Professional Documents

Culture Documents

Nakamura Lacquer Global Strategy

Uploaded by

Abhishek JhaveriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nakamura Lacquer Global Strategy

Uploaded by

Abhishek JhaveriCopyright:

Available Formats

Nakamura lacquer Company

Presented by: ABDUL HASEEB AHMED ABHISHEK JHAVERI ADITYA KUMAR BARMAN AJITESH MOHAN ALISHA SAHU ANIRUDDHA MONDAL ANKIT WADHWANI ANKUR MAHESHWARI ARUN KUMAR PANDIT BHANU SINGH

Situation Analysis After 11 years that Young Mr. Nakamura had taken over the reigns of the Nakamura Lacquer Company, the company has conquered the domestic market.

The strategy change with effective mechanization of the trade of producing lacquer wares ,named the "Chrysanthemum brand at large volumes and effective prices bore fruit.

With growth in the domestic sector attaining levels of saturation, globalization was what other companies were offering to Nakamura Lacquer Company. With the brand spreading, American companies started showing interest in starting ventures in this domain. Two first rate companies, National China Company and Semmelback and Whittacher lined up immediately, offering Mr Nakamura, substantial growth, valid prices, increasing brand domain and new investment opportunities.

The strategic process will be as follows: 1) Frame a choice: To opt for National China Company for partnership in its globalization strategy. To opt for Semmelback and Whittacher for partnership in its globalization strategy. 2) Generate Possibilties: The other inclusive possibilities are To maintain a status quo, i.e. to remain focused in the domestic sector. To opt for a Company for partnership in its globalization strategy after surveying the market scenario itself.

Specify Conditions: Brand value Initial investment in deal/cost Time duration of the contract Order quantity Risk associated with deal Profit from the deal

EVALUATION OF OPTIONS: If he make a deal with company A There is no global representation of his brand. He has to supply with Rose and Crown trademark and he cant sell with his own brand Chrysanthemum. So after the end of 3 year Mr. Nakamura's company might have to restart all business again. Time duration of contract is 3 years The order quantity of order is annually 400,000 sets of lacquer dinnerware. The cost has to be endured by Mr. Nakamura himself. The profit margin will increase by 5%.

Why not to make a deal with co. A Have to sacrifice the brand. Company cannot sell its merchandise to anyone else. If the company enters US market directly after the lock period there is no security in demand. Govt policies hinder investing abroad. In order to produce double the number of dinnerware man power and machinery has to be increased which increases the operation costs.

If he makes a deal with company B: There is a global promotion and representation of his brand Chrysanthemum in U.S. market. There is no risk. Time duration of contract is 5 years, which is a long term investment for Nakamura Lacquer Company. The order quantity is at least 600,000 sets per year and expected to increase couple of million in next 5 years. The company is willing to pay the full cost of introduction for the next two years for introduction and promotion with budget $ 1,500,000. The profit margin will be more

Maintaining Status Quo: The present demand of 500,000/year will be maintained with only marginal increase in subsequent years as the domestic market seems to have attained saturation levels .The profit would largely remain the same, as increase of price is not feasible with other competitors prevailing. Further reduction in costs is an option, but further investments would be required in more efficient mechanization .Brand Presence will remain confined to the domestic market. Competition in the domestic market is bound to increase in subsequent years, maintaining dominance as well as profit margin would be a tough task.

Conduct the Test Production capabilities and resources, for example new technology, skilled manpower, need to be assessed and brought into action to deliver the products at the scheduled time. Logistics, regarding transportation, inventory management must be worked out, for the most optimal cost. For efficient marketing of the new product, marketing strategy inputs, which have been successful in the domestic market, must also be shared with the partnering company.

If you were in the position of Mr.Nakamura what would you do.

I would opt for Semmelback and Whittacher for partnership in its globalization strategy. The reasons for my decision are based on certain criterias: 1. Brand value: There is a global promotion and representation of his brand Chrysanthemum in U.S. market, which will enhance the market of Chrysanthemum. 2. Risk associated with deal:There is no risk and no conflict with government policies.

