Professional Documents

Culture Documents

Capital Structure 1

Uploaded by

Yash SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Structure 1

Uploaded by

Yash SharmaCopyright:

Available Formats

Capital Structure

Capital Structure refers to the combination or mix of debt and equity which a company uses to finance its long- term operations. In other words, Capital structure is the permanent financing of the firm, represented by long- term debt, preferred stock and net- worth.

Capitalization is the determination of the quantum of capital whereas capital structure refers to the determination of forms or types of capital.

Point of Indifference

It refers to that EBIT level at which EPS remains the same irrespective of the debt- equity mix. In other words, at this point, rate of return on capital employed is equal to the rate of interest on debt. This is also known as Break- Even Level of EBIT for alternative financial plans.

( X I1 ) (1 T ) PD S1

= ( X I2 ) ( 1- T) PD S2

Where, X = Point of Indifference or Break Even EBIT Level I1 = Interest under alternative 1 I2 = Interest under alternative 2 T = Tax Rate PD = Preference Dividend S1 = Number of Equity Shares (or amount of equity share capital) under alternative 1 S2 = Number of Equity Shares (or amount of equity share capital) under alternative 2

Patterns of Capital Structure

In case of new company the capital structure may be of any of the following four patterns: Capital structure with equity shares only Capital structure with both equity and preference shares Capital structure with equity shares and debentures Capital structure with equity shares, preference shares and debentures

Optimum Capital Structure

The optimum capital structure of a firm is obtained when the market value per equity share is the maximum. In other words, the relationship of debt and equity securities which maximizes the value of a companys share in the stock exchange. In case a company borrows and this borrowings helps in increasing the value of the companys shares in the stock exchange, it can be said that the borrowing has helped the company in moving towards its optimum capital structure. The objective of the firm should therefore be to select a financing or debt equity mix which will lead to maximum value of the firm.

Capital Structure Theories

Net Income Approach Net Operating Income Approach Traditional Approach Modigliani- Miller Approach

Assumptions

The firm employs only two types of capital debt and equity. There are also no preference shares.

The firm pays 100% of its earnings as dividend. Thus, there are no retained earnings.

The firms total assets are given and they do not change. In other words the investment decisions are assumed to be constant. The firms total financing remains constant. The operating earnings (EBIT) are not expected to grow.

The business risk remains constant and is independent of capital structure and financial risks. All investors have the same subjective probability distribution of the future expected operating earnings (EBIT) for a given firm. The firm has a perpetual life.

Net Income (NI) Approach

This approach has been suggested by Durand. According to this theory, a firm can increase the value of the firm and reduce the overall cost of capital by increasing the proportion of debt in its capital structure to the maximum possible extent. Debt is generally a cheaper source of funds because (i) interest rates are lower than dividend rates due to the element of risk and (ii) the benefit of tax as the interest is deductible expense for income tax purpose.

When a firm increases the proportion of debt financing, a cheaper source of funds, in its capital structure, it results in a decrease in overall cost (weighted average) of capital leading to an increase in the value of the firm as well as market value of equity shares i.e. a higher debt content in the capital structure will result in decline in the overall cost of capital. The optimal capital structure of such a firm is the point at which the overall cost of capital is minimum and the value of the firm is maximum.

Assumptions

The cost of debt is cheaper than the cost of equity. Income tax has been ignored.

The cost of debt capital and cost of equity capital remain constant i.e. the use of debt does not change the perception of investors in evaluating the risk.

Total Value of Firm = Market Value of Equity + Market Value of Debt =S+D

Market Value of Shares (S) is calculated by S= E or NI Ke Ke

Here, E = Earnings available for equity shareholders Ke = Equity Capitalization Rate or Cost of Equity Capital

Overall Capitalization Rate = Earnings Value of the Firm Ko = EBIT V

Net Operating Income (NOI) Approach

NOI approach has also been suggested by Durand. This is just opposite of Net Income approach. According to this approach, the market value of the firm is not at all affected by the capital structure changes. The overall cost of capital (ko) remains fixed irrespective of the debt- equity mix.

The market value of equity is ascertained by deducting the market value of the debt from the market value of the firm.

It is also known as Irrelevant Theory of Capital Structure.

Assumptions

The overall cost of capital (k) remains constant for all degrees of debt- equity mix or leverage. The market capitalizes the value of the firm as a whole and therefore, the split between debt and equity is not relevant. The use of debt having low cost increases the risk of equity shareholders, this results in increase in equity capitalization rate. Thus, the advantage of debt is set off exactly by increase in equity capitalization rate. There are no corporate taxes.

Value of the firm (V) = Net Operating Income Overall Cost of Capital

Or V = EBIT Ko

Value of Equity (S) = V D V = Value of firm D = Value of Debt

Modigiliani- Miller Approach

This approach is similar to the Net Operating Income (NOI) approach. According to this approach, the value of a firm is independent of its capital structure. MM approach maintains that the average cost of capital does not change with change in the debt weighted equity mix or capital structure of the firm.

Assumptions

Capital market are perfect.

Investors are free to buy and sell securities.

The investors can borrow without restriction on the same terms on which the firm can borrow. The investors are well informed. The investors behave rationally. There are no transaction costs.

Arbitrage Process

The term Arbitrage refers to an act of buying an asset or security in one market having lower price and selling it in another market at a higher price. The consequence of such a action is that the market price of the securities of the two firms, exactly similar in all respects except in their capital structure, cannot for long remain in different markets. Thus, arbitrage process restores equilibrium in value of securities.

Traditional Approach

The traditional approach is similar to NI Approach to the extent that it accepts that the capital structure or leverage of the firm affects the cost of capital and its valuation. However, it does not subscribe to the NI approach that the value of the firm will necessarily increase with all degree of leverages. It subscribes to the NOI approach that beyond a certain degree of leverage, the overall cost of capital increases resulting in decrease in the total value of the firm. However, it differs from NOI approach in the sense that the overall cost of capital will not remain constant for all degree of leverages.

Traditional Approach

According to this approach, a firm can reduce the overall cost of capital or increase the total value (V) of the firm by increasing the debt proportion in its capital structure to a certain limit. Beyond this limit, the additional doses of debt may result in a decrease in the total value of the firm because the cost of equity capital will increase due to financial risk. Hence, through judicious mix of debt and equity, the overall cost of capital can be minimized and the total value of the firm is maximized. This approach recognizes the existence of an optimum capital structure.

Features of an Appropriate Capital Structure

Profitability Solvency Flexibility Conservatism Control

Factors Determining Capital Structure

Trading on Equity Retaining Control Nature of Enterprise Legal Requirements Purpose of Financing Period of Finance Market Sentiments Requirement of Investors Size of the Company Provision for the Future

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Plumbing ArithmeticDocument23 pagesPlumbing ArithmeticAdrian sanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Financial Markets and Institutions OverviewDocument43 pagesFinancial Markets and Institutions Overviewdhiviraj100% (3)

- Accounting NotesDocument22 pagesAccounting NotesVinay ChawlaNo ratings yet

- Financial Analysis of Prime BankDocument72 pagesFinancial Analysis of Prime BankImran Khan0% (1)

- Mba ProjectDocument77 pagesMba Projectrahul pandeyNo ratings yet

- Financial Project Report On Asian PaintsDocument36 pagesFinancial Project Report On Asian Paintsdhartip_169% (13)

- Capital Expenditure Pengelolaan Tambang Pasir Kuarsa Iup-Op PT Kidul Makmur JayaDocument7 pagesCapital Expenditure Pengelolaan Tambang Pasir Kuarsa Iup-Op PT Kidul Makmur JayaSu MantoNo ratings yet

- FMCG Sector in Rural India - Case Study HLLDocument8 pagesFMCG Sector in Rural India - Case Study HLLYash SharmaNo ratings yet

- Scheduling TechniquesDocument13 pagesScheduling TechniquesYash SharmaNo ratings yet

- CH-2 Sales Force ManagementDocument20 pagesCH-2 Sales Force Managementyaash3sharmaNo ratings yet

- Capital BudgetingDocument30 pagesCapital BudgetingYash SharmaNo ratings yet

- Importance of Plant LocationDocument3 pagesImportance of Plant LocationYash SharmaNo ratings yet

- Production Planning & ControlDocument15 pagesProduction Planning & ControlYash SharmaNo ratings yet

- Production Planning & ControlDocument15 pagesProduction Planning & ControlYash SharmaNo ratings yet

- Plant LayoutDocument13 pagesPlant LayoutYash SharmaNo ratings yet

- KTDS Violence Survey ResultsDocument2 pagesKTDS Violence Survey ResultsYash Sharma0% (1)

- D.R. Horton account links and detailsDocument121 pagesD.R. Horton account links and detailsMohamed SaeedNo ratings yet

- Working Capital FinancingDocument11 pagesWorking Capital FinancingShaRiq KhAnNo ratings yet

- Elemente Ale Manage Mentul Lui Lanțului de Aprovizionare Livrare. Aspecte În Domeniul Militar. - 17 Oct 2019 - 17-19Document92 pagesElemente Ale Manage Mentul Lui Lanțului de Aprovizionare Livrare. Aspecte În Domeniul Militar. - 17 Oct 2019 - 17-19Marius SorinNo ratings yet

- Chapter 1 - FMDocument23 pagesChapter 1 - FMYoutube OnlyNo ratings yet

- Financial Performance MeasuresDocument6 pagesFinancial Performance MeasuresDEEPAK GROVERNo ratings yet

- Business finance essentialsDocument17 pagesBusiness finance essentialsMark DavidNo ratings yet

- Quantitative TechniquesDocument18 pagesQuantitative TechniquesPing PingNo ratings yet

- 2020 06b FI Core-Concepts IPSAS 29 PPDocument27 pages2020 06b FI Core-Concepts IPSAS 29 PPFebby Grace SabinoNo ratings yet

- Introduction to Financial Markets and Their RoleDocument12 pagesIntroduction to Financial Markets and Their RoleRenda QiutiNo ratings yet

- A K A: A Review of The Models Used To Measure Intellectual CapitalDocument25 pagesA K A: A Review of The Models Used To Measure Intellectual CapitalBundanya SavinaNo ratings yet

- FIN 420 Chapter 3 (Financial Ratio and Analysis)Document20 pagesFIN 420 Chapter 3 (Financial Ratio and Analysis)Damia AlyaNo ratings yet

- Financial Institution and Marketing Cha 4Document23 pagesFinancial Institution and Marketing Cha 4Gadisa TarikuNo ratings yet

- AssignmentDocument18 pagesAssignmentBidur KhanalNo ratings yet

- ACG2071 Managerial AccountingDocument40 pagesACG2071 Managerial AccountingJadeNo ratings yet

- MA Sem-4 2018-2019Document23 pagesMA Sem-4 2018-2019Akki GalaNo ratings yet

- Citi Career Insights: Training, Culture and Diversity at One of the World's Leading BanksDocument21 pagesCiti Career Insights: Training, Culture and Diversity at One of the World's Leading BanksJambo ShahNo ratings yet

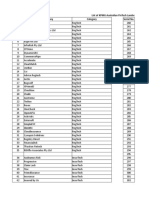

- List of KPMG Australian Fintech LandscapeDocument12 pagesList of KPMG Australian Fintech LandscapeFaysal Bank Strategy TeamNo ratings yet

- Allied Bank Ltd. Financial Statements AnalysisDocument22 pagesAllied Bank Ltd. Financial Statements Analysisbilal_jutttt100% (1)

- 12th Commerce 21-22Document104 pages12th Commerce 21-22P.sekaran P.sekaran100% (1)

- MCQ Quiz on Capital Markets and Stock ExchangeDocument19 pagesMCQ Quiz on Capital Markets and Stock ExchangeAshlinJoel BangeraNo ratings yet

- Edurev: Case Studies - (Chapter - 9) Financial Management, BST Class 12Document20 pagesEdurev: Case Studies - (Chapter - 9) Financial Management, BST Class 12Heer SirwaniNo ratings yet

- Chapter 22 Share CapitalDocument25 pagesChapter 22 Share CapitalHammad AhmadNo ratings yet

- Jurnal 2012 AndiaanDocument13 pagesJurnal 2012 AndiaanZura IdaNo ratings yet