Professional Documents

Culture Documents

Group9 Morrissey Forgings

Uploaded by

Varun GargOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group9 Morrissey Forgings

Uploaded by

Varun GargCopyright:

Available Formats

Aditya Ahluwalia Ankur Jain Gurveen Singh Taneja Kaustubh Mohite Mithun Naik Varun Garg

GROUP 9 11P122 11P124 11P140 11P143 11P149 11P179

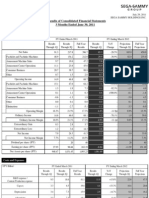

Total Selling cost = Selling Cost + Sales commissions Promotion and Advertising cost only for ovens As 2 teams are working independently in core and non core area so sales commission will be equally divided between the two Only the selling cost has become 2.5 times from 1983 to 1985

Year 1983 1985

Activity Selling Selling Selling

Stove (Units) 30,000 25,000

Oven (Units)

Total Cost 1,540,00 0 (40%) 1,283,33 3

Per Unit Cost 51.33 51.33 92.08 12.08

20,000 25,000 5,000

1,841,66 7 362,500

1985

Sales com. (Core) Sales com. (Non Core) Total Selling Total Selling

15,000

362,500

24.17

25,000 20,000

1,585,33 3 2,325,00 0

63.41 116.25

Stove

Oven

Total manufacturing cost (per unit) Total shipping cost (per unit) Total selling cost (per unit) Unit Variable cost Unit Price Contribution margin Fixed Overhead

163 33 63.41 259.41 300 40.59 1,225,000

189 83.5 116.25 388.5 350 (38.5) 1,300,000

Company is not able to recover the variable cost (negative contribution margin) in case of ovens so it has to increase the unit price of ovens.

Thank You

You might also like

- Group 7 - Morrissey ForgingsDocument10 pagesGroup 7 - Morrissey ForgingsVishal AgarwalNo ratings yet

- Morrisey Forgings - STCM - Group 1Document8 pagesMorrisey Forgings - STCM - Group 1Parul JainNo ratings yet

- Management Accounting/Series-4-2011 (Code3024)Document18 pagesManagement Accounting/Series-4-2011 (Code3024)Hein Linn Kyaw100% (2)

- Period 4Document18 pagesPeriod 4redbull855No ratings yet

- An Accounting Approach To Linear Programming: Dennis F. TogoDocument9 pagesAn Accounting Approach To Linear Programming: Dennis F. TogoMohammed Mohammed MohammedNo ratings yet

- 4587 - 2179 - 10 - 1486 - 54 - Unit CostingDocument24 pages4587 - 2179 - 10 - 1486 - 54 - Unit CostingApoorv TiwariNo ratings yet

- S2 G9 Hanson CaseDocument2 pagesS2 G9 Hanson CaseShraddha PandyaNo ratings yet

- Chapter Vi Unit Costing SolutionsDocument10 pagesChapter Vi Unit Costing SolutionsKishan SolankiNo ratings yet

- Ecocina Calculator: Sales Projection Entry Enter Projected Stoves Sold Stoves % Waste % Unsold Produced Replacement DemosDocument45 pagesEcocina Calculator: Sales Projection Entry Enter Projected Stoves Sold Stoves % Waste % Unsold Produced Replacement DemosFanny Mabel GermanNo ratings yet

- Cost Accounting/Series-3-2007 (Code3016)Document18 pagesCost Accounting/Series-3-2007 (Code3016)Hein Linn Kyaw50% (6)

- Revenue Variance ExampleDocument1 pageRevenue Variance ExampleImperoCo LLCNo ratings yet

- Financial Projections For Bakery BusinessDocument5 pagesFinancial Projections For Bakery BusinessOni SundayNo ratings yet

- 05 Lilac Flour MillsDocument6 pages05 Lilac Flour Millsspaw1108No ratings yet

- Crescent PureDocument7 pagesCrescent PureShubham RankaNo ratings yet

- Management Accounting Level 3: LCCI International QualificationsDocument17 pagesManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (2)

