash A. OzaNo ratings yet

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakFerry JohNo ratings yet

- HW1Document4 pagesHW1Asm BurraqNo ratings yet

- Statement of Comprehensive INCOME22Document58 pagesStatement of Comprehensive INCOME22Christine SalvadorNo ratings yet

- Ch02 SolDocument7 pagesCh02 Solalex5566No ratings yet

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- SM Ch3-6Document14 pagesSM Ch3-6Danka PredolacNo ratings yet

- Financial Statements Practice ProblemsDocument5 pagesFinancial Statements Practice ProblemsnajascjNo ratings yet

- Dwnload Full Corporate Finance Canadian 7th Edition Ross Solutions Manual PDFDocument26 pagesDwnload Full Corporate Finance Canadian 7th Edition Ross Solutions Manual PDFgoblinerentageb0rls7100% (9)

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- Corporate Finance Canadian 7th Edition Ross Solutions ManualDocument25 pagesCorporate Finance Canadian 7th Edition Ross Solutions ManualToniSmithmozr100% (60)

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakpurnamaNo ratings yet

- Chapter 2 Exercises 1Document13 pagesChapter 2 Exercises 1Ana María Del CerroNo ratings yet

- ANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)Document13 pagesANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)senzo scholarNo ratings yet

- Topic 2 ExercisesDocument6 pagesTopic 2 ExercisesRaniel Pamatmat0% (1)

- FCFF and FcfeDocument23 pagesFCFF and FcfeSaurav VidyarthiNo ratings yet

- Concepts Rev Iew and Critical Thinking QuestionsDocument8 pagesConcepts Rev Iew and Critical Thinking Questionsdt0035620No ratings yet

- 6 - Capital Budgeting in PracticeDocument21 pages6 - Capital Budgeting in PracticeJosh AckmanNo ratings yet

- Solutions Ch2Document3 pagesSolutions Ch2darkroyan426No ratings yet

- Measuring Cash Flows & Financial Planning: Dr. C. Bulent AybarDocument47 pagesMeasuring Cash Flows & Financial Planning: Dr. C. Bulent AybarKenneth PimentelNo ratings yet

- Chapter - 4, CF Free Cash Flow CU (Ismat)Document27 pagesChapter - 4, CF Free Cash Flow CU (Ismat)Anik ChakmaNo ratings yet

- Lecture Week 2Document34 pagesLecture Week 2soliman salmanNo ratings yet

- How to Analyze Cash Flows and Financial PlanningDocument68 pagesHow to Analyze Cash Flows and Financial Planninghunkie71% (7)

- Business Finance - Tutorial QuestionsDocument2 pagesBusiness Finance - Tutorial QuestionsButhaina HNo ratings yet

- Business Finance - Tutorial QuestionsDocument2 pagesBusiness Finance - Tutorial QuestionsButhaina HNo ratings yet

- Solutions Manual Corporate Fiance Ross W-75%Document10 pagesSolutions Manual Corporate Fiance Ross W-75%Desrifta FaheraNo ratings yet

- Ias 16Document4 pagesIas 16Alloysius ParilNo ratings yet

- A Study On The Sensitivity of Stock Options' Premium To Changes in The Underlying Stock's Dividend YieldDocument27 pagesA Study On The Sensitivity of Stock Options' Premium To Changes in The Underlying Stock's Dividend YieldAlloysius ParilNo ratings yet

- 03 Share Split and Treasury SharesDocument17 pages03 Share Split and Treasury SharesAlloysius ParilNo ratings yet

- 01 Review of Share Capital TransactionsDocument15 pages01 Review of Share Capital TransactionsAlloysius ParilNo ratings yet

- 02 Options, Rights and WarrantsDocument16 pages02 Options, Rights and WarrantsAlloysius ParilNo ratings yet

- Stockholders' EquityDocument68 pagesStockholders' EquityAlloysius Paril100% (1)

- IAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFDocument20 pagesIAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFMichelle TanNo ratings yet

- FA RevaluationDocument54 pagesFA RevaluationABCNo ratings yet

- SomethingDocument46 pagesSomethingcostakapoNo ratings yet

- Instructions On How To Create A Units of Production Depreciation ScheduleDocument2 pagesInstructions On How To Create A Units of Production Depreciation ScheduleMary100% (3)

- Primer On ValuationDocument6 pagesPrimer On ValuationPawan KasatNo ratings yet

- Latihan PAK Pert 5Document3 pagesLatihan PAK Pert 5Yudi HallimNo ratings yet

- Ias 40Document20 pagesIas 40Reever RiverNo ratings yet

- ANALYSIS of FINANCIAL STATEMENT Using Technique of Ratio Analysis by Furkan KamdarDocument72 pagesANALYSIS of FINANCIAL STATEMENT Using Technique of Ratio Analysis by Furkan Kamdarhumayunrashid84No ratings yet

- Impairment of Nonfinancial AssDocument6 pagesImpairment of Nonfinancial AssMarjorie Joyce BarituaNo ratings yet

- FAQ: Oracle Assets 'Upload Tax Book Interface' (FATAXUP) (Doc ID 579666.1)Document4 pagesFAQ: Oracle Assets 'Upload Tax Book Interface' (FATAXUP) (Doc ID 579666.1)Karen VilchesNo ratings yet

- I Light. Feasibility Study Paper FinalDocument48 pagesI Light. Feasibility Study Paper FinalDorothy Kate100% (1)

- Ahrend Sen 2012Document12 pagesAhrend Sen 2012sajid bhattiNo ratings yet

- BP OP ENTPR S4HANAX USV1 CO Master Data EN XXDocument144 pagesBP OP ENTPR S4HANAX USV1 CO Master Data EN XXLê Đình ChinhNo ratings yet

- Consolidated Mines Inc. Vs CTADocument1 pageConsolidated Mines Inc. Vs CTAAlyanna Barre100% (2)

- Project ReportDocument20 pagesProject ReportSrihari Babu100% (1)

- Exercise 05 (Individual Graded)Document2 pagesExercise 05 (Individual Graded)nininini2923No ratings yet

- DT Chart BookDocument62 pagesDT Chart BookShagun Chandrakar100% (1)

- 2015 Commentary NewDocument49 pages2015 Commentary NewHung Faat ChengNo ratings yet

- Assignment 1 Answers - Preparing Income StatementsDocument9 pagesAssignment 1 Answers - Preparing Income Statementsvarun022084No ratings yet

- IAS 40 ICAB QuestionsDocument5 pagesIAS 40 ICAB QuestionsMonirul Islam Moniirr100% (1)

- Asset AccountingDocument29 pagesAsset AccountingPallaviNo ratings yet

- Chapter 4Document24 pagesChapter 4Tanzeel HussainNo ratings yet

- Group3 Business Plan12Document24 pagesGroup3 Business Plan12Woldie Firiew100% (1)

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Beaver. Financial Ratios As Predictors of FailureDocument42 pagesBeaver. Financial Ratios As Predictors of FailureBudi PurwantoNo ratings yet

- 01 Capitalized CostDocument3 pages01 Capitalized CostDexter JavierNo ratings yet

- Soal Ujian AK1Document126 pagesSoal Ujian AK1tyasardyraNo ratings yet

- BADM741 Chapter 4Document29 pagesBADM741 Chapter 4eyob yohannesNo ratings yet

- Zynga 2019 Annual Report - Excerpts - FinalDocument7 pagesZynga 2019 Annual Report - Excerpts - FinalAlexa WilcoxNo ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAditi KhaitanNo ratings yet

- PP Descriptives-FACRDocument11 pagesPP Descriptives-FACRMisbah IlyasNo ratings yet