Professional Documents

Culture Documents

Cash Management

Uploaded by

Paramjit Sharma100%(3)100% found this document useful (3 votes)

2K views17 pagesHow to Manage cash and Marketable securties,Different types

Original Title

Cash Management

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHow to Manage cash and Marketable securties,Different types

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

100%(3)100% found this document useful (3 votes)

2K views17 pagesCash Management

Uploaded by

Paramjit SharmaHow to Manage cash and Marketable securties,Different types

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 17

Cash and Marketable Securities Management

Liquid Asset Management

CASH- motives for holding cash:

• Transactions: to meet cash needs

that arise from doing business.

• Precautionary: having cash on hand

for unexpected needs.

• Speculative: to take advantage of

potential profit-making situations.

Liquid Asset Management

Cash

• Trade Off: cash decreases risk of

insolvency, but earns no returns!

Cash Management

Managing Cash Inflow

• Lockbox System

Instead of mailing checks to the firm, customers mail

checks to a nearby P.O. Box.

A commercial bank collects and deposits the checks.

This reduces mail float, processing float and transit float.

Cash Management

Managing Cash Inflow

• Preauthorized Checks (PACs)

Arrangement that allows firms to create checks to collect

payments directly from customer accounts .

This reduces mail float and processing float.

Cash Management

Managing Cash Inflow

Depository Transfer Checks (DTCs)

Moves cash from local banks to concentration

bank accounts.

Firms avoid having idle cash in multiple banks in

different regions of the country.

Cash Management

Managing Cash Inflow

• Wire Transfers

Moves cash quickly between banks.

Eliminates transit float.

Cash Management

Managing Cash Outflow

• Zero Balance Accounts (ZBAs)

Different divisions of a firm may write checks from

their own ZBA.

Division accounts then have negative balances.

Cash is transferred daily from the firm’s master

account to restore the zero balance.

Allows more control over cash outflows .

Cash Management

Managing Cash Outflow

• Payable-Through Drafts (PTDs)

Allows the firm to examine checks written

by the firm’s regional units.

Checks are passed on to the firm, which can

stop payment if necessary.

Cash Management

Managing Cash Outflow

Remote Disbursing

Firm writes checks on a bank in a distant town.

This extends disbursing float.

Marketable Securities

Considerations

• Financial Risk - uncertainty of expected returns due to changes in

issuer’s ability to pay.

• Interest rate risk - uncertainty of expected returns due to changes

in interest rates.

Marketable Securities

Considerations

• Liquidity - ability to transform securities into

cash.

• Taxability - Taxability of interest income and

capital gains.

• Yield - Influenced by the previous 4

considerations.

Marketable Securities

Types

• Treasury Bills - short term securities issued by

the government.

Marketable Securities

Types

• Bankers’ Acceptances - short term securities used in

international trade. Sold on discount basis.

• Negotiable CDs - short-term securities issued by banks,

with typical deposits

Marketable Securities

Types

• Commercial Paper - short-term unsecured “IOUs” sold

by large reputable firms to raise cash.

• Repurchase Agreements - an investor acquires short-

term securities subject to a commitment from a bank to

repurchase the securities on a specific date.

Marketable Securities

Types

• Money Market Mutual Funds - a pool of money

market securities, divided into shares, which

are sold to investors.

?

You might also like

- Types of PsychologyDocument62 pagesTypes of PsychologyParamjit SharmaNo ratings yet

- Retrenchment Strategies in HRDocument34 pagesRetrenchment Strategies in HRParamjit Sharma88% (8)

- Mapping Competency of ManpowerDocument28 pagesMapping Competency of ManpowerParamjit Sharma100% (1)

- Industrial & Business PsychologyDocument58 pagesIndustrial & Business PsychologyParamjit Sharma100% (1)

- Bobatrader: Guide To Consistent Daytrading: Wsodownloads - inDocument33 pagesBobatrader: Guide To Consistent Daytrading: Wsodownloads - inram ramNo ratings yet