- Cost AccountingDocument5 pagesCost AccountingMAk KhanNo ratings yet

- MANAC II - Morrissey Forgings CaseDocument8 pagesMANAC II - Morrissey Forgings CaseKaran Oberoi100% (1)

- Pile cp2Document108 pagesPile cp2casarokarNo ratings yet

- Chapter 15Document7 pagesChapter 15Rahila RafiqNo ratings yet

- Chapter 10Document9 pagesChapter 10Patrick Earl T. PintacNo ratings yet

- Answer Key (SW1 To SW3)Document6 pagesAnswer Key (SW1 To SW3)MA. CRISSANDRA BUSTAMANTENo ratings yet

- Caso Bill FrenchDocument3 pagesCaso Bill Frenchplito21No ratings yet

- Cost Accounting Level 3: LCCI International QualificationsDocument20 pagesCost Accounting Level 3: LCCI International QualificationsHein Linn Kyaw33% (3)

- Cost Accounting - Case-Daniel DobbinsDocument1 pageCost Accounting - Case-Daniel DobbinsRatin Mathur100% (4)

- Whirlpool SpreadsheetsDocument8 pagesWhirlpool SpreadsheetsGopi223No ratings yet

- Costing - ManufacturingDocument36 pagesCosting - ManufacturingMadiha MaddyNo ratings yet

- Qty Price TotalDocument6 pagesQty Price TotalpaulynNo ratings yet

- Craik VeneerDocument6 pagesCraik VeneerbrijmohanjakhmolaNo ratings yet

- Berkshire Threaded FastenersDocument3 pagesBerkshire Threaded FastenersVenkatesh Gopal100% (1)

- Using Absorption Costing and Marginal Costing and Find The Net Profit of The Each MethodDocument3 pagesUsing Absorption Costing and Marginal Costing and Find The Net Profit of The Each Methoddesignnine_melanNo ratings yet

- Analisis Econ Financ Yacon Final FinallllllllllllllllllllllllllllllllllllesDocument19 pagesAnalisis Econ Financ Yacon Final FinallllllllllllllllllllllllllllllllllllesvitelioatNo ratings yet

- Average 2.06318109Document12 pagesAverage 2.06318109Dina ErtoleuNo ratings yet

- Chapter Xvii Decisions Involving Alternative Choices SolutionsDocument6 pagesChapter Xvii Decisions Involving Alternative Choices Solutionsshital_vyas1987No ratings yet

- Group Members: 1) FENG Shile (54052978) 2) 3) : Semester B 2015-2016 Department of Accounting Group Project CB2101/T01Document5 pagesGroup Members: 1) FENG Shile (54052978) 2) 3) : Semester B 2015-2016 Department of Accounting Group Project CB2101/T01Ong Ming KaiNo ratings yet

- Chapter 9 Excel Budget AssignmentDocument4 pagesChapter 9 Excel Budget Assignmentapi-261038165No ratings yet

- Hot Wheels Marketing AnalysisDocument6 pagesHot Wheels Marketing AnalysisSouptik MukherjeeNo ratings yet

- SM Supersonic Stereo ExhibitsDocument9 pagesSM Supersonic Stereo ExhibitsAshish MittalNo ratings yet

- Level 4 New Assesment Battachment-3Document11 pagesLevel 4 New Assesment Battachment-3biniamNo ratings yet

- Abc DemmDocument8 pagesAbc DemmsagarNo ratings yet

- Chapter 3 - Budgetary Process - 15022022Document14 pagesChapter 3 - Budgetary Process - 15022022linh nguyễnNo ratings yet

- Molla Sajidur Rahim,,,Id 181 019 811Document9 pagesMolla Sajidur Rahim,,,Id 181 019 811Shariar ShawoŋNo ratings yet

- Chapter 4 Accounting For Partnership AnswerDocument17 pagesChapter 4 Accounting For Partnership AnswerTan Yilin0% (1)

- CHAPTER 11 Answer KeyDocument8 pagesCHAPTER 11 Answer KeyEnsot Soriano33% (3)

