Professional Documents

Culture Documents

Accounting Standard - 22

Uploaded by

Rana Haider0 ratings0% found this document useful (0 votes)

48 views25 pagesAccounting standards

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting standards

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

48 views25 pagesAccounting Standard - 22

Uploaded by

Rana HaiderAccounting standards

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 25

Accounting Standard - 22

Accounting for Taxes on Income

- By Pratap Karmokar, ACA

Index

Introduction

Objective

Scope

Definitions

Recognition

Re-assessment of unrecognised Deferred Tax Assets

Measurement

Review of Deferred Tax Assets

Presentation and disclosure

Transitional Provisions

Examples of Timing Difference

Illustration - 1

Illustration - 2

Illustration - 3

INTRODUCTION

Comes into effect from 1

st

April, 2001

Mandatory in Nature

Applicable for all enterprises

For accounting periods commencing on or after

1

st

April 2003

OBJECTIVE

Prescribe accounting treatment for taxes on income in

accordance with the matching concept:

Matching of taxes with the corresponding revenue and

expenses since taxable income significantly varies with the

accounting income

Reasons

Difference between items of Revenue and expense as per

profit & Loss account and those considered for tax purpose

Difference between the amount of the items of Revenue and

expenses as per profit and loss account and those considered

for tax purpose

Scope

Applied For accounting for taxes on income:

Determination of expenses or savings related to taxes

on income for a particular period

Disclosure of such amount in Financial Statement

Includes both domestic and foreign taxes

Tax payable on distribution of dividends and other

distribution not covered

Definition

Accounting income (loss) is the net profit or loss for a period,

as reported in the statement of profit and loss, before deducting

income tax expense or adding income tax saving.

Taxable income (tax loss) is the amount of the income (loss)

for a period, determined in accordance with the tax laws, based

upon which income tax payable (recoverable) is determined.

Tax expense (tax saving) is the aggregate of current tax and

deferred tax charged or credited to the statement of profit and

loss for the period.

Current tax is the amount of income tax determined to be

payable (recoverable) in respect of the taxable income (tax loss)

for a period.

Definitions .Contd

Deferred tax is the tax effect of timing differences.

Timing differences are the differences between taxable

income and accounting income for a period that originate in

one period and are capable of reversal in one or more

subsequent periods.

Permanent differences are the differences between

taxable income and accounting income for a period that

originate in one period and do not reverse subsequently.

Definitions .Contd

Taxable income is calculated as per tax laws

Hence there is a difference between the tax

income and accounting income

This difference can be classified into

Permanent differences

Difference originated in one period which do not reverse

subsequently

Timing differences

Difference originated in one period which is capable of

reversal in one or more subsequent periods

Recognition

Tax expense (Accrued tax)

= Current tax + Deferred Tax

Tax expense should be included in the determination of net profit

or loss for the period

Tax effects of timing difference are included in tax expenses and

as deferred tax assets or as deferred tax liability

This has to be done for all the timing differences

Deferred tax assets are recognized subject to the consideration of

prudence i.e. there is reasonable certainty that sufficient future

taxable income will be available against which deferred tax asset

can be realized Past record of the enterprise should be referred.

Tax effects of permanent difference do not result in deferred tax

assets or deferred tax liabilities.

Re-assessment of Unrecognized

Deferred Tax Assets

Re-assessment of unrecognised Deferred

tax assets has to be done at each balance

sheet date

Recognize previously unrecognized

deferred tax asset to the extent it is

reasonably certain

Measurement

Current tax should be measured at the amount expected to

be paid to (recovered from) the taxation authorities, using

the applicable tax rates and tax laws.

Deferred tax assets and liabilities should be measured using

the tax rates and tax laws that have been enacted or

substantively enacted by the balance sheet date.

For different tax rates for levels of income average rates

should be used for deferred tax assets and liabilities

Deferred tax assets and liabilities should not be discounted

to their present value

Review of Deferred Tax Asset

The carrying amount of deferred tax asset should

be reviewed at each balance sheet date.

The carrying amount should be written down to

the extent that it is no longer reasonably certain

or virtually certain that the future taxable income

will be available against the deferred tax asset

Any such write-down may be reversed to the

extent the future taxable income becomes

reasonably certain.

Presentation and disclosure

An enterprise should offset assets and liabilities

representing current tax if the enterprise:

has a legally enforceable right to set off the recognised

amounts; and

intends to settle the asset and the liability on a net basis.

An enterprise should offset deferred tax assets and

deferred tax liabilities if:

the enterprise has a legally enforceable right to set off assets

against liabilities representing current tax; and

the deferred tax assets and the deferred tax liabilities relate to

taxes on income levied by the same governing taxation laws.

Presentation and disclosure ...Contd

Deferred tax assets and liabilities should be distinguished

from assets and liabilities representing current tax for the

period.

