Professional Documents

Culture Documents

Chap 003

Uploaded by

Tam NguyenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 003

Uploaded by

Tam NguyenCopyright:

Available Formats

Securities Markets

Bodie, Kane, and Marcus Essentials of Investments, 9th Edition

McGraw-Hill/Irwin

Copyright 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

3.1 How Firms Issue Securities

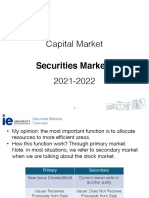

Primary vs. Secondary Market Security Sales

Primary

New issue created/sold Key factor: Issuer receives proceeds from sale Public offerings: Registered with SEC; sale made to

investing public

Private offerings: Not registered; sold only to limited

number of investors with restrictions on resale

Secondary

Existing owner sells to another party Issuing firm doesnt receive proceeds, is not directly

involved

3-2

3.1 How Firms Issue Securities

Privately Held Firms

Up to 499 shareholders Fewer obligations to release financial

statements to public

Private placement: Primary offerings sold

directly to a small group of investors

3-3

3.1 How Firms Issue Securities

Publicly Traded Companies

Sell securities to the general public; allow

investors to trade shares in securities markets

Initial public offering: First sale of stock by a

formerly private company

Underwriters: Purchase securities from issuing

company and resell them

Prospectus: Description of firm and security

being issued

3-4

Figure 3.1 Relationship among a Firm Issuing Securities, the Underwriters, and the Public

3-5

3.1 How Firms Issue Securities

Shelf Registration

SEC Rule 415

Security is preregistered and then may be

offered at any time within the next two years

24-hour notice: Any or all of preregistered

amount may be offered

Introduced in 1982 Allows timing of issues

3-6

3.1 How Firms Issue Securities

Initial Public Offerings

Issuer and banker put on road show Purpose: Bookbuilding and pricing Underpricing

Post-initial sale returns average 10% or

morewinners curse problem?

Easier to market issue; costly to issuing firm

3-7

Figure 3.2 Average First-Day Returns for European IPOs

3-8

Figure 3.2 Average First-Day Returns for Non-European IPOs

3-9

3.2 How Securities Are Traded

Functions of Financial Markets

Overall purpose: Facilitate low-cost investment

Bring together buyers and sellers at low cost

Provide adequate liquidity by minimizing time

and cost to trade and promoting price continuity

Set and update prices of financial assets

Reduce information costs associated with

investing

3-10

3.2 How Securities Are Traded

Types of Markets

Direct Search Markets

Buyers and sellers locate one another on their own

Brokered Markets

Third-party assistance in locating buyer or seller

Dealer Markets

Third party acts as intermediate buyer/seller

Auction Markets

Brokers and dealers trade in one location

Trading is more or less continuous

3-11

3.2 How Securities Are Traded

Types of Orders

Market order: Execute immediately at best price

Bid price: price at which dealer will buy security Ask price: price at which dealer will sell security

Price-contingent order: Buy/sell at specified price

or better

Limit buy/sell order: specifies price at which

investor will buy/sell

Stop order: not to be executed until price point

hit

3-12

Figure 3.3 Average Market Depth for Large (S&P 500) and Small (Russel 2000) Firms

3-13

Figure 3.4 Limit Order Book for Intel on the NYSE Arca Market, July 22, 2011

3-14

3.2 How Securities Are Traded

Trading Mechanisms Dealer markets

Over-the-counter (OTC) market: Informal network of

brokers/dealers who negotiate securities sales

NASDAQ stock market: Computer-linked price quotation

system for OTC market

Electronic communication networks (ECNs)

Computer networks that allow direct trading without market

makers

Specialist markets

Specialist: Makes market in shares of one or more firms;

maintains fair and orderly market by dealing personally

3-15

Figure 3.5 Price-Contingent Orders

3-16

3.3 The Rise of Electronic Trading

Timeline of Market Changes

1969: Instinet (first ECN) established 1975: Fixed commissions on NYSE eliminated

Congress amends Securities and Exchange Act

to create National Market System (NMS)

1994: NASDAQ scandal

SEC institutes new order-handling rules NASDAQ integrates ECN quotes into display SEC adopts Regulation Alternative Trading