3. Time duration of the contract:Time duration of contract is 5 years, which is a long term investment for Nakamura Lacquer Company. 4. Order quantity:The order quantity is at least 600,000 sets per year and expected to increase couple of million in next 5 years. 5. Initial investment in deal/cost:The company is willing to pay the full cost of introduction for the next two years for introduction and promotion with budget $ 1,500,000. 6. Profit from the deal: The profit margin will be more .

You might also like

- 6th GATEDocument33 pages6th GATESamejiel Aseviel LajesielNo ratings yet

- Philippine Christian UniversityDocument4 pagesPhilippine Christian UniversityMina SaflorNo ratings yet

- Tchaikovsky Piano Concerto 1Document2 pagesTchaikovsky Piano Concerto 1arno9bear100% (2)

- Case Study 1 AmcottDocument1 pageCase Study 1 AmcottRONA MAE R. RODRIGUEZNo ratings yet

- The Unseelie Prince Maze of Shadows Book 1 by Kathryn AnnDocument267 pagesThe Unseelie Prince Maze of Shadows Book 1 by Kathryn Annanissa Hri50% (2)

- Summary Refinery Sulfur Recovery ProjectsDocument8 pagesSummary Refinery Sulfur Recovery ProjectsAli MNo ratings yet

- Business Research Final Report Proposal - ATamangDocument12 pagesBusiness Research Final Report Proposal - ATamangKBA AMIRNo ratings yet

- Mid Term Business Economy - Ayustina GiustiDocument9 pagesMid Term Business Economy - Ayustina GiustiAyustina Giusti100% (1)

- International Marketing PlanDocument5 pagesInternational Marketing PlanShohabe Khan100% (1)

- Numerical Solution of Ordinary Differential EquationsDocument31 pagesNumerical Solution of Ordinary Differential Equationschandu3072002100% (1)

- Market Segmentation of NokiaDocument93 pagesMarket Segmentation of Nokiapriyanka9086% (22)

- Online Shopping Survey Reveals Consumer PreferencesDocument4 pagesOnline Shopping Survey Reveals Consumer PreferencesMS editzzNo ratings yet

- (Economic Themes) Impact of National Culture On International Human Resource ManagementDocument20 pages(Economic Themes) Impact of National Culture On International Human Resource ManagementAshleyKumarNo ratings yet

- Master in Business Administration Managerial Economics Case StudyDocument7 pagesMaster in Business Administration Managerial Economics Case Studyrj carrera100% (1)

- First Aid Emergency Action PrinciplesDocument7 pagesFirst Aid Emergency Action PrinciplesJosellLim67% (3)

- JFC LongverDocument4 pagesJFC LongverKirkNo ratings yet

- XDM-300 IMM ETSI B00 8.2.1-8.2.2 enDocument386 pagesXDM-300 IMM ETSI B00 8.2.1-8.2.2 enHipolitomvn100% (1)

- Cursos Link 2Document3 pagesCursos Link 2Diego Alves100% (7)

- Swot Analysis: ThreatsDocument7 pagesSwot Analysis: ThreatsWenuri KasturiarachchiNo ratings yet

- Financial Statements and Ratio Analysis: All Rights ReservedDocument68 pagesFinancial Statements and Ratio Analysis: All Rights ReservedAshis Ur RahmanNo ratings yet

- Final Paper for Managerial Accounting: Analysis of DTI Projects' BudgetsDocument14 pagesFinal Paper for Managerial Accounting: Analysis of DTI Projects' Budgetsaishafajardo100% (1)

- Marketing PlanDocument11 pagesMarketing PlanBryce BajadoNo ratings yet

- CaseDocument12 pagesCaseShankar ChaudharyNo ratings yet

- Strama BasicsDocument121 pagesStrama BasicsChristine OrdoñezNo ratings yet

- Employee Benefits and Services Administration HandoutDocument5 pagesEmployee Benefits and Services Administration Handoutapi-3705268100% (2)

- Manila Bulletin Publishing Corporation-ManualDocument13 pagesManila Bulletin Publishing Corporation-ManualMoises CalastravoNo ratings yet

- Strategic Management Group Assignment: Industry Name:-InsuranceDocument59 pagesStrategic Management Group Assignment: Industry Name:-InsuranceReemaChavan1234No ratings yet

- Executive SummaryDocument5 pagesExecutive SummaryMariah Blez BognotNo ratings yet