Deferred tax assets and liabilities should be disclosed under

a separate heading in the balance sheet of the enterprise,

separately from current assets and current liabilities.

The break-up of deferred tax assets and deferred tax

liabilities into major components of the respective balances

should be disclosed in the notes to accounts.

The nature of the evidence supporting the recognition of

deferred tax assets should be disclosed, if an enterprise has

unabsorbed depreciation or carry forward of losses under

tax laws.

Transitional Provisions

Application of AS 22 for the first time

The opening balance of assets and liabilities for accounting purposes

and for tax purposes are compared and the difference if any are

determined.

Tax effect of these differences if any, should be recognised as deferred

tax asset or liability if these differences are timing differences.

The enterprise should recognise, in the financial statements, the

deferred tax balance that has accumulated prior to the adoption of this

Statement as deferred tax asset/liability with a corresponding

credit/charge to the revenue reserves, subject to the consideration of

prudence in case of deferred tax assets.

The amount so credited/charged to the revenue reserves should be

the same as that which would have resulted if this Statement had

been in effect from the beginning.

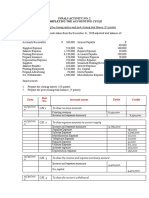

Solution - 1

20x1 20x2 20x3

Profit before depreciation and taxes 200 200 200

Less: Depreciation for accounting purposes 50 50 50

Profit before taxes 150 150 150

Tax expenses

Current Tax (WN1) - (a) 20 80 80

Deferred Tax (WN2) - (b) 40 (20) (20)

60 60 60

Profit after Tax 90 90 90

Statement of Profit and Loss

(for the three years ending 31st March, 20x1, 20x2, 20x3)

(Rupees in thousands)

Examples of Timing Difference

(Illustrative)

Expenses debited in the statement of profit and loss for accounting

purposes but allowed for tax purposes in subsequent years

Expenses amortized in the books over a period of years but are allowed

for tax purposes wholly in the first year

Where book and tax depreciation differ. This could arise due to:

Differences in depreciation rates.

Differences in method of depreciation e.g. SLM or WDV.

Differences in method of calculation

Differences in composition of actual cost of assets.

Where a deduction is allowed in one year for tax purposes on the basis of

a deposit made under a permitted deposit scheme

Income credited to the statement of profit and loss but taxed only in

subsequent years e.g. conversion of capital assets into stock in trade.

If for any reason the recognition of income is spread over a number of

years in the accounts but the income is fully taxed in the year of receipt.

Illustration - 1

A company, ABC Ltd., prepares its accounts annually on

31st March. On 1st April, 20x1, it purchases a machine at a

cost of Rs. 1,50,000. The machine has a useful life of three

years and an expected scrap value of zero. Although it is

eligible for a 100% first year depreciation allowance for tax

purposes, the straight-line method is considered

appropriate for accounting purposes. ABC Ltd. has profits

before depreciation and taxes of Rs. 2,00,000 each year

and the corporate tax rate is 40 per cent each year.

The purchase of machine at a cost of Rs. 1,50,000 in 20x1

gives rise to a tax saving of Rs. 60,000. If the cost of the

machine is spread over three years of its life for accounting

purposes, the amount of the tax saving should also be

spread over the same period as shown below:

WN 1 Current Tax

20x1 20x2 20x3

Profit before depreciation and taxes 200 200 200

Depreciation as per Taxation 150 - -

Profit before Tax (Taxation P & L) 50 200 200

Tax (@ 40%) (a) 20 80 80

(Rupees in thousands)

WN 2 Deferred Tax

20x1 20x2 20x3

Tax effect of timing differences originating during the

year Depreciation as per Taxation 150 - -

Less: Depreciation as per Accounts 50 50 50

Profit reduced by (b) 100 (50) (50)

Deferred Tax Liability (b) * 40% 40

(Since Rs 40/- is required to be paid in future)

Tax effect of timing differences reversing during the year

(b) * 40% - (20) (20)

40 (20) (20)

(Rupees in thousands)

Illustration - 2

If in Illustration 1, the substantively

enacted tax rates for 20x1, 20x2 and 20x3

are 40%, 35% and 38% respectively, how

will be the amount of deferred tax liability

computed.

Solution - 2

If the rate of tax changes, it would be

necessary for the enterprise to adjust the

amount of deferred tax liability carried

forward by applying the tax rate that has

been enacted or substantively enacted by

the balance sheet date on accumulated

timing differences at the end of the

accounting year.