- Creditrisk Credit SuisseDocument92 pagesCreditrisk Credit SuisseAdarsh Kumar50% (6)

- Goals CongruenceDocument23 pagesGoals CongruenceParamjit Sharma100% (1)

- Bliss v. California Coop ProducersDocument1 pageBliss v. California Coop ProducersTrinca DiplomaNo ratings yet

- Managing Stress in AdolescentsDocument42 pagesManaging Stress in AdolescentsParamjit SharmaNo ratings yet

- Management Control Systems in Services OrganizationDocument17 pagesManagement Control Systems in Services OrganizationParamjit Sharma100% (2)

- Strategic Performance ManagementDocument34 pagesStrategic Performance ManagementParamjit SharmaNo ratings yet

- The Tribute (A Short Story)Document9 pagesThe Tribute (A Short Story)Paramjit SharmaNo ratings yet

- Male Female PsychologyDocument38 pagesMale Female PsychologyParamjit SharmaNo ratings yet

- Working CapitalDocument61 pagesWorking CapitalSharmistha Banerjee100% (1)

- Capital MarketDocument6 pagesCapital Marketmdsabbir100% (1)

- Depository System Project Report for Jalgaon Peoples Cooperative BankDocument58 pagesDepository System Project Report for Jalgaon Peoples Cooperative BankUrwashi0% (1)

- Strategic Human Resource ManagementDocument27 pagesStrategic Human Resource ManagementParamjit Sharma67% (3)

- Strategic Financial ManagementDocument16 pagesStrategic Financial ManagementParamjit SharmaNo ratings yet

- Technology and Innovation in Global Shared Service CentersDocument28 pagesTechnology and Innovation in Global Shared Service CentersInstant Assignment HelpNo ratings yet

- Training of TrainersDocument26 pagesTraining of TrainersParamjit SharmaNo ratings yet

- Training & Development StrategiesDocument15 pagesTraining & Development StrategiesParamjit SharmaNo ratings yet

- Measuring & Controlling Assets EmployedDocument26 pagesMeasuring & Controlling Assets EmployedParamjit SharmaNo ratings yet

- TTQTDocument24 pagesTTQTXu XuNo ratings yet

- What If ?: Scanning The Horizon: 12 Scenarios For 2021Document74 pagesWhat If ?: Scanning The Horizon: 12 Scenarios For 2021Daiuk.DakNo ratings yet

- The Entrepreneurial Employee in The Public and Private SectorDocument52 pagesThe Entrepreneurial Employee in The Public and Private SectorDaiuk.DakNo ratings yet

- Trainee Train Guard: Information PackDocument22 pagesTrainee Train Guard: Information PackstanleyNo ratings yet

- Leadership and Values: What Is Leadership-Some InsightsDocument5 pagesLeadership and Values: What Is Leadership-Some InsightssharathNo ratings yet

- 5 Tips To Effective Succession PlanningDocument11 pages5 Tips To Effective Succession PlanningSumTotal Talent ManagementNo ratings yet

- KD0120288ENN enDocument142 pagesKD0120288ENN enDaiuk.DakNo ratings yet

- Management of Expatriates: By: Ishu Mahajan Ritu Sharma Urvashi SultaniaDocument24 pagesManagement of Expatriates: By: Ishu Mahajan Ritu Sharma Urvashi Sultaniarak_sai15No ratings yet

- Finding Hope Amid Poverty: Micro FinancingDocument30 pagesFinding Hope Amid Poverty: Micro FinancingParamjit Sharma100% (4)

- SumTotal Strategic HCM BrochureDocument4 pagesSumTotal Strategic HCM BrochureSumTotal Talent ManagementNo ratings yet

- Inancial Lanning: Paramjit SharmaDocument34 pagesInancial Lanning: Paramjit SharmaParamjit Sharma100% (3)