- Chapter 09 NotesDocument5 pagesChapter 09 NotesNik Nur MunirahNo ratings yet

- Case Study Politics of PA (Pms Case Study)Document5 pagesCase Study Politics of PA (Pms Case Study)AYESHA BOITAINo ratings yet

- Pepsi Burma Case TamarishDocument1 pagePepsi Burma Case TamarishKumar AvnishNo ratings yet

- California Auto Club Reengineers Customer ServiceDocument5 pagesCalifornia Auto Club Reengineers Customer ServiceJennifer Guanco100% (2)

- Case How Innovation Drives Research and DevelopmentDocument4 pagesCase How Innovation Drives Research and DevelopmentMohit KumarNo ratings yet

- ID 18241108 (B) Quiz-4 SubmissionDocument11 pagesID 18241108 (B) Quiz-4 SubmissionSakibur RahmanNo ratings yet

- Huawei Case PaperDocument3 pagesHuawei Case Papercpinto1No ratings yet

- Indonesia-Asia's Stumbling Giant 111Document3 pagesIndonesia-Asia's Stumbling Giant 111Ovi JuniorNo ratings yet

- 4 Factor Influencing The Foreign Entry Mode of Asian and Latin American BanksDocument22 pages4 Factor Influencing The Foreign Entry Mode of Asian and Latin American BanksWang VivianNo ratings yet

- Analyse and Evaluate The Processing of NewDocument3 pagesAnalyse and Evaluate The Processing of NewQuequ AppiahNo ratings yet

- Revision 1 ST TermDocument33 pagesRevision 1 ST Term_dinashNo ratings yet

- Anglo American PLC in South AfricaDocument11 pagesAnglo American PLC in South AfricaAvaneesh Srivastava80% (5)

- Challenges of International BusinessDocument4 pagesChallenges of International BusinessRikesh SapkotaNo ratings yet

- 1 Human Resource Accounting PDFDocument11 pages1 Human Resource Accounting PDFTALAINo ratings yet

- Advanced Operations Management AssignmentDocument3 pagesAdvanced Operations Management AssignmentTop Engineering SolutionsNo ratings yet

- Yansha leverages ERP, SCM to stay competitiveDocument2 pagesYansha leverages ERP, SCM to stay competitiveMINH Trần ThịNo ratings yet

- Football Scandal - EditedDocument3 pagesFootball Scandal - EditedEdwin MianoNo ratings yet

- PrefaceDocument16 pagesPrefaceNavaneeth RameshNo ratings yet

- SMPH Prospectus VFINALDocument444 pagesSMPH Prospectus VFINALbluepperNo ratings yet

- 03 Krispy KremeDocument14 pages03 Krispy Kreme84112213No ratings yet

- IMC Project State Bank of IndiaDocument18 pagesIMC Project State Bank of IndiaRinni Shukla0% (1)

- Case Study StarbucksDocument7 pagesCase Study StarbucksPhoebeilsie RaimiNo ratings yet

- ZapposDocument22 pagesZapposKaterina LisNo ratings yet

- Case Study Logic and Logical ReasoningDocument11 pagesCase Study Logic and Logical ReasoningZeeshan ch 'Hadi'No ratings yet

- North South University: Marketing PlanDocument23 pagesNorth South University: Marketing PlanMahir UddinNo ratings yet

- 6-Step Marketing Research Process: Define Problems and Collect DataDocument17 pages6-Step Marketing Research Process: Define Problems and Collect DatadonnigamNo ratings yet

- SubwayDocument5 pagesSubwaykashfi350% (1)

- Space Matrix SampleDocument3 pagesSpace Matrix SampleAngelicaBernardoNo ratings yet

- FentimansDocument0 pagesFentimanszhenglin0620_2205311No ratings yet

- Recruitment & Selection 1Document63 pagesRecruitment & Selection 1Anuj ShahNo ratings yet

- Consumer Behavior Product Adoption Cycle Project-Vignesh Ramanujam P18067Document16 pagesConsumer Behavior Product Adoption Cycle Project-Vignesh Ramanujam P18067Bashyam RamNo ratings yet

- Questionnaire Impact of E-Commerce On Purchase Behavior of Student in Higher Education: A Study of CSJMU KanpurDocument2 pagesQuestionnaire Impact of E-Commerce On Purchase Behavior of Student in Higher Education: A Study of CSJMU KanpurarpitNo ratings yet