Systems, giving ECNs ability to register as stock exchanges

3-17

3.3 The Rise of Electronic Trading

Timeline of Market Changes

1997: SEC drops minimum tick size from 1/8 to

1/16 of $1

2000: National Association of Securities Dealers

splits from NASDAQ

2001: Minimum tick size $.01 2006: NYSE acquires Archipelago Exchanges and

renames it NYSE Arca

SEC adopts Regulation NMS, requiring

exchanges to honor quotes of other exchanges

3-18

Figure 3.6 Effective Spread vs. Minimum Tick Size

3-19

3.4 U.S. Markets

NASDAQ

Approximately 3,000 firms

New York Stock Exchange (NYSE)

Stock exchanges: Secondary markets where

already-issued securities are bought and sold

NYSE is largest U.S. Stock exchange

ECNs

Latency: Time it takes to accept, process, and

deliver a trading order

3-20

Figure 3.7 Market Share of Trading in NYSE-Listed Shares

3-21

3.5 New Trading Strategies

Algorithmic Trading

Use of computer programs to make rapid

trading decisions

High-frequency trading: Uses computer

programs to make very rapid trading decisions in order to compete for very small profits

Dark Pools

ECNs where participants can buy/sell large

blocks of securities anonymously

Blocks: Transactions of at least 10,000 shares

3-22

Figure 3.8 Market Capitalization of Major World Stock Exchanges, 2011

3-23

3.6 Globalization of Stock Markets

Moving to automated electronic trading Current trends will eventually result in 24-

hour global markets

Moving toward market consolidation

3-24

3.7 Trading Costs

Commission: Fee paid to broker for making

transaction

Spread: Cost of trading with dealer

Bid: Price at which dealer will buy from you

Ask: Price at which dealer will sell to you

Spread: Ask bid

Combination: On some trades both are

paid

3-25

3.8 Buying on Margin

Margin: Describes securities purchased

with money borrowed in part from broker

Net worth of investor's account

Initial Margin Requirement (IMR)

Minimum set by Federal Reserve under

Regulation T, currently 50% for stocks

Minimum % initial investor equity 1 IMR = Maximum % amount investor can

borrow

3-26

3.8 Buying on Margin

Equity

Position value Borrowing + Additional cash

Maintenance Margin Requirement (MMR)

Minimum amount equity can be before

additional funds must be put into account

Exchanges mandate minimum 25%

Margin Call

Notification from broker that you must put up

additional funds or have position liquidated

3-27

3.8 Buying on Margin

If Equity / Market value MMR, then

margin call occurs

(Market value Borrowed) / Market Value

MMR; solve for market value

A margin call will occur when:

Market value = Borrowed/(1 MMR)

3-28

3.8 Buying on Margin

Margin Trading: Initial Conditions

X Corp: Stock price = $70 50%: Initial margin 40%: Maintenance margin

1000 shares purchased

Initial Position Stock $70,000 Borrowed Equity $35,000 $35,000

3-29

3.8 Buying on Margin

Stock price falls to $60 per share

Position value Borrowing + Additional cash

Margin %: $25,000/$60,000 = 41.67%

How far can price fall before margin call?

Market value = $35,000/(1 .40) = $58,333

New Position Stock $60,000 Borrowed $35,000 $25,000

Equity

3-30

3.8 Buying on Margin

With 1,000 shares, stock price for margin

call is $58,333/1,000 = $58.33

Margin % = $23,333/$58,333 = 40%

To restore IMR, equity = x $58,333 = $29,167

New Position Stock $60,000 Borrowed Equity $35,000 $23,333

3-31

3.8 Buying on Margin

Buy at $70 per share

Borrow at 7% APR interest cost if using margin;

use full amount margin

APRs (365-day year)

Buy at $70 No margin Margin Leverage factor Sell at $72 in 90 days 11.59% 16.17% 1.4x Sell at $68 in 90 days 11.59% 30.17% 2.6x

3-32

Table 3.1 Illustration of Buying Stock on Margin

3-33

3.9 Short Sales

Sale of shares not owned by investor but

borrowed through broker and later purchased to replace loan

Mechanics

Borrow stock from broker; must post margin

Broker sells stock, and deposits proceeds/margin

in margin account (you cannot withdraw proceeds until you cover)