- Tenaris University Case Study: Improving The Flexibility of Learning Management To Expand Its Reach and Meet Corporate Training ObjectivesDocument3 pagesTenaris University Case Study: Improving The Flexibility of Learning Management To Expand Its Reach and Meet Corporate Training ObjectivesSumTotal Talent ManagementNo ratings yet

- Employee Engagement Survey of 10 CompaniesDocument16 pagesEmployee Engagement Survey of 10 CompaniespujanswetalNo ratings yet

- Techniques of Work With The Public: - Organization of "Pseudo"/media/-EventsDocument10 pagesTechniques of Work With The Public: - Organization of "Pseudo"/media/-EventsRajanRanjanNo ratings yet

- Types of ContractsDocument27 pagesTypes of ContractsWaelBouNo ratings yet

- Effective Interviewing Skills:: A Self-Help GuideDocument29 pagesEffective Interviewing Skills:: A Self-Help Guideaqas_khanNo ratings yet

- Reliabilityedge V12i1Document32 pagesReliabilityedge V12i1NdomaduNo ratings yet

- An Examination of Organizational Change and Structure in The Healthcare IndustryDocument167 pagesAn Examination of Organizational Change and Structure in The Healthcare IndustryrezasattariNo ratings yet

- 2018 Global Assessment Trends Report en PDFDocument40 pages2018 Global Assessment Trends Report en PDFstanleyNo ratings yet

- 07 SelectionMethods 28pDocument28 pages07 SelectionMethods 28paqas_khanNo ratings yet

- Reliability Basics II Using FMRA To Estimate Baseline ReliabilityDocument10 pagesReliability Basics II Using FMRA To Estimate Baseline ReliabilityNdomaduNo ratings yet

- Estimating & TenderingDocument21 pagesEstimating & TenderingRajanRanjanNo ratings yet

- Leadership Topic - Motivation, Satisfaction and Performance: AgendaDocument8 pagesLeadership Topic - Motivation, Satisfaction and Performance: AgendasharathNo ratings yet

- SOCIAL COHESION INTERVIEW TIPSDocument7 pagesSOCIAL COHESION INTERVIEW TIPSRajanRanjanNo ratings yet

- Marketing CompetitionDocument36 pagesMarketing CompetitionParamjit Sharma100% (7)

- Revenue Account AsignmentDocument6 pagesRevenue Account Asignmentmshabnam100% (2)

- Leadership PDFDocument252 pagesLeadership PDFaboubakr soultanNo ratings yet

- Emergency procedures at a glanceDocument21 pagesEmergency procedures at a glanceigoeneezmNo ratings yet

- Cooperative EnvironmentDocument23 pagesCooperative EnvironmentParamjit Sharma100% (1)

- Material Listing and ExclusionDocument5 pagesMaterial Listing and ExclusionmshabnamNo ratings yet

- GKN Case Study: Global High-Tech Manufacturer Aligns Workforce Processes Using SumTotalDocument2 pagesGKN Case Study: Global High-Tech Manufacturer Aligns Workforce Processes Using SumTotalSumTotal Talent ManagementNo ratings yet

- Estimation and Quantity Surveying Document TitleDocument21 pagesEstimation and Quantity Surveying Document TitleRajanRanjanNo ratings yet

- The Campaign FrameworkDocument11 pagesThe Campaign FrameworkgagansrikankaNo ratings yet

- CTRL Keyboard Shortcuts for Word Formatting & CommandsDocument1 pageCTRL Keyboard Shortcuts for Word Formatting & CommandsTilahun MikiasNo ratings yet

- Working in Systems: The Landscapes Framework: Centre For Innovation in Health ManagementDocument21 pagesWorking in Systems: The Landscapes Framework: Centre For Innovation in Health Managementevansdrude993No ratings yet

- How To Use ScribdDocument67 pagesHow To Use Scribdremarkableva_lfq0% (1)

- Contingency Theories of LeadershipDocument7 pagesContingency Theories of LeadershipsharathNo ratings yet