- Employee survey questions for satisfaction, importance, appraisal & workDocument3 pagesEmployee survey questions for satisfaction, importance, appraisal & workYogesh GowdaNo ratings yet

- Market SegmentationDocument23 pagesMarket SegmentationRahul AroraNo ratings yet

- Good Hopes For Global OutsourcingDocument3 pagesGood Hopes For Global OutsourcingRaktim MajumderNo ratings yet

- Parle ProductsDocument4 pagesParle ProductsMehul Dak100% (1)

- Write Up Zakaria SirDocument14 pagesWrite Up Zakaria Sirdinar aimcNo ratings yet

- Report On HPDocument62 pagesReport On HPshanky_banga02No ratings yet

- Competitive Strategies For Market LeadersDocument24 pagesCompetitive Strategies For Market LeadersAmir KhanNo ratings yet

- It’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersFrom EverandIt’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersNo ratings yet

- Harassment Case StudyDocument13 pagesHarassment Case StudyAbhishek JhaveriNo ratings yet

- Cash Flo2Document71 pagesCash Flo2Urvashi GuptaNo ratings yet

- Ankit 8130422322 Kunal Sinha: 8800980677Document1 pageAnkit 8130422322 Kunal Sinha: 8800980677Abhishek JhaveriNo ratings yet

- Market Basket Analysis NewDocument21 pagesMarket Basket Analysis NewAbhishek JhaveriNo ratings yet

- KM 3 Market BasketDocument13 pagesKM 3 Market BasketAbhishek JhaveriNo ratings yet

- Cluster AnalysisDocument32 pagesCluster AnalysisAbhishek JhaveriNo ratings yet

- International Monetary SystemsDocument27 pagesInternational Monetary SystemsArun ChhikaraNo ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingAbhishek JhaveriNo ratings yet

- TATA Steel Working Capital QuestionnaireDocument1 pageTATA Steel Working Capital QuestionnaireAbhishek JhaveriNo ratings yet

- Market Basket Analysis and Advanced Data Mining: Professor Amit BasuDocument24 pagesMarket Basket Analysis and Advanced Data Mining: Professor Amit BasuDinesh GahlawatNo ratings yet

- Market Basket Analysis and Advanced Data Mining: Professor Amit BasuDocument24 pagesMarket Basket Analysis and Advanced Data Mining: Professor Amit BasuDinesh GahlawatNo ratings yet

- Market Basket Analysis NewDocument21 pagesMarket Basket Analysis NewAbhishek JhaveriNo ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingAbhishek JhaveriNo ratings yet

- ForfeitingDocument7 pagesForfeitingvandana_daki3941No ratings yet

- Marketing ResearchDocument5 pagesMarketing ResearchAbhishek JhaveriNo ratings yet

- Tea PRINTDocument8 pagesTea PRINTAbhishek JhaveriNo ratings yet

- Market Basket Analysis NewDocument21 pagesMarket Basket Analysis NewAbhishek JhaveriNo ratings yet

- Non Banking FinanceDocument7 pagesNon Banking FinanceAbhishek JhaveriNo ratings yet

- Nakamura Lacquer Global StrategyDocument12 pagesNakamura Lacquer Global StrategyAbhishek Jhaveri50% (2)

- Nakamura Lacquer Global StrategyDocument12 pagesNakamura Lacquer Global StrategyAbhishek Jhaveri50% (2)

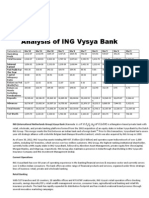

- Analysis of ING Vysya Bank's Financial Performance from 2003-2012Document2 pagesAnalysis of ING Vysya Bank's Financial Performance from 2003-2012Abhishek JhaveriNo ratings yet

- Maharashtra State Branch of Indian Council of Social WelfareDocument2 pagesMaharashtra State Branch of Indian Council of Social WelfareAbhishek JhaveriNo ratings yet

- Tea PRINTDocument8 pagesTea PRINTAbhishek JhaveriNo ratings yet

- TATA Steel Working Capital QuestionnaireDocument1 pageTATA Steel Working Capital QuestionnaireAbhishek JhaveriNo ratings yet

- AirasiamainDocument20 pagesAirasiamainAbhishek JhaveriNo ratings yet

- Maharashtra State Branch of Indian Council of Social WelfareDocument2 pagesMaharashtra State Branch of Indian Council of Social WelfareAbhishek JhaveriNo ratings yet

- Various Savings Instruments Issued by NBFCDocument2 pagesVarious Savings Instruments Issued by NBFCAbhishek JhaveriNo ratings yet

- About The Compan1Document34 pagesAbout The Compan1Abhishek JhaveriNo ratings yet

- Chapter 27 Protists I. Evolution of EukaryotesDocument7 pagesChapter 27 Protists I. Evolution of EukaryotesNadeem IqbalNo ratings yet

- De Thi Thu Tuyen Sinh Lop 10 Mon Anh Ha Noi Nam 2022 So 2Document6 pagesDe Thi Thu Tuyen Sinh Lop 10 Mon Anh Ha Noi Nam 2022 So 2Ngọc LinhNo ratings yet

- Making An Appointment PaperDocument12 pagesMaking An Appointment PaperNabila PramestiNo ratings yet

- Download C How To Program An Objects Natural Approach 11E 11Th Edition Paul Deitel full chapter pdf scribdDocument67 pagesDownload C How To Program An Objects Natural Approach 11E 11Th Edition Paul Deitel full chapter pdf scribdjack.bowlin207100% (4)

- Schedule For Semester III, Class of 2021Document7 pagesSchedule For Semester III, Class of 2021Jay PatelNo ratings yet

- Aluminium FOil SearchDocument8 pagesAluminium FOil SearchAtul KumarNo ratings yet

- Interviews: Personal Interview. Advantages and Disadvantages Business Is Largely A Social PhenomenonDocument8 pagesInterviews: Personal Interview. Advantages and Disadvantages Business Is Largely A Social PhenomenonSanjeev JayaratnaNo ratings yet

- Or Medallist Results WorldSkills Scale and 100 ScaleDocument39 pagesOr Medallist Results WorldSkills Scale and 100 ScaleJoseNo ratings yet

- MinistopDocument23 pagesMinistopAlisa Gabriela Sioco OrdasNo ratings yet

- Crio - Copy Business Operations - Case Study AssignmentDocument3 pagesCrio - Copy Business Operations - Case Study Assignmentvaishnawnikhil3No ratings yet

- Chapter 4 and 5 - For StudentsDocument6 pagesChapter 4 and 5 - For Studentsdesada testNo ratings yet

- Ipaspro Co PPP ManualDocument78 pagesIpaspro Co PPP ManualCarlos Alberto Mucching MendozaNo ratings yet

- Optra - NubiraDocument37 pagesOptra - NubiraDaniel Castillo PeñaNo ratings yet

- M Audio bx10s Manuel Utilisateur en 27417Document8 pagesM Audio bx10s Manuel Utilisateur en 27417TokioNo ratings yet

- Documentation Control HandbookDocument9 pagesDocumentation Control Handbookcrainvictor 45No ratings yet

- Introduction To Machine Learning Top-Down Approach - Towards Data ScienceDocument6 pagesIntroduction To Machine Learning Top-Down Approach - Towards Data ScienceKashaf BakaliNo ratings yet

- REVISION OF INTEREST RATES ON DEPOSITS IN SANGAREDDYDocument3 pagesREVISION OF INTEREST RATES ON DEPOSITS IN SANGAREDDYSRINIVASARAO JONNALANo ratings yet

- IPIECA - IOGP - The Global Distribution and Assessment of Major Oil Spill Response ResourcesDocument40 pagesIPIECA - IOGP - The Global Distribution and Assessment of Major Oil Spill Response ResourcesОлегNo ratings yet

- JMC250Document2 pagesJMC250abhijit99541623974426No ratings yet

- Regional Office X: Republic of The PhilippinesDocument2 pagesRegional Office X: Republic of The PhilippinesCoreine Imee ValledorNo ratings yet

- Entrepreneurial Intentions of Cavite Business StudentsDocument12 pagesEntrepreneurial Intentions of Cavite Business StudentsKevin Pereña GuinsisanaNo ratings yet