Covering or closing out position: Buy stock; broker

returns title to party from which it was borrowed

3-34

3.9 Short Sales

Round Trips

Long position

Buy first, sell later

Bullish

Short position

Sell first, buy later Bearish

Round trip is a purchase and a sale

3-35

3.9 Short Sales

Required initial margin: Usually 50%

More for low-priced stocks

Liable for any cash flows

Dividend on stock

Zero tick, uptick rule

Eliminated by SEC in July 2007

3-36

3.9 Short Sales

Short-sale maintenance margin

requirements (equity)

Price < $2.50 $2.50 MMR

$2.50-$5.00 $5.00-$16.75 > $16.75

100% market value $5.00 30% market value

3-37

3.9 Short Sales

Example

You sell 100 short shares of stock at $60 per

share

$6,000 must be pledged to broker You must also pledge 50% margin You put up $3,000; now you have $9,000 in

margin account

Short sale equity = Total margin account

Market value

3-38

3.9 Short Sales

Example

Maintenance margin for short sale of stock with

price > $16.75 is 30% market value

30% x $6,000 = $1,800

You have $1,200 excess margin What price for margin call?

3-39

3.9 Short Sales

Example

When equity (.30 x Market value)

Equity = Total margin account Market value

When Market value = Total margin account / (1

+ MMR)

Market value = $9,000/(1 + 0.30) = $6,923 Price for margin call: $6,293/100 shares =

$69.23

3-40

3.9 Short Sales

Example

If this occurs:

Equity = $9,000 $6,923 = $2,077

Equity as % market value = $2,077/$6,923 =

30%

To restore 50% initial margin:

($6,923/2) $2,077 = $1,384.50

3-41

Table 3.2 Cash Flows from Purchasing vs. Short-Selling

Purchase of Stock Time 0 1 Action Buy share Receive dividend, sell share Short Sale of Stock Time 0 Action Borrow share; sell it Cash Flow* + Initial price Cash Flow* Initial price Ending price + Dividend

Profit = (Ending price + Dividend) Initial price

Repay dividend and buy share to replace share originally borrowed

(Ending price + Dividend)

Profit = Initial price (Ending price + Dividend)

*Note: A negative cash flow implies a cash outflow.

3-42

3.10 Regulation of Securities Markets

Self-Regulation The Sarbanes-Oxley Act Insider Trading

Inside information: Nonpublic knowledge about

a corporation possessed by officers, major owners, etc., with privileged access to information

3-43

You might also like

- LN-Session 2-Chapter 3-How Securities Are TradedDocument72 pagesLN-Session 2-Chapter 3-How Securities Are Tradedchaudhari vishalNo ratings yet

- Securities MarketDocument30 pagesSecurities MarketFacundo Bernal AlfaroNo ratings yet

- Organization and Functioning of Securities Markets: Questions To Be AnsweredDocument33 pagesOrganization and Functioning of Securities Markets: Questions To Be AnsweredAaryaAustNo ratings yet

- CH 04Document32 pagesCH 04sabariaz5309No ratings yet

- Ch3ppt 1s CorrectedDocument26 pagesCh3ppt 1s CorrectedKoon Sing ChanNo ratings yet

- CH 04Document33 pagesCH 04Mohammad FahimNo ratings yet

- How Securities Are TradedDocument23 pagesHow Securities Are TradedGreg AubinNo ratings yet

- How Securities Are Traded (Only Specific Topics in Chapter 3 Are Covered)Document28 pagesHow Securities Are Traded (Only Specific Topics in Chapter 3 Are Covered)Hiu Yin YuenNo ratings yet

- TCDNDocument52 pagesTCDNHuyen Le Thi PhuongNo ratings yet

- Msa l1 Organisation of The Securities MKTDocument34 pagesMsa l1 Organisation of The Securities MKTSam GosaNo ratings yet

- Topic 4 Securities MarketsDocument43 pagesTopic 4 Securities MarketsOne AshleyNo ratings yet

- Zaky Zaljuhdi 1401103010148Document5 pagesZaky Zaljuhdi 1401103010148Zaky ZaljuhdiNo ratings yet

- FM 5Document17 pagesFM 5Taaran ReddyNo ratings yet

- Investment Analysis and Portfolio Management: Organizing and Functioning of Security MarketDocument47 pagesInvestment Analysis and Portfolio Management: Organizing and Functioning of Security MarketShadowNo ratings yet

- How Securities Are TradedDocument28 pagesHow Securities Are TradedYap JoyinNo ratings yet

- 18th Century Origins of Indian Securities MarketsDocument47 pages18th Century Origins of Indian Securities MarketsManvendra ChaudharyNo ratings yet

- S1 MarketsandData F 2019Document71 pagesS1 MarketsandData F 2019WeiminChowNo ratings yet

- Introduction To Investment: Bruce VineyDocument111 pagesIntroduction To Investment: Bruce Vineyfrieda20093835No ratings yet

- Security AnalysisDocument93 pagesSecurity AnalysisKetan ThakkarNo ratings yet

- How Do The Stock Market Works?Document48 pagesHow Do The Stock Market Works?Jezza Mae Gomba RegidorNo ratings yet

- Bodie Investments CH03Document41 pagesBodie Investments CH03rafat.jalladNo ratings yet

- Chapter2 - Organization and Functioning of Securities MarketsDocument74 pagesChapter2 - Organization and Functioning of Securities MarketsBerhanu ShankoNo ratings yet

- Week 2: Investment VehiclesDocument37 pagesWeek 2: Investment Vehiclesmike chanNo ratings yet

- Introduction. Financial MarketsDocument35 pagesIntroduction. Financial MarketsDiana Mark AndrewNo ratings yet

- Lecture Presentation on Organization and Functioning of Securities MarketsDocument75 pagesLecture Presentation on Organization and Functioning of Securities MarketsAmrit KeyalNo ratings yet

- Securities Markets: Mcgraw-Hill/IrwinDocument45 pagesSecurities Markets: Mcgraw-Hill/IrwinNaman BansalNo ratings yet

- Must Business School: Mirpur University of Science and Technology (Must), Azad KashmirDocument77 pagesMust Business School: Mirpur University of Science and Technology (Must), Azad KashmirSadia KhanNo ratings yet

- Securities Markets: Mcgraw-Hill/Irwin © 2008 The Mcgraw-Hill Companies, Inc., All Rights ReservedDocument45 pagesSecurities Markets: Mcgraw-Hill/Irwin © 2008 The Mcgraw-Hill Companies, Inc., All Rights ReservedBujana BujanaNo ratings yet

- Buying and Selling SecuritiesDocument35 pagesBuying and Selling SecuritiesSajjad AhmadNo ratings yet

- FinanceDocument15 pagesFinanceRamit GulatiNo ratings yet

- Lecture16 PDFDocument30 pagesLecture16 PDFkate ngNo ratings yet

- ArbitrageDocument16 pagesArbitrageRishabYdvNo ratings yet

- Stock Markets Overview: - Stockholders Are The Legal Owners of ADocument32 pagesStock Markets Overview: - Stockholders Are The Legal Owners of AGaurav JindalNo ratings yet

- Investment Analysis and Portfolio Management Seventh Edition by Frank K. Reilly & Keith C. BrownDocument75 pagesInvestment Analysis and Portfolio Management Seventh Edition by Frank K. Reilly & Keith C. BrownUsman KWLNo ratings yet

- 003 15 Trading NewDocument37 pages003 15 Trading NewkahramanemailNo ratings yet

- Carbon TradingDocument32 pagesCarbon TradingCarlos ChangNo ratings yet

- Functioning of Security MarketsDocument33 pagesFunctioning of Security MarketsRafia NaveedNo ratings yet

- Chapter 4 - Stock ExchangeDocument36 pagesChapter 4 - Stock ExchangeHoàng Anh NguyễnNo ratings yet

- Overview of Key Financial System Concepts - Markets, Instruments, Participants & RegulatorsDocument50 pagesOverview of Key Financial System Concepts - Markets, Instruments, Participants & RegulatorsshahyashrNo ratings yet

- Smo Chapter 1 & 2Document34 pagesSmo Chapter 1 & 229.Kritika SinghNo ratings yet

- Money Market and Capital MarketDocument36 pagesMoney Market and Capital Marketmisakisakura1102No ratings yet

- Financial MarketsDocument43 pagesFinancial MarketsTecho NendoNo ratings yet

- Bus 315 - Chapter 3 - Trading On Securities MarketsDocument48 pagesBus 315 - Chapter 3 - Trading On Securities Marketsmiaotianrun0810No ratings yet

- CH 4 Securities Market Matter To All Investors 2020Document30 pagesCH 4 Securities Market Matter To All Investors 2020Abdihamid AliNo ratings yet

- Trading Mechanism and Process at BSEDocument30 pagesTrading Mechanism and Process at BSEPooja Malhotra KwatraNo ratings yet

- Money Markets Chapter Explains Short-Term Financial InstrumentsDocument66 pagesMoney Markets Chapter Explains Short-Term Financial InstrumentsAykaNo ratings yet

- SecondaryDocument39 pagesSecondarySunil BharadwajNo ratings yet

- Topic 2 Indirect Investing Securities Markets STUDocument45 pagesTopic 2 Indirect Investing Securities Markets STUPhạm Hải MỵNo ratings yet

- Module 3 Merchant Banking: Nature of Services, structure of merchant banking firms. Financial Markets: Capital Market, Money Market, Forex Market, Linkage between the marketsDocument6 pagesModule 3 Merchant Banking: Nature of Services, structure of merchant banking firms. Financial Markets: Capital Market, Money Market, Forex Market, Linkage between the marketsSandeep YogeshwaranNo ratings yet

- Presentation on Capital and Securities MarketsDocument30 pagesPresentation on Capital and Securities Marketspriyankshah_bkNo ratings yet

- International Equity Markets ExplainedDocument36 pagesInternational Equity Markets ExplainedVrinda GargNo ratings yet

- How To Trade Stocks and BondsDocument28 pagesHow To Trade Stocks and Bondsmohitjainrocks100% (1)

- Capital Market: Overview & OperationsDocument37 pagesCapital Market: Overview & OperationsEldho VargheseNo ratings yet

- Original Cse 1Document31 pagesOriginal Cse 1api-3825789100% (1)

- An overview of the secondary market mechanismDocument50 pagesAn overview of the secondary market mechanismRafiul Munir100% (1)

- PP 01Document63 pagesPP 01Evgeniy DenkovychNo ratings yet

- SAPM MIdsem NotesDocument97 pagesSAPM MIdsem NotesRoshan JhaNo ratings yet

- Apexum - Forex Broker Business Plan 2Document43 pagesApexum - Forex Broker Business Plan 2Khaleel Musleh67% (3)

- Day Trading Bitcoin & Ethereum : Advanced Strategies To Day Trade For A LivingFrom EverandDay Trading Bitcoin & Ethereum : Advanced Strategies To Day Trade For A LivingRating: 5 out of 5 stars5/5 (9)

- Mastering Cryptocurrency Arbitrage: A Comprehensive Guide to Profitable Trading Strategies: way to wealth, #22From EverandMastering Cryptocurrency Arbitrage: A Comprehensive Guide to Profitable Trading Strategies: way to wealth, #22No ratings yet

- Islamiat CSS Notes CompleteDocument30 pagesIslamiat CSS Notes Completeamir87% (15)

- English Essay 2009 - 2014Document7 pagesEnglish Essay 2009 - 2014Muzzammil Ali100% (1)

- General KnowledgeDocument26 pagesGeneral KnowledgesheenNo ratings yet

- DerivativesDocument19 pagesDerivativesMuzzammil AliNo ratings yet

- Ch01 - International Financial ManagementDocument47 pagesCh01 - International Financial Managementalsatusatusatu100% (1)

- Learning About Organizational BehaviorDocument26 pagesLearning About Organizational BehaviorupasanamohantyNo ratings yet

- Europe in Crisis: Social Upheaval, Religious Conflict and Witch Hunts (1560-1650Document5 pagesEurope in Crisis: Social Upheaval, Religious Conflict and Witch Hunts (1560-1650Muzzammil AliNo ratings yet

- Aayatul QursiDocument7 pagesAayatul QursiMuzzammil AliNo ratings yet