Solution 2 .Contd

The deferred tax liability carried forward each year would

appear in the balance sheet as under:

31st March, 20x1 = 0.40 (1,00,000) = Rs.40,000

31st March, 20x2 = 0.35 (50,000) = Rs.17,500

31st March, 20x3 = 0.38 (Zero) = Rs.Zero

Accordingly, the amount debited/(credited) to the profit and

loss account (with corresponding credit or debit to deferred tax

liability) for each year would be as under:

31st March, 20x1 Debit = Rs.40,000

31st March, 20x2 (Credit) = Rs.(22,500)

31st March, 20x3 (Credit) = Rs.(17,500)

Illustration - 3

A company, ABC Ltd., prepares its accounts annually on 31st

March.

The company has incurred a loss of Rs. 1,00,000 in the year 20x1

and made profits of Rs. 50,000 and 60,000 in year 20x2 and year

20x3 respectively.

It is assumed that under the tax laws, loss can be carried forward

for 8 years and tax rate is 40% and at the end of year 20x1, it

was virtually certain, supported by convincing evidence, that the

company would have sufficient taxable income in the future years

against which unabsorbed depreciation and carry forward of losses

can be set-off.

It is also assumed that there is no difference between taxable

income and accounting income except that set-off of loss is

allowed in years 20x2 and 20x3 for tax purposes.

Solution - 3

(Rupees in thousands)

20x1 20x2 20x3

Profit (loss) (100) 50 60

Less: Current tax - - (4)

Deferred tax:

Tax effect of timing differences originating during the year 40

Tax effect of timing differences reversing during the year (20) (20)

Profit (loss) after tax effect (60) 30 36

Deferred Tax Asset 40 20 0

(40 - 20) *

* Since the loss of Rs 50/- is adjusted

Statement of Profit and Loss

(for the three years ending 31st March, 20x1, 20x2, 20x3)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Waste Management FraudDocument12 pagesWaste Management FraudRana Haider67% (3)

- Waste Management FraudDocument12 pagesWaste Management FraudRana Haider67% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Excel Formulas and FunctionsDocument16 pagesExcel Formulas and Functionsgoyal.pavan100% (1)

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Accounting For Property Plant and EquipmentDocument6 pagesAccounting For Property Plant and EquipmentmostafaNo ratings yet

- Assign 6 Option C Excel - 7edDocument17 pagesAssign 6 Option C Excel - 7edFaaiz Yousaf0% (1)

- Id Fas Brochure Noexp PDFDocument24 pagesId Fas Brochure Noexp PDFDaniel PandapotanNo ratings yet

- Youth Empowerment Programs for Improving Self-EfficacyDocument38 pagesYouth Empowerment Programs for Improving Self-EfficacyRana HaiderNo ratings yet

- Chapter 14 Multiple Choice Questions and ProblemsDocument14 pagesChapter 14 Multiple Choice Questions and Problemsjediiik50% (2)

- Share Price GufranDocument24 pagesShare Price GufranMuhammad Saleem SattarNo ratings yet

- Capital Budgeting Part 1 - Revision NotesDocument14 pagesCapital Budgeting Part 1 - Revision Notessohail merchantNo ratings yet

- 7 ProcessCostingDocument2 pages7 ProcessCostingRana HaiderNo ratings yet

- Sample Paper State Bank of PakistanDocument7 pagesSample Paper State Bank of PakistanShahid JappaNo ratings yet

- Monthly Demand ABC Corporation (Jan '98 - Dec '02)Document2 pagesMonthly Demand ABC Corporation (Jan '98 - Dec '02)Rana HaiderNo ratings yet

- Microfinance For Youth in Conflict SettingsDocument52 pagesMicrofinance For Youth in Conflict SettingsRana HaiderNo ratings yet

- HEC Committee Minutes on Degree RecognitionDocument91 pagesHEC Committee Minutes on Degree RecognitionSohaib Ahmed100% (2)

- Introduction To Operations and Supply Chain ManagementDocument44 pagesIntroduction To Operations and Supply Chain ManagementRana HaiderNo ratings yet

- EqualVoice YouthEmpowerment Toolkit-WebDocument36 pagesEqualVoice YouthEmpowerment Toolkit-WebRana HaiderNo ratings yet

- Method One of Reading:-: Standard Costing - IDocument9 pagesMethod One of Reading:-: Standard Costing - IRana HaiderNo ratings yet

- Report On Operation of KapcoDocument45 pagesReport On Operation of KapcoZunaira RasheedNo ratings yet

- Marketing Strategies of Dawlance and LGDocument7 pagesMarketing Strategies of Dawlance and LGRana HaiderNo ratings yet

- New Microsoft Office Word DocumentDocument1 pageNew Microsoft Office Word DocumentRana HaiderNo ratings yet

- AIOU Research Methods PacketDocument8 pagesAIOU Research Methods PacketRana HaiderNo ratings yet

- KSE 100 Executive Summary of CFA Level 1 reading on Security Market IndexesDocument6 pagesKSE 100 Executive Summary of CFA Level 1 reading on Security Market IndexesRana HaiderNo ratings yet