- 02 Recruitment 16pDocument16 pages02 Recruitment 16paqas_khanNo ratings yet

- Output ControlDocument8 pagesOutput ControlmshabnamNo ratings yet

- The Time Value of MoneyDocument5 pagesThe Time Value of MoneyBijay AgrawalNo ratings yet

- Discuss the results and emphasize the importance of people skills in all rolesDocument12 pagesDiscuss the results and emphasize the importance of people skills in all rolesigoeneezmNo ratings yet

- Strategic Management Chap012Document49 pagesStrategic Management Chap012rizz_inkays100% (1)

- OD Practitioner CompetenciesDocument13 pagesOD Practitioner CompetenciesKavita TiwariNo ratings yet

- Insurance Services: Module 2-Merchant Banking and Financial Services MBA III Semester Finance Elective Ranjani JDocument15 pagesInsurance Services: Module 2-Merchant Banking and Financial Services MBA III Semester Finance Elective Ranjani Jwelcome2jungleNo ratings yet

- Six Sigma PresentationDocument25 pagesSix Sigma PresentationWaelBouNo ratings yet

- HRD 16 Employee Warning NoticeDocument2 pagesHRD 16 Employee Warning NoticeHOSAM HUSSEINNo ratings yet

- IC Agile Project With Gantt 10578 - 0Document5 pagesIC Agile Project With Gantt 10578 - 0thanhloan1902No ratings yet

- Intelligent Infrastructure For Next Generation Rail Systems PDFDocument9 pagesIntelligent Infrastructure For Next Generation Rail Systems PDFNalin_kantNo ratings yet

- Shared Services OpportunityDocument13 pagesShared Services OpportunityteemickdeeNo ratings yet

- HIRING WINNING TRAINEEDocument4 pagesHIRING WINNING TRAINEEusersumitNo ratings yet

- STRATEGYDocument20 pagesSTRATEGYBijay AgrawalNo ratings yet

- Employee turnover cost calculatorDocument1 pageEmployee turnover cost calculatorsimmi2768No ratings yet

- Marketing-Managing Sales ForceDocument22 pagesMarketing-Managing Sales ForceParamjit Sharma100% (5)

- SumTotal Toolbook 11.0Document6 pagesSumTotal Toolbook 11.0SumTotal Talent ManagementNo ratings yet

- Managing Cash and Marketable SecuritiesDocument39 pagesManaging Cash and Marketable SecuritiesindraNo ratings yet

- Arief Taufiqqurrakhman (C1B018115) Cash and Marketable Securities Management and Working Capital and Short-Term Financing PDFDocument6 pagesArief Taufiqqurrakhman (C1B018115) Cash and Marketable Securities Management and Working Capital and Short-Term Financing PDFBikin RelaxNo ratings yet

- Cash Management Varun 10808154 Project OnDocument24 pagesCash Management Varun 10808154 Project Ondont_forgetme2004No ratings yet

- In Search of The Lost FatherDocument11 pagesIn Search of The Lost FatherParamjit SharmaNo ratings yet

- Beating Tough TargetsDocument43 pagesBeating Tough TargetsParamjit SharmaNo ratings yet

- Selection & Personality TestsDocument70 pagesSelection & Personality TestsParamjit SharmaNo ratings yet

- Strategic Management ProcessDocument95 pagesStrategic Management ProcessParamjit SharmaNo ratings yet

- Interpersonal RelationshipDocument57 pagesInterpersonal RelationshipParamjit SharmaNo ratings yet

- Excellence in CommitmentDocument43 pagesExcellence in CommitmentParamjit SharmaNo ratings yet

- Motivating ManpowerDocument32 pagesMotivating ManpowerParamjit SharmaNo ratings yet

- Few Tips For Job InterviewDocument11 pagesFew Tips For Job InterviewParamjit SharmaNo ratings yet

- Atonement (A Short Story)Document9 pagesAtonement (A Short Story)Paramjit SharmaNo ratings yet

- Shatabdi Express (A Short Story)Document10 pagesShatabdi Express (A Short Story)Paramjit SharmaNo ratings yet

- Training Dynamics-Using Modern ToolsDocument34 pagesTraining Dynamics-Using Modern ToolsParamjit SharmaNo ratings yet

- Management Control Systems: Paramjit SharmaDocument33 pagesManagement Control Systems: Paramjit SharmaParamjit Sharma0% (1)

- Sparkling Spectacles (A Short Story)Document8 pagesSparkling Spectacles (A Short Story)Paramjit SharmaNo ratings yet

- Responsibility CentresDocument25 pagesResponsibility CentresParamjit Sharma100% (2)

- Profit CentresDocument8 pagesProfit CentresParamjit SharmaNo ratings yet

- National Pension System (NPS) Subscriber Registration FormDocument2 pagesNational Pension System (NPS) Subscriber Registration Formkumarvaibhav301745No ratings yet

- "Corporate Strategy": by H I AnsoffDocument14 pages"Corporate Strategy": by H I AnsoffjashanNo ratings yet

- Keith Brown ResumeDocument2 pagesKeith Brown ResumekeithbrownfinanceNo ratings yet

- Etf Guide PDFDocument2 pagesEtf Guide PDFFalconsNo ratings yet

- Financial Accounting 7th EditionDocument4 pagesFinancial Accounting 7th Editiongilli1trNo ratings yet

- Daftar Akun Nomor Nama Akun Fungsi Untuk Mencatat Mutasi NilaiDocument4 pagesDaftar Akun Nomor Nama Akun Fungsi Untuk Mencatat Mutasi NilaiFhina LarioNo ratings yet

- Ireland - Shareholders Agreement Existing Company Shareholder DirectorsDocument3 pagesIreland - Shareholders Agreement Existing Company Shareholder Directorsclark_taylorukNo ratings yet

- APC313 Assessment Brief January19Document3 pagesAPC313 Assessment Brief January19Hoài Sơn VũNo ratings yet

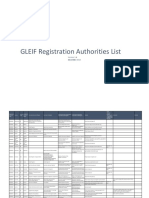

- GLEIF Registration Authorities List: 4 December 2018Document33 pagesGLEIF Registration Authorities List: 4 December 2018fhrjhaqobNo ratings yet

- South African Airways v. Commissioner of Internal Revenue: The CorrectDocument2 pagesSouth African Airways v. Commissioner of Internal Revenue: The CorrectJeliSantosNo ratings yet

- AigDocument22 pagesAigHarsh MehtaNo ratings yet

- Alasseel Financial ResultsDocument17 pagesAlasseel Financial ResultsmohamedNo ratings yet

- Annaly Investor PresentationDocument22 pagesAnnaly Investor PresentationFelix PopescuNo ratings yet

- BCG MatrixDocument14 pagesBCG Matrixamits797No ratings yet

- PROFITMART - Franchisee-1Document17 pagesPROFITMART - Franchisee-1Suyash KhairnarNo ratings yet

- Skolkovo InvestmentsDocument14 pagesSkolkovo InvestmentsSegah MeerNo ratings yet

- Akash BrahmbhattDocument73 pagesAkash Brahmbhattnisarg_No ratings yet

- Assignment Risk and ReturnDocument3 pagesAssignment Risk and ReturnCheong Yu ShuangNo ratings yet

- Kirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemDocument33 pagesKirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemMurali MohanNo ratings yet

- Course Schedule and Cases 2-20-2021Document16 pagesCourse Schedule and Cases 2-20-2021Christian Ian LimNo ratings yet

- Nexa - Financial Statements 2021Document74 pagesNexa - Financial Statements 2021Jefferson JuniorNo ratings yet

- Sample Exam Questions (And Answers)Document22 pagesSample Exam Questions (And Answers)Diem Hang VuNo ratings yet

- Performance of Mutual Fund Schemes in IndiaDocument8 pagesPerformance of Mutual Fund Schemes in IndiaPankaj GuravNo ratings yet