Professional Documents

Culture Documents

Portfolio Performance Measures

Uploaded by

9986212378Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Performance Measures

Uploaded by

9986212378Copyright:

Available Formats

Portfolio Performance Measures

What do we require of portfolio

managers?

1. Earn an average (or fair) return for the

level of risk in the portfolio

2. Ability to manage risk

3. Eliminate unnecessary risks

Portfolio Performance

Measurement

Benchmarking

Gives us a reference point for comparison

Comparison of return and risk

Portfolio Performance

Measurement

Choosing a benchmark

The most important consideration for

portfolio performance measurement is

benchmark choice. All portfolio evaluation

is dependent on benchmark choice

1. Make sure the benchmark is unambiguous

2. Make sure the benchmark is an investable

index

3. Make sure the benchmark has a

measurable value

Portfolio Performance

Measurement

Choosing a benchmark

4. Make sure that the benchmark is

appropriate for the style of portfolio that you

are evaluating

5. Make sure the benchmark is specified in

advance

6. Make sure the benchmark reflects current

knowledge and opinion

7. Dont change indices. Be consistent

across portfolios

Portfolio Performance Measures

Treynors measure

i

f i

i

R R

T

|

=

Portfolio Performance Measures

Treynors measure

Treynors measure basically gives us a

measure of return per unit of market risk (or

systematic risk) that our investment earns

Strictly speaking, the larger the Treynor

measure the better. However, we would like

to have some benchmark with which to

compare our individual Treynor measures.

Portfolio Performance Measures

Tryenors measure

Benchmark comparison

f m

m

f m

m

R R

R R

T =

=

|

Portfolio Performance Measures

Treynors measure

If Ti > Tm, the portfolio would plot above the

security market line, indicating superior

performance by the portfolio manager.

If Ti < Tm, the portfolio would plot below the

security market line, indicating poor

performance by the portfolio manager.

Portfolio Performance Measures

Sharpe performance measure

i

f i

i

R R

S

o

=

Portfolio Performance Measures

Sharpe performance measure

Thus, the Sharpe measure gives us a

measure of return per unit of total risk.

Again, the higher the Sharpe measure, the

better the performance. We can also

compare individual Sharpe measures to a

benchmark:

m

f m

m

R R

S

o

=

Portfolio Performance Measures

Sharpe performance measure

Instead of plotting deviations from the security

market line, like the Treynor measure, we are

plotting deviations from the market determine

price of risk as defined by the capital market

line (CML).

Portfolio Performance Measures

Sharpe measure

If Si > Sm, the asset earn more than the risk

premium required by the capital market line,

indicating superior performance by the

portfolio manager.

If Si < Sm the asset earn less than the risk

premium required by the capital market line,

indicating poor performance by the portfolio

manager.

Portfolio Performance Measures

Comparing the Treynor and Sharpe

measures

For a completely diversified portfolio of

assets, the Sharpe and Treynor measures

would be identical in what they are measuring

Treynor measures performance relative to

systematic risk

Sharpe measure s performance relative to

total risk

Portfolio Performance Measures

Comparing the Treynor and Sharpe

measures

Sharpe measure gives some indication of how

good the portfolio manager is at diversifying

away unsystematic risk

A poorly diversified portfolio could have a high

Treynor ranking

Portfolio Performance Measures

Jensens Alpha

Jensens alpha is based on the ideas

contained in the CAPM. It, like the Treynor

measure, measures how well a portfolio

manager does at dealing with systematic

risk

To calculate Jensens alpha we need to

estimate the following regression model:

) (

, , , , t f t m i i t f t i

R R R R + = | o

Portfolio Performance Measures

Jensens Alpha

o measures the degree to which managers

are earning significant returns after

accounting for market risk, as measured by

beta. If the manager is earning a fair return

for the given portfolios systematic risk, then o

would be zero.

Portfolio Performance Measures

Jensens Alpha

(+) o indicates good performance

(-) o indicates poor performance

Jensens alpha allows us to statistically test

whether the return the manager earns is

significantly more (or less) than what we

would expect using the CAPM.

Jensens alpha allows us to get a

performance measure that incorporates

information from more than one time period.