- New Microsoft Word DocumentDocument6 pagesNew Microsoft Word DocumentRana HaiderNo ratings yet

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentRana HaiderNo ratings yet

- Price Earning Ratio:: Market AverageDocument25 pagesPrice Earning Ratio:: Market AverageRana HaiderNo ratings yet

- TT05B - Investment Plan Example InstructionsDocument12 pagesTT05B - Investment Plan Example InstructionsRana HaiderNo ratings yet

- Functions of Stock ExchangeDocument24 pagesFunctions of Stock Exchangesaqibch44No ratings yet

- M/s. Dawood Hercules Chemical Limited: ProposingDocument2 pagesM/s. Dawood Hercules Chemical Limited: ProposingRana HaiderNo ratings yet

- Market Research ReportDocument32 pagesMarket Research ReportRana HaiderNo ratings yet

- New Microsoft Word DocumentDocument5 pagesNew Microsoft Word DocumentRana HaiderNo ratings yet

- Womens Empowerment in The Context of Microfinance - A PhotovoiceDocument147 pagesWomens Empowerment in The Context of Microfinance - A PhotovoiceRana HaiderNo ratings yet

- Zjyc Youth Baseline Survey Executive Report Final10marchDocument48 pagesZjyc Youth Baseline Survey Executive Report Final10marchRana HaiderNo ratings yet

- Closing EntriesDocument23 pagesClosing EntriesLeonabelle Yago DawitNo ratings yet

- Finance ManagerDocument4 pagesFinance Managerknowledge musendekwaNo ratings yet

- Comp-Xm® Inquirer0Document21 pagesComp-Xm® Inquirer0Jasleen Kaur (Ms)No ratings yet

- 4.01 Accounting and FinanceDocument17 pages4.01 Accounting and FinanceAbhishekNo ratings yet

- Review risks related to asset lives, depreciation, inventory counts and insurance claimsDocument2 pagesReview risks related to asset lives, depreciation, inventory counts and insurance claimsTashfeenNo ratings yet

- Analytical Procedures Used in The Overall Review StageDocument6 pagesAnalytical Procedures Used in The Overall Review StageQueen ValleNo ratings yet

- PD 1445Document18 pagesPD 1445Mil Roilo B EspirituNo ratings yet

- Final Examination - Fabm - Ms. Alrose - 17 CopiesDocument2 pagesFinal Examination - Fabm - Ms. Alrose - 17 CopiesAlrose Balani MacapunoNo ratings yet

- Chapter 3-The Recording Process and Accounting CycleDocument7 pagesChapter 3-The Recording Process and Accounting CycleParvez TuhenNo ratings yet

- FAT MCQsDocument3 pagesFAT MCQsnajane100% (1)

- Bharat Telecom LTD Condensed Audited Financial Statements For The Year Ended 31 March 2015Document1 pageBharat Telecom LTD Condensed Audited Financial Statements For The Year Ended 31 March 2015L'express MauriceNo ratings yet

- Management Information (ICAI)Document43 pagesManagement Information (ICAI)Rajib HossainNo ratings yet

- Ledger Accounting and Double Entry Bookkeeping: Chapter Learning ObjectivesDocument46 pagesLedger Accounting and Double Entry Bookkeeping: Chapter Learning Objectiveskoti kebele100% (1)

- Sap Fi End User Practice Work: AR AP Asset AccountingDocument19 pagesSap Fi End User Practice Work: AR AP Asset AccountingHany RefaatNo ratings yet

- Applied Auditing 2Document11 pagesApplied Auditing 2Leny Joy DupoNo ratings yet

- The Audit Expectations Gap in BritainDocument33 pagesThe Audit Expectations Gap in Britainnguyenthuan1211No ratings yet

- Engagement Letter (ISA 210) 2020Document2 pagesEngagement Letter (ISA 210) 2020Noman AnserNo ratings yet

- 2019 Vol 2 CH 4 AnswersDocument8 pages2019 Vol 2 CH 4 AnswersElla LopezNo ratings yet

- Hedge Fund ResumeDocument6 pagesHedge Fund Resumec2s1s8mr100% (1)

- Accounting Education in Nigerian Universities: Challenges and ProspectsDocument9 pagesAccounting Education in Nigerian Universities: Challenges and Prospectsoluwafemi MatthewNo ratings yet

- Aps Stawi 23 001Document23 pagesAps Stawi 23 001kithomez100% (1)

- Accounting Level 3: LCCI International QualificationsDocument21 pagesAccounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (4)

- BHM Syllabus MG University Kottayam Kerala IndiaDocument95 pagesBHM Syllabus MG University Kottayam Kerala IndiaprismruthiNo ratings yet

- Example Assignment 7003Document14 pagesExample Assignment 7003Javeriah Arif75% (4)