Professional Documents

Culture Documents

CH 08 Hull OFOD9 TH Edition

Uploaded by

seanwu950 ratings0% found this document useful (0 votes)

32 views13 pagescoursematerials John Hull Slides_pptx_ OFOD9e

Original Title

Ch08HullOFOD9thEdition

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcoursematerials John Hull Slides_pptx_ OFOD9e

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views13 pagesCH 08 Hull OFOD9 TH Edition

Uploaded by

seanwu95coursematerials John Hull Slides_pptx_ OFOD9e

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

Chapter 8

Securitization and the Credit

Crisis of 2007

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014 1

Securitization

Traditionally banks have funded loans with

deposits

Securitization is a way that loans can

increase much faster than deposits

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014

2

Asset Backed Security (Simplified)

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014 3

Asset 1

Asset 2

Asset 3

Asset n

Principal:

$100 million

SPV

Senior Tranche

Principal: $80 million

Return = LIBOR + 60bp

Mezzanine Tranche

Principal:$15 million

Return = LIBOR+ 250bp

Equity Tranche

Principal: $5 million

Return =LIBOR+2,000bp

The Waterfall

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014 4

Equity Tranche

Senior

Tranche

Mezzanine Tranche

Asset

Cash

Flows

ABS CDOs or Mezz CDOs (Simplified)

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014 5

Assets Senior Tranche (80%)

AAA

Mezzanine Tranche (15%)

BBB

Equity Tranche (5%)

Not Rated

Senior Tranche (65%)

AAA

Mezzanine Tranche

(25%) BBB

Equity Tranche (10%)

The mezzanine tranche is

repackaged with other

mezzanine tranches

ABSs

ABS CDOs

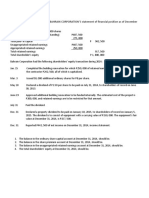

Losses to AAA Senior Tranche of ABS

CDO (Table 8.1, page 189)

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014 6

Losses on

Subprime

portfolios

Losses on

Mezzanine

Tranche of

ABS

Losses on

Equity

Tranche of

ABS CDO

Losses on

Mezzanine

Tranche of

ABS CDO

Losses on

Senior

Tranche of

ABS CDO

10% 33.3% 100% 93.3% 0%

13% 53.3% 100% 100% 28.2%

17% 80.0% 100% 100% 69.2%

20% 100% 100% 100% 100%

U.S. Real Estate Prices, 1987 to 2013:

S&P/Case-Shiller Composite-10 I ndex

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014 7

What happened

Starting in 2000, mortgage originators in the US relaxed their

lending standards and created large numbers of subprime

first mortgages.

This, combined with very low interest rates, increased the

demand for real estate and prices rose.

To continue to attract first time buyers and keep prices

increasing they relaxed lending standards further

Features of the market: 100% mortgages, ARMs, teaser

rates, NINJAs, liar loans, non-recourse borrowing

Mortgages were packaged in financial products and sold to

investors

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014

8

What happened...

Banks found it profitable to invest in the AAA rated tranches

because the promised return was significantly higher than the

cost of funds and capital requirements were low

In 2007 the bubble burst. Some borrowers could not afford

their payments when the teaser rates ended. Others had

negative equity and recognized that it was optimal for them to

exercise their put options.

Foreclosures increased supply and caused U.S. real estate

prices to fall. Products, created from the mortgages, that were

previously thought to be safe began to be viewed as risky

There was a flight to quality and credit spreads increased to

very high levels

Many banks incurred huge losses

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014

9

What Many Market Participants

Did Not Realize

Default correlation goes up in stressed market

conditions

Recovery rates are less in stressed market conditions

A tranche with a certain rating cannot be equated

with a bond with the same rating. For example, the

BBB tranches used to create ABS CDOs were

typically about 1% wide and had all or nothing loss

distributions (quite different from BBB bond)

This is quite different from the loss distribution for a

BBB bond from a BBB bond

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014

10

Regulatory Arbitrage

The regulatory capital banks were required to

keep for the tranches created from mortgages

was less than that for the mortgages

themselves

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014

11

I ncentives

The crisis highlighted what are referred to as

agency costs

Mortgage originators (Their prime interest was in

in originating mortgages that could be securitized)

Valuers (They were under pressure to provide

high valuations so that the loan-to-value ratios

looked good)

Traders (They were focused on the next end-of

year bonus and not worried about any longer term

problems in the market)

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014

12

The Aftermath

A huge amount of new regulation (Basel II.5,

Basel III, Dodd-Frank, etc). For example:

Banks required to hold more equity capital with the

definition of equity capital being tightened

Banks required to satisfy liquidity ratios

CCPs and SEFs for OTC derivatives

Bonuses limited in Europe

Bonuses spread over several years

Proprietary trading restricted

Options, Futures, and Other Derivatives 9th Edition,

Copyright John C. Hull 2014

13

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Simulation of Diffusion ProcessesDocument4 pagesSimulation of Diffusion Processesseanwu95No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- JD Vs Sfa Vs DataDocument1 pageJD Vs Sfa Vs Dataseanwu95No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Topics in Continuous-Time Finance, Spring 2003: T X 2 XX: (AF) (X, T)Document4 pagesTopics in Continuous-Time Finance, Spring 2003: T X 2 XX: (AF) (X, T)seanwu95No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Slides100203 4Document2 pagesSlides100203 4seanwu95No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Topics in Continuous-Time FinanceDocument4 pagesTopics in Continuous-Time Financeseanwu95No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- hw6 001Document1 pagehw6 001seanwu95No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Simple Way To Find Prices, Greeks, and Static Hedges For Barrier OptionsDocument3 pagesA Simple Way To Find Prices, Greeks, and Static Hedges For Barrier Optionsseanwu95No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- SGSG Asf Asf AsfDocument1 pageSGSG Asf Asf Asfseanwu95No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Topics in Continuous-Time Finance, Spring 2003Document2 pagesTopics in Continuous-Time Finance, Spring 2003seanwu95No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Nordea Markets Complex Risk Presentation Wed, 14 May, 2003, ? Aud ?Document2 pagesNordea Markets Complex Risk Presentation Wed, 14 May, 2003, ? Aud ?seanwu95No ratings yet

- SGSG Asf Asf AsfDocument1 pageSGSG Asf Asf Asfseanwu95No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Plan AsdDocument5 pagesPlan Asdseanwu95No ratings yet

- Suff - PR As Oject2Document3 pagesSuff - PR As Oject2seanwu95No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- ReadmeDocument1 pageReadmeseanwu95No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Cir Asfda Asfd AsdfDocument4 pagesCir Asfda Asfd Asdfseanwu95No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Five Easy Steps To Fixing The Credit Rating AgenciesDocument6 pagesFive Easy Steps To Fixing The Credit Rating Agenciesseanwu95No ratings yet

- A Lonely Lament From A Whistle-Blower Our Own Harry Markopolos - 2010 Harry - LamentDocument3 pagesA Lonely Lament From A Whistle-Blower Our Own Harry Markopolos - 2010 Harry - Lamentseanwu95No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Black-Scholes Model With Markov SwitchingDocument26 pagesA Black-Scholes Model With Markov Switchingseanwu95No ratings yet

- Sugga EstionsDocument4 pagesSugga Estionsseanwu95No ratings yet

- QuantDocument1 pageQuantvamsi.iitkNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Testing: TrainingDocument25 pagesTesting: Trainingseanwu95No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Maybe Smart Money Isn't So Smart-MaybesmartmoneyDocument28 pagesMaybe Smart Money Isn't So Smart-Maybesmartmoneyseanwu95No ratings yet

- Djangocms InstallerDocument31 pagesDjangocms Installerseanwu95No ratings yet

- Risk Stabilization and Asset Allocation-Risk - 2008!10!01Document4 pagesRisk Stabilization and Asset Allocation-Risk - 2008!10!01seanwu95No ratings yet

- Ex 7Document1 pageEx 7seanwu95No ratings yet

- Towers-Watson - PPT - Private Equity Emerging From The CrisisDocument37 pagesTowers-Watson - PPT - Private Equity Emerging From The Crisisseanwu95No ratings yet

- 890 IV SurfaceDocument24 pages890 IV Surfaceseanwu95No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Harry Markopolos, Whistleblower Extraordinaire Forme - HarryDocument5 pagesHarry Markopolos, Whistleblower Extraordinaire Forme - Harryseanwu95No ratings yet

- AnswersDocument5 pagesAnswersseanwu95No ratings yet

- CH 5 MCQ AccDocument7 pagesCH 5 MCQ AccabiNo ratings yet

- Services Quality Analysis in SBI BankDocument110 pagesServices Quality Analysis in SBI Bankvinodksrini007100% (4)

- Chequing Statement-1606 2023-07-04Document2 pagesChequing Statement-1606 2023-07-04Kashif AhmedNo ratings yet

- Loans and Advances (Mba Finance Internship Project)Document84 pagesLoans and Advances (Mba Finance Internship Project)Niki niki83% (6)

- IntroductionDocument11 pagesIntroductionGokul BansalNo ratings yet

- Policy Amendment FormDocument8 pagesPolicy Amendment FormN V Sumanth VallabhaneniNo ratings yet

- X Ä A A Ä A A X: Values of Joint-Life Actuarial Functions Based On The AM92 Mortality Table at I 4%Document1 pageX Ä A A Ä A A X: Values of Joint-Life Actuarial Functions Based On The AM92 Mortality Table at I 4%Fung AlexNo ratings yet

- AR18 - Financial Statements and Independent Auditor ReportDocument57 pagesAR18 - Financial Statements and Independent Auditor ReportKira LimNo ratings yet

- ICICI Bank (And Investment Corporation of India,: NSE Icicibank BSE 532174 Nyse IBN Marathi IndiaDocument4 pagesICICI Bank (And Investment Corporation of India,: NSE Icicibank BSE 532174 Nyse IBN Marathi IndiaprajaktaghaseNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Konverter CSV - Batch UploaddDocument20 pagesKonverter CSV - Batch UploaddDevi Merry Sonia Sitepu50% (2)

- WQU Financial Markets Module 3 PDFDocument30 pagesWQU Financial Markets Module 3 PDFAbhishek Jyoti100% (1)

- Millennium Company - Projected Financial StatementDocument2 pagesMillennium Company - Projected Financial StatementKathleenCusipagNo ratings yet

- The Shareholder's Equity Section BAHRAIN CORPORATION'S Statement of Financial Position As of December 31, 2013, Is As FollowsDocument4 pagesThe Shareholder's Equity Section BAHRAIN CORPORATION'S Statement of Financial Position As of December 31, 2013, Is As FollowsCyril John ReyesNo ratings yet

- Tds ChallanDocument2 pagesTds Challannilesh vithalaniNo ratings yet

- Liquidity Analysis of Nepal Investment Bank LTDDocument39 pagesLiquidity Analysis of Nepal Investment Bank LTDsuraj banNo ratings yet

- Banking and Financial Institution 1ST Term MT ReviewerDocument16 pagesBanking and Financial Institution 1ST Term MT ReviewerAly JoNo ratings yet

- 12345Document17 pages12345xjammer0% (3)

- Adjusting EntriesDocument27 pagesAdjusting EntriesEarl Hyannis ElauriaNo ratings yet

- BDPL 4103 6.3.2020 PDFDocument6 pagesBDPL 4103 6.3.2020 PDFRusydi cantikNo ratings yet

- Account Statement UnlockedDocument12 pagesAccount Statement UnlockedDeepeNo ratings yet

- TWO: Financial Analyses and PlanningDocument18 pagesTWO: Financial Analyses and Planningsamuel kebedeNo ratings yet

- Top 50 CAIIB Practice Questions For BFM: Download Free PDF NowDocument10 pagesTop 50 CAIIB Practice Questions For BFM: Download Free PDF NowAkthar fathimaNo ratings yet

- E10-1B: (Horizontal Analysis - Increase /decrease Method) : Name: Date: Score: Professor: ScheduleDocument3 pagesE10-1B: (Horizontal Analysis - Increase /decrease Method) : Name: Date: Score: Professor: ScheduleMarc SantosNo ratings yet

- FINAL PROJECT SDocument19 pagesFINAL PROJECT SPooja PanjavaniNo ratings yet

- Works Card: Part No Description QTY Units Disc (%) Unit Price IDR Amount IDRDocument2 pagesWorks Card: Part No Description QTY Units Disc (%) Unit Price IDR Amount IDRIbrohim BinladinNo ratings yet

- Test Bank For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy Doupnik 3Document71 pagesTest Bank For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy Doupnik 3deborahfritzxmdjcaiknw100% (31)

- Receipt ReportDocument34 pagesReceipt ReportFiroz shaikNo ratings yet

- FAR 02 - Conceptual Framework For Financial ReportingDocument11 pagesFAR 02 - Conceptual Framework For Financial ReportingJohn Bohmer Arcillas PilapilNo ratings yet

- Unit - 3 Bank Reconciliation StatementDocument21 pagesUnit - 3 Bank Reconciliation StatementMrutyunjay SaramandalNo ratings yet

- IFRS Vs GAAP DifferencesDocument5 pagesIFRS Vs GAAP DifferencesMahmoud SalahNo ratings yet