Portfolio Performance Measures

Jensens Alpha

The validity of the Jensen performance

measure is tied to the validity of the CAPM.

Thus, some individuals will choose estimate

Jensen's alpha performing the regression

model without subtracting the risk-free rate.

This gives us the alpha from the characteristic

line. Its interpretation is the same as the

interpretation of Jensen's alpha.

Portfolio Performance Measures

Fama and French (1993) three factor

model alpha

t i t i t i t m i i t i

HMLSIZE HMLBEME R R

, , 3 , 2 , , 1 , 1 ,

c | | | o + + + + =

Portfolio Performance Measures

Fama and French (1993) three factor

model

The alpha in this model can be interpreted in

the same way as the Jensen's alpha. A

positive Fama/French alpha would indicate

performance better than expectations.

Given that the Fama/French model predicts

returns better than the CAPM, the

Fama/French alpha should be a more precise

measure of portfolio performance than the

Jensen's alpha.

Portfolio Performance Measures

Famas performance measure

Fama breaks performance by a portfolio

manager into two categories: selectivity and

diversification. Famas measure incorporates

measures for managing both systematic and

unsystematic risk.

Portfolio Performance Measures

Famas performance measure

Selectivity: measures the ability of the

portfolio manager to earn a return that is

consistent with the portfolios market

(systematic) risk. The selectivity measure is:

)) ( ( (

f m i f i

R R R R + |

Portfolio Performance Measures

Famas performance measure

(+) selectivity indicates that the manager

earned a higher return than the systematic

risk of the portfolio would indicate. Basically,

you are just comparing the return on the asset

with the return earned by the CAPM.

Portfolio Performance Measures

Famas performance measure

Diversification: Diversification measures the

extent to which the portfolio may not have

been completely diversified. Diversification is

measured as:

( )

i f m f

m

i

f m f

R R R R R R |

o

o

) ( ) ( +

|

|

.

|

\

|

+

Portfolio Performance Measures

Famas performance measure

If the portfolio is completely diversified, contains

no unsystematic risk, then diversification measure

would be zero. A positive diversification measure

indicates that the portfolio is not completely

diversified; it would contain unsystematic risk.

If the diversification measure is positive, it

represents the extra return that the portfolio

should earn for not being completely diversified.

Portfolio Performance Measures

Famas performance measure

Net selectivity = selectivity - diversification

Net selectivity measures how well the

portfolio manager did at earning a fair

return for the portfolios systematic risk and

how well the portfolio manager did at

diversifying away unsystematic risk.

Positive net selectivity indicates the

portfolio manager did a good job. Negative

net selectivity indicates that the portfolio

manager did a poor job.

You might also like

- Sharpe Treynor N JensenDocument4 pagesSharpe Treynor N JensenjustsatyaNo ratings yet

- Structured Financial Product A Complete Guide - 2020 EditionFrom EverandStructured Financial Product A Complete Guide - 2020 EditionNo ratings yet

- Forecasting Volatility in the Financial MarketsFrom EverandForecasting Volatility in the Financial MarketsRating: 4 out of 5 stars4/5 (1)

- Sectors and Styles: A New Approach to Outperforming the MarketFrom EverandSectors and Styles: A New Approach to Outperforming the MarketRating: 1 out of 5 stars1/5 (1)

- Assignment Portfolio Analysis 2015 Masters in FinanceDocument7 pagesAssignment Portfolio Analysis 2015 Masters in FinanceSENo ratings yet

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideFrom EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideNo ratings yet

- Quantitative Risk Management: A Practical Guide to Financial RiskFrom EverandQuantitative Risk Management: A Practical Guide to Financial RiskNo ratings yet

- Two Stage Fama MacbethDocument5 pagesTwo Stage Fama Macbethkty21joy100% (1)

- Capital Flows and the Emerging Economies: Theory, Evidence, and ControversiesFrom EverandCapital Flows and the Emerging Economies: Theory, Evidence, and ControversiesNo ratings yet

- A Practical Guide to Forecasting Financial Market VolatilityFrom EverandA Practical Guide to Forecasting Financial Market VolatilityNo ratings yet