- Managerial Accounting and ControlDocument62 pagesManagerial Accounting and ControlAshutosh KumarNo ratings yet

- AMF Bowling Ball - SSCDocument3 pagesAMF Bowling Ball - SSCAbubakar ShafiNo ratings yet

- Huron Automotive Company - ExcelDocument6 pagesHuron Automotive Company - Excelanubhav110957% (7)

- Hosoku e FinalDocument6 pagesHosoku e FinalSaberSama620No ratings yet

- Revenue Variance ExampleDocument1 pageRevenue Variance ExampleNakkolopNo ratings yet

- Bolt Project ReportDocument4 pagesBolt Project ReportRaviNo ratings yet

- Athens Glass WorksDocument13 pagesAthens Glass WorksAdityaImannudinSuryomurtjitoNo ratings yet

- India and China - Savings and Spending PattersDocument30 pagesIndia and China - Savings and Spending PattersVarun GargNo ratings yet

- Personality ProfilingDocument24 pagesPersonality ProfilingVarun GargNo ratings yet

- Tower AssociatesDocument8 pagesTower AssociatesVarun GargNo ratings yet

- Corporate Outsourcing: Hidden CostsDocument11 pagesCorporate Outsourcing: Hidden CostsVarun GargNo ratings yet

- Clint-Wheelock-Pike Research - SG TutorialDocument56 pagesClint-Wheelock-Pike Research - SG TutorialVarun GargNo ratings yet

- Photovoltaic Cells and Its Potential in India: Mdi GurgaonDocument53 pagesPhotovoltaic Cells and Its Potential in India: Mdi GurgaonVarun GargNo ratings yet

- Topic 4:: Exchange Rate Regimes & PoliciesDocument50 pagesTopic 4:: Exchange Rate Regimes & PoliciesVarun GargNo ratings yet

- IntEco Case2-Krugman Nobel Prize LectureDocument14 pagesIntEco Case2-Krugman Nobel Prize LectureVarun GargNo ratings yet

- Krugman-Increasing Returns 1978Document11 pagesKrugman-Increasing Returns 1978Varun GargNo ratings yet

- Reciprocal DumpingDocument4 pagesReciprocal DumpingVarun GargNo ratings yet

- IntEco Case 99-Mexico FordDocument22 pagesIntEco Case 99-Mexico FordVarun GargNo ratings yet

- IntEco Case 2 GravityModel XRate Exports HrushikeshMallickDocument39 pagesIntEco Case 2 GravityModel XRate Exports HrushikeshMallickVarun GargNo ratings yet

- Value Ipad IphoneDocument11 pagesValue Ipad IphoneVarun GargNo ratings yet

- Topic2a WorldTrade InstitutionsDocument54 pagesTopic2a WorldTrade InstitutionsVarun GargNo ratings yet

- Case Price Discrimination Nescafe CoffeeDocument7 pagesCase Price Discrimination Nescafe CoffeeVarun GargNo ratings yet

- Topic 3 - New Trade TheoriesDocument60 pagesTopic 3 - New Trade TheoriesVarun GargNo ratings yet

- Group B9 - Co-Movement of Various Global Stockmarket Indices Couses and ImplicationsDocument21 pagesGroup B9 - Co-Movement of Various Global Stockmarket Indices Couses and ImplicationsVarun GargNo ratings yet

- Report2 GST ImpactDocument87 pagesReport2 GST ImpactNishigandha SharmaNo ratings yet

- Carrot and Stick Model Approach in Organizations-1Document15 pagesCarrot and Stick Model Approach in Organizations-1Varun GargNo ratings yet

- Consumer Behavior in IndiaDocument15 pagesConsumer Behavior in IndiaNISHANo ratings yet

- The AssignmentDocument9 pagesThe Assignmentkapil sharmaNo ratings yet

- Hospital Project 1Document49 pagesHospital Project 1Rutvi Shah RathiNo ratings yet

- Final Report Askari BankDocument117 pagesFinal Report Askari BankAsha JadunNo ratings yet

- MBA - 101 - AnswersDocument9 pagesMBA - 101 - AnswersramtgemNo ratings yet

- 1.1 Introduction To EconomicsDocument9 pages1.1 Introduction To EconomicsManupa PereraNo ratings yet

- India Post - ToWSDocument10 pagesIndia Post - ToWSTushar BallabhNo ratings yet

- A Beginner's Guide To Altcoin Day TradingDocument16 pagesA Beginner's Guide To Altcoin Day Tradingblowinzips67% (6)

- 2017 04 Monthly ReportDocument134 pages2017 04 Monthly ReporttexasbigNo ratings yet

- Dividend PolicyDocument24 pagesDividend PolicyKômâl MübéèñNo ratings yet

- Financial Markets and Services NotesDocument94 pagesFinancial Markets and Services NotesShravan Richie100% (7)

- Bo SungDocument10 pagesBo SungYên Khuê TrầnNo ratings yet

- 1.design A Chart of Accounts - ManagerDocument4 pages1.design A Chart of Accounts - ManagerIsrael EmbayarteNo ratings yet

- Instrument Loan Agreement FormDocument2 pagesInstrument Loan Agreement FormBrianNo ratings yet

- Chapter 1 - Cost Accounting FundamentalsDocument16 pagesChapter 1 - Cost Accounting FundamentalsPrincess Jay NacorNo ratings yet

- Water Refilling Station Business ProposalDocument4 pagesWater Refilling Station Business ProposalCarren BorasNo ratings yet

- Excerpt From "Newcomers: Gentrification and Its Discontents" by Matthew Schuerman.Document13 pagesExcerpt From "Newcomers: Gentrification and Its Discontents" by Matthew Schuerman.OnPointRadioNo ratings yet

- Market Research WorksheetDocument7 pagesMarket Research WorksheetNabila Nailatus SakinaNo ratings yet

- How Can Smes Effectively Implement The CSR Agenda: Kelompok 5Document21 pagesHow Can Smes Effectively Implement The CSR Agenda: Kelompok 5Vitha MasyitaNo ratings yet

- Pableo - Case Analysis Paper - Case Study 1.2Document2 pagesPableo - Case Analysis Paper - Case Study 1.2Gerline PableoNo ratings yet

- Learning Activity 3 - Inc TaxDocument3 pagesLearning Activity 3 - Inc TaxErica FlorentinoNo ratings yet

- IFID BrochureDocument6 pagesIFID BrochurePrabhakar SharmaNo ratings yet

- Human Resource ManagementDocument66 pagesHuman Resource ManagementMwanza MaliiNo ratings yet

- Benefits AccountingDocument4 pagesBenefits AccountingJulian Christopher Torcuator50% (2)

- Sped'Ers C.A.R.E Organization Financial Statement: Don Mariano Marcos Memorial State UniversityDocument2 pagesSped'Ers C.A.R.E Organization Financial Statement: Don Mariano Marcos Memorial State Universitychenee liezl horarioNo ratings yet

- LSCM Assignment 1 - Diet 1 2020 - 21Document7 pagesLSCM Assignment 1 - Diet 1 2020 - 21Ronisha ShresthaNo ratings yet

- Artificial Flowers Import Business PlanDocument34 pagesArtificial Flowers Import Business PlanZUZANI MATHIYANo ratings yet

- Regular Result of Bba (B I) 2015 Batch e T Exam May-June 2016Document35 pagesRegular Result of Bba (B I) 2015 Batch e T Exam May-June 2016Parmeet SinghNo ratings yet

- Economic Incentive SystemsDocument23 pagesEconomic Incentive SystemsMark Arboleda GumamelaNo ratings yet

- General Mills 2017 Annual ReportDocument96 pagesGeneral Mills 2017 Annual ReportIrfan Ahmed Ayaz AhmedNo ratings yet

- Business PlanDocument57 pagesBusiness Plankim john SiaNo ratings yet