- Microscopic Simulation of Financial Markets: From Investor Behavior to Market PhenomenaFrom EverandMicroscopic Simulation of Financial Markets: From Investor Behavior to Market PhenomenaNo ratings yet

- Achieving Market Integration: Best Execution, Fragmentation and the Free Flow of CapitalFrom EverandAchieving Market Integration: Best Execution, Fragmentation and the Free Flow of CapitalNo ratings yet

- Using Volatility To Improve Momentum StrategiesDocument10 pagesUsing Volatility To Improve Momentum Strategiespderby1No ratings yet

- Statistical Modelling of Financial Time Series - An IntroductionDocument41 pagesStatistical Modelling of Financial Time Series - An IntroductionKofi Appiah-Danquah100% (1)

- 101 MeasuresDocument40 pages101 Measuressaisurya10No ratings yet

- Ratio AnalysisDocument12 pagesRatio AnalysisMrunmayee MirashiNo ratings yet

- Sharpe RatioDocument7 pagesSharpe RatioSindhuja PalanichamyNo ratings yet

- Demystifying Managed FuturesDocument29 pagesDemystifying Managed Futuresjchode69No ratings yet

- Alpha InvestingDocument4 pagesAlpha Investingapi-3700769No ratings yet

- SSRN Id937847Document18 pagesSSRN Id937847Srinu BonuNo ratings yet

- What Is Mean Reversion?Document3 pagesWhat Is Mean Reversion?Jonhmark AniñonNo ratings yet

- Option Trading: Pricing and Volatility Strategies and TechniquesDocument5 pagesOption Trading: Pricing and Volatility Strategies and TechniquesrockochenNo ratings yet

- Risk On Risk Off 1Document16 pagesRisk On Risk Off 1ggerszteNo ratings yet

- A Quantitative Analysis of Managed Futures Strategies: Lintner RevisitedDocument40 pagesA Quantitative Analysis of Managed Futures Strategies: Lintner RevisitedIshan SaneNo ratings yet

- Factor Investing RevisedDocument22 pagesFactor Investing Revisedalexa_sherpyNo ratings yet

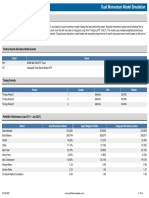

- Model Description: Ticker NameDocument14 pagesModel Description: Ticker NameOleg KondratenkoNo ratings yet

- 342 Chapter 13Document51 pages342 Chapter 13nneiroukh2218No ratings yet

- Investor Demand For Sell-Side Research: Lawrence@haas - Berkeley.eduDocument57 pagesInvestor Demand For Sell-Side Research: Lawrence@haas - Berkeley.eduBhuwanNo ratings yet

- A Century of Evidence On Trend FollowingDocument12 pagesA Century of Evidence On Trend FollowingSamuel KristantoNo ratings yet

- The Statistics of Statistical Arbitrage' in Stock MarketsDocument10 pagesThe Statistics of Statistical Arbitrage' in Stock MarketskillemansNo ratings yet

- SSRN Id2607730Document84 pagesSSRN Id2607730superbuddyNo ratings yet

- A Practical Guide To Volatility Forecasting Through Calm and StormDocument23 pagesA Practical Guide To Volatility Forecasting Through Calm and StormwillyNo ratings yet

- Macquarie Technicals PDFDocument30 pagesMacquarie Technicals PDFcaxapNo ratings yet

- Bac 309Document63 pagesBac 309WINFRED KYALONo ratings yet

- SSRN Id4336419Document26 pagesSSRN Id4336419brineshrimpNo ratings yet

- Flow Chart For Quant StrategiesDocument1 pageFlow Chart For Quant StrategiesKaustubh KeskarNo ratings yet

- Barra Model JournalDocument6 pagesBarra Model JournalKurniawan Indonanjaya100% (1)

- Efficient Market HypothesisDocument40 pagesEfficient Market HypothesisZia Ur RehmanNo ratings yet

- TradeDocument6 pagesTradekyleleefakeNo ratings yet

- Fabozzi Bmas7 Ch03 ImDocument27 pagesFabozzi Bmas7 Ch03 ImWakas KhalidNo ratings yet

- Topic 4 Risk ReturnDocument48 pagesTopic 4 Risk ReturnBulan Bintang MatahariNo ratings yet

- Bollinger Bands & ADX: This Lesson Is Provided byDocument4 pagesBollinger Bands & ADX: This Lesson Is Provided bymjmariaantonyrajNo ratings yet

- Chapter 24: Portfolio Performance EvaluationDocument30 pagesChapter 24: Portfolio Performance EvaluationfbhackaNo ratings yet

- Dynamic Asset AllocationDocument323 pagesDynamic Asset AllocationRegis e Fabiela Vargas e AndrighiNo ratings yet

- Option Pricing Under Power Laws A RobustDocument5 pagesOption Pricing Under Power Laws A RobustLucas D'AmelioNo ratings yet

- Returns To Buying Winners and Selling Lose RS: Implications For Stock Market EfficiencyDocument48 pagesReturns To Buying Winners and Selling Lose RS: Implications For Stock Market Efficiencymuath alzahraniNo ratings yet

- Log Skew VolatilityDocument15 pagesLog Skew VolatilityJerrodNo ratings yet

- Notes On Efficient Market HypothesisDocument4 pagesNotes On Efficient Market HypothesiskokkokkokokkNo ratings yet

- WP - Volatility Surface - VR (2012)Document4 pagesWP - Volatility Surface - VR (2012)PBD10017No ratings yet

- Tactical Asset Allocation, Mebane FaberDocument13 pagesTactical Asset Allocation, Mebane FabersashavladNo ratings yet

- BLK Risk Factor Investing Revealed PDFDocument8 pagesBLK Risk Factor Investing Revealed PDFShaun RodriguezNo ratings yet

- Literature ReviewDocument7 pagesLiterature ReviewadjoeadNo ratings yet

- Unix & Shell Programming - MCA34Document160 pagesUnix & Shell Programming - MCA34api-3732063100% (1)

- 5 Force ModelDocument2 pages5 Force Model9986212378No ratings yet

- Decision Making in POMDocument2 pagesDecision Making in POM9986212378No ratings yet

- Control Chart P, NP, C, UDocument64 pagesControl Chart P, NP, C, USakthi Tharan SNo ratings yet

- Seven Quality ToolsDocument64 pagesSeven Quality Tools9986212378No ratings yet

- 32 Thinking Hats Explanation and ExerciseDocument3 pages32 Thinking Hats Explanation and ExerciseCharu SharmaNo ratings yet

- 3D PrintingDocument26 pages3D Printing9986212378No ratings yet

- Fund Based ServicesDocument6 pagesFund Based Services9986212378No ratings yet

- Merchant BankerDocument7 pagesMerchant Banker9986212378No ratings yet

- Evaluation of Portfolio PerformanceDocument80 pagesEvaluation of Portfolio Performance9986212378No ratings yet

- Stock Holding Corporation of India LTD, BangaloreDocument17 pagesStock Holding Corporation of India LTD, Bangalore9986212378No ratings yet

- Performance EvaluationDocument68 pagesPerformance Evaluation9986212378No ratings yet

- Reliance Money: A Reliance Capital CompanyDocument34 pagesReliance Money: A Reliance Capital Company9986212378No ratings yet

- 33Document16 pages339986212378No ratings yet

- Buying Center RolesDocument14 pagesBuying Center Roles9986212378No ratings yet

- 1Document14 pages19986212378No ratings yet

- Financial Strategies: Components of F-StrategiesDocument11 pagesFinancial Strategies: Components of F-Strategies9986212378No ratings yet

- Module 1 SDocument16 pagesModule 1 S9986212378No ratings yet

- Marketing ImplicationsDocument6 pagesMarketing Implications9986212378100% (1)

- Module 5Document26 pagesModule 59986212378No ratings yet

- Venture CapitalDocument10 pagesVenture Capital9986212378No ratings yet

- The Nature of Industrial BuyingDocument40 pagesThe Nature of Industrial Buying99862123780% (1)

- Choice of Right Distributors & Channel LogisticsDocument12 pagesChoice of Right Distributors & Channel Logistics9986212378No ratings yet

- Dimensions of Industrial MarketingDocument45 pagesDimensions of Industrial Marketing9986212378100% (2)

- ImfDocument38 pagesImf9986212378No ratings yet

- Short-Term Finance and PlanningDocument25 pagesShort-Term Finance and Planningjoe2005No ratings yet

- Public RelationsDocument1 pagePublic Relations9986212378No ratings yet

- EFFIE 2002 Case StudiesDocument16 pagesEFFIE 2002 Case Studies9986212378100% (1)

- Short-Term Finance and PlanningDocument25 pagesShort-Term Finance and Planningjoe2005No ratings yet

- Financial ManagementDocument13 pagesFinancial Management9986212378No ratings yet

- Emgoldex by Selvaam Rev1Document28 pagesEmgoldex by Selvaam Rev1Veenesha MuralidharanNo ratings yet

- 2 SJ 117Document3 pages2 SJ 117Nacho ConsolaniNo ratings yet

- Sol14 4eDocument103 pagesSol14 4eKiều Thảo Anh100% (1)

- African Development BankDocument7 pagesAfrican Development BankAasma HaseebNo ratings yet

- F18, H24 Parts CatalogDocument299 pagesF18, H24 Parts CatalogKLE100% (6)

- Class 5 Manac II 2014Document55 pagesClass 5 Manac II 2014Amit Kumar100% (1)

- Business Proposal FormatDocument4 pagesBusiness Proposal FormatAgnes Bianca MendozaNo ratings yet

- GRE Data InterpretationDocument19 pagesGRE Data InterpretationVikram JohariNo ratings yet

- Chapter 7 - Accepting The Engagement and Planning The AuditDocument9 pagesChapter 7 - Accepting The Engagement and Planning The Auditsimona_xoNo ratings yet

- WNS PresentationDocument24 pagesWNS PresentationRohit Prasad100% (1)

- Country RiskDocument3 pagesCountry RiskBet TranNo ratings yet

- Infineon SPP04N80C3 DS v02 91 enDocument10 pagesInfineon SPP04N80C3 DS v02 91 entombeanNo ratings yet

- Verb Tense Exercise 5 8Document8 pagesVerb Tense Exercise 5 8Delia CatrinaNo ratings yet

- Intermediate Accounting CH 4 SolutionsDocument65 pagesIntermediate Accounting CH 4 SolutionsTracy Wright100% (1)

- Swot Analysis - DHA 1Document15 pagesSwot Analysis - DHA 1Laxmi PriyaNo ratings yet

- Emu Farming FactsDocument4,911 pagesEmu Farming FactsKanda VinayNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- Company Profile TPSLDocument2 pagesCompany Profile TPSLbhagawathiNo ratings yet

- Barringer E3 TB 06 PDFDocument17 pagesBarringer E3 TB 06 PDFXiAo LengNo ratings yet

- Pmo Framework and Pmo Models For Project Business ManagementDocument22 pagesPmo Framework and Pmo Models For Project Business Managementupendras100% (1)

- Week 4-1 Types of MAJOR AccountsDocument2 pagesWeek 4-1 Types of MAJOR AccountsSelenaNo ratings yet

- TBCH04Document14 pagesTBCH04Shayne LimNo ratings yet

- Demand and Elasticity PacketDocument4 pagesDemand and Elasticity PacketakmohideenNo ratings yet

- Cash Flow StatementDocument46 pagesCash Flow StatementSiraj Siddiqui100% (1)

- Entrepreneurship EXAM AugDocument3 pagesEntrepreneurship EXAM AugBJ ShNo ratings yet

- The Economic Times: Name Designation CompanyDocument49 pagesThe Economic Times: Name Designation CompanyArvind Kumar SNo ratings yet

- Placard IngDocument3 pagesPlacard IngNaresh LalwaniNo ratings yet

- Finman - Q2 Cost Os CaptDocument2 pagesFinman - Q2 Cost Os CaptJennifer RasonabeNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument4 pagesSworn Statement of Assets, Liabilities and Net WorthLance Aldrin AdionNo ratings yet

- Chapter 6Document10 pagesChapter 6narasimha100